- Home

- »

- Medical Devices

- »

-

Hemodialysis & Peritoneal Dialysis Market Size Report, 2030GVR Report cover

![Hemodialysis And Peritoneal Dialysis Market Size, Share & Trends Report]()

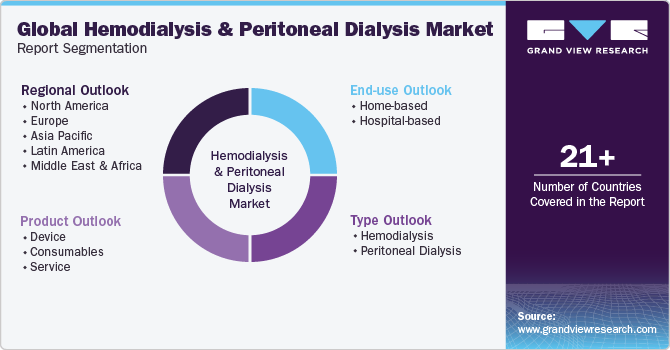

Hemodialysis And Peritoneal Dialysis Market (2024 - 2030) Size, Share & Trends Analysis By Type (Hemodialysis, Peritoneal Dialysis), By Product (Device, Consumables, Service), By End-use (Home-based, Hospital-based), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-771-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hemodialysis And Peritoneal Dialysis Market Summary

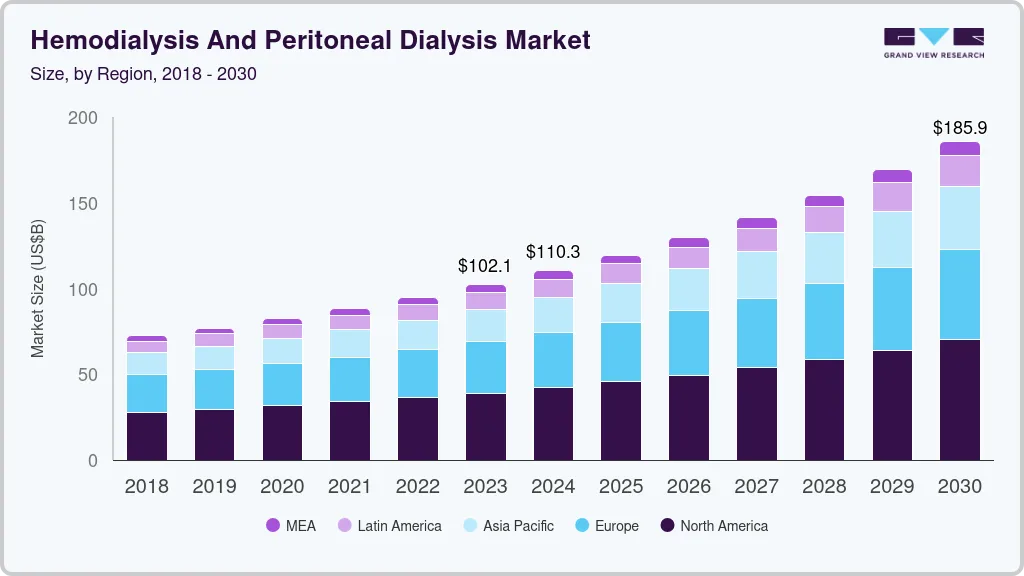

The global hemodialysis and peritoneal dialysis market size was estimated at USD 102.1 billion in 2023 and is projected to reach USD 185.88 billion by 2030, growing at a CAGR of 9.1% from 2024 to 2030. The demand for hemodialysis & peritoneal dialysis is being driven by the scarcity of organ donors, rising incidence of acute kidney injury (AKI), risks involved with transplants, advancements in technology, and initiatives by leading players to introduce advanced products and services.

