- Home

- »

- Medical Devices

- »

-

High Potency API Contract Manufacturing Market Report, 2030GVR Report cover

![High Potency API Contract Manufacturing Market Size, Share & Trends Report]()

High Potency API Contract Manufacturing Market Size, Share & Trends Analysis Report By Product Type (Innovative, Generic), By Dosage Form (Injectable, Creams), By Application, By Synthesis, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-970-5

- Number of Report Pages: 220

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

The global high potency API contract manufacturing market size was valued at USD 6.74 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 9.0% from 2022 to 2030. Few of the factors supporting the growth of the industry are the rising prevalence of cancer globally and growing demand for drugs and therapies for its treatment, increasing advancements in high potency API (HPAPI) manufacturing technologies, coupled with the quest for more effective drugs to enhance patient outcomes have significantly boosted the number of HPAPIs in development pipelines, thus accelerating the industry growth. Furthermore, an increasing trend in outsourcing activities owing to better risk management, fewer expenses, and availability of contemporary approaches to HPAPI controls has boosted the growth.

The COVID-19 pandemic has boosted the demand for HPAPIs. The usage of various APIs increased during the pandemic due to a rise in respiratory disorders and an increase in demand for vaccines and drugs to prevent COVID-19 infection. A significant spike in demand for novel drugs has led to the higher manufacturing, export, and import of HPAPIs thus, leading to an average price hike of 10 to 15% in API products and intermediates. According to Pharmaceutical Export Promotion Council (PHARMEXCIL) data, the price of API Penicillin is currently USD 8.69 per unit compared to USD 6.16 per unit in January 2020, likewise, several other HPAPI substances have witnessed significant price hikes post the initial period of the COVID-19 pandemic.

Such factors have led to significant growth across the global industry in 2020 and 2021. The industry is witnessing lucrative growth and the suppliers are promptly investing in new facilities and expanding their laboratories for research and development. For instance, in December 2020, Piramal Pharm Solutions expanded its API and HPAPI development and manufacturing facilities in Michigan with greater capacity and newer capabilities. The company invested USD 32 million in the facility to meet up with expected demand, which included potential prospects. The regulatory control of HPAPI has strengthened over the years.

The regulators globally have placed increased focus on appropriate facility design for multi-product processes that operated HPAPIs and reduce cross-contamination. This trend has introduced additional validation and cleaning requirements for contract developers that are being overcome by most companies by using single-use systems and technologies. Also, the contract manufacturers are now asked to rely on engineering controls rather than on Personal Protective Equipment (PPE) and standard work practices to reduce exposure to HPAPIs. Such regulations have significantly supported the production of HPAPIs among the contract manufacturers, thus boosting the industry growth.

Product Type Insights

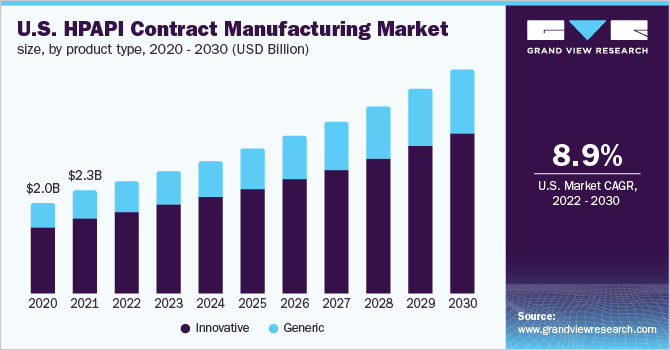

Based on product type, the innovative segment accounted for the largest share of more than 72.00% in 2021. This growth can be attributed to increased R&D initiatives for novel medicine development and favorable government policies. The robust drug pipeline of major pharmaceutical players coupled with growing investment in pharmaceutical R&D is likely to boost segment growth during the forecast period. For instance, as per an article published by the contract pharma, the demand for HPAPI molecules is anticipated to witness substantial growth as the pipeline for cancer drugs along with autoimmune disease therapies is significantly growing.

The generic segment is expected to register the fastest CAGR during the forecast period. The segment’s expansion is being fueled by factors, such as rising biopharmaceutical therapeutic demand and increasing patent expirations of blockbuster drugs in the past few years. In addition, there is a growing trend of pharmaceutical companies engaging with a single partner who can deliver HPAPI manufacturing and development services, which helps in reducing the overall time and cost of drug development. Hence, the aforementioned factors have led to a lucrative CAGR in the generic segment.

