- Home

- »

- HVAC & Construction

- »

-

Heavy Construction Equipment Market Size Report, 2030GVR Report cover

![Heavy Construction Equipment Market Size, Share & Trends Report]()

Heavy Construction Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Machinery, By Application, By Propulsion, By Power Output, By Engine Capacity, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-283-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Heavy Construction Equipment Market Summary

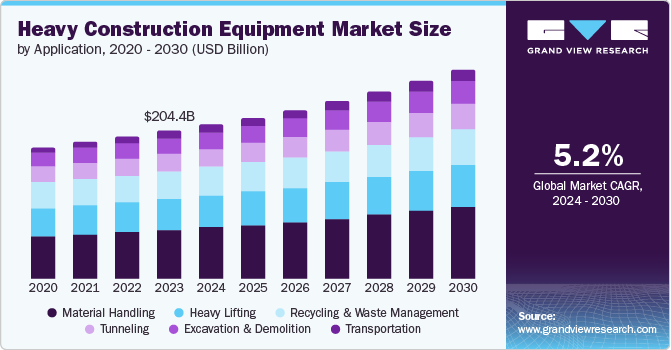

The global heavy construction equipment market size was estimated at USD 204.41 billion in 2023 and is projected to reach USD 289.30 billion by 2030, growing at a CAGR of 5.2% from 2024 to 2030. Key growth drivers for this market are unceasing urbanization, population growth leading to the growing demand for housing solutions and continuous infrastructural enhancements in developing economies.

Key Market Trends & Insights

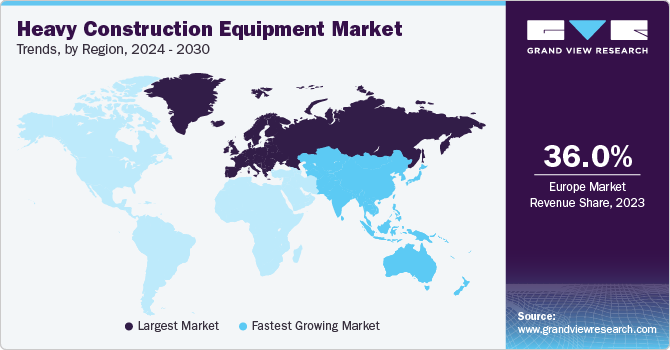

- Europe heavy construction equipment market dominated the global industry in 2023 with a revenue share of 36.0%.

- The U.S. heavy construction equipment market dominated the regional industry in 2023.

- Based on machinery, the material handling equipment segment dominated the market and accounted for a revenue share of 51.0% in 2023.

- Based on propulsion, the internal combustion engines (ICEs) accounted for the largest revenue share in 2023.

- Based on engine capacity, 5-10L segment accounted for the largest revenue share in 2023.

- Based on the power output range, <100 HP segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 204.41 Billion

- 2030 Projected Market Size: USD 289.30 Billion

- CAGR (2024-2030): 5.2%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, the emergence of fuel-efficient machinery and the increasing development of high-rise buildings in developed countries is expected to generate greater demand for the heavy construction equipment market. The continuous focus of multiple governments worldwide on modifying and developing new infrastructural provisions such as bridges, road networks, ports, railroads, metros, and others in the country's prime revenue-generating areas is developing a rise in demand for this heavy construction equipment market.

The rising inclination of people towards improving their standard of living is fueling the need for improved sanitation and hygiene infrastructure facilities, leading to growth in the utilization of heavy construction equipment for various public welfare projects. The key factors, such as rapid urbanization and the rising migration of people from rural parts of the country to urbanized areas for livelihood, fuel the need for residential and commercial constructions and are anticipated to develop growth for this industry during the forecast period. According to the United Nations Department of Economic and Social Affairs, nearly 68% of the world's population is projected to live primarily in urban areas by the year 2050.

The rising penetration of artificial intelligence (AI) and automation in the construction industry encourages key companies to incorporate innovative technologies in this equipment, driving the rise in demand. For instance, in March 2024, Komatsu Ltd., one of the prominent companies in the industry, announced that the commercial deployment of the Komatsu FrontRunner, an Autonomous Haulage System (AHS) truck, had exceeded the sale count of 700 units by February 2024. Moreover, with an increasing preference for renting or leasing construction equipment due to the rising costs of machinery and maintenance and other benefits of renting, such as the leasing companies offering machinery along with necessary professional staff and drivers, the market is expected to experience significant growth during the forecast period.