Key Market Trends & Insights

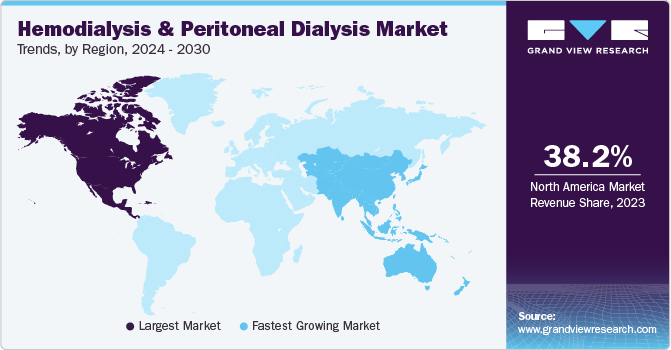

- North America dominated the hemodialysis and peritoneal dialysis industry with the largest revenue share of 38.25% in 2023.

- The Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

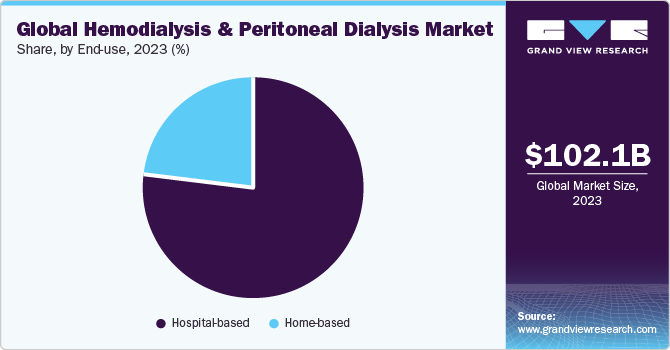

- Based on end-use, the hospital-based segment dominated the market with a revenue share of 76.75% in 2023.

- Based on product, the service segment dominated the market with a revenue share of 56.61% in 2023.

- Based on type, the hemodialysis segment dominated the market with the largest revenue share of 82.71% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 102.1 Billion

- 2030 Projected Market Size: USD 185.88 Billion

- CAGR (2024-2030): 9.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Any condition with reduced kidney function leads to chronic kidney disease, which may develop into End-Stage Renal Disease (ESRD) over a period. An increase in prevalence of CKD is expected to boost demand for dialysis products.

For instance, according to the CDC’s 2023 report, CKD affects about 35.5 million people in the U.S. each year. For instance, as per the reports of National Institute of Diabetes and Digestive and Kidney Diseases in 2022, 25,499 individuals in the U.S. underwent kidney transplants.

Renal disease and renal failure are becoming more common among the population due to an increasing incidence of diabetes and hypertension. A prominent effect of both type 1 and type 2 diabetes is diabetic nephropathy, which is caused by damage to the kidney's blood artery clusters that aid in the body's waste removal process and ultimately lead to renal impairment. For example, the 10th edition of the International Diabetes Federation's 2022 statistics stated that 5,141.3 thousand individuals in Spain had diabetes in 2021. In addition, as per the American Kidney Fund, Inc., in the U.S., more than 562,000 people receive dialysis. Over 245,000 Americans currently have kidney transplants. This, in turn, is anticipated to boost market growth soon.

Moreover, in past few years, requirement for dialysis has increased. For instance, FDA data indicates that approximately 10,000 children in the U.S. get acute AKI. The survival rate for these kids is between 38% and 43%. Neonates with AKI have a 60% fatality rate. Critically sick newborns and infants frequently have fluid overload, particularly following procedures like heart surgery. These factors are probably going to fuel the need for newborn hemodialysis, which will fuel market expansion.

The increase in incidence of diabetes due to aging, obesity, and an unhealthy lifestyle is one of the factors contributing to the growth of the market. Diabetes is also becoming increasingly prevalent globally. For instance, according to statistics collected by the Endocrine Society, approximately 33% of persons over the age of 65 were considered to have diabetes in January 2022. The International Diabetes Federation also reported that the prevalence of diabetes is increasing globally, with the highest increases seen in low- and middle-income countries.

The market is primarily driven by the rise in geriatric population. For instance, as per the reports of the World Health Organization, around 80% of elderly people by 2050 will reside in nations with low or middle income. In addition, it is anticipated that the number of people 80 years of age or older will be around 426 million by 2050. Therefore, with the constant increase in geriatric population, increase in short- and long-term healthcare needs will drive market growth at a global level.

