- Home

- »

- Advanced Interior Materials

- »

-

High Speed Blowers Market Size, Industry Report, 2030GVR Report cover

![High Speed Blowers Market Size, Share & Trends Report]()

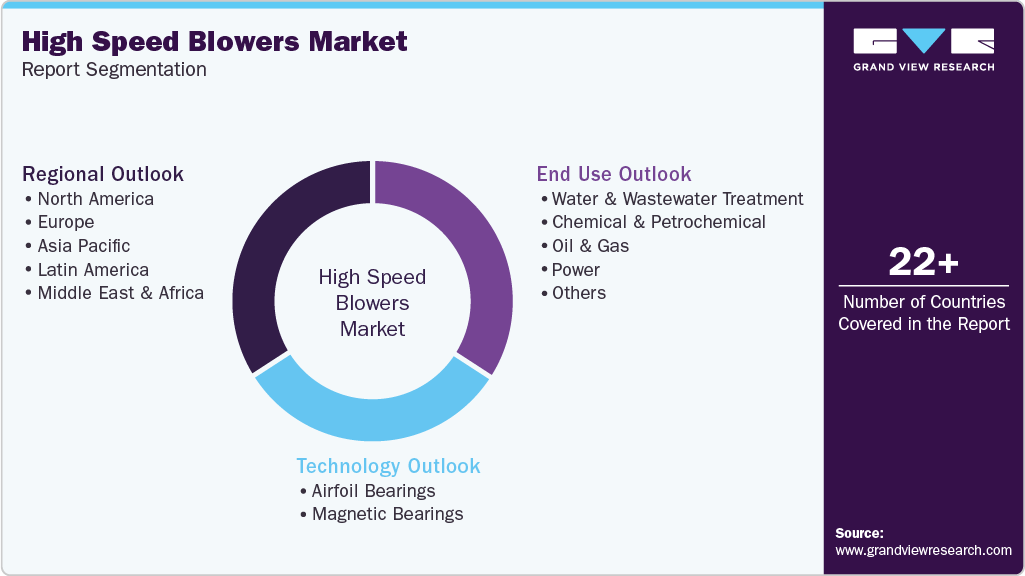

High Speed Blowers Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Airfoil Bearings, Magnetic Bearings), By End Use (Water & Wastewater Treatment, Chemical & Petrochemical, Oil & Gas, Power), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-613-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

