- Home

- »

- Clinical Diagnostics

- »

-

Hematocrit Testing Market Size, Share, Industry Report 2033GVR Report cover

![Hematocrit Testing Market Size, Share & Trends Report]()

Hematocrit Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Technology, By Sample (Impedance-Based Methods), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-828-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hematocrit Testing Market Summary

The global hematocrit testing market size was estimated at USD 1.25 billion in 2024 and is projected to reach USD 2.01 billion by 2033, growing at a CAGR of 5.30% from 2025 to 2033, driven by a rising prevalence of hematological and chronic diseases, including anemia, blood loss monitoring (trauma/surgery), polycythemia screening, and chronic disease management (kidney disease, cancer). According to the 2025 PubMed Central study, anemia affects approximately 42% of patients with chronic kidney disease (CKD) in Asia.

Key Market Trends & Insights

- North America hematocrit testing market dominated the global market and accounted for the largest revenue share of 33.65% in 2024.

- The U.S. led the North American market and held the largest revenue share of 83.28% in 2024

- Based on the product, the consumables & reagents segment dominated the global market with a 73.39% market share in 2024.

- Based on technology, the impedance-based methods segment held the largest revenue share of 37.56% in 2024.

- On the basis of sample, the whole blood segment held the largest revenue share of 76.87% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.25 Billion

- 2033 Projected Market Size: USD 2.01 Billion

- CAGR (2025-2033): 5.30%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

It has also been estimated that as CKD progresses, anemia rates can go up to 80% in late-stage disease. In the same year, a systematic review reported that the prevalence is up to 65% of cancer patients globally, spanning multiple tumor types. Given these disease patterns, demand for hematocrit testing continues to rise. Because hematocrit is a core component of the CBC panel used to screen and monitor these conditions, the growing disease burden is increasing demand for hematocrit testing, thereby driving the rapid growth of the global hematocrit testing market.

The growing use of automated and digital hematology analyzers is propelling market growth as healthcare systems transition to high-throughput, precision-driven diagnostic platforms. In August 2024, Abbott received FDA clearance for its Alinity h-series hematology instruments, enabling advanced, fully automated CBC and hematocrit testing with faster turnaround times and enhanced workflow efficiency. The platform combines smart sample management, digital reporting, and high analytical sensitivity to reduce manual intervention while improving laboratory performance. This trend is consistent with the broader global shift toward digitized hematology, in which AI-assisted interpretation, automated quality control, and remote connectivity are becoming standard features in modern laboratories. These innovations significantly improve testing capacity, accuracy, and clinical reliability. Therefore, the market is constantly expanding due to the increased adoption of automated analyzers, the modernization of diagnostic laboratories, and the rising need for efficient, high-volume hematological testing.

The market is experiencing strong growth opportunities as it transitions to point-of-care (POC) hematocrit testing. Rapid, near-patient diagnostics are becoming increasingly important in emergency departments, ambulances, intensive care units, and rural clinics, where immediate hematocrit assessment facilitates faster decision-making for trauma care, anemia detection, dehydration assessment, and surgical blood-loss monitoring. Rising demand for faster turnaround times is driving the adoption of portable, user-friendly hematology analyzers. For instance, in August 2023, the FDA approved PixCell Medical's HemoScreen, a point-of-care CBC device that enables direct capillary sampling and provides rapid hematocrit results, significantly improving ease of use and testing throughput. These advancements reduce manual steps, shorten wait times, and increase access to diagnostic testing in decentralized settings. As healthcare systems prioritize faster triage, decentralized workflows, and operational efficiency, the use of point-of-care hematocrit testing increases. This ongoing shift is driving overall market growth by enhancing patient outcomes and enabling real-time clinical decision support.

