- Home

- »

- Pharmaceuticals

- »

-

Herpes Simplex Virus Treatment Market Size Report, 2030GVR Report cover

![Herpes Simplex Virus Treatment Market Size, Share & Trends Report]()

Herpes Simplex Virus Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (HSV-1, HSV-2), By Drug (Acyclovir, Valacyclovir, Famciclovir), By Vaccine (Simplirix, Others), By Route of Administration, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-983-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Herpes Simplex Virus Treatment Market Summary

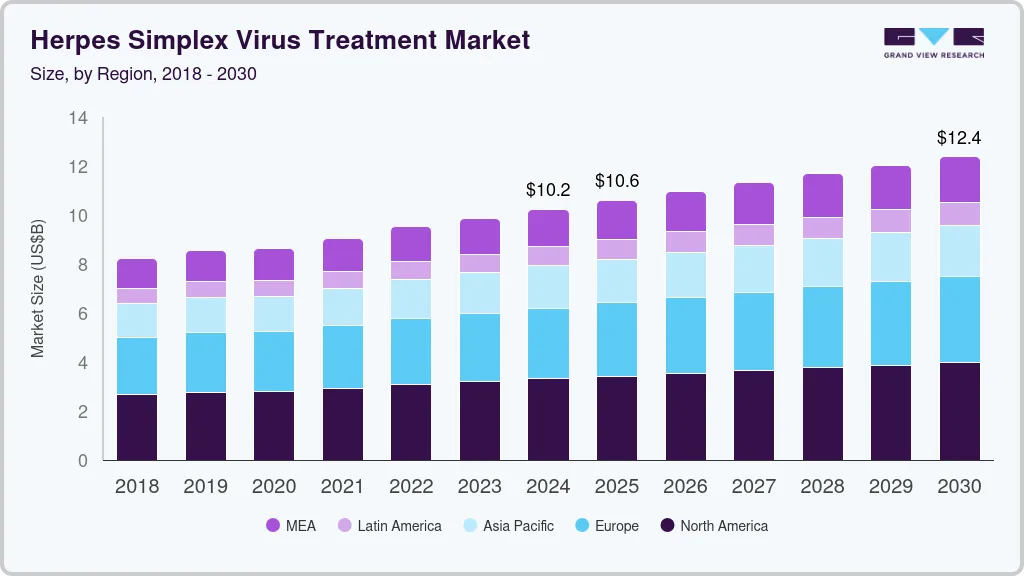

The global herpes simplex virus treatment market size was estimated at USD 2.47 billion in 2023 and is projected to reach USD 4.08 billion by 2030, growing at a CAGR of 8.1% from 2024 to 2030. The market growth can be attributed to the growing concerns over herpes simplex virus (HSV) infection, including oral and genital herpes.

Key Market Trends & Insights

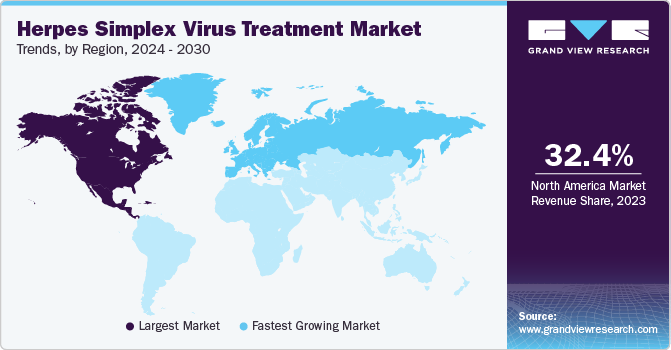

- North America accounted for the largest market share of 32.35% in 2023.

- The U.S. accounts for a substantial share of the market.

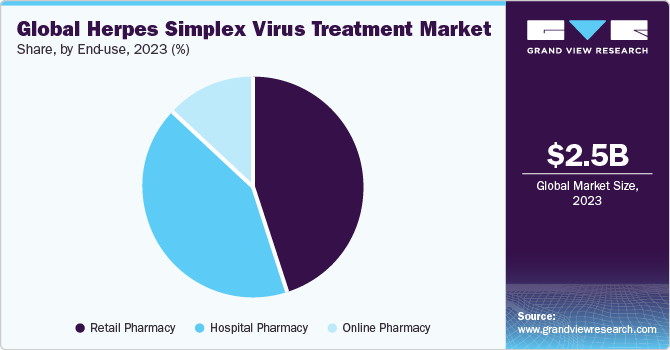

- By end-use, the retail pharmacy segment accounted for the largest market revenue share of over 45.15% in 2023.

