- Home

- »

- Clinical Diagnostics

- »

-

Imaging Biomarkers Market Size, Industry Report, 2033GVR Report cover

![Imaging Biomarkers Market Size, Share & Trends Report]()

Imaging Biomarkers Market (2025 - 2033) Size, Share & Trends Analysis Report By Biomarkers (Molecular/Nuclear Biomarkers, Quantitative Imaging Biomarkers), By Imaging Technology, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-792-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Imaging Biomarkers Market Summary

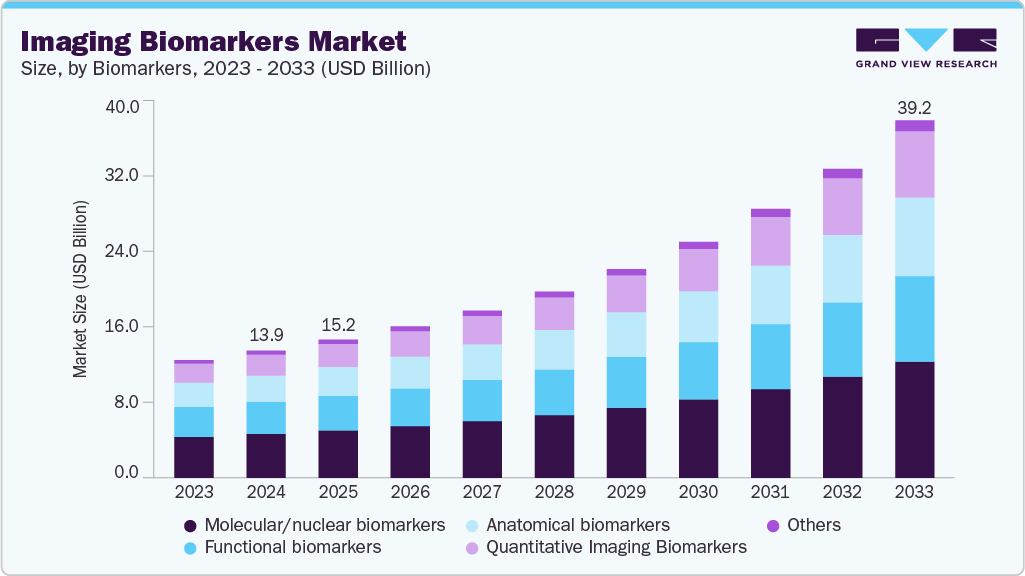

The global imaging biomarkers market size was estimated at USD 13.95 billion in 2024 and is projected to reach USD 39.23 billion by 2033, growing at a CAGR of 12.62% from 2025 to 2033. The growth of the market can be attributed to the increasing burden of chronic diseases such as cancer, neurological disorders, and cardiovascular conditions.

Key Market Trends & Insights

- North America imaging biomarkers industry dominated the global market and accounted for the largest revenue share of 32.90% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- By biomarkers, molecular/nuclear biomarkers segment led the market with the largest revenue share of 34.63% in 2024.

- By applications, the diagnostic segment led the market with the largest revenue share of 35.00% in 2024.

- By technology, the CT segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.95 Billion

- 2033 Projected Market Size: USD 39.23 Billion

- CAGR (2025-2033): 12.62%

- North America: Largest market in 2024

The need for precise, non-invasive diagnostic methods and early disease detection has elevated the clinical relevance of imaging biomarkers. Furthermore, the growing emphasis on precision medicine and patient stratification has reinforced their role in therapeutic decision-making and clinical trial design. Supportive regulatory developments from agencies such as the U.S. FDA and EMA, which are advancing qualification pathways for imaging biomarkers, are enhancing industry confidence. Concurrently, public-private investments in translational imaging research are strengthening discovery, validation, and standardization initiatives across academic and industrial settings.The current market dynamics emphasize upon an active period of innovation and consolidation. In 2025, Roche was granted FDA approval over its Elecsys PRO-C3 test to measure liver fibrosis and Thermo Fisher Scientific and Roche Diagnostics enlarged their biomarker cancer portfolios with companion diagnostic assays. Such strategic takeovers like the one of Eurofins Scientific to acquire the diagnostic activities of Synlab in Spain show a sense of move towards a networked biomarker services. Thermo Fisher has collaborated with UK Biobank in partnerships with technology developers to undertake massive validation and data integration of biomarkers and bioinformatics.

