- Home

- »

- Medical Devices

- »

-

Hospital Linen Supply And Management Services Market ReportGVR Report cover

![Hospital Linen Supply And Management Services Market Size, Share & Trends Report]()

Hospital Linen Supply And Management Services Market Size, Share & Trends Analysis Report By Product, By Material, By End-use, By Service Provider, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-336-2

- Number of Report Pages: 86

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

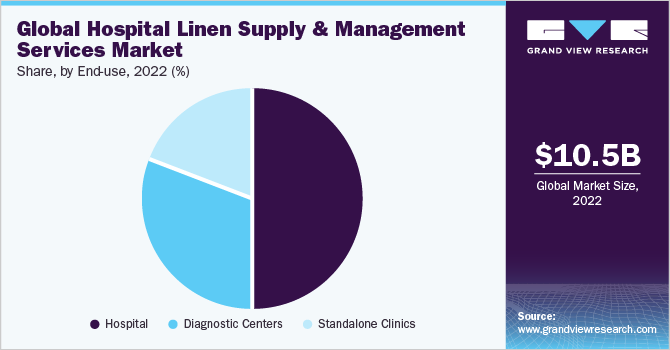

The global hospital linen supply and management services market size was valued at USD 10.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.2% from 2023 to 2030. Increased demand during COVID-19 pandemic is expected to have a long-term positive impact on the demand for disposable linens in hospital. Hospitals are focused on keeping additional stock in reserve for potential waves in future. The growing number of surgeries globally is a key factor expected to drive the market over the forecast period. For instance, as per Mölnlycke Health Care AB, 70 million surgical procedures are performed every year in Europe. As such, hospital gowns-being an essential requirement for surgical procedures-are expected to witness high demand over the forecast period. According to Healthcare Cost and Utilization Project (HCUP), in 2014, around 9,942,000 surgeries were performed in the U.S. within ambulatory care settings. Hospital gowns can help protect against nosocomial infections to some extent, owing to which, surgeons consistently recommend patients to wear patient gowns. Such factors are expected to drive the market growth.

Key players in the market offer various services along with linen supplies. They provide linen & apparels, medical apparels, gowns, towels, washcloths, bath towels, bed covers, pillow covers, and different gowns for patients. In addition to these offerings, value-added services provided by these companies attract the end users. Some of the value-added services include uniform rental service, laundry, and waste removal system. Majority of the key players such as Unitex Textile Rental Services, Inc.; Angelica Corporation; Healthcare Services Group, Inc.; ImageFIRST Healthcare Laundry Specialists, Inc.; Swisslog Holding AG; and AmeriPride Services, Inc. offer laundry services along with linen supply management. The laundry services include in-house as well as contractual services. Some of these companies also provide laundry installation systems.

In addition to laundry services, some of the key players such as Unitex Textile Rental Services, Inc.; Tetsudo Linen Service; and AmeriPride Services, Inc. also provide uniform rental services. These companies provide personalized uniforms on the basis of the requirement, which can be customized for size, length, color, and any other specification as per the end user’s requirement. Moreover, companies like Unitex Textile Rental Services, Inc. have on-site linen and uniform management programs. Similarly, Angelica Corporation has web-based linen management software. Therefore, these additional services offered by the key players in the market help them to increase their market share and boost the demand for hospital linen supply, which ultimately drives the hospital linen supply and management services market.

Increasing incidence of HAIs due to lack of sanitation and precaution is one of the leading factors contributing to market growth. For instance, as per the CDC, about one in 25 hospital patients contracts at least one HAI every year. Hospital gowns provide general protection against contamination and can help lower the risk of contracting HAIs. Furthermore, they can prevent bacterial and other microbial infections from entering a patient’s body. Thus, surgeons recommend patients to wear gowns before medical procedures. These factors are anticipated to propel market growth over the forecast period.