According to a 2024 BMC Central study, the overall prevalence of anemia among elderly people ranges between 10% and 24%, indicating a significant baseline burden. The risk increases in clinical settings, with anemia affecting 40% of hospitalized older adults and 47% of nursing home residents. As anemia, chronic kidney disease, inflammation, and nutritional deficiencies increase with age, regular monitoring of hemoglobin and hematocrit becomes critical for diagnosis, treatment optimization, and disease management. This growing clinical need is driving steady growth in the market, as healthcare systems increasingly use point-of-care devices, automated analyzers, and routine screening protocols designed for aging populations.

Moreover, the rising global demand for surgical procedures, particularly in cardiac, orthopedic, and cancer surgeries, is driving the need for precise perioperative hematocrit monitoring as part of modern Patient Blood Management strategies. In 2024, a study published in Cardiology and Therapy reported that implementing PBM protocols in cardiovascular surgery reduced red-blood-cell transfusions by 21%, demonstrating the clinical and economic value of structured blood-management programs. In 2025, a PubMed-indexed surgical review identified key advances, including intraoperative cell salvage, low-volume autotransfusion systems, and retrograde autologous priming, all of which reduce dependence on donor blood and require continuous hematocrit assessment for safe implementation. In addition, in 2024, ERAS Cardiac guidelines further emphasized preoperative anemia optimization, restrictive transfusion thresholds, and real-time intraoperative hematocrit monitoring to improve outcomes in high-risk surgeries. The global demand for hematocrit testing is increasing as hospitals accelerate the deployment of PBM and integrate new surgical blood-conservation technologies.

Market Concentration & Characteristics

The market is highly innovative, driven by continuous advancements in hematology analyzers, digital diagnostics, and point-of-care testing technologies. Manufacturers are combining AI-assisted algorithms, microfluidics, compact optical systems, and automation to enhance accuracy, reduce sample volumes, and deliver rapid hematocrit results in various clinical settings. Innovations in integrated CBC/HCT platforms, capillary sampling devices, and cloud-connected analyzers improve real-time decision support and workflow efficiency. Furthermore, novel biomarker discovery, improved reagent stability, and user-friendly interfaces are driving adoption.

Mergers and acquisitions in the hematocrit testing market remain moderate, driven primarily by companies seeking to strengthen their diagnostic portfolios, expand hematology product lines, and gain a competitive advantage. The majority of activity consists of targeted acquisitions of smaller technology developers, reagent manufacturers, or automation specialists with the objective of increasing efficiency and expanding capabilities. Large-scale, transformative acquisitions are rare, as many market participants prioritize internal R&D and incremental product innovation. Instead, companies use selective M&A to close technological gaps, integrate advanced testing solutions, or expand their market reach into emerging regions. Overall, M&A activity is steady but measured, indicating a focus on strategic, capability-driven consolidations.

The market is heavily regulated due to the FDA's stringent oversight of hematology devices and reagents. Hematology reagents are classified according to risk in 21 CFR Part 864, with varying levels of regulatory submission required. While Class I general-purpose reagents may be exempt from 510(k), the majority of hematocrit-related reagents are classified as Class II, requiring 510(k) clearance and strict compliance with analytical and clinical validity standards. High-risk Class III reagents may require PMA approval, increasing the regulatory burden. Furthermore, labeling rules under 21 CFR 809.10 and restrictions on RUO/IUO products raise compliance requirements and market entry barriers.

The market is experiencing moderate product expansion, with manufacturers focusing on upgrading hematology analyzers, improving reagents, and integrating CBC/HCT solutions rather than introducing entirely new product categories. Companies are expanding their product lines with automated, compact, multi-parameter analyzers designed for small, medium, and high-throughput laboratories. Incremental innovations, such as improved diagnostic menus, digital workflow tools, and connectivity upgrades, are propelling portfolio diversification. Although product launches are common, most developments build on existing platforms rather than introducing new categories. Thus, product expansion is consistent but measured, in line with market demands for efficiency, automation, and diagnostic accuracy.

