- Home

- »

- Agrochemicals

- »

-

3-Hydroxypropionic Acid Market Size & Share Report, 2030GVR Report cover

![3-Hydroxypropionic Acid Market Size, Share & Trends Report]()

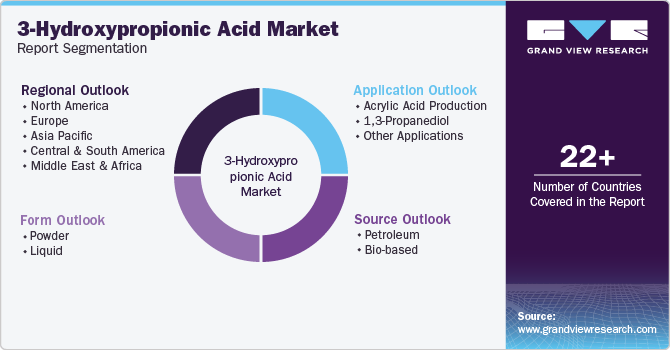

3-Hydroxypropionic Acid Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Chemical, Bio-based), By Form (Powder, Liquid), Application (Acrylic Acid Production, 1,3 Propanediol), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-331-0

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3-Hydroxypropionic Acid Market Trends

The global 3-hydroxypropionic acid market size was estimated at USD 713.8 million in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030. The market growth is attributed to the increasing acrylic acid application areas. Acrylic acid is a major 3-HPA derivative that is used to manufacture a wide range of products such as plastics, fibers, paints, and super-absorbent diapers. It is also used in the production of coatings, widely used in the global automotive industry.

3-Hydroxypropionic acid is a type of monocarboxylic acid in which a hydroxy group is substituted for one of the hydrogens on the terminal carbon of propionic acid. It is used in the production of acrylic acid. 3-HPA can serve as a bio-based alternative to traditional petrochemical-derived compounds in paint formulations. It can be polymerized to create biodegradable polymers that can be used as binders or additives in paints and coatings. These biodegradable coatings can be particularly useful in applications where environmental impact is a concern, such as architectural coatings or coatings for outdoor equipment.

Stricter government regulations on traditional petroleum-based chemicals have created lucrative opportunities for bio-based sources of 3HPA. Consumers are increasingly interested in eco-friendly products which is further positively impacting the market growth of 3-hydroxypropionic acid over the forecast period.

The synthesis method of 3-hydroxypropionic acid mainly includes chemical and microbial processes. The chemical method uses nonrenewable energy resources and produces several by-products that are challenging to separate and can easily cause environmental pollution.

Glycerol and glucose are used to synthesize 3-hydroxypropionic acid. This is a two-step reaction where the first step involves the conversion of glycerol to 3-hydroxypropionaldehyde using glycerol dehydratase. The next step is the conversion of 3-hydroxy propionaldehyde to equimolar quantities of 3-HP and 1,3-propanediol by aldehydic disproportionation, mainly when glycerol fermentation occurs in the absence of sugar.

3-hydroxypropionic acid (3-HP) can be synthesized through a biosynthesis process using microbial cell factories. One approach involves genetically engineering microorganisms like Saccharomyces cerevisiae or Klebsiella pneumoniae to produce 3-HP efficiently.

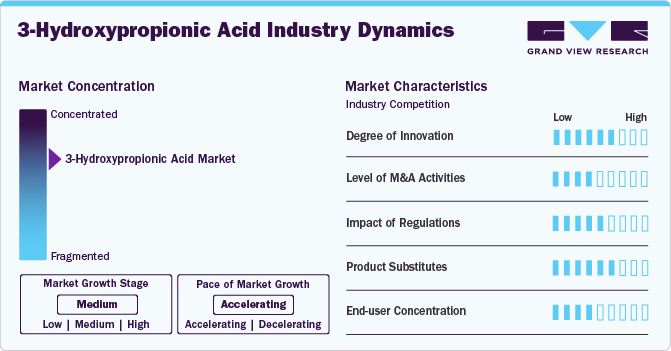

Key market players are taking initiatives to enhance their product portfolios and facilitate their geographical expansion across the world. The 3-HPA industry is niche, characterized by the presence of limited players, such as Cargill Inc., Cayman Chemicals, Fluoropharm Co., Ltd., TCI America, and LG Chem, among others. Mergers, acquisitions, and joint ventures are anticipated to remain the key success factors for industry participants over the forecast period.