High Speed Blowers Market Summary

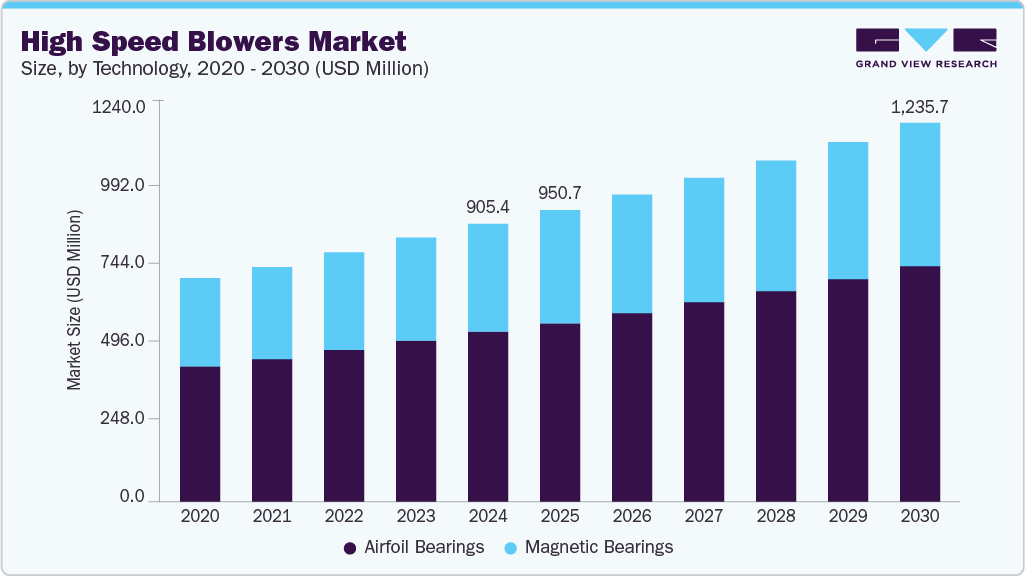

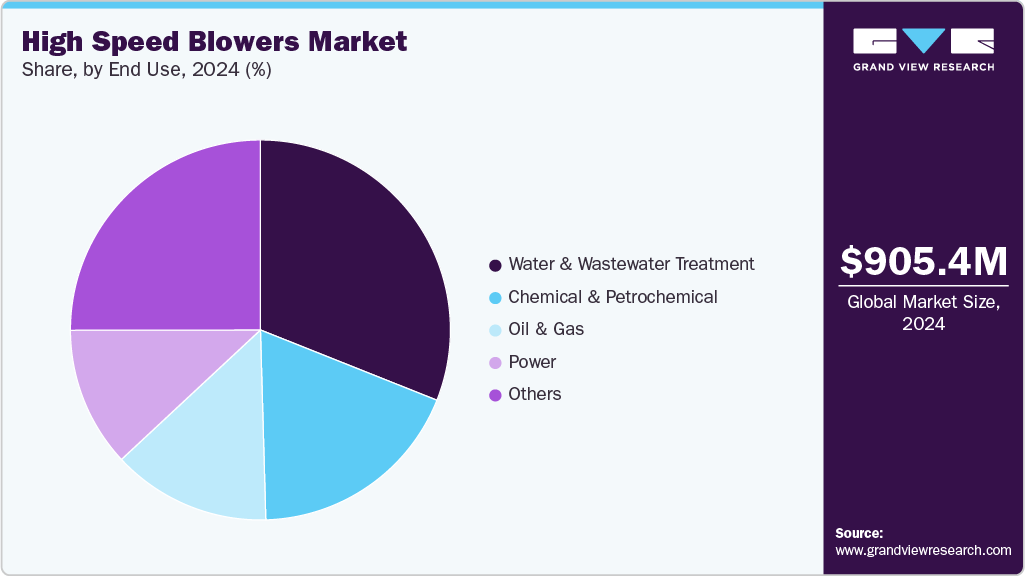

The global high speed blowers market size was estimated at USD 905.4 million in 2024, and is projected to reach USD 1,235.7 million by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The market is gaining momentum due to rising emphasis on energy efficiency across industrial sectors.

Key Market Trends & Insights

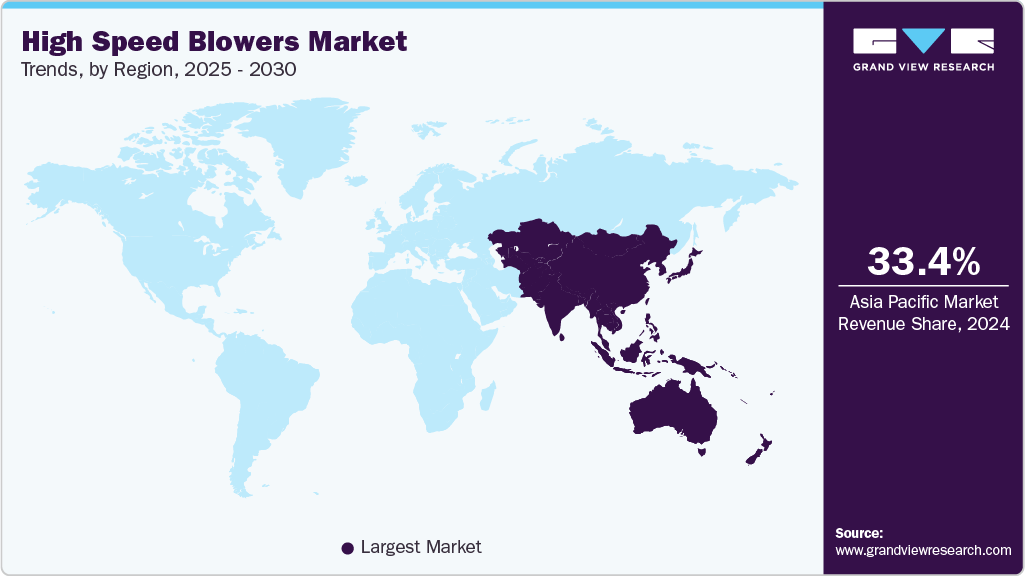

- Asia Pacific high speed blowers industry dominated globally in 2024 with a 33.4% share in the global market.

