Hyoscine Market Size & Trends

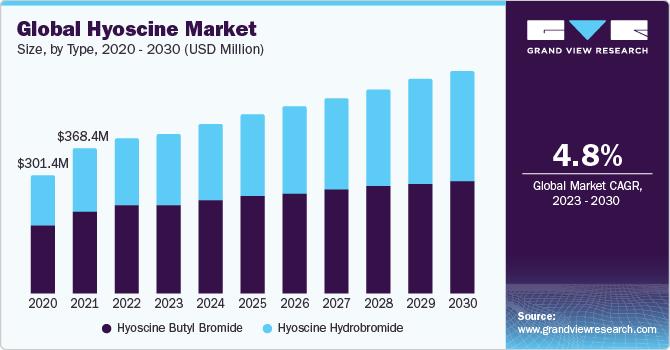

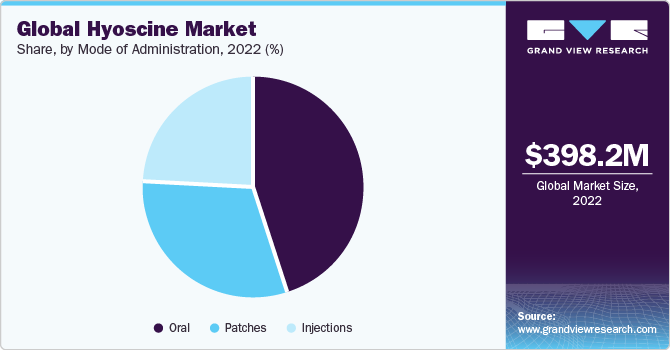

The global hyoscine market size was valued at USD 398.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. The increasing incidence of motion sickness due to an increase in the number of travelers, virtual reality exposure around the world, and the rise in pharma R&D activities are expected to fuel this market's growth over the forecast period. According to the National Library of Medicine 2018 statistics, motion sickness is common, and it was stated that 1 in 3 persons are extremely prone to motion sickness. Hyoscine is commonly used to treat motion sickness, nausea, vomiting, and irritable bowel syndrome. Moreover, as the global population ages and healthcare awareness increases, the demand for drugs like hyoscine is likely to grow.

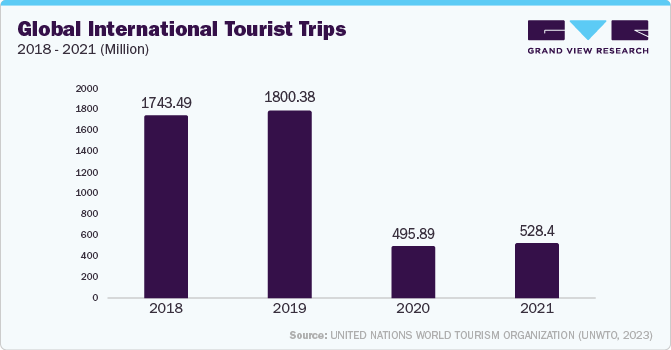

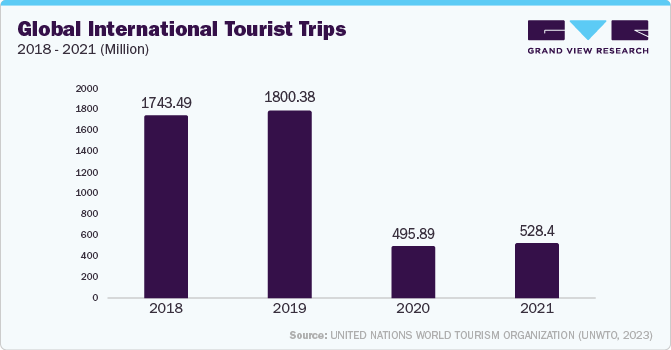

The COVID-19 pandemic significantly impacted the hyoscine market growth. There was a temporary disruption in the production, supply, and distribution of various pharmaceutical products, including hyoscine. The reduced patient visits to healthcare facilities during the pandemic affected the prescription and consumption of medications such as hyoscine, particularly for conditions such as motion sickness and gastrointestinal disorders, which are often managed on an outpatient basis. Moreover, the pandemic also highlighted the importance of remote consultations and telemedicine. Healthcare providers and patients turned to telehealth solutions, potentially affecting the prescription patterns of hyoscine and other medications. However, the market witnessed growth over the last two years due to increased consumer travel.

The increasing cases of irritable bowel syndrome (IBS), also called stomach cramps, among the population further fueled the market growth. Buscopan (hyoscine butylbromide) relieves painful stomach cramps and period cramps. The medicine works quickly and provides relaxation within 15 minutes. According to a survey report published by Cedars-Sinai in September 2023, Irritable bowel syndrome (IBS) prevalence was higher than previously reported in a large countrywide study of 89,000. The prevalence was 4.1% compared with 4.7% to 5.3% in studies of substantially lower sample sizes. In addition, the COVID-19 pandemic also contributed to the rise in IBS cases, which opened numerous opportunities for healthcare researchers to analyze data to investigate potential treatment options.

