- Home

- »

- Plastics, Polymers & Resins

- »

-

High-Temperature Polyimide Films Market Size Report, 2033GVR Report cover

![High-Temperature Polyimide Films Market Size, Share & Trends Report]()

High-Temperature Polyimide Films Market (2025 - 2033) Size, Share & Trends Analysis Report By Thickness (<25 µm, 25-50 µm, 50-75 µm, >75 µm), By Application (Electronics & Semiconductor, Automotive Electronics, Aerospace & Defense, Industrial Equipment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-820-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High-Temperature Polyimide Films Market Summary

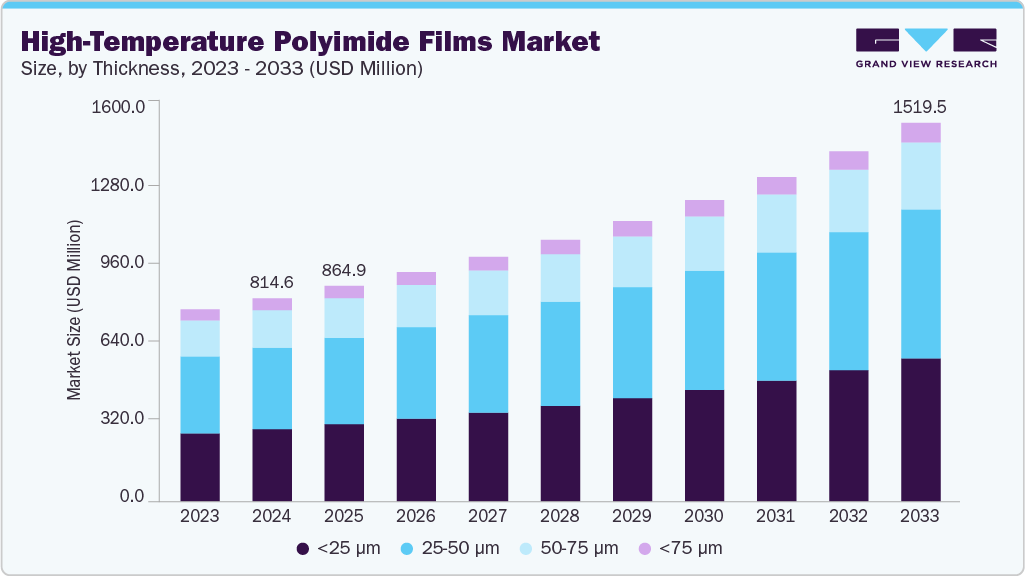

The global high-temperature polyimide films market size was estimated at USD 814.6 million in 2024 and is projected to reach USD 1,519.5 million by 2033, growing at a CAGR of 7.3% from 2025 to 2033. A growing focus on reliability in high-density electronics is prompting OEMs to adopt films that provide stable electrical performance under extreme thermal cycling conditions.

Key Market Trends & Insights

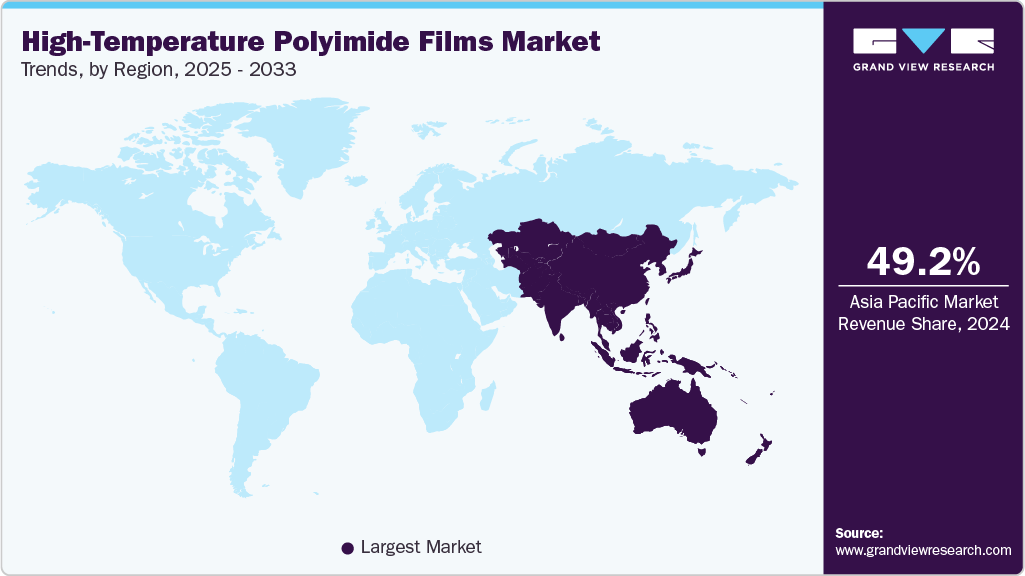

- Asia Pacific dominated the high-temperature polyimide films market with the largest revenue share of 49.23% in 2024.

