- Home

- »

- Clinical Diagnostics

- »

-

HIV Diagnostics Market Size & Share, Industry Report, 2030GVR Report cover

![HIV Diagnostics Market Size, Share & Trends Report]()

HIV Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Mode (Self-test), By Test Type, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-461-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

HIV Diagnostics Market Summary

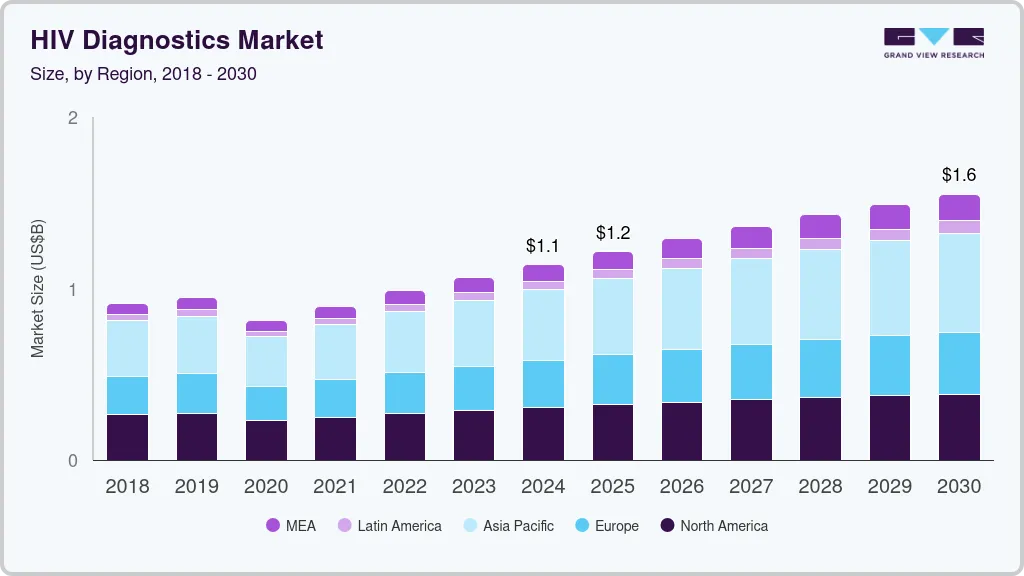

The global hiv diagnostics market size was estimated at USD 1.1 billion in 2024 and is projected to reach USD 1.55 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. Increasing investments in the chloride production processes and the flourishing construction industry worldwide are anticipated to contribute to the growth of the market for titanium dioxide (TiO2)in the coming years.

Key Market Trends & Insights

- North America HIV diagnostics industry accounted for a revenue share of 26.9% in 2024.

- The HIV diagnostics industry in the U.S. is projected to grow significantly during the forecast period.

- By product, the consumables segment accounted for the largest revenue share of 49.5% in 2024.

- By mode, the lab-based segment accounted for the largest revenue share of 92.9% in 2024.

- By test type, the antibody test segment dominated the industry and accounted for the largest revenue share of 56.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.1 Billion

- 2030 Projected Market Size: USD 1.55 Billion

- CAGR (2025-2030): 5.0%

- North America: Largest market in 2024

According to the data published by UNAIDS in 2024, by the end of 2023, approximately 39.9 million people were living with HIV, and 1.3 million were newly diagnosed with the disease. There is a further need to introduce easily accessible and efficient diagnostic tests in the most affected regions, as the limited availability of resources presents difficulties in performing current, complex screening, staging, and monitoring tests.

The lack of enough testing labs and qualified clinical professionals to perform these tests can restrain the industry growth in less developed countries. However, these limitations of laboratory-based testing have been a catalyst for the development of portable and easy-to-implement point-of-care, rapid tests. In the present scenario, several POC/rapid tests are being developed by some major market players and are expected to obtain regulatory authorization in a number of regions. This can further increase the number of product offerings and lead to increased accessibility of HIV diagnostics tests across the world. There is no cure for HIV, but the development of new and advanced treatment options and medicines can help in identifying and fighting the disease.