The market still continues to be redefined by technological advancement. Novel hybrid imaging systems (PET/CT, PET/MRI), novel high-specificity radiotracers, and artificial intelligence and radiomics are allowing quantitative imaging biomarkers (QIBs), which compose objective, reproducible measurements of disease states. Harmonized imaging protocols and cloud-based analytics platforms are enhancing cross-site reproducibility, which is a requirement to qualify regulation and multicenter trials.

The imaging biomarkers industry is growing in recent years due to the essential advances in molecular diagnostics. Cizzle Biotech introduced CIZ1B biomarker assay in March 2025, which is a non-invasive blood test to detect lung cancer at its early stage. This assay can be used to complement imaging-based diagnostic tests like CT and PET scans by identifying high-risk patients, allowing them to be intervened earlier and enhancing their diagnostic processes. The partnership with iGenomeDX will provide scalable accessibility in the U.S., improving its accessibility and supporting the combination of molecular and imaging biomarkers.

In August 2024, Hitachi High-Tech collaborated with Gencurix to create digital technology-based cancer molecular diagnostic tests with biomarker discovery. This project aids personalized medicine by connecting the molecular knowledge to the imaging data to allow the creation of a more specific diagnosis and treatment plan. These two developments point to the trend of combining molecular and imaging biomarkers which is fueling the growth of the market by enhancing diagnostic accuracy, speeding up the process of drug development and by facilitating earlier detection of the disease. All these developments lend strength to the trends toward the use of a more combined biomarker approach, a trend that ongoing future development has put the market squarely on the road to innovation, clinical integration, and a long-term growth trajectory.

As the issue of reimbursement and standardization continues, the integration of imaging with data science and molecular diagnostics is making imaging biomarkers a key component of the diagnostics, drug development, and personalized therapy. Further investment on AI-based quantification as well as approved imaging outcomes will support sustainable market expansion during the forecast period.

