- Home

- »

- Electronic & Electrical

- »

-

Household Humidifier Market Size And Share Report, 2030GVR Report cover

![Household Humidifier Market Size, Share & Trends Report]()

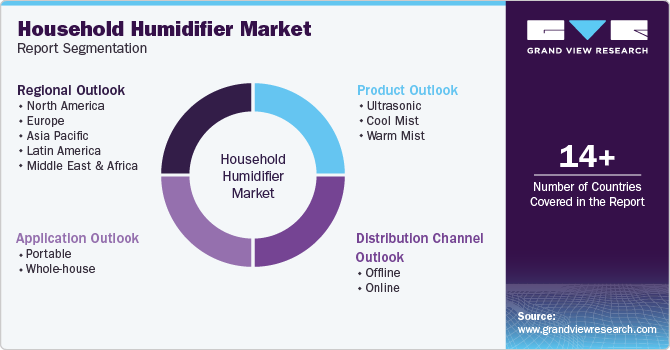

Household Humidifier Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Portable, Whole House), By Product, By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-462-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Household Humidifier Market Size & Trends

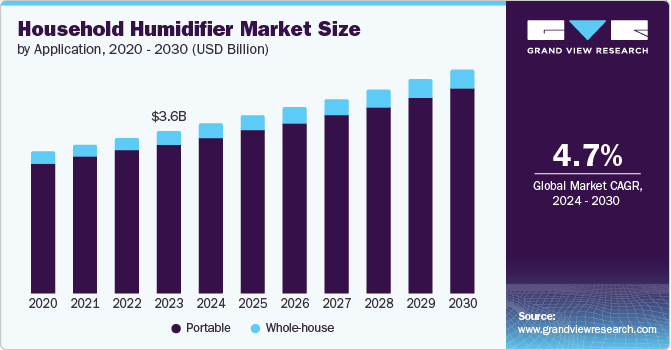

The global household humidifier market size was valued at USD 3.58 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The increasing awareness about health benefits, declining air quality and rising air pollution are the key factors driving the market. Consumer inclination for well-maintained air humidity and better household air quality is driving the growth. Furthermore, increased concerns over the adverse effects associated with dry air, such as dry skin, dry throat, nose irritation, dry cough, sinus congestion, and bloody noses, are expected to propel the demand for humidifiers. Heating systems can cause dry indoor air during winter season hence, the residential sector is anticipated to register a significant rise in demand for household humidifiers.

Humidifiers maintain proper humidity and provide a safe electric environment by effectively reducing static electricity. These products are also useful for reducing the symptoms of Chronic Obstructive Pulmonary Disease (COPD). Awareness regarding these advantages is projected to bode well for the overall demand for household humidifiers during the forecast period.

Humidifiers have been gaining popularity among indoor plant owners, as these plants require specific temperature and humidity levels for growth. Rising prevalence of sinusitis, asthma, and other allergies caused by dry air has raised awareness regarding the importance of proper humidity level. As a result, the household humidifier market is anticipated to expand at a significant pace in the coming years.

Application Insights

Portable household humidifier dominated the market and accounted for a share of 91.7% in 2023. This dominance can be attributed to device convenience and rapid urbanization. Portable humidifiers offer great convenience due to their compact size which allows them to move from room to room providing relief wherever required. Moreover, portable humidifiers are more cost effective and consume less energy compared to large humidifier models. Further the rising demand from healthcare and medical facilities for portable humidifiers is contributing to the growth.

Whole-house humidifier is anticipated to witness the fastest CAGR during the forecast period, owing to rising demand for smart home integration coupled with health benefits and energy efficiency. Whole house humidifier directly integrates with home’s heating, ventilation and air conditioning (HVAC), distributing moisture evenly throughout the entire dwelling which ensures consistent humidity levels in all rooms, eliminating need for multiple portable units. Moreover, the advancement in technology and rising innovation is likely to further accelerate the growth during the forecast period.

