Home Fitness Market Size & Trends

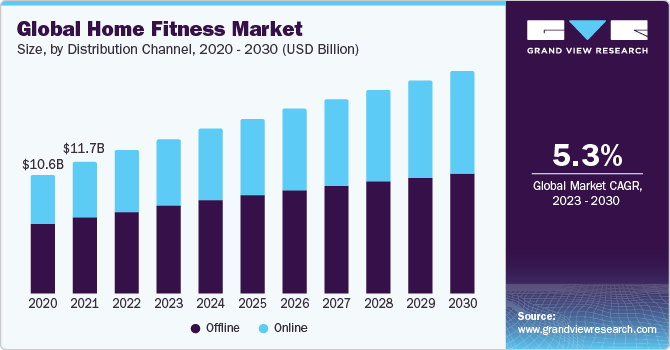

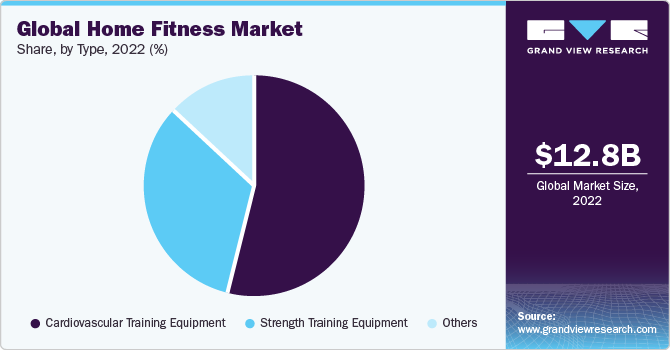

The global home fitness market size was valued at USD 12.81 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The rising awareness of healthy lifestyles has fueled a notable surge in the popularity of home fitness. Consumers, eager to enhance their energy levels and motivation in daily life, are increasingly drawn to a variety of home fitness products. The growing engagement of individuals in diverse fitness activities such as biking, jogging, swimming, and more has led to a heightened demand for these products. This trend allows users to build stamina conveniently within the comfort of their own homes.

The global demand for home fitness has experienced a significant upswing, propelled by a heightened awareness of health. The surge in obesity rates and an increased focus on health consciousness have emerged as primary drivers for the substantial growth of the global home fitness market. Factors such as the upsurge in urban population, a rise in disposable income, a growing emphasis on health, a burgeoning trend in bodybuilding, and governmental initiatives promoting a healthy lifestyle have collectively contributed to the widespread adoption of home fitness equipment.

The incorporation of artificial intelligence (AI) and machine learning technology into at-home fitness equipment is playing a pivotal role in propelling the growth of the global market. A notable emerging trend is the development of AI-based personal trainers within home fitness equipment. Major technology players like Google LLC and Apple Inc. are actively involved in the development of smart wearable devices designed to virtually guide and assist users by leveraging collected health data. As a result, these technological advancements are expected to serve as the primary driving force behind the ongoing expansion of the global home fitness market.

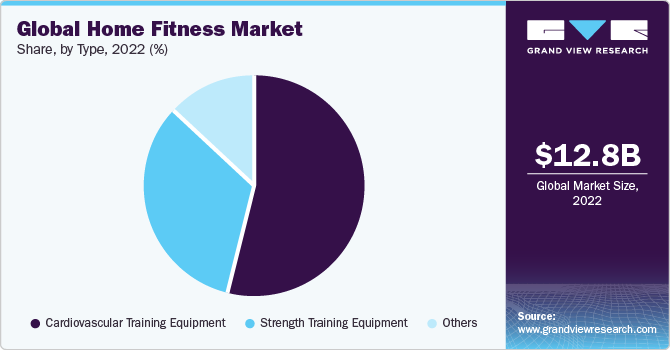

Type Insights

Based on the type, the home fitness market is segmented into cardiovascular training equipment, strength training equipment, and others. The cardiovascular training equipment segment held the largest market share in 2022. The scope of cardiovascular training equipment encompasses a range of machines, including treadmills, stationary cycles, and elliptical trainers & others. These machines, along with innovative features and technological advancements, are driving market growth. In addition, the increasing usage of wearable devices and fitness apps has created a demand for cardiovascular training fitness equipment seamlessly integrated with technologies, such as Internet of Things (IoT) devices, cloud computing, and mobile applications.

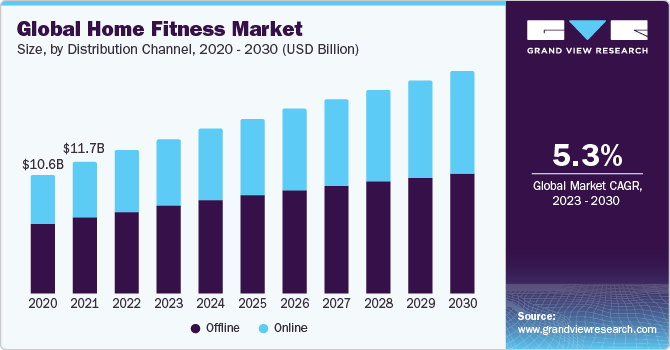

Distribution Chanel Insights

On the basis of distribution channels, the market is segmented into online and offline. The offline segment held the largest market share in 2022. Offline fitness stores are gaining popularity as consumers seek personalized shopping experiences, offering a wide range of products and expert advice. Omnichannel retail is increasing, allowing customers to shop online, in-store, or both for convenience and wider reach. Moreover, in-person fitness experiences and traditional fitness distribution channels continued to play a vital role.

Regional Insights

North America dominated the market in 2022owing to the consumers’ growing health awareness and increased adoption of a healthy lifestyle that promotes weight management, physical well-being, improved body stamina, and muscular strength. The high obese or overweight population base in North America drives the demand in this region. In addition, increasing government regulations to promote health consciousness among its citizens has led North America to dominate the industry.

Key Companies & Market Share Insights

Key players operating in the market areImpulse Health Technology Co., Ltd.; Core Health & Fitness; Precor Incorporated; Torque Fitness; Technogym; TRUE; Nautilus, Inc.; Life Fitness (KPS Capital); Shandong EM Health Industry Group Co., Ltd.; Icon Health & Fitness; and Johnson Health Tech. Vendors active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including mergers & acquisitions, partnerships, collaborations, and new product/ technology development. The following are some instances of such initiatives.

-

In February 2023, adidas, a German athletic apparel and footwear corporation, partnered with Les Mills International Ltd, a company engaged in the wellness and fitness sector. The collaboration aims to build a new age of fitness experiences by integrating their innovation, expertise, and heritage. Additionally, the partnership can lead to the creation of cutting-edge wearables, training tools, and digital solutions that improve the effectiveness and enjoyment of workouts.

-

In January 2022, NordicTrack, the Icon Health & Fitness Inc. brand, launched the NordicTrack iSelect Adjustable Dumbbells. These voice-controlled dumbbells are designed to work with Alexa, enabling users to electronically adjust the weight from 5 to 50 pounds using voice commands through a compatible Alexa-enabled device. This innovative feature ensures a smooth and convenient workout experience.