Regional expansion in the industry is moderate, driven by rising adoption of hematology testing solutions in emerging markets such as Asia-Pacific, Latin America, and the Middle East. Companies are strengthening distribution networks, forming regional partnerships, and obtaining regulatory approval to enter high-potential markets. However, varying regulatory requirements, infrastructure disparities, and procurement challenges in low-resource settings all impact expansion efforts. While demand for hematocrit testing continues to rise globally, particularly in primary care and point-of-care settings, market penetration varies by region. As a result, geographic expansion continues steadily but not rapidly.

Product Insights

On the basis of product, the consumables & reagents segment held the largest share of 73.39% in 2024, owing to their recurring use, high replacement frequency, and important function in routine hematocrit analysis across clinical laboratories and point-of-care settings. Unlike analyzers, which require a one-time investment, reagents like diluents, lysing agents, calibrators, and control materials must be replenished on a regular basis to ensure test accuracy and device functionality. The growing global burden of anemia, trauma-related blood loss cases, and chronic diseases has increased the volume of CBC and hematocrit tests, driving up reagent demand. Furthermore, the expansion of automated hematology platforms and the increasing adoption of quality-control compliant consumables in accredited laboratories contribute to this segment's dominance.

In addition, it is also expected to grow the fastest during the forecast period, driven by increasing test standardization requirements, the introduction of advanced, ready-to-use reagent kits, the shift toward high-sensitivity hematology assays, and the rising adoption in decentralized testing environments, such as emergency departments and mobile health units. The expansion of plasma collection centers, as well as the need for contamination-free, single-use consumables in high-throughput labs, is driving up demand. In 2025, RareDiseaseAdvisor reported that decreased coagulation and fluctuating hematocrit levels during hemophilia surgeries necessitate frequent perioperative CBC and hematocrit monitoring, which directly increases the consumption of reagents, quality-control materials, and capillary sampling supplies required for accurate hematocrit analysis.

The instruments segment held the second-largest share of the global hematocrit testing industry in 2024, supported by widespread adoption of automated hematology analyzers across hospitals, diagnostic laboratories, and emergency departments. In 2023, a PubMed-indexed analytical evaluation reported that next-generation 5-part and 6-part differential analyzers significantly improved throughput, precision, and hematocrit reliability through enhanced optical sensing and impedance technologies. In 2024, a study published in the Journal of Laboratory Automation emphasized the growing adoption of digital sample-management systems, automated quality-control modules, and AI-assisted flagging tools, which enable laboratories to minimize manual steps and reduce diagnostic errors. These technological improvements, combined with the shift of healthcare systems toward high-volume automation and standardized workflows, have strengthened the instruments segment's strong global market position.

Technology Insights

Based on technology, the impedance-based methods segment represented the largest market share of 37.56% in 2024, due to their long-standing clinical adoption, cost-effectiveness, and dependability in routine complete blood count (CBC) workflows. Impedance technology uses electrical resistance to measure red blood cell volume quickly and accurately, making it an ideal choice for hospitals, diagnostic laboratories, and point-of-care applications. Its compatibility with high-throughput automated hematology analyzers and low maintenance requirements contributes to its dominance. Furthermore, widespread availability, standardized performance, and suitability for both large and small laboratory environments continue to fuel demand for impedance-based hematocrit testing in global healthcare systems.

Moreover, the optical/photometric methods segment is poised to exhibit the fastest CAGR over the forecast period. This growth is driven by the increasing demand for non-invasive, rapid and point-of-care hematocrit measurement. Recent studies reported that optical techniques such as diffuse reflectance spectroscopy and RGB-imaging can estimate hematocrit with high accuracy and without the need for traditional centrifugation. The lower cost, reduced sample volume, and alignment with decentralized healthcare delivery are key drivers. Besides, advances in miniaturised sensors and integrated optical modules are enabling compact hematocrit analyzers suited for small labs and mobile clinics. The optical/photometric segment is therefore becoming a technology-enabled approach for broader hematocrit testing adoption across regions, fueling market growth.