Market Concentration & Characteristics

The global 3-hydroxypropionic acid market is consolidated with few players enjoying a majority of the market share by achieving optimum business growth and strong market positioning through partnerships and merger & acquisition. For instance, LG Chem and Caltex announced a joint development agreement for developing mass production technologies for 3HPA, which is an eco-friendly and bio-degradable material for producing prototypes. The aim of the collaboration is to achieve sustainable production methods such as fermented production and process equipment technologies.

Manufacturers have anticipated a huge gap in product and technology development, thus, are investing in research & development to add new products to their portfolios and develop better technology for various end-use industries of product.

LG Chem, Thermo Fisher Scientific Inc., Cargill, Incorporated, and Fluoropharma Co., Ltd, among others, are the key manufacturers operating in the product market. These companies have a stronghold in the emerging markets while exporting their products to various end-use applications.

Source Insights

Petrochemical based products segment dominated the market with a revenue share of 82.3% in 2023 owing to reduce the cost of production of 3-HPA using petrochemical source and its easy availability in the market. The most common petrochemical sources used for 3-HPA production are acrolein and glycerol. Acrolein is a byproduct of propylene oxide production, while glycerol is a byproduct of biodiesel production.

These petrochemical sources are converted to 3-HPA through various chemical reactions. The market for 3-HPA obtained from petrochemical sources is expected to grow across the world in the coming years due to increasing demand for biobased chemicals and the surging requirement for reducing greenhouse gas emissions. Additionally, using petrochemical sources can help manufacturers meet the demand for 3-HPA and reduce the reliance on biological sources.

The biobased source of 3-HPA are microorganisms such as bacteria that convert renewable feedstocks like sugar into 3-HPA. This conversion process is carried out through fermentation of raw materials such as glucose and glycerol wherein the microorganisms consume the sugar and convert it into 3-hydroxypropionic acid as a byproduct. This biobased method to produce 3-hydroxypropionic acid is gaining popularity globally due to its sustainability benefits.

Form Insights

Liquid form segment dominated the market with a revenue share of 65.5% in 2023. The liquid form of 3-HPA is a colorless, odorless, and transparent organic acid. It is soluble in water, ethanol, and ether. It is also used in the food & beverage industry as an acidulant and flavor enhancer. This form is stable under normal conditions but can decompose under high temperatures and pressures.

The powder form of 3-HPA allows easy handling and storage. 3 HPA in this form can be used in multiple applications, such as bioplastics and other biodegradable materials. It is also used in the manufacture of various chemicals and pharmaceuticals. It is a white crystalline powder soluble in water and organic solvents.

In the manufacturing of bioplastics, 3-HPA is used as a building block to manufacture biodegradable and compostable polymers. Bioplastics have numerous applications and are particularly useful in reducing plastic pollution. The powder form of 3-hydroxypropionic acid is an essential ingredient in various industries striving to become more environmentally friendly. Its versatility and ease of handling make it valuable in creating eco-friendly products.

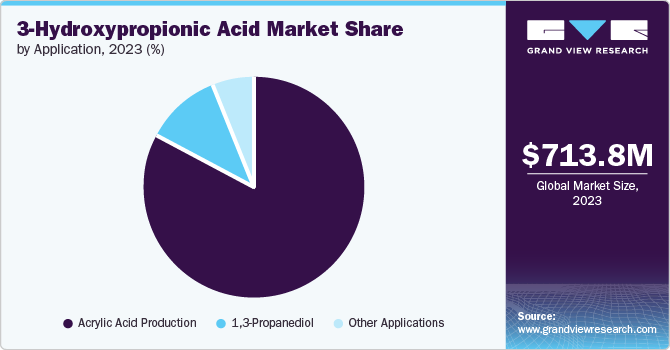

Application Insights

Acrylic acid production application dominated the market with a revenue share of 82.5% in 2023. 3-Hydroxypropionic acid (3HPA) is a key intermediate in the production of acrylic acid. The synthesis of acrylic acid is achieved through the process known as microbial fermentation. In this process, certain microbes convert 3-HPA into acrylic acid, which is further processed to produce a variety of valuable compounds, such as acrylates.

