- Home

- »

- Healthcare IT

- »

-

High Volume Dispensing Systems Market Size Report, 2030GVR Report cover

![High Volume Dispensing Systems Market Size, Share & Trends Report]()

High Volume Dispensing Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Systems/Cabinets, Software Solutions), By End-use (Retail Pharmacies, Hospital Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-431-4

- Number of Report Pages: 83

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global high volume dispensing systems market size was valued at USD 2.41 billion in 2022 and projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2023 - 2030. High volume dispensing systems can be defined as cabinets for handling and dispensing large volumes of medication inventory. Technological advancements, increasing incidence of medication errors, and growing adoption of pharmacy automation systems and software for high volume dispensing are among the key trends driving the market growth. The U.S. FDA receives more than 100,000 reports related to suspected medication errors every year. According to the World Health Organization (WHO), in 2017, medical errors caused at least one death every year and were responsible for injuries in about 1.3 million people in the U.S. annually.

Increasing number of prescriptions and mounting cases of non-communicable diseases are poised to provide a fillip to the market. According to the latest update by the Centers for Disease Control and Prevention (CDC), 6 out of 10 U.S. citizens suffer from at least one chronic condition and 4 out of 10 suffer from two chronic conditions. In addition, spiraling demand for faster and more accurate prescription processing is anticipated to further propel the market.

Recent technological advancements in the structural designing of automated cabinets to process large volume prescriptions at a faster rate are likely to bolster the demand for these systems in retail pharmacy chains. In March 2022, Walgreens Boots Alliance launched 22 micro-fulfillment centers in the U.S. These centers use robots to fill customers' prescriptions, reflecting changes in the role of stores and pharmacists. Each robot can fill 300 prescriptions in an hour.

With the rise in the number of retail and mail-order pharmacies, the requirement for efficient systems and software for handling and dispensing large volumes of medication inventory increases. There were 44,900 pharmacies & drug stores businesses in the U.S. as of June 2023. This, in turn, translates into an upswing in the demand for high volume dispensing systems. Moreover, rising pressure on the healthcare sector to curb the prices of medications is further generating strong demand for these software and cabinets as they help avoid the costs of excess inventory.

Increasing government funding for the installation of these cabinets in hospitals is estimated to help the market gain tremendous traction over the coming years. For instance, in 2016, Right to Care, a non-profit organization, initiated a pharmacy automation scale-up program in collaboration with the government of South Africa at Helen Joseph Hospital. Besides this, surging demand for reducing the number of inventory discrepancies in pharmacies and hospitals is one of the primary growth stimulants for the market.

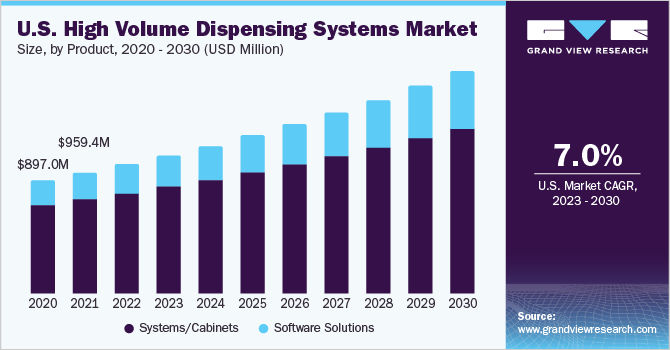

Product Insights

On the basis of product, the market is segmented into systems/cabinets and software solutions. Systems/cabinets dominated the market with a significant share in 2022. Soaring demand for effective pharmacy workflow coupled with growing concerns regarding the safe dispensing of medications is expected to augur well for the sales of high volume cabinets. Furthermore, the increasing number of pharmacies globally coupled with the increasing number of prescriptions is responsible for generating a large medication inventory, which in turn is projected to contribute to the segment growth.

Technological advancements in cabinet designs for improving patient safety and prescription processing are supplementing the growth of the high volume dispensing systems market. Recent developments in cabinet designs include the use of RFID, barcode, and imaging technologies along with the implementation of innovative software solutions. For instance, the iA SmartPod automated dispensing system is designed to achieve high volume central pharmacy fulfillment which maximizes performance and improves fulfillment process throughput.

Software solutions are expected to grow at the fastest CAGR over the forecast period. Increasing demand for pharmacy software solutions in order to streamline workflow is one of the key factors anticipated to trigger the growth of the segment over the same period. NEXiA software (iA) is one of the leading-edge suites of intelligent pharmacy software. In addition, the growing adoption of these large-volume dispensing software solutions and systems in various medical applications, especially in the case of controlled substances, is stimulating the growth of the overall market.

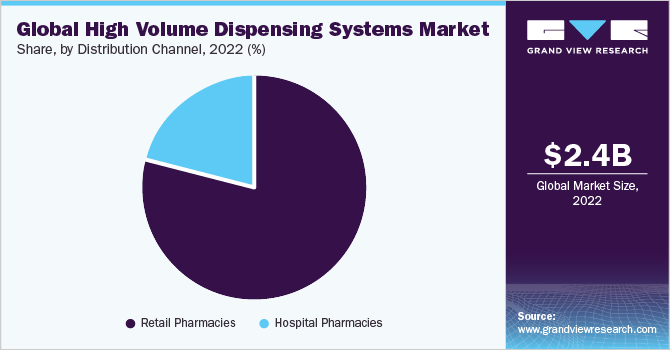

End-use Insights

On the basis of end use the market is segmented into independent pharmacies and hospital pharmacies. Retail pharmacies dominated the market with a share of 80.2% in 2022 and is expected to grow at the fastest CAGR of 8.3% over the forecast period. This is owing to the rising number of retail pharmacies and prescriptions, which in turn, is generating significant volumes of medication inventory. Apart from this, burgeoning demand for specialty medicines spurs the need for these cabinets and software that allow safe and efficient dispensing of medications. For instance, in2021, about USD 603 billion was spent on medication in the U.S., USD 301 billion of which was spent on specialty drugs.

