- Home

- »

- Next Generation Technologies

- »

-

Image Recognition Market Size, Share, Industry Report 2030GVR Report cover

![Image Recognition Market Size, Share & Trends Report]()

Image Recognition Market (2024 - 2030) Size, Share & Trends Analysis Report By Technique, By Component (Hardware, Software, Service), By Deployment Mode, By Vertical, By Application (Augmented Reality, Security & Surveillance), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-351-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Image Recognition Market Summary

The global image recognition market size was valued at USD 53.3 billion in 2023 and is projected to reach USD 128.3 billion by 2030, growing at a CAGR of 12.8% from 2024 to 2030. This growth is attributed to the increasing volumes of image data, advancements in artificial intelligence (AI) and machine learning (ML), and the growing demand for automation across various sectors are pivotal.

Key Market Trends & Insights

- North America dominated the global market and accounted for the revenue share of 34.0% in 2023.

- The image recognition market in the U.S. dominated the North American market in 2023.

- Based on technique, the facial recognition segment accounted for the largest share of 22.5% in 2023.

- Based on component, the service segment led the market with a revenue share of 39.1% in 2023.

- Based on deployment mode, the cloud segment held the largest revenue share of 71.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 53.3 Billion

- 2030 Projected Market Size: USD 128.3 Billion

- CAGR (2024-2030): 12.8%

- North America: Largest market in 2023

In addition, the integration of image recognition in applications such as healthcare, retail, and security enhances operational efficiency and customer engagement. Furthermore, the rise of edge computing and mobile solutions further supports market expansion. Image recognition technology, powered by machine learning, has been embedded in several fields, such as self-driving vehicles, automated image organization of visual websites, and face identification on social networking websites. One of the most popular applications of image identification is social media monitoring, as visual listening and visual analytics are essential factors of digital marketing. Image recognition is highly used in applications related to safety and security, such as facial recognition used by law enforcement agencies. Furthermore, airports are increasingly using face remembrance technology at security checkpoints.

The growing popularity of high-bandwidth data services and advanced machine learning has led to a higher demand for image recognition technology among people. Establishments in different sectors such as media & entertainment, retail, IT & telecom, and Banking, Financial Services, and Insurance (BFSI) have led to the growing utilization of advanced technologies within their companies, consequently driving the acceptance of image recognition. The system for image recognition assists in recognizing objects, buildings, locations, logos, individuals, and other images. Moreover, advances in image recognition tech enable connecting offline materials such as brochures and magazines with promotional videos, AR experiences, and product details using images from a smartphone.

In addition, an automated system for recognizing images is essential in computer vision, as it can pinpoint an image or attribute within digital photos and videos. It allows users to collect and analyze data in real-time. Information is gathered in complex dimensions and results in numerical or symbolic data. Computer vision, an image recognition component, allows for object recognition, event detection, image reconstruction, learning, and video tracking tasks. Image recognition technology has seen various opportunities arise in areas such as big data analysis and successful branding of products and services, thanks to the expanding use of image databases.

Furthermore, since the database serves as the training material for image recognition solutions, open-source frameworks such as software libraries and software tools form the building blocks of the solution. These frameworks help prepare or train machines to learn from the images available in the database by providing different types of computer vision functions, such as medical screening, obstacle detection in vehicles, and emotion and facial recognition, among others. Some of the leading libraries for image recognition include UC Berkeley's Caffe, Google Tensor Flow, and Torch.

Technique Insights

Facial recognition dominated the market and accounted for the largest revenue share of 22.5% in 2023. The increasing demand for enhanced security measures across various industries, such as government, banking, and retail, has significantly contributed to the dominance of facial recognition systems. Facial recognition's ability to provide convenient and secure identity verification, prevent unauthorized access, and detect potential threats or fraudulent activities has made it a sought-after solution in these sectors.

The pattern recognition segment is predicted to grow at a CAGR of 14.0% over the forecast period. The rise of artificial intelligence and machine learning has significantly contributed to its importance. Pattern recognition is crucial for tasks such as image and speech recognition, natural language processing, anomaly detection, and recommendation systems. Increasing AI and machine learning integration in various applications has led to a growing demand for robust pattern recognition techniques.

Component Insights

The service segment led the market and accounted for the largest revenue share of 39.1% in 2023. The service segment offers tailored image recognition solutions that can be customized to meet the specific needs of businesses across various industries. This level of personalization allows companies to integrate image recognition technology seamlessly into their existing systems and workflows, resulting in enhanced efficiency and productivity.

The software segment is projected to grow significantly over the forecast period. Factors such as the growing adoption of image processing software for various applications, such as medical imaging, computer graphics, and photo editing, and the trend of using digital image processing in developing computer vision-related software with the help of API are expected to enhance the demand for the market over the forecast period.

