- Home

- »

- Next Generation Technologies

- »

-

Hydrogen Aircraft Market Size, Share & Trends Report, 2030GVR Report cover

![Hydrogen Aircraft Market Size, Share & Trends Report]()

Hydrogen Aircraft Market (2024 - 2030) Size, Share & Trends Analysis Report By Platform (UAV, Passenger Aircraft), By Range (Short-haul, Long-haul), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-401-4

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Aircraft Market Summary

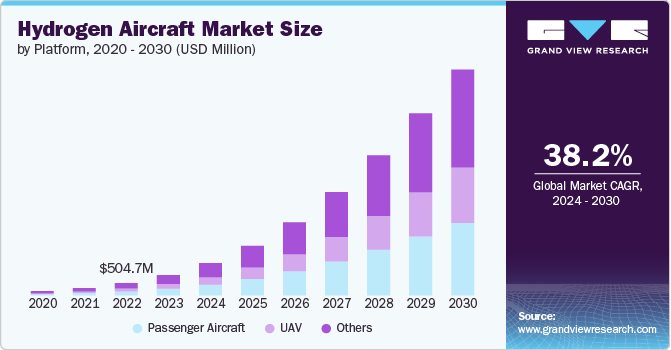

The global hydrogen aircraft market size was estimated at USD 826.0 million in 2023 and is expected to reach USD 9.13 billion by 2030, growing at a CAGR of 38.2% from 2024 to 2030. The market is witnessing a surge in public and private sector investments.

Key Market Trends & Insights

- North America accounted for a significant revenue share of over 41% in 2023.

- By platform, the passenger aircraft segment dominated the market in 2023 with a significant market share of over 34%.

- By range, the short-haul (Upto 1000 km) segment held the highest revenue share in 2023.

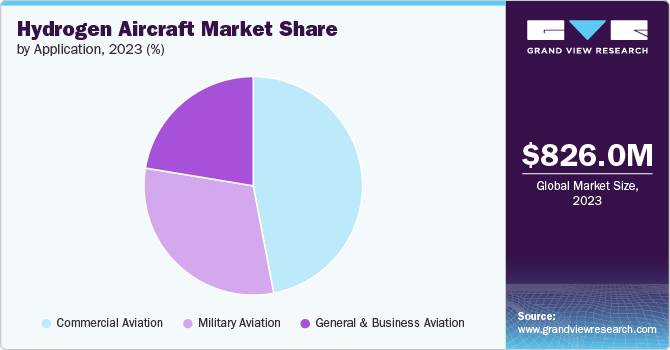

- By application, the commercial aviation segment accounted for the highest market share in 2023.

- By technology, the hydrogen fuel cells segment held the highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 826.0 Million

- 2030 Projected Market Size: USD 9.13 Billion

- CAGR (2024-2030): 38.2%

- North America: Largest market in 2023

- Middle East and Africa: Fastest growing market

Governments are increasingly funding research and development initiatives to explore the viability of hydrogen as a sustainable aviation fuel. Private companies, including major aerospace manufacturers and startups, are also driving resources into developing hydrogen-powered aircraft. This influx of capital is accelerating technological advancements and pushing the boundaries in hydrogen aviation.

Furthermore, a key trend in the market is the parallel development of hydrogen infrastructure. Establishing a robust supply chain for hydrogen production, storage, and refueling is essential as the industry moves toward commercial viability. Airports around the world are beginning to invest in hydrogen refueling stations, and collaborations between energy companies and aviation stakeholders are forming to ensure a steady supply of green hydrogen. This infrastructure development is critical for the widespread adoption of hydrogen aircraft.

Technological advancements in hydrogen fuel cell technology drive market growth. Fuel cells offer a promising solution for converting hydrogen into electricity efficiently and with zero emissions. Recent innovations have improved fuel cell efficiency, durability, and power density, making them more suitable for aviation applications. These advancements pave the way for developing short-haul and long-haul hydrogen-powered aircraft.

