- Home

- »

- Next Generation Technologies

- »

-

Household Cooking Appliances Market Size Report, 2030GVR Report cover

![Household Cooking Appliance Market Size, Share & Trends Report]()

Household Cooking Appliance Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Cooktops & Cooking Ranges, Ovens, Specialized Appliances), By Structure, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-544-1

- Number of Report Pages: 142

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Household Cooking Appliance Market Summary

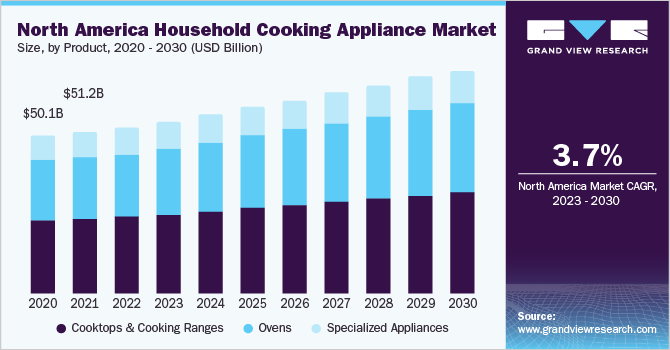

The global household cooking appliance market size was valued at USD 238.16 billion in 2022 and is projected to reach USD 380.55 billion by 2030, growing at a CAGR of 6.1% from 2023 to 2030. Changing dietary preferences, sustained growth of nuclear families, and a growing percentage of employed women and independent professionals are offering numerous growth opportunities in the market.

Key Market Trends & Insights

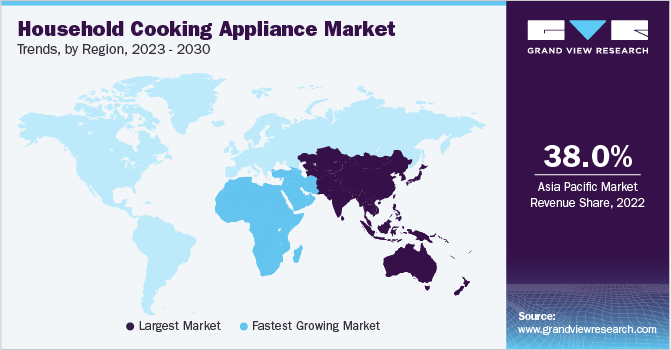

- The Asia Pacific regional market accounted for nearly 38% of the total revenue in 2022.

- The Middle East & Africa market is expected to expand at the highest CAGR of 9.4% between 2023 and 2030.

- By product, the cooktops & cooking ranges segment witnessed a revenue share of over 46% of the total market in 2022.

- By structure, the freestanding category contributed to nearly 61% of the total revenue of the market in 2022.

- By distribution channel, the e-commerce segment is estimated to register the highest CAGR of 7.4% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 238.16 Billion

- 2030 Projected Market Size: USD 380.55 Billion

- CAGR (2023-2030): 6.1%

- Asia Pacific: Largest market in 2022

- Middle East & Africa: Fastest growing market

Moreover, stringent energy efficiency laws across various regions, simple access to household kitchen equipment on e-commerce websites, and continuing introductions of innovative cooking items are projected to fuel further market growth. The demand for advanced kitchen electronic appliances has risen in recent years, owing to the augmented need for appliances that could reduce cooking time and lessen hassles in food preparation. Hectic schedules of consumers, especially among the urban and working class, are likely to favor the development of the global market for household cooking appliances in the coming years.For instance, in March 2023, GE Profile, a brand of GE Appliances, introduced the ‘Smart Oven with No Preheat’ appliance, a smart oven with a temperature range of up to 500˚F and zero preheat technology to save cooking time. Furthermore, the smart oven can be connected to the company’s SmartHQ application and has 11 presets of smart functions, including Warm, Air Fry, Broil, Toast, Pastry, Roast, Cookies, Pizza, Reheat, Bake, and Bagel.

Smart kitchen appliances find extensive utilization in many developed countries, such as the U.S., Canada, Japan, and Germany. The high demand for artificial intelligence (AI) and the Internet of Things (IoT) to access and regulate several smart kitchen appliances through mobile or remote devices has recently gained much traction. Several companies have started integrating these latest technologies into their smart cooking appliances to reap their benefits.

These factors are foreseen to emerge as prominent growth drivers for the global market in the coming years. For instance, in January 2023, GE Appliances launched 14 new induction cooktops through various brands. Through this launch, the company has introduced advanced features such as precision temperature control, which allows customers to adjust the burner's degree for optimum performance and consistency.