- By type, the Herpes Simplex Virus-1 (HSV-1) segment accounted for the largest market revenue share of 83.73% in 2023.

- By drug, the valacyclovir drug segment accounted for the largest market revenue share of 39.28% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.47 Billion

- 2030 Projected Market Size: USD 4.08 Billion

- CAGR (2024-2030): 8.1%

- North America: Largest market in 2023

- Europe: Fastest growing market

Moreover, the infection is highly contagious that can spread via saliva, vaginal secretion, or semen, and is acquired unknowingly. These factors highlight the increasing need for treatment throughout the projected period.

The prevalence of herpes simplex virus (HSV) infection is on the rise. According to an estimate from WHO, as of April 2023 approximately 3.7 billion people under age 50, which account for 67% of the population, are living with HSV-1 infection and an estimated 491 million people between ages 15 and 49 years are living with HSV-2 infection. Such a high number of HSV cases will require adequate therapeutic management.

The efforts to develop novel treatment regimens, such as gene therapy & mRNA therapeutics are expected to provide lucrative growth opportunities in market during the forecasted period. For instance, in September 2022, researchers from the Fred Hutchinson Cancer Center found a potential cure for herpes simplex using gene therapy. The scientists showed that the experimental gene therapy for herpes kicked off the latent infections in experimental animals and suppressed the transmission rates into other animals.

The increase in government funding for promoting research in HSV infection space is anticipated to drive the market growth during the forecast period. HSV is a kind of STD with limited treatment approaches; hence, governments, public & private organizations, and nonprofit organizations are granting funds to boost research activities to develop novel therapeutic approaches in HSV and other sexually transmitted diseases.

For instance, in August 2022, Rational Vaccines announced clinical trial results of RVx-001-PSS with 200 patients indicated for recurrent HSV-2 infection. Similarly, in June 2022, Virios Therapeutics' pilot study, in collaboration with the University of Alabama, showed a correlation between active herpes simplex virus type 1 infection in gastric mucosa and functional gastrointestinal disorders. It underscores the potential efficacy of combination antiviral therapies, such as IMC-1, in addressing chronic illnesses like fibromyalgia and irritable bowel syndrome.

End-use Insights

The retail pharmacy segment accounted for the largest market revenue share of over 45.15% in 2023. The segment dominance is due to the easy accessibility of over-the-counter products for herpes treatment. Furthermore, patients counseling regarding treatment options for common symptoms like cold sores is provided at these pharmacies, thereby providing a unique advantage to the segment. The experience and physical presence of a pharmacist and proximity of these pharmacies give the segment a competitive edge over online pharmacies. Moreover, accessing Rx & OTC products for gastrointestinal diseases and infections is easy at these pharmacies, as there is no time lag and treatment access is immediate.

Online pharmacies are expected to grow at a lucrative rate over the forecast period as rapid adoption of online pharmacies is reported in Germany, Italy, and Spain. It is due to improved access to the internet and increased awareness about OTC products. Furthermore, COVID-19 has affected the segment positively, driving the market at an exponential rate, which can be attributed to restrictions on movement of people. However, with the COVID-19 situation de-escalating in most regions, online pharmacies are experiencing a decline in sales. E-prescriptions are attributed to segment growth, and as the trend grows, it will potentially improve the online pharmacy scenario.

Regional Insights

North America accounted for the largest market share of 32.35% in 2023, which can be attributed to higher consumption of branded herpes drugs, escalating healthcare expenditure, increasing launch of generics, and favorable reimbursement policies. Key players are trying to gain more market share through various strategic initiatives. In addition, players in the U.S. are leveraging their commercialization abilities to improve their profit margins. Thus, the U.S. accounts for a substantial share of the market. Moreover, in August 2022, U.S.-based Rational Vaccines Inc. announced the launch of a recurrent HSV-2 infection observational clinical trial with 200 patients for its product RVx-001-PSS.

Europe market is expected to grow at the fastest CAGR during the forecast period. Regional players are developing effective and economical treatment therapeutics to address the increasing prevalence and growing need for herpes treatment therapeutics, fueling market growth in the region. The presence of key market players in Germany, increasing focus on geographic expansion, and launch of new products are among the factors driving the market in Germany.

Market Dynamics

In the current scenario, leading market participants are developing live-attenuated vaccines, subunit vaccines, replication defective viral vaccines, DNA vaccines, and mRNA vaccines. For instance, gD2 subunit vaccine is a potential HSV candidate from GSK plc in phase II of its trial, and HSV529 is a replication-defective viral vaccine of Sanofi in phase I of its trial. Furthermore, GSK3943104A+ Therapeutic HSV is a novel vaccine candidate of GSK in phase I, investigated for active immunization to suppress genital herpes recurrence in adults aged 18 and older. Thus, several advanced approaches by biopharmaceutical companies are facilitating market expansion.

