- Home

- »

- Advanced Interior Materials

- »

-

Hot Isostatic Pressing Market Size, Industry Report, 2033GVR Report cover

![Hot Isostatic Pressing Market Size, Share & Trends Report]()

Hot Isostatic Pressing Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Metal & Alloys, Others), By Application (Medical, Automotive, Oil & Gas, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-754-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hot Isostatic Pressing Market Summary

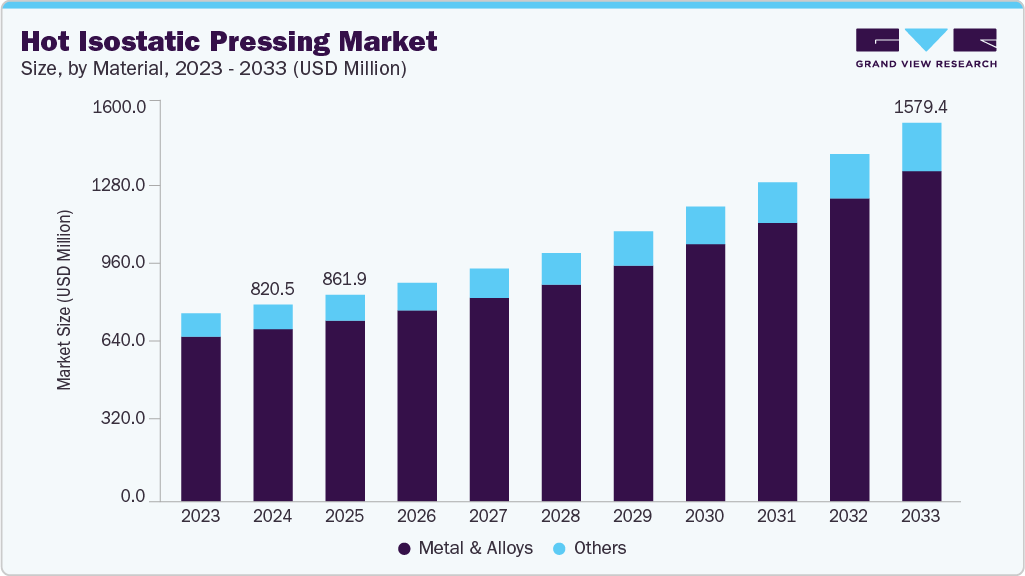

The global hot isostatic pressing market size was estimated at USD 820.5 million in 2024 and is projected to reach USD 1,579.4 million by 2033, at a CAGR of 7.9% from 2025 to 2033. The market valuation and growth projections also consider the consumption of metal powders used in hot isostatic pressing (HIP) processes, as they form a critical input for achieving desired material density, structural integrity, and performance characteristics in end-use applications.