Synthesis Insights

On the basis of synthesis, the global industry has been segmented into synthetic and biotech. The synthetic segment dominated the global industry in 2021 and accounted for the largest share of more than 75.00% of the overall revenue. The synthetic molecules are cost-efficient, time-saving, and effective in the treatment of a wide range of diseases, and the specialized expertise offered by CDMOs are factors likely to propel the segment growth during the forecast period. In addition, many synthetic molecules are expected to go off patent, which is expected to further fuel the growth of this segment.

The biotech segment is anticipated to register the fastest growth rate during the forecast period. This is due to the developments in technology and the high level of potency of these compounds. Drug compounds produced via molecular methods, like recombinant DNA technology, make up the majority of biotech HPAPIs. The industry is extremely profitable and attracts a number of large participants due to the increased revenue connected with API related to biotech. High investments in the biotechnology and biopharmaceutical sectors might also be linked to the expansion of the biotech market. This enables the development of novel compounds that help treat diseases like cancer.

Dosage Form Insights

On the basis of dosage forms, the global industry has been further categorized into injectables, oral solids, creams, and others. The injectable dosage form segment dominated the global industry in 2021 and accounted for the largest share of more than 52.00% of the overall revenue. The segment is estimated to expand further at a steady CAGR retaining its leading position throughout the forecast years. The growth of this segment can be attributed to the rapid delivery of HPAPI to the target location. They can be delivered as either subcutaneous (in the fat layer), intradermal (between the layer of the skin), or intramuscular (in the muscle).

On the other hand, the oral solids dosage form segment is anticipated to register the fastest growth rate during the forecast period. Oral solids help in reducing time and costs as well as decreasing cross-contamination. In addition, manufacturing oral solids helps in improving the safety of the operator by reducing the potential exposure and increasing fill speeds. Moreover, oral solids are much more patient-centric as these are a very convenient method of drug delivery, thus leading to greater demand for this dosage type. Hence, the aforementioned factors are anticipated to support the growth of the oral solids segment.

Application Insights

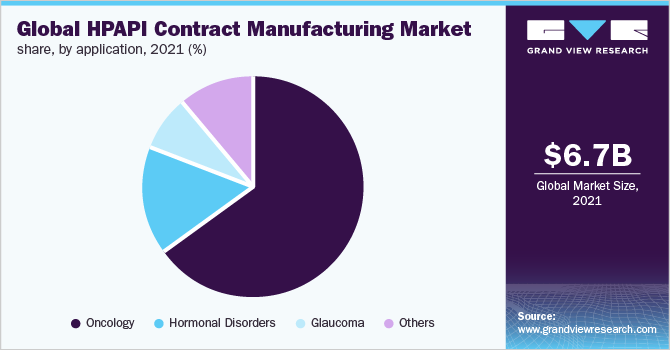

The oncology segment dominated the application segment in 2021 and accounted for the largest share of more than 64.5% of the overall revenue. The main driver of this segment is the increasing number of cancer cases globally. For instance, according to The Cancer Atlas, there will be 29 million cancer cases by 2040, up from nearly 18 million in 2018. Moreover, several novel cancer therapies in the pipeline are extremely precise, unlike traditional, systemic treatments. Examples of such targeted HPAPIs include antibody-drug conjugates, which can have occupational exposure levels, or monoclonal antibodies combined with small molecule cytotoxic compounds. Owing to the rapid growth among the oncology targets, the percentage of HPAPI applicants in the drug pipeline is increasing gradually.

The glaucoma segment is anticipated to register the second-fastest CAGR during the forecast period. The segment growth can be attributed to the high prevalence of glaucoma in both developed and emerging economies. For instance, as per the World Glaucoma Association, it is estimated that around 79 million individuals across the world had glaucoma in 2020 and the number is likely to upsurge to around 111 million individuals by 2040. Moreover, the rapidly growing condition has attracted several researchers to conduct clinical studies on the topic, which has further boosted the demand for HPAPIs, as it is considered to be one of the most effective formulations of treatment therapies for the condition.