Rising health expenditures and government support to boost the increasing demand for effective therapeutics are encouraging companies to develop innovative and novel medicines globally. For instance, In December 2022, BioNtech SE dosed the first patient with its herpes vaccine candidate, BNT163. The vaccine was planned to be used for to prevent HSV-1 and HSV-2 infection after approval.

The commercial unavailability of a vaccine against HSV is hampering the global herpes simplex virus treatment market. There is no approved treatment for HSV infection, but some antiviral agents are used in symptomatic disease treatment to avoid further complications. Despite being one of the leading infectious disease, there is no approved vaccine for HSV because the herpes virus is more evasive and complicated than other such infections. So, developing a vaccine for this condition has is still a challenge.

Type Insights

The Herpes Simplex Virus-1 (HSV-1) segment accounted for the largest market revenue share of 83.73% in 2023 and is estimated to be the fastest-growing segment over the forecast period. The segment dominance is attributed to the increasing prevalence of HSV-1 infection among population. According to the WHO 2022 report, nearly 3.7 billion individuals worldwide under 50 years (67%) have HSV-1 infection. Most HSV-1 infections are acquired during childhood. Moreover, the market is driven by the increasing risk associated with the transmission of HSV-1. The infection may transmit via contact with virus through saliva, sores, or even through genital area through oral-genital contact.

Famciclovir and valacyclovir have higher prescription rates than acyclovir due to their greater oral bioavailability and lower dose frequency. Moreover, adjuvant therapy is given to patients with severe infections, such as herpetic gingivostomatitis; these patients often require either oral or topical analgesics. For short-term pain relief, physicians prescribe viscous lidocaine or topical benzocaine along with antiviral treatment, while in case of odynophagia, intravenous rehydration may be prescribed.

The Herpes Simplex Virus-2 (HSV-2) treatment segment is expected to grow at a significant CAGR over the forecast period. High disease prevalence and infection recurrence rates are expected to boost segment growth. According to WHO, approximately 491 million individuals aged between 15 and 49 (13%) across the globe have HSV-2 infection. Due to biological anatomy, women are more prone to HSV infection than men. In addition, according to an NCBI study, recurrent genital herpes has been reported in approximately 80% of individuals, followed by primary genital HSV-2 infection, whereas it is 50% in the case of HSV-1 infection. The recurrence ability of infection leads to long-term treatment, further supporting the segment's growth.

Drug Insights

The valacyclovir drug segment accounted for the largest market revenue share of 39.28% in 2023. The drug is cost-effective, readily available, and effective in blocking the herpes virus from reproducing in the body, thereby helping to control the symptoms of a herpes outbreak. Moreover, valacyclovir is most widely used for cold sores due to its higher absorption rate, as acyclovir is easily broken down by the liver when consumed orally. Furthermore, the drug’s high market penetration is due to the robust availability of its generic players across the globe, which is anticipated to fuel market growth over the coming years.

The Acyclovir drug segment is expected to show the fastest growth over the forecast period owing to the acceptance of acyclovir as gold standard for herpes infection treatment. Frequent approvals and new product launches are supporting market growth of acyclovir. For instance, in November 2020, Amneal Pharmaceuticals, Inc. received ANDA approval from the U.S. FDA for its Acyclovir Cream, 5%. This cream is the generic version of Zovirax used to treat reoccurring herpes labialis (cold sores) in immunodeficient adults and adolescents 12 years and older. Similarly, recently, Avet Pharmaceuticals, Inc. launched acyclovir capsules, the AB-rated generic equivalent to the antiviral Zovirax, to treat genital herpes.

Vaccine Insights

The urgent demand for an HSV cure drives leading players to focus on vaccine development, with forecasts suggesting a global market entry by 2030. The mRNA technology breakthrough offers a lucrative avenue, promising to outperform conventional vaccines. The UK's fast-track grant for RVx-201 positions it for an early launch in major markets. Accelerated vaccine development, urged by the COVID-19 pandemic, strengthens the market's call for a prophylactic/therapeutic solution. Leading the charge, Rational Vaccines boasts a robust pipeline, featuring RVx-2001 and RVx-1001 as prophylactic vaccines, alongside RVx-201, the first-in-human live-attenuated therapeutic vaccine, set to launch by 2026 after securing ILAP designation and MHRA Innovation Passport in July 2022.