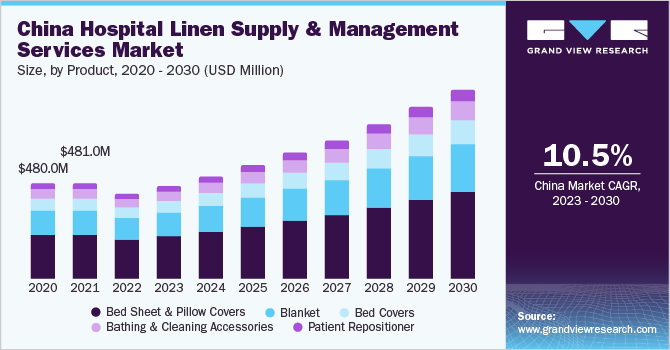

Product Insights

The bed sheet & pillow covers segment held the largest market share of 45.9% in 2022 and is anticipated to witness considerable growth over the forecast period. Bed sheets used in the hospitals are of various types such as flat sheets, fitted sheets, bariatric sheets, hyperbaric sheets, gurney sheets, mortuary sheets, and birthing sheets. These sheets are categorized based on the size of bed as single bed sheets and double bedsheets. In addition, companies offer bed sheets that are shrink-resistant and are easily washable. These bed sheets also have stain-release properties, which makes them look newer for longer duration, thereby reducing maintenance expenses. Pillow covers are also available in different colors and sizes depending on the needs of the customers. Pillow covers have features such as stain resistance and they minimize shrinkage of pillow.

The bathing & cleaning accessories segment is anticipated to witness the fastest growth over the forecast period. The bathing & cleaning accessories segment is expected to witness the fastest growth during the forecast period. This can be attributed to the increasing awareness about hygiene standards and the need for sanitation maintenance. It includes wipes, washcloth, and various types of towels such as bath, hand, & face towels. Bathing and cleaning accessories are available as disposable as well as reusable products. Maintenance and dry-cleaning services for these clothes are provided by various companies such as Unitex Textile Rental Services, Inc.; E-town Laundry Company; and Healthcare Services Group, Inc.

Material Insights

Non-woven segment is anticipated to witness the fastest growth of more than 9.9% over the forecast period. The segment majorly includes protective materials such as hospital gowns, drapes, and sheets used during surgeries. The products are especially made for these purposes as they have certain advantages over traditional materials, such as added barrier to the infectious microorganisms, durability, and involve easy recycling procedures after appropriate sterilization.

The increasing demand of hospital gowns, drapes, and medical sheets due to the rising hospital admissions owing to the pandemic outbreak across the globe is one of the major factors influencing the segment growth. Furthermore, to meet the growing demand of hospital gowns, the World Health Organization has appealed the industries and government to increase the manufacturing of hospital gowns by 40.00%. Therefore, a significant growth rate is anticipated over the forecast period.

End-use Insights

The hospital segment held the largest market share of 49.8% in 2022 and is anticipated to witness considerable growth rate over the forecast period.This is due to the rising number of patient admissions in hospitals for surgeries and treatments for COVID-19. As per the study conducted by University of California, San Francisco, in 2016, on an average more than 2000 tons of waste are generated by operating room per day, of which, a significant portion of waste is from disposables medical supplies. Thus, such high usage of medical disposables in the hospital may promote the segment growth over the forecast period.

The diagnostic centers are anticipated to witness the fastest growth over the forecast period. Diagnostic centers require linen for beds, gowns, and apparel for patients as well as the staff. Apparels for patients are available in both reusable and disposable categories. In addition, the linen can be rented from various companies, which are later washed and dry cleaned based on the industry’s hygiene standards. The linen required by diagnostic centers include diagnostic pants, diagnostic gowns, bath blankets, towels, lab coats, scrubs, sheets, pillowcases, patient gowns, and washcloths.

Service Provider Insights

The contractual segment of the hospital linen supply and management services segment is expected to show fasted growth rate of around 10.0% during the forecast period. Contractual services are gaining popularity due to the increase in the number of services pertaining to linen and rise in the number of hospitals, beds, & working professionals.

Contractual laundry saves space and resources in the hospitals; therefore, the hospitals can focus more on their core competencies. It is also a cost-curbing tool employed by the hospitals, as they do not have to spend on the installation of the systems and hire professionals for the services.