The HIV diagnostics industry is also driven by growing public awareness and government initiatives, such as the launch of the inaugural HIV Testing Month by the Department of Health and the Hong Kong Advisory Council on AIDS. These efforts encourage individuals to undergo regular HIV testing, particularly targeting those who are sexually active, in order to track their health status and promote early diagnosis. The focus on early intervention for HIV treatment to ensure viral suppression and health restoration further emphasizes the importance of accessible and timely diagnostic solutions, thereby fostering industry growth.

Several national and international organizations are working toward eradicating HIV and AIDS. For instance, in December 2020, the UNAIDS released new targets calling for 95% of all patients suffering from HIV to know their HIV status, 95% of patients with diagnosed HIV infection to receive sustained antiretroviral therapy (ART), and 95% of patients receiving ART to have viral suppression by 2025. Such programs can encourage further innovation in HIV diagnostics and treatment options. Moreover, the increasing need for blood transfusions and the consequent rise in blood donation and diagnostics tests can further increase the demand for HIV diagnostics tests. According to an article published by the World Health Organization (WHO) in June 2023, approximately 118.5 million blood donations are collected worldwide, 40% of these are from high-income countries and 16% from low-income countries.

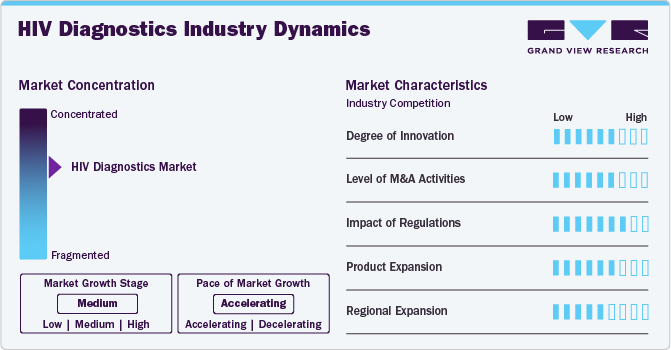

Market Concentration & Characteristics

The degree of innovation has been significant, driven by the development of advanced testing technologies that offer faster, more accurate, and less invasive results. For instance, point-of-care diagnostic tests, such as Cepheid's Xpert HIV-1 Qual XC, provide early detection of HIV in infants and use dried blood spots for testing, making it more accessible in resource-limited settings. In addition, rapid antigen-based tests and self-testing kits are being introduced, enhancing convenience and improving detection rates, particularly in high-risk populations. These innovations contribute to better monitoring, early diagnosis, and effective treatment strategies for HIV.

Collaboration and partnerships are crucial in the HIV diagnostics industry, with organizations like the World Health Organization, Global Fund, and local governments working together to improve access to testing and treatment. Companies such as Cepheid collaborate with health organizations to ensure their products meet international standards. In addition, research partnerships focus on developing new diagnostic tools, such as rapid testing technologies and point-of-care solutions, to improve early detection and management of HIV. These joint efforts are essential to advancing global HIV response strategies.

Regulations play a significant role in shaping the HIV diagnostics industry by ensuring the safety, quality, and efficacy of diagnostic tools, with organizations like the WHO and FDA setting stringent standards. Compliance with these regulations is critical for manufacturers to gain market approval and facilitate global distribution, promoting better healthcare outcomes.

The HIV diagnostics industry is driven by the development of innovative diagnostic tools such as rapid tests, point-of-care devices, and molecular assays for earlier and more accurate detection. Manufacturers are continuously enhancing their product portfolios to include tests for different stages of HIV infection and to cater to diverse patient populations, improving accessibility and convenience in testing.

