- Home

- »

- Medical Devices

- »

-

High Level Disinfection Services Market Size Report, 2030GVR Report cover

![High Level Disinfection Services Market Size, Share & Trends Report]()

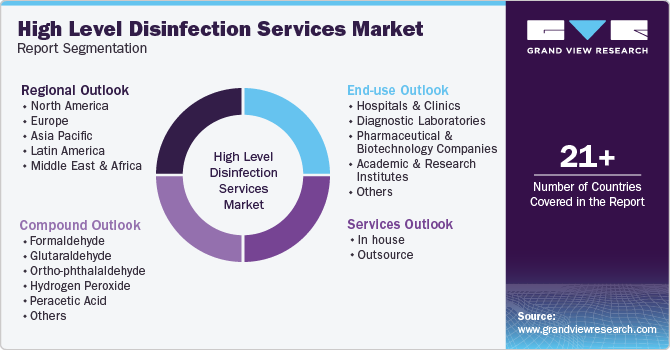

High Level Disinfection Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (In house, Outsource), By Compound (Glutaraldehyde, Ortho-phthalaldehyde), By End Use (Hospital & Clinics, Diagnostic Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-372-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Level Disinfection Services Market Summary

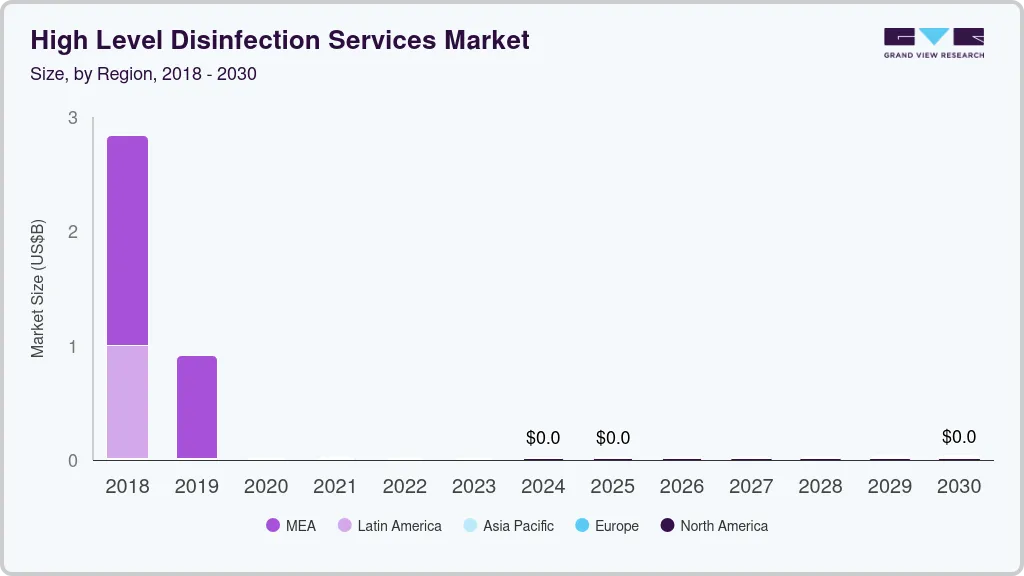

The global high level disinfection services market size was estimated at USD 27.51 billion in 2024 and is projected to reach USD 42.12 billion by 2030, growing at a CAGR of 7.39% from 2025 to 2030.The demand for high-level disinfection services is increasing owing to the surge in Hospital-acquired Infections (HAIs), rising incidence of infectious diseases, and growing number of surgical procedures across the globe.

