- Home

- »

- Clinical Diagnostics

- »

-

Helicobacter Pylori Diagnostics Market, Industry Report, 2030GVR Report cover

![Helicobacter Pylori Diagnostics Market Report]()

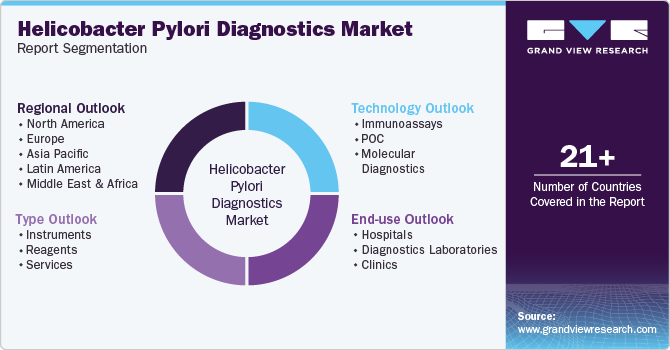

Helicobacter Pylori Diagnostics Market (2025 - 2030) Analysis Report By Type (Instruments, Reagents, Services), By Technology (Immunoassays, POC, Molecular Diagnostics), By End Use, By Region And Segment Forecasts

- Report ID: GVR-3-68038-699-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Helicobacter Pylori Diagnostics Market Summary

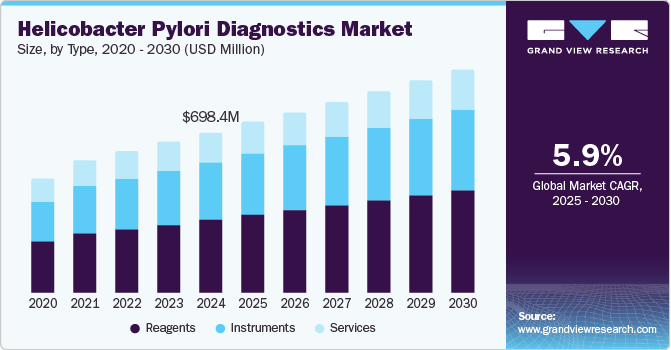

The global helicobacter pylori diagnostics market size was estimated at USD 698.44 million in 2024 and is projected to reach USD 966.19 million by 2030, growing at a CAGR of 5.87% from 2025 to 2030. The increasing risk of developing gastritis, gastric ulcers, and stomach cancer, among others, has led to an increase in the demand for the diagnosis of helicobacter pylori at an early stage of infection.

Key Market Trends & Insights

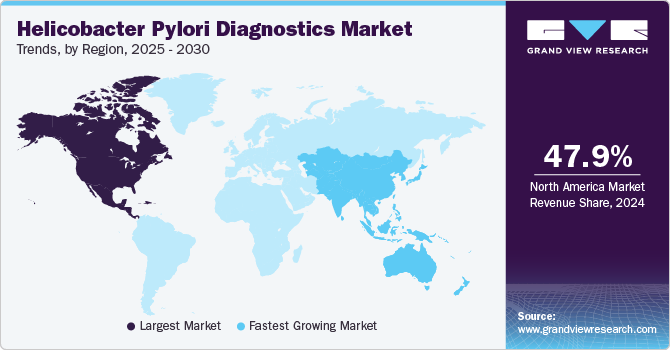

- North America helicobacter pylori diagnostics market dominated and accounted for a revenue share of 47.97% in 2024.

- The U.S. helicobacter pylori diagnostics market is experiencing growth.

- Based on type, the reagents segment dominated the market with 44.47% in 2024.

