- Home

- »

- Medical Devices

- »

-

Hyperbaric Oxygen Therapy Devices Market Report, 2030GVR Report cover

![Hyperbaric Oxygen Therapy Devices Market Size, Share & Trends Report]()

Hyperbaric Oxygen Therapy Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Monoplace, Multiplace, Topical HBOT Devices), By Application (Wound Healing, Infection Treatment, Gas Embolism), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-845-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hyperbaric Oxygen Therapy Devices Market Summary

The global hyperbaric oxygen therapy devices market size was estimated at USD 3.3 billion in 2022 and is projected to reach USD 4.9 billion by 2030, growing at a CAGR of 4.9% from 2023 to 2030. Introducing the hyperbaric oxygen therapy (HBOT) technique enhances the effectiveness of leukocytes, especially in the wound site, and hinders the toxic effects of carbon monoxide (CO) and cyanide.

Key Market Trends & Insights

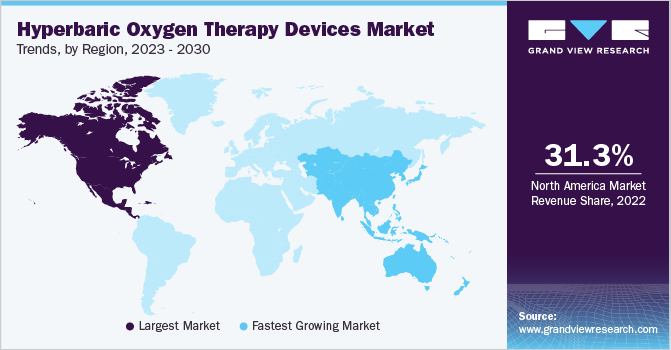

- North America was the leading segment, accounting for the largest revenue share of 31.3% in 2022.

- Emerging economies such as India, China, the Philippines, Vietnam, and Brazil have been experiencing strong economic growth.

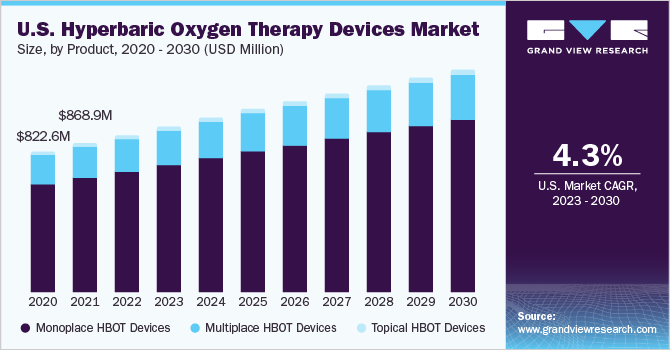

- Based on product, The Monoplace HBOT devices segment accounted for the largest revenue share in 2022.

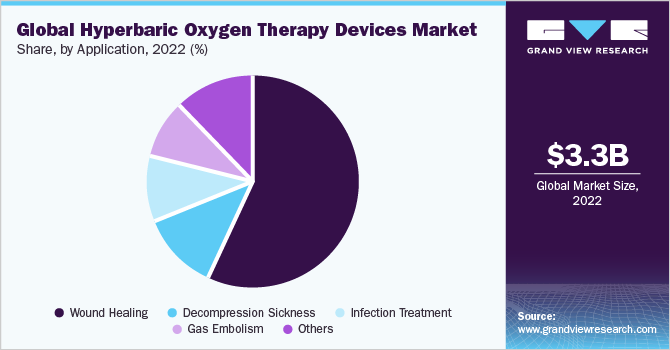

- In terms of application, the wound healing segment will remain dominant on the back of the increasing popularity of adventure activities and leisure sports amongst most of the global population.

- On the basis of application, the others segment is expected to grow at the fastest CAGR of 6.5% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 3.3 billion

- 2030 Projected Market Size: USD 4.9 billion

- CAGR (2023-2030): 4.9%

- North America: Largest market in 2022

Growing acceptance of this technology globally is one of the key factors expected to boost the market during the forecast period. The growing investment by private players such as OxyHealth and SOS Group Global Ltd. to develop technologically advanced HBOT systems is among the few factors anticipated to propel growth. The development of portable HBOT systems and a growing number of clinical trials sponsored by various universities & players indicate ongoing advancements and contribute to the market's growth.