Key Market Trends & Insights

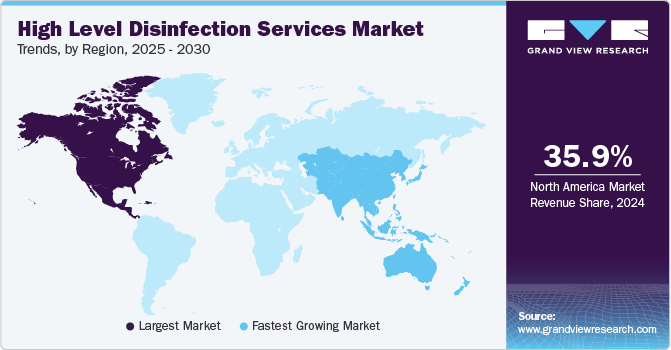

- North America high level disinfection services market accounted for revenue of 35.96% of the global market and is projected to maintain its dominance throughout the forecast period.

- The high-level disinfection services market in the U.S. is expected to dominate the North American market over the forecast period.

- Based on services, the outsource segment dominated the market with the highest revenue share in 2024.

- Based on compound, the glutaraldehyde segment dominated the market and held the largest revenue share of 22.68% in 2024.

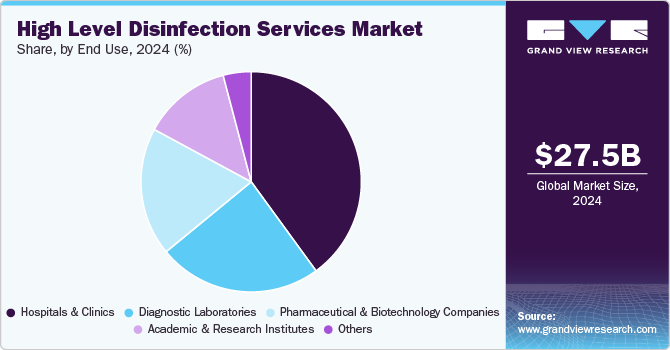

- Based on end-use, the hospitals and clinics segment dominated the market and held the largest revenue share of 39.99% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.51 Billion

- 2030 Projected Market Size: USD 42.12 Billion

- CAGR (2025-2030): 7.39%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

For instance, the data published by the Centers for Disease Control and Prevention (CDC) in November 2024 estimated that 1 in every 31 patients admitted to hospitals has an HAI on any given day. Thus, the increasing burden of HAIs propels the demand for high-level disinfection services.

A variety of causes, including a lack of proper hygiene in healthcare facilities, the use of high level disinfection services, and an overuse of antibiotics, might surge susceptibility to HAIs. These types of diseases may often lead to central line-related bloodstream infections, surgical site infections, Urinary Tract Infections (UAIs) associated with high level disinfection services, ventilator, and hospital-acquired pneumonia, and infections associated with Clostridium difficile.

The most common HAIs are:

-

Methicillin-resistant Staphylococcus aureus (MRSA)

-

Central line-associated bloodstream infections

-

Clostridium difficile

-

Vancomycin-resistant Enterococci bloodstream infections

-

Surgical site infections (SSIs)

An increase in the prevalence of HAIs due to a lack of sanitation and preventive measures is a major factor expected to propel the market growth for high-level disinfection services over the forecast period. A report published by the CDC in November 2024, using data from the National Healthcare Safety Network (NHSN) and the Emerging Infections Program Healthcare-Associated Infections - Community Interface (EIP HAIC), highlighted an 8% increase in surgical site infections following abdominal hysterectomy compared to 2022 standardized infection ratios.

The rising prevalence of chronic diseases such as diabetes, cancer, and other autoimmune diseases is expected to drive demand for high-level disinfectant services. The data published by the Global Alliance for Chronic Diseases in March 2024 reports that chronic diseases kill 41 million people each year, equivalent to 71% of all deaths globally. Healthcare facilities must enhance infection control, ensure the sterility of medical equipment, and maintain hygiene standards to manage long-term patient care during chronic disease treatments. Thus, such a high burden of chronic diseases, leading to increased hospitalizations, is anticipated to propel the demand for disinfection services in the coming years.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace is accelerating. The high level disinfection services market is characterized by growth owing to the rising number of surgical procedures and increasing prevalence of HAIs, along with the increasing burden of chronic diseases.