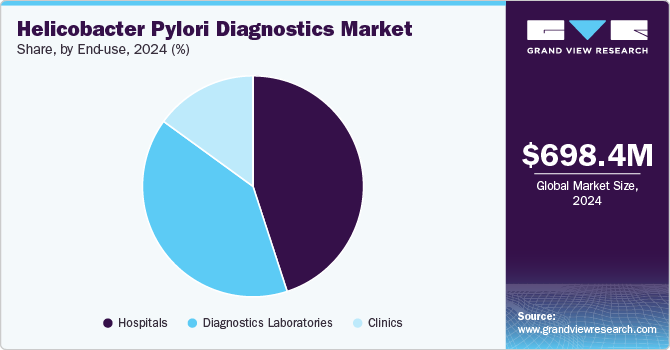

- Based on end use, the hospitals segment dominated the H. pylori diagnostics market in 2024, capturing 44.64% of the market share.

- By technology method, the immunoassays method segment dominated the market in 2024 with a revenue share of 43.49%.

Market Size & Forecast

- 2024 Market Size: USD 698.44 Million

- 2030 Projected Market Size: USD 966.19 Million

- CAGR (2025-2030): 5.87%

- North America: Largest market in 2024

Moreover, the increasing geriatric population and growing adoption of non-invasive diagnostic techniques are further anticipated to increase the market growth. For instance, according to the National Library of Medicine, about 10% of H.pylori-infected individuals develop a peptic ulcer, and 1 to 3% of people develop gastric adenocarcinoma.

Helicobacter pylori, a bacterium linked to chronic gastritis, peptic ulcer disease, and gastric cancer, continues to drive advancements in diagnostic and therapeutic solutions. In recent years, groundbreaking developments have been seen, particularly in nanotechnology, which offers potential alternatives to traditional endoscopic procedures. Biosensors, capable of detecting antigens or antibodies associated with H. pylori, have emerged as a promising innovation. These devices leverage piezoelectric, thermal, and sensor array technologies to produce precise results, presenting a less invasive and cost-effective diagnostic approach compared to PCR tests and immunoassays.

PCR and real-time PCR testing have revolutionized the diagnosis of Helicobacter pylori, providing high specificity and sensitivity. These techniques can identify H. pylori in diverse sample types, including stomach biopsy, digestive fluid, saliva, dental plaque, and stool. PCR's ability to detect spiral and coccoid forms of H. pylori makes it superior to many traditional diagnostic methods. In addition, PCR's capability to analyze DNA from mailed urease test samples without strict transportation requirements further enhances its practicality. However, its utility in stool samples may be constrained by low DNA copy numbers and PCR inhibitors. Despite these challenges, real-time PCR with fluorescence resonance energy transfer probes is emerging as a promising tool for assessing clarithromycin resistance with exceptional accuracy. However, the cost, equipment, and technical expertise required for PCR limit its widespread adoption, particularly in developing countries.

Peptide Mass Fingerprinting (PMF) technology, exemplified by MALDI-TOF MS, offers a rapid, cost-effective, and accurate approach to identifying and characterizing microorganisms, including H. pylori. This method uses an ultraviolet laser to ionize microbial biomass and sorts particles based on mass-to-charge ratios. MALDI-TOF MS has been instrumental in building a comprehensive Helicobacter library, enabling differentiation between various Helicobacter species and even detecting antibiotic resistance. The system has been enhanced with specialized software like Compass Explorer 4.1 to create main spectrum library (MSP) dendrograms, aiding in precise species identification. This technology's ability to identify antimicrobial resistance and support demographic research highlights its role in managing bacterial infections and informing public health initiatives. MALDI-TOF MS represents a significant advancement in clinical microbiology, offering a powerful tool for diagnosing H. pylori and other pathogens. Together, PCR and PMF technologies are shaping the future of H. pylori diagnostics, offering precise, efficient, and innovative approaches to detection and management.

