- Home

- »

- Plastics, Polymers & Resins

- »

-

High Performance Polyamides Market Size Report, 2030GVR Report cover

![High Performance Polyamides Market Size, Share & Trends Report]()

High Performance Polyamides Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Polyamide 6T (PA 6T), Polyarylamide (PARA), Polyamide 12 (PA 12)), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-813-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Performance Polyamides Market Summary

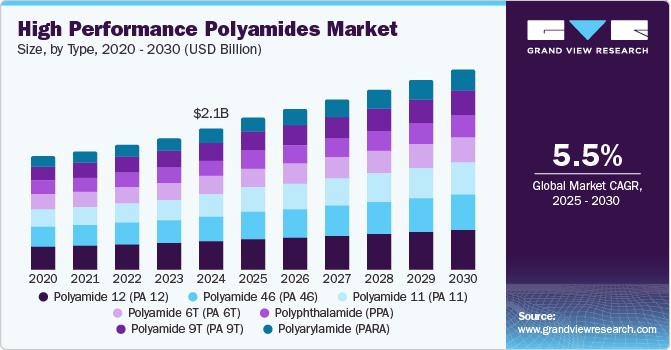

The global high performance polyamides market size was estimated at USD 2.14 billion in 2024 and is projected to reach USD 3.03 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030, driven by the rising demand for lightweight materials in the automotive and aerospace sectors to enhance fuel efficiency. The market is supported by the growth of electronics requiring high thermal and chemical resistance.

Key Market Trends & Insights

- North America high performance polyamides market held a significant share in the global market in 2024.

- The U.S. high performance polyamides market dominated the North America market with a significant revenue share in 2024.

- By type, the polyamide 12 (PA 12) segment dominated the market, with a revenue share of 20.1% in 2024.

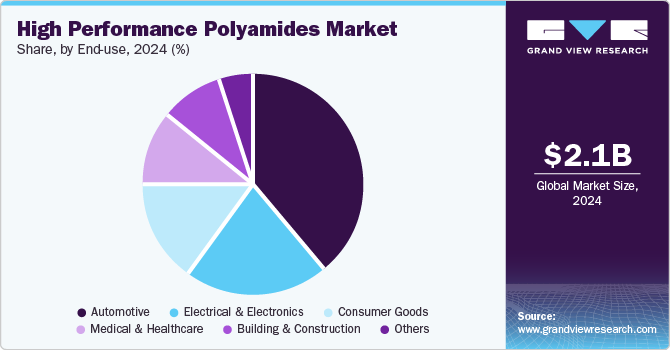

- By end use, the automotive segment dominated the market with the largest revenue share of 39.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.14 Billion

- 2030 Projected Market Size: USD 3.03 Billion

- CAGR (2025-2030): 5.5%

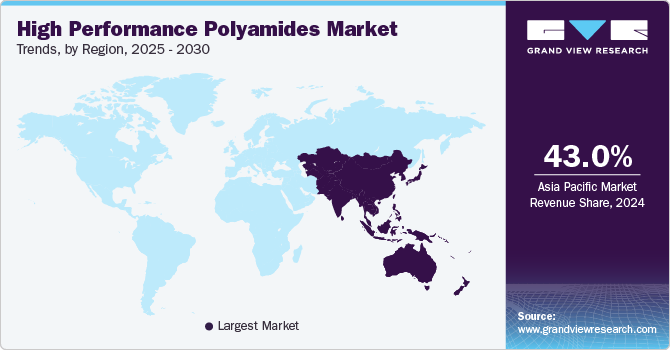

- Asia Pacific: Largest market in 2024

Moreover, advancements in manufacturing technologies contribute significantly to this growth. Furthermore, there is an increasing emphasis on sustainability and recyclability in material choices, reinforcing the market expansion.

The demand for lightweight materials is driven by the need for improved fuel efficiency and performance in various industries, particularly automotive and aerospace. Moreover, lighter materials contribute to lower energy consumption, which is essential for meeting rigid emissions regulations and reducing environmental impact. In addition, in the automotive sector, reducing vehicle weight enhances acceleration, handling, and overall safety. Similarly, in aerospace, lightweight components lead to increased payload capacity and longer flight ranges. Therefore, high performance polyamides are increasingly favored, as they offer the necessary strength and durability while significantly reducing weight compared to traditional materials.

