- Home

- »

- Automotive & Transportation

- »

-

In-flight Catering Services Market Size & Share Report, 2030GVR Report cover

![In-flight Catering Services Market Size, Share & Trends Report]()

In-flight Catering Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Flight Type (Full Service Carrier, Low Cost Carrier), By Airlines, By Airline Class, By F&B Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-068-2

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In-flight Catering Services Market Summary

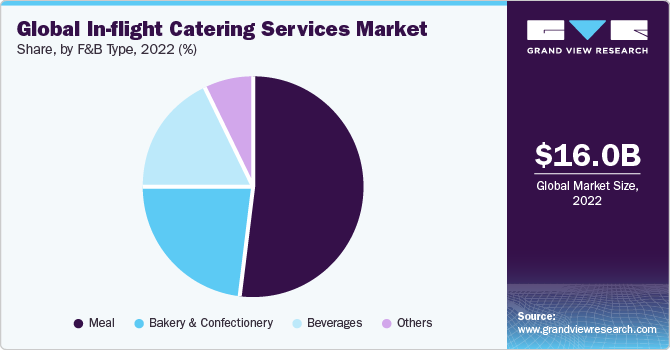

The global in-flight catering services market size was estimated at USD 16.01 billion in 2022 and is projected to reach USD 27.62 billion by 2030, growing at a CAGR of 5.9% from 2023 to 2030. A rise in long-haul and non-stop flights, mainly due to increased leisure and business travel, has increased passenger demand for in-flight catering services.

Key Market Trends & Insights

- The Asia Pacific accounted for the largest revenue share of 30.6% in 2022.

- Europe is estimated to expand at a significant CAGR of 6.3% during the forecast period.

- By F&B type, the meal segment accounted for the largest revenue share of 51.7% in 2022.

- By flight type, the full-service carrier segment accounted for the largest revenue share of 71.2% in 2022.

- By airlines, the large airline segment accounted for the largest revenue share of 64.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 16.01 Billion

- 2030 Projected Market Size: USD 27.62 Billion

- CAGR (2023-2030): 5.9%

- Asia Pacific: Largest market in 2022

In addition, to enhance passengers overall travel experience and thereby provide a better in-flight experience, airlines worldwide benchmark themselves against the competition by establishing a decent price range for on-board meals. The upsurge in demand for the product for diverse applications worldwide is fuelling the expansion of the market.

Airlines are providing a rich passenger experience due to the rising automation of the in-flight catering system and improvements in catering management. Airlines continually seek personalized services to potential on-board consumers, like pre-ordered meal services. In February 2020, American Airlines expanded its pre-ordered meal service to premium cabin customers on domestic American Eagle flights. The service intends to offer passengers meals that are specific to their location. In turn, this is expected to fuel the market's growth.

Additionally, businesses are adopting a novel trend of providing continental meal options to their customers, which helps meet their specific meal requests and raises customer satisfaction. Most airline caterers and in-flight catering service suppliers are working to improve their supply chain management (SCM) to produce high-quality goods while running their in-flight catering operations efficiently. For instance, in June 2021, Newrest signed a new agreement with American Airlines for in-flight catering. The company's in-flight catering standards allow the teams to deliver the premier food safety level, including HACCP tracking of food production and end-to-end cold chain management. The outcome of the agreement depends on maintaining the implementation of new international standards set forth by COVID-19, such as showers, air blowers, and thermal cameras.

The key players in the in-flight catering services industry are embracing innovative categories and systems from the production management arena to enhance and increase the efficiency of the processes and systems. Catering providers' key tools for improving their offerings include IT management systems, inventory management systems, lean manufacturing, and just-in-time manufacturing. Digitally enabled F&B services are being offered by airlines worldwide, including Virgin America, Air New Zealand, FlyDubai, and Japan Airlines. Passengers can order through these services using the in-seat IFE system. Emirates recently gave Meal Ordering Devices to every flight attendant serving business class.

Introducing new, vital safety protocols for professional commercial kitchens and the high demand for commercial aircraft also influence the market. In addition, changes in consumer lifestyle, rapid urbanization, a gain in disposable income, and a growing number of international and domestic air passengers all positively impact the market for in-flight catering services. Furthermore, advancements in the flight food ordering framework and an increase in onboard cooking will likely provide profitable opportunities to industry players during the forecast period.

F&B Type Insights

The meal segment accounted for the largest revenue share of 51.7% in 2022. The advent of ready-to-eat meals for travelers and rising demand for catering services on long-distance, nonstop flights are key factors fuelling growth. The major companies that provide in-flight catering are taking initiatives to provide meals to culturally diverse passengers. The rising demand for healthy and nutritious meals among passengers and customer willingness to pay a higher price for such meals are expected to facilitate growth over the next eight years.

The bakery and confectionery segment is expected to grow at the fastest CAGR of 6.8% for the forecast period. Raising passenger interest in healthy juices, coffee, and tea, typically on short-haul flights, is one of the main factors driving the segment. A range of beverage options for the passengers, including juices and different types of alcohol, is another factor promoting the segment's growth. Additionally, some airline flight attendants have started providing customized drinks to increase customer satisfaction.

Regional Insights

The Asia Pacific accounted for the largest revenue share of 30.6% in 2022 and is expected to grow at the fastest CAGR of 6.9% for the forecast period. The factors contributing to the regional growth include growth in international travel and tourism, rapid urbanization, a rising standard of living to complement aspirational traveling, and a resurgence in discretionary spending. In addition, the increasing number of airline operators in the region is expected to create significant growth opportunities for in-flight catering providers. The region is anticipated to grow at the fastest rate primarily as a result of substantial increases in both international air travel and tourism in developing countries like China, India, and Vietnam.

Europe is estimated to expand at a significant CAGR of 6.3% during the forecast period. The region has seen an increase in the number of legacy carriers entering the low-cost market, which is anticipated to increase the demand for in-flight catering services on low-cost flights. Additional factors expected to generate significant growth opportunities in the coming years include the growing willingness of travelers to spend money on purchasing healthy and organic meals and airline collaboration with food professionals with real-world experience. The key operators' addition of new routes and expansion of their airline fleet is also anticipated to spur growth.

Flight Type Insights

The full-service carrier segment accounted for the largest revenue share of 71.2% in 2022 and is expected to grow at the fastest CAGR of 6.1% during the forecast period. Since full-service carriers typically operate international or long-haul flights, the rising popularity of international flights is expected to boost segment growth. To encourage market expansion, full-service carriers give passengers a choice between business class, economy class, premium economy, and first class on some flights.

The low-cost carrier segment is expected to grow significantly over the forecast period. Most air travelers still prefer low-cost airlines. Due to passengers' rising expectations for eating hygienic food, the demand for in-flight catering is expected to increase regardless of the seating class. In addition, LCCs are frequently chosen for the short- and medium-haul segments.