Machinery Insights

The material handling equipment segment dominated the market and accounted for a revenue share of 51.0% in 2023. This growth is attributed to the continuous demand of various heavy construction equipment especially for the construction of high-rise buildings. Some of the commonly used heavy construction equipment in material handling are cranes, forklifts, conveyer belts, excavators, hoists, crawler cranes, telescopic handler cranes, tower cranes, gantry cranes, passenger hoists, and others. Increasing number of redevelopments, construction of new bridges or other amenities in crowded areas and growing development of high rise structure is expected to develop growth for this segment.

The earthmoving equipment is expected to experience the fastest CAGR of 5.9% during the forecast period. Applying earthmoving equipment in projects such as mining, excavation, heavy lifting, demolition, and others drives the demand for heavy construction equipment. Moreover, the market is driven by the rising trade and demand for core earth minerals due to their numerous applications in various industries. Some commonly used earthmoving equipment include excavators, backhoe loaders, motor graders, wheel loaders, compact rollers, and dump trucks.

Application Insights

The material handling segment accounted for the largest revenue share in 2023. Heavy construction equipment such as hoists, conveyors, cranes, forklift trucks, tractors, and dump trucks are utilized for material handling applications. Bulk materials can be easily transported using material handling equipment in complicated construction sites, warehouses, and other settings. Manufacturers in this industry are focusing on designing user-friendly and technologically advanced equipment for numerous types of material handling. These aspects are expected to drive growth for this segment.

The transportation segment is anticipated to experience the fastest CAGR over the forecast period. The market is driven by the availability of various types and sizes of heavy motor vehicles for transporting different kinds of heavy materials. Rising road and railway line constructions are fueling the need for equipment such as dump trucks of multiple sizes, haulers, and other equipment for transporting materials from the vendors to the construction sites. Moreover, heavy construction equipment is also used in the transportation of liquids, gases, and waste materials on public roadways and highways.

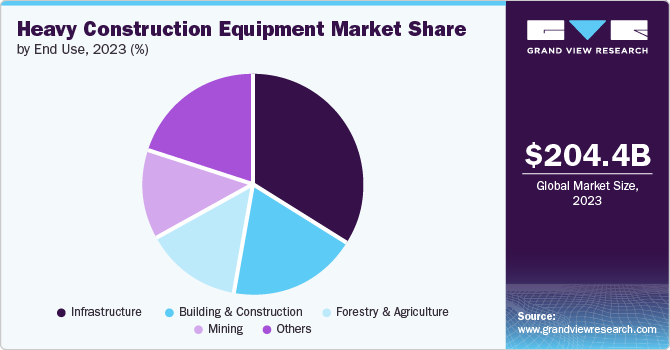

End Use Insights

The infrastructure segment dominated the global industry in 2023. Growing number of infrastructure enhancement projects by governments across the world and unceasing urbanization leading to higher demand for newly developed infrastructural amenities are driving the growth of this segment. Governing authorities in developing economies are constantly investing in development and improvement of energy facilities, transportation systems, communication networks, water management systems, and other public welfare infrastructural projects. These factors are expected to generate greater demand for the segment in approaching years.

The mining segment is anticipated to experience significant CAGR growth over the forecast period. Mining plays a crucial role in modern society as the minerals are utilized as prime ingredient in multiple consumer products utilized worldwide. Essential minerals such as copper, cobalt, nickel, iodine, lithium, and rare earths are vital for producing clean energy technologies such as wind turbines and electric vehicles. Many economies consider energy-related critical minerals as crucial for the desired transition to a low-carbon emission economy. These factors are anticipated to develop upsurge in demand for heavy construction equipment used in mining.

Propulsion Insights

Internal combustion engines (ICEs) accounted for the largest revenue share in 2023. This growth is attributed to ICEs' benefits, such as being inexpensive to maintain and manufacture, compatibility with a variety of fuels, and having a high power-to-weight ratio ideal for tasks that need a high power output in limited space. Moreover, internal combustion engines are capable of delivering optimal performance and efficiency by utilizing hydrogen as fuel, leading to low-to-zero harmful emissions.