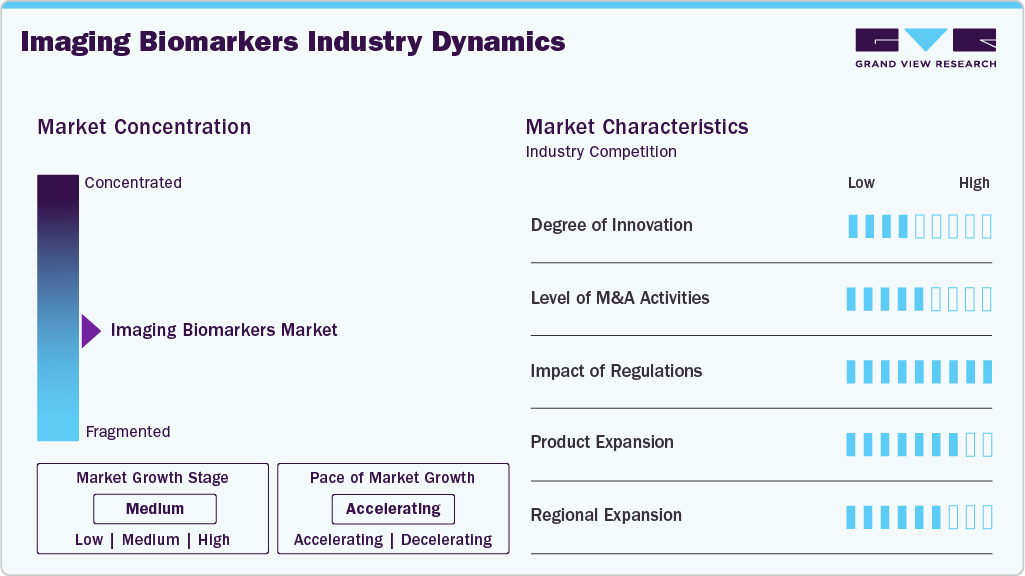

Market Concentration & Characteristics

The high degree of innovation in the market for imaging biomarkers is driven by advancements in imaging technologies, artificial intelligence (AI), and data analytics. These innovations enable the development of more precise and non-invasive diagnostic tools, facilitating early disease detection and personalized treatment plans. For instance, in October 2023, Samsung India through its subsidiary, NeuroLogica, introduced next-generation mobile CT product portfolio in India. This program will work to strengthen diagnostic imaging systems in different medical settings such as ICUs, operating rooms, and emergency departments and will, therefore, increase the access to high-quality imaging, especially in rural and underserved locations.

The merger and acquisition is critical in imaging biomarkers industry in promoting innovation, market penetration, and development of products. Academic institutions, research laboratories and manufacturers can work together to bring about new solutions and improvements in imaging biomarkers technologies. One of such examples is the possibility of acquisition of Qscan, a cancer care provider and diagnostic imaging provider, by Affinity Equity Partners. This USD more than USD 700 million acquisition is expected to increase the portfolio of healthcare by Affinity, especially in the field of diagnostic imaging services.

Regulations may have a significant influence on the market, such as affecting different components of development to market-entry, and on reimbursement. Favorable regulatory systems can also help to hasten the use of imaging biomarkers through succinct guidelines on the development and approval systems. On the other hand, strict policies can be a challenge especially in new markets where healthcare systems are dynamic. One of the recent changes in the United States is the state-wide requirement of Connecticut to cover biomarker testing through insurance, which would take effect at the beginning of 2026. The intention of this policy is to enhance the diagnosis and treatment of chronic diseases like Alzheimer, cancer, and Parkinson through the increased availability of biomarkers tests. The act is indicative of an increased understanding of the relevance of biomarker tests in personalized medicine.

Product expansion in the market involves the introduction of new imaging modalities, biomarkers, and diagnostic platforms to address a broader range of medical conditions and improve diagnostic accuracy. Companies are increasingly focusing on developing multiplex biomarker imaging technologies that allow for the simultaneous detection of multiple biomarkers, enhancing the comprehensiveness of diagnostic assessments.

Regional expansion in the market is a strategic approach to scale operations, penetrate new markets, and leverage opportunities created by regional differences in healthcare needs, regulatory environments, and technological advancements. Companies are focusing on expanding their presence in emerging markets where there is a growing demand for advanced diagnostic solutions. The Asia-Pacific region, in particular, is anticipated to experience significant growth due to increasing healthcare investments, rising disease prevalence, and improving healthcare infrastructure.

Biomarkers Insights

The molecular/nuclear biomarkers segment held the largest market share of 34.63% in 2024. This segment encompasses biomarkers that are utilized in molecular imaging techniques, aiding in the diagnosis and monitoring of various diseases. Recent advancements in imaging technologies have enhanced the sensitivity and specificity of these biomarkers, leading to improved clinical outcomes.

The quantitative imaging biomarkers (QIB) segment is anticipated to register a significant CAGR over the forecast period. The increasing demand for precise and reproducible measurements in clinical settings. QIBs provide objective data that can be used to assess disease progression and response to treatment, facilitating personalized medicine approaches. Companies are investing in developing and validating QIBs to support regulatory approvals and clinical adoption. In February 2024, Quibim introduced QP-Insights, a comprehensive web-based platform designed to manage, store, and quantitatively analyze medical images and other clinical data. This platform facilitates the deployment of imaging-based algorithms to accelerate drug development programs. By integrating imaging data with multi-omics information, QP-Insights aids researchers in stratifying patients and identifying those most likely to benefit from or experience side effects from investigational medicines.

