- Home

- »

- Medical Devices

- »

-

Hysteroscopy Procedures Market Size, Industry Report, 2030GVR Report cover

![Hysteroscopy Procedures Market Size, Share & Trends Report]()

Hysteroscopy Procedures Market (2025 - 2030) Size, Share & Trends Analysis Report By Procedure (CPT Code 58558, CPT Code 58562), By End Use (Ambulatory Surgical Centers, Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-506-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hysteroscopy Procedures Market Summary

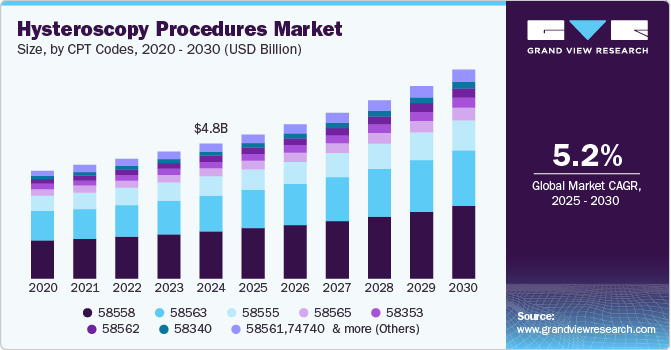

The global hysteroscopy procedures market size was estimated at USD 13.90 billion in 2024 and is projected to reach USD 18.98 billion by 2030, growing at a CAGR of 5.21% from 2025 to 2030. The increasing prevalence of gynecological disorders, such as uterine abnormalities, abnormal uterine bleeding, uterine fibroids, polyps, and other fertility disorders, is a key factor driving the growth.

Key Market Trends & Insights

- North America led the global hysteroscopy procedures market, with a revenue share of 38.2% in 2024.

- By CPT code, the 58558 CPT code segment held the largest revenue share of 34.8% in 2024.

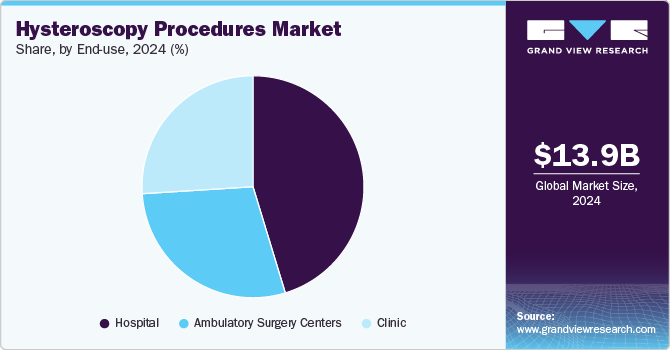

- By end use, the hospitals segment led the market, with the largest revenue share of 52.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.90 billion

- 2030 Projected Market Size: USD 18.98 billion

- CAGR (2025-2030): 5.21%

- North America: Largest market in 2024

Moreover, the rising adoption and awareness of minimally invasive surgeries over traditional methods and technological advancements in hysteroscopy devices are other major factors fueling the market growth.

The rising incidence of uterine cancer has increased the number of hysteroscopy procedures, thereby accelerating market growth. In the U.S., endometrial cancer, affecting the uterine lining, ranks as the primary cancer among female reproductive organs. The American Cancer Society projects for 2024 reveal that approximately 67,880 new cases of uterine cancer will be diagnosed, with around 13,250 women falling victim to this condition. Predominantly affecting post-menopausal women, endometrial cancer typically occurs around the age of 60 on average. Presently, there are over 600,000 survivors of endometrial cancer in the U.S.

Technological progress has resulted in the development of advanced miniature hysteroscopes with high-definition capabilities. These devices enable hysteroscopy to be conducted safely and efficiently in office settings while maintaining excellent optical quality. For instance, a study published by BioMed Central in February 2024 , indicates that infertile women might benefit from office hysteroscopy prior to undergoing artificial reproductive technology (ART), regardless of previous imaging results not detecting intrauterine abnormalities. Detecting and treating lesions like endometrial polyps, submucosal fibroids, and endometritis through hysteroscopy could enhance live births and clinical pregnancy rates linked with ART. Given that these lesions can adversely affect pregnancy outcomes, their identification and treatment with hysteroscopy should be considered.

