- Home

- »

- Healthcare IT

- »

-

Hospital Information System Market, Industry Report, 2033GVR Report cover

![Hospital Information System Market Size, Share & Trends Report]()

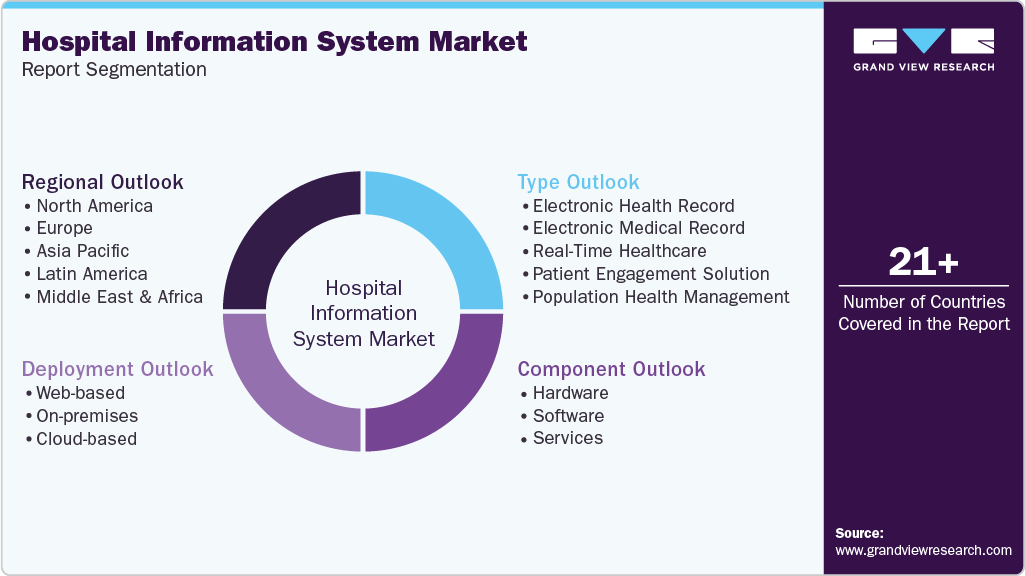

Hospital Information System Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Population Health Management, Electronic Health Record), By Deployment (Web-based, On-premises, Cloud-based), By Component, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-364-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hospital Information System Market Summary

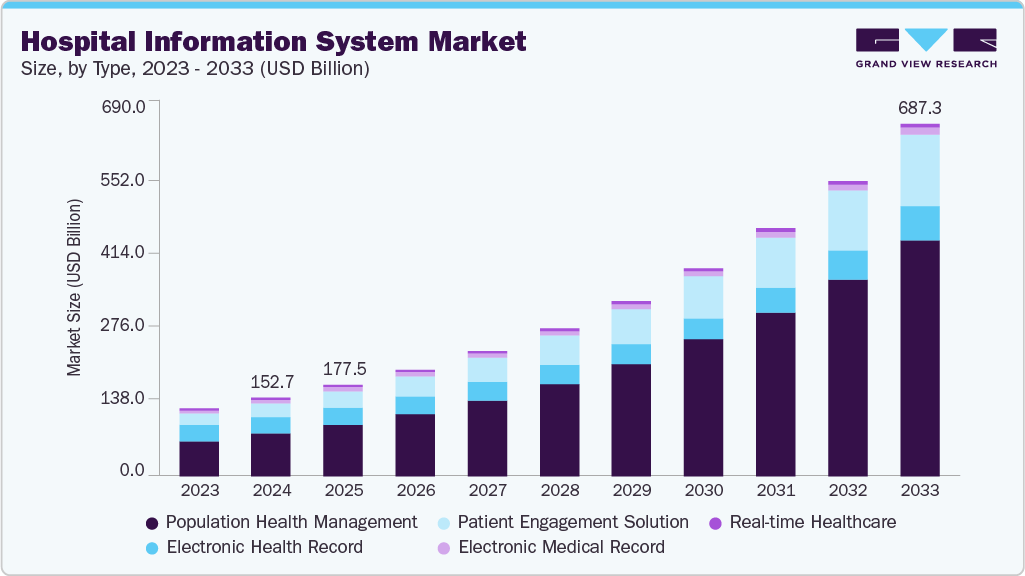

The global hospital information system market size was estimated at USD 152.72 billion in 2024 and is projected to reach USD 687.32 billion by 2033, growing at a CAGR of 18.44% from 2025 to 2033. Hospital Information Systems (HIS) help healthcare facilities improve their operational outcomes and reduce the workload on the staff, which is expected to boost industry growth.