Electric propulsion segment is anticipated to experience the fastest CAGR from 2024 to 2030. Significant progress in battery efficiency and affordability, rising regional and global environmental concerns are primarily driving growth for this segment. Growing availability and networks of charging infrastructure also contributes to the shift toward incorporating electric propulsion into heavy construction equipment. As supply and demand for construction equipment rises, along with technological advancements, electrification is emerging as a more affordable alternative. For instance, in June 2023, Volvo Construction Equipment announced the launch of two electric machines in Japan: the L25 Electric compact wheel loader and ECR25 Electric compact excavators.

Power Output Insights

Based on the power output range, <100 HP segment accounted for the largest revenue share in 2023. Heavy construction equipment with a power output of less than 100 HP facilitates tasks in limited space and are mainly used in projects such as maintenance and highway repair in urban areas due to space limitations. Some of the low-power heavy construction equipment includes compactors, mini excavators, and loaders. Therefore, rising urbanization is anticipated to drive the demand for heavy construction equipment with less than 100 HP. The ability of this equipment to work in remote and intricate settings is expected to drive the growth during the forecast period.

The 201-400 horsepower (HP) power output range segment is projected to grow at the fastest CAGR over the forecast period. This equipment is widely used in complex tasks such as heavy-duty construction, mining, and lifting heavy debris and soil, which requires 201-400 horsepower output. Some heavy construction equipment with this power output range includes crawler excavators, towable scrapers, and other excavators.

Engine Capacity Insights

Based on engine capacity, 5-10L segment accounted for the largest revenue share in 2023. Rising investment in numerous commercial projects such as the construction of railways, roads, dams, and urban infrastructure is driving growth for heavy construction equipment with 5-10L energy capacity. Construction equipment such as road rollers, compactors, crawler excavators, and others are incorporated with this engine capacity.

The >10L segment is projected to grow at the fastest CAGR over the forecast period. Heavy construction equipment with > 10L engine capacity is utilized for heavy tasks such as mining, and excavations due to the requirement of higher energy. These tasks need durable motor engines with a heavy engine capacity range which can operate for longer period of time without interruptions. The growth of this segment is primarily driven by the increase in mining activities and excavations in multiple countries with large sources of fuel and energy.

Regional Insights & Trends

North America heavy construction equipment market held significant share of global industry in 2023. The key factors driving the growth for this market are urbanization, increasing population, enhancements in infrastructure, technological progress, and mining activities in the region. According to National Geographic Society, North America is top producer of coal. In addition, the region exports multiple materials to other countries and businesses such as bauxite, iron, copper, and nickel. Furthermore, the region has promoted construction of engineering marvels, advanced infrastructural projects and large cities. These aspects have contributed to the vital role of this regional market in growth of global industry.

U.S. Heavy Construction Equipment Market Trends

The U.S. heavy construction equipment market dominated the regional industry in 2023. Presence of large cities with heavily populated areas such as New York, Chicago, Los Angeles, Houston, Phoenix and others has contributed to growing demand for this market. According to Pew Research Center, one fifth of international migrants worldwide live in the U.S. In addition, according to Federal Reserve Bank of St. Louis, USD 2,142,126 million were spent on construction in the U.S. during May 2024. This one of the highest total construction spending in the history of the country’s economy. Rising construction, enhancements in infrastructure and growing redevelopments are expected to fuel growth for this market in approaching years.

Europe Heavy Construction Equipment Market Trends

Europe heavy construction equipment market dominated the global industry in 2023 with a revenue share of 36.0%. The market growth is mainly influenced by rapid urbanization in the region. According to European Urban Initiative, one of the most urbanized regions in the world is European Union (EU). It further estimated that 75 % inhabitants in the EU region live in cities, towns and suburbs. This has resulted in a significant increase in the construction of housing projects and commercial infrastructure. Moreover, the growth of the market is fueled by the increase in automation within construction, driven by the shortage of skilled labor and a focus on reduction of costs and project timelines. Also, the market growth is driven by various factors including increasing urbanization, rising infrastructure development, and government investments in construction and transportation projects.

Germany heavy construction equipment market held significant revenue share of the regional industry in 2023. This market is primarily driven by the factors such as robust manufacturing industry present in the country, export activities, substantial growth in investments related to infrastructural enhancements, growing urbanization and increasing use of heavy construction equipment for processes such as redevelopments, road repairs and more.