Key Market Trends & Insights

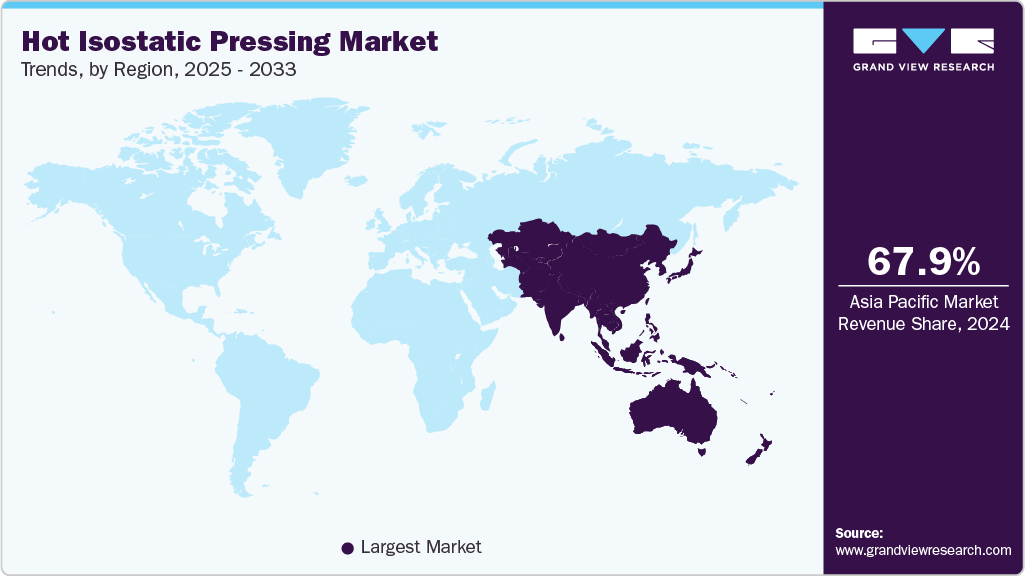

- Asia Pacific dominated the hot isostatic pressing market with the largest market revenue share of 67.9% in 2024.

- Hot isostatic pressing market in the U.S. is expected to grow at a substantial CAGR of 9.2% from 2025 to 2033.

- By material, the metals & alloys segment accounted for the largest market revenue share of over 87% in 2024.

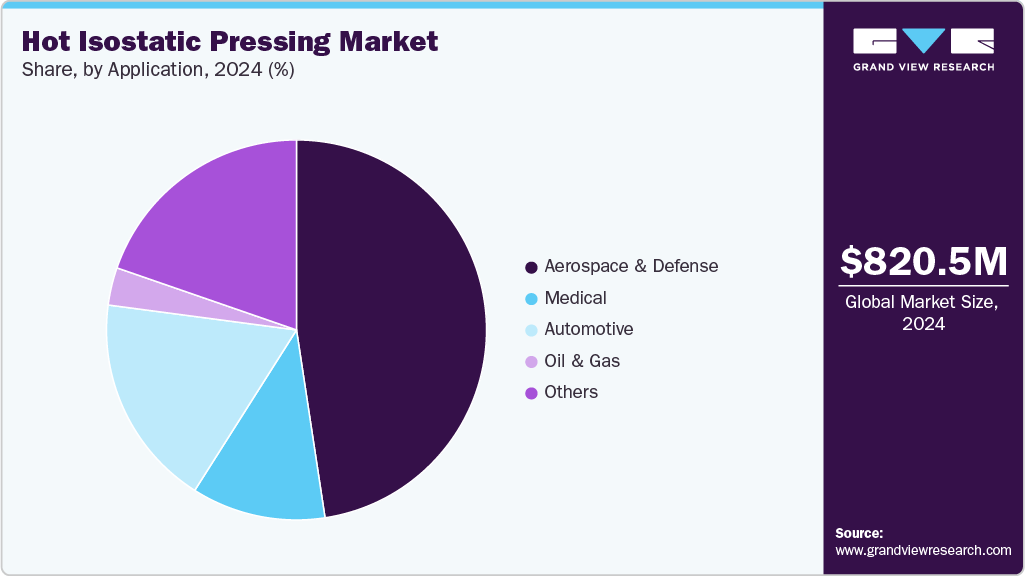

- By application, the aerospace & defense segment accounted for the largest market revenue share of 47.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 820.5 Million

- 2033 Projected Market Size: USD 1,579.4 Million

- CAGR (2025-2033): 7.9%

- Asia Pacific: Largest market in 2024

The market is experiencing significant growth due to multiple factors across different industries. One of the main drivers is the rising demand for high-performance materials in sectors such as aerospace, automotive, medical devices, and defense. HIP improves material properties by eliminating porosity, enhancing density, and ensuring uniformity, essential for components exposed to high stress and strict safety requirements. In the aerospace sector, the need for lightweight yet durable components has fueled the adoption of HIP. Materials such as titanium alloys and nickel-based superalloys, used in jet engines and structural parts, benefit from HIP's ability to improve mechanical properties and fatigue resistance. This aligns with the industry's focus on performance optimization and adherence to safety standards.