Industry players and researchers are actively pursuing innovative technologies and products for high-level disinfection. For example, in April 2023, a high-level disinfection system developed and tested at University Hospitals for disinfecting personal protective equipment was accepted into the 2023 Homeland Security Startup Studio (HSSS). This system utilizes a modified atomic oxygen (or oxygen free radicals) method for disinfection, providing quick and effective results without chemicals, thus minimizing the risk of infection transmission. The embrace of such advanced technologies by healthcare facilities and startups is expected to drive market growth.

Regulatory agencies such as the European Union (EU), the Food and Drug Administration (FDA), Health Canada, and other bodies establish quality and safety standards for medical devices, including high-level disinfection equipment and products. These authorities oversee the marketing and clearance of chemicals, sterilant, and solutions used during high-level disinfection services. For instance, the FDA has cleared around 37 sterilant and high-level disinfectants for processing reusable medical and dental devices.

Companies in the high-level disinfection services market are increasingly acquiring smaller firms to expand their service offerings and better serve a wider range of healthcare facilities. Major players often seek to acquire smaller firms to enhance their market presence, broaden their service lines, or access innovative technologies.

Players in the high-level disinfection services industry are strategically pursuing regional expansion to capture emerging opportunities and enhance their market presence. For example, in July 2024, STERIS, a provider of infection prevention solutions, launched a new ethylene oxide processing facility in Singapore. This initiative strengthens medical device manufacturing in Asia by increasing EO processing capacity. Such collaborations enable companies to extend their reach across different regions.

Services Insights

The outsource segment dominated the market with the highest revenue share in 2024. The segment is expected to grow considerably over the forecast period. Hospitals and clinic diagnostics centers usually prefer outsourcing disinfection services. Several benefits are associated with outsourcing, such as cost-saving, customized cleaning services, and advanced technology usage. Furthermore, advances in global healthcare practices have resulted in hospitals outsourcing disinfection and sterilization services. This has provided new opportunities for manufacturers of HLD equipment.

The in-house segment is anticipated to witness a considerable growth rate at a CAGR of 6.43% in the market over the forecast period. In-house disinfection provides complete control over service movement and eliminates the extra handling and charges associated with shipping loads to and from the facility. However, in-house disinfection is only feasible if there is enough volume to keep the disinfection facility running at or near capacity. Moreover, it is costlier as compared to outsourcing. Outsourcing has several advantages over in-house services; thus, the segment will experience sluggish growth in the forecast period.

Compound Insights

The glutaraldehyde segment dominated the market and held the largest revenue share of 22.68% in 2024. The segment is anticipated to grow considerably over the forecast period. Aldehyde disinfectants are often used for endoscopic procedures and surgical unit reprocessing. Glutaraldehyde has long been widely used as an HLD for reusable surgical equipment in healthcare facilities. The growing number of surgical procedures globally is expected to fuel demand for these services. Furthermore, hospital-acquired infections caused by excessive surgical unit reprocessing are expected to fuel demand for these solutions, causing the segment to rise profitably over the forecast period.

The ortho-phthalaldehyde segment is anticipated to witness the highest growth rate over the forecast period. Ortho-phthalaldehyde (OPA) has potent microbiocidal and mycobactericidal activity compared with other high-level disinfectants such as glutaraldehyde. It has been recognized as a safer alternative to glutaraldehyde in most U.S. healthcare facilities, owing to many advantages such as better stability at different pH ranges, optimal exposure monitoring, and a wider range of material compatibility.

End Use Insights

The hospitals and clinics segment dominated the market and held the largest revenue share of 39.99% in 2024. It is also expected to grow fastest in the coming years. The growing prevalence of healthcare-associated infections generates a high demand for HLD in hospitals and other healthcare settings. Furthermore, stringent safety guidelines for staff and patients, increased surgical procedures, and medical waste disposal drive the adoption of disinfection services in hospitals.