Nowadays, minimally invasive surgical procedures are gaining popularity owing to the reduced risk associated with these procedures. Minor incisions, reduced postoperative pain, and speedy recovery are leading to high adoption of these procedures. Hysteroscopy is associated with reduced hospitalizations, faster recovery, and less blood loss. Moreover, hysteroscopy induces fewer complications during surgery and a low risk of abdominal wounds. For instance, according to Medical Xpress, in December 2022, Skoltech and KU Leuven researchers created a gynecological training simulator for in-office hysteroscopy with tactile feedback. This innovation enables gynecologists to practice minimally invasive procedures effectively. Thus, an increase in patient preference for noninvasive or minimally invasive treatment and the benefits offered by these techniques are anticipated to boost market growth at a significant rate during the forecast period.

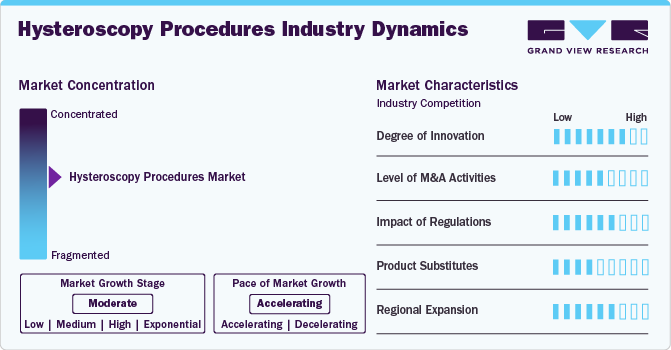

Market Concentration & Characteristics

The hysteroscopy procedures industry displays a moderate level of concentration, with several key players dominating the market. Characteristics include continuous technological advancements leading to the development of more efficient and minimally invasive devices. Additionally, there's a growing emphasis on outpatient settings for hysteroscopy procedures, contributing to increased patient convenience and reduced healthcare costs. Key trends include the rising prevalence of gynecological disorders necessitating hysteroscopy, such as. normal uterine bleeding and fibroids.

The hysteroscopy procedures industry exhibits notable innovation, with advancements in imaging tech, automation, and AI algorithms. For instance, according to NCBI in December 2023, utilizing an AI-driven algorithm for diagnosing uterine fibroids based on MRI scans showed encouraging potential for enhancing the effectiveness of hysteroscopic myomectomy procedures.

Stringent guidelines govern the training and certification of healthcare professionals performing hysteroscopies, contributing to standardized practices and reducing procedural risks. Regulatory frameworks also oversee the approval and monitoring of hysteroscopy devices, ensuring their effectiveness and safety for patient use. For instance, the classification of medical devices in India, along with regulation, approval, and registration, is done through the Drug Controller General of India (DCGI), controlled by CDSCO. Additionally, reimbursement policies influence the accessibility of hysteroscopy procedures, affecting patient affordability and healthcare provider reimbursement rates.

Mergers and acquisitions in the hysteroscopy procedures industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in October 2024, Caldera Medical acquired UVision360 and its LUMINELLE hysteroscopy system, expanding Caldera's minimally invasive gynecology portfolio. The acquisition includes the LUMINELLE Bx, featuring on-demand biopsy technology. This strategic move enhances Caldera's offerings for treating conditions like polyps and fibroids, providing surgeons with advanced tools for improved precision and patient outcomes.

Product substitution in hysteroscopy procedures involves the consideration of alternative diagnostic and therapeutic interventions for uterine conditions. This can include imaging techniques like transvaginal ultrasound or saline infusion sonography, which may offer comparable diagnostic information without the need for invasive procedures. Additionally, alternative treatments such as hormonal therapies or non-surgical approaches such as endometrial ablation may be explored depending on the patient's condition and preferences.

The hysteroscopy procedures industry is expanding regionally due to rising global demand. This expansion may encompass efforts to enhance healthcare infrastructure, provide specialized training to healthcare professionals, and increase awareness among patients and referring physicians about the benefits of hysteroscopy. For instance, in February 2023 , Hologic Inc., a renowned company in women’s health worldwide, received the NovaSure V5 Global Endometrial Ablation (GEA) device’s approval in Canada and Europe.