Key Market Trends & Insights

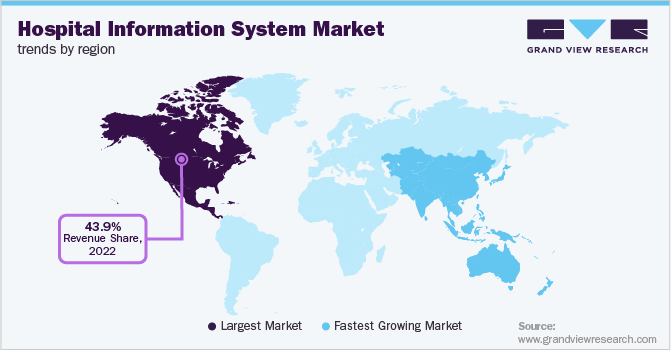

- North America dominated the hospital information system market with the largest revenue share of 43.19% in 2024.

- The hospital information system market in the U.S. has witnessed significant growth.

- Based on type, the population health management segment led the market with the largest revenue share of 54.12% in 2024.

- By deployment, the web-based segment led the market with the largest revenue share of 42.03% in 2024.

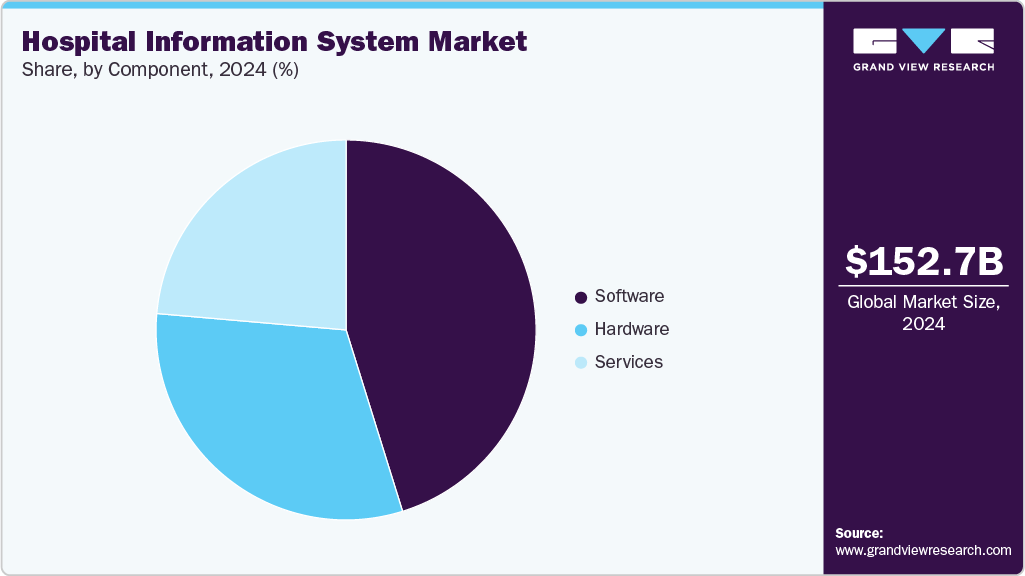

- By component, the software segment led the market with the largest revenue share of 45.19% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 152.72 Billion

- 2033 Projected Market Size: USD 687.32 Billion

- CAGR (2025-2033): 18.44%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Various initiatives undertaken by governments across the globe and the rising demand for the deployment of advanced IT solutions in hospitals for enhanced operational efficiency are some of the key factors expected to boost the adoption of HIS.The need to curb healthcare expenditures due to hospital workflow inefficiencies is also anticipated to increase the adoption of these systems globally. Thus, the growing demand for effective clinical outcomes and reduced healthcare costs is a significant factor boosting the adoption of HIS in developed and emerging economies. The rising implementation of healthcare IT services and solutions by hospitals to provide enhanced care to patients at reduced costs, combined with the increasing need to upgrade the existing systems, is likely to be a key driver for the industry's growth.