- The U.S. high speed blowers industry remains the dominating market and accounted for the largest revenue share in the North America region in 2024.

- By technology, the magnetic bearings segment is expected to grow at a significant CAGR of 5.0% from 2025 to 2030 in terms of revenue.

- By end use, the chemical & petrochemical segment is expected to grow at a significant CAGR of 5.9% from 2025 to 2030 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 905.4 Million

- 2030 Projected Market Size: USD 1,235.7 Million

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

These blowers are favored for their ability to reduce energy consumption, leading to lower operational costs and environmental impact. Industries such as HVAC, wastewater treatment, and industrial ventilation are increasingly adopting high-speed blowers to comply with stricter energy regulations. Their performance advantages and environmental benefits make them an attractive solution for facilities aiming to meet sustainability targets.

In addition, growing industrial activity in developing regions, particularly in Asia-Pacific, is fueling market expansion. Countries like India and China are witnessing rapid urbanization and infrastructure development, creating demand for efficient air handling systems. High-speed blowers, especially centrifugal and oil-free models, are being widely integrated into processes such as water treatment and manufacturing. For example, initiatives in China to expand wastewater treatment capacity highlight the essential role of these technologies in supporting industrial growth and environmental compliance.Market Concentration & Characteristics

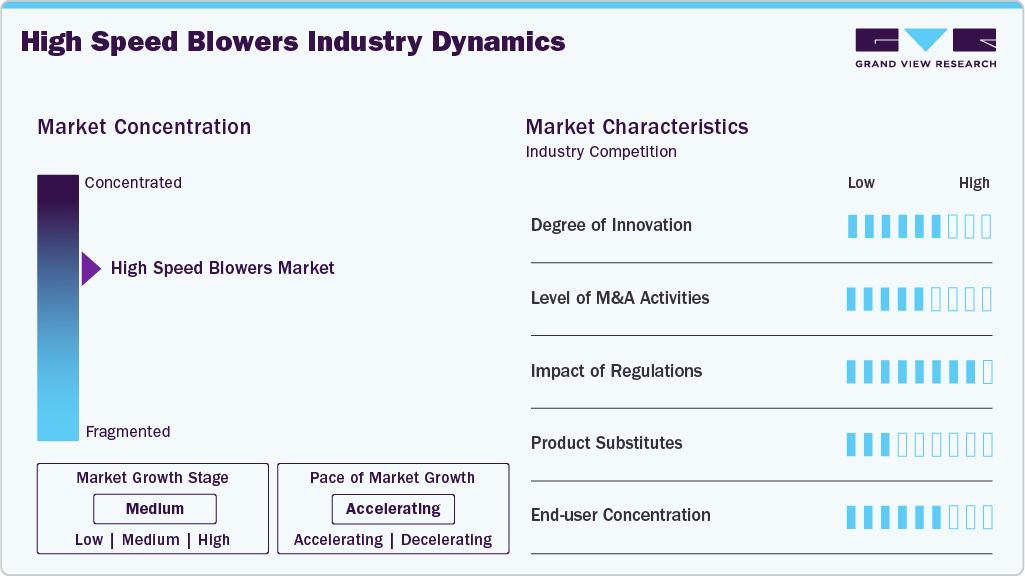

The global high speed blowers industry is moderately concentrated, with a few key players dominating the landscape. Leading companies such as Atlas Copco, Ingersoll Rand, and Howden hold significant market shares due to their strong technological capabilities and global reach. However, the presence of several regional manufacturers offering cost-effective solutions introduces a degree of fragmentation, especially in emerging markets.

The high speed blowers industry is characterized by a steady pace of innovation, primarily focused on improving energy efficiency, noise reduction, and compact design. Manufacturers are investing in advanced materials, digital monitoring systems, and aerodynamic designs to enhance performance. Innovation is also being driven by the demand for oil-free technologies, especially in sensitive applications like food processing and pharmaceuticals. Continuous R&D efforts help companies differentiate their offerings and meet evolving industrial requirements.