The presence of technology assessment organizations, such as Cochrane Collaboration, Alberta Heritage Foundation for Medical Research, and Agency for Healthcare Research & Quality (AHRQ), that review evidence backing the use of hyperbaric oxygen for various conditions is also one of the factors indicating the ongoing R&D activities in this field. Technological advancement in hyperbaric oxygen therapy devices is anticipated to drive the demand over the coming years.The growing usage of hyperbaric oxygen therapy in wound healing and cosmetic procedures is one of the factors anticipated to boost the demand over the coming few years. An increasing number of athletes resulted in a surge in demand for this technology. However, the rift between FDA-approved uses and off-level uses is one of the factors that is impacting the growth negatively. The FDA has approved using these devices for thirteen conditions, such as gas embolism, carbon monoxide poisoning, diabetic foot ulcers, decompression sickness, necrotizing infections, and wound healing.

In December 2022, Aviv Clinics Dubai utilized hyperbaric oxygen treatment innovations to support the UAE government's longevity and healthy aging strategy. Their personalized, holistic program enables brain and body regeneration, improving cognitive, mental, and physical performance. Patients undergo rigorous testing to ensure treatment is tailored to their individual needs. The program includes cognitive and physical training sessions, specialized hyperbaric chambers, and a nutritional regime to maximize the body's healing process.

Some other uses of this device that the U.S. FDA has not cleared are stroke, Parkinson's disease, multiple sclerosis, depression, Alzheimer's disease, AIDS/HIV, and others. Both approved, and unapproved uses are extensive and include a similar number of physiological and neurological conditions. Despite the abovementioned restraining factor, HBOT continues to witness a surge in its adoption rate in hospitals and clinics. Based on a research paper, nearly 90% (1,800 out of 2,000) hospitals and 71% (500 out of 700) clinics now offer hyperbaric oxygen therapies due to their noninvasive nature.

In May 2023, Hyperbaric Awareness USA launched the third annual Hyperbaric Aware national campaign, an initiative by CutisCare to raise awareness of hyperbaric oxygen therapy (HBOT). The increasing awareness and adoption of hyperbaric oxygen therapies are expected to grow the market further.

Product Insights

Based on the product, the market is segmented into multiplace HBOT devices, monoplace HBOT devices, and topical HBOT devices. The Monoplace HBOT devices segment accounted for the largest revenue share in 2022. The high adoption rate and commercial availability of monoplace systems, due to their ease of handling and minimum requirement of hospital gas supply, are some of the key factors that can be accounted for its larger revenue share. A few products by major companies such as BARA-MED, BARA-MEDXD, BARA-MED Select by ETC Hyperbaric Chambers; PAH-S1-3800 Hyperbaric Chamber & PAH-S1 Hyperbaric Chamber by Pan-America Hyperbarics, Inc. are widely used. The Hyperbaric Treatment Unit (HTU) at ADK Hospital uses Monoplace HBOT chambers to heal burns and non-healing wounds and treat decompression sickness.

Moreover, the monoplace HBOT devices segment is anticipated to exhibit the fastest CAGR over the forecast period from 2023 to 2030. The growing demand for monoplace systems in hospitals & clinics due to their higher availability and ease of installation is also a pivotal factor expected to drive the market further. The technological advancement related to monoplace systems, such as portability, and some other features, such as user-friendly operability and low maintenance costs, are anticipated to propel the HBOT Equipment market growth over the coming few years.

Some frequently used & commercially available multiplace systems include OxyHeal 5000 rectangular multiplace hyperbaric chamber, OxyHeal 4000 multiplace hyperbaric chamber, and decompression hyperbaric chamber. Multiplace hyperbaric chamber is also expected to grow significantly over the forecast period. Multiplace systems are more expensive and require a larger workforce to maintain & operate. However, the growing requirement to treat more patients in one cycle has increased demand for such systems in large-scale hospitals, which is anticipated to drive the hyperbaric oxygen therapy devices market over the forecast period.

