- Home

- »

- Automotive & Transportation

- »

-

Helicopter Simulator Market Size, Industry Report, 2030GVR Report cover

![Helicopter Simulator Market Size, Share & Trends Report]()

Helicopter Simulator Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Full Flight Simulators, Fixed Base Simulators), By Application, By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-635-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Helicopter Simulator Market Summary

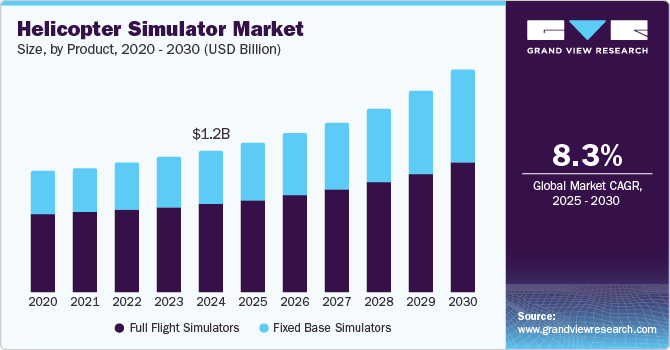

The global helicopter simulator market size was valued at USD 1.15 billion in 2024 and is expected to grow at a CAGR of 8.3% from 2025 to 2030. This growth can be attributed to the increasing focus on enhancing pilot training programs.

Key Market Trends & Insights

- North America helicopter simulator market dominated the global market with a revenue share of 38.3% in 2024.

- By product, the full-flight simulators segment held the largest market revenue share of 62.1% in 2024.

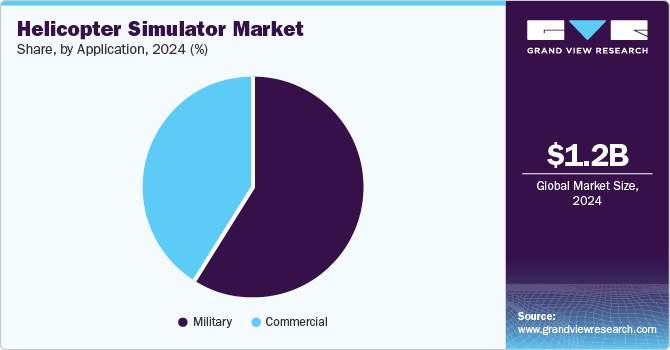

- By application, the military segment held the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.15 Billion

- 2030 Projected Market Size: USD 1.81 Billion

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

Helicopter simulators provide a controlled environment where pilots can practice complex maneuvers, emergency protocols, and challenging flight conditions without the risks associated with real-world scenarios. This approach reduces the likelihood of accidents and enhances pilot skill levels, leading to more effective training outcomes. The aviation sector's efforts to improve safety and minimize human error highlight the essential role of simulators in pilot development.

In addition, the rising demand for helicopters in defense, Emergency Medical Services (EMS), Search and Rescue (SAR), and oil and gas exploration has intensified the need for skilled pilots. Helicopter simulators offer a cost-effective alternative to traditional in-air training, often constrained by high fuel expenses, maintenance costs, and aircraft wear and tear. By significantly lowering operational expenses, simulators provide an optimal solution for civilian and military organizations aiming to enhance training efficiency while maintaining high standards.

Moreover, technological advancements are driving growth within the helicopter simulator industry. Modern simulators incorporate advanced Virtual Reality (VR) and Augmented Reality (AR) technologies, delivering immersive experiences that closely replicate real-life flying conditions. These technological improvements have heightened the realism and effectiveness of simulators, further boosting their adoption worldwide. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have also integrated simulation-based training into pilot certification requirements. These regulatory initiatives have further fueled demand, underscoring the growing reliance on simulators to enhance aviation safety and operational excellence.