Deployment Mode Insights

The cloud segment held the largest market revenue share of 71.6% in 2023. The rise in the cloud-based market is due to its greater use in industries needing centralized monitoring, such as BFSI, media, government, and entertainment. Furthermore, utilizing a cloud-based deployment grants users access to the various APIs (Application Programming Interfaces) found in different servers or sources. Various organizations are adopting cloud-based image processing solutions to protect sensitive information and enhance marketing efforts. These solutions help users incorporate new methods into their daily routines without affecting their finances. For instance, Amazon Recognition, powered by deep learning technology, gives highly accurate facial search capabilities and facial analysis to detect, analyze, and compare faces for various user verification and public safety use cases. Also, Google Vision, part of the Google Cloud Platform, enables developers to implement machine learning models to understand the image's content.

The on-premises segment is estimated to grow with the fastest CAGR over the forecast period. On-premise image recognition solutions allow organizations to customize and tailor the software to their needs. This level of customization enables businesses to integrate image recognition capabilities seamlessly into their existing workflows, applications, or proprietary systems. Moreover, the ability to fully control the solution and adapt it to specific use cases drives the demand for on-premise image recognition.

Vertical Insights

The retail & e-commerce segment dominated the market with a share of 21.0% in 2023. E-commerce websites prioritize content management to enhance their product offerings and boost sales. Visual data provides extensive information for e-commerce websites. Businesses utilize AI and image recognition to improve the productivity of their content management staff and deliver tailored content to individual customers. With the help of image identification, online shoppers can search for clothing or accessories by taking a picture of a garment, texture, print, or color of their choice. The photo captured by the smartphone is uploaded to an app that searches an inventory of products to find similar products using AI technology.

The healthcare segment is anticipated to grow at the fastest CAGR over the forecast period. Image recognition technology streamlines and automates several aspects of healthcare workflows. Due to technological advancements, image recognition methods have improved in accuracy and efficiency, enabling healthcare professionals to analyze medical images such as X-rays, MRIs, and CT scans with exceptional precision. In radiology, image recognition algorithms can easily detect abnormalities or possible diseases, assisting radiologists with their diagnoses. By automating repetitive tasks, image recognition improves operational efficiency, reduces human error, and enhances the overall output of healthcare facilities. This efficiency allows healthcare providers to allocate resources more effectively, improving patient care and final results. Furthermore, the demand for image recognition solutions grows as healthcare organizations prioritize optimizing their workflows.

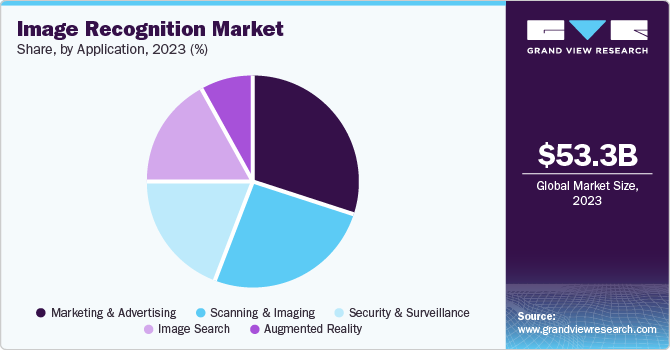

Application Insights

The marketing & advertising segment held the largest market share of 29.6% in 2023. Many businesses adopted technology with advanced advertising, customer interaction, and branding to improve their marketing activities. The major social media platforms use AI-enabled image recognition technologies to improve the user experience and allow advertisers to place contextually relevant advertisements. Moreover, the application of image recognition technology by many enterprises in marketing & advertising to enhance promotional strategies involves the analysis of visual content for targeted advertising, personalized marketing events, and collaborative experiences.

The security & surveillance segment is projected to grow significantly over the forecast period. Image recognition is essential for security and surveillance purposes, such as implementing facial recognition for monitoring and access control. Moreover, security and surveillance advantages come from facial recognition technologies that identify people in real time through CCTV footage; apart from this, organizations are installing biometric or facial recognition systems for employee credentials for attendance and security purposes. In addition, the growing demand for advanced image recognition solutions is fueled by the rising importance of public safety and security.

Regional Insights

North America image recognition market dominated the global market and accounted for the largest revenue share of 34.0% in 2023. The rise in the market is due to the growing inclusion of AI and mobile computing in online shopping and e-commerce industries. Furthermore, the prompt uptake of computer vision technologies is enhancing the region’s dominant position in the global market. The regional market growth is also supported by the adoption of software-driven business process automation with the utilization of cognitive technologies such as text recognition, natural language processing, and image detection & recognition.

U.S. Image Recognition Market Insights

The image recognition market in the U.S. dominated the North American market in 2023 attributed to the rising use of AI and ML technologies in many sectors boosted the need for advanced image recognition solutions. These technologies improve the precision and effectiveness of image analysis in various fields, including healthcare diagnostics, retail analytics, and autonomous vehicles. There is an intense demand from the private sector for surveillance as a component of access control, with facial recognition technology playing a major demand factor. On average, the FBI conducts around 4,055 monthly searches utilizing image recognition technology to identify individuals. The U.S. Customs and Border Protection employs a facial recognition system to detect and prevent criminals and terrorists from entering the border. The traveler's face is scanned by the new facial comparison biometric system and compared to the passport photo.