Acrylic acid is a versatile compound with various applications in industries. It is commonly used to produce plastics, synthetic rubbers, paints, and textiles. Acrylic esters and polymers are highly adaptable and offer several properties such as flexibility, transparency, super-absorbency, toughness, and hardness, making them valuable in plastic additives, diapers, training pants, surface coatings, sealants, adhesives, water treatment, and adult incontinence.

3-Hydroxypropionic acid has been studied as a potential precursor for producing acrylamide, a chemical commonly used in the production of plastics, adhesives, and other industrial materials. Using 3-HPA as a starting material, researchers have developed a more sustainable method for producing acrylamide. This approach helps reduce the reliance on petroleum-based feedstock and decreases the carbon footprint of the acrylamide production process.

Regional Insights

The construction industry in North America is expected to witness significant growth in the coming years owing to the high demand for non-residential construction projects such as hospitals, commercial buildings, and colleges. Implementing the "Affordable Healthcare Act" in 2023 is expected to stimulate the construction of a more significant number of healthcare units and hospitals, which, in turn, is expected to boost the demand for architectural and decorative paints and coatings in the region over the forecast period. This rise in construction projects has led to an increased demand for acrylic acid and 3-hydroxypropionic acid, which are used as raw materials for producing acrylic acid.

U.S. 3-hydroxypropionic Acid Market Trends

The U.S. market is expected to grow over the forecast period due to the rise in demand for biobased polymers. 3-hydroxypropionic acid is used to make biodegradable polymers such as poly (3-hydroxypropionic acid) (P(3-HPA) or P-3HP). This is also used to manufacture 1,3 propanediol acrylic acid, which is widely used in paints & coatings.

The U.S. has witnessed massive growth in automobile production in recent years. For instance, in June 2022, automotive manufacturer Ford Motor Company announced its EV and battery plan and raw material gaining plan to produce 2 million electric vehicles (EVs) annually by 2026. Capacity additions and expansion of plants by automotive companies in the U.S. are further expected to augment the demand for paint and coating products, which is expected to increase the demand for acrylic acid. This is expected to increase the demand for raw materials that produce acrylic acid, such as 3-hydroxypropionic acid.

Asia Pacific 3-Hydroxypropionic Acid Market Trends

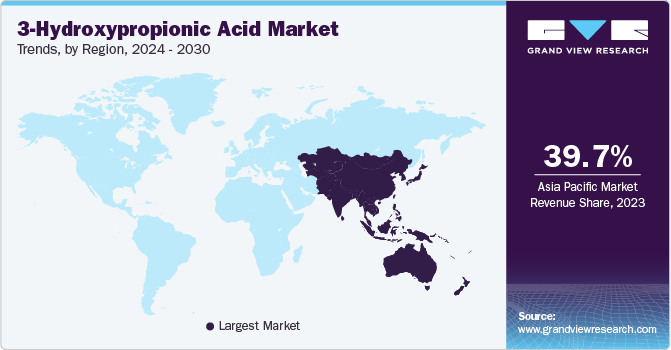

Asia Pacific dominated the market segment with a revenue share of 39.7% in 2023 owing to the rising construction activities and increasing demand from the automotive sector in emerging countries, such as India, South Korea, Japan, Indonesia, and the Philippines, which are expected to drive the market over the forecast period.

Furthermore, the easy availability of raw materials and the rising use of sustainable materials have provided enormous opportunities for using paints, coatings, and pharmaceuticals in various end-use sectors such as construction, automotive, and cosmetics. Low labor costs in the emerging countries of Asia-Pacific have attracted many foreign investors to set up their manufacturing facilities in the region. The growing automotive, cosmetic, and construction industries are boosting the market to meet consumer demand.