Sample Insights

In terms of sample, the whole blood segment accounted for the largest market share of 76.87% in 2024, driven by the shift toward point-of-care hematology diagnostics. Whole blood is the most clinically relevant sample in emergency, hospital, and mobile settings, allowing for rapid bedside measurements without extensive pre-processing. According to secondary analysis, POC hematology testing is rapidly expanding, driven by the need for quick, accurate results in resource-constrained and decentralized settings. In addition, technological advancements in whole-blood analyzers, such as the incorporation of microfluidics, improved sensors, and more advanced data analysis, are making devices more compact, faster, and easier to use, thereby accelerating their adoption. Clinical protocols are increasingly favoring minimal-preparation testing to reduce turnaround times, sample degradation, and patient discomfort, reinforcing the use of whole-blood tests for hematocrit measurement.

The capillary blood segment is projected to grow at the fastest CAGR during the forecast period, driven by the rising need for minimally invasive point-of-care testing, especially in remote, pediatric, and home-care settings. Capillary sampling requires only a finger prick, enabling easier, faster collection compared to venous draws, a key advantage for neonatal screening, community outreach, and decentralized diagnostics. According to recent studies from PubMed Central, Trajan Scientific Australia Pty Ltd., and Taylor and Francis Group, the novel microsampling approaches using capillary blood allow stable, accurate biomarker measurement with reduced sample volume and enhanced convenience. In addition, capillary microsampling eliminates several logistical challenges, such as reducing the need for cold chain transport, minimizing biohazard risk, and lowering costs associated with venous collection. Advances in capillary-based optical hematocrit analyzers (compact, microfluidic, and digital readout) are also fueling adoption, supporting the growth of this segment across point-of-care and decentralized testing markets.

Application Insights

Based on application, the anemia screening & diagnosis segment accounted for the largest market share of 44.64% in 2024. This is due to the rising global burden of nutritional deficiencies, an increase in maternal anemia cases, and widespread adoption of routine hemoglobin and hematocrit assessments across primary healthcare systems. In 2025 joint call by the WHO, UNICEF, and SAARC urged governments to take immediate, coordinated action in South Asia, the region with the highest global burden of anemia among girls and women. According to the organizations, anemia affects nearly half of all adolescent girls and women in South Asia, and if no action is taken soon, 18 million more women and girls may become anemic by 2030, adding to the current 259 million. This rising prevalence has accelerated national-level screening programs and the procurement of rapid hematocrit testing solutions, thereby reinforcing the global market dominance of the anemia screening and diagnosis segment.

Furthermore, blood loss monitoring (trauma, surgery) is poised to be the fastest-growing segment during the forecast period, driven by the rising global burden of traumatic injuries, increased volumes of major and emergency surgeries, and the critical need for rapid measurement to guide transfusion and fluid-resuscitation decisions. Several recent clinical studies emphasize the importance of accurately assessing blood loss. The 2024 WSES-AAST consensus paper emphasized the importance of structured strategies for preventing blood loss and reducing unnecessary transfusions in emergency general surgery, highlighting the significance of timely hematocrit monitoring. In 2024, the BMC Surgery cohort study on major abdominal procedures highlighted ongoing challenges in quantifying intraoperative bleeding. Meanwhile, a 2024 BMC literature review outlined limitations in current calculation methods, emphasizing the importance of real-time testing. Additional evidence from 2024-2025 orthopedic fracture surgery and burn surgery, which documents significant hidden and procedure-related blood loss, strengthens the demand for fast, point-of-care hematocrit analyzers in perioperative and trauma settings around the world.

