- Home

- »

- Sensors & Controls

- »

-

Human Centric Lighting Market Size & Share Report, 2030GVR Report cover

![Human Centric Lighting Market Size, Share, & Trends Report]()

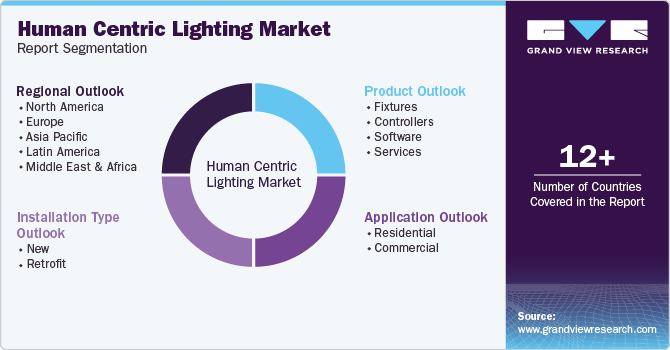

Human Centric Lighting Market (2024 - 2030) Size, Share, & Trends Analysis Report By Product (Fixtures, Controllers), By Installation Type (New, Retrofit), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-363-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Human Centric Lighting Market Summary

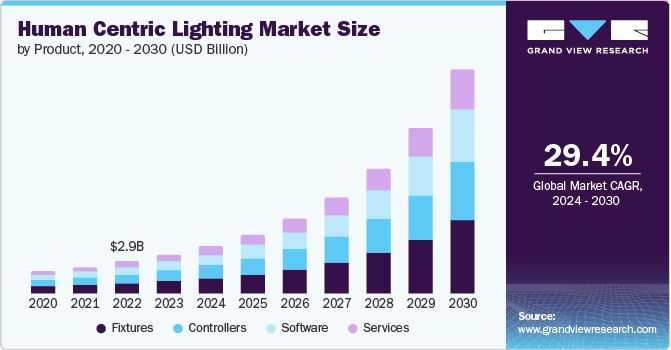

The global human centric lighting market size was estimated at USD 3.45 billion in 2023 and is projected to reach USD 19.83 billion by 2030, growing at a CAGR of 29.4% from 2024 to 2030. Rising urbanization and infrastructure development are key factors driving the market growth.

Key Market Trends & Insights

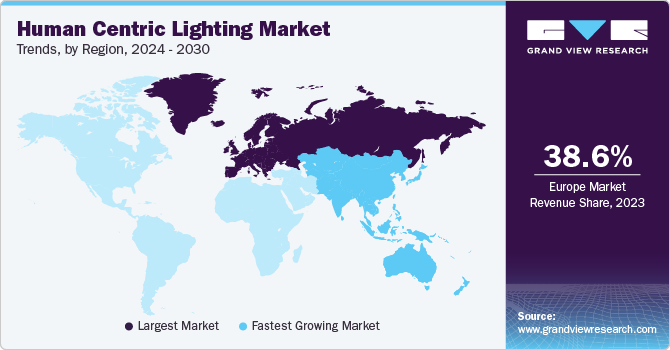

- Europe dominated the global human centric lighting market with the largest revenue share of 38.6% in 2023.

- By product, the fixtures segment led the market with the largest revenue share of 33.0% in 2023.

- By installation type, the new installation segment led the market with the largest revenue share of 66.0% in 2023.

- By application, the residential segment is expected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3.45 Billion

- 2030 Projected Market Size: USD 19.83 Billion

- CAGR (2024-2030): 29.4%

- Europe: Largest market in 2023

As cities expand and modernize, there's a growing recognition of the importance of creating healthier and more sustainable living and working environments.

In healthcare facilities and educational institutions located in urban areas, human-centric lighting (HCL) positively impacts patient outcomes, student performance, and overall well-being. Dynamic lighting solutions are tailored to support healing processes in hospitals and provide optimal learning environments in schools and universities. As urban populations grow, there's an increasing demand for residential properties prioritizing occupant health and comfort. HCL systems in residential buildings can enhance sleep quality, regulate mood, and create more inviting living spaces.