The COVID-19 pandemic significantly impacted the global household cooking appliances market, through disruptions in the supply chain. China is one of the leading suppliers of finished products and raw materials. However, due to government-imposed lockdowns and strict measures implemented by the Chinese government to contain the spread of COVID-19, the industry suffered. Currently, the price of these cooking appliances is quite high, which may act as a barrier to industry growth in the coming years.

Nevertheless, rising standards of living, increasing disposable income, and growing demand for high-end devices are projected to keep the market growth moving over the forecast period. In addition, steady growth in the varieties of cooktops available, such as electric, gas, induction, coil, and smooth surface, is expected to drive industry growth. The availability of high-end features on enhanced wall ovens and ranges is also expected to positively impact their demand.

Product Insights

In 2022, the cooktops & cooking ranges segment witnessed a revenue share of over 46% of the total market. The segment is further divided into gas cooktops & cooking ranges, electrical cooktops & cooking ranges, and induction cooktops & cooking ranges. Household cooking ranges and cooktops are available in various sizes, are simple to install, and include user-friendly features.

For instance, in February 2023, Prizer-Painter Stove Works, Inc. launched a 36-inch cooktop with a ‘Power Boost’ feature. The newly-launched cooktop provides an enhanced temperature control feature with approximately 12 cooking settings. Technological developments and the availability of modern cooktops have increased customer popularity and established new commercial prospects, particularly in North America and Europe.

On the other hand, the ovens segment is projected to witness the highest CAGR of approximately 6.7% from 2023 to 2030. The ability to cook restaurant-quality meals in homes offers significant growth opportunities for the segment. In January 2023, Samsung unveiled a portfolio of customizable Bespoke smart appliances at CES 2023. In this launch, the company introduced the Bespoke AI Oven with touch controls and a seven-inch screen. The oven can be integrated with Samsung Health to analyze diet goals and workout stats.

The ovens segment is further divided into microwave, conventional & convection, and combination ovens. The microwave oven segment is expected to witness a CAGR of approximately 7% during the projection period in the household cooking appliance market, owing to the availability of additional features in these appliances such as voice control and Wi-Fi connectivity, and the eco-friendly, convenient, and versatile nature of these products.

Structure Insights

In 2022, the freestanding category contributed to nearly 61% of the total revenue of the market. Compared to their built-in equivalents, freestanding appliances are less expensive, and their spare parts are also readily available. Freestanding household appliances are versatile in terms of placement, as they are easy to relocate and can be placed anywhere. Furthermore, cleaning and maintaining freestanding household products are also simple, resulting in increased growth for the segment over the forecast period.

The built-in structure segment is projected to witness the highest CAGR of 7.1% from 2023 to 2030. Built-in structures provide an integrated and seamless look to modern kitchens, while also performing basic functionalities and saving space. The built-in appliances majorly include built-in ovens, built-in refrigerators, built-in dishwashers, and built-in hobs. The increased demand for effective utilization of space is expected to drive the market growth of built-in kitchen appliances in the coming years.

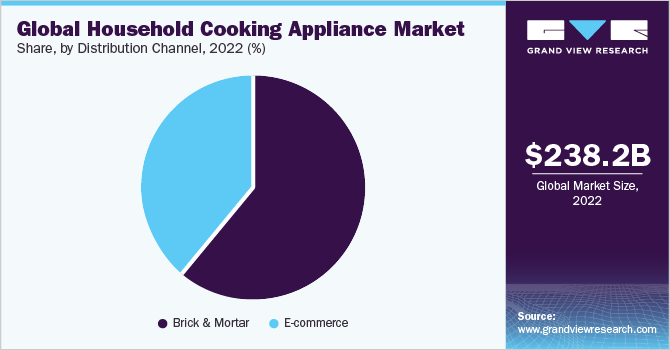

Distribution Channel Insights

The e-commerce segment is estimated to register the highest CAGR of 7.4% from 2023 to 2030. E-commerce has witnessed a boom in the last few years due to its associated features such as a faster buying process, price reductions & offers, easy price & product comparison, easy return options, stock availability, and flexibility in the choice of products. With the increasing popularity of online commerce, most manufacturers have introduced their e-commerce websites. The popularity of e-commerce over retail stores has become evident and is expected to take over the market in the coming years.

On the other hand, the brick-and-mortar segment accounted for nearly 60% of the market share in 2022, as this distribution channel provides buyers with physical access to products before purchase. Several consumers visit stores to have a hands-on experience and understand product features. Furthermore, some customers of household cooking appliances prefer in-store cooking demonstrations to understand their capabilities and features.

