- Home

- »

- Disinfectants & Preservatives

- »

-

Propionic Acid Market Size, Share And Trends Report, 2030GVR Report cover

![Propionic Acid Market Size, Share & Trends Report]()

Propionic Acid Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Animal Feed, Calcium And Sodium Propionate, Cellulose Acetate Propionate), By Region, And Segment Forecasts

- Report ID: 978-1-68038-294-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Propionic Acid Market Summary

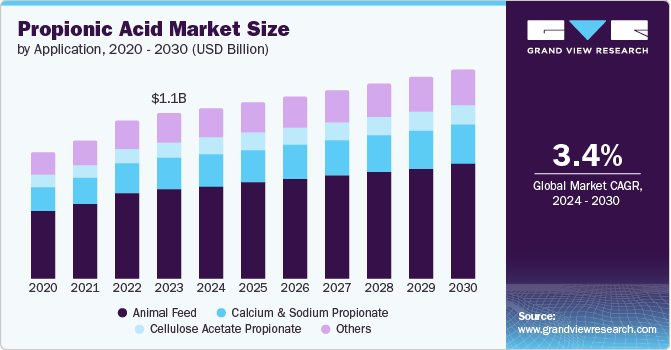

The global propionic acid market size was estimated at USD 1.11 billion in 2023 and is projected to reach USD 1.40 billion by 2030, growing at a CAGR of 3.4% from 2024 to 2030. This growth is attributed to its significant applications in several industries, such as food preservation, cosmetics, and pharmaceuticals, and also used as an antifungal and antibacterial agent in agricultural and livestock activities.

Key Market Trends & Insights

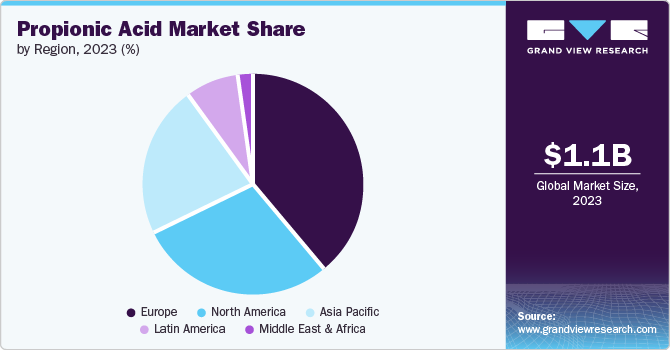

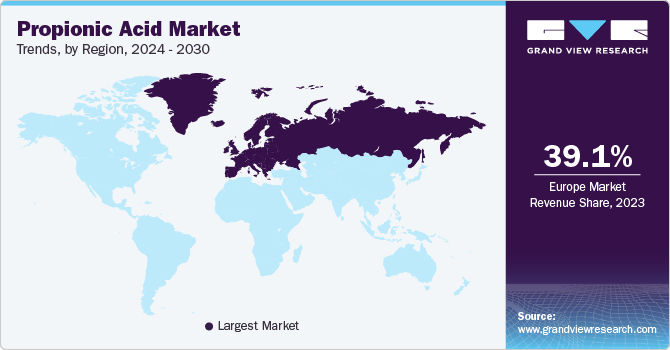

- The Europe propionic acid market dominated the global market and accounted for the largest revenue share of 39.1% in 2023.

- The propionic acid market in Asia Pacific is expected to grow at a CAGR of 4.0% over the forecast year.

- Based on application, the animal feed dominated the market and accounted for the largest revenue share of 54.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.11 Billion

- 2030 Projected Market USD 1.40 Billion

- CAGR (2024-2030): 3.4%

- Europe: Largest market in 2023

In addition, this acid is used for the preservation of the flavor of cheeses and baked goods, i.e., bread and tortillas, thereby boosting the market’s growth.

Propionic acid has diverse industrial applications beyond its use as a food preservative. It is employed as a chemical intermediate in the production of various compounds, including herbicides, rubber chemicals, emulsions, and eco-friendly solvents for coating formulations. Propionic acid is also used to manufacture artificial fruit flavors and modified synthetic cellulose fibers.