Regional expansion in the HIV diagnostics industry is focused on increasing access to testing in emerging markets, especially in regions like Africa, Asia-Pacific, and Latin America, where HIV prevalence remains high. Companies are targeting these areas with cost-effective, portable diagnostic solutions to address the urgent need for early detection and treatment, while also navigating regional regulatory frameworks and collaborating with local health authorities.

Product Insights

The consumables segment accounted for the largest revenue share of 49.5% in 2024, owing to the prevalence of HIV cases and the need to improve the accuracy of the results. Various screening and confirmatory tests are conducted for the diagnosis of HIV-1, HIV-2, and group O incidences. These tests have primary applications to screen and differentiate between the various groups and subtypes of human immunodeficiency virus. Therefore, accurate consumables need to be used to improve the quality of results and treatments.

Moreover, the software & services segment is expected to grow at a significant CAGR of 4.9% over the forecast period due to technological advancements and increasing awareness regarding HIV and AIDS. Various government campaigns to create awareness and reduce the stigma around these diseases can also be attributed to this growth. For instance, Let’s Stop HIV Together (Together) is a campaign by the Centers for Disease Control and Prevention, which aims to raise awareness regarding HIV, promote diagnostics & testing, and reduce stigma around it.

Mode Insights

The lab-based segment accounted for the largest revenue share of 92.9% in 2024, owing to the accuracy of their results. Lab-based tests are performed in diagnostic laboratories or healthcare facilities by skilled professionals using advanced equipment. It gives accurate results, allows for prolonged monitoring, and is essential for confirmatory testing and complex analysis. Rapid and point-of-care testing technologies also allow for early intervention and reduce the time between testing and the start of the treatment. The market has enormous potential to increase accessibility, accuracy, and efficiency, ultimately leading to better outcomes for HIV patients and global disease-fighting efforts.

The self-testing segment is expected to grow at the fastest CAGR of 6.4% over the forecast period due to their user-friendliness and convenience. Self-testing allows individuals to run diagnostic tests at home using a self-collection kit and interpret the results independently. It offers ease, and anonymity, and facilitates early detection. Self-test kits have become more accessible with higher accuracy and faster turnaround times. It has given people the ability to take control of their health and overcome challenges, such as stigma and inconvenience with traditional testing techniques. Both self-testing and lab-based testing approaches aid in HIV diagnosis by catering to different needs and preferences, promoting awareness, and enabling effective viral control.

Test Type Insights

The antibody test segment dominated the industry and accounted for the largest revenue share of 56.6% in 2024. The segment is projected to remain dominant, growing at the fastest CAGR of 5.8% during the forecast period. The segment’s growth can be attributed to the presence of several antibody tests.

These tests include HIV-1 screening, confirmatory HIV-2, and Group-O tests, which can be further divided into 3rd- and 4th-generation ELISA tests, POC and non-POC dried blood spot tests, western blot, and line immunoassays. These tests are increasingly being used in disease subtyping, screening, and confirmation. The confirmatory western blot test is regarded as 100% accurate post-antibody screening. The high utilization rates and accuracy of these tests are further expected to drive the antibody testing segment growth.

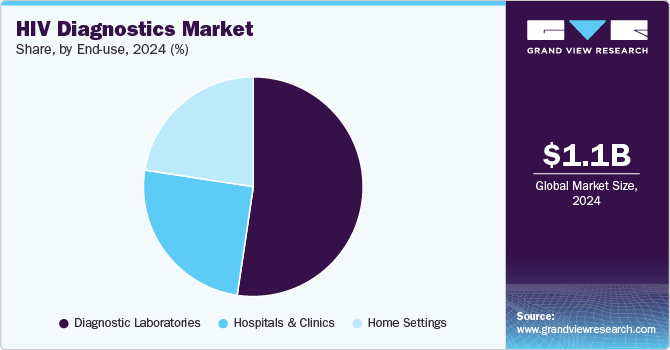

End Use Insights

The diagnostic laboratories segment held the largest revenue share of 52.4% in 2024 as diagnostic laboratories conduct rigorous testing and analysis using advanced instruments and qualified personnel, resulting in accurate results. The home settings segment is expected to register the fastest CAGR of 5.6% over the forecast period.