Product Insights

Warm mist accounted for the largest market revenue share of 41.6% in 2023. Warm mist humidifiers emit a stream of warm vapor that can be particularly soothing for irritated respiratory passages. Moreover, the rising demand from geriatric end is contributing to the growth of warm mist as it can provide relief from cough, sickness and dry sinuses and enhances better sleep quality.

Ultrasonic is expected to witness the fastest CAGR of 5.2% during the forecast period. The growth can be attributed to growing emphasis on indoor air quality and well-being is causing a significant increase in the demand for ultrasonic humidifiers. The compact size and convenience make them ideal for smaller rooms, where space is limited. Moreover, ultrasonic humidifier is safer than other humidifiers as it does not generate any heat and offer several health benefits such as alleviating respiratory problems and improving sleep quality.

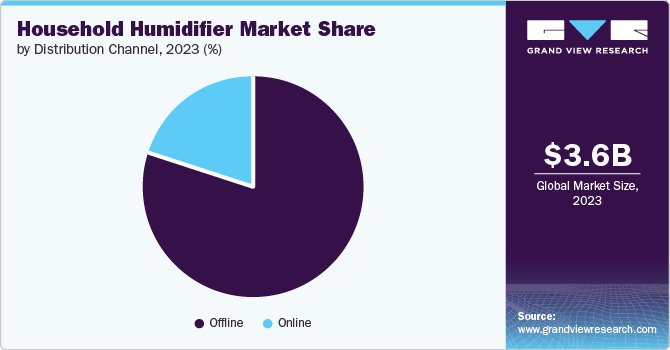

Distribution Channel Insights

The offline segment dominated the market in 2023. The growth can be attributed to a rise in specialty store shopping as these stores focus on products such as electronic or home appliances etc. This specialization allows them to provide a wide range of household humidifiers that caters to different consumer needs such as budget, specifications and preference. Moreover, the presence of skilled and knowledgeable staff in stores is an advantage as consumers seeking humidifiers can benefit from their expertise. Offline channels are expected to have high penetration in emerging economies including China and India where the consumers prefer brick and mortar for purchasing appliances including household humidifiers.

The online segment is anticipated to expand at the fastest CAGR during the forecast period. Online sales offer several benefits such as home delivery, convenience and product reviews which helps consumer to make purchase decision. For instance, there were 2.71 billion consumers buying from online platform in 2024, an increase of 2.7% from previous years. The rapid adoption of e-commerce and digitalization has been fueling the online sales of household humidifiers. Third-party logistics have been benefiting e-commerce as they help enhance customer satisfaction, service delivery, and efficiency. Also, the growth of online wallets and payment platforms including Payoneer and Amazon Payments has been fueling the growth of the e-commerce sector. The timesaving shopping experience along with effortless transactions is expected to drive consumer inclination toward using online channels to buy household humidifiers.

Regional Insights

North America household humidifier market dominated the market in 2023, driven by factors such as changing weather patterns, increased prevalence of respiratory illnesses, and rising consumer awareness. The increased consumer awareness about the ill effects of dry air or low humid climate and the presence of cold have raised the demand for the product in this region. The market in North America is highly dependent on the weather. Therefore, the sales of the product fluctuate significantly between cold and warm seasons. Also, the presence of many manufacturers coupled with product promotion by the regulatory bodies including ASHRAE (The American Society of Heating, Refrigerating and Air-Conditioning Engineers) and USEPA (The Environmental Protection Agency) attribute to the growth of the industry in this region. Similarly, Europe held a significant share of the market due to the increasing consumer awareness and the colder climate of the region.

U.S. Household Humidifier Market Trends

The U.S. household humidifier market dominated the North America market in 2023 owing rising consumer awareness about indoor air quality and surge in health concerns. The increasing prevalence of dry skin, which is more common among individuals having diabetes, or skin conditions is growing in the country. According to American Association of Dermatology, acne, which is caused due to dry skin is the most common skin problem in the country, affecting over 50 million Americans annually.