Environmental regulations play a critical role in shaping the market. Stricter emissions and energy efficiency standards in regions like North America and Europe are pushing industries to upgrade to eco-friendly blower systems. Regulatory bodies are increasingly mandating energy audits and compliance with standards such as ISO 50001. This has led to a surge in demand for blowers that align with sustainability goals and help reduce carbon footprints.

High speed blowers serve essential functions in many industrial processes; they face competition from other air movement technologies like positive displacement blowers and traditional centrifugal fans. These substitutes may be preferred in low-speed or low-cost applications. However, in high-demand environments requiring energy efficiency and precision, high-speed blowers offer clear advantages. The choice between products often depends on specific operational needs, cost considerations, and energy consumption targets.

Drivers, Opportunities & Restraints

One of the main drivers of the global high-speed blowers industry is the increasing demand for energy-efficient and low-maintenance air movement solutions. Industries such as wastewater treatment, food processing, and electronics manufacturing rely heavily on these blowers for consistent performance and reduced energy consumption. The growing push for sustainability and compliance with energy regulations is further accelerating adoption. In addition, advancements in blower technology are enhancing reliability and operational efficiency.

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities due to rapid industrialization and infrastructure development. There is a rising need for efficient wastewater treatment and air handling systems in urban expansion projects. Furthermore, the integration of smart technologies and IoT-enabled blowers opens new avenues for predictive maintenance and system optimization. These trends are encouraging investment and innovation in the sector.

High initial costs and complex installation requirements can hinder the adoption of high-speed blowers, especially among small and medium enterprises. In addition, the availability of alternative low-cost air handling systems may deter some buyers. Technical challenges, such as the need for skilled maintenance and compatibility with existing systems, also pose limitations. Economic slowdowns and supply chain disruptions can further impact market growth.

Technology Insights

The airfoil bearing segment dominated the market with a share of 61.2% in 2024, due to its cost-effectiveness, reliability, and suitability for continuous-duty applications. These bearings require no lubrication, reducing maintenance needs and operating costs. Their proven performance in industries like wastewater treatment and HVAC makes them the preferred choice for many end users.

Magnetic bearings are experiencing significant growth due to their ability to operate without physical contact, resulting in minimal wear and high precision. They are increasingly adopted in high-performance and sensitive applications, such as pharmaceuticals and electronics, where vibration-free and contamination-free operation is critical. Although more expensive, their long-term efficiency and reduced maintenance make them an attractive emerging option.

End Use Insights

The water & wastewater treatment segment led the market with a share of 31.0% in 2024 due to its continuous demand for efficient and energy-saving aeration systems. High-speed blowers are ideal for maintaining airflow in treatment tanks while reducing energy costs. Their low maintenance and oil-free operation make them a preferred choice in municipal and industrial treatment plants.

The chemical and petrochemical sector is witnessing significant growth in high-speed blower adoption driven by the need for precise, contamination-free air supply in critical processes. These industries benefit from the reliability and efficiency of advanced blower systems in handling corrosive or hazardous environments. Increasing investments in plant upgrades and safety compliance further support market growth in this segment.

Regional Insights

The North America high speed blowers industry is expected to grow at a significant CAGR of 5.7% over the forecast period, driven by a strong emphasis on energy efficiency and environmental compliance. The U.S. and Canada are upgrading aging infrastructure and wastewater facilities, creating a need for modern, high-performance blowers. In addition, the presence of advanced technology providers and R&D investments supports the region's growth trajectory. The adoption of smart and oil-free blowers is particularly notable.

U.S. High Speed Blowers Market Trends

The U.S. high speed blowers industry remains the dominating market and accounted for the largest revenue share in the North America region in 2024, driven by advanced industrial infrastructure and stringent energy efficiency regulations. Significant investments in upgrading municipal water treatment facilities and adopting sustainable manufacturing practices drive demand.