Supportive regulations and policy initiatives are playing a significant role in the market's growth. Governments worldwide are setting ambitious targets for reducing aviation emissions and promoting hydrogen as a key component of their strategies. Incentives such as subsidies, tax breaks, and grants for hydrogen research and development encourage companies to invest in this emerging technology. In addition, international aviation bodies are working on establishing standards and certifications for hydrogen-powered aircraft, which will facilitate their entry into the market.

Moreover, there is a growing demand for sustainable aviation solutions among airlines, passengers, and environmental groups. Airlines are under pressure to reduce their carbon footprint and are looking for viable alternatives to fossil fuels. Hydrogen-powered aircraft offer a promising solution, with the potential to reduce greenhouse gas emissions significantly. As awareness of climate change and environmental sustainability increases, the demand for hydrogen aircraft is expected to grow, driving further investment and innovation in the market.

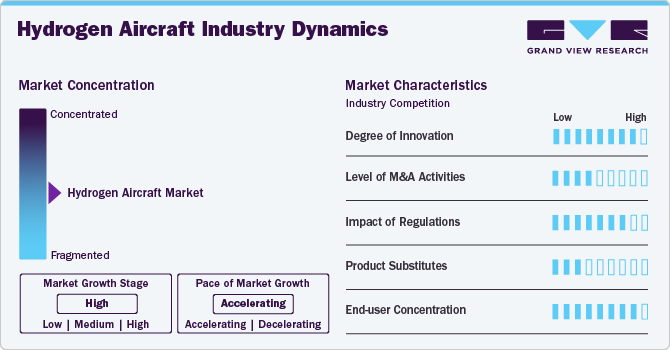

Market Concentration & Characteristics

The degree of innovation in the market is high, driven by the need for sustainable and eco-friendly aviation solutions. Innovations occur across various aspects, including hydrogen fuel cell efficiency, lightweight materials, and aerodynamics. The high level of innovation is further fueled by substantial investments from governments and private companies and collaborative efforts among aerospace manufacturers, energy providers, and research institutions.

The level of mergers and acquisitions in the market is currently moderate. While there is notable interest and investment in hydrogen technologies, the market is still emerging, and the consolidation of key players is gradual. M&A activities are focused on acquiring specialized technology and forming strategic partnerships to accelerate development and commercialization. As the market matures and competition intensifies, a higher level of M&A activity is expected to consolidate expertise and enhance capabilities in hydrogen-powered aviation.

The impact of regulation on the market is high. Stringent regulations are critical in ensuring aviation safety, efficiency, and environmental compliance. The development and deployment of hydrogen aircraft face regulatory scrutiny concerning safety standards, emissions, and operational procedures. These regulations can drive innovation by setting higher standards and pose challenges by increasing the complexity and cost of compliance.

The level of product substitutes in the market is low. Hydrogen aircraft are specialized and represent a novel approach to reducing aviation emissions, distinct from conventional fossil-fuel-powered and electric aircraft. The unique advantages of hydrogen, such as its potential for longer flight ranges and zero emissions, differentiate it from existing technologies. While electric and hybrid aircraft are alternatives, they do not offer the same range and operational capabilities that hydrogen aircraft are designed to achieve, making substitutes less competitive in this niche market.

The market's end-user concentration is currently high, as it is in its early stages. A few key players, including major aerospace manufacturers and specialized companies, are leading the development and deployment of hydrogen-powered aircraft. The focus is primarily on large commercial airlines, government agencies, and defense sectors that have the resources and interest to invest in and adopt cutting-edge technologies.

Platform Insights

The passenger aircraft segment dominated the market in 2023 with a significant market share of over 34% due to the growing emphasis on reducing carbon emissions in aviation, coupled with significant advancements in hydrogen fuel technology. Airlines and manufacturers are increasingly adopting hydrogen as a sustainable alternative to conventional jet fuel, driven by regulatory pressures and a global push towards greener transportation. This shift is further supported by investments in hydrogen infrastructure and the development of long-range hydrogen-powered passenger aircraft, making the segment a key driver in the market's growth.