Furthermore, Meridian Bioscience recently expanded its H. pylori product line with the FDA-cleared Premier HpSA FLEX. This non-invasive stool antigen test detects H. pylori-specific antigens in fresh, frozen, or preserved samples. Its enhanced workflow allows greater flexibility in sample types, aligning with the needs of evolving healthcare practices. Similarly, TECHLAB introduced the H. PYLORI QUIK CHEK and H. PYLORI CHEK tests, offering rapid and reliable antigen detection within 30 minutes to one hour. These tests simplify sample collection and provide high diagnostic accuracy, addressing the need for effective, non-invasive H. pylori detection.

These advancements in H. pylori diagnostics underscore the importance of innovation in addressing global health challenges. The field is moving toward more accurate, efficient, and patient-friendly solutions, from biosensors and nanotechnology to next-generation diagnostic tools.

Type Insights

Based on type, the reagents segment dominated the market with 44.47% in 2024. The reagents segment plays a crucial role in the industry, driven by advancements in diagnostic assays such as enzyme immunoassays (EIA), rapid antigen tests, and molecular diagnostics like PCR. The increased global prevalence of H. pylori-related gastrointestinal diseases, including peptic ulcers and gastric cancer, fuels the demand for reliable and efficient reagents. Innovations in reagent formulations for stool antigen tests and non-invasive diagnostic methods further drive market growth. Moreover, the growing adoption of point-of-care testing and the need for precise and rapid diagnostics in clinical and laboratory settings contribute significantly to expanding the reagents segment.

Moreover, the instrument segment is anticipated to experience a considerable market share over the forecast period driven by technological advancements in diagnostic tools such as urea breath analyzers, PCR systems, and immunoassay platforms. Increasing demand for non-invasive diagnostic techniques, such as breath tests and stool antigen detection, has spurred the adoption of advanced instruments. Integrating automation and real-time PCR technology in molecular diagnostics ensures higher precision and speed, making instruments indispensable for accurate H. pylori detection. Furthermore, the growing prevalence of gastric disorders and an emphasis on early diagnosis and monitoring drive investments in innovative diagnostic instruments globally.

End Use Insights

The hospitals segment dominated the H. pylori diagnostics market in 2024, capturing 44.64% of the market share. This is attributed to the convenience of diagnosing and treating diseases such as duodenal ulcers, gastric ulcers, gastritis, stomach cancer, and small intestine infections in hospital settings. Hospitals provide access to advanced diagnostic instruments and skilled healthcare professionals, enabling accurate and timely diagnosis. In addition, the increasing prevalence of digestive disorders further fuels this segment.

The diagnostics laboratories segment is anticipated to experience the fastest growth rate over the forecast period. The increasing prevalence of H. pylori infections, a leading cause of gastric ulcers and cancer, drives the Helicobacter pylori diagnostics market. Rising awareness about early detection has boosted demand for advanced diagnostic tools such as urea breath tests, stool antigen tests, and molecular diagnostics. For example, laboratories like Quest Diagnostics and LabCorp offer comprehensive H. pylori testing services. In addition, advancements in non-invasive and accurate diagnostic technologies contribute to improved patient outcomes, fueling market growth in diagnostic laboratories.

Technology Method Insights

The immunoassays method segment dominated the market in 2024 with a revenue share of 43.49%, which can be attributed to high usage rates. Conventional diagnostic methods are based on microscopic & macroscopic identification of pathogens through gram stain, pathogen culturing, biochemical methods, and serology tests. Relatively higher availability of conventional methods, compared to modern techniques, across a large number of labs and clinics is a key factor that has enabled this segment to dominate the market. However, these tests exhibit certain speed, timeline, and accuracy limitations. Furthermore, rapid technological advances are compelling end users to opt for molecular/modern methods over conventional methods.