- The high-temperature polyimide films industry in China is expected to grow at a substantial CAGR of 8.0% from 2025 to 2033.

- By thickness, the <25 μm segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033 in terms of revenue.

- By application, the automotive electronics segment is expected to grow at a considerable CAGR of 7.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 814.6 Million

- 2033 Projected Market Size: USD 1,519.5 Million

- CAGR (2025-2033): 7.3%

- Asia Pacific: Largest Market in 2024

Manufacturers value these materials because they reduce failure rates and extend the operating life of components in compact devices. Demand is moving from commodity Kapton-style films to application-specific high-temperature polyimides with tailored optical, dielectric, and mechanical profiles. Thin-gauge films for flexible printed circuits and colorless variants for flexible displays are rising fastest. Producers are investing in downstream coating and value-added lamination to capture OEM margins. Regional capacity additions are concentrated in East Asia, where electronics supply chains cluster.

Drivers, Opportunities & Restraints

Accelerated electrification and miniaturization in consumer electronics, automotive power electronics, and telecom hardware are increasing the need for films that withstand >200-300°C while preserving dielectric strength. Aerospace and satellite programs also demand radiation-resistant, thermally stable substrates for long-life installations. This combination of higher temperature tolerance and electrical reliability is the single largest demand-side driver today.

There is a clear growth window in developing colorless, low-CTE polyimides and hybrid stacks optimized for OLED/foldable displays and advanced IC packaging. Manufacturers that offer engineered surface chemistries, thin-gauge precision calendering, and integrated adhesive or barrier coatings can win design wins and premium pricing. Adjacent opportunities exist in EV inverter insulation and space-grade films where performance premiums justify long qualification cycles.

Feedstock volatility, complex multi-step synthesis, and stringent process control increase production costs and hinder capacity expansion. Achieving high optical clarity without sacrificing thermal stability remains technically difficult and increases R&D and yield risk. Supply concentration among a few specialty producers in Asia also exposes buyers to lead-time and price swings, which can constrain adoption in cost-sensitive segments.

Market Characteristics

The market growth stage of the high-temperature polyimide films market is medium, and the pace is accelerating. The market exhibits consolidation, with key players dominating the industry landscape. Major companies, including DuPont de Nemours, Inc., PI Advanced Materials Co., Ltd., Kaneka Corporation, Ube Industries, Ltd., Taimide Technology Co., Ltd., Mitsubishi Gas Chemical Company, Inc., Saint-Gobain Performance Plastics, Toray Industries, Inc., and others, play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in high-temperature polyimide films is concentrated on functional differentiation rather than basic chemistry. Colorless polyimides and low-CTE formulations now enable the creation of transparent, dimensionally stable substrates for flexible displays and optical applications. Roll-to-roll thin-gauge processing and nanocomposite barrier coatings are improving yield and opening new form factors. Suppliers that combine tailored surface chemistries with integrated coatings capture higher-value design wins and shorten OEM qualification cycles.

Substitution pressure varies by application. In structural and very high mechanical load cases, PEEK and other high-performance thermoplastics compete on strength and chemical resistance. For cost-sensitive insulation tasks, PET, PEN, and PPS remain lower-cost alternatives where peak temperature demands are moderate. Liquid crystal polymers are a viable option for high-frequency electronics where dielectric loss is a critical factor. Polyimide keeps the edge where continuous service temperatures above 300°C or extreme dimensional stability are required.

Thickness Insights

The 25-50 μm segment dominated the high-temperature polyimide films industry, accounting for a revenue share of 40.09% in 2024. This mid-gauge range currently captures the largest share of semiconductor and flexible circuit demand, as it strikes a balance between mechanical strength and electrical insulation. Films in the 25-50 μm range offer robust manufacturing during handling and lamination, while meeting dielectric requirements for multilayer builds. Buyers in PCB and wafer-level packaging prefer this thickness to reduce process rejects and qualification time. Market reports identify this band as the volume spine of polyimide consumption today.