Regional Insights

North America held the largest market share of more than 41.6% in 2022, owing to the increasing number of surgeries and presence of key market players in this region. Moreover, the increase in number of COVID-19 patients in this region has spurred the demand of hospital gowns. As per the report published by the WHO on 20th April 2020, more than more than 33,909 existing cases were reported and more than 1,509 new confirmed cases were detected in Canada. Moreover, the number of cases is expected increase exponentially over the next month or two. Such factors are anticipated to increase the demand for hospital linen supply & management services in the region.

Asia Pacific is expected to witness the fastest growth over the forecast period, owing to its increasing geriatric population and prevalence of cardiovascular diseases. Moreover, Asia Pacific has been one of the worst hit regions by COVID-19. China and South Korea have reported very high COVID-19 cases. In addition, the densely populated pockets in this region are making it easier for community transmission of the virus. Such a high number of potential patients in this region is anticipated to drive market growth over the forecast period.

Key Companies & Market Share Insights

The key players that dominated the global hospital linen supply & management services market in 2019 include Unitex Textile Rental Services, Inc., Emes Textiles Pvt. Ltd., Angelica, Elizabethtown Laundry Company, and Healthcare Services Group, Inc. The market players are adopting various strategies, such as mergers & acquisitions, partnerships, and product launches to strengthen their foothold in the market.For instance, in May 2016, Unitex opened its12th facility in Linden, New Jersey and is the fourth facility owned and operated by the company. The new facility has capability to process 1.1 million pounds of linen per week and will serve nursing homes and hospitals in New Jersey. This new facility is anticipated to strengthen the company’s position in this region.

In September 2019, Angelica Corporation recertified three of its largest facilities for Hygienically Clean Healthcare Certification Program and remains certified for all 23 facilities. Thus, the company had the most hygienically clean healthcare-certified laundries in the U.S. This is expected to increase the customer base of the company. Some prominent players in the global hospital linen supply and management services market include:

-

Unitex Textile Rental Services, Inc.

-

Emes Textiles Pvt. Ltd

-

Angelica

-

Elizabethtown Laundry Company

-

Healthcare Services Group, Inc.

-

ImageFIRST

-

Tetsudo Linen Service Co., Ltd

-

Celtic Linen

-

Swisslog Holding Ltd.

Hospital Linen Supply And Management Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.5 billion

Revenue forecast in 2030

USD 21.3 billion

Growth rate

CAGR of 9.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion, volume in unit sold, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, service provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India, Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Unitex Textile Rental Services; Inc., Emes Textiles Pvt. Ltd; Angelica; Elizabethtown Laundry Company; Healthcare Services Group; Inc.; ImageFIRST; Tetsudo Linen Service Co.; Ltd.; Celtic Linen; Swisslog Holding Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Linen Supply And Management Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hospital linen supply and management services market report on the basis of product, material, end-use, service provider, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bed Sheet & Pillow Covers

-

Blanket

-

Bed Covers

-

Bathing & Cleaning Accessories

-

Patient Repositioner

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Woven

-

Non-woven

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Diagnostic Centers

-

Standalone Clinics

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Contractual

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the hospital linen supply and management services market with a share of 41.6% in 2022. This is attributable to the presence of major players in the market and stringent healthcare policies for hygiene and safety in the region.

b. Some key players operating in the hospital linen supply & management services market include Unitex Textile Rental Services, Inc., Emes Textiles Pvt. Ltd., Angelica Corporation, E-town Laundry Company, Healthcare Services Group, Inc.

b. Key factors that are driving the hospital linen supply and management services market growth include value-added services provided by key players, increasing outsourcing of hospital linen supplies & services, increasing patient base due to the rise in various diseases, and increasing geriatric population.

b. The global hospital linen supply and management services market size was estimated at USD 10.5 billion in 2022 and is expected to reach USD 11.5 billion in 2023.

b. The global hospital linen supply and management services market is expected to grow at a compound annual growth rate of 9.2% from 2023 to 2030 to reach USD 21.3 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."