The UAV (Unmanned Aerial Vehicles) segment is expected to record a significant CAGR of 39.8% from 2024 to 2030 due to the increasing demand for longer flight endurance and reduced carbon footprint in drone operations. Hydrogen fuel cells offer a lightweight and efficient power source, enabling UAVs to extend flight times compared to traditional batteries. This makes hydrogen-powered UAVs particularly attractive for surveillance, delivery, and environmental monitoring applications, where long-duration flights and sustainability are critical. Furthermore, hydrogen storage and fuel cell technology advancements are accelerating the adoption of hydrogen-powered UAVs, driving robust market growth.

Range Insights

The short-haul (Upto 1000 km) segment held the highest revenue share in 2023, owing to hydrogen technology's immediate feasibility and practicality for shorter routes. These flights require less fuel and simpler infrastructure than long-haul operations, making them ideal for the early adoption of hydrogen-powered aircraft. Short-haul routes often involve frequent flights and higher passenger volumes, which aligns well with the growing demand for sustainable aviation solutions in regional and domestic travel. This segment's success reflects a strategic starting point for integrating hydrogen technology before scaling up to longer distances.

The long-haul (>4000 km) segment is estimated to register the highest growth rate from 2024 to 2030, driven by the significant advancements in hydrogen storage and fuel cell technology, which address the challenges of extended flight durations. The push for reducing aviation's carbon footprint on international routes and the increasing commitment of airlines and governments to sustainable aviation solutions further drive investment and development in this segment.

Application Insights

The commercial aviation segment accounted for the highest market share in 2023 due to the sector's substantial focus on reducing carbon emissions and achieving sustainability goals. Commercial airlines are under increasing pressure to meet stringent environmental regulations and address growing passenger demand for greener travel options. Hydrogen-powered aircraft offer a promising solution by significantly cutting emissions and providing a cleaner alternative to conventional jet fuel. The substantial investments and research in hydrogen technology by major airlines and aerospace companies, combined with the high operational volume of commercial flights, have driven the segment's leading market position and growth.

The general & business aviation segment is anticipated to expand at a significant CAGR from 2024 to 2030, owing to increasing interest in sustainable, cost-effective, and efficient aviation solutions among private and corporate flight operators. Moreover, advancements in hydrogen fuel technology are making it feasible to develop smaller, more versatile aircraft suitable for general and business aviation. As these aircraft become more commercially viable, they are expected to attract investment and adoption, fueling significant growth in the segment.

Technology Insights

The hydrogen fuel cells segment held the highest revenue share in 2023 due to their superior energy efficiency and lower emissions compared to other hydrogen propulsion technologies. Fuel cell technology's maturity, coupled with advancements in energy density and system integration, has made it the preferred choice for hydrogen-powered aircraft, driving its dominant market position.

The hydrogen combustion segment is estimated to register a significant growth rate from 2024 to 2030 due to its potential to leverage existing aircraft engine technologies and infrastructure while achieving lower emissions than conventional jet fuels. Advances in combustion technology and the increasing focus on decarbonizing aviation drive investments and research into this segment, making it an attractive option for retrofit and new aircraft designs.

Regional Insights

The hydrogen aircraft market in North America accounted for a significant revenue share of over 41% in 2023, owing to the substantial investments in clean aviation technology and strong support from government policies to reduce carbon emissions. The region benefits from advanced aerospace infrastructure and collaboration between major aviation manufacturers and research institutions.

U.S. Hydrogen Aircraft Market Trends

The hydrogen aircraft market in the U.S. is anticipated to grow at a CAGR of over 12% from 2024 to 2030 due to significant government funding for research and development, coupled with initiatives like the Hydrogen Shot program, which aims to lower the cost of hydrogen production. The presence of major aerospace companies and technological innovation hubs further drives growth.