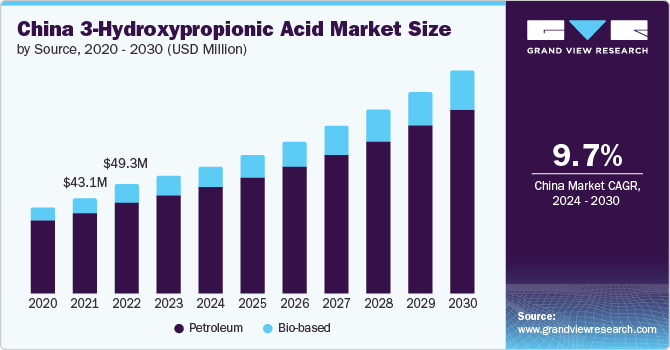

The 3-hydroxypropionic acid market in China is expected to grow over the forecast period. The growth is attributed to the expanding chemicals industry. China’s rising chemicals industry will lead to an increase in the production of chemicals in order to meet consumer demand. 3-hydroxypropionic acid is also poised to grow with the demand for sustainable chemicals.

India 3-hydroxypropionic acid market is expected to grow over the forecast period. This 3-hydroxypropionic acid is used to manufacture chemicals such as acrylic acid, 1,3 propanediol, and lactic acid, which have various end-uses in automotive, construction, food and beverages, and textile industries. The rising Indian market in these industries has led to high demand for 3-hydroxypropionic acid.

In February 2024, according to the India Brand Equity Foundation, the total production of passenger vehicles, including two-wheelers, three-wheelers, and quadracycles, was 2.22 million units in 2021. The global market for electric vehicles (EVs) was estimated to be approximately USD 250 Thousand in 2021, and it is projected to grow five times by 2028, reaching USD 1,318 Thousand.

Europe 3-Hydroxypropionic Acid Market Trends

The European market is expected to grow over the forecast period due to the surge in automobile production in Germany, Hungary, Romania, Austria, and the UK. The strong manufacturing base of companies, such as Volkswagen AG, Chevrolet, Mercedez Benz, and Dodge, is expected to drive the product demand in the region.

Germany 3-hydroxypropionic acid market dominated the automotive market in Europe with 41 engine production plants in 2023 and an assembly that contributes to one-third of the total automobile production in the region, according to Autobei Consulting Group. The sales of new vehicles are constantly increasing with improvement in the economy, reflecting consumer confidence. This is expected to positively impact the paints and coatings market in the coming year, with rising demand for 3-hydroxypropionic acid used for manufacturing acrylic acid for paints and coatings.

Central & South America 3-Hydroxypropionic Acid Market Trends

The Central & South America market is expected to grow over the forecast period. This growth is attributed to the surge in construction, cosmetic, and automobile production in Argentina, Chile, Ecuador, Colombia, and Brazil. This has led to an increase in demand for 3-hydroxypropionic acid for use in end-use industries, such as construction and automotive, in paints and coatings, and for manufacturing moisturizing creams due to its excellent moisturizing properties.

Brazil 3-hydroxypropionic acid market is witnessing immense growth in the automotive industry. The country is a significant automobile producer in Central and South America. It is the ninth-largest automobile producer in the world. According to the International Organization of Motor Vehicle Manufacturers, in 2023, Brazil’s automotive industry manufactured around 1,781,612 cars and commercial vehicle production was around 543,226 resulting in total car production of around 2,234,838. The high automotive production will eventually lead to a rise in demand for paints and coatings which are heavily used by the automotive industry. Acrylic acid demand is also on the rise due to an increase in paints and coatings demand leading to the rising demand for the 3-hydroxypropionic acid which is the raw material used in the production of acrylic acid.

Middle East & Africa 3-Hydroxypropionic Acid Market Trends

Middle East & Africa is expected to grow over the forecast period owing to the growing automotive, construction, and cosmetic industries. This has eventually led to a high demand for raw materials such as 3-hydroxypropionic acid for manufacturing acrylic acid which is further used in paints and coatings. These paints and coatings are widely used in the automotive and construction industries.

Saudi Arabia 3-hydroxypropionic acid market is expected to grow over the forecast period. Rising construction and automotive industries have led to a rise in demand for 3-hydroxypropionic acid. The Saudi Arabian government is also focused on improving other manufacturing sectors apart from oil and gas. This has decreased reliance on income generated from oil to other diverse industries such as construction and automotive.

Key 3-Hydroxypropionic Acid Company Insights

Some of the key players operating in the market include LG Chem, Cargill Incorporated, and TotalEnergies among others.

-

Companies such as LG Chem, and Cargill Incorporated are among the leaders, as they have a strong product portfolio and are engaged in several research & development activities. These players are leaders in the global market, in terms of revenue, employee count, broad product portfolio, global footprint, and clientele.

-

Established players compete and outplay the regional players by strategically integrating across the value chain to ensure seamless supply chain activities and reducing the production & operating costs. Companies are also integrating in the value chain order to save the operations cost involved in raw material procurement.

-

Cargill Inc. is a global player wholly integrated into the value chain, from manufacturing raw materials to producing end-use products. Cargill Inc. produces raw materials for manufacturing 3-hydroxypropionic acid. This product is used to make other products, such as bio-based acrylic acid.

Key 3-hydroxypropionic Acid Companies:

The following are the leading companies in the 3-hydroxypropionic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Zhengzhou Alfa Chemical Co., Ltd.

- Fluoropharm Co., Ltd.

- LG Chem

- Thermo Fisher Scientific Inc.

- Beijing PhaBuilder Biotechnology Co., Ltd.

- Cargill, Incorporated

- Tokyo Chemical Industry Co., Ltd. (TCI)

Recent Developments

-

In October 2023, Lummus Technology announced its agreement with Air Liquide Engineering & Construction to obtain the rights to license and market technology related to ester-grade acrylic acid and light and heavy acrylates process. Acrylic acid is fundamental in producing super-absorbent polymers, various coatings, and adhesives. Ester-grade acrylic acid is a critical component in synthesizing different acrylate esters vital in rubber, plastics, resins, and many other everyday goods.

-

In May 2024, Nippon Shokubai Co., Ltd, a global chemical company, has announced opening a new acrylic acid facility with a production capacity of 100,000 metric tons per year in Baten, Indonesia. The PT Nippon Shokubai Indonesia subsidiary will use integrated production from acrylic acid (AA) to super absorbent polymers (SAP) to ensure a stable and wide product supply worldwide; with this addition of the new facility, the AA production of Nippon Shokubai Co., Ltd capacity will increase to 980,000 metric tons annually, comprising 540,000 metric tons domestically and 440,000 metric tons overseas. This expansion will help Nippon Shokubai Group to meet the growing consumer demand for acrylic acid.

-

In October 2023, LG Chem and GS Caltex announced collaboration in order to accelerate the commercialization of the world's first 3 HPA eco-friendly biomaterial. GS Caltex Yeosu plant has successfully completed test production of eco-friendly 3-HPA, with a target set to produce a prototype in the first quarter of 2024.

3-Hydroxypropionic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 777.5 million

Revenue forecast in 2030

USD 1.34 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Itay; France, China; India; Japan; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Zhengzhou Alfa Chemical Co., Ltd.; Fluoropharm Co., Ltd.; LG Chem, Thermo Fisher Scientific Inc.; Beijing PhaBuilder Biotechnology Co., Ltd.; Cargill, Incorporated; Tokyo Chemical Industry Co., Ltd. (TCI)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3-Hydroxypropionic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3-hydroxypropionic acid market report based on source, form, application, and region.

-

Source Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Petroleum

-

Bio-based

-

-

Form Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Powder

-

Liquid

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Acrylic Acid Production

-

1,3-Propanediol

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3-hydroxypropionic acid market size was estimated at USD 713.8 million in 2023 and is expected to reach USD 777.5 million in 2024.

b. The global 3-hydroxypropionic acid market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 1.34 billion by 2030.

b. Asia Pacific dominated the market segment with a revenue share of 39.7% in 2023 owing to the rising construction activities and increasing demand from the automotive sector in emerging countries, such as India, South Korea, Japan, Indonesia, and the Philippines,

b. Some key players operating in the 3-hydroxypropionic acid market include Teladoc; Doctor on Demand; iCliniq; IBM; Intel Corporation; Philips Healthcare; McKesson Corporation; AMD Telemedicine; GE Healthcare; CardioNet Inc.; 3m Health Information Systems; Medic4all; CirrusMD Inc.; Cisco; and American Telecare Inc.

b. Key factors that are driving the market growth include increasing acrylic acid application over the forecast period. Acrylic acid is a major 3-HPA derivative that is used to manufacture a wide range of products such as plastics, fibers, paints, and super-absorbent diapers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.