Imaging Technology Insights

Based on imaging, the CT segment held the largest market share in 2024. CT imaging enables clinicians to examine the abnormalities and anatomy of a structure in a detailed manner that is cross-sectional in nature. The new advances in CT technology in recent times like developing the mobile CT systems have enhanced both accessibility and patient treatment. As an example, Samsung India in partnership with NeuroLogica launched the wide variety of mobile CT products that are aimed at offering high-quality diagnostic images in a wide range of medical settings, including ICU, or emergency departments. Moreover, a three-wave approach to the diagnosis of Alzheimer's disease was described in a review published in The Lancet in September 2025, which combines clinical examination with regular imaging (MRI or CT) with biomarker assays (blood or cerebrospinal fluid) and subsequently uses PET scans where needed. This solution tries to achieve earlier, more precise and fair diagnoses through integrating clinical skills with sophisticated biomarkers..

The PET segment is anticipated to grow at the fastest CAGR over the forecast period. This is primarily due to the advancements in imaging technology and increasing applications in oncology and neurology. PET imaging allows for the visualization of metabolic processes, aiding in the detection and monitoring of diseases. In April 2025, IXICO highlighted findings from the Bio-Hermes study, demonstrating the efficacy of a two-stage screening process for Alzheimer's diagnosis. This method utilizes initial blood-based biomarkers (BBMs) followed by amyloid PET scans for ambiguous cases, enhancing trial efficiency by reducing PET screen failure rates and improving the identification of suitable candidates for clinical trials.Technological improvements have enhanced the sensitivity and resolution of PET scanners, expanding their clinical utility.

Application Insights

Based on application, the diagnostics segment held the largest share of 35.00% in 2024. The segment is driven by innovations that increase the early detection of the disease and clinical decision-making. Non-invasive visualization and quantification of biological processes with imaging biomarkers can be used to assist in accurate diagnosis of oncology, neurology, and cardiovascular diseases. The latest inventions are a continuation of this tendency: the AI-based platform developed by IXICO has helped the FDA to approve blood-based Alzheimer biomarkers, which, with the help of PET imaging, can be used to better detect the disease. Likewise, PET/CT biomarkers of Siemens Healthineers allow analyzing the pathology of Alzheimer in detail. All these innovations reveal the transition of imaging biomarkers in the field of diagnostics through their ability to detect earlier, more precisely, minimise invasive interventions and direct personalised therapeutic approaches, which supports market expansion in the segment.

The drug discovery and development segment is anticipated to grow at the fastest CAGR over the forecast period. Biomarkers that can be assessed using imaging also allow the evaluation of biological processes and disease mechanisms to be used, which facilitates the discovery of possible drug targets and monitoring of treatment responses. Thus, the major actors in this niche are interested in using biomarkers in drug development, which is resulting in strategic alliances and, as a result, driving the market.As an example, in June 2022, InterVenn Biosciences partnered with the Biomarker Consortium of the Foundation of the National Institutes of Health and the Worldwide Innovative Network (WIN) Consortium, which is focused on promoting clinical trials, patient care, precision oncology, and accelerated biomarker discovery.