Asia Pacific Hydrogen Aircraft Market Trends

The hydrogen aircraft market in Asia Pacific accounted for a significant revenue share of over 16% in 2023 due to increasing investments in sustainable transportation solutions and rising environmental awareness. Countries in this region also focus on reducing air pollution and investing in next-generation aviation technologies.

India hydrogen aircraft market is estimated to record the highest growth rate from 2024 to 2030. India’s market is anticipated to grow as it seeks to improve its aviation infrastructure and address environmental challenges. Government initiatives supporting green technologies and investments in sustainable aviation fuel research contribute to market expansion.

The hydrogen aircraft market in China is projected to grow at a CAGR from 2024 to 2030, fueled by the country's strategic focus on becoming a global leader in clean energy technologies. The country’s significant investments in hydrogen infrastructure and ambitious plans for reducing carbon emissions drive the development of hydrogen-powered aircraft.

Japan hydrogen aircraft market is projected to grow at a CAGR from 2024 to 2030, supported by its advanced technology sector and government initiatives focused on reducing carbon emissions. The country’s investment in hydrogen infrastructure and partnerships with aerospace firms drive progress in hydrogen-powered aviation.

Europe Hydrogen Aircraft Market Trends

The hydrogen aircraft market in Europe is anticipated to register a CAGR of around 37% from 2024 to 2030 due to its ambitious climate goals and strong regulatory framework supporting green aviation. The European Union’s commitment to reducing aviation emissions and funding sustainable aviation projects bolsters the development of hydrogen-powered aircraft.

The UK hydrogen aircraft market is projected to grow at a CAGR from 2024 to 2030 due to government-backed initiatives like the Jet Zero strategy, which aims to achieve net-zero aviation emissions. The UK's focus on developing hydrogen infrastructure and supporting innovation in green aviation technologies also supports market growth.

The hydrogen aircraft market in Germany is estimated to record a CAGR from 2024 to 2030, driven by its leading role in renewable energy technology and industrial capabilities. The country’s significant investments in hydrogen infrastructure and collaborative projects with aerospace companies facilitate advancements in hydrogen aircraft technology.

Middle East and Africa (MEA) Hydrogen Aircraft Market Trends

The hydrogen aircraft market in the Middle East and Africa (MEA) region is anticipated to grow at the highest CAGR of around 37% from 2024 to 2030 due to increasing investments in sustainable aviation and infrastructure development. Countries in this region are exploring hydrogen as part of their broader strategies to diversify energy sources and reduce environmental impact.

Saudi Arabia hydrogen aircraft market accounted for a considerable revenue share in 2023, driven by the country's strategic investment in green technologies as part of its Vision 2030 plan, which aims to diversify its economy and reduce dependence on fossil fuels. Significant funding for hydrogen infrastructure development and research into sustainable aviation technologies supports the advancement of hydrogen-powered aircraft in the country.

Key Hydrogen Aircraft Company Insights

Some key players operating in the market are Airbus SE and The Boeing Company, among others.

-

Airbus SE is an aerospace and defense company known for its innovative commercial and defense aircraft, including the A320, A330, A350, and A380. Airbus designs, manufactures, and sells commercial aircraft, helicopters, and defense systems. The company's product lineup includes the popular A320, A330, A350, and A380 aircraft, renowned for their innovation and efficiency. Airbus is known for its commitment to sustainability and advanced technology, including efforts in hydrogen-powered aircraft and digital advancements in aviation. The company is also advancing the future of aviation with its hydrogen-powered aircraft initiatives, aiming to reduce emissions and revolutionize sustainable flight significantly.

-

The Boeing Company is a major American aerospace manufacturer headquartered in Chicago, Illinois. It specializes in designing and producing commercial jetliners, defense, space, and security systems. Boeing's portfolio includes iconic aircraft such as the 737, 787 Dreamliner, and 777. The company is also investing in the future of aviation by developing hydrogen-powered aircraft, aiming to achieve significant reductions in carbon emissions and drive advancements in sustainable aviation technology.

ZeroAvia, Inc. and Urban Aeronautics are some emerging market participants.

