- Home

- »

- Next Generation Technologies

- »

-

Identity Verification Market Size, Share & Trends Report 2030GVR Report cover

![Identity Verification Market Size, Share & Trends Report]()

Identity Verification Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Service), By Type (Biometric, Non-biometric), By Deployment, By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-945-5

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Identity Verification Market Summary

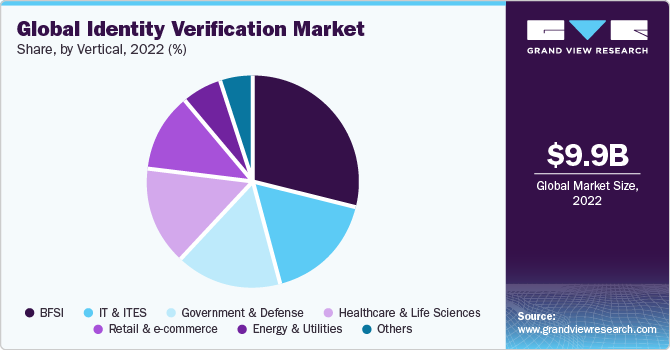

The global identity verification market size was estimated at USD 9.87 billion in 2022 and is anticipated to reach USD 33.93 billion by 2030, growing at a CAGR of 16.7% from 2023 to 2030. The growing frequency of identity-related fraud and cybercrime has increased digitization initiatives.

Key Market Trends & Insights

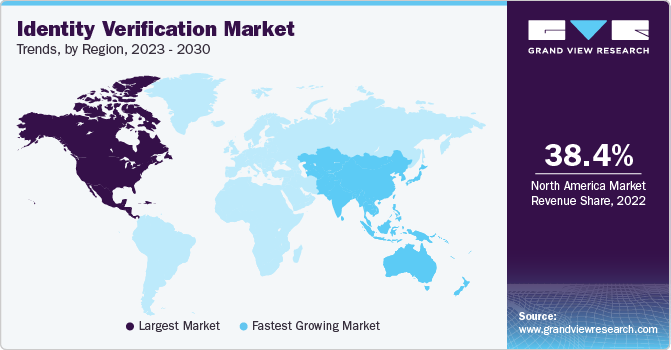

- North America dominated the market with a revenue share of 38.4% in 2022.

- Asia Pacific is predicted to be the fastest-growing region with the highest CAGR during the forecast period.

- Based on component, the solution segment led with a revenue share of more than 71.0% in 2022.

- Based on type, the biometric segment dominated the market with a revenue share of more than 68.0% in 2022.

- Based on deployment, the on-premises segment led the market with a revenue share of more than 59.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 9.87 Billion

- 2030 Projected Market Size: USD 33.93 Billion

- CAGR (2023-2030): 16.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The increasing use case of data security across verticals propels the identity verification industry forward. Furthermore, measures by governments and companies focusing on digitalization and the use of emerging technologies in identity verification systems, such as artificial intelligence (AI), machine learning (ML), and automation, would present attractive prospects for identity verification suppliers. Increased regulations and the obligation to comply with standards across all industries, particularly in the financial sector, are likely to provide numerous opportunities for market participants. Furthermore, the growing trend of building your own device (BYOD) and enterprise mobility are propelling the market forward. For instance, in November 2020, LexisNexis Risk Solutions Group announced the launch of LexisNexis Fraud Intelligence, a tool that assists businesses in reducing the risk of account opening fraud. This solution assists enterprises in minimizing new account fraud risk by combining consumer application activity and identity events to produce a comprehensive and robust score that provides a complete picture of identity proof.

During COVID-19, various organizations increased their identity verification measures to protect customers from fraud. Businesses are turning to digital channels and services as citizens have advanced their relationship with technology and digital gadgets. With digitalization, the possibility of cyber-attacks and security flaws increases, positively affecting the growth of identity verification used to address security concerns. Verification services like blockchain-based identity verification, adoption of BYOD in organizations, KYC norms, Anti-money Laundering (AML), and identity verification in healthcare are actively responding to organizations’ increasing cyber risks and vulnerabilities. In 2021, the Financial Action Task Force (FATA) expanded the scope of reporting entities and encouraged member countries to constrain virtual asset dealers, art dealers, and legal professionals to conduct AML screening on their customers.

The key companies in the market invest in continuous R&D processes and launch innovative products to fight cyber-attacks and security concerns. In November 2021, Experian launched Work Report, an automated verification solution that allows users to agree to share their payment details with another organization digitally. It connects to an employer's payroll information in seconds to confirm a consumer's net and gross income, job tenure, and status. In July 2023, AU10TIX, an identity verification company based in Israel, introduced the AU10TIX App, which simplifies identity verification with an impressive verification time of 4-8 seconds for global IDs and age documents. This app integrates AI and ML to mitigate identity fraud risks and provides adaptable biometric checks to meet specific business needs, ensuring adherence to KYC regulations.