Moreover, constant upgrades in the healthcare and IT infrastructure and increased adoption of cloud-based services in healthcare facilities are expected to drive the market further. For instance, in July 2024, King’s College Hospital London in Dubai (KCH Dubai) migrated its Oracle Health Electronic Health Record (EHR) to Oracle Cloud Infrastructure (OCI), achieving a 50% reduction in patient information access time, 20% less time reviewing medical charts, and a 25% overall decrease in EHR usage time.

“The combined power of OCI and our EHR is enabling KCH Dubai physicians to be more productive, waste less time in medical records, and refocus more time on patient care. Moreover, they have the comprehensive platform to continually be able to plug in the technologies they need to solve their toughest challenges and be more adaptable, predictive, and responsive to evolving healthcare needs.”

-Seema Verma, executive vice president and general manager, Oracle Health and Life Sciences.

Integrating Artificial Intelligence (AI) into hospital information systems transforms hospital workflows, enhancing efficiency, accuracy, and patient outcomes. AI streamlines repetitive administrative functions such as data entry, billing, and coding. This automation reduces human error and allows healthcare professionals to focus more on patient care.

By analyzing large amounts of patient data, AI provides predictive insights and personalized treatment recommendations, helping clinicians in making informed decisions. In addition, it facilitates seamless data sharing across different healthcare systems, enhancing collaboration among healthcare providers and ensuring comprehensive patient care. For instance, Oracle Health has developed a Clinical AI Agent that provides a comprehensive mobile solution to help physicians navigate workflow challenges, supporting time- and cost-efficient operations by combining clinical automation, note generation, integrated dictation, and proposed actions in a unified experience.

Furthermore, government initiatives and modernization programs are key market drivers in the hospital information systems industry. National strategies such as India's Ayushman Bharat Digital Health Mission, Saudi Arabia's Vision 2030, and the UAE's National Unified Medical Record program exemplify efforts to create integrated, unified healthcare data ecosystems. These programs enhance healthcare delivery quality, regulatory compliance, and operational transparency. Such government-backed initiatives provide a robust foundation for sustained market expansion.

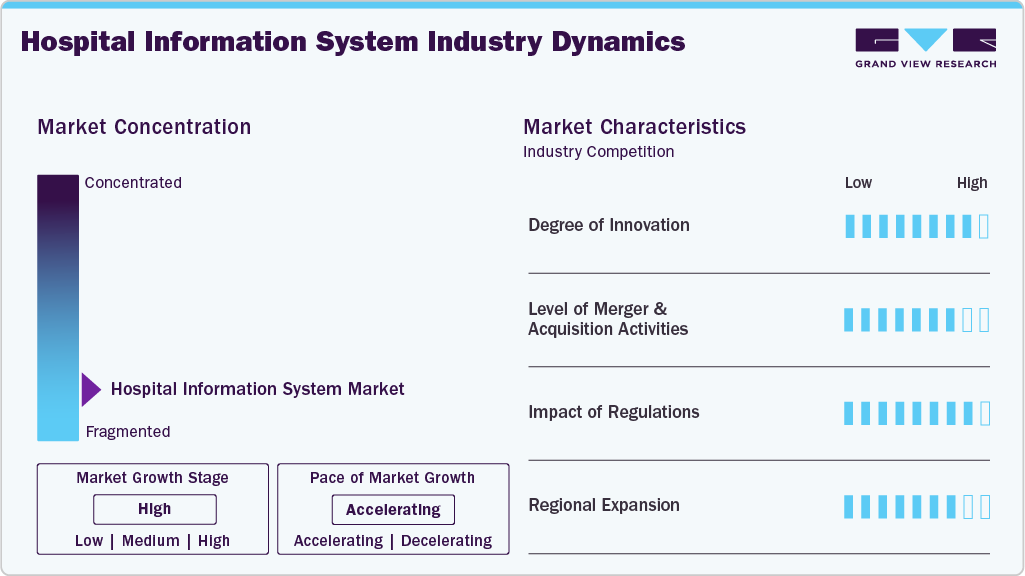

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations activities, impact of regulations, and geographic expansion. The hospital information system industry is fragmented, with many small players entering the market and offering new products. The level of partnerships & collaborations activities, the impact of regulations, and the regional expansion of the market is medium.