The market is reliant on collaboration among all segments, including diagnostic laboratories, hospitals & clinics, and home settings, to work together to ensure that people have access to accurate testing, counseling, and appropriate care to assist in the improvement of public health worldwide. The growth of this segment can be attributed to the privacy and convenience offered by home-based HIV testing kits, which allow individuals to administer tests and receive results in the privacy of their own homes.

Regional Insights

North America HIV diagnostics industry accounted for a revenue share of 26.9% in 2024. The market position can be attributed to technological advancements and regulatory approvals of advanced point-of-care diagnostics. For instance, in January 2025, Health Canada approved MedMira Inc.'s RevealRapid G4 HIV-1/2 test that delivers immediate and accurate results for HIV-1/2 antibodies using a simple finger-prick sample, completing the process in less than a minute. Such innovations cater to the growing demand for quick, reliable, and accessible diagnostic solutions, highlighting the region's focus on improving early detection and treatment accessibility.

U.S. HIV Diagnostics Market Trends

The HIV diagnostics industry in the U.S. is projected to grow significantly during the forecast period. The growing focus of biotechnology and diagnostic companies on treating and eradicating HIV contributes to the market growth in the country. For instance, in June 2024, OraSure Technologies, Inc., a U.S.-based company functioning in point-of-care and home diagnostic tests, supported HIV testing initiatives in the country on the occasion of National HIV Testing Day (June 27th). Promoting widespread HIV testing across the country, such programs raise awareness and encourage thousands to get tested. This emphasis on early detection aligns with the increasing adoption of point-of-care and home diagnostic solutions, fueling market growth by meeting the demand for accessible and efficient HIV testing options.

Europe HIV Diagnostics Market Trends

The Europe HIV diagnostics industry is driven by a combination of targeted testing initiatives and policy reforms across the region. For instance, according to the ECDC data published in November 2024, the resurgence of HIV testing and the implementation of new testing policies in the eastern part of the WHO European Region have driven the HIV diagnostics market in Europe. Following the subsiding of the COVID-19 pandemic, countries in this subregion have prioritized identifying undiagnosed cases, leading to a significant rebound in case detection. Meanwhile, in the EU/EEA and western parts of the region, increased diagnoses among migrants from high-prevalence countries and the expansion of HIV testing services have further contributed to market growth. These targeted efforts reflect the region’s commitment to closing the gap in undiagnosed HIV cases and enhancing access to diagnostics.

The HIV diagnostics market in the UK is projected to grow during the forecast period. The adoption of digital solutions, such as Idox plc’s Lilie clinical management platform, is a significant driver in the region. Lilie’s electronic patient record system streamlines administrative tasks, provides immediate access to patient data, a such as Idox plc’s Lilie clinical management platform, and improves overall efficiency in sexual health services. Its flexibility supports diverse clinic needs, while features like SMS reminders have reduced non-attendance rates by 60%, enhancing patient engagement. This integration of technology into sexual health services, including HIV diagnostics, reflects the UK’s commitment to improving patient experiences and meeting the growing demand for efficient, accessible healthcare solutions.

Asia Pacific HIV Diagnostics Market Trends

The Asia Pacific HIV diagnostics industryis expected to experience a notable growth rate during the forecast period. Advancements in research and development in the region are significant drivers for the HIV diagnostics market. For instance, researchers from Tokyo Medical and Dental University (TMDU) have identified a novel compound, a derivative of YSE028, that can efficiently reactivate latent HIV-1 in human cells. This breakthrough addresses the critical need for effective latency-reversing agents, which are essential for strategies combining reactivation of latent HIV-1 with antiretroviral treatments. Such innovations not only enhance therapeutic options but also drive demand for advanced diagnostic tools to monitor and manage treatment progress, fueling market growth in the region.