Mexico high speed blowers industry is emerging as a key growth market within North America due to its expanding industrial base and increased investments in infrastructure and environmental management. The country’s focus on modernizing its water and wastewater treatment systems is creating opportunities for high-speed blower deployment.

Asia Pacific High Speed Blowers Market Trends

Asia Pacific high speed blowers industry dominated globally in 2024 with a 33.4% share in the global market, driven by rapid industrialization, urban development, and expanding infrastructure projects. Countries like China, India, and Japan are investing heavily in wastewater treatment, electronics manufacturing, and energy-efficient industrial systems. The region's focus on sustainability and clean technology adoption further boosts demand. Competitive manufacturing costs and government-backed environmental initiatives also contribute to market leadership.

China high speed blowers industry held a significant share in the Asia Pacific market in 2024, owing to its massive industrial output and government-led initiatives to improve environmental sustainability. Rapid urbanization and expansion of wastewater treatment facilities have significantly increased the demand for energy-efficient blower systems. In addition, China’s push for clean manufacturing and stricter emission regulations is encouraging the adoption of advanced, oil-free, and low-maintenance blower technologies.

The high speed blowers industry in India is propelled by increasing investments in infrastructure, wastewater management, and industrial modernization. Government programs like “Namami Gange” and Smart Cities Mission are boosting the deployment of advanced blower technologies in water treatment projects. The rise of sectors such as pharmaceuticals, food processing, and chemicals also contributes to demand.

Europe High Speed Blowers Market Trends

Europe high speed blowers industry maintained a significant market share in 2024 due to its stringent environmental regulations and focus on sustainable industrial practices. Countries such as Germany, France, and the UK are promoting energy-efficient technologies in sectors such as wastewater management and manufacturing. Technological advancements and widespread awareness of carbon reduction targets are key growth drivers. However, market saturation in some areas may limit faster expansion.

Germany high speed blowers industry held a leading position in 2024 in the European market, driven by its strong industrial base and commitment to energy efficiency. The country’s advanced wastewater treatment infrastructure and focus on sustainable manufacturing processes create consistent demand for high-performance blowers. German companies are also at the forefront of integrating smart technologies and automation, enhancing the efficiency and monitoring of blower systems. Supportive government policies and environmental regulations further encourage adoption across sectors.

The UK high speed blowers industry is a significant contributor to the European market, with growing demand in sectors such as water treatment, pharmaceuticals, and food processing. Ongoing investments in green infrastructure and initiatives to reduce industrial carbon emissions are boosting the need for energy-efficient air movement solutions. The country is also encouraging modernization of utility services, including water and waste management. These factors, combined with strong regulatory oversight, are driving steady market growth.

Middle East & Africa High Speed Blowers Market Trends

The Middle East and Africa high speed blowers industry showed gradual growth in 2024, mainly driven by water treatment needs in arid areas and expanding petrochemical industries. Countries such as Saudi Arabia and the UAE are investing in advanced infrastructure, creating demand for reliable blower technologies. While market potential exists, challenges like limited local manufacturing and high import dependence may slow growth. Increasing environmental concerns could support future market development.

The UAE’s rapid growth in the high speed blowers industry is driven by large-scale infrastructure projects and a national push toward sustainability. Government initiatives like the Net Zero 2050 Strategy and industrial diversification are increasing demand for energy-efficient air handling systems. Sectors such as construction, manufacturing, and water treatment are key contributors. The country’s focus on innovation and clean technologies supports continued market expansion.

Latin America High Speed Blowers Market Trends

Latin America high speed blowers industry presents emerging opportunities, particularly as infrastructure and industrial development increase in countries like Brazil and Mexico. Investments in water treatment and energy-efficient solutions are gradually rising. However, limited technological awareness and economic fluctuations can act as barriers. Growth is expected to be moderate, supported by international funding for environmental projects.

Brazil high speed blowers industry showed rapid growth in 2024, driven by expanding industrial activities and infrastructure development. The country's increasing demand for energy-efficient and environmentally compliant solutions in sectors like wastewater treatment, power generation, and manufacturing is driving this growth. Government initiatives aimed at enhancing industrial competitiveness and environmental sustainability are further supporting the adoption of advanced blower technologies.

