- Home

- »

- Clinical Diagnostics

- »

-

Histology And Cytology Market Size & Share Report, 2030GVR Report cover

![Histology And Cytology Market Size, Share & Trends Report]()

Histology And Cytology Market Size, Share & Trends Analysis Report By Type Of Examination (Histology, Cytology), By Product (Instruments, Consumables), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-917-3

- Number of Report Pages: 196

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

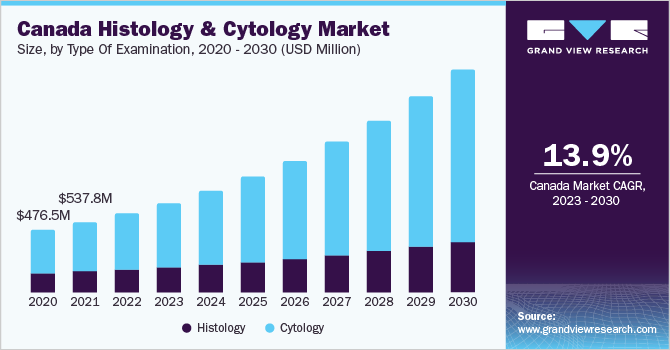

The global histology and cytology market size was estimated at USD 16.11 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.15% from 2023 to 2030. The increasing prevalence of cell-based diseases such as cancer and rising demand for the detection of tissue and cell characteristics are major factors driving the market growth throughout the forecast period. The integration of digital solutions for cytological diagnosis offers the advantage of rapid interpretation of primary diagnostic data. In addition, companies are launching new and advanced digital cytology systems for assisting in the rapid on-site evaluation of cytology samples. For instance, in March 2023, OptraSCAN, a digital pathology solution provider announced the launch of OnDemand Digital Pathology solution in North America.

The rise in the popularity of immunohistochemistry for visualizing cellular components to diagnose a wide range of diseases such as various infectious diseases and cancer is driving the histology & cytology market growth. Several companies are developing innovative immunohistochemistry instruments and reagents. For instance, in January 2023, Agilent Technologies collaborated with Akoya Biosciences to develop multiplex chromogenic and immunohistochemistry diagnostic products to analyze tissue.

The In-Vitro Diagnostic (IVD) labeled system will enable diagnostic laboratories to maximize their sample throughput processing with ideal turn-around time. The COVID-19 pandemic had a positive impact on the growth of the market for histology and cytology. Various strategic collaborations were observed between the companies for developing antibodies specific for validation with immunohistochemistry. For instance, in September 2020, GeneTex, Inc. partnered with HistoWiz, Inc. to establish various validated antibodies for immunohistochemistry in human COVID-19-infected tissues.

Type Of Examination Insights

The cytology segment dominated the market with the largest revenue share of 70.51% in 2022. It is expected to continue the trend during the forecast period. The integration of Artificial Intelligence (AI) for developing advanced cytology systems can be attributed to segment growth. For instance, in March 2023, Fujifilm Healthcare Americas announced its novel Synapse Pathology solution, formerly called Dynamyx, at the United States and Canadian Academy of Pathology (USCAP) annual meeting held in New Orleans.

The breast cancer segment accounted for a significant share of the cytology segment revenue in 2022. The prognosis of breast cancer depends on early screening and detection. Fine Needle Aspiration Cytology (FNAC) is the most affordable procedure used to detect breast cancer.FNAC is crucial for the preoperative pathological evaluation of breast cancer management. Fine Needle Aspiration Cytology is an operator-dependent method and reporting of breast cytological results is more demanding than histological analysis

Low and middle-income countries particularly create a favorable environment for the emerging industry participants keen on establishing market presence; attributed to comparatively high incidences of cancer. Hence, for reducing the mortality rate, effective screening methods and early detection of Human Papillomavirus (HPV) are essential. The WHO has recommended Papanicolaou cytology (Pap smear) for cervical cytology screening as it can detect precursor lesions of cervical cancer at low cost, with flexibility, and at high rates. Hence, an increase in the employment of innovative cytology solutions in cervical cancer screening is set to contribute to the growth of the market for histology and cytology.

Product Insights

The consumables and reagents segment dominated the market for histology and cytology with the largest revenue share of 59.74% in 2022. The segment is expected to continue its dominance from 2023 to 2030. Several consumables are used for the histology and cytology process such as tissue sample containers, kits, stain reagents, fixative solutions, medium reagents, and other reagents. The large share of the segment can be primarily attributed to the routine adoption of histology and cytology consumables.

In addition, companies are developing technologically advanced consumables and reagents, which are further anticipated to drive the market for histology and cytology. For instance, in March 2023, 3DHISTECH along with Epredia announced the launch of a pathology innovation incubator that would accelerate advancements used for cancer diagnostics.

The instruments and analysis software system segment is expected to grow significantly throughout the forecast period owing to the increasing application of technologically advanced instruments such as photoacoustic microscopy, stimulated Raman spectroscopy, and multimodal nonlinear microscopy for histopathology. However, the significant infrastructure costs, along with technical and practical limitations in the pathology industry have affected the adoption of such large-scale digital transformative solutions. Hence, the reduction in the cost of the digitization process will improve the rate of digital adoption in pathology.