The HIV diagnostics market in China is projected to expand throughout the forecast period. In China, efforts to enhance access to HIV testing and care, expand HIV education, and emphasize equality and accessibility in healthcare are significant driving factors in the country. For instance, initiatives similar to Taiwan CDC’s (Centers for Disease Control) free-shipping service for HIV self-test kits and partnerships with designated hospitals to create HIV-friendly environments can inspire increased adoption of self-testing solutions and improve HIV testing. While addressing the gap in undiagnosed cases, China aligns with global goals like UNAIDS’ “95-95-95” targets. Such strategies not only reduce barriers to testing but also boost demand for advanced diagnostic tools, fueling market growth.

Latin America HIV Diagnostics Market Trends

The Latin America HIV diagnostics industryis expected to experience significant growth throughout the forecast period. The HIV diagnostics market is driven by the region's progress in reducing HIV-related deaths, which have declined by 28% in Latin America and 57% in the Caribbean over the past decade. This improvement reflects the growing availability of modern treatment options and early diagnostic tools that enable timely interventions. The focus on expanding access to diagnostic services and enhancing the effectiveness of treatment strategies underscores the region's commitment to improving health outcomes, thereby fueling the demand for advanced HIV diagnostic technologies.

The HIV diagnostics market in Brazil is likely to grow over the forecast period, driven by significant investments and international collaborations in HIV diagnostics. For instance, in August 2024, the USD 5 million grant from the Pan American Health Organization (PAHO) and Unitaid, announced in Rio de Janeiro, aims to strengthen HIV surveillance, introduce innovative diagnostic tools, and train healthcare workers to improve the prevention and management of advanced HIV disease. This initiative addresses critical gaps in national HIV programs and facilitates the adoption of cutting-edge technologies, enhancing the country’s capacity to combat HIV and fueling the demand for advanced diagnostics in Brazil.

Middle East and Africa HIV Diagnostics Market Trends

The Middle East and Africa HIV diagnostics market is expected to grow at a CAGR of 8.1%. Advancements in HIV testing and treatment have been pivotal in driving the diagnostics market. For instance, significant progress in preventing vertical transmission has led to rates below 5% in countries such as Ethiopia, South Africa, and Tanzania, showcasing the success of targeted interventions. The steep decline in new infections among children and a 64% reduction in AIDS-related child deaths between 2010 and 2022 highlights the effectiveness of expanded diagnostic and prevention programs. Such achievements, coupled with the ongoing need to address the remaining gaps, sustain the demand for innovative and accessible HIV diagnostic tools in the region.

The HIV diagnostics industry in the Saudi Arabia is anticipated to experience lucrative growth during the forecast period. The market is propelled by advancements in the availability and distribution of rapid testing solutions in the country. For instance, in December 2024, the World Health Organization approved a packaging and shipping site for a prequalified HIV rapid test which enables governments and international organizations like PEPFAR and the Global Fund to procure these tests efficiently. This milestone facilitates widespread access to reliable diagnostic tools, supporting national efforts to improve HIV detection and treatment, and bolstering the demand for advanced diagnostic solutions in South Africa.

Key HIV Diagnostics Company Insights

Key players are focusing on clinical research and development of CD4, p24 antigen, and viral load testing methodologies to reduce their implementation complexity and boost accessibility and portability in order to address unmet needs in HIV treatment and prevention.

For instance, in November 2024, Gilead Sciences, Inc. announced the upcoming presentation of over 40 research findings at the HIV Glasgow 2024 congress, which showcases their focus on person-centered drug development strategies. Their exploration of innovative treatments like Lenacapavir, which could offer a twice-yearly HIV prevention option, and the real-world data from studies like BICSTaR, which demonstrate the efficacy of their drug Biktarvy, highlight the industry's commitment to improving care. Such developments are likely to bring new innovative products into the market.