The combination of HIP with additive manufacturing (AM) has emerged as a key growth driver. Additive manufacturing allows the creation of complex geometries, and when paired with HIP, it significantly enhances the mechanical properties of the final product. This integration streamlines production, reduces material waste, and improves manufacturing efficiency, making it increasingly attractive across industries.

Technological innovations in HIP equipment and processes have also boosted market growth. Advances in system design, automation, and process control have increased operational efficiency and scalability. These improvements enable manufacturers to meet growing demand for high-quality components while optimizing production costs and timelines.

The medical device industry is further contributing to the HIP market expansion. Medical components require exceptional strength, biocompatibility, and reliability. HIP's capability to produce dense, defect-free materials makes it ideal for implants and surgical instruments. The HIP market is driven by demand for advanced materials, integration with additive manufacturing, technological improvements, and expanding medical applications.

Drivers, Opportunities & Restraints

HIP enhances material properties by eliminating internal porosity, improving density, and ensuring uniformity, critical for components subjected to high mechanical stress and strict safety requirements. The increasing adoption of advanced materials such as titanium alloys, nickel-based superalloys, and stainless steel in critical applications has further propelled the need for HIP technology. In addition, the integration of HIP with additive manufacturing has strengthened its role in producing complex, high-precision components with superior mechanical properties.

Significant opportunities exist for the HIP market due to technological advancements and expanding applications in emerging sectors. Innovations in equipment design, process control, and automation enable more efficient, scalable, and cost-effective operations. The medical device industry presents a growing market, as HIP-produced components are ideal for implants and surgical instruments requiring exceptional strength and biocompatibility. Moreover, industries such as energy, electronics, and 3D-printed metal parts are increasingly exploring HIP to improve component performance, creating new avenues for market growth and diversification.

Despite strong growth prospects, the HIP market faces certain restraints. The high initial investment cost of HIP equipment and maintenance can be a barrier for small and medium-sized manufacturers. The process also requires significant energy and specialized expertise, which may limit its adoption in cost-sensitive applications.

Material Insights

Metal & alloys held the revenue share of 87.5% in 2024. HIP technology is essential for producing high-performance components such as turbine blades, engine parts, and structural elements that require exceptional strength and durability. The aerospace sector, in particular, demands materials with high strength-to-weight ratios to improve fuel efficiency and overall performance, which directly fuels the adoption of HIP for metals and alloys.

Others segment is anticipated to register the fastest CAGR over the forecast period. HIP technology enhances ceramic and composite components' mechanical properties and reliability by eliminating internal porosity and achieving uniform density. This is particularly crucial in applications such as turbine blades, medical implants, and energy systems, where material integrity is paramount. The aerospace industry, for instance, requires materials that can withstand extreme conditions, and HIP-treated ceramics and composites meet these stringent requirements.

Application Insights

Aerospace & defense held the revenue share of 47.6% in 2024. HIP technology is integral in producing critical parts such as turbine blades, engine components, and structural assemblies, where material integrity is paramount. The aerospace industry, in particular, requires materials that offer exceptional strength-to-weight ratios and resistance to extreme conditions, making HIP-treated components essential for enhancing fuel efficiency, reliability, and overall performance. In defense, HIP produces advanced materials for missile platforms, naval systems, and armor technologies, where durability and performance are crucial. The integration of HIP with additive manufacturing further expands its application, enabling the production of complex geometries with enhanced material properties.

The medical sector is anticipated to register the fastest CAGR in the market, fueled by the rising demand for high-performance implants and medical devices. HIP is widely used to produce dense, reliable components for applications such as hip and knee replacements, dental implants, and spinal devices. The need for materials that combine durability with biocompatibility has made HIP a preferred technology for ensuring the long-term performance of medical implants.