Degree of Innovationin the hospital information system industry is high.eHealth initiatives encompass the development of current IT infrastructure and the promotion of patient engagement, along with patient-physician coordination tools. In addition, increasing adoption of remote patient monitoring solutions drives market growth further.

The impact of mergers and acquisitions on the hospital information system industry is high. Mergers and acquisitions in the hospital information system industry are increasing, with several companies acquiring smaller players to strengthen their market position, expand product portfolios, and improve competencies. For instance, in August 2025, CareCloud completed the acquisition of Medsphere Systems Corporation, expanding its reach into the hospital information system industry with inpatient EHR and revenue cycle management (RCM) solutions for small and mid-sized hospitals across the U.S.

“Medsphere and CareCloud are creating a next-generation platform-faster, smarter, and well aligned with the evolving needs of health systems. Our 600+ clients will benefit from integrating our full-stack offering with CareCloud’s AI and R&D infrastructure, positioning the combined company as an unmatched provider across the full care continuum.”

- Robert Hendricks, a member of the Board of Directors of Medsphere

Regulations play a crucial role in the hospital information system industry by establishing standards for data security, interoperability, and patient privacy. For instance, legislation such as HIPAA mandates stringent protocols to protect sensitive health data, constraining providers to adopt advanced information systems that adhere to these regulatory frameworks.

The impact of regional expansion in market is high. Several market players are involved in geographical expansion to enhance capabilities and have a direct presence in countries that have high demand. For instance, in July 2025, Seoul National University Bundang Hospital exported its Hospital Information System, "BESTCare 2.0A," to Saudi Arabia, which is expected to be implemented in major hospitals.

Type Insights

Based on type, the population health management segment led the market with the largest revenue share of 54.12% in 2024. The rising demand for effective disease management strategies is expected to boost segment growth. Population health management (PHM) has made significant progress as a structured, transformative, and data-driven approach that aims to enhance overall population health and well-being, improve the patient care experience, and ultimately reduce healthcare costs. In addition, this segment is anticipated to grow at the fastest CAGR over the forecast period. The transition of the healthcare industry to value-based healthcare from volume-based healthcare has strengthened the approach for incentives around risk reduction, improving outcomes, and appropriate utilization.

For most organizations, PHM adoption starts with managing chronic conditions such as cardiovascular diseases, diabetes, and hypertension. The increasing adoption of artificial intelligence in PHM to enhance patient engagement, clinical documentation, and hospital administration supports innovations in the market. For instance, in September 2024, HealthEC and VirtualHealth partnered to integrate HealthEC’s advanced population health analytics with VirtualHealth’s HELIOS care management platform.

Deployment Insights

The web-based segment led the market with the largest revenue share of 42.03% in 2024. Web-based hospital information system offers enhanced accessibility, facilitating seamless communication and data sharing among medical personnels, patients, & stakeholders.Major EHR vendors are launching new web-based solutions and expanding their services to cater to the growing demand, which is anticipated to boost the segment growth during the forecast period.

The cloud-based segment is expected to grow at the fastest CAGR during the forecast period. Cloud-based platforms enable real-time data access, seamless patient-provider communication, and secure storage of health information. For instance, in March 2022, Tata Elxsi introduced TEngage, a cloud-based digital health platform designed to help hospitals and healthcare providers deliver a seamless patient experience across multiple channels, enabling access to healthcare services anytime and anywhere.

Component Insights

The software segment led the market with the largest revenue share of 45.19% in 2024. The rising demand for comprehensive integrated software solutions in healthcare facilities significantly contributed to the growth of this segment. The software solutions perform critical functions, such as data capture, storage, interpretation, and analysis. The software solutions need periodic upgrades to sync with the latest analytics methods, which helps the facilities in managing their workflows.

The services component segment is expected to register at the fastest CAGR during the forecast period. This rapid growth can be attributed to the factors, such as the increasing adoption of technologically advanced solutions. In addition, cost-effective solutions offered by the key companies, which are also easy to install, are positively contributing to the growth of this segment. Several vendors in the global industry offer various services, such as optimization, hosting, consulting, and installation, which help hospitals in managing their information systems.