-

ZeroAvia, Inc. is an aerospace company that develops hydrogen-powered aircraft to revolutionize the aviation industry with sustainable solutions. The company aims to deliver zero-emission, hydrogen fuel cell-powered aircraft, targeting regional and short-haul flights. Their flagship project includes the development of a hydrogen-electric powertrain that promises to reduce the environmental impact of aviation significantly.

-

Urban Aeronautics is an innovative aerospace company based in Israel, specializing in developing advanced VTOL (Vertical Take-Off and Landing) aircraft. The company focuses on creating urban air mobility solutions, including developing hydrogen-powered VTOL aircraft to address the increasing need for sustainable and efficient urban transportation. Their flagship project, the CityHawk, is designed to be a hydrogen-powered VTOL aircraft aimed at revolutionizing urban mobility with zero-emission technology.

Key Hydrogen Aircraft Companies:

The following are the leading companies in the hydrogen aircraft market. These companies collectively hold the largest market share and dictate industry trends.

- AeroDelft

- AeroVironment, Inc.

- Airbus SE

- GKN Aerospace

- Pipistrel

- Thales Group

- The Boeing Company

- Universal Hydrogen Co.

- Urban Aeronautics

- ZeroAvia, Inc.

Recent Developments

-

In July 2024, GKN Aerospace launched a major initiative to develop a 2MW liquid hydrogen-electric propulsion system called H2FlyGHT, supported by around USD 56.8 million in funding. This project is set to improve aircraft payload and range, representing a crucial advancement toward sustainable aviation. It aligns with GKN’s broader commitment to combat climate change and lower emissions in the aerospace industry.

-

In July 2024, TCS and Rolls-Royce plc joined forces to explore hydrogen fuel system technology, aiming to establish hydrogen as a feasible zero-carbon aviation fuel for the future. TCS will contribute engineering expertise and support to Rolls-Royce in overcoming critical challenges related to hydrogen’s application in aviation.

-

In July 2024, Swiss company JEKTA teamed up with ZeroAvia Inc. to create a hydrogen-powered version of their aircraft. ZeroAvia will supply its fuel cell power generation system (PGS) technology to improve the aircraft's performance, targeting a range of 500 to 600 kilometers and a payload capacity of up to one ton.

Hydrogen Aircraft Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.31 billion

Revenue forecast in 2030

USD 9.13 billion

Growth rate

CAGR of 38.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, range, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AeroDelft; AeroVironment, Inc.; Airbus SE; GKN Aerospace; Pipistrel; Thales Group; The Boeing Company; Universal Hydrogen Co.; Urban Aeronautics; ZeroAvia, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Aircraft Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global hydrogen aircraft market report based on platform, range, technology, application, and region.

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

UAV (Unmanned Aerial Vehicles)

-

Passenger Aircraft

-

Others

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Short-haul (Upto 1000 km)

-

Medium-haul (1500 km to 4000 km)

-

Long-haul (>4000 km)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydrogen Combustion

-

Hydrogen Fuel Cells

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Aviation

-

Military Aviation

-

General & Business Aviation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydrogen aircraft market size was estimated at USD 826.0 million in 2023 and is expected to reach USD 1.31 billion in 2024.

b. The global hydrogen aircraft market is expected to grow at a compound annual growth rate of 38.2% from 2024 to 2030 to reach USD 9.13 billion by 2030.

b. The hydrogen aircraft market in North America accounted for a significant revenue share of over 41% in 2023, owing to the substantial investments in clean aviation technology and strong support from government policies aimed at reducing carbon emissions.

b. Some key players operating in the hydrogen aircraft market include AeroDelft, AeroVironment, Inc., Airbus SE, GKN Aerospace, Pipistrel, Thales Group, The Boeing Company, Universal Hydrogen Co., Urban Aeronautics, ZeroAvia, Inc.

b. Key factors that are driving hydrogen aircraft market growth include surge in investments from both public and private sectors, parallel development of hydrogen infrastructure, and technological advancements in hydrogen fuel cell technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.