Regional Insights

Asia Pacific accounted for the largest market revenue share of 67.9% in 2024. The Asia Pacific hot isostatic pressing market is experiencing significant growth, driven by several key factors. One of the primary drivers is the rapid industrialization and economic development in countries such as China, India, and Japan. These nations invest heavily in advanced manufacturing technologies to meet the increasing demand for high-performance materials in various industries, including aerospace, automotive, and medical. Adopting HIP technology allows manufacturers to produce components with enhanced mechanical properties, such as improved density and reduced porosity, which are crucial for ensuring the reliability and performance of critical parts.

North America Hot Isostatic Pressing Market Trends

The HIP market in North America is experiencing significant growth, driven by several key factors. HIP technology enables the production of components with enhanced mechanical properties, such as improved density and reduced porosity, which are crucial for ensuring the reliability and performance of critical parts. As these industries evolve, the need for advanced manufacturing techniques like HIP becomes more pronounced. Another significant factor contributing to the market's expansion is North America's growing adoption of additive manufacturing, or 3D printing. Integrating HIP with additive manufacturing allows for the production of complex and customized components with superior material properties.

The U.S. hot isostatic pressing market is a major contributor to market growth. With the increasing emphasis on fuel efficiency and performance, automakers seek advanced materials that can withstand high stress and temperature conditions. HIP processing facilitates the production of components with superior mechanical properties, such as engine parts and structural components, which are essential for meeting the stringent performance standards in the automotive sector. The demand for lightweight and durable materials is expected to drive the adoption of HIP technology in automotive manufacturing.

Europe Hot Isostatic Pressing Market Trends

The HIP market in Europe is gaining momentum, driven by strong aerospace, defense, and automotive sectors across key countries such as Germany, France, and the UK. The aerospace industry, in particular, is investing heavily in lightweight, high-strength components to improve fuel efficiency and reduce emissions, creating a substantial demand for HIP-processed parts. European aerospace manufacturers are increasingly using HIP to enhance the mechanical properties of nickel-based superalloys and titanium alloys, which are critical for turbine engines and airframe components.

Latin America Hot Isostatic Pressing Market Trends

The hot isostatic pressing market in Latin America is witnessing steady growth, driven by the expanding aerospace sector in countries like Brazil and Mexico. The increasing demand for high-performance materials and components for aircraft manufacturing encourages the adoption of HIP technology, which enhances the mechanical properties of metals and alloys, ensuring safety and reliability in critical aerospace applications.

Middle East & Africa Hot Isostatic Pressing Market Trends

The hot isostatic pressing market in the Middle East and Africa is experiencing significant growth, driven by several key factors across various industries. One of the primary drivers is the increasing demand for high-performance materials in sectors such as aerospace, automotive, medical devices, and energy. HIP technology enables the production of components with enhanced mechanical properties, such as improved density and reduced porosity, which are crucial for ensuring the reliability and performance of critical parts in these industries.

Key Hot Isostatic Pressing Company Insights

Some key players operating in the market include American Isostatic Presses, Inc., Bodycote, and others.

-

American Isostatic Presses, Inc. was founded in 1991 to supply high-quality hot and cold isostatic presses at competitive prices. The company is headquartered in Columbus, Ohio, maintains its engineering and manufacturing in the U.S., and is family-owned. It has built a reputation around the reliability of its HIP equipment: AIP emphasizes that none of its pressure systems or subsystems have experienced failure since being installed.

-

Bodycote is a major global provider of specialist thermal processing services, heat treatment, and HIP. It operates the largest network of HIP capacity worldwide, with over 50 HIP vessels of various sizes across multiple locations. Its facilities handle large volumes of small parts and very large components, up to tens of thousands of kilograms in weight. The company services aerospace, power generation, medical, automotive, defense, and additive manufacturing industries.

Key Hot Isostatic Pressing Companies:

The following are the leading companies in the hot isostatic pressing market. These companies collectively hold the largest market share and dictate industry trends.

- American Isostatic Presses Inc.

- Bodycote

- DORST Technologies GmbH

- EPSI

- FREY & Co. GmbH

- Hiperbaric

- Höganäs AB

- Kobe Steel Ltd.

- MTI Corporation

- Nikkiso Co. Ltd.