Regional Insights

North America dominated the hospital information system market with the largest revenue share of 43.19% in 2024. Robust healthcare infrastructure with high digital literacy and policies supporting the adoption of electronic health records (EHRs), increasing adoption of Healthcare Information Technology (HCIT) by healthcare providers and payers, and rising preference for telehealth and remote patient monitoring are factors contributing to market growth. For instance, according to the Elation article published in March 2023, approximately 9 out of 10 U.S.-based physicians have implemented EHR.

U.S. Hospital Information System Market Trends

The hospital information system market in the U.S.has witnessed significant growth, fueled by the country’s shift toward value-based care, which emphasizes improving patient outcomes and reducing healthcare costs. Factors include the widespread adoption of digital health technologies such as telemedicine, mobile health apps, remote monitoring tools, and increasing patient demand for personalized and convenient healthcare experiences. In addition, increasing regulatory requirements and presence of large established companies such as Epic Systems, NextGen Healthcare, eClinicalWorks, Oracle, GE Healthcare, and Veradigm, LLC. Further fuel market growth.

Europe Hospital Information System Market Trends

The hospital information system market in Europe is anticipated to grow at a significant CAGR during the forecast period, due to digital transformation, improving healthcare efficiency, and patient outcomes. The presence of developed economies such as Germany, the UK, France, Spain, and Italy is expected to fuel the market growth during the forecast period. For instance, in December 2023, WHO/Europe and the European Commission signed a USD 14 million (€12 million), four-year partnership to strengthen health information systems and enhance health data governance and interoperability across 53 European countries.

The Germany hospital information system market is expected to grow at a significant CAGR during the forecast period. Germany is one of the key markets for healthcare IT in Europe. High utilization of EHRs to access patient information for treatment and reduce multiple investigations & treatment time, coupled with growing emphasis on healthcare data analytics, is expected to drive the market in Germany. For instance, in February 2025, Munich-based Avelios Medical secured USD 35 million (Euro 30 million) Series A funding led by Sequoia Capital to modernize hospital IT with its AI-driven, modular hospital information system (HIS).

The hospital information system market in the UK is anticipated to grow at a lucrative CAGR over the forecast period. This is attributable to an increasing number of initiatives, including developing integrated care systems for digital health and eHealth.

Asia Pacific Hospital Information System Market Trends

The hospital information system market in Asia Pacific is expected to witness at the fastest CAGR over the forecast period. This growth is attributed to the increasing digitalization of healthcare systems, government initiatives promoting healthcare IT adoption, and improvements in patient care quality and safety. In addition, growing focus on improving operational efficiency and the need for better data management and interoperability across hospitals are anticipated to drive market demand over the coming years.

The Japan hospital information system market accounted for the largest market revenue share in Asia Pacific in 2024, owing to factors such as rapid healthcare digitalization, government initiatives promoting smart healthcare, and increasing demand for cloud-based and AI-driven platforms. For instance, in March 2023, Fujitsu launched a cloud-based healthcare platform in Japan that securely collects and aggregates health data from medical institutions and personal devices, complying with HL7 FHIR standards. The platform supports personalized healthcare and drug development by enabling detailed data analysis and research.

The hospital information system market in India is growing rapidly, driven by the growing geriatric population, the increasing burden of chronic diseases, and government initiatives supporting the country’s eHealth scenario. For instance, in July 2025, the Delhi Government launched a new digital Health Information Management System (HIMS) to create a fully digital healthcare ecosystem.

Latin America Hospital Information System Market Trends

The hospital information system market in Latin America is anticipated to grow at a significant CAGR during the forecast period, due to demand for advanced healthcare amid a rapidly aging population and rising prevalence of chronic diseases. In addition, a growing population with diverse healthcare needs is driving the demand for improved patient care and operational efficiency, leading to an increased demand for the market.

Middle East & Africa Hospital Information System Market Trends

The hospital information system market in the Middle East & Africa region is anticipated to witness at a significant CAGR during the forecast period, due to increased healthcare expenditures and government investments in interoperability and artificial intelligence (AI), leveraging hospital information systems.

