- Home

- »

- Next Generation Technologies

- »

-

HR Software Market Size, Share And Trends Report, 2030GVR Report cover

![HR Software Market Size, Share & Trends Report]()

HR Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Organization Size (Large Enterprises, Small & Medium Enterprises), By Deployment (Hosted, On-premise), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-420-3

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

HR Software Market Summary

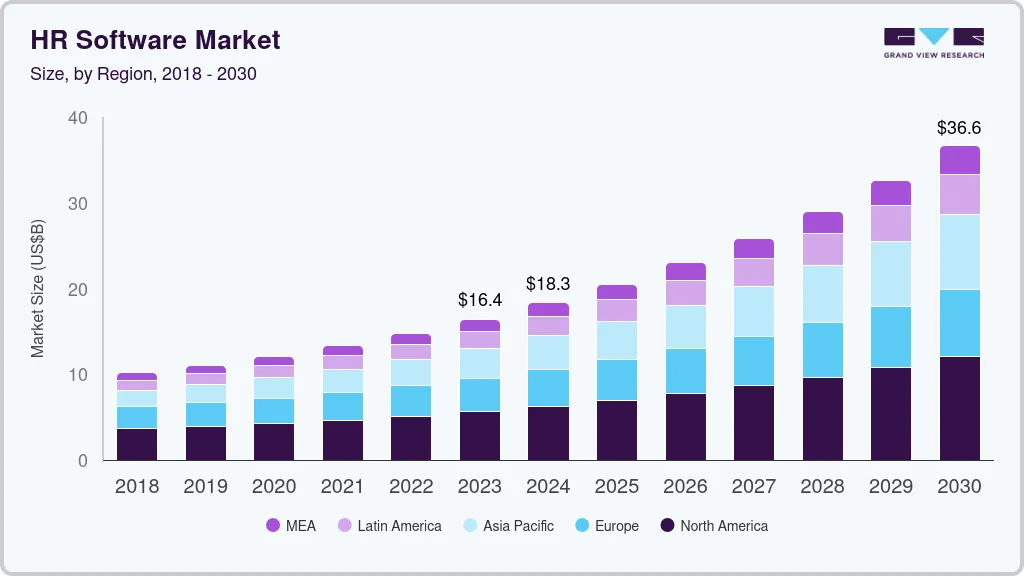

The global HR software market size was estimated at USD 16.43 billion in 2023 and is projected to reach USD 36.62 billion by 2030, growing at a CAGR of 12.2% from 2024 to 2030. The market growth is attributed to the widespread adoption of cloud-based solutions.

Key Market Trends & Insights

- The HR software market in North America accounted for a significant revenue share of over 34% in 2023.

- The U.S. HR software market is anticipated to grow at a CAGR of over 11% from 2024 to 2030.

- By type, the core HR segment dominated the market with revenue share of around 33% in 2023.

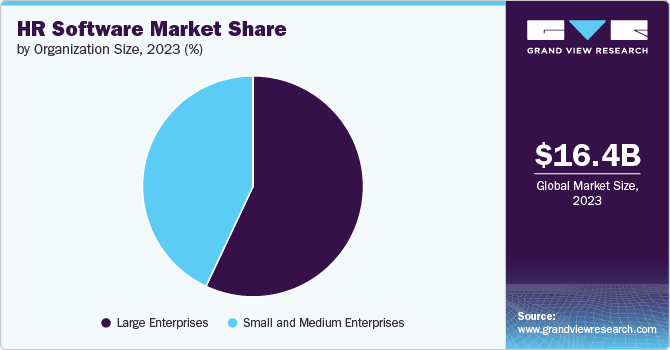

- By organization size, the large enterprises segment held the highest revenue share in 2023.

- By deployment, the on-premise segment held the highest revenue share in 2023.

Market Size & Forecast

- 2023 Revenue: USD 16.43 Billion

- 2030 Projected Market Size: USD 36.62 Billion

- CAGR (2024-2030): 12.2%

- North America: Largest Market in 2023

Companies are increasingly moving away from on-premise systems to cloud-based platforms due to their scalability, flexibility, and cost-effectiveness. These platforms enable organizations to manage HR functions such as payroll, recruitment, and employee performance from any location, providing real-time data access and reducing the need for extensive IT infrastructure, thereby driving market growth. Artificial intelligence (AI) and machine learning (ML) are transforming HR software by enabling more sophisticated data analytics, automation of repetitive tasks, and predictive insights. AI-driven tools are being used for talent acquisition, where they can screen resumes, analyze job descriptions, and match candidates more effectively. ML algorithms help in identifying trends in employee performance and engagement, allowing HR professionals to make data-driven decisions and personalize the employee experience, thereby fueling market growth.