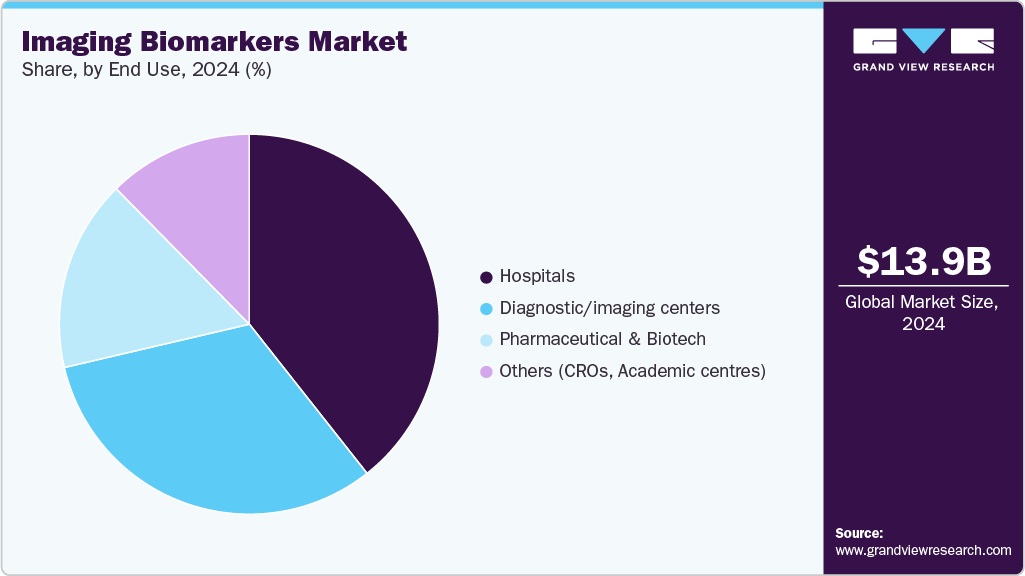

End Use Insights

In 2024, the hospital segment dominated the market, with a share 39.37% of the revenue. Hospitals are increasingly adopting advanced imaging technologies to enhance patient care and streamline workflows. For example, GE Healthcare reported growth driven by its ultrasound imaging and diagnostic drug products, highlighting the integration of imaging technologies in hospital settings.

The diagnostic/imaging centers segment is anticipated to grow at the fastest CAGR over the forecast period, driven by the increasing demand for specialized diagnostic services and the adoption of advanced imaging technologies. These centers offer focused imaging services, providing patients with timely and accurate diagnostic information.

Regional Insights

North America imaging biomarkers industry accounted for the largest global market share of 32.90% in 2024, primarily attributed to its well-developed healthcare system with significant biotechnology research centers. The state of innovations in imaging technologies has been achieved due to constant investments and advancements in these areas, and the technologies have become more efficient and reliable. The development of the market has been in great part due to government efforts in North America to advance the quality and accessibility of healthcare, as well as government spending in the research and development of the imaging diagnostics field. More so, CaliberMRI along with the Radiological Society of North America Quantitative Imaging Biomarkers Alliance (RSNA QIBA) claimed the first conformance certification of diffusion-weighted MRI (DWI) in November 2022. The certification is awarded to NHS Greater Glasgow and Clyde and is an indicator that the MRI systems in use at the institution have passed standardized technical performance conditions of ensuring that the apparent diffusion coefficient (ADC) value is accurate. Standardization of this kind is fundamental in achieving consistency and reliability in quantitative imaging in various clinical practice settings, which can boost uptake of QIBs in the clinical practice and clinical trials.

U.S. Imaging Biomarkers Market Trends

The imaging biomarkers industry in the U.S. is expected to grow over the forecast period due to advancements in imaging technologies, increased prevalence of chronic diseases, and a strong focus on personalized medicine. The market is expected to expand significantly over the forecast period, supported by substantial investments in research and development and a favorable regulatory environment. For instance, in February 2023, the National Institutes of Health announced funding of USD 4 million to Eastern Virginia Medical School for research and development of biomarkers for early detection of aggressive prostate cancer.