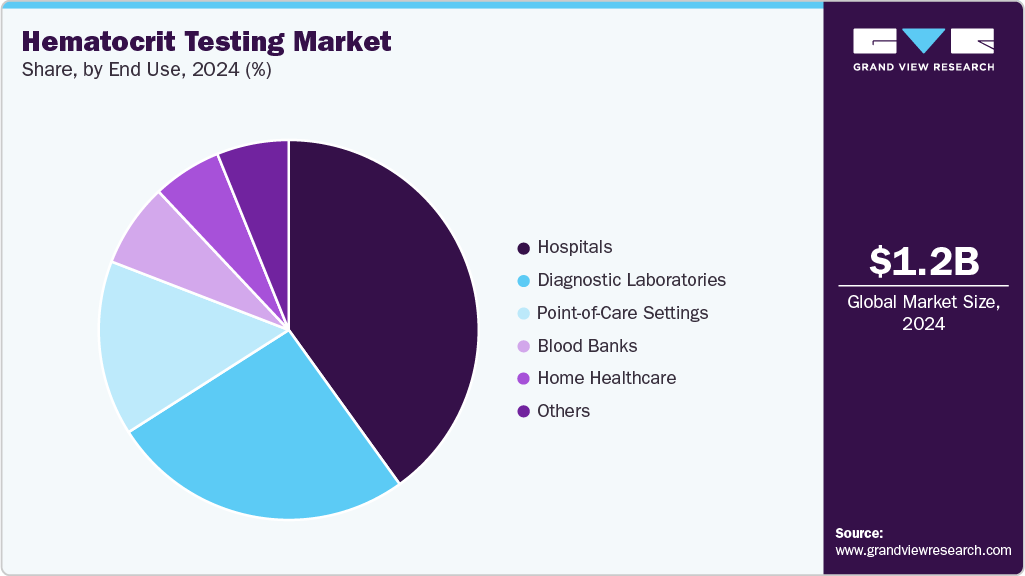

End Use Insights

Hospitals dominated the hematocrit testing industry in 2024, accounting for a 40.08% share, driven by the owing to the increased volumes of trauma and surgical cases requiring blood-loss monitoring, the burden of chronic diseases managed in inpatient settings, and the growing use of hematocrit as a prognostic indicator in critical care. Automated hematology analyzers are being increasingly installed in hospital labs, enabling high-throughput HCT testing and rapid turnaround. For example, PubMed Central (Health Science Reports) published an observational study in 2025, which found that maintaining a hematocrit above 33% significantly improved hospital and ICU survival outcomes in sepsis patients, emphasizing the importance of HCT measurement in acute care management.

In addition, the point-of-care settings segment is expected to witness the fastest growth during the forecast period, driven by the increasing demand for rapid, on-site hematocrit assessment in emergency departments, ambulatory clinics, and remote healthcare environments. The growing use of portable microhematocrit devices and CLIA-waived analyzers enables clinicians to obtain immediate HCT values for anemia screening, dehydration assessment, and trauma management, eliminating the need for reliance on central laboratories. The growing demand for decentralized diagnostics in rural and resource-limited areas hastens this transition. In addition, advances in handheld POC CBC/HCT technologies, which provide faster turnaround times, lower sample volumes, and higher accuracy, continue to drive adoption in urgent care and mobile health services.

Regional Insights

The hematocrit testing industry in North America held the largest share of 33.65% in 2024, owing to the region's strong presence of major diagnostic manufacturers, advanced laboratory infrastructure, and rapid adoption of automated hematology solutions. Companies such as Abbott, Siemens Healthineers, and Mindray are expanding their hematology portfolios to meet the growing demand for high-throughput, accurate, and integrated hematocrit tests. In the U.S. and Canada, popular products include Abbott's Alinity hq hematology system, which is known for its automated CBC and HCT precision; Siemens Healthineers' ADVIA 2120i and Mindray's BC-700 series, which were recently launched to support CBC + ESR testing, are also gaining traction in hospital and physician office labs. This robust product ecosystem helps to maintain North America's leadership in hematocrit testing.

U.S. Hematocrit Testing Market Trends

The U.S. hematocrit testing industry is expanding steadily, driven by increasing demand for decentralized and patient-friendly blood diagnostics, the rising prevalence of anemia and chronic conditions that require routine hematocrit monitoring, including chronic kidney disease and oncology patients, as well as the rapid adoption of point-of-care and pharmacy-based testing. In December 2024, Becton, Dickinson and Company (BD) received FDA 510(k) clearance for its MiniDraw Capillary Blood Collection System, a fingertip-based device that enables minimally invasive capillary blood collection suitable for hemoglobin and hematocrit testing. This innovation expands testing access beyond traditional phlebotomy settings, leading to higher screening rates in retail clinics, urgent care centers, and home-based care settings. The U.S. market continues to grow steadily, owing to increased adoption of compact hematology analyzers and a growing federal focus on improving early anemia detection.