Europe Image Recognition Market Insights

Europe image recognition market is expected to witness lucrative growth over the forecast period, owing to advancements in automobile obstacle-detection technologies. There has been a growing use and integration of facial biometrics technology for the region's security, government, and non-government industries. The market in regions such as the UK, Germany, and France is analyzed for an overall market assessment. It is predicted that significant market growth in these areas will be driven by rising demand for facial recognition technologies, advancements in artificial intelligence and machine learning, favorable government regulations, and changing customer preferences.

Asia Pacific Image Recognition Market Insights

The image recognition market in the Asia Pacific is anticipated to grow significantly over the forecast period. This growth is attributed to the increasing use of mobiles and tablets, rapid technological advancements, and the popularity of online streaming in emerging economies, such as China and India. The high adoption of mobility and cloud solutions to address information security. Apart from this, the economic growth of countries such as China and India, the growing adoption of smartphones, and the developing e-commerce sector are crucial factors fueling regional growth.

The growing applications of face remembrance in security and surveillance systems in China are projected to drive market growth in the Asia Pacific. For instance, the Chinese government has enforced real-name registration policies in the country, under which citizens must link their online account with the official government ID. These policies have made image recognition more ubiquitous across the nation.

Key Image Recognition Company Insights

Some key companies in the image recognition market include Attrasoft, Inc., Blinkfire Analytics, Inc., Kairos AR, Inc., Catchroom, Chooch., Cloudsight, Inc., Google, GumGum, Inc., Hitachi, Ltd.; and others that focus on development with continuous innovations and enhancements.

-

Blinkfire Analytics, Inc. specializes in AI-powered visual content analysis for sports, media, and entertainment industries. Blinkfire's proprietary platform uses computer vision and machine learning algorithms to automatically detect, track, and analyze brand exposures, logos, and sponsorships within images and videos, providing valuable insights for brands, teams, and leagues. The company's offerings include sponsorship valuation, brand monitoring, and audience engagement metrics, enabling clients to measure the effectiveness of their marketing efforts and optimize their sponsorship strategies.

-

Kairos AR, Inc. provides facial recognition and image analysis solutions, offering products and services that leverage artificial intelligence and machine learning to deliver accurate and efficient image recognition capabilities. Kairos' flagship platform, Kairos Face Recognition, provides real-time facial recognition, identification, and verification, with security, access control, and customer experience applications. The company's other offerings include Kairos Demographics, which analyzes age, gender, and emotions, and Kairos Emotions, which detects and interprets emotional responses. Kairos' solutions are used across various industries, including healthcare, finance, and retail, and are designed to integrate with existing systems and infrastructure, enabling seamless deployment and scalability.

Key Image Recognition Companies:

The following are the leading companies in the image recognition market. These companies collectively hold the largest market share and dictate industry trends.

- Attrasoft, Inc.

- Blinkfire Analytics, Inc.

- Catchroom

- Chooch.

- Cloudsight, Inc.

- GumGum, Inc.

- Hitachi, Ltd.

- Honeywell International Inc.

- Kairos AR, Inc.

- LTU Tech

- NEC Corporation

- Qualcomm Technologies, Inc.

- DEEPSIGNALS

- Calrifai, Inc.

- Wikitude, a Qualcomm company

Recent Developments

-

In April 2023, Chooch launched ImageChat, a solution that enables enterprises to create detailed computer vision models using text prompts. Trained on over 11 billion parameters and 400 million images, ImageChat can identify more than 40 million visual details. This innovative tool offered users to generate captions and keywords for images and videos and interact with visual content to gain deeper insights. Combining AI Vision with large language models, ImageChat enhances data reliability and accuracy, making it ideal for object detection and detailed reasoning applications.

Image Recognition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 62.3 billion

Revenue forecast in 2030

USD 128.3 billion

Growth Rate

CAGR of 12.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, component, deployment mode, vertical, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Attrasoft, Inc.; Blinkfire Analytics, Inc.; Catchroom; Chooch.; Cloudsight, Inc.; Google; GumGum, Inc.; Hitachi, Ltd.; Honeywell International Inc.; Kairos AR, Inc.; LTU Tech; NEC Corporation; Qualcomm Technologies, Inc.; DEEPSIGNALS; Calrifai, Inc.; Wikitude, a Qualcomm company

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Image Recognition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global image recognition market report based on, technique, component, deployment mode, vertical, application, and region.

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

QR/ Barcode Recognition

-

Object Recognition

-

Facial Recognition

-

Pattern Recognition

-

Optical Character Recognition

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

Managed

-

Professional

-

Training, Support, and Maintenance

-

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-commerce

-

Media & Entertainment

-

BFSI

-

Automobile & Transportation

-

Telecom & IT

-

Government

-

Healthcare

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmented Reality

-

Scanning & Imaging

-

Security & Surveillance

-

Marketing & Advertising

-

Image Search

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.