Key High Speed Blowers Company Insights

Some of the key players operating in the market include AERZEN Maschinenfabrik GmbH, APG-Neuros, and Atlas Copco.

-

AERZEN Maschinenfabrik GmbH is in the development and production of high-performance blowers, compressors, and gas meters. The company specializes in oil-free and energy-efficient technologies tailored for various industries, including maritime, chemical, food, and wastewater. AERZEN products are known for their robust construction, reliability, and low lifecycle costs. With a presence in over 100 countries, AERZEN emphasizes innovation and customer-centric solutions.

-

Atlas Copco is a globally recognized provider of industrial solutions, including air compressors, vacuum systems, generators, blowers, and power tools. Serving a wide range of industries-from manufacturing and construction to mining and oil & gas-Atlas Copco is known for innovation, quality, and sustainability. Their products are designed to deliver maximum productivity while minimizing energy consumption.

Key High Speed Blowers Companies:

The following are the leading companies in the high speed blowers market. These companies collectively hold the largest market share and dictate industry trends.

- AERZEN Maschinenfabrik GmbH

- APG-Neuros

- Atlas Copco

- Fuji Electric Co. Ltd.

- Gardner Denver

- Howden Group

- Raetts Group

- Shandong Zhangqiu Blower Co., Ltd.

- United Blowers Inc.

- Spencer Turbine Company

- Xylem Inc.

- Ingersoll Rand

- Hitachi Ltd.

- Piller Blowers & Compressors GmbH

- Hoffman & Lamson

Recent Developments

-

In March 2025, Runtech Systems introduced the RunEco EP650 AMB Turbo Blower, featuring active magnetic bearings (AMB) for enhanced energy efficiency and reduced maintenance in paper machine vacuum systems. The blower's compact design, with impellers mounted directly onto the motor shaft, simplifies installation and improves reliability.

-

In August 2023, Delta Electronics unveiled its High-Speed Maglev Blower Solution, integrating advanced automation components for enhanced energy efficiency and streamlined air transmission. The system employs the AMBD Series Magnetic Bearing Controller for precise magnetic levitation control, eliminating the need for traditional AC/DC converters. Coupled with the C2000-HS Series High-Frequency Motor Drive and output reactors, it minimizes current ripples and prevents overheating.

High Speed Blowers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 950.7 million

Revenue forecast in 2030

USD 1,235.7 million

Growth rate

CAGR of 5.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

AERZEN Maschinenfabrik GmbH; APG-Neuros; Atlas Copco; Fuji Electric Co. Ltd.; Gardner Denver; Howden Group; Raetts Group; Shandong Zhangqiu Blower Co., Ltd.; United Blowers Inc.; Spencer; Turbine Company; Xylem Inc.; Ingersoll Rand; Hitachi Ltd.; Piller; Blowers & Compressors GmbH; Hoffman & Lamson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Speed Blowers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high speed blowers market report based on technology, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Airfoil Bearings

-

Magnetic Bearings

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Water & Wastewater Treatment

-

Chemical & Petrochemical

-

Oil & Gas

-

Power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high speed blowers market size was estimated at USD 905.4 million in 2024 and is expected to be USD 950.7 million in 2025.

b. The global high speed blowers market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 1,235.7 million by 2030.

b. Asia Pacific dominated the global high-speed blowers market in 2024 with a 33.4% share. Growth is driven by rapid industrialization and infrastructure expansion in countries like China, India, and Japan.

b. Some of the key players operating in the global high speed blowers market include AERZEN Maschinenfabrik GmbH; APG-Neuros; Atlas Copco; Fuji Electric Co. Ltd.; Gardner Denver; Howden Group; Raetts Group; Shandong Zhangqiu Blower Co., Ltd.; United Blowers Inc.; Spencer; Turbine Company; Xylem Inc.; Ingersoll Rand; Hitachi Ltd.; Piller; Blowers & Compressors GmbH; Hoffman & Lamson

b. The global high-speed blowers market is driven by increasing demand for energy-efficient and low-maintenance air handling systems across various industries. Growth in sectors such as wastewater treatment, electronics manufacturing, and chemical processing is further propelling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.