The risk of side effects associated with the medication and strict regulatory norms is expected to hamper the market growth over the forecast period. For instance, in July 2023, the Medicines & Healthcare Products Regulatory Agency (MHRA) issued a drug safety warning on hyoscine bromide patches. The MHRA said the patches' negative effects were most common when used without a license.

Type Insights

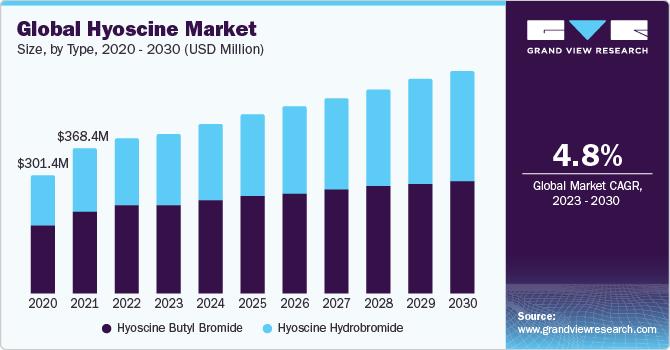

The hyoscine market is segmented based on type into hyoscine butyl bromide and hydrobromide. Hyoscine butyl bromide is commonly used to treat gastrointestinal conditions such as abdominal cramps and irritable bowel syndrome. The increasing prevalence of such disorders is projected to drive the demand for this type of hyoscine. On the other hand, hyoscine hydrobromide is commonly used to prevent motion sickness and nausea. As travel and tourism continue to grow, so does the demand for medications to alleviate these symptoms. In addition, with the emergence of space tourism and prolonged space missions, hyoscine hydrobromide is a potential market to address motion sickness among astronauts.

Mode of Administration Insights

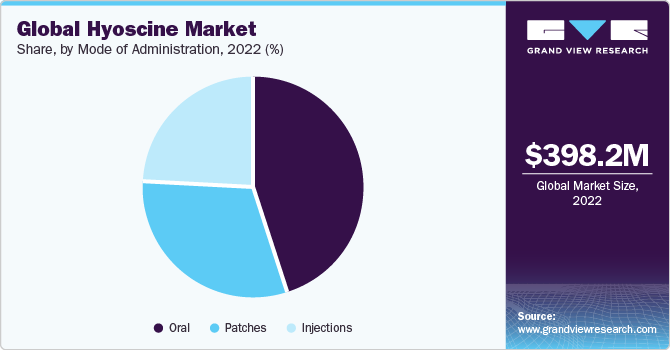

Based on the mode of administration, this market is segmented into oral, patches, and injections. The oral segment held the largest market share in 2022. This growth is attributed to easy availability, ease of administration, and widespread preference for treating motion sickness and cramping in the abdominal muscles. Oral tablets are easier to find at pharmacies than injections and patches, as they can be bought without a prescription. Furthermore, they are more cost-effective than injections, which helps the oral section grow even more. Moreover, a larger patient pool and a growing number of travelers contribute to the increasing demand for hyoscine and propelling the market for oral hyoscine.

Regional Insights

North America dominated the market in 2022. This growth is attributed to the large number of pharmaceutical companies boasting a well-developed healthcare infrastructure, which allows for the easy availability of medications such as hyoscine. The presence of advanced healthcare facilities can further stimulate market growth. Moreover, the aging population in North America is increasing, leading to a higher incidence of age-related conditions. Hyoscine is frequently used by the geriatric population, leading to increased demand. Ongoing innovation in drug formulations and delivery methods can lead to the introduction of new hyoscine-based products, further driving market growth.

Key Companies & Market Share Insights

Key players operating in the market are Caleb Pharmaceuticals, Inc., Baxter, Prestige Consumer Healthcare Inc., WellSpring Pharmaceutical Corporation, Amneal Pharmaceuticals LLC., Perrigo Company plc, and Defender Pharmaceuticals. The market participants are involved in new product development and other collaborations or alliances to explore new market opportunities.

Following are some instances of recent initiatives undertaken by players in this market:

-

In September 2023, Defender Pharmaceuticals announced that the Food and Drug Administration (FDA) had granted priority review to a new drug application for intranasally given scopolamine (also known as hyoscine) gel (DPI-386 nasal gel) as a motion sickness prevention medication

-

In September 2022, hyoscine butylbromide was one of the 384 medications listed in 27 categories on the National List of Essential Medicines 2022, unveiled by India's Union Health and Family Welfare Minister.