Molecular/modern method is anticipated to experience the fastest growth rate over the forecast period. An increase in R&D for molecular diagnostic techniques and a rise in demand for point-of-care products is expected to boost the market growth at a CAGR of 5.04% by 2030. American Leprosy Missions (ALM) has launched an innovative project to develop molecular diagnostics for detecting five skin-neglected tropical diseases (NTDs): leprosy, Buruli ulcer, yaws, cutaneous leishmaniasis, and mycetoma. Supported by the Anesvad and Raoul Follereau Foundations, this initiative aims to create a multiplex assay that simplifies the simultaneous detection of these diseases, which require similar diagnostic and management approaches. Collaborating with Biomeme, Inc., ALM leverages advanced qPCR technology, including a mobile thermocycler and smartphone integration. This portable setup enables rapid DNA and RNA detection, delivering results in 30-45 minutes without electricity or complex logistics. Building on prior successes, ALM has already developed assays for Buruli ulcer and leprosy, which are undergoing prequalification and evaluation phases. The new multiplex assay is poised to address diagnostic challenges in low-resource settings, significantly reducing delays and costs while advancing global efforts to eliminate skin NTDs.

Regional Insights

North America helicobacter pylori diagnostics market dominated and accounted for a revenue share of 47.97% in 2024. The region's high infection rate and growing government healthcare expenditures drive market growth. For instance, according to a recent article published by the Canadian Association of Gastroenterology in March 2022, the prevalence of Helicobacter pylori is estimated between 23% and 38 %. The high number of H. pylori infections is expected to drive the market over the forecast period.

U.S. Helicobacter Pylori Diagnostics Market Trends

The U.S. helicobacter pylori diagnostics market is experiencing growth driven by the increasing prevalence of gastrointestinal disorders, rising awareness about early detection, and advancements in diagnostic technologies. Non-invasive testing methods such as urea breath tests (UBT) and stool antigen tests are gaining traction due to their accuracy and patient convenience. Furthermore, the growing adoption of molecular diagnostic techniques like PCR enhances sensitivity and specificity. Key challenges include cost considerations and accessibility in rural areas.

Europe Helicobacter Pylori Diagnostics Market Trends

The helicobacter pylori diagnostics market in Europe is shaped by rising awareness of gastrointestinal health and the increasing prevalence of H. pylori infections. Non-invasive diagnostic methods, such as urea breath tests and stool antigen tests, are gaining traction due to their accuracy and patient convenience. Adopting advanced molecular diagnostics, supported by technological advancements, also drives market growth. Furthermore, government initiatives promoting early detection of gastric diseases are encouraging the expansion of diagnostic services across healthcare facilities in the region.

The UK helicobacter pylori diagnostics market is expanding due to the increasing prevalence of H. pylori infections, which are linked to conditions like gastritis and peptic ulcers. Rising public health initiatives promoting early detection and treatment are boosting demand for diagnostic tests. The market also benefits from integrating advanced technologies such as immunoassays and multiplex PCR for accurate detection. Growing awareness among healthcare providers and patients about H. pylori’s role in gastric cancer prevention is another key driver, along with a steady increase in government and private sector healthcare funding.

The helicobacter pylori diagnostics market in France is witnessing steady growth, fueled by increasing cases of gastric infections and ulcers caused by H. pylori. A robust healthcare system and widespread adoption of advanced diagnostic technologies such as ELISA and histological testing support market expansion. Public health campaigns emphasizing early detection of H. pylori to reduce the risk of gastric cancer are driving awareness. In addition, the growing use of serological tests for screening and research initiatives aimed at improving diagnostic accuracy further propels market demand. The presence of skilled healthcare professionals ensures the effective implementation of diagnostic protocols.

Germany helicobacter pylori diagnostics market is growing due to the increasing focus on preventive healthcare and the rising incidence of gastrointestinal diseases linked to H. pylori infections. Demand is supported by advancements in diagnostic technologies, such as non-invasive breath and stool tests, which are becoming more widely adopted for convenience and reliability. The market also benefits from government-backed healthcare initiatives to reduce gastric cancer risks. Moreover, high awareness among patients and clinicians about early detection, combined with the integration of molecular diagnostic tools in clinical settings, is driving market expansion.