Europe Hematocrit Testing Market Trends

The hematocrit testing industry in Europe is expected to grow steadily over the forecast period, owing to rising anemia prevalence, expanded diagnostic infrastructure, and increased adoption of automated hematology analyzers in countries such as France, Italy, Spain, the Netherlands, and the Nordic region. The increasing demand for preoperative hematocrit screening, particularly in cardiovascular and oncology care, is driving market growth. Southern European countries are reporting higher rates of iron deficiency anemia, which contributes to increased testing volumes. Furthermore, increased investment in point-of-care hematology systems across Scandinavian emergency and primary care networks, combined with favorable national reimbursement frameworks for CBC testing, is driving regional growth.

The UK hematocrit testing industry is expanding rapidly, due to growing awareness of hematocrit's role in cardiovascular risk stratification, increased demand for monitoring drug-induced hematologic effects, and the rise of personalized care pathways. A recent UK Biobank Mendelian randomization study investigated the causal relationships between genetically predicted hematocrit and cardiovascular outcomes, reporting that hematocrit's potential as a useful biomarker in preventive cardiology. Meanwhile, the British Society for Haematology's 2025 guidelines for managing drug-induced immune and secondary hemolytic anemia emphasize the importance of closely monitoring hematocrit levels in patients taking erythropoiesis-stimulating agents or other hematotoxic medications. As drug-induced erythrocytosis (e.g., from testosterone or SGLT-2 inhibitors) becomes more common, systematic reviews have recommended frequent haematocrit testing to manage risks such as thrombosis.

The hematocrit testing industry in Germany is primarily driven by a well-established hematology diagnostics ecosystem, which is supported by robust clinical laboratory networks and widespread use of automated analyzers. The growing demand for routine blood examinations, driven by chronic disease management, pre-surgical assessment, and aging population health programs, underscores the importance of accurate hematocrit measurement. Germany's dominance in IVD manufacturing, particularly in hematology reagents and consumables, fuels market expansion. Favorable reimbursement structures, increased integration of point-of-care testing, and ongoing investments in diagnostic modernization at hospitals and private labs all contribute to the country's strong position in hematocrit testing expansion.

Asia Pacific Hematocrit Testing Market Trends

The hematocrit testing industry in the Asia Pacific is experiencing significant growth, owing to the region’s high burden of anemia, expanding public-health screening programs, rapid urbanization, and increased adoption of point-of-care hematology devices across hospitals and primary care settings. Recent studies from India show that anemia prevalence exceeds 50% among adolescent girls in several districts, reinforcing the need for routine hematocrit evaluation. A 2024 study in the Healthcare Bulletin also emphasizes the rising incidence of hematological disorders in South Asia, further increasing the demand for testing. Meanwhile, PIB 2024 reported that India’s national anemia control efforts under large-scale government initiatives have strengthened systematic screening across schools and community centers. In addition, innovations such as the 2024 blood-test technology developed to enhance the effectiveness of cancer treatment are expanding hematocrit testing applications in oncology and precision medicine, supporting continued market acceleration across the region.

The Japan hematocrit testing industry is primarily driven by rising demand for advanced diagnostic technologies, increasing prevalence of anemia among the aging population, and the growing need for regular hematology monitoring in patients with chronic diseases such as kidney disorders and cancer. In addition, the growth factors include a strong government focus on preventive healthcare and the rapid adoption of automated hematology analyzers in hospitals and diagnostic laboratories. Key companies shaping the market landscape include HORIBA Ltd., Siemens Healthineers, and Abbott, all of which continue to expand their hematology testing portfolios through technological innovation and enhanced clinical workflow solutions.