Asia Pacific Heavy Construction Equipment Market Trends

Asia Pacific heavy construction equipment market is anticipated to witness the fastest growth from 2024 to 2030. In recent years, the region has experienced significant demand for heavy-duty construction equipment owing to continuous growth in construction, infrastructure development and enhancements, mining and other activities related to the industry. According to India Brand Equity Foundation, an Initiative by Ministry of Commerce and Industry of Government of India, in December 2023, foreign direct investments accomplished by India in development and construction of townships, housing projects, built-up infrastructure and other construction development projects was USD 33.52 billion. In addition, it states, Saudi Arabia has been seeking to invest nearly USD 100 billion in India through multiple projects such as energy, refineries, agricultural, mining, petrochemicals and minerals. Aspects such growing construction and mining in China, technological advancements and innovation in the sector by Japan are expected to generate greater growth for this industry in approaching years.

China heavy construction equipment market held a significant revenue share of regional industry in 2023. The presence of multiple major industry participants such as Komatsu Corp., SANY,Hitachi Construction Machinery Ltd. and others have been fueling growth for this market. Lithium mining in China plays vital role in growing use of heavy construction equipment in the country.

Key Heavy Construction Equipment Company Insights

Some of the key companies in the heavy construction equipment market include Caterpillar, Komatsu Ltd., AB Volvo, Hitachi Construction Machinery Co., Ltd., Deere & Company., CNH Industrial N.V., and others. To address the competitive state of industry, the key companies have adopted strategies such as growing investments in research & development, rising adoption of innovation, collaborations with companies and governments, participation in welfare initiatives related to infrastructural enhancements and more.

-

Caterpillar Inc., one of the prominent companies in manufacturing industry of construction and mining equipment, off-highway natural gas and diesel engines, diesel-electric locomotives and industrial gas turbines as well. Some of the heavy construction equipment offered by the company includes articulated trucks, backhoe loaders, compactors, draglines, drills, motor graders, hydraulic mining shovels, off-highway trucks, road reclaimers, pipelayers, excavators, dozers, lift trucks and more.

-

Komatsu Ltd., a Japan-based global corporation, manufactures mining, forestry, construction, and military machinery, some of its heavy construction equipment offerings are excavators, bulldozers, motor graders, wheel loaders, dump trucks, wheel dozers and others.

Key Heavy Construction Equipment Companies:

The following are the leading companies in the heavy construction equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Komatsu Ltd.

- AB Volvo

- Hitachi Construction Machinery Co., Ltd.

- Deere & Company.

- CNH Industrial N.V.

- LIEBHERR

- Kobelco Construction Machinery Co., Ltd.

- SANY

- XCMG GROUP

Recent Developments

-

In February 2024, Caterpillar introduced its medium dozer line with two technology package upgrades. The Cat Assist with ARO (attachment-ready option) package is anticipated to become a standard feature on Cat D5, D4, D6, D6 XE, and D7 models from early 2024.

-

In June 2024, Volvo CE launched Volvo EC210, 20-tonne category, ‘Built for Bharat’, heavy excavator and rolled out “Karo Zyada ki Umeed” campaign. The introduction of this addition of the diverse portfolio of company’s construction equipment reinforces its commitment to continue its role in Indian markets to offer innovation backed, technologically advanced products associated with construction equipment industry.

Heavy Construction Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 213.15 billion

Revenue forecast in 2030

USD 289.30 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machinery, application, propulsion, power, engine capacity, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, and South Africa

Key companies profiled

Caterpillar; Komatsu Ltd.; AB Volvo; Hitachi Construction Machinery Co., Ltd.; Deere & Company; CNH Industrial N.V.; LIEBHERR; Kobelco Construction Machinery Co., Ltd.; SANY; XCMG GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heavy Construction Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heavy construction equipment market report based on machinery, application, propulsion, power output, engine capacity, end use, and region.

-

Machinery Outlook (Revenue, USD Billion, 2018 - 2030)

-

Earthmoving Equipment

-

Material Handling Equipment

-

Heavy Construction Equipment

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Excavation & Demolition

-

Heavy Lifting

-

Material Handling

-

Tunneling

-

Transportation

-

Recycling & Waste Management

-

-

Propulsion Outlook (Revenue, USD Billion, 2018 - 2030)

-

ICE

-

Electric

-

-

Power Output Outlook (Revenue, USD Billion, 2018 - 2030)

-

<100HP

-

101-200 HP

-

201 - 400 HP

-

>400 HP

-

-

Engine Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

-

<5L

-

5-10L

-

>10L

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Building & Construction

-

Forestry & Agriculture

-

Infrastructure

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.