Verticals Insights

Based on vertical, the market is divided into BFSI, government & defense, healthcare & life sciences, retail & e-commerce, energy & utilities, IT & ITES, and others. The BFSI segment dominated with a revenue share of more than 28.0% in 2022. The increased digitization of banking procedures, such as digital onboarding and digital payments, aimed at improving the client experience simultaneously increases the need for identity verification worldwide. The rise of online and mobile banking services has increased the need for secure identity verification to protect digital financial interactions and enhance the customer experience. The adoption of innovative technologies such as biometrics and AI in identity verification is helping the BFSI sector simplify customer onboarding and authentication processes, further driving the demand for advanced solutions.

Banks depend on identification technology to safeguard the confidentiality and security of personal data they have collected about customers, workers, and partners. Identity management technologies are essential in the financial services industry because they allow for the construction of secure and efficient mechanisms for access control and identity verification. The retail and e-commerce segment is expected to grow at the fastest CAGR of 19.6% from 2023 to 2030, due to aspects such as the necessity to minimize cyber threats and the adoption of a risk-based fraud defense approach. With a rise in online transactions, businesses in this sector are increasingly aware of the necessity for robust identity verification to prevent fraud, secure customer interactions, and ensure trust in digital purchases.

Component Insights

Based on component, the market is categorized into solutions and services, and the solution segment led with a revenue share of more than 71.0% in 2022. Identity authentication, digital identity verification, and ID verification are the three sub-categories of the solution segment. The services segment is expected to present significant growth prospects from 2023 to 2030 due to advancements in technology and the need for businesses to comply with regulatory requirements, such as KYC and AML regulations. The rising prevalence of digital transactions, cybersecurity concerns, and the expansion of digital services further drive the demand for innovative and secure identity verification solutions.

Digital identity verification has gained prominence as both private and government agencies rely on digital channels for services and border control. This change highlights the increasing significance of secure and efficient identity verification within the contemporary digital environment. Smart border control uses facial recognition for identity authentication and verification, electronic ID cards (e-ID), smart airports, and smart cities where liveness detection and video analytics are used for identity verification worldwide. For instance, in 2021, a Sandbox was established in Spain to allow biometric authentication and KYC/AML to be applied to various business areas in a secure testing environment.

Regional Insights

North America dominated the market with a revenue share of 38.4% in 2022. It is an advanced technological region with many early adopters and key market players. The market demand is expected to be driven by the development of government initiatives like smart cities, smart infrastructure, and digital identity-based driver's licenses. The increasing integration of various technologies, such as blockchain AI & ML for securing digital identities, the proliferation of digital services, and the adoption of online platforms for various transactions have made identity verification a critical element to secure digital interactions and protect user data. The region is known for its digitally literate population that readily adopts innovative identity verification methods, including biometrics and AI.

Asia Pacific is predicted to be the fastest-growing region with the highest CAGR during the forecast period because it has become prepared by adopting new technologies. The revenue growth in this region is being driven by factors such as government initiatives to combat identity-related fraud and reinforcing e-KYC to verify identities. Furthermore, Asia Pacific is among the fastest-growing regions in GDP, resulting in business expansion and new startup formations. It increased the need for strong identity verification ways of preventing data breaches by creating a need for rapid, safe, and paperless digital transactions across these growing corporations.

Type Insights

Based on type, the biometric segment dominated the market with a revenue share of more than 68.0% in 2022. Biometric identification verification is the most common type of identification verification, and it establishes a person's legitimacy based on one or more biological traits. Fingerprints, retina & iris patterns, and other biometric verification procedures are commonly used. Biometric solutions use lock-and-capture mechanisms to verify individuals and assist in providing access to a limited set of services. The biometric segment is expanding due to its ability to offer heightened security, reduce fraud, and enhance user convenience, particularly in the context of remote and digital transactions.

Traditional non-biometric solutions are less secure and acquire more traction than biometric alternatives. Due to the increasing intrinsic demand from consumers for compliance management, seamless onboarding, and fraud prevention, the biometric solutions industry is growing at a significant rate. Non-biometric solutions are primarily used to detect fraudulent ID, business process automation, remote customer onboarding, and KYC/AML compliance.

After integrating AI and ML technologies into identity verification solutions, organizations can stay proactive and make very effective remediation and detection in response to invasive and suspicious activities and unauthorized access requests on an enterprise network. For instance, in August 2020, GBG partnered with Contemi Solutions to fully automate anti-money laundering and Know Your Customer processes for financial services institutions and Contemi clients. This alliance provides a paperless onboarding experience through a single API without sacrificing security.