Human-centric lighting improves visibility and safety in urban environments and has the potential to enhance the overall quality of life for city residents. HCL solutions contribute to creating more livable cities by providing lighting that supports circadian rhythms, promoting well-being, and creating aesthetically pleasing environments. Smart city initiatives that prioritize the integration of HCL technologies help make urban spaces that are functional and conducive to human health.

Smart city initiatives positively impact the market growth. These initiatives seamlessly integrate advanced lighting systems into urban infrastructure. Smart cities increasingly integrate centralized platforms to manage a wide range of services. HCL systems are well-suited for this environment due to their adaptive nature and IoT connectivity. This integration allows for dynamic lighting solutions that adjust based on human activity and natural light availability, enhancing the overall efficiency and functionality of urban lighting.

The World Cities Report 2022 by the United Nations highlights a significant growth in adopting smart city technologies, projecting an annual increase in demand by 25%. This surge is anticipated to drive the market's value to around USD 517 billion. The growth is largely attributed to governmental efforts to embrace technology in response to the escalating urban population. The rapid evolution and widespread application of digital and interconnected technologies further fuel the expansion. The integration of smart solutions in urban areas is highlighted by the strong interest in Internet of Things (IoT) technology, which is anticipated to experience an annual growth rate of over 20% in the upcoming years.

Market Concentration & Characteristics

The product environment in human-centric lighting market is evolving, and companies are launching new products to cater to the increasing demand. For instance, in January 2024, Signify Holding launched a range of Philips Hue lighting solutions and accessories to deliver customizable lighting experiences. The Philips Hue Dymera wall light is equipped with independent controls for upward and downward illumination, making it suitable for use in both indoor and outdoor environments. Moreover, the launch includes a 3D-printed pendant cord and connectors specifically designed for the Philips Hue Perifo track lighting system, offering increased options for creative design.

As the corporate sector continues to evolve, there is an increasing demand for human-centric lighting solutions. Industry players are collaborating to introduce innovative products and expand their presence in the market. For instance, in January 2023, Acuity Brands Lighting Inc. entered a partnership with Biological Innovations and Optimization Systems (BIOS) LLC through the BIOS ILLUMINATED program. Under this partnership, Acuity Brands planned to purchase specific LED lighting components designed to benefit human wellness from BIOS. These components are to be incorporated into Acuity Brands' architectural lighting products. In addition, Acuity Brands secures global rights to utilize the BIOS trademark to promote and market its lighting products featuring the innovative BIOS SkyBlue technology.

Regulatory trends in the market focus on safety and energy efficiency standards of the buildings. These encompass the Occupational Safety and Health Administration (OSHA) standards, energy efficiency regulations, and building codes and standards. OSHA sets workplace safety regulations in many countries, including guidelines for lighting levels, glare, and flicker rates, to ensure the well-being and productivity of employees.

The threat of substitutes can be termed moderate, as daylighting solutions can be considered one of the substitutes. Daylighting solutions represent a fundamental approach to integrating natural light into indoor environments, offering numerous benefits akin to human-centric lighting. By strategically incorporating elements such as skylights, windows, and light wells into building design, daylighting maximizes the penetration of natural sunlight while minimizing glare and heat gain.

Product Insights

The fixtures segment accounted for the largest market share of 33% in 2023. Businesses are increasingly adopting human-centric lighting to enhance workplace environments. Companies recognize that investing in high-quality lighting fixtures can improve employee productivity, reduce absenteeism, and enhance overall workplace satisfaction. Thus, adopting human-centric lighting fixtures in corporations is significantly driving the segment's growth.

The services segment is anticipated to expand at the fastest CAGR during the forecast period. Due to the growing awareness about the impact of lighting on human health and well-being, there is a rising demand for human-centric lighting solutions. These solutions are designed to improve mood, productivity, and overall health by mimicking natural daylight patterns. Service providers offer consulting, design, and implementation services to help organizations and individuals optimize their lighting environments for better health outcomes.