CPT Codes Insights

The 58558 CPT code segment accounted for the largest revenue share of 34.8% in 2024. This procedure involves the insertion of a hysteroscope into the uterus to visualize and identify intrauterine adhesions or scar tissue. Following visualization, the surgeon utilizes instruments to lyse or break apart these adhesions, restoring the normal anatomy of the uterine cavity. This procedure is typically performed under general anesthesia to ensure patient comfort and optimal visualization. CPT code 58558 is essential for accurate billing and documentation of hysteroscopic procedures involving the lysis of intrauterine adhesions, aiding in reimbursement and healthcare recordkeeping.

The 58562 CPT Code segment shows the fastest CAGR from 2025 to 2030. This procedure involves the insertion of a hysteroscope into the uterus to visualize and identify fibroids, also known as leiomyomata. Once identified, the surgeon utilizes specialized instruments to remove the fibroids from the uterine cavity. This procedure may be performed to alleviate symptoms associated with fibroids, such as abnormal uterine bleeding or pelvic pain.

End Use Insights

The hospitals segment accounted for the largest revenue share of 52.4% in 2024. The rising prevalence of conditions like uterine fibroids, endometriosis, and various gynecological cancers, along with an escalating volume of gynecological surgical procedures, significantly propel the segment's growth. Operative hysteroscopy, conducted in hospitals, addresses abnormalities identified during diagnostic hysteroscopy. This single procedure can rectify detected issues, eliminating the necessity for subsequent surgeries.

The hospitals sector experiences a notably more significant patient influx for gynecological procedures than alternative healthcare settings, primarily due to its capability to manage emergent situations during and after surgeries and its wide array of available treatment choices. For instance, in May 2023, NCBI reports that approximately 30,000 myomectomies are conducted annually in the U.S. to address leiomyomata (fibroids). Furthermore, hospitals serve as the predominant healthcare institution in many nations, leading to a relatively higher volume of hysteroscopy procedures performed in hospitals than in other healthcare settings.

The ambulatory surgery centers segment shows the fastest CAGR from 2025 to 2030. These centers provide outpatient surgical care, including diagnostic and operative hysteroscopy. ASCs are equipped with state-of-the-art technology and staffed by skilled healthcare professionals trained in hysteroscopic techniques. Patients benefit from shorter wait times, reduced costs, and a more personalized experience than hospitals. For instance, according to ASCA in December 2022 , there are over 6,200 Medicare-certified ASCs in the U.S. Additionally, ASCs adhere to strict safety and quality standards, ensuring optimal outcomes for hysteroscopy procedures while catering to the increasing demand for minimally invasive gynecological treatments in a comfortable outpatient setting.

Regional Insights

North America hysteroscopy procedures market dominated the overall global market and accounted for the 38.2% revenue share in 2024. The region's expansion is driven by favorable government regulations and reimbursement policies, the prominence of significant industry players, heightened product approvals and commercialization, and increasing awareness about the accessibility of diagnostic tests and treatments. In addition, market growth is fueled by rising demand for minimally invasive procedures and increased investments in gynecological system research and development.

U.S. Hysteroscopy Procedures Market Trends

The hysteroscopy procedures market in the U.S. held a significant share of North America's hysteroscopy procedures market in 2024. The increasing prevalence of gynecological conditions and heightened awareness among the public regarding the advantages of minimally invasive surgical techniques are anticipated to foster market expansion in the future. For instance, according to the CDC, in June 2023 , approximately 11,500 new instances of cervical cancer were identified in the U.S. every year, with roughly 4,000 women succumbing to this disease. This trend underscores the growing demand for hysteroscopy procedures as an effective means of diagnosis and treatment for such conditions, driving the market's growth.

Europe Hysteroscopy Procedures Market Trends

The Europe hysteroscopy procedures market is experiencing notable growth as region is considered one of the most advanced regions globally, characterized by technological progress and robust infrastructure, facilitating ample healthcare facilities and high-quality patient care. Moreover, the increasing incidence of conditions such as uterine fibroids, polyps, cervical cancer, and abnormal vaginal bleeding, coupled with a rising number of surgical interventions, are major factors positively affecting the market growth. The presence of numerous key industry players, and the introduction of advanced technological products, are anticipated to drive further market expansion in Europe.

The hysteroscopy procedures market in the UK is projected to expand owing to the increasing number of patients suffering from endometrial conditions, especially uterine fibroids, and uterine cancer, which is expected to drive market growth. For instance, according to NCBI in December 2021, endometrial cancer (EC) is the prevalent gynecological malignancy in the UK, with more than 9,700 newly diagnosed cases annually.

France hysteroscopy procedures market is expected to grow over the forecast period. France's robust healthcare system, characterized by substantial spending and quality-centered services, ensures widespread access to high-quality treatment. Consequently, technological advancements and government support are expected to drive market growth in France.

The hysteroscopy procedures market in Germany is expected to expand in the foreseeable future as rising cases of infertility drive the market among women due to significant lifestyle changes. For instance, according to Deutsche Welle, in February 2024, one out of every six women in Germany experienced infertility. Schemes such as Statutory Health Insurance (SHI) are strengthening healthcare infrastructure, facilitating people to undergo advanced treatment, and thereby increasing the demand for hysteroscopy procedures.

Asia Pacific Hysteroscopy Procedures Market Trends

The hysteroscopy procedures market in the Asia Pacific region is projected to experience notable expansion. The growing prevalence of women's health-related conditions and subsequent rise in surgical interventions are projected to drive market expansion throughout the Asia Pacific region in the forecast period.

Japan hysteroscopy procedures market is poised for substantial growth, driven by the increasing prevalence of cervical and endometrial cancer, along with endometriosis. The implementation of enhanced healthcare infrastructure through government initiatives and the presence of prominent industry players are among the factors anticipated to drive market expansion. In Japan, despite approximately 3000 annual deaths from cervical cancer, as reported by NCBI in August 2022 , efforts to combat the disease are ongoing.

The hysteroscopy procedures market in China is expected to grow, driven by the constant development of medical infrastructure and increasing investments by government & private players to promote the adoption of safer and cost-effective healthcare solutions are among factors expected to fuel market growth.

India hysteroscopy procedures market is poised for substantial growth, driven by the rising prevalence of chronic ailments such as cervical cancer, endometriosis, and menorrhagia, alongside increasing government efforts to screen and diagnose cancer, along with the advantages associated with hysteroscopy procedures. As reported by Bennett, Coleman & Co. in February 2024, over 340,000 women in India receive diagnoses of cervical cancer. These factors are expected to drive market growth during the forecast period.

Latin America Hysteroscopy Procedures Market Trends

The hysteroscopy procedures market in Latin America is experiencing significant growth. The market is experiencing growth driven by factors such as its proximity to the U.S., rising medical tourism from North America attracted by cost-effective healthcare facilities, and the expanding accessibility of innovative technologies.

Middle East & Africa Hysteroscopy Procedures Market Trends

The Middle East and Africa (MEA) hysteroscopy procedures market is experiencing significant growth, driven by increasing awareness about women's health, advancements in medical technology, and rising healthcare expenditure.

The hysteroscopy procedures market in Saudi Arabia is anticipated to expand in the forecast period. As economic expansion and urbanization progress, the anticipated increase in disposable income is poised to create novel growth opportunities. The Saudi Arabian government is directing resources toward bolstering healthcare infrastructure by initiating the construction of new hospitals. As per ITP Media Group's report in April 2023, Dr. Sulaiman Al Habib Medical Group (HMG) revealed a USD 1.73 billion expansion initiative, intending to establish six new hospitals. The plan outlines the operation of two hospitals in 2023, three in 2024, and one in 2025.

The Kuwait hysteroscopy procedures market is expected to grow over the forecast period due to increasing awareness about women's health issues, advancements in medical technology, and the availability of skilled healthcare professionals. Additionally, government initiatives aimed at enhancing healthcare infrastructure and improving access to medical services contribute to market growth.

Key Hysteroscopy Procedures Company Insights

The competitive scenario in the hysteroscopy procedures market is highly competitive, with key players such as Medtronic, Stryker Corp., and Hologic, Inc. holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Hysteroscopy Procedures Companies:

The following are the leading companies in the hysteroscopy procedures market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker Corp.

- Hologic, Inc.

- KARL STORZ SE & Co. KG

- Medical Devices Business Services, Inc. (Ethicon, Inc.)

- Olympus Corp.

- Delmont Imaging

- B. Braun Melsungen AG

- Richard Wolf GmbH

- CooperCompanies

- Maxer Endoscopy GmbH

- Boston Scientific Corp.

- MedGyn Products, Inc.

- Lina Medical APS

- Luminelle

Recent Developments

-

In May 2023, B. Braun unveiled its latest laparoscopic AESCULAP EinsteinVision 3.0 FI at the International Society for Gynecologic Endoscopy (ISGE).

-

In October 2023, Hologic, Inc. announced a pioneering partnership with the American Association of Gynecologic Laparoscopists (AAGL) and Inovus Medical.

-

In May 2023, Olympus Corporation, a leading global technology provider known for pioneering innovative solutions in medical and surgical procedures, announced the FDA clearance of EVIS X1 endoscopy system alongside two compatible gastrointestinal endoscopes.

Hysteroscopy Procedures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.72 billion

Revenue forecast in 2030

USD 18.98 billion

Growth rate

CAGR of 5.21% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

March 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

CPT codes, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic; Stryker Corp.; Hologic, Inc.; KARL STORZ SE & Co. KG; Medical Devices Business Services, Inc. (Ethicon, Inc.); Olympus Corp.; Delmont Imaging; B. Braun Melsungen AG; Richard Wolf GmbH; CooperCompanies; Maxer Endoscopy GmbH; Boston Scientific Corp.; MedGyn Products, Inc.; Lina Medical APS; Luminelle; Meditrina, Inc. (Aveta)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

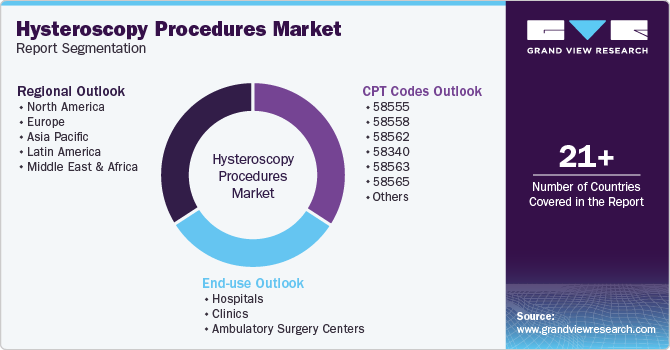

Global Hysteroscopy Procedures Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the hysteroscopy procedures market report based on the CPT codes, end use, and region:

-

CPT Codes Outlook (Revenue, USD Million, 2018 - 2030)

-

58555

-

58558

-

58562

-

58340

-

58563

-

58565

-

58353

-

58561,74740

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgery Centers

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hysteroscopy procedures market size was estimated at USD 13.90 billion in 2024 and is expected to reach USD 14.72 billion in 2025.

b. The global hysteroscopy procedures market is expected to grow at a compound annual growth rate of 5.21% from 2025 to 2030 to reach USD 18.98 billion by 2030.

b. North America dominated the hysteroscopy procedures market with a share of 38.18% in 2024.This can be attributed to presence of major market players, technological advancements and well established healthcare infrastructure

b. Some of the key players operating in the hysteroscopy procedures market include Medtronic, Stryker Corporation, Hologic, Inc., KARL STORZ SE & Co. KG, Medical Devices Business Services, Inc. (Ethicon, Inc.), Olympus Corporation, Delmont Imaging, B. Braun Melsungen AG, Richard Wolf GmbH, CooperCompanies, Maxer Endoscopy GmbH, Boston Scientific Corporation, MedGyn Products, Inc., Lina Medical APS, Luminelle, and Meditrina, Inc. (Aveta).

b. Key factors that are driving the hysteroscopy procedures market growth include the increasing prevalence of gynecological disorders such as uterine abnormalities, abnormal uterine bleeding, uterine fibroids, fertility disorders, amongst other gynecological disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.