The agricultural sector utilizes propionic acid as a bactericide and for controlling bacteria and fungi in stored grains, hay, poultry litter, grain storage areas, and livestock drinking water. This widespread use in agriculture is expected to drive market growth, particularly due to increasing interest in propionic acid from the food industry for preservatives and the plastic industry for thermoplastics.

Another factor contributing to the growth of the propionic acid market is the pharmaceutical industry's demand for propionic acid as a solvent and in the production of non-steroidal anti-inflammatory drugs. Additionally, the rising need for vitamin E in poultry feed and its use as a key ingredient in skin creams, hairspray, and other cosmetic products are expected to further boost the market.

Application Insights

Animal feed dominated the market and accounted for the largest revenue share of 54.1% in 2023. This growth is attributed to its useful uses as a fungicide and bactericide, regulated to minimize the growth of bacteria and fungi in stored hay, drinking water for livestock, grains, poultry litter, and grain storage containers. In addition, the rising demand for safe animal feed, increasing concern for improving animal nutrition, and growing popularity of dairy and poultry products are fueling the adoption of propionic acid in animal feed applications. Furthermore, the ban on antibiotics in animal feed in regions like the EU has led to propionic acid emerging as a safer alternative to promote animal health and growth.

Calcium and sodium propionate are expected to grow at a CAGR of 3.5% over the forecast period. As a food additive, it is used to extend the shelf life of various goods, including bread with other baked goods, processed meat, whey, and other dairy products. Humans and animals can metabolize and absorb it as a precursor for glucose synthesis. In addition, the increasing demand for food preservatives, particularly in the bakery and dairy sectors, enhances the use of these propionates due to their antifungal properties. The rising consumer preference for safe and extended shelf-life products further propels market growth. Furthermore, the expanding agriculture sector and the need for effective grain preservation methods significantly boost the adoption of calcium and sodium propionate in various applications.

Regional Insights

The propionic acid market in North America is augmented by its significant uses in numerous sectors. The market is evaluated across the U.S., Canada, and Mexico. In addition, North America is a huge market for packaged and ready-to-eat food products. The competitive lifestyle impacts the use of preserved food products in the region, giving a positive outlook for propionic acid implementation.

U.S. Propionic Acid Market Trends

The U.S. Propionic Acid Market is expected to grow substantially over the forecast years. This growth is attributed to government support for its applications across industries. Propionic acid is a naturally occurring carboxylic acid used in food and beverage, agriculture, pharmaceuticals, and other industries. Moreover, the growing agriculture sector and rise in demand for poultry products led to increased use of propionic acid, which drives the market growth.

Europe Propionic Acid Market Trends

The Europe propionic acid market dominated the global market and accounted for the largest revenue share of 39.1% in 2023. This growth is driven by robust development in the European food and beverage, cosmetic, and healthcare sectors, which is expected to boost the demand for the propionic acid market in the forecast years.

The propionic acid market in Germany dominated the European market, with the largest revenue share of 14.5% in 2023. The country is the major food industry and agriculture region market. However, propionic acid is adopted in both industries. Germany has a significant focus on the development of the pharmaceutical industry by maintaining stringent quality and standards. Propionic acid has gained approval as a reliable and suitable element in pharmaceutical formulations.

The UK propionic acid market is expected to grow significantly over the forecast years. Companies are increasing their demand for propionic acid in feed and packaged food preservative applications, which promotes the growth of the propionic acid market in the country.

Asia Pacific Propionic Acid Market Trends

The propionic acid market in Asia Pacific is expected to grow at a CAGR of 4.0% over the forecast year. The region is experiencing growth because of the rising demand for packaged food. The large population relies upon agriculture and livestock production; thus, propionic acid, with its broad uses, leads the market growth.

China propionic acid market is the largest customer and heavily imports propionic acid from other countries. There has been a rise in demand for propionic acid in China. It has been widely used in the pharmaceuticals, agriculture, livestock, and food and beverage industries for useful benefits.

The propionic acid market in India is expected to experience significant growth in the forecast period owing to its industrial presence, ample production to meet requirements, sufficient labor resources, and infrastructure. Its implementation as a preservative in packaged foods and the agricultural sector for formulating fungicides, herbicides, and bactericides has also propelled the market expansion. In addition, government subsidies and programs promote domestic manufacturing, and rising investments in propionic acid production boost market growth.

Key Propionic Acid Company Insights

Some of the key companies in the propionic acid market include BASF SE, Dow, Eastman Chemical Company, Perstorp, Otto Chemie Pvt. Ltd., Merck KGaA, and Celanese Corporation in the market are focusing on development & to gain a competitive edge in the industry.

-

Dow Chemical Company is a chemical and plastics producer that is one of the suppliers of plastics, chemicals, agricultural products, and synthetic fibers over the world.Dow Chemical contributes to the packaging, infrastructure, agricultural, and consumer care industries worldwide. It is a manufacturer of various specialty chemicals, which include polyethylene, ethylene oxide, and silicone rubber. Their products have broad applications in both consumer and industrial end markets.

-

Eastman Chemical Company is a manufacturer and distributor of specialty chemicals. They provide a wide range of specialty additives, advanced materials, chemicals, and fibers functional products. The product portfolio of the company includes window films, PVB sheets, aftermarket applied films, protective films, propylene derivatives, copolyesters, alkylamine derivatives, alkylamine derivatives, organic acids, polyester polymers, and derivatives, among others, with applications in food and beverage, animal feeds, agriculture, packaging, consumables, consumer durables, and other sectors.

Key Propionic Acid Companies:

The following are the leading companies in the propionic acid market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Dow

- Eastman Chemical Company

- Perstorp

- Otto Chemie Pvt. Ltd.

- Merck KGaA

- Celanese Corporation

- OQ Chemicals GmbH

- Daicel Corporation

- SONTARA ORGANO

- KANTO KAGAKU.

- Junsei Chemical Co., Ltd.

Recent Developments

-

In February 2024, Daicel Corporation and Inabata & Co., Ltd. finalized a joint venture agreement, establishing Novacel Co., Ltd. Daicel is expected to transfer a 66.7% stake in Novacel, which will succeed its resin coloring and compounding business on July 1, 2024. The agreement excludes SAN resin and cellulose acetate resin. Novacel's establishment is subject to regulatory approvals. This move aligns with Daicel's "Accelerate 2025" strategy to transform its business structure and enhance engineering plastics. The partnership aims to leverage Daicel's resin expertise and Inabata's manufacturing capabilities to create collaborations in the market.

-

In September 2023, Eastman Chemical sold by entering a definitive agreement of Texas City Operations in Texas City, TX, to INEOS Acetyls, a well-recognized manufacturer and supplier of acetic acid and other chemicals. This Texas City Operations unit was under Eastman's Chemical Intermediates segment before the agreement. Apart from this, Eastman and INEOS have signed an MOU with aim of delving into options for a long-term agreement regarding the supply of vinyl acetate monomer (VAM) to the company.

Propionic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.15 billion

Revenue forecast in 2030

USD 1.40 billion

Growth Rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, China, India, Japan, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

BASF SE; Dow; Eastman Chemical Company; Perstorp; Otto Chemie Pvt. Ltd.; Merck KGaA; Celanese Corporation; OQ Chemicals GmbH; Daicel Corporation; SONTARA ORGANO; KANTO KAGAKU.; Junsei Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Propionic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global propionic acid market report based on application and region.

-

Application Outlook (Volume in Kilotons; Revenue, USD Million, 2018 - 2030)

-

Animal feed

-

Calcium and sodium propionate

-

Cellulose acetate propionate

-

Others

-

-

Regional Outlook (Volume in Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.