End-use Insights

In terms of end-use, the market is segmented into home-based and hospital based. In 2023, the hospital-based segment dominated the market with a revenue share of 76.75%. The segmental dominance is likely to continue to be robust in the coming years because of the significant availability of highly qualified and experienced healthcare personnel in the hospitals. The presence of a professional and experienced renal care team ensures optimal treatment and enhanced dialysis results in healthcare settings such as dialysis centers and hospitals. In addition, the growing focus of players on building independent dialysis centers, and high adoption of patients for treatment in in-center dialysis are some of the factors projected to drive segment growth. Moreover, companies are focusing on the development of customized hemodialysis machines with a variety of interventions. This is likely to influence the end-user experience.

However, the home-based segment is projected to grow at the fastest CAGR over the forecast period. The adoption rate of home dialysis is expected to increase in the years ahead due to its many benefits, which include improved quality of life, reduced travel expenses, flexibility, and simpler patient mobility. Similarly, a rise in the older population's preference for home dialysis therapy due to a variety of renal dysfunctions may enhance segment income even further. More patients are preferring this type of dialysis to preserve their independence and high functional status due to the development of smaller, nightstand-sized dialysis machines, as well as simpler blood tubing and dialyzer connections.

Product Insights

Based on product, the market is categorized into devices, consumables, and service segments. In 2023, the service segment dominated the market with a revenue share of 56.61%. This dominant share is attributed both to the prevalence of ESRD and the increased number of dialysis service providers. Segment growth is anticipated to be aided by the opening and acquisition of new dialysis centers by a number of major dialysis service providers, who are aiming to broaden their service offerings globally. The market is anticipated to grow even more as a result of technological developments and initiatives from different manufacturers. For instance, in February 2021, DaVita incorporated secured telehealth technology, DaVita Care Connect, into its home dialysis sector. It was one of the many connective technologies in its suite of services aimed at improving treatment and outcomes for patients who choose to treat themselves at home.

However, the consumables segment is anticipated to witness the fastest CAGR over the forecast period. Over the projection period, the segment expansion is anticipated to be fueled by significant investments made by the governments to improve patient safety, patient-centered treatment, and efficacy. Catheters constructed of advanced materials resistant to chemicals including alcohol, iodine, and peroxides are being produced by companies. This can lessen the likelihood of a catheter malfunction and help it last longer. Moreover, there is a growing need for catheters coated with antimicrobial agents to reduce the incidence of bloodstream infections. Comparably, the expansion of the consumable market is positively impacted by novel dialyzer production technologies, such as enhanced surface contact and cutoff membrane dialyzers for better diffusion. The market for consumables has been further divided into categories such as catheters, concentrates, bloodlines, and others.

Regional Insights

North America dominated the hemodialysis and peritoneal dialysis industry with the largest revenue share of 38.25% in 2023. Important players in the industry, significant government funding for the creation of cutting-edge medical equipment, and a fair reimbursement environment all contribute to the region's market expansion. Dialysis is becoming more and more necessary as the prevalence of kidney failures and chronic kidney diseases (CKD) rises. A few key factors driving the market expansion are rising healthcare costs, government efforts, and increased disposable income. Also, increasing incidences of diabetes and obesity lead to kidney disorders, which boosts industry growth. For instance, the 2022 National Diabetes Statistics Report was recently made available by the Centers for Disease Control and Prevention. According to this study, there are more than 130 million people in the U.S. who have diabetes or prediabetes.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. Growing rates of renal failure, aging population, and increased research and development of cutting-edge technologies are anticipated to fuel market expansion throughout the projected period. In addition, according to the IDF, there are already 88 million adults in Southeast Asia who have diabetes, and by 2045, that figure is predicted to rise to 153 million. In addition, a few other factors driving market expansion are expanding government initiatives, CKD awareness programs, technologically advanced products, and the availability of recently built, modern healthcare facilities in the area.

Type Insights

Based on type, the market is categorized into hemodialysis and peritoneal dialysis segments. In 2023, the hemodialysis segment dominated the market with the largest revenue share of 82.71% and it is expected to grow at the fastest CAGR over the forecast period. In addition, the hemodialysis segment is further fragmented into conventional, short daily hemodialysis, nocturnal hemodialysis.