Furthermore, improving employee experience has become a central focus in HR, driving the demand for software that supports personalized engagement, wellness initiatives, and continuous feedback mechanisms. This trend reflects a broader shift towards recognizing the importance of employee satisfaction and retention, with HR software evolving to offer tools that foster a more engaged and motivated workforce.

The increasing adoption of mobile HR solutions is another key trend, fueled by the rise of remote work and the need for on-the-go access to HR services. Mobile apps that allow employees to manage tasks like leave requests, payroll access, and training participation from their smartphones are becoming essential. This trend highlights the growing importance of mobility and convenience in the HR tech landscape.

Moreover, the trend toward advanced analytics and reporting tools within HR software is gaining momentum. Organizations are leveraging these tools to gain deeper insights into workforce metrics, track performance indicators, and forecast hiring needs. This trend emphasizes the growing importance of strategic, data-driven HR planning, aligning HR functions more closely with broader business objectives.

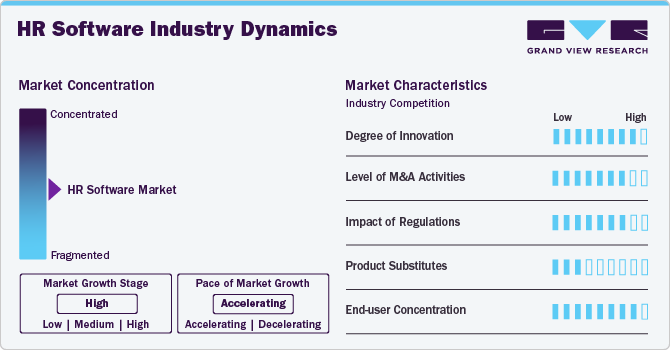

Market Concentration & Characteristics

The degree of innovation in the market is high. This sector is rapidly evolving with advancements in artificial intelligence, machine learning, and automation, which enhance functionalities such as talent acquisition, employee engagement, and data analytics. The integration of these technologies is driving significant innovations, such as predictive analytics for workforce planning and AI-driven recruitment tools, thereby continuously transforming HR processes and improving efficiency.

The level of mergers and acquisitions in the market is high. This trend is driven by the need for companies to expand their technology offerings, integrate complementary solutions, and enhance their competitive positioning. Acquisitions enable firms to acquire advanced technologies, such as AI and data analytics tools, and access new customer segments, accelerating growth and innovation in the rapidly evolving HR software landscape.

The impact of regulation on the market is high. Compliance with data protection laws, such as GDPR in Europe and various local regulations globally, is critical for HR software providers. These regulations mandate stringent data handling, privacy, and security standards, influencing how HR software is designed, implemented, and maintained. As a result, compliance requirements significantly shape market dynamics, drive software development priorities, and increase operational costs.

The level of product substitutes in the market is relatively low. HR software solutions are highly specialized and integrated systems designed to manage various human resources functions such as payroll, recruitment, and employee management. While there are alternative solutions like manual HR processes or less integrated tools, they do not offer the same comprehensive, automated capabilities and efficiencies. This specialization reduces the availability of direct substitutes, making the market less susceptible to high levels of product substitution.

The level of end-user concentration in the market is low. HR software caters to a wide range of industries and organizations of various sizes, from small businesses to large enterprises. This broad applicability means that the market serves a diverse customer base, reducing the concentration of end-users within specific sectors. Additionally, the need for HR software across different sectors and company sizes contributes to a fragmented end-user base, where no single industry or organization type dominates the market.

Type Insights

The core HR segment dominated the market with revenue share of around 33% in 2023, due to its essential role in managing fundamental HR functions such as payroll, benefits administration, and employee records. As organizations increasingly recognize the need for streamlined, integrated systems to handle these critical tasks efficiently, core HR solutions have become fundamental to operational success, thereby driving segment growth.

The talent management segment is expected to record a significant CAGR of over 14% from 2024 to 2030, due to the increasing focus on optimizing workforce performance and development. Organizations are investing more in advanced talent management solutions to attract, retain, and foster top talent amidst a competitive job market. These tools enhance recruitment processes, employee development, and performance evaluation, aligning talent strategies with business goals and improving overall organizational effectiveness. The growing recognition of talent management's impact on business success drives this rapid growth.

End-use Insights

The IT & telecom segment accounted for the highest market share in 2023, due to the industry's rapid growth and high demand for efficient human resource management. Companies in this sector often have large, diverse workforces and complex HR needs, driving the adoption of advanced HR software solutions to streamline operations, manage talent, and ensure compliance. Additionally, the fast-paced nature of the IT & telecom industry necessitates robust HR systems that can handle recruitment, performance management, and employee engagement effectively, contributing to the segment's leading market share.