- Pressure Technology Inc.

Recent Development

-

In September 2025, after a successful audit, Paulo's Cleveland Division was approved by GE Aviation for Hot Isostatic Pressing (HIP), specifically GT193 Process Code FF. This approval enhances Paulo's services to GE Aviation suppliers by providing HIP and vacuum heat treatment processes under one roof. The combination of these processes at the Cleveland facility, alongside the largest commercial vacuum heat treatment operation in North America, allows Paulo to reduce outside processing time and improve efficiency for its customers.

Hot Isostatic Pressing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 861.9 million

Revenue forecast in 2033

USD 1,579.4 million

Growth rate

CAGR of 7.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

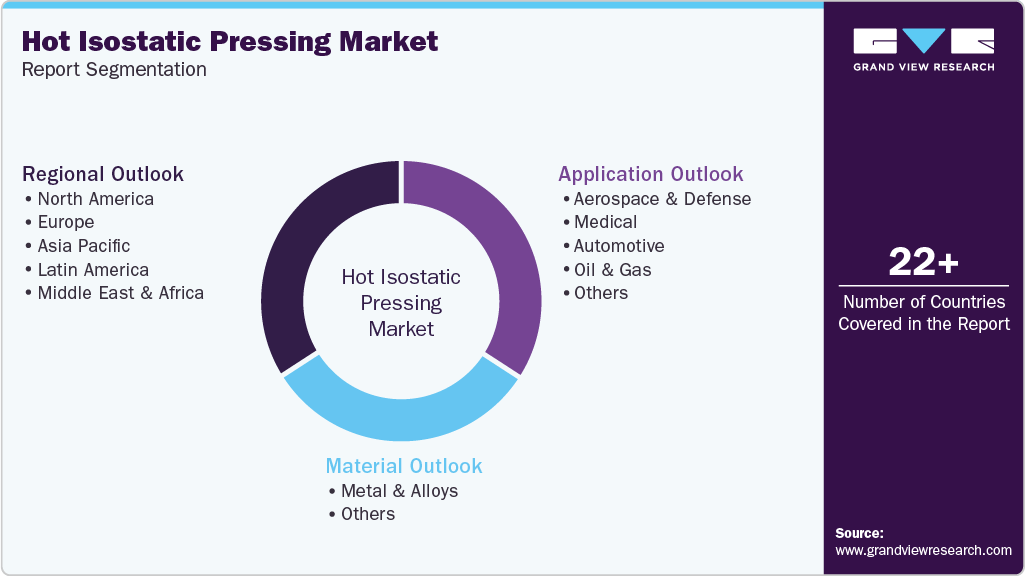

Segments covered

Application, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil

Key companies profiled

American Isostatic Presses Inc.; Bodycote; DORST Technologies GmbH; EPSI; FREY & Co. GmbH; Hiperbaric; Höganäs AB; Kobe Steel Ltd.; MTI Corporation; Nikkiso Co. Ltd.; Pressure Technology Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hot Isostatic Pressing Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hot isostatic pressing market report based on application, material, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal & Alloys

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Medical

-

Automotive

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global hot isostatic pressing market size was estimated at USD 820.5 million in 2024 and is expected to reach USD 861.9 million in 2025.

b. The global hot isostatic pressing market is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2033 to reach USD 1,579.4 million by 2033.

b. The aerospace & defense segment dominated the market with a revenue share of 47.6% in 2024.

b. Some of the key players of the global hot isostatic pressing market are American Isostatic Presses Inc, Bodycote, DORST Technologies GmbH, EPSI, FREY & Co. GmbH, Hiperbaric, Höganäs AB, Kobe Steel Ltd., MTI Corporation, Nikkiso Co. Ltd., Pressure Technology Inc, PTC Industries Limited, Sandvik AB, and others.

b. The key factor driving the growth of the global hot isostatic pressing market is the increasing demand for high-performance materials with enhanced mechanical properties across aerospace, automotive, and medical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.