Installation Type Insights

The new installation segment accounted for the largest market share of 66% in 2023. The rise of smart homes and the focus on enhancing residential living standards drive the adoption of human-centric lighting in new residential developments. Homeowners and builders are increasingly seeking lighting solutions that can be customized to suit different times of the day and personal preferences. Integrated with smart home technologies, human-centric lighting systems allow residents to control lighting settings through mobile apps or voice commands, creating a more comfortable and adaptive living environment.

The retrofit installation segment is anticipated to grow at a significant CAGR during the forecast period. The increasing number of retrofit projects is driving the segment's growth. Retrofitting office buildings with human-centric lighting can improve employee well-being and productivity by providing better lighting conditions that support circadian rhythms and reduce eye strain. This enhanced work environment can lead to enhanced work efficiency.

Application Insights

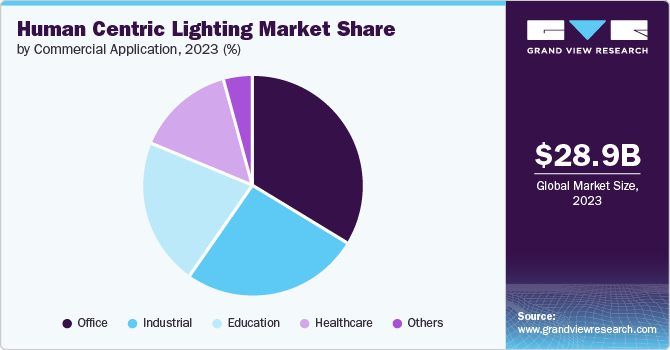

The commercial segment accounted for the largest market share of 58% in 2023. The commercial segment comprises office, education, healthcare, and others. Human-centric lighting significantly enhances worker productivity and safety in industrial environments. Proper lighting reduces eye strain and fatigue, leading to better focus and fewer errors. Additionally, well-lit workspaces help prevent accidents and injuries by ensuring that hazards are visible. This increased safety and efficiency make human-centric lighting a valuable investment for industrial facilities.

The residential segment is anticipated to grow at the fastest CAGR during the forecast period. Human-centric lighting enhances both the aesthetics and functionality of residential spaces. By adjusting the color temperature and brightness throughout the day, these lighting systems can create a more pleasant and visually appealing environment. They also improve visibility and comfort, making daily reading, cooking, and relaxing more enjoyable.

Regional Insights

North America held a significant share of 26% in 2023. The proliferation of smart technologies facilitates the adoption of HCL systems in North America. With the rise of the Internet of Things (IoT) and connected devices, lighting systems can now be integrated with sensors, data analytics, and user interfaces to create dynamic environments tailored to individual preferences and needs.

U.S. Human Centric Lighting Market Trends

The human-centric lighting market in the U.S. is expected to grow significantly at a CAGR of 29.2% from 2024 to 2030. The growing emphasis on sustainability and energy efficiency contributes to the adoption of human-centric lighting in the U.S. Compared to traditional lighting technologies, human-centric lighting consumes less energy and has a longer lifespan, reducing maintenance costs and environmental impact.

Europe Human Centric Lighting Market Trends

The Europe human-centric lighting market dominated and accounted for a revenue share of 38.6% in 2023. The presence of regulatory frameworks and building standards in Europe is driving the adoption of human-centric lighting. Initiatives aimed at improving energy efficiency, such as the EU's Energy Performance of Buildings Directive (EPBD), have spurred the development of innovative lighting solutions that reduce energy consumption and enhance occupant comfort and well-being.

The UK human-centric lighting market is anticipated to garner a significant CAGR of 29.7% from 2024 to 2030. The U.K.'s commitment to advancing sustainability and combating climate change is driving the market's growth. There is a growing focus on energy-efficient technologies, such as human-centric lighting, to reduce carbon emissions and transition to a low-carbon economy. These technologies can provide substantial environmental benefits without compromising human comfort and productivity.