The diagnostic laboratories segment is projected to grow significantly over the forecast period. The need for optimal sterility and precision in testing procedures has led to increased demand for disinfection equipment in diagnostic laboratories and research centers. Majorly due to the rising prevalence of infectious diseases, the number of people undertaking various tests has surged. This situation has created a burden on diagnostic and pathology laboratories that necessitates the use of high-level disinfection solutions. These are commonly used in research laboratories to clean medical equipment and testing kits. In addition, the dissection of infected medical instruments after use is an essential aspect of research centers' safety procedures that will curb false results. The FDA has set guidelines to review the safety and sterility practices in research labs, which is expected to boost segment growth.

Regional Insights

North America high level disinfection services market accounted for revenue of 35.96% of the global market and is projected to maintain its dominance throughout the forecast period. This is attributed to several factors, including a rising incidence of chronic illnesses, an aging population, and the presence of major players that contribute to regional growth. The increasing prevalence of chronic diseases-such as cancer, heart disease, and diabetes-has notably raised hospital admission rates in North America. According to a report from the CDC published in October 2024, 60% of Americans have at least one chronic disease, while 40% have two or more. As a result, this growing prevalence of chronic conditions is anticipated to drive the growth of the high-level disinfection services market in North America during the forecast period.

U.S. High Level Disinfection Services Market Trends

The high-level disinfection services market in the U.S. is expected to dominate the North American market over the forecast period. The demand for high-level disinfection services is anticipated to be driven by the growing prevalence of chronic disease and the rising number of surgical procedures nationwide. According to the data published by the American College of Rheumatology in February 2024, about 544,000 hip and 790,000 total knee replacements are performed annually in the U.S.