Regional Insights

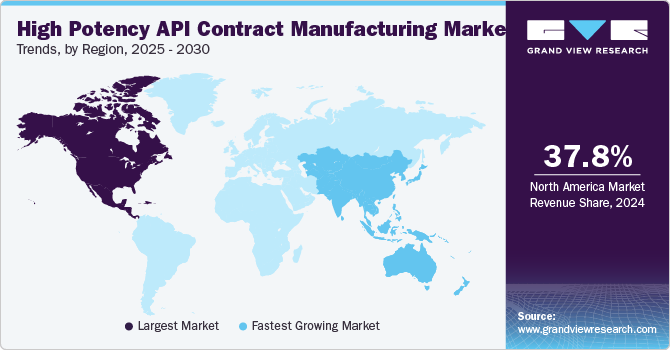

North America dominated the global industry in 2021 and accounted for the maximum revenue share of more than 38.50%. The high revenue share can be attributed to the fact that almost around 40% of the new chemical entity manufacturing is outsourced to big contract manufacturers across developed regions, such as North America. Moreover, North America is the predominant region for contract developers with high potency drug engineering capabilities, thus leading to a high number of projects being outsourced to the region. In addition, stringent regulations regarding the manufacturing and quality of products are expected to create growth opportunities for contract manufacturing services, especially across the U.S.

The Asia Pacific region, on the other hand, is expected to register the fastest growth rate during the forecast period. The growth can be attributed to the increasing scope of opportunities, especially in Japan, China, and India. Factors, such as an improved regulatory framework, the high scope for cost savings, increased risk management capabilities, and a robust drug pipeline, is expected to augment the region’s growth in the years to come. Furthermore, the availability of a skilled workforce at lower costs than in developed economies, such as the U.S., is anticipated to propel the regional market’s growth further.

Key Companies & Market Share Insights

The key companies are continuously involved in expanding their facilities, collaborating, and engaging in partnerships, mergers, and acquisitions of companies. These are key strategic initiatives that are influencing the industry dynamics. For instance, in June 2021, Lonza invested USD 21.5 billion in its facility in Nansha, China, to expand its API development and manufacturing capacity. Three 1,000 L GMP trains with a total reactor volume of 12 cu. m. will be included in additional investments, as well as new development and GMP laboratories capable of producing small-scale batches of highly effective APIs. Some of the players operating in the global high potency API contract manufacturing market include:

-

Piramal Pharma Solutions

-

Lonza

-

Catalent, Inc.

-

VxP Pharma, Inc.

-

Pfizer CentreOne

-

Gentec Pharmaceutical Group

-

AbbVie

-

Aurigene Pharmaceutical Services Ltd.

-

CordenPharma International

-

Curia Global, Inc.

High Potency API Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 7.32 billion

Revenue forecast in 2030

USD 14.65 billion

Growth rate

CAGR of 9.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, synthesis, dosage form, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Piramal Pharma Solutions; Lonza, Catalent, Inc.; VxP Pharma, Inc.; Pfizer CentreOne, Gentec Pharmaceutical Group; AbbVie; Aurigene Pharmaceutical Services Ltd.; CordenPharma International; Curia Global, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Potency API Contract Manufacturing Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global high potency API contract manufacturing market report based on product type, application, synthesis, dosage form, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Innovative

-

Generic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Hormonal Disorders

-

Glaucoma

-

Others

-

-

Synthesis Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Biotech

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable

-

Oral Solids

-

Creams

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high potency API contract manufacturing market size was estimated at USD 6.74 billion in 2021 and is expected to reach USD 7.32 billion in 2022.

b. The global high potency API contract manufacturing market witnessed a considerable growth rate of 9.0% from 2022 to 2030 to reach USD 14.65 billion by 2030.

b. The by-application, oncology segment dominated the market with a share of 64.9% in 2021. This is attributable to the increasing pipeline of HPAPI-based oncology target therapies.

b. Some key players operating in the market include Piramal Pharma Solutions, Lonza, Catalent Inc, VxP Pharma, Inc., Pfizer CentreOne, Gentec Pharmaceutical Group, AbbVie, Aurigene Pharmaceutical Services Ltd., CordenPharma International, Curia Global, Inc., and a few others.

b. The increasing pipeline of pharmaceutical drugs, growing expansion of HPAPI production facilities, increasing trend of outsourcing, and rising application of HPAPIs are a few of the factors supporting the HPAPI contract manufacturing market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."