The human-centric lighting market in Germany is expected to exhibit a CAGR of 29.3% from 2024 to 2030. Germany's robust industrial sector is a significant driver of this growth. Germany is renowned for its manufacturing prowess and technological innovation, with a diverse range of industries spanning automotive, engineering, pharmaceuticals, and electronics.

Asia Pacific Human Centric Lighting Market Trends

The market in Asia Pacific is projected to witness a significant CAGR of 30.5% from 2024 to 2030. The region's rapid urbanization and population growth drive the market growth. The population in urban areas tends to spend more time indoors. This shift towards indoor lifestyles has heightened awareness of the importance of lighting in influencing mood, productivity, and overall well-being. Human centric lighting solutions enhance indoor environments and promote wellness inside the homes.

The human centric lighting market in China is expected to grow significantly at a CAGR of 32.0% from 2024 to 2030. China's growing focus on smart cities and intelligent infrastructure presents opportunities for the integration of HCL into urban development projects. As cities across the country seek to enhance livability, sustainability, and resilience, there's increasing interest in deploying smart lighting systems that can adapt to the needs of residents and contribute to creating healthier and more inclusive urban environments.

India human centric lighting market is anticipated to garner a CAGR of 31.1% from 2024 to 2030. The burgeoning corporate sector in India is driving the growth of the country's market. As businesses compete to attract and retain talent, there's a growing recognition of the importance of creating healthy, comfortable, and productive work environments. HCL, with its ability to mimic natural light patterns and support circadian rhythms, is increasingly seen as a strategic investment by Indian corporations to enhance employee well-being, satisfaction, and performance.

Middle East & Africa Human Centric Lighting Market Trends

The accelerating pace of infrastructure development projects in the Middle East is driving market growth in the region. In addition, the Middle East's hospitality and tourism sectors present opportunities for the integration of HCL into luxury hotels, resorts, and entertainment complexes. As the region seeks to attract international visitors and promote leisure and cultural experiences, there's increasing interest in creating immersive environments that prioritize guest comfort and satisfaction. HCL's ability to create dynamic lighting scenarios that enhance ambiance, mood, and relaxation resonates with the hospitality industry's focus on delivering exceptional guest experiences and differentiating properties in a competitive market.

The human centric lighting market in Saudi Arabia is expected to witness at a CAGR of 29.4% from 2024 to 2030. The educational and corporate sectors in Saudi Arabia are expanding rapidly, with new schools, universities, and office buildings being constructed. These institutions are increasingly prioritizing the well-being and productivity of students and employees, leading to the adoption of HCL systems.

Key Human Centric Lighting Company Insights

Some of the key companies operating in the market include Signify Holding, ACUITY BRANDS, INC., and ams-OSRAM AG, among others.

-

Signify Holding is a global lighting company that provides high-quality, energy-efficient lighting products, systems, and services. It offers various lighting solutions, including incandescent, specialty, compact and linear fluorescent, halogen, high-intensity discharge, LEDs, fluorescent, electronic ballasts, and drivers. The company also provides integrated and customized lighting systems and management services, including light engineering, design, remote monitoring, and managed services. Moreover, it offers human-centric lighting that simulates natural daylight patterns and optimizes lighting conditions to enhance employee productivity, comfort, and overall health.

-

Acuity Brands, Inc. provides lighting and building management solutions for commercial, institutional, industrial, and residential applications. Acuity Brands offers many products and services, including luminaires (e.g., recessed, surface, and suspended lighting), lighting controls and components, integrated lighting systems, building management systems, and location-aware applications. The company offers humanistic lighting for healthcare, education, commercial office, industrial, and retail sectors. The company's brands include Holophane, Peerless, Lithonia Lighting, Gotham, Mark Architectural Lighting, and Atrius IoT. Acuity Brands serves customers through electrical distributors, electric utilities, retail home improvement centers, and lighting showrooms.