The hematocrit testing industry in China is rapidly expanding as a result of the country's high anemia burden, which is particularly associated with chronic kidney disease (CKD), as well as the growing demand for routine hematological assessments in hospitals, dialysis centers, and primary care clinics. China has one of the world's largest CKD populations, and anemia affects more than half of non-dialysis CKD patients, highlighting the critical clinical need for regular hematocrit monitoring. In addition, rising cancer cases, an increase in surgical procedures, expanded public health screening programs, and greater availability of hematology analyzers in county-level hospitals are all driving adoption. The increased focus on perioperative blood management and chronic disease monitoring is contributing to the continued growth of hematocrit testing across the country.

Latin America Hematocrit Testing Market Trends

The hematocrit testing industry in Latin America is expanding rapidly, driven by a combination of healthcare modernization and emerging regional priorities. Brazil, Mexico, and Colombia are expanding primary-care screening programs, which now include routine anemia and hematological tests. Factors such as increased emphasis on maternal and child health, with many governments strengthening antenatal screening protocols in response to high anemia prevalence among pregnant women. Furthermore, Latin America is seeing rapid growth in decentralized diagnostics, as public hospitals and rural clinics use compact hematology analyzers to address geographic disparities in care. The expansion of public-private laboratory networks, particularly in urban areas, is also accelerating the adoption of automated hematocrit testing throughout the region.

The Brazil hematocrit testing industry is growing steadily, owing to the rising prevalence of anemia and hematological disorders, increasing demand for routine blood screening in primary care settings, and the expansion of diagnostic services through Brazil’s Unified Health System (SUS). Growth is further fueled by digital-health and smart-hospital initiatives; for instance, Mindray is aggressively promoting its “Device + IT + AI” ecosystem across more than 6,000 institutions in Brazil, integrating laboratory diagnostics with AI-assisted tools to improve accuracy and workflow efficiency. Moreover, innovation in blood-processing technology is contributing to market momentum. Taiwanese biotech firm PuriBlood has entered the Brazilian market through partnerships with ABHH (the Brazilian Association of Hematology, Hemotherapy & Cell Therapy) and Cromo, bringing its real-time leukocyte-reduction filter and high-platelet-recovery technologies advances that can improve the quality of blood products and thereby influence demand for hematology testing.

Middle East & Africa Hematocrit Testing Market Trends

The hematocrit testing industry in the Middle East and Africa is growing steadily, due to rising anemia prevalence, expanded maternal and neonatal healthcare programs, and increased investments in hospital and laboratory infrastructure across the Gulf Cooperation Council (GCC) and Sub-Saharan African countries. Growth is further aided by the implementation of point-of-care hematology testing in rural and remote areas, government-led initiatives aimed at early detection of nutritional deficiencies, and the entry of global diagnostic companies forming partnerships to improve access to hematology analyzers and reagents in emerging markets.

The Saudi Arabia hematocrit testing industry is expanding, driven by the rapid modernization of diagnostic labs and investment in blood-management systems. In December 2024, KFSHRC launched an Advanced Hematology Diagnostics Laboratory, equipped with the region’s largest automated hematology track, AI-powered image analysis, and high-resolution flow cytometry, which is expected to boost the demand for high-accuracy blood testing. Meanwhile, the implementation of GPI Group’s Hematos IIG transfusion information system across 133 Saudi blood banks has strengthened traceability, reduced risk, and improved hemovigilance. Additional favorable factors stem from the increasing adoption of automation and digital systems in immunohematology, supported by government initiatives aimed at ensuring safe and efficient blood transfusion.