Asia Pacific Helicobacter Pylori Diagnostics Market Trends

The helicobacter pylori diagnostics market in Asia Pacific is driven by the high prevalence of H. pylori infections and increasing healthcare awareness across the region. Rising demand for non-invasive diagnostic methods, such as urea breath tests and stool antigen tests, is a key trend. Rapid urbanization and improved healthcare infrastructure further support market growth. Countries like China and India are witnessing significant adoption of advanced diagnostic tools, fueled by growing investments in healthcare technology and initiatives promoting early detection of gastric disorders.

China helicobacter pylori diagnostics market is experiencing rapid growth due to the high prevalence of H. pylori infections, a leading cause of gastritis and peptic ulcers in the region. Increasing investments in healthcare infrastructure and advancements in diagnostic technologies, such as rapid antigen tests and polymerase chain reaction (PCR), are fueling market demand. Public health initiatives promoting awareness of H. pylori-associated gastric cancer risks encourage early testing. Furthermore, the growing middle class and rising disposable incomes have improved access to healthcare services, further driving the adoption of diagnostic solutions across urban and rural areas.

The helicobacter pylori diagnostics market in Japan is advancing steadily, driven by a high prevalence of H. pylori infections and the country's aging population, which is more susceptible to gastrointestinal disorders. National healthcare policies mandating H. pylori testing for patients with gastritis and other related conditions are a significant growth driver. The market benefits from the widespread use of advanced diagnostic techniques, such as urea breath tests (UBT) and endoscopic biopsies, which offer high accuracy. Increased awareness of the link between H. pylori and gastric cancer has further boosted demand for early detection and treatment options.

Latin America Helicobacter Pylori Diagnostics Market Trends

The helicobacter pylori diagnostics market in Latin America is expanding due to the high prevalence of H. pylori infections across the region, often linked to suboptimal sanitation and limited access to clean water. Growing awareness campaigns about the health risks of untreated infections, including gastritis and gastric cancer, are driving demand for diagnostic services. Non-invasive tests such as stool antigen tests and urea breath tests are gaining popularity due to their affordability and ease of use. Moreover, improving healthcare infrastructure and increasing government investments in public health programs support market growth across urban and rural areas.

Brazil helicobacter pylori diagnostics market is growing, driven by a high prevalence of H. pylori infections and an increasing focus on gastrointestinal health. Rising public awareness about the connection between H. pylori and conditions like peptic ulcers and gastric cancer has boosted demand for diagnostic testing. Non-invasive methods, such as urea breath tests and stool antigen tests, are gaining traction due to their cost-effectiveness and simplicity. Government initiatives to improve healthcare accessibility and expanded insurance coverage for diagnostic services are further propelling market growth, particularly in underserved rural areas.

Middle East & Africa Helicobacter Pylori Diagnostics Market Trends

The helicobacter pylori diagnostics market in MEA is growing due to the rising prevalence of H. pylori infections and increased awareness of gastrointestinal health. Due to their convenience and reliability, the adoption of noninvasive diagnostics, such as stool antigen tests and urea breath tests, is expanding. Investments in healthcare infrastructure across the Middle East, along with government initiatives for early detection and treatment of gastric diseases, are driving the market. Moreover, advancements in molecular diagnostics are gradually penetrating the region, enhancing diagnostic accuracy.

Saudi Arabia Helicobacter pylori diagnostics market is growing due to increasing awareness about gastrointestinal health and the rising prevalence of H. pylori infections linked to lifestyle and dietary factors. Advancements in healthcare infrastructure and the adoption of modern diagnostic techniques, such as urea breath tests and stool antigen tests, are enhancing early detection rates. Public health initiatives and government investments to reduce the burden of gastric diseases are key drivers. In addition, a growing expatriate population and improved access to private healthcare facilities further support market expansion in urban and rural regions.