The peritoneal dialysis segment is further sub-segmented into Continuous Ambulatory Peritoneal Dialysis (CAPD) and Ambulatory Peritoneal Dialysis (APD). The segment is growing due to several important factors, including an increase in the number of patients with end-stage renal disease (ESRD), rise in the elderly population with kidney illnesses, and increase in the incidence of diabetes and hypertension. According to a report released by WHO in March 2023, approximately 1.28 billion people worldwide suffer from hypertension. Consequently, the increasing number of patients suffering from associated diseases is expected to surge the demand for hemodialysis.

Hemodialysis is the process of eliminating excess and waste fluids and substances from the body through the use of a hemodialyzer. When the blood flows through the filter, it comes into contact with dialysate, which is identical to body fluid but contains pollutants. This kind of dialysis is more complex than others, with tight guidelines for treatment and limited options for patients' time, movement, and mode of transportation. A dialysis catheter, an AV fistula, or an AV graft in the arm or groin are examples of vascular access that must be established and maintained to obtain the high blood flow necessary for dialysis.

Key Companies & Market Share Insights

The key players are focusing on growth strategies, such as new product launches, regulatory approvals, expansion, collaborations, acquisitions, partnerships. Moreover, the industry key players are also involved in enhancing the R&D for hemodialysis. For instance, in April 2023, with its Tablo Hemodialysis System, Outset Medical, Inc. decided to lower the cost and complexity of dialysis. At the National Kidney Foundation Spring Clinical Meetings, the company will be presenting five new abstracts that offer promising findings on the clinical and economic advantages of home hemodialysis (HHD), gender biases against female nephrologists, and other relevant topics related to kidney disease. Thus, due to such initiatives the demand for hemodialysis & peritoneal dialysis products will increase in the near future.

Key Hemodialysis And Peritoneal Dialysis Companies:

- Baxter

- B. Braun SE

- Fresenius Medical Care AG

- Medtronic

- Asahi Kasei Medical Co., Ltd.

- Nipro Corp.

- DaVita

- BD

- Nikkiso Co., Ltd.

- Cantel Medical

Hemodialysis And Peritoneal Dialysis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 110.28 billion

Revenue forecast in 2030

USD 185.88 billion

Growth rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 203

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Baxter; B. Braun SE; Fresenius Medical Care AG; Medtronic; Asahi Kasei Medical Co., Ltd.; Nipro Corp.; DaVita; BD; Nikkiso Co., Ltd.; Cantel Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hemodialysis And Peritoneal Dialysis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hemodialysis and peritoneal dialysis market report based on type, product, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemodialysis

-

Conventional hemodialysis

-

Short daily hemodialysis

-

Nocturnal hemodialysis

-

-

Peritoneal dialysis

-

Continuous Ambulatory Peritoneal Dialysis (CAPD)

-

Automated Peritoneal Dialysis (APD)

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Device

-

Machine

-

Dialyzer

-

Water treatment system

-

Others

-

-

Consumables

-

Bloodline

-

Concentrates

-

Catheters

-

Others

-

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home-based

-

Hospital-based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hemodialysis and peritoneal dialysis market size was estimated at USD 102.07 billion in 2023 and is expected to reach USD 110.28 billion in 2024.

b. The global hemodialysis and peritoneal dialysis market is expected to witness a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 185.88 billion by 2030.

b. North America held the largest share of 38.25% in 2023 due to the presence of a large number of dialysis centers and the introduction of technologically advanced products by the key players in the region.

b. Some key players operating in the hemodialysis and peritoneal dialysis market include Baxter, B. Braun Melsungen AG, Fresenius Medical Care AG, Medtronic, Asahi Kasei Medical Co., Ltd., Nipro Corp., DaVita, BD, Nikkiso Co., Ltd., and Cantel Medical.

b. Increasing incidence of chronic kidney disease, the availability of advanced dialysis, machines disposables and replacement fluids, and rising government initiatives to increase the accessibility of dialysis treatment and growing adoption of home hemodialysis are expected to drive market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.