The retail segment is anticipated to expand at a significant CAGR from 2024 to 2030, due to the sector's increasing need for efficient workforce management solutions amid evolving consumer demands and market conditions. As retailers expand their operations and adapt to trends such as omnichannel retailing, they require advanced HR systems to manage large, dynamic teams, streamline recruitment, optimize scheduling, and enhance employee engagement. The rise in automation and data-driven HR practices is also driving the adoption of sophisticated HR software in retail, facilitating better management of both front-line and corporate staff.

Deployment Insights

The on-premise segment held the highest revenue share in 2023, due to the preference of many organizations for maintaining control over their HR data and systems within their IT infrastructure. On-premise solutions offer greater customization, enhanced security, and compliance with strict data regulations, which appeals to enterprises with specific security requirements or complex HR processes. Additionally, established companies with existing IT infrastructure often find on-premise systems more aligned with their operational needs and integration capabilities.

The hosted segment is estimated to register the highest CAGR from 2024 to 2030, owing to its flexibility, scalability, and lower upfront costs compared to on-premise solutions. Hosted HR software allows organizations to access and manage their HR functions via the cloud, reducing the need for extensive internal IT infrastructure and maintenance. This model supports remote and hybrid work environments, offers easier updates and integrations, and provides scalability for growing businesses, making it an attractive option for companies seeking efficient and adaptable HR management solutions.

Organization Size Insights

The large enterprises segment held the highest revenue share in 2023, owing to their extensive and complex human resource needs. These organizations often require comprehensive and scalable HR solutions to manage large and diverse workforces, integrate with existing enterprise systems, and comply with various regulatory requirements. Their larger budgets and greater emphasis on optimizing HR processes and analytics contribute to the high revenue share in this segment.

The small and medium enterprises segment is estimated to register the highest CAGR from 2024 to 2030, due to the increasing adoption of digital solutions among SMEs. As these businesses seek to enhance their HR capabilities and streamline processes without substantial investments, they are increasingly turning to affordable, scalable HR software solutions. Additionally, the growing availability of cloud-based and subscription-based HR software makes these solutions more accessible and cost-effective for SMEs, driving their rapid growth in the market.

Regional Insights

The HR software market in North America accounted for a significant revenue share of over 34% in 2023, driven by the high adoption of advanced HR technologies, a mature market with substantial investments in digital transformation, and the presence of numerous leading HR software providers. Companies in this region are increasingly leveraging sophisticated HR systems to improve workforce management, compliance, and operational efficiency.

U.S. HR Software Market Trends

The U.S. HR software market is anticipated to grow at a CAGR of over 11% from 2024 to 2030, fueled by the strong demand for innovative HR solutions from a diverse range of enterprises seeking to enhance their workforce management capabilities. The country's robust technology infrastructure, combined with a focus on integrating AI and automation into HR processes, drives the adoption of advanced HR software solutions.

Asia Pacific HR Software Market Trends

The HR Software Market in Asia Pacific accounted for a significant revenue share of over 21% in 2023, due to its dynamic economic development, a large and diverse workforce, and the increasing need for HR software to streamline human resources functions. As businesses in this region expand and modernize, there is a growing emphasis on digital tools to manage complex HR operations efficiently.

India HR software market is estimated to record the highest CAGR from 2024 to 2030, due to the significant growth in the IT and services sectors, coupled with a focus on digitizing HR processes to support rapid business expansion. The rising demand for cloud-based HR solutions and advanced analytics is driving the adoption of innovative HR technologies across various industries.

The HR software market in China is projected to grow at a CAGR from 2024 to 2030. China's HR software market benefits from its large industrial base and the ongoing digital transformation across businesses. The need for sophisticated HR systems to handle a vast and diverse workforce, combined with efforts to enhance operational efficiency and compliance, contributes to the market's growth.

Japan HR software market is projected to grow at a CAGR from 2024 to 2030. Japan's market is growing as businesses seek advanced HR solutions to address challenges related to an aging workforce, productivity, and compliance. The country's emphasis on technological innovation and automation in HR processes is driving the adoption of state-of-the-art HR software.

Europe HR Software Market Trends

The HR software market in the Europe region is anticipated to register a CAGR of around 10% from 2024 to 2030. The growth is supported by stringent regulatory requirements, a strong focus on digital transformation, and the increasing adoption of HR technologies to navigate complex labor laws and enhance organizational efficiency. European companies are investing in HR software to improve compliance and streamline HR operations.

The UK HR software market is projected to grow at a CAGR from 2024 to 2030, driven by a need for compliance with evolving labor regulations, the rise of remote and hybrid working models, and a significant investment in digital HR solutions. Companies are adopting HR software to manage diverse workforces, improve employee engagement, and enhance operational efficiency.

The HR software market in Germany is estimated to record a CAGR from 2024 to 2030, due to the country's strong industrial sector, high emphasis on efficient HR management, and adoption of digital technologies to meet complex regulatory and operational needs. The focus on enhancing productivity and managing large-scale workforces drives the demand for advanced HR systems.