Application Insights

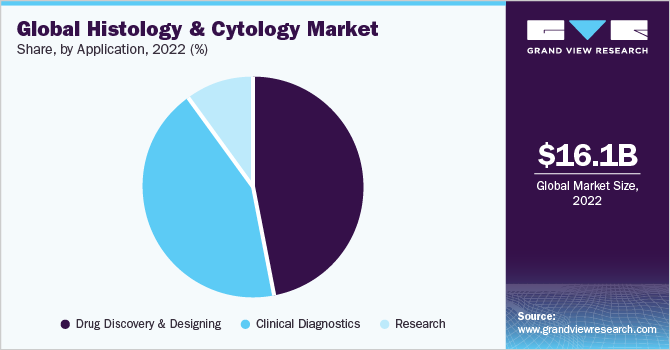

The drug discovery and designing segment held the largest revenue share of 47.20% in 2022. The segment is expected to continue its dominance over the forecast period. The growth of the segment can be attributed to the widespread use of histomorphometry and IHC staining in biotechnology and pharmaceutical companies for drug development. The image analysis is applied across several steps of drug discovery & development such as drug efficacy & safety studies, target validation, drug repositioning, patient stratification, and biomarker expression studies.

The clinical diagnostics segment is expected to witness significant growth at a CAGR of 14.71% over the forecast period. This growth can be attributed to the increasing application of histopathology studies for the diagnosis of various cancers. The cells and tissues are removed from suspicious lump sites for identifying abnormalities and malignancies. They are widely used for screening various cancers including breast, bowel, and cervical cancer.

Regional Insights

North America dominated the histology and cytology market and accounted for the largest revenue share of 40.14% in 2022. The growth of the region can be attributed to several factors such as high incidences of cancer, extensive R&D activities, presence of key players, and established research infrastructure for pathology services. In addition, the high rate of product approval and commercialization in the region is further contributing to the growth of the market for histology and cytology.

In Asia Pacific, the market for histology and cytology is expected to witness the fastest CAGR over the forecast period. The growth in the region is due to several factors such as rising cancer awareness, a large target population, and improving healthcare infrastructure. In addition, researchers are increasingly evaluating new cytology which is further fueling the growth of the market for histology and cytology in the region.

For instance, in August 2022, Tagrisso was licensed in Japan for the adjuvant therapy of patients with EGFRm non-small cell lung cancer (NSCLC). The Health Minister of Japan, Labour, and Welfare granted the permission based on favorable findings from the worldwide ADAURA Phase III study.

Key Companies & Market Share Insights

Various cancer screening pathology solutions have undergone rapid introductions and approvals in the market in recent years. For instance, in April 2023, Danaher’s Leica Biosystems announced the U.S. FDA clearance for its Bond MMR Antibody Panel, which offers a high-performing immunohistochemistry (IHC) mismatch repair (MMR) opportunity for clients that are screening colorectal cancer (CRC) individuals for probable Lynch syndrome. The various launch for efficient screening of tissues and cells for diagnostic purpose is anticipated to propel the market growth over the forecast period. Some prominent players in the global histology and cytology market include:

-

Hologic, Inc.

-

BD

-

Abbott

-

Merck KgaA

-

F. Hoffmann-La Roche Ltd

-

Thermo Fisher Scientific, Inc.

-

Danaher

-

Trivitron Healthcare

-

Sysmex Corporation

-

Koninklijke Philips N.V.

Histology And Cytology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.44 billion

Revenue forecast in 2030

USD 49.48 billion

Growth rate

CAGR of 15.15% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type of examination, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Thailand; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hologic, Inc.; F. Hoffmann-La Roche Ltd.; Abbott; Becton, Dickinson, and Company; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Sysmex Corporation; Trivitron Healthcare; Koninklijke Philips N.V.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Histology And Cytology Market Report Segmentation

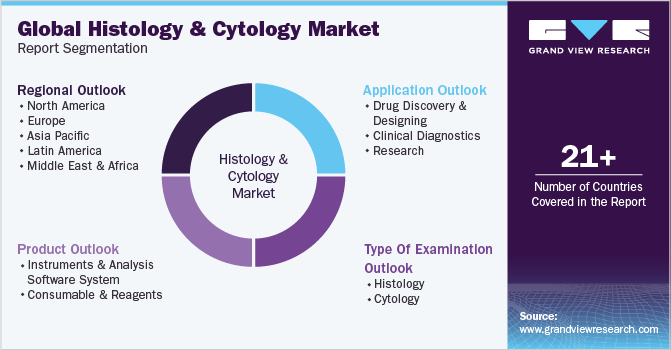

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global histology and cytology market report based on type of examination, product, application, and region:

-

Type Of Examination Outlook (Revenue, USD Million, 2018 - 2030)

-

Histology

-

By Technique

-

Microscopy

-

Immunohistochemistry

-

Molecular Pathology

-

Cryostat & Microtomy

-

-

-

Cytology

-

By Technique

-

Microscopy

-

Immunohistochemistry

-

Molecular Pathology

-

Cryostat & Microtomy

-

-

By Application

-

Breast Cancer

-

Cervical Cancer

-

Bladder Cancer

-

Lung Cancer

-

Other Cancers

-

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments And Analysis Software System

-

Consumable And Reagents

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Designing

-

Clinical Diagnostics

-

Point-of-Care (PoC)

-

Non-Point-of-Care

-

-

Research

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global histology and cytology market size was estimated at USD 16.11 billion in 2022 and is expected to reach USD 18.44 billion in 2023.

b. The global histology and cytology market is expected to grow at a compound annual growth rate of 15.15% from 2023 to 2030 to reach USD 49.48 billion by 2030.

b. The consumables and reagents segment dominated the global histology and cytology market and accounted for the largest revenue share of 59.74% in 2022.

b. Some key players operating in the histology and cytology market include Trivitron Healthcare; Hologic, Inc.; Sysmex Corporation; Danaher; Abbott; Becton, Dickinson and Company; and F. Hoffmann-La Roche Ltd.

b. Key factors that are driving the histology and cytology market growth include rapid advancements in microscopy & immunohistochemistry, the advent of liquid-based cytology, and the increasing demand for virtual microscopy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."