Europe High Level Disinfection Services Market Trends

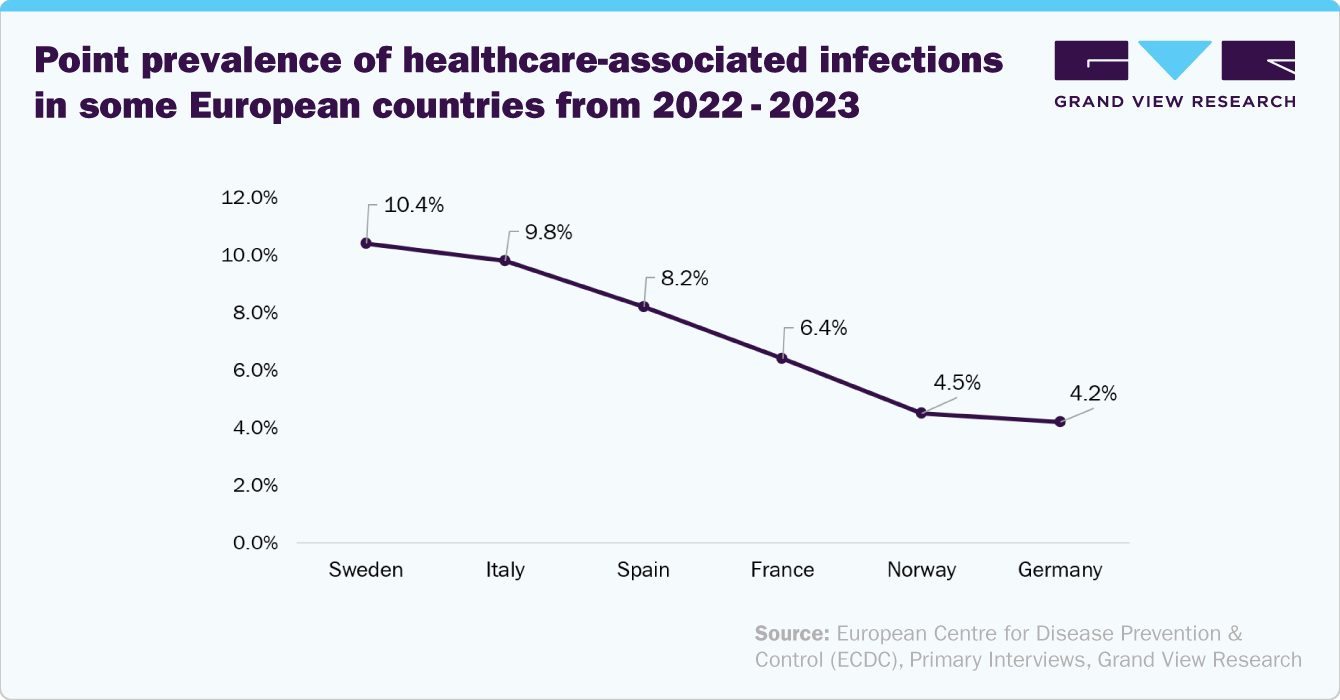

Europe's high-level disinfection services market is anticipated to grow significantly in the coming years. A growing number of surgeries and increasing incidence of HAIs are among the factors expected to fuel market growth over the forecast period. For instance, according to ECDC estimates in May 2023, every year, around 3.1 million to 4.6 million people acquire HAIs in Europe.

The high-level disinfection services market in the UK is expected to grow moderately over the forecast period, driven by factors such as an aging population, increasing prevalence of chronic diseases, and advancements in disinfection technology. According to the Centre for Ageing Better, there were 21 million people aged over 50 in England in 2023, with this number expected to rise in the coming years.

France's high-level disinfection services market is witnessing steady growth, fueled by an aging population and increasing cases of chronic diseases. This trend is further driven by growing concerns over hospital-acquired infections and the demand for advanced infection control solutions.

The high-level disinfection services market in Germany is experiencing steady growth due to the rising incidence of hospital-acquired infections (HAIs), which pose a significant threat to patient safety. A study conducted by the Robert Koch Institute in February 2024 estimated that between 400,000 and 600,000 patients in Germany contract HAIs each year, resulting in 10,000 to 20,000 fatalities. These alarming figures highlight the urgent need for effective infection prevention strategies.

Asia Pacific High Level Disinfection Services Market Trends

Asia Pacific high level disinfection services market region is anticipated to grow at the fastest CAGR over the forecast period. The rising prevalence of chronic diseases and technological advancements in high-level disinfection services are expected to drive the Asia Pacific market. For instance, according to a report by the Australian Bureau of Statistics published in March 2022, about 46.6% (11.6 million) of the Australian population had at least one chronic condition. These factors are expected to propel the region over the forecast period.

The high-level disinfection services market in India is projected to grow significantly at the highest CAGR during the forecast period. A significant factor driving this growth is the increasing incidence of hospital-acquired infections, which affect 10% to 20% of patients admitted to hospitals in India.

China high-level disinfection services market is expected to experience significant growth during the forecast period, driven by the rising burden of chronic diseases and the increasing elderly population. In 2023, China's population aged 60 and above reached approximately 297 million, accounting for 21.1% of the total population. It further stated that by 2040, an estimated 402 million individuals, constituting 28% of the total population, will be over 60.

Middle East and Africa High Level Disinfection Services Market Trends

The high level disinfection services in the MEA region is expected to experience moderate growth over the forecast period. The increasing awareness of high-level disinfection services and the rising prevalence of chronic diseases are anticipated to drive market growth. In addition, the increase in healthcare expenditure by the governments of MEA countries is also expected to contribute to this growth.

Saudi Arabia high-level disinfection services market is expected to experience significant growth during the forecast period. This growth can be attributed to several factors, including rising investments in healthcare, increasing awareness of infection control measures, and the need for advanced solutions to combat hospital-acquired infections.

The graph illustrates the burden of healthcare-associated infections (HAIs) in the European region, highlighting that Sweden recorded a point prevalence of approximately 10.4% between 2022 and 2023. This significant prevalence underscores the urgent need for healthcare facilities to prioritize infection prevention measures and implement stringent hygiene protocols. High-level disinfection services are crucial in mitigating the risk of HAIs, thereby driving market growth. By enhancing infection control strategies, these services are essential for safeguarding patient health and improving overall healthcare outcomes.