Europe Imaging Biomarkers Market Trends

The imaging biomarkers industry in Europe is identified as a lucrative industry. Europe has seen a rise in the number of chronic. diseases, prompting increased demand for advanced diagnostic tools. In addition, the developed healthcare systems and excellent research and development in European nations favour the implementation of advanced diagnosis techniques which are likely to favour market expansion. Recently, as of June 2025, the IXICO, located in UK, declared that it helped Fujirebio Diagnostics to have a new blood-based diagnostic biomarker of Alzheimer disease cleared by FDA. The validation process, using the AI powered imaging analysis platform of IXICO, used the data of the Bio-Hermes-001 study, which was a joint venture of the Global Alzheimer's Platform Foundation.

The imaging biomarkers industry in the UK held a significant share in 2024. The government of the UK has invested in research and development, which is one of the most significant factors behind the development of the market in the country. Huge research and development programs and emphasis on precision medicine. It is observed that more and more hospitals and diagnostic centers are employing high-end imaging options such as PET/MRI and multiparametric MRI to enhance the early detection of cancer and neurological conditions. The UK National Health Service (NHS) awarded Quibim the opportunity to enter the Small Business Research Initiative (SBRI) in July 2025 to test AI-based technologies in prostate cancer detection. The firm was awarded PS2.6 million to roll out its QP-Prostate AI technology in seven hospitals in the NHS, where it will process the medical images of around 3000 patients. This project highlights the increasing confidence in the use of AI-based imaging biomarkers to detect cancer at an early and precise time, potentially revamping the diagnostic procedures and the treatment outcomes of a patient.

The imaging biomarkers industry in Germany is anticipated to grow significantly over the forecast period. Investment in AI-assisted imaging analytics and standardized imaging protocols is enhancing diagnostic precision and reproducibility. Collaborative initiatives between research institutions and imaging technology providers continue to drive innovation, particularly in quantitative imaging biomarkers (QIBs) for clinical trials and drug development

Asia Pacific Imaging Biomarkers Market Trends

The imaging biomarkers industry in Asia Pacific held the fastest CAGR of 6.19% over the forecast period. Countries in the Asia Pacific region, such as China, India, Japan, South Korea, and Thailand, are experiencing rapid industrialization and economic growth. This growth is fueling demand across various industries, including pharmaceuticals and biotechnology, require imaging biomarkers. Governments and private businesses are making substantial investments in life sciences, pharmaceutical research, and healthcare infrastructure. This investment increases the demand for imaging biomarkers, which are crucial in diagnosing infectious diseases. The Asia Pacific region is home to a large and rapidly growing population, coupled with increasing urbanization, driving the demand for healthcare services and boosting the imaging biomarkers market.

Japan imaging biomarkers industry is witnessing significant growth over the forecast period. linical adoption of high-resolution MRI, PET, and hybrid imaging systems is rising, particularly in oncology and neurology. In September 2025, the Korea Research Institute of Standards and Science (KRISS) introduced an ultra-sensitive diagnostic platform capable of detecting Alzheimer's biomarkers in body fluids. This platform offers high sensitivity and reliability, complementing conventional imaging-based diagnostics and facilitating early disease detection and monitoring. The integration of AI and radiomics into imaging workflows is facilitating more accurate and quantitative biomarker analysis, supporting early disease detection and monitoring treatment response. Research collaborations between hospitals, universities, and private companies are further driving innovation, enabling Japan to remain at the forefront of imaging biomarker development.

LATAM Imaging Biomarkers Market Trends

The imaging biomarkers industry in LATAM is expected to grow exponentially over the forecast period. Regional growth is supported by initiatives to improve diagnostic coverage and clinical trial participation. AI-assisted imaging and standardized protocols are gaining traction, enabling accurate monitoring and early diagnosis, while collaborations with global imaging technology providers are accelerating local market maturity. Recently, in June 2025, Columbia University launched the Center for Innovation in Imaging Biomarkers and Integrated Diagnostics (CIMBID). Led by Dr. Despina Kontos, CIMBID aims to advance research, education, and clinical translation in AI-driven imaging biomarkers and integrated diagnostics, bridging technological innovation with clinical application.