Advancements in manufacturing technologies for high performance polyamides include enhanced injection molding and extrusion processes, which improve control over material properties such as strength and thermal stability. Furthermore, innovations in compounding techniques enable the integration of additives and fillers for tailored applications. In addition, the rise of additive manufacturing, particularly 3D printing, allows for complex geometries and custom designs that traditional methods can't achieve. Therefore, these improvements reduce production costs and waste, expanding the versatility and application range of high performance polyamides across various industries.

Type Insights

The polyamide 12 (PA 12) segment dominated the market, with a revenue share of 20.1% in 2024, due to its excellent chemical resistance and low moisture absorption, making it ideal for environments. Moreover, its flexibility and toughness enhance performance in automotive, electronics, and industrial applications. In addition, PA 12 maintains stability under high temperatures, further boosting its appeal. Therefore, these properties position PA 12 as a preferred choice among manufacturers, driving its market dominance.

The Polyarylamide (PARA) segment is projected to witness the fastest CAGR of 6.4% over the forecast period, attributed to exceptional thermal stability and high mechanical strength, making it ideal for demanding applications. Moreover, the growing demand in aerospace and automotive industries, where lightweight and durable materials are crucial, significantly drives its adoption. In addition, innovations in manufacturing processes are improving cost-effectiveness and expanding the possibilities of PARA's applications. Therefore, these key factors collectively contribute to the rapid growth of the PARA segment in the high performance polyamides market.

End Use Insights

The automotive segment dominated the market with the largest revenue share of 39.5% in 2024, attributed to growing demand for lightweight materials that improve fuel efficiency and reduce emissions. High performance polyamides offer excellent thermal stability and chemical resistance, making them suitable for critical automotive components such as engine parts and fuel systems. As the automotive industry shifts towards electric vehicle, the need for materials that provide durability while minimizing weight has intensified. In addition, advancements in manufacturing processes enable the efficient production of complex components using polyamides. Therefore, these factors solidify the automotive sector's position as a leading driver in the high performance polyamides market.

The electrical & electronics segment is projected to grow at a CAGR of 6.2% over the forecast period, due to the increasing demand for lightweight and heat-resistant materials in various electronic components. Moreover, the rapid growth of consumer electronics, including smartphones, laptops, and smart devices, drives the need for high performance polyamides that provide superior insulation and durability. Therefore, high performance polyamides excellent chemical resistance enhances electronic products reliability and longevity, positioning this sector for significant growth in the market.

Regional Insights

North America high performance polyamides market held a significant share in the global market in 2024, fueled by advanced aerospace and automotive industries that require lightweight and durable materials to enhance performance. Moreover, technological advancements are expanding application possibilities, while consumer electronics and telecommunications growth boost demand for thermally stable and chemically resistant materials. Therefore, focusing on sustainability and regulatory support for emissions reduction further enhances the adoption of high performance polyamides in the region.

U.S. High Performance Polyamides Market Trends

The U.S. high performance polyamides market dominated the North America market with a significant revenue share in 2024, driven by the U.S. being home to major aerospace manufacturers such as Boeing and Lockheed Martin and automotive giants such as General Motors and Ford. These industries require high performance polyamides for components that demand lightweight and durable materials to improve fuel efficiency and performance.

Europe High Performance Polyamides Market Trends

Europe high performance polyamides market held a substantial market share in 2024, attributed to its strong key sectors, including automotive, aerospace, electronics, and consumer goods. In addition, the automotive industry is particularly significant, producing over 16 million vehicles annually, as per the European Automobile Manufacturers Association (ACEA, 2022). Furthermore, this high production drives the demand for lightweight and durable materials such as HPPA, which help reduce vehicle weight and improve fuel efficiency. Therefore, using HPPA contributes to lower emissions, aligning with sustainability goals.

The high performance polyamides market in Germany is expected to grow in the forecast period, attributable to several high performance polyamides key players in Germany, which are enhancing its technological leadership globally. Moreover, major manufacturers such as BASF, Evonik, and Lanxess are crucial to HPPA production. In addition, BASF invests heavily in research and development to create innovative polyamide solutions. Therefore, in 2022 (BASF Press Release), the company announced plans to expand its production capacity in Europe, involving significant investments in new technologies to improve product performance and showcasing its commitment to innovation.

Asia Pacific High Performance Polyamides Market Trends

Asia Pacific high performance polyamides market dominated the global market with a revenue share of 43.0% in 2024 and is projected to grow at the fastest CAGR of 6.1% from 2025 to 2030, due to rapid industrialization and urbanization, witnessing accelerated industrialization and urbanization, particularly in countries such as China, India, and Southeast Asian nations. In addition, the expanding automotive sector fuels this growth as manufacturers seek lightweight and durable materials to improve efficiency.