In addition, these devices can accommodate many patients with various conditions and facilitate medical staff monitoring of every patient’s signs and symptoms. Thus, the overall cost of the services for patients is low compared to monoplace devices, raising the adoption rate of such devices. One of the key Unique Selling Propositions (USPs) of multiplace chambers is that they allow extended patient treatment time. The increasing awareness among hospital professionals regarding the benefits of this system is anticipated to boost the HBOT Equipment market.

Application Insights

According to the estimates reported in the NCBI, about 1 to 2% of the total population of developed nations will experience a chronic wound in their lifetime. In emerging economies, the share is expected to be higher. Moreover, the rising threat of chronic wounds due to the increasing prevalence of diabetes and obesity is also among some contributing factors.

The increasing popularity of adventure activities and leisure sports amongst most of the global population also drives the need for HBOT systems in wound healing applications. In addition, commercially available products such as BARA-MEDXD, BARA-MED, BARA-MED Select, BARA-PRESS Software Control System, and PAH-S1 Hyperbaric Chamber are majorly used for wound healing and decompression sickness. Such a huge product portfolio for treating chronic wounds is also among the few factors that can account for the largest market share.

The others segment is expected to grow at the fastest CAGR of 6.5% during the forecast period. The increasing number of clinical trials with hyperbaric oxygen therapy equipment for conditions such as periodontitis, diabetes mellitus, aging, hypoxic-ischemic encephalopathy, and diabetic foot ulcer outcome is a key determinant indicating the lucrative growth of the other segment. Some of the sponsors of these clinical trials are Loma Linda University and Nanfang Hospital of Southern Medical University. According to the European Society of Cardiology, cardiovascular disease (CVD) each year causes 3.9 million deaths in Europe and over 1.8 million in the European Union. The study by ESC suggests that hyperbaric oxygen therapy (HBOT) promotes recovery of cardiac function in patients with post-COVID syndrome.

Regional Insights

North America was the leading segment, accounting for the largest revenue share of 31.3% in 2022. Emerging economies such as India, China, the Philippines, Vietnam, and Brazil have been experiencing strong economic growth. The increasing population and rising need for wound healing treatment have spurred the demand for HBOT in the region. Growing disposable income has triggered consumers to avail themselves of technologically advanced medical treatments and therapies. In Feb 2023, Maui Memorial Medical Center in the U.S. launched a wound care clinic with hyperbaric oxygen therapy, which offers a comprehensive approach to non-healing wounds. Similarly, in February 2023, HCA Florida Woodmont Hospital introduced the Wound Care and Hyperbaric Center, partnering with specialists in wound care and hyperbaric medicine.

According to the American Venous Forum, advanced venous diseases characterized by skin changes and leg ulceration affect over 2.5 million people annually in the U.S. The increasing prevalence of chronic & acute wounds and simultaneously growing treatment rate due to the presence of developed healthcare technology, growing healthcare expenditure by the government, and huge disposable income are expected to boost the market over the coming years. North Carolina military veterans suffering from traumatic brain injuries and post-traumatic stress disorder receive relief through hyperbaric oxygen therapy (HORT). The therapy, administered at Durham's Extivita clinic, uses 100% oxygen under two hypobaric chambers, funded by the General Assembly.

However, the Asia Pacific segment is expected to grow at the fastest CAGR of 5.4% during the forecast period. This region is anticipated to deliver enormous growth due to increasing per capita income, a growing medical tourism industry, and rising public awareness regarding the benefits of HBOT devices. China is anticipated to witness significant growth in the Asia-Pacific region. In August 2022, HBOT-India launched one of the First Medical Grade Hyperbaric Oxygen Therapies in Gurugram, Delhi NCR, India. In January 2023, Kamalaya Koh Samui in Thailand launched new integrative treatments at its Longevity House. They have introduced a series of new treatments to support integrative healing, including IV vitamin infusions, ozone therapy, hyperbaric oxygen therapy, and high-sensitivity cancer screening.