Key Hematocrit Testing Company Insights

The market is characterized by several key players driving innovation and adoption. Leading companies include Danaher Corporation (Beckman Coulter, Inc.), Thermo Fisher Scientific, Inc., Siemens Healthineers, and Abbott, among others. These companies are making significant investments in advancing hematology technologies, driving continuous product innovation, expanding their geographic footprints, and forming strategic alliances to strengthen market presence. Their efforts include developing more precise hematocrit measurement systems, enhancing point-of-care testing capabilities, and integrating digital diagnostics to improve accuracy and workflow efficiency. These companies are shaping the competitive landscape through partnerships, acquisitions, and R&D initiatives, accelerating the global adoption of advanced hematocrit testing solutions in hospitals, diagnostic laboratories, and decentralized care settings.

Key Hematocrit Testing Companies:

The following are the leading companies in the hematocrit testing market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher Corporation (Beckman Coulter, Inc.)

- Thermo Fisher Scientific, Inc.

- Siemens Healthineers

- Abbott

- Medline Industries, LP

- Sysmex

- EKF Diagnostics Holdings plc.

- Boule

- Drucker Diagnostics

- HORIBA, Ltd.

- Bio-Rad Laboratories, Inc.

- Mindray

- ACON Laboratories

Recent Developments

-

In November 2025, ACON Laboratories maintained FDA 510(k) clearance (K122553) for its Mission Plus Hb Hemoglobin Testing System, a point-of-care platform designed for quantitative hemoglobin measurement with integrated estimated hematocrit calculation. The system provides quick results, a broad analytical range, and a highly portable format, making it ideal for various clinical and decentralized testing environments. However, because the hematocrit value is algorithm-derived rather than directly measured, users should interpret results accordingly, ensure compliance with local regulatory requirements, and perform appropriate performance validation prior to routine use.

-

In April 2024, Mindray launched its BC-700 Series hematology analyzers, offering integrated CBC and ESR testing for small- to mid-sized labs. The BC-700/720 open-vial and BC-760/780 autoloader models utilize Mindray’s SF Cube 3D analysis technology to deliver more accurate cell differentiation, including improved measurement of RBC parameters essential for hematocrit calculation. Built on the high-end BC-6000 platform, the compact BC-700 Series enhances workflow efficiency while providing reliable hematology outputs, including precise hematocrit reporting within a single streamlined system.

-

In April 2024, HORIBA, Ltd. launched HELO 2.0, a next-generation fully automated hematology platform that improves high-throughput CBC testing, including core parameters like hematocrit. The system, which is CE-IVDR approved and awaiting FDA clearance in the United States, integrates advanced technologies into Yumizen H1500 and H2500 analyzers, including 360-degree sample mixing and improved data, tube, and smear management. HELO 2.0 is designed to optimize pre-, post-, and analytical workflows, with three scalable configurations and track-based automation for continuous loading, automatic QC transfer, and effective hematocrit and CBC workflow management.

Hematocrit Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.33 billion

Revenue forecast in 2033

USD 2.01 billion

Growth rate

CAGR of 5.30% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, sample, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Danaher Corporation (Beckman Coulter, Inc.); Thermo Fisher Scientific, Inc.; Siemens Healthineers; Abbott; Medline Industries, LP; Sysmex; EKF Diagnostics Holdings plc.; Boule; Drucker Diagnostics; HORIBA, Ltd.; Bio-Rad Laboratories, Inc.; Mindray; ACON Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hematocrit Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hematocrit testing market report based on product, technology, sample, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables & Reagents

-

Capillary tubes

-

Reagent bottles

-

Cartridges for POC analyzers

-

-

Instruments

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Centrifugation-Based Testing

-

Conductivity-Based Testing

-

Optical/Photometric Methods

-

Impedance-Based Methods

-

Others

-

-

Sample Outlook (Revenue, USD Million, 2021 - 2033)

-

Whole Blood

-

Capillary Blood

-

Venous Blood

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Anemia Screening & Diagnosis

-

Blood Loss Monitoring (Trauma, Surgery)

-

Polycythemia Screening

-

Chronic Disease Management (kidney disease, cancer)

-

Blood Donation Centers

-

Newborn & Pediatric Testing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Laboratories

-

Point-of-Care Settings

-

Blood Banks

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.