Middle East & Africa (MEA) HR Software Market Trends

The MEA HR software market is anticipated to grow at the highest CAGR of around 12% from 2024 to 2030, fueled by the increased investments in infrastructure, modernization of HR practices, and the need for scalable solutions to manage diverse and expanding workforces. The region's economic diversification and focus on digital transformation are driving the adoption of HR software.

The HR software market in Saudi Arabia accounted for a considerable revenue share in 2023, due to government initiatives promoting digital transformation, increased investment in technology, and a growing need for efficient HR management systems.

Key HR Software Company Insights

Some key players operating in the market are NetSuite, Inc. and IBM Corporation.

-

NetSuite, Inc., is a provider of cloud-based enterprise resource planning (ERP) and business management software. The company offers a comprehensive suite of integrated business applications, including ERP, financial management, CRM (Customer Relationship Management), and e-commerce solutions. Its cloud-based platform is designed to streamline business operations, enhance visibility, and support scalability for organizations of all sizes.

-

IBM Corporation is a technology and consulting company renowned for its broad portfolio of technology and services, including cloud computing, artificial intelligence (AI), data analytics, and enterprise software. The company provides a wide range of solutions, including hardware, software, and consulting services, catering to various industries and business needs. IBM's software offerings include solutions for business automation, data management, and security.

Talentsoft, and UKG, Inc. are some emerging market participants in the market.

-

Talentsoft is a provider of cloud-based talent management and human resources (HR) software solutions. The company specializes in providing an integrated suite of HR solutions designed to manage various aspects of the employee lifecycle. Its offerings include talent acquisition, performance management, learning and development, and succession planning. The company has a strong presence in Europe and is expanding its reach globally.

-

UKG, Inc. is a provider of human capital management (HCM) and workforce management solutions. The company offers a comprehensive range of HR, payroll, and workforce management solutions, including core HR, talent management, time and attendance, and workforce analytics. UKG focuses on delivering solutions that enhance employee experience, streamline HR operations, and drive organizational success. With a strong global presence, UKG serves a diverse range of industries and has a reputation for innovative technology and customer service.

Key HR Software Companies:

The following are the leading companies in the HR software market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Cezanne HR Limited

- IBM Corporation

- NetSuite, Inc.

- Zellis Group

- PwC

- SAP SE

- Talentsoft

- UKG, Inc.

- Workday Inc.

Recent Developments

-

In May 2024, Cezanne HR Limited launched its new payroll solution, Cezanne Payroll, enhancing its HRIS offerings with an integrated, native payroll tool. This solution streamlines payroll processing by combining HR and payroll data in a single system, ensuring compliance with UK regulations and HMRC recognition for RTI submissions.

-

In April 2024, Zellis Group launched HCM Cloud 8.0, a major update aimed at enhancing HR and payroll operations. The new version features advanced Power BI dashboard enhancements for better visibility on pay diversity, automatic National Minimum Wage calculations, and improvements to the Zellis Intelligence Platform (ZIP) for better data management and integration.

-

In April 2023, Pocket smHRt Tech Pvt. Ltd. launched "Digital Bharat 2.0," a mission designed to help SMEs in India digitalize their HRMS and payroll systems using WhatsApp in regional languages. This initiative offers an intuitive, easy-to-use platform for managing HR and payroll tasks, including compliance with various regulations.

HR Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18,333.0 million

Revenue forecast in 2030

USD 36,628.3 million

Growth rate

CAGR of 12.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, organization size, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture plc; Cezanne HR Limited; IBM Corporation; NetSuite, Inc.; Zellis Group; PwC; SAP SE; Talentsoft; UKG, Inc.; Workday Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HR Software Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global HR software market report based on type, organization size, deployment, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Core HR

-

Employee Collaboration & Engagement

-

Recruiting

-

Talent Management

-

Workforce Planning & Analytics

-

Others

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academia

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global HR software market size was estimated at USD 16.43 billion in 2023 and is expected to reach USD 18,333.0 million in 2024.

b. The global HR software market is expected to grow at a compound annual growth rate of 12.2% from 2024 to 2030 to reach USD 36,628.3 million by 2030.

b. The HR software market in North America accounted for a significant revenue share of over 34% in 2023, driven by the high adoption of advanced HR technologies, a mature market with substantial investments in digital transformation, and the presence of numerous leading HR software providers.

b. Some key players operating in the HR software market include Accenture plc, Cezanne HR Limited, IBM Corporation, NetSuite, Inc., Zellis Group, PwC, SAP SE, Talentsoft, UKG, Inc., Workday Inc.

b. Key factors that are driving HR software market growth include the widespread adoption of cloud-based solutions, increasing adoption of mobile HR solutions and the trend towards advanced analytics and reporting tools within HR software.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.