Key High Level Disinfection Services Company Insights

STERIS, Fortive (ASP- Advanced Sterilization Products), Getinge AB, Steelco S.p. A, Ecolab, GE Healthcare, Metrex Research, LLC, Altapure, Olympus Corporation, Microchem Laboratory, EcoFMR, Jani-King International, Inc, and Rentokil Initial plc are some major players in the high-level disinfection market. Companies are acquiring other industry players. Moreover, industry players are also expanding their manufacturing facilities to meet the growing demand for disinfection services.

Key High Level Disinfection Services Companies:

The following are the leading companies in the high level disinfection service market. These companies collectively hold the largest market share and dictate industry trends.

- STERIS

- Fortive (ASP- Advanced Sterilization Products)

- Getinge AB

- Steelco S.p. A

- Ecolab

- GE Healthcare

- Altapure

- Olympus Corporation

- Microchem Laboratory

- Metrex Research, LLC

- EcoFMR

- Jani-King International, Inc

- Rentokil Initial plc

Recent Developments

-

In July 2024, STERIS, an infection prevention solution provider, announced the establishment of a new ethylene oxide processing facility in Singapore. This initiative aims to bolster medical device manufacturing in Asia by providing additional EO processing capacity.

-

In June 2024, Metall Zug and Miele finalized a joint venture, merging their subsidiaries-Belimed Infection Control, Belimed Life Science, and Steelco-under the new brand, SteelcoBelimed. This strategic alliance aims to create a leading provider in the Infection Control and Life Science sectors by combining the strengths and expertise of both companies.

-

In December 2023, Advanced Sterilization Products (ASP), a Fortive company, expanded its Sterilization Monitoring (SM) portfolio with new steam monitoring products. These additions enhance sterility assurance and improve efficiency, helping sterile processing departments achieve greater confidence in sterilization results.

High Level Disinfection Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.50 billion

Revenue forecast in 2030

USD 42.12 billion

Growth rate

CAGR of 7.39% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, compound, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Russia; Japan; China; India; South Korea; Australia; ASEAN; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Israel; Egypt; Nigeria; GCC countries

Key companies profiled

STERIS; Fortive (ASP- Advanced Sterilization Products); Getinge AB; Steelco S.p. A; Ecolab; GE Healthcare; Altapure; Olympus Corporation; Microchem Laboratory; Metrex Research, LLC; EcoFMR; Jani-King International, Inc; Rentokil Initial plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Level Disinfection Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high level disinfection services market report based on services, compound, end use, and region:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

In house

-

Outsource

-

-

Compound Outlook (Revenue, USD Million, 2018 - 2030)

-

Formaldehyde

-

Glutaraldehyde

-

Ortho-phthalaldehyde

-

Hydrogen Peroxide

-

Peracetic Acid

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global high-level disinfection services market size was estimated at USD 27.51 billion in 2024 and is expected to reach USD 29.50 billion in 2025.

b. The global high-level disinfection services market is expected to grow at a compound annual growth rate of 7.39% from 2025 to 2030 to reach USD 42.12 billion by 2030

b. North America dominated the high-level disinfection services market, accounting for the largest revenue share of 35.96% in 2024.

b. Some of the key players operating in the high-level disinfection services market include STERIS, Fortive (ASP—Advanced Sterilization Products), Getinge AB, Steelco S.p. A, Ecolab, GE Healthcare, Altapure, Olympus Corporation, Microchem Laboratory, Metrex Research, LLC, EcoFMR, Jani-King International, Inc., and Rentokil Initial plc.

b. Key factors that are driving the high-level disinfection services market growth include the growing burden of hospital-acquired infections (HAIs), rising incidence of infectious disease, and increasing number of surgical procedures across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.