The <25 μm segment is anticipated to grow at the fastest CAGR of 8.0% through the forecast period. Ultra-thin films under 25 μm are gaining momentum as foldable displays and wearable sensors require substrates with low thickness and high flexibility. Suppliers are investing in roll-to-roll coating and barrier technology to improve yield at these gauges. The cost per square meter is higher, but the design wins in premium devices justify the premium. Recent industry activity ties ultrathin demand to increased equipment orders for thin-film processing.

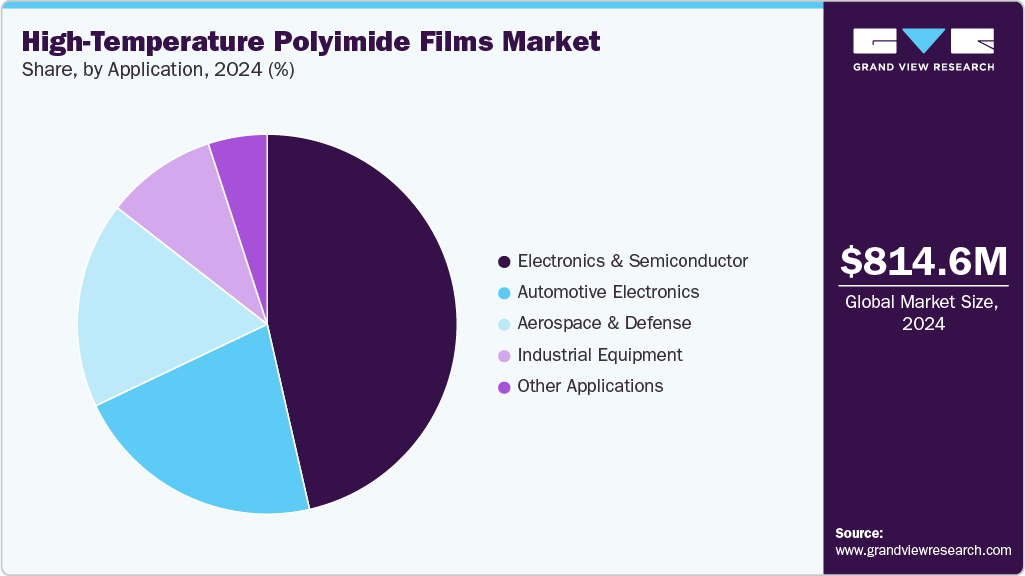

Application Insights

The electronics & semiconductors segment dominated the high-temperature polyimide films market, accounting for a revenue share of 46.43% in 2024, and is forecasted to grow at a 7.5% CAGR from 2025 to 2033. Semiconductor manufacturers require polyimide films that offer thermal stability during high-temperature back-end processes and maintain stable dielectric performance in advanced packaging. As packaging shifts toward fan-out and organic substrates, demand for engineered polyimide films that withstand reflow and plasma steps rises. Suppliers who offer qualified film chemistry and tight thickness tolerances gain faster adoption in fabs and OSATs. This application is therefore a primary growth vector for specialty film suppliers.

The sports & fitness segment is expected to expand at a substantial CAGR of 7.9% through the forecast period. Electrification is driving the need for films that deliver electrical insulation at elevated temperatures in inverters, battery systems, and power modules. Automotive programs demand long-term reliability and supplier traceability. Materials that reduce weight while meeting thermal and flame-retardant standards win specification at the system level. The EV content-per-vehicle dynamic makes automotive electronics a durable, high-value growth opportunity for polyimide producers.

Regional Insights

Asia Pacific led the high-temperature polyimide films market, with the largest revenue share of 49.23% in 2024, and is expected to grow at the fastest CAGR of 7.7% over the forecast period. The Asia Pacific region leads in volume due to its hosting of the world’s largest electronics and display supply chains. High-throughput consumer electronics manufacturing and the expansion of EV production create continuous, scale-driven demand for mid- and thin-gauge polyimide films. Regional capacity additions for thin-film processing and barrier coatings are shortening lead times for OEMs. Local partnerships between filmmakers and contract manufacturers are accelerating product adoption.