Key HIV Diagnostics Companies:

The following are the leading companies in the HIV diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Alere Inc.

- Abbott

- Bristol-Myers Squibb Company

- Janssen Global Services, LLC

- Gilead Sciences, Inc.

- Merck & Co. Inc.

- VIIV Healthcare

- BD

- Beckman Coulter, Inc.

- Sysmex Europe SE

- Apogee Flow Systems

- Point Care

- Zyomtronix, Inc.

- Mylan N.V.

- F. Hoffmann-La Roche Ltd.

- Siemens Healthcare GmbH

- QIAGEN

Recent Developments

-

In November 2024, Arab Republic of Egypt partnered with the Global Fund to enhance health systems in the fight against HIV and tuberculosis, focusing on supporting vulnerable communities. This collaboration, which includes efforts in HIV prevention, early detection, and treatment, aims to strengthen health resilience and improve access to crucial diagnostic services for those in need.

-

In April 2024, Cepheid announced that its Xpert HIV-1 Qual XC test received World Health Organization prequalification, meeting the organization’s rigorous performance and safety standards. This point-of-care diagnostic tool enables early detection of HIV infections in infants and provides a reliable solution for HIV-1 testing using dried blood spots and blood specimens. This development is expected to accelerate HIV diagnosis and treatment initiation.

HIV Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2030

USD 1.55 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode, test type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

Alere Inc.; Abbott; Bristol-Myers Squibb Company; Janssen Global Services, LLC; Gilead Sciences, Inc.; Merck & Co. Inc.; VIIV Healthcare

BD; Beckman Coulter, Inc.; Sysmex Europe SE; Apogee Flow Systems; Point Care; Zyomtronix, Inc.; Mylan N.V.; F. Hoffmann-La Roche Ltd.; Siemens Healthcare GmbH; QIAGEN.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global HIV Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HIV diagnostics market report based on product, mode, test type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Instruments

-

Software and Services

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-test

-

Lab-based

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibody Test

-

HIV-1 Screening Tests

-

ELISA/EIA

-

Home Access Dried Blood Spot

-

Rapid Tests (Dot plot, Agglutination Tests)

-

-

-

HIV-1 Antibody Confirmatory Tests

-

Western Blot Test

-

Indirect Immunofluorescent Antibody Assay (IFA)

-

Line Immunoassay

-

RadioImmunoPrecipitation Assay (RIPA)

-

-

HIV-2 & Group O Diagnostic Tests

-

Blood Antibody Tests

-

Dried Blood Spot (DBS) Test

-

Others and (Oral, Urine)

-

-

Viral load test

-

CD4 test

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Laboratories

-

Hospitals & Clinics

-

Home Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global HIV diagnostics market size was estimated at USD 1.14 billion in 2024 and is expected to reach USD 1.22 billion in 2025.

b. The global HIV diagnostics market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 1.55 billion by 2030.

b. The antibody tests segment dominated the HIV diagnostics market with a share of 56.6% in 2024. This is attributed to the presence of a large number of commercial antibody tests for HIV-1 screening, 1 confirmatory, and 2 & Group O testing.

b. Some key players operating in the HIV diagnostics market include Alere Inc., Abbott Healthcare, Abbvie Inc., Brsitol-Myers Squibb, Janssen Therapeutics, Gilead Sciences, Merck & Co. Inc, VIIV Healthcare, BD Biosciences, Beckman Coulter, Partec, Sysmex, Apogee Flow Systems, PointCare Technologies Inc., Zyomyx Inc., Mylan inc., Roche Diagnostics, Siemens Healthcare, Qiagen, and bioMerieux.

b. Key factors that are driving the HIV diagnostics market growth include the development & commercialization of novel HIV tests, the advent of point-of-care tests; and the increasing need to introduce easily accessible, efficient, and robust HIV tests.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.