These cabinets are proven effective in decreasing labor costs as well as in avoiding understocking or overstocking of medications. Furthermore, an increase in favorable initiatives by governments and public & private players to implement these systems in pharmacies is augmenting the market. Growing cost burden and risk of medication errors are further fueling the demand for high volume dispensing systems.

The implementation of these systems in hospital pharmacies is likely to increase at a noteworthy growth rate of 7.3% over the forecast period. Increasing inventory discrepancies, rising number of medication errors, and growing focus on reduction in workload are boosting the demand for these systems in hospitals.

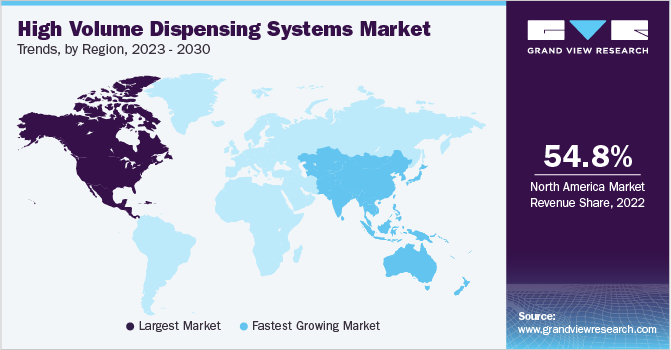

Regional Insights

North America dominated the market with a revenue share of 54.8% in 2022, owing to the presence of a large number of market players that increase the availability of these systems in the region, established healthcare infrastructure, and high prevalence of chronic diseases. Early adoption of such cabinets and software by pharmacies as well as hospitals and rapid technological advancements are working in favor of the market in this region. Besides this, increasing investments by public and private bodies in the sector of pharmacy automation are estimated to help the region retain its position through 2030. Growing concerns pertaining to inadequate inventory management are providing a remarkable push to the demand for these cabinets and software in the region.

Asia Pacific is expected to grow at the fastest CAGR of 9.8% over the forecast period. Rising number of prescriptions, shortage of qualified pharmacists, and continual efforts for improvement in healthcare infrastructure are among the key factors fostering the regional market growth. As of April 2022, there were 16,86,342 registered pharmacists in India. In recent years, due to increasing healthcare expenditure, growing incidence of dispensing errors, and mounting disease burden, medication inventory is projected to rise. This, in turn, is stoking the demand for high volume dispensing systems over the forecast period.

Key Companies & Market Share Insights

The market is highly competitive and the players are undertaking strategies such as mergers & acquisitions, product launches, and collaborations to gain market share. For instance in April 2023, iA announced the introduction of NEXiA Enterprise Analytics, a cloud-based application specifically designed for pharmacy fulfillment. This software offers a cutting-edge intelligence application that allows customers to observe pharmacy operations in multiple locations in real-time. Additionally, in March 2022, Omnicell introduced IVX Station Robotic Compounding Technology. It is fully automated, reduces human error rate while delivering accuracy, patient safety, supply chain control, cost savings, and compliance benefits. Some of the major players in the global high volume dispensing systems market:

-

McKesson Corporation

-

HEALTHMARK GROUP

-

TCGRx

-

R/X Automation Solutions

-

ScriptPro LLC

-

iA

-

Omnicell, Inc.

High Volume Dispensing Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.61 billion

Revenue forecast in 2030

USD 4.50 billion

Growth Rate

CAGR of 8.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

McKesson Corporation; HEALTHMARK GROUP; TCGRx; R/X Automation Solutions; ScriptPro LLC; iA; Omnicell, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

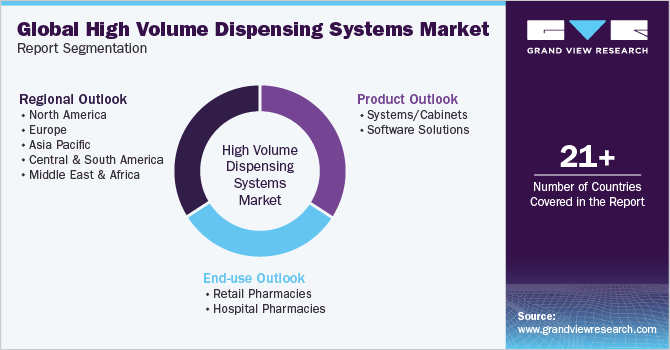

Global High Volume Dispensing Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high volume dispensing systems market based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Systems/Cabinets

-

Software Solutions

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacies

-

Hospital Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global high volume dispensing systems market size was estimated at USD 2.41 billion in 2022 and is expected to reach USD 2.61 billion in 2023.

b. The global high volume dispensing systems market is expected to grow at a compound annual growth rate of 8.1% from 2023 to 2030 to reach USD 4.5 billion by 2030.

b. The system segment dominated the high volume dispensing systems market with a share of 77.7% in 2022. This is attributable to the increasing demand for efficient pharmacy workflow and rapid technological advancements.

b. Some key players operating in the high volume dispensing systems market include Omnicell, Inc.; McKesson Corporation; Innovation Associates; TCGRx; and ScriptPro, LLC.

b. Key factors that are driving the market growth include technological advancements, increasing incidence of medication errors, and growing adoption of pharmacy automation systems and software for high volume dispensing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.