Product Insights

The full-flight simulators segment held the largest market revenue share of 62.1% in 2024. These simulators precisely replicate helicopter flight conditions, enabling trainees to navigate various challenging scenarios, such as adverse weather or emergencies, without the risks associated with real-world operations. Full-flight simulator systems also help reduce costs related to the use of actual helicopters for training, including expenses for fuel, maintenance, and aircraft wear. Furthermore, regulatory requirements mandating high-quality simulation training, particularly for military and commercial pilots, drive demand within the helicopter simulator industry and further strengthen the adoption of full-flight simulators.

The fixed base simulators segment is expected to grow at the highest CAGR during the forecast period. These simulators provide realistic training environments without expensive motion systems, making them more accessible to aviation schools and smaller operators. They are useful for practicing essential skills such as instrument navigation, emergency procedures, and operational protocols, which do not require full-motion feedback. In addition, advancements in software and visualization technologies have significantly improved the realism and functionality of fixed base simulators, further driving their adoption of comprehensive, high-quality training at a lower cost.

Application Insights

The military segment held the largest market revenue share in 2024. This dominance is due to the extensive use of simulators for training pilots in complex combat maneuvers, tactical operations, and emergency protocols. Simulators provide a controlled and cost-effective environment for military training, reducing the need for live exercises that involve high operational costs, fuel consumption, and equipment wear. Furthermore, the helicopter simulator industry has benefited from government investments to modernize defense capabilities and regulatory emphasis on using advanced simulation technologies for pilot certification and readiness programs.

The commercial segment is expected to grow at the highest CAGR over the forecast period. Urban Air Mobility (UAM) initiatives, such as intercity transport and air taxis, require highly trained pilots capable of managing complex urban airspace. The increasing use of helicopters in disaster management and emergency response further emphasizes the importance of advanced training. Simulators provide pilots with a safe and controlled environment to develop critical skills for high-pressure situations. Furthermore, strict regulatory requirements for pilot certification encourage commercial operators to adopt advanced simulators, reducing costs and time associated with traditional flight training. These factors collectively contribute to the segment's rapid growth.

Regional Insights

The North America helicopter simulator market dominated the global market with a revenue share of 38.3% in 2024. This dominance is driven by the region's established aviation training infrastructure and the presence of key manufacturers in the helicopter simulator industry. Elevated defense spending and the widespread adoption of simulators for military pilot training significantly contribute to the region's growth. Furthermore, the increasing demand for sophisticated training solutions in commercial sectors, including EMS and UAM, strengthens the market's position. Strict regulatory standards for pilot certification also play a key role in accelerating the adoption of advanced simulation technologies across North America.

U.S. Helicopter Simulator Market Trends

The U.S. helicopter simulator market held the largest revenue share regionally in 2024. The U.S. military's ongoing modernization efforts, including growing pilot training programs, drive demand for advanced simulation technologies that offer cost-effective and risk-free training. Commercial helicopter operators, such as those in the EMS and oil and gas industries, increasingly use simulators to enhance pilot proficiency and safety. The rise in civilian aviation and stricter FAA regulations requiring more comprehensive pilot training have further boosted the use of helicopter simulators nationwide.

Europe Helicopter Simulator Market Trends

The Europe helicopter simulator market held a significant revenue share of the global market in 2024, driven by stringent aviation regulations and safety standards enforced by authorities such as the EASA. Expanding helicopter operations in sectors such as EMS, law enforcement, and offshore energy have amplified the need for skilled pilots, boosting demand for advanced training solutions. High-quality simulators are crucial in meeting these needs by providing realistic, efficient, cost-effective training environments. In addition, the region's emphasis on pilot certification and safety compliance further drives the market growth.