Brazil imaging biomarkers industry is witnessing significant growth over the forecast period. The market is benefiting from government initiatives to improve diagnostic infrastructure and training, alongside partnerships between hospitals and imaging technology companies. There is increasing interest in quantitative imaging biomarkers and AI-based image analysis to optimize diagnosis and treatment planning in clinical settings.

MEA Imaging Biomarkers Market Trends

The imaging biomarkers industry in MEA is expected to grow exponentially over the forecast period. MEA is witnessing increasing adoption of imaging biomarkers, driven by national healthcare modernization programs and investments in advanced imaging infrastructure. Saudi Arabia and UAE are integrating CT, MRI, and PET imaging in oncology and cardiology diagnostics, supported by AI-based analytics for treatment monitoring. Partnerships between local hospitals and technology providers are enabling the development of tailored imaging biomarker solutions that address regional disease prevalence and healthcare priorities.

Key Imaging Biomarkets Company Insights

The market players operating in the market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Imaging Biomarkets Companies:

The following are the leading companies in the imaging biomarkets market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- Hologic

- QIAGEN

- Bio-Rad Laboratories, Inc.

- PerkinElmer Inc.

- Brainomix

- IXICO plc

- Median Technologies

Recent Development

-

In October 2025, Alamar Biosciences launched the NULISAqpcr BD-pTau217 Assay, a breakthrough in non-invasive, brain-specific biomarker detection for Alzheimer's disease research. This assay precisely detects brain-derived phosphorylated tau 217 (pTau217) in blood or serum using only 10 µL of biological sample. The assay's direct measurement of CNS-derived pTau217 without the need for cerebrospinal fluid (CSF) collection or PET imaging removes existing barriers to widespread adoption in population-based studies or longitudinal clinical trials.

-

In June 2025, IXICO based in the UK announced its role in assisting Fujirebio Diagnostics with the FDA clearance of a new blood-based diagnostic biomarker for Alzheimer's disease. Utilizing IXICO's AI-driven imaging analysis platform, the validation process incorporated data from the Bio-Hermes-001 study, a collaborative effort with the Global Alzheimer's Platform Foundation.

-

In February 2024, Quibim introduced QP-Insights, a comprehensive web-based platform designed to manage, store, and quantitatively analyze medical images and other clinical data. This platform facilitates the deployment of imaging-based algorithms to accelerate drug development programs.

-

In September 2021, QMENTA's AI Imaging Biomarker Analysis Catalog, launched at RSNA 2021, provides over 50 proprietary and industry gold-standard algorithms that offer objective biomarker and brain structure measurement and disease progression tracking for use in clinical studies. The catalog allows algorithms to be searched by disease focus, biomarker type, and regulatory clearance status, facilitating the integration of AI-driven imaging biomarkers into clinical practice.

Imaging Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.16 billion

Revenue forecast in 2033

USD 39.23 billion

Growth rate

CAGR of 12.62% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Biomarkers, imaging technology,application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche AG; Abbott Laboratories; Thermo Fisher Scientific Inc.; Hologic; Siemens Healthineers AG; QIAGEN; Bio-Rad Laboratories; PerkinElmer Inc; Brainomix; IXICO plc; Median Technologies

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Imaging Biomarkers Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global imaging biomarkers market report based on biomarkers, imaging technology,application, end use, and region.

-

Biomarkers Outlook (Revenue, USD Billion, 2021 - 2033)

-

Anatomical biomarkers

-

Functional biomarkers

-

Molecular/Nuclear Biomarkers

-

Quantitative Imaging Biomarkers

-

Others

-

-

Imaging Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

MRI

-

CT

-

PET

-

SPECT

-

Ultrasound

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Diagnostics

-

Drug Discovery & Development

-

Personalized Medicine

-

Disease Risk Assessment

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals

-

Diagnostic/imaging centers

-

Pharmaceutical and Biotech Companies

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.