Moreover, vaccine development procedures have enhanced during the COVID-19 pandemic, further accelerating the demand for a prophylactic/therapeutic vaccine for HSV. In July 2022, Rational Vaccines' RVx201 received ILAP (Innovative Licensing and Access Pathway) designation and MHRA Innovation Passport. RVx201 is the first-in-human modified HSV type 2 live-attenuated therapeutic vaccine. This vaccine is entering phase 1 and is expected to launch by 2026 due to its fast-track designation.

Route of Administration Insights

The oral segment accounted for the largest market revenue share of 48.05% in 2023. The segment growth can be attributed to the effectiveness and ease of administration. Acyclovir, valacyclovir, and famciclovir are available as an oral formulation. Moreover, studies have shown that oral intake of acyclovir reduces the average duration of pain caused by cold sore by about 36% compared to placebo. The healing time with oral acyclovir is 27% faster than alternative formulations. Furthermore, oral formulations provide quick action, increasing its acceptance within population pool.

Topical segment is expected to show fastest growth over the forecast period. Acyclovir and penciclovir are available as topical formulations in form of cream. Tropical products, such as Abreva 10% docosanol cream, are among the highly prescribed topical drugs with a high adoption rate. It is the only U.S. FDA-approved antiviral drug for treatment of cold sores but not approved for treatment of genital herpes. However, for genital herpes, topical products, such as FemiClear and 1% hydrocortisone cream, have high market penetration. The wide availability of all these OTC products in the market is expected to fuel segment growth.

Key Companies & Market Share Insights

The market's leading companies are concentrating on joint ventures, strategic alliances, and regional expansion in emerging and developed regions.

-

In October 2023, Gilead Sciences and Assembly Biosciences entered a 12-year partnership for antiviral therapies, focusing on herpesviruses, hepatitis B, and hepatitis D.

-

In October 2023, Rational Vaccines received $2.8 million in NIH grants for HSV research, including a new diagnostic test, live-attenuated HSV-1 strain for ocular herpes, and development of a prophylactic and therapeutic vaccine.

-

In July 2022, Eurocine Vaccines AB collaborated with Redbiotec AG for development of an HSV-2 vaccine. As per the deal, Redbiotec was entrusted to receive royalties on Eurocine's net sales of an approved HSV-2 vaccine.

Key Herpes Simplex Virus Treatment Companies:

- GSK plc

- Emcure Pharmaceuticals Ltd.

- Carlsbad Tech

- Glenmark Pharmaceuticals Inc.

- Viatris, Inc.

- Fresenius Kabi AG

- Teva Pharmaceuticals Industries Ltd.

- Apotex Inc.

- Sanofi

- Novartis AG

Herpes Simplex Virus Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.56 billion

Revenue forecast in 2030

USD 4.08 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type,drug, vaccine, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Norway, Denmark; Sweden; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GSK plc; Carlsbad Tech; Emcure Pharmaceuticals Ltd.; Glenmark Pharmaceuticals Inc.; Fresenius Kabi AG; Apotex, Inc.; Viatris, Inc.; Teva Pharmaceuticals Industries Ltd.; Sanofi; Novartis AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Herpes Simplex Virus Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global herpes simplex virus treatment market report based on type, drug, vaccine, route of administration, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Herpes Simplex Virus-1 (HSV-1)

-

Herpes simplex virus-2 (HSV-2)

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Acyclovir

-

Valacyclovir

-

Famciclovir

-

Other Drugs

-

-

Vaccine Outlook (Revenue, USD Million, 2018 - 2030)

-

Simplirix

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global herpes simplex virus treatment market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 4.08 billion by 2030.

b. Herpes Simplex Virus-1 (HSV-1) dominated the herpes simplex virus treatment market with a share of 83.73% in 2023. This is attributable to increasing prevalence of HSV-1 infection among population. For instance, according to WHO , an estimated 3.7 billion of total population above the age of 50 years are living with HSV-1 infection.

b. The global herpes simplex virus treatment market size was estimated at USD 2.47 billion in 2023 and is expected to reach USD 2.56 billion in 2024.

b. Some key players operating in the herpes simplex virus treatment market include Key companies profiled GSK plc, Carlsbad Tech, Emcure Pharmaceuticals Ltd., Glenmark Pharmaceuticals Inc., Fresenius Kabi AG, Apotex Inc., Viatris Inc., Teva Pharmaceuticals Industries Ltd., Sanofi, Novartis AG

b. Key factors that are driving the market growth include growing burden of herpes simplex virus infection, including oral herpes & genital herpes and development of novel treatment options. The promising pipeline of vaccines is expected to act as a driver in upcoming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.