Asia Pacific Helicopter Simulator Market Trends

The Asia Pacific helicopter simulator market is anticipated to experience the highest CAGR during the forecast period. This growth can be attributed to the robust military modernization programs in nations such as China, India, and Japan. These programs emphasize adopting advanced solutions within the helicopter simulator industry to enhance pilot training and operational readiness. The rising demand for air transportation across sectors such as tourism and EMS has further amplified the need for skilled pilots. Helicopter simulators offer cost-effective, safe, and efficient training solutions, particularly in the region's diverse and challenging geographical terrains. Furthermore, increasing investment in aviation infrastructure and technological advancements in simulation tools drive market growth.

The China helicopter simulator market held the largest revenue share of the regional market in 2024. This growth is due to the country's expanding military capabilities and rising demand for skilled pilots. The increasing use of helicopters for various military and civil applications, such as SAR, border patrol, and infrastructure development, has created a need for effective training solutions. Simulators offer a cost-effective method for training pilots in complex and high-risk scenarios, contributing to their widespread adoption. Moreover, the country's growing reliance on helicopters for emergency response and offshore energy further drives the demand for advanced training tools.

Key Helicopter Simulator Company Insights

Some key companies in the helicopter simulator industry include Thales, TRU Simulation + Training Inc., FRASCA International, Inc., RYAN AEROSPACE, and Reiser Simulation and Training (RST). These organizations are focused on expanding their market presence and maintaining a competitive edge. To achieve these objectives, key players are actively pursuing strategic initiatives such as mergers and acquisitions and forming partnerships with other industry leaders. By leveraging these strategies, companies in the helicopter simulator market aim to enhance training capabilities, improve operational efficiency, and offer advanced solutions to meet the growing demand for highly skilled pilots. This approach allows them to address the evolving needs of the aviation industry and strengthen their market positions.

-

Thales specializes in providing advanced helicopter simulators designed to meet the needs of civilian and military aviation. Its offerings include high-fidelity, full-motion simulators with cutting-edge technology to replicate real-world flight conditions. The company enables organizations to enhance pilot training, improve safety, and reduce costs through its innovative training solutions.

-

FRASCA International, Inc. produces flight simulators globally for airlines, flight schools, and military organizations. They provide a broad range of helicopter simulators, including Full Flight Simulators (FFS), Flight Training Devices (FTDs), and Advanced Aviation Training Devices (AATDs). These simulators are created to offer realistic and dependable training settings for different uses, such as EMS, law enforcement, oil and gas, and corporate pilot training.

Key Helicopter Simulator Companies:

The following are the leading companies in the helicopter simulator market. These companies collectively hold the largest market share and dictate industry trends.

- Thales

- TRU Simulation + Training Inc.

- FRASCA International, Inc.

- RYAN AEROSPACE

- Reiser Simulation and Training (RST)

- CAE Inc.

- ELITE Simulation Solutions

- Fidelity’s Simulation & Training (S&T)

- FLYIT Simulators, Inc.

- iSim Limited

Recent Developments

-

In January 2025, ELITE Simulation Solutions installed an Open Cockpit Advanced Aviation Training Device, Diamond DA-42, with full-motion technology for a private pilot in Switzerland. The simulator features a dual-pilot configuration, dynamic control loading, and a 6DOF full-motion system to provide a realistic and immersive training experience. This installation underscores ELITE's commitment to advancing aviation education globally with FAA-certified devices.

-

In July 2024, Reiser Simulation and Training GmbH achieved the D3 Flight Model qualification for its H145 Full-Flight Simulator. This certification enhances pilot training for Swiss Air-Rescue Rega and allows the simulator to be used by third-party operators. The update reflects significant advancements in helicopter simulation technology, improving training realism and safety. This milestone further strengthens Reiser’s position in the helicopter simulator market.

Helicopter Simulator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.21 billion

Revenue forecast in 2030

USD 1.81 billion

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

SITA; Bosch Sicherheitssysteme GmbH; Thales; Honeywell International Inc.; Leidos; Siemens; Amadeus IT Group SA; IBM; Elbit Systems Ltd.; Genetec Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Helicopter Simulator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global helicopter simulator market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Full Flight Simulators

-

Fixed Base Simulators

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.