Europe Household HumidifierMarket Trends

Europe household humidifier market held a significant market share in 2023 owing to rising geriatric population, advancements in technology and surging consumer awareness. Europe has some of the coldest countries, such as Germany, Norway, Iceland, and Switzerland where dry skin problem are very common especially among people aged 60 and above.

The Germany household humidifier market accounted largest revenue share in 2023. The growth can be attributed to rising consumer awareness about health benefits of proper humidity and rising aging population.

Household humidifier market in UK is expected to grow rapidly during the forecast period driven by rising health concerns and climate in the region. The rising health concerns such as skin problems and respiratory diseases, is driving demand for household humidifier to maintain optimal humidity level and maintain healthier home environment

Asia Pacific Household Humidifier Market Trends

Asia pacific household humidifiers market is anticipated to witness CAGR of 11.8% during the forecast period, owing to rapid urbanization and rising disposable income. Moreover, the rising aging population in the region is likely to propel the market growth as people above age 60 are more prone to respiratory and skin related diseases.

The China household humidifiers market held a substantial market share in 2023. Rising concerns about personal health, increasing the purchasing power of the consumers and rising popularity e-Commerce are driving the market in China.

Household humidifiers market in India is expected to witness significant growth during the forecast period, due to rising disposable income and increasing awareness among people about health benefits of humidifiers. Moreover, the rising standard of living promotes maintaining good home well-being and healthier environment.

Key Household Humidifier Company Insights

Some of the key companies in the household humidifier marketincludeJarden Corporation (Newell Rubbermaid), Honeywell International Inc., Crane USA and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Crane USA is a manufacturer of household air quality products. The company is known for its diverse range of humidifiers and offers various models catering to different needs and preferences.

Key Household Humidifier Companies:

The following are the leading companies in the household humidifier market. These companies collectively hold the largest market share and dictate industry trends.

- Jarden Corporation (Newell Rubbermaid)

- Boneco AG

- Aprilaire

- Dyson Ltd

- Crane USA

- Honeywell International Inc.

- Essick Air Products, Inc.

- Hunter Home Comfort

- Guardian Technologies (Lasko)

- Venta Air Technologies, Inc.

- Stadler Form Aktiengesellschaft

Recent Developments

-

In January 2024, AprilAire launched the 720 Fan powered evaporative humidifier integrated with HydroCore technology. The newly launched 720 humidifier is suitable for larger homes and offers some advanced performance such as 60% reduction in wasted water, easy installation and low maintenance cost.

-

In October 2023, Dyson, a Singapore based company, launched its new air purifier named Cool Gen 1 in India. The Dyson cool gen 1 offers additional features such as LCD screen, remote controlling and WIFI connectivity. The cool gen 1 offer powerful and effective air purification and improve indoor quality and promote healthier home environment.

-

In September 2023, Smartmi launched Evaporative Humidifier 3. It offers mist-free, uninterrupted, pure, comfort and moisture for whole home hydration. The organization’s evaporative system mimics natural air humidity which feels fresh & inviting.

-

In September 2023, Dreo entered into a new category by introducing Dreo Humidifier Series. The collection comprises 3 models i.e. HM311S, HM512S and HM713S, all of them feature smart monitoring & control system, enhanced safety features and accurate humidity detection.

Household Humidifier Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.75 billion

Revenue forecast in 2030

USD 4.93 billion

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia & New Zealand, South Korea, Brazil, South Africa.

Key companies profiled

Jarden Corporation; Boneco AG; Aprilaire; Dyson Ltd; Crane USA; Honeywell International Inc.; Essick Air Products, Inc.; Hunter Home Comfort; Guardian Technologies; Venta Air Technologies, Inc.; Stadler Form Aktiengesellschaft;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Household Humidifier Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global household humidifier market report based on application, product, distribution channel and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Whole-house

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrasonic

-

Cool mist

-

Warm mist

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.