Key Companies & Market Share Insights

Growing investments in R&D activities and new product development are expected to be the key parameters for maintaining a competitive edge, with frequent partnerships being undertaken to diversify product portfolios and gain share.

In January 2023, The ADK Hospital officially became the first medical facility in the Maldives to launch a Hyperbaric Treatment Unit or decompression chamber. In February 2023, Western University of Health Sciences (WesternU) and NexGen Hyperbaric partnered to support research on hyperbaric oxygen therapy for treating physical and mental conditions. The collaboration focuses on cellular research and clinical trials for traumatic brain injury (TBI) and post-traumatic stress disorder (PTSD).

Various other trends further expected to propel growth include strategic alliances between key players focusing on product expansions and market establishment in emerging regions through increased investment. Moreover, geographic expansion activities in developing countries and focus on introducing cost-effective medical devices by market players are expected to strengthen the market and establish their position in the global market. The following are some of the major participants in the global hyperbaric oxygen therapy devices market:

-

Fink Engineering

-

ETC Hyperbaric Chambers (Environmental Tectonics Corporation)

-

HAUX-LIFE-SUPPORT

-

Gulf Coast Hyperbarics, Inc.

-

HEARMEC

-

IHC Hytech B.V. (Royal IHC)

-

Hyperbaric SAC

-

Sechrist Industries, Inc.

-

OxyHeal International

-

SOS Group Global Ltd

Hyperbaric Oxygen Therapy Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.5 billion

Revenue forecast in 2030

USD 4.9 billion

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Fink Engineering; ETC Hyperbaric Chambers (Environmental Tectonics Corporation); HAUX-LIFE-SUPPORT; Gulf Coast Hyperbarics, Inc.; HEARMEC; IHC Hytech B.V. (Royal IHC); Hyperbaric SAC; Sechrist Industries, Inc.; OxyHeal International; SOS Group Global Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

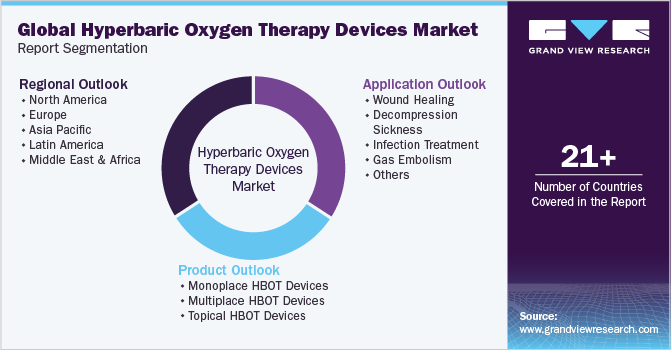

Global Hyperbaric Oxygen Therapy Devices Market Report SegmentationThis report forecasts revenue growth at global, regional, & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hyperbaric oxygen therapy devices market based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoplace HBOT devices

-

Multiplace HBOT devices

-

Topical HBOT devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wound healing

-

Decompression sickness

-

Infection treatment

-

Gas embolism

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hyperbaric oxygen therapy devices market size was estimated at USD 3.3 billion in 2022 and is expected to reach USD 3.5 billion in 2023.

b. The global hyperbaric oxygen therapy devices market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 4.9 billion by 2030.

b. Monoplace HBOT devices dominated the hyperbaric oxygen therapy devices market with a share of 76.8% in 2022. This is attributable to the commercial availability of monoplace systems and high adoption of such devices, due to ease of handling and less requirement of hospital gas supply.

b. Some key players operating in the hyperbaric oxygen therapy devices market include Fink Engineering; ETC Hyperbaric Chambers (Environmental Tectonics Corporation); HAUX-LIFE-SUPPORT; Gulf Coast Hyperbarics, Inc.; HEARMEC; IHC Hytech B.V. (Royal IHC); Hyperbaric SAC; Sechrist Industries, Inc.; OxyHeal International; and SOS Group Global Ltd.

b. Key factors that are driving the market growth include growing acceptance of hyperbaric oxygen therapy (HBOT) technique as itenhances the effectiveness of leukocytes, growing investment by private players to develop technologically advanced HBOT systems, and growing number of clinical trials sponsored by various universities & players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.