Modern brick-and-mortar stores focus on providing special deals and exclusive deals and an improved showroom experience, allowing customers to touch and inspect the appliances and make informed decisions. Therefore, the retail shops are expected to maintain steady growth during the forecast period.

Regional Insights

The Asia Pacific regional market accounted for nearly 38% of the total revenue in 2022. The growth is owing to the availability of raw materials at competitive prices and low labor costs. The region has thus become a significant location for household kitchen appliance manufacturers. Therefore, numerous companies from other areas have expanded their business operations in the Asia Pacific. Continued urbanization, changing lifestyles, rising consumer spending power, and early acceptance of breakthrough technologies are expected to contribute to the regional market's growth.

The market for household cooking appliances in the Middle East & Africa region is expected to expand at the highest CAGR of 9.4% between 2023 and 2030. The market is still in its infancy in the region, but consumer spending patterns are changing. IoT-enabled appliances are expected to be increasingly popular as high-speed data networks and modular kitchens continue to be deployed. Household consumers in the area are increasingly choosing multi-functional cooking ovens due to their availability at premium prices.

Key Companies & Market Share Insights

The major players in the household cooking appliances business are paying attention to market needs for smaller, more efficient, and affordable cooking appliances. For instance, in March 2023, Butterfly Gandhimathi Appliances merged with Crompton Greaves Consumer Electricals Ltd. (CGCEL) to focus on product innovation and build effective marketing strategies.

The major players in the market continue to upgrade their product lines with cutting-edge technology. In addition, they spend significantly on research and development to manufacture advanced products, through the integration of Internet of Things (IoT) and Artificial Intelligence (AI). AI-enabled intelligent kitchen appliances such as Perfect Bake Pro can be connected to the consumer’s phone through an application to monitor ingredients in real-time closely. Some of the eminent players operating in the global household cooking appliance market include:

-

Electrolux AB

-

GE Appliances

-

Haier Group

-

Koninklijke Philips N.V.

-

LG Electronics

-

Robert Bosch GmbH

-

Samsung

-

Smeg S.p.A

-

Whirlpool Corporation

-

Winiadaewoo Co. Ltd.

-

Panasonic Corporation

-

Thermador

Household Cooking Appliance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 252.10 billion

Revenue forecast in 2030

USD 380.55 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, structure, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; China; India; Japan; Brazil

Key companies profiled

Electrolux AB; GE Appliances; Haier Group; Koninklijke Philips N.V.; LG Electronics; Robert Bosch GmbH; Samsung; Smeg S.p.A; Whirlpool Corporation; Winiadaewoo Co. Ltd.; Panasonic Corporation; Thermador

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Household Cooking Appliance Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysisof the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global household cooking appliance market report based on product, structure, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cooktops & Cooking Ranges

-

Gas Cooktops & Cooking Ranges

-

Electrical Cooktops & Cooking Ranges

-

Induction Cooktops & Cooking Ranges

-

-

Ovens

-

Conventional & Convection Ovens

-

Microwave Ovens

-

Combination Ovens

-

-

Specialized Appliances

-

-

Structure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Built-in

-

Freestanding

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Brick & Mortar

-

E-commerce

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global household cooking appliance market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 380.55 billion by 2030.

b. Market revenue in the Asia Pacific region accounted for more than 37% of total revenue in 2022. The growth is attributed to the availability of raw materials at competitive prices and low labor costs; the region has become a significant location for household kitchen appliance manufacturers

b. Some key players operating in the household cooking appliance market include AB Electrolux, GE Appliances, Haier Group, Koninklijke Philips N.V., LG Electronics, Robert Bosch Gmbh, Samsung, Smeg S.P.A, Whirlpool Corporation, Winiadaewoo, Panasonic Corporation, and Thermador among others.

b. Key factors that are driving the household cooking appliance market growth include an increasing shift towards nuclear families and more working women, induction as a better alternative to gas or electric cooktops, and technological advancement in household cooking equipment/appliance/devices.

b. The global household cooking appliance market size was estimated at USD 238.16 billion in 2022 and is expected to reach USD 252.10 billion in 2023.

b. In 2022, the cooktops and cooking ranges segment witnessed a revenue share of over 46% of the total market. The segment is further divided into gas cooktops & cooking ranges, electrical cooktops & cooking ranges, and induction cooktops & cooking ranges. Household cooking ranges and cooktops are available in various sizes, are simple to install, and include user-friendly features

b. The freestanding category contributed to nearly 61% of total revenue in 2022. Compared to the products' built-in equivalents, freestanding appliances are less expensive, and freestanding household product spare parts are also readily available

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.