Key Helicobacter Pylori Diagnostics Company Insights

Some of the key market players include Thermo Fisher Scientific, Biohit Oyj, Quest Diagnostics Incorporated, Meridian Bioscience, Bio-Rad Laboratories, Alpha Laboratories Ltd, F. Hoffmann-La Roche Ltd, Coris BioConcept, Certest Biotec, Epitope Diagnostics, Inc. These players are undertaking various strategic initiatives to increase their share in the market. New product development, collaborations, and partnerships are some such endeavors.

Key Helicobacter Pylori Diagnostics Companies:

The following are the leading companies in the helicobacter pylori diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Biohit Oyj

- Quest Diagnostics Incorporated

- Meridian Bioscience

- Bio-Rad Laboratories

- Alpha Laboratories Ltd

- F. Hoffmann-La Roche Ltd

- Coris BioConcept

- Certest Biotec

- Epitope Diagnostics, Inc.

Recent Developments

-

In July 2023, Meridian Bioscience, Inc., a global leader in diagnostic solutions, received FDA clearance for its Premier HpSA FLEX, a non-invasive enzyme immunoassay for detecting Helicobacter pylori (H. pylori) antigens in both preserved and unpreserved stool samples. This innovation enhances diagnostic flexibility by allowing preserved stools in Cary-Blair and C&S media alongside fresh or frozen samples. This advancement complements Meridian's comprehensive H. pylori portfolio, including BreathID (urea breath test), Curian HpSA (fluorescent immunoassay), and ImmunoCard Stat! HpSA (rapid antigen test). H. pylori infections are a leading cause of upper gastrointestinal conditions, such as chronic gastritis, peptic ulcers, and gastric cancer, underscoring the significance of accessible and reliable diagnostics in improving patient outcomes.

-

In December 2023, Biomerica, Inc. announced that it had received FDA 510(k) clearance for its HP Detect Stool Antigen ELISA test (K232892), a new diagnostic tool designed to detect Helicobacter pylori (H. pylori) infection. With approximately 35% of the U.S. population infected and over 80% of gastric cancers linked to H. pylori, this test aims to aid in diagnosing and monitoring H. pylori infection, particularly after treatment. Gastric cancer, which is the third leading cause of cancer-related death globally, underscores the importance of early detection and effective management of H. pylori infections. This test provides physicians and medical centers with a reliable means to assess H. pylori presence and infection status, contributing to improved patient outcomes.

Helicobacter Pylori Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 740.90 million

Revenue forecast in 2030

USD 966.19 million

Growth rate

CAGR of 5.87% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific; Biohit Oyj; Quest Diagnostics Incorporated; Meridian Bioscience; Bio-Rad Laboratories; Alpha Laboratories Ltd; F. Hoffmann-La Roche Ltd; Coris BioConcept; Certest Biotec; Epitope Diagnostics, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Helicobacter Pylori Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global helicobacter pylori diagnostics market report based on type, technology, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

POC

-

Molecular Diagnostics

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics Laboratories

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global helicobacter pylori diagnostics market size was estimated at USD 698.44 million in 2024 and is expected to reach USD 740.90 million in 2025.

b. The global helicobacter pylori diagnostics market is expected to grow at a compound annual growth rate of 5.87% from 2025 to 2030 to reach USD 966.19 million by 2030.

b. North America dominated the helicobacter pylori diagnostics market with a share of 47.97% in 2024. This is attributable to increasing healthcare expenditure, favorable reimbursement scenarios, and the presence of major players in the region.

b. Some key players operating in the helicobacter pylori diagnostics market include Thermo Fisher Scientific, Biohit, Quest Diagnostics, Meridian Bioscience, Bio-Rad Laboratories, Alpha Laboratories, F. Hoffmann-La Roche, Coris BioConcept, Certest Biotec, and Epitope Diagnostics.

b. Key factors that are driving the market growth include increasing demand for personalized antibiotic therapy and improving cost-effectiveness of diagnosis of helicobacter pylori infection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.