Helvar, LEDVANCE GmbH, and Lutron Electronics Co., Inc are some of the emerging market participants in the market.

-

Helvar, a Finnish technology company, provides energy-efficient lighting systems and solutions. The company offers smart lighting solutions with a strong focus on innovation and sustainability. Its core offerings include intelligent lighting controls, smart building solutions, and a wide range of professional lighting components. In addition, it provides human-centric lighting solutions for optimal well-being and performance in offices, healthcare, education, and other sectors.

-

Lutron Electronics Co., Inc. manufactures lighting controls and lighting control systems for residential and commercial applications. From dimmers for the home to lighting systems for whole buildings, Lutron offers a wide range of energy-saving products. The company offers HXL, a human-centric lighting approach focused on the human experience that allows people to be, work, and feel their best.

Key Human Centric Lighting Companies:

The following are the leading companies in the human centric lighting market. These companies collectively hold the largest market share and dictate industry trends.

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Cree Lighting USA LLC

- Eaton Corporation

- Fagerhults Belysning AB

- Helvar

- Hubbell Lighting

- LEDVANCE GmbH

- Legrand SA

- Lutron Electronics Co., Inc

- Schneider Electric

- Signify Holding

- Trilux Group

- Wipro Lighting

- Zumtobel

Recent Developments

-

In January 2024, Lutron Electronics Co., Inc. introduced Maestro dual controls, featuring the innovative LED+ advanced dimming technology. These versatile 2-in-1 devices, available as both a dimmer/switch and a dimmer/timer, deliver excellent dimming capabilities for an array of LED, incandescent, and halogen lights. The devices are enhanced with Lutron's unique LED+ technology, guaranteeing smooth, flawless dimming of LED bulbs without any unwanted flickering or shimmering.

-

In October 2023, Lutron Electronics Co., Inc. introduced the myRoom XC system for the hospitality industry. This cloud-enabled system allows for the management of properties through a unified dashboard, covering guestrooms, communal areas, event spaces, and private residences. The myRoom XC system showcases Lutron's focus on lighting innovation and its dedication to enhancing the hospitality sector.

-

In June 2023, Helvar, a provider of lighting control systems and components, collaborated with BUCK Lighting, a provider of premium LED lighting products from Germany. The partnership is focused on offering smart, energy-efficient lighting solutions designed to improve ambiance, comfort, and environmental sustainability for customers.

Human Centric Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.23 billion

Revenue forecast in 2030

USD 19.83 billion

Growth rate

CAGR of 29.4% from 2024 to 2030

Historic data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, installation type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

ACUITY BRANDS, INC.; ams-OSRAM AG; Cree Lighting USA LLC; Eaton Corporation; Fagerhults Belysning AB; Helvar; Hubbell Lighting; LEDVANCE GmbH; Legrand SA; Lutron Electronics Co., Inc; Schneider Electric; Signify Holding; Trilux Group; Wipro Lighting; Zumtobel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Human Centric Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global human centric lighting market report based on product, installation type, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixtures

-

Controllers

-

Sensors

-

Drivers

-

Microcontrollers

-

Others

-

-

Software

-

Services

-

-

Installation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

New

-

Retrofit

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Education

-

Office

-

Healthcare

-

Industrial

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global human centric lighting market size was estimated at USD 3.45 billion in 2023 and is expected to reach USD 4.23 billion in 2024.

b. The global human centric lighting market is expected to reach USD 19.83 billion by 2030, at a compound annual growth rate of 29.4%.

b. The new installation type segment held the largest revenue share of 66.4% in 2023 in the human centric lighting market.

b. Some key players operating in the human centric lighting market include Signify Holding, ACUITY BRANDS, INC, ams-OSRAM AG, Zumtobel, Wipro Lighting; Helvar, LEDVANCE GmbH, and Lutron Electronics Co., Inc.

b. Rising urbanization and infrastructure development projects are driving growth of the human centric lighting market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.