China is leading the way by producing a significant number of vehicles each year, with the International Organization of Motor Vehicle Manufacturers reporting over 26 million vehicles produced in 2022. Furthermore, this high production volume drives substantial demand for high performance polyamides in automotive applications. In addition, manufacturers increasingly seek lightweight materials to improve fuel efficiency and reduce emissions, aligning with global sustainability goals. Therefore, as the automotive industry focuses on innovation and performance, the role of HPPA becomes increasingly critical in meeting the evolving needs of the sector.

Key High Performance Polyamides Company Insights

Some key companies operating in the market include Solvay, RTP Company, KURARAY CO., LTD., MITSUI CHEMICALS AMERICA, INC., and Koninklijke DSM N.V.. Companies are implementing strategic initiatives, including mergers, acquisitions, and product launches, to expand their market presence and address evolving healthcare demands through ambulance type.

-

Solvay offers a range of High Performance Polyamides (HPPA) designed for demanding applications across various industries, including automotive, aerospace, and electronics. Their products, such as KetaSpire and Amodel, provide exceptional thermal stability, chemical resistance, and mechanical strength. In addition to materials, it offers technical support and expertise to help customers optimize their designs and processes. Overall, their focus on innovation and sustainability enhances the performance of HPPA in critical applications.

-

RTP Company offers a range of custom engineered thermoplastics, including High Performance Polyamides (HPPA), tailored for various industries such as automotive, electronics, and medical. Their product offerings include blends and compounds that enhance thermal stability, chemical resistance, and mechanical properties. In addition, it offers technical support and design assistance to help clients optimize material selection for specific applications. Their commitment to innovation ensures that customers receive high quality solutions for demanding performance requirements.

Key High Performance Polyamides Companies:

The following are the leading companies in the high performance polyamides market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- RTP Company

- KURARAY CO., LTD.

- MITSUI CHEMICALS AMERICA, INC.

- Koninklijke DSM N.V.

- Arkema

- EMS-CHEMIE HOLDING AG

- Evonik Industries AG

- BASF SE

- LANXESS

Recent Developments

-

In March 2024, Mitsui Chemicals launched recycled chemical products utilizing pyrolysis oil derived from plastic waste. This innovation marks Japan's first bio and circular cracker, emphasizing sustainability in chemical production. The process transforms discarded plastics into valuable raw materials, reducing environmental impact. The company aims to minimize reliance on fossil fuels by integrating circular economy principles.

-

In July 2023, Solvay introduced a new grade of Rhodianyl made from 100% pre-consumer recycled polyamide, produced at its Santo Andre plant in Brazil. This product has achieved SCS Recycled Content Certification, demonstrating Solvay's commitment to a circular economy. Rhodianyl is suitable for engineering plastics in automotive, small appliances, and textiles.

High Performance Polyamides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.32 billion

Revenue forecast in 2030

USD 3.03 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type,end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Solvay; RTP Company; Emergency Medical Products, Inc; First Care Products Ltd; Koninklijke DSM N.V.; Arkema; EMS-CHEMIE HOLDING AG; Evonik Industries AG; BASF SE.; LANXESS.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Performance Polyamides Market Report Segmentation

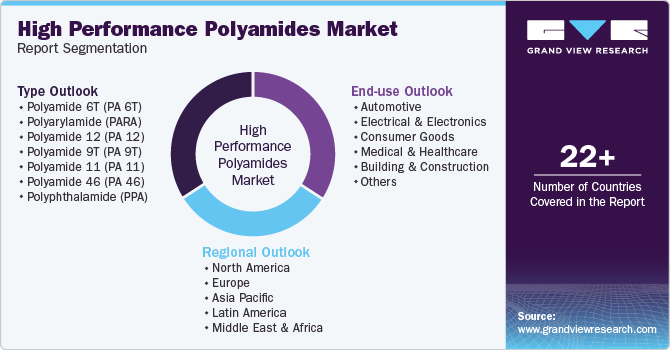

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global high performance polyamides market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyamide 6T (PA 6T)

-

Polyarylamide (PARA)

-

Polyamide 12 (PA 12)

-

Polyamide 9T (PA 9T)

-

Polyamide 11 (PA 11)

-

Polyamide 46 (PA 46)

-

Polyphthalamide (PPA)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Consumer Goods

-

Medical & Healthcare

-

Building & Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.