The UAE hospital information system market is expected to grow at a substantial CAGR over the forecast period. This growth is attributed to the increasing adoption of healthcare IT solutions. For instance, in January 2025, Saudi German Hospitals UAE (SGH UAE) partnered with Megamind IT Solutions to implement advanced Hospital Information Systems (HIS) and Enterprise Resource Planning (ERP) solutions. Moreover, rising government initiatives are expected to boost the market.

Key Hospitals Information System Company Insights

Key players operating in the hospital information system industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships are playing a key role in propelling market growth.

Key Hospitals Information System Companies:

The following are the leading companies in the hospital information system market. These companies collectively hold the largest market share and dictate the industry.

- Carestream Health

- Siemens Healthineers

- McKesson Corp.

- Philips Healthcare

- GE Healthcare

- Veradigm, LLC.

- Oracle

- NextGen Healthcare

- Conifer Health Solutions, LLC

- eClinicalWorks

- Optum, Inc.

- Epic Systems Corporation

Recent Developments

-

In June 2025, Integra Connect launched RCM Sphere, a next-generation revenue cycle management ecosystem designed to unify people, processes, and technology for healthcare organizations. Powered by advanced AI, proprietary platforms, and agentic AI, it offers end-to-end execution from patient intake through collections, optimizing financial outcomes, operational efficiency, and transparency.

-

In January 2025, Percipio Health launched an AI-powered population health platform, securing USD 20 million in Series A funding led by UPMC Enterprises, WAVE Ventures, and Labcorp. The platform uses a smartphone app to collect vision-based and vocal AI biomarkers and other health signals, enabling real-time, device-free, holistic health monitoring and predictive insights for value-based care.

-

In December 2024, Allied Digestive Health partnered with Adonis to leverage its AI-driven Revenue Intelligence and Automation platform to enhance revenue cycle management (RCM). The platform provides real-time alerts, trend insights, and recommended actions, supporting Allied’s growing provider network with unified billing.

-

In October 2024, Oracle unveiled its next-generation Electronic Health Record (EHR) system. The EHR integrates AI across clinical workflows, automating processes, providing real-time insights, simplifying appointment preparation, documentation, and follow-ups. It supports seamless information exchange between payers and providers, facilitates clinical trial recruitment, optimizes financials, and accelerates value-based care adoption.

-

In November 2023, Thoma Bravo acquired NextGen Healthcare, Inc., a leading EHR systems manufacturer, to expand its capabilities in the market.

Hospital Information System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 177.52 billion

Revenue forecast in 2033

USD 687.32 billion

Growth rate

CAGR of 18.44% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, component, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Carestream Health; Siemens Healthineers; McKesson Corp.; Philips Healthcare GE Healthcare Veradigm, LLC.; Oracle; NextGen Healthcare; Conifer Health Solutions, LLC; eClinicalWorks; Optum, Inc.; Epic Systems Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Information System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hospital information system market report based on deployment, component, type, and region.

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Web-based

-

On-premises

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronic Health Record

-

Electronic Medical Record

-

Real-Time Healthcare

-

Patient Engagement Solution

-

Population Health Management

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital information system market size was estimated at USD 152.72 billion in 2024 and is expected to reach USD 177.52 billion in 2025.

b. The global hospital information system market is expected to grow at a compound annual growth rate of 18.44% from 2025 to 2033 to reach USD 687.32 billion by 2033.

b. Web-based technology dominated the hospital information system market with a share of 42.03% in 2024. Web-based hospital information system offers enhanced accessibility, facilitating seamless communication and data sharing among medical personnel, patients, & stakeholders.

b. Some key players operating in the HIS market include Carestream Health; Siemens Healthineers; McKesson Corp.; Philips Healthcare GE Healthcare Veradigm, LLC.; Oracle; NextGen Healthcare; Conifer Health Solutions, LLC; eClinicalWorks; Optum, Inc.; Epic Systems Corporation.

b. Key factors that are driving the hospital information system market growth include a rapid increase in the adoption of these systems for efficient management of hospital operations and rising demand for efficient management of the large volume of data generated and its availability for medical practitioners.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.