China High-Temperature Polyimide Films Market Trends

The China high-temperature polyimide films market is expected to grow during the forecast period. China’s strategy to boost domestic semiconductor and electronic materials capability is increasing local demand and supplier investment. Policymakers and industry funds support vertical integration and indigenous material development. This expands the domestic polyimide supply base, shortens procurement cycles for local OEMs, and intensifies price and quality competition. Export controls and trade dynamics also push Chinese buyers to prioritize local sourcing.

North America High-Temperature Polyimide Films Market Trends

Demand in the North America high-temperature polyimide films industry is anchored by aerospace, defense, and industrial electronics programs that require long-life thermal stability and rigorous qualification. Procurement cycles favor suppliers with proven track records of traceability and regulatory compliance. Suppliers who can deliver certified space- and avionics-grade films win large, long-duration contracts. This structural demand supports steady, higher-margin volumes versus consumer applications.

Domestic semiconductor reshoring and advanced packaging incentives are driving near-term demand for high-performance films. Government funding and tax credits under the CHIPS framework are driving the development of new packaging plants and the sourcing of materials. Recent awards and greenfield packaging investments are already creating qualified demand lines for polyimide films used in reflow and advanced interconnect processes. Materials suppliers that localize supply and shorten qualifications lead times gain a strategic advantage.

Europe High-Temperature Polyimide Films Market Trends

Europe’s push to electrify transport and modernize aviation systems is creating robust demand for high-temperature insulating films. Vehicle electrification raises requirements for inverter and battery insulation that tolerate sustained heat and meet strict flame-retardancy standards. Aerospace primes continue to specify polyimide for high-reliability avionics and satellite harnesses. Regulatory emphasis on supply-chain certification further privileges established specialty producers.

Key High-Temperature Polyimide Films Company Insights

The high-temperature polyimide films market is highly competitive, with several key players dominating the landscape. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key High-Temperature Polyimide Films Companies:

The following are the leading companies in the high-temperature polyimide films market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont de Nemours, Inc.

- PI Advanced Materials Co., Ltd.

- Kaneka Corporation

- Ube Industries, Ltd.

- Taimide Technology Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Saint-Gobain Performance Plastics Corporation

- Toray Industries, Inc.

Recent Developments

-

In July 2025, Toray Industries launched a new photosensitive polyimide solution called STF-2000, which supports high-aspect-ratio fine patterning. It is ideal for advanced electronics and microfabrication.

-

In March 2025, DuPont showcased a next-generation Kapton-based polyimide film at DesignCon 2025, designed for high-temperature applications such as EV inverters, 5G modules, and AI data-center PCBs.

High-Temperature Polyimide Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 864.9 million

Revenue forecast in 2033

USD 1,519.5 million

Growth rate

CAGR of 7.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Thickness, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

DuPont de Nemours, Inc.; PI Advanced Materials Co., Ltd.; Kaneka Corporation; Ube Industries, Ltd.; Taimide Technology Co., Ltd.; Mitsubishi Gas Chemical Company, Inc.; Saint-Gobain Performance Plastics Corporation; Toray Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-Temperature Polyimide Films Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the high-temperature polyimide films market report based on thickness, application, and region:

-

Thickness Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

<25 μm

-

25-50 μm

-

50-75 μm

-

>75 μm

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Electronics & Semiconductor

-

Automotive Electronics

-

Aerospace & Défense

-

Industrial Equipment

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high-temperature polyimide films market size was estimated at USD 814.6 million in 2024 and is expected to reach USD 864.9 million in 2025.

b. The global high-temperature polyimide films market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 1,519.5 million by 2033.

b. 25–50 μm dominated the high-temperature polyimide films market across the thickness segmentation in terms of revenue, accounting for a market share of 40.09% in 2024 and is forecasted to grow at 7.1% CAGR from 2025 to 2033.

b. Some key players operating in the high-temperature polyimide films market include DuPont de Nemours, Inc., PI Advanced Materials Co., Ltd., Kaneka Corporation, Ube Industries, Ltd., Taimide Technology Co., Ltd., Mitsubishi Gas Chemical Company, Inc., Saint-Gobain Performance Plastics Corporation, and Toray Industries, Inc.

b. A growing focus on reliability in high-density electronics is pushing OEMs to adopt films that offer stable electrical performance under extreme thermal cycling. Manufacturers value these materials because they reduce failure rates and extend the operating life of components in compact devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.