Deployment Insights

The on-premises segment led the market with a revenue share of more than 59.0% in 2022. On-premises services enable the enterprise to authenticate its client base and store its information on its servers. No third party has access to the client data after a one-time installation, so a second vendor or service provider is not needed. Companies can ensure a secure customer onboarding procedure with the help of this service, keeping the acquired data safe from criminal activity. On-premise solutions provide an enhanced level of data security by functioning within isolated network environments, effectively mitigating the risks associated with external breaches and unauthorized access. This capability makes them an attractive choice for organizations prioritizing stringent security measures in their identity verification processes.

Cloud-based identity verification solutions are suitable for enterprises with limited security budgets. Small businesses can identify vulnerabilities and minimize threat landscapes at a lower cost with a cloud-based implementation, increasing customer service. Cloud-based identity verification solutions assist enterprises in managing their costs and improving their business efficiency. Cloud-based solutions also offer the advantage of global reach, strong security features, and compliance with industry-specific regulations, making them increasingly popular among organizations looking for robust and compliant identity verification services.

Organization Size Insights

The large enterprises segment led the market with a revenue share of above 65.0% in 2022. Due to increasing fraudulent activity, money laundering, processing of high-risk transactions, identity theft, cost-cutting on manual processes, and compliance with various legislation, large corporations have chosen identity verification systems. Many organizations are turning to identity verification services to improve the consistency of their security tools and platforms. Large enterprises value the scalability and integration capabilities offered by cloud-based identity verification solutions, which align with their complex IT infrastructures. As these enterprises expand their digital operations and interact with a global customer base, the demand for customized identity verification services contributes to the expanding market segment.

The small & medium enterprises segment is anticipated to grow with the highest CAGR from 2022-2030. Identity verification software provides SMEs with a hassle-free, simple, low-cost, intuitive, and secure solution to suit their growing needs. Because of limited resources and budget constraints, SMEs focus on implementing identity verification software to save resources, time, money, and assets. SMEs are recognizing the importance of secure and efficient identity verification to protect their online transactions and customer interactions. Moreover, cloud-based identity verification solutions are particularly appealing to SMEs for their affordability, scalability, and ease of deployment, enabling these businesses to enhance their security measures without substantial upfront investments.

Key Companies & Market Share Insights

The market is characterized by intense competition with the presence of a few major global players holding a significant market share. Key players emphasize on new product developments and alliances as options for higher profitability through improved client interactions. In December 2020, Trulioo partnered with Credit Sesame, an online banking services company; this collaboration entitled Credit Sesame to advance privacy for its clients through Trulioo’s Global Gateway biometric identification platform. In June 2023, Socure, a U.S.-based tech firm, made its first acquisition with the purchase of identity verification service Berbix for $70 million in cash and stock transactions. The acquisition aims to combine Berbix's real-time ID verification and fraud detection expertise with Socure's comprehensive identity verification approach to enhance security and compliance across various industries.

Key Identity Verification Companies:

- Acuant, Inc.

- Equifax, Inc.,

- Experian Plc

- GB Group PLC

- IDEMIA

- Intellicheck Inc.

- Mitek Systems, Inc.,

- Nuance Communications Inc.

- Thales Group S.A.,

- TransUnion LLC.

Identity Verification Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.50 billion

Revenue forecast in 2030

USD 33.93 billion

Growth rate

CAGR of 16.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, type, deployment, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil

Key companies profiled

Acuant, Inc.; Equifax Inc.; Experian Plc; GB Group PLC; Intellicheck Inc.; IDEMIA; Mitek Systems, Inc.; Nuance Communications Inc.; Thales Group S.A.; TransUnion LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Identity Verification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global identity verification market report based on type, component, deployment, organization size, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Biometrics

-

Non-biometrics

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Organization size Outlook (Revenue, USD Million, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Government and Defense

-

Healthcare & Life Sciences

-

Retail and eCommerce

-

IT & IteS

-

Energy and Utilities

-

Others (Education, Travel, and Gaming)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global identity verification market size was estimated at USD 9.87 billion in 2022 and is expected to reach USD 11.49 billion in 2023.

b. The global identity verification market is expected to grow at a compound annual growth rate of 16.7% from 2023 to 2030 to reach USD 33.93 billion by 2030.

b. North America dominated the identity verification market with a share of 38.4% in 2022. This is attributable to many early adopters and key market players. Identity verification market demand is expected to be driven by the development of government initiatives like smart cities, smart infrastructure, and digital identity-based driver's licenses.

b. Some key players operating in the identity verification market include Acuant, Inc., Equifax Inc., Experian Plc, GB Group PLC, Intellicheck Inc., IDEMIA, Mitek Systems, Inc., Nuance Communications Inc., Thales Group S.A., and TransUnion LLC.

b. Key factors that are driving the identity verification market growth include the growing frequency of identity fraud and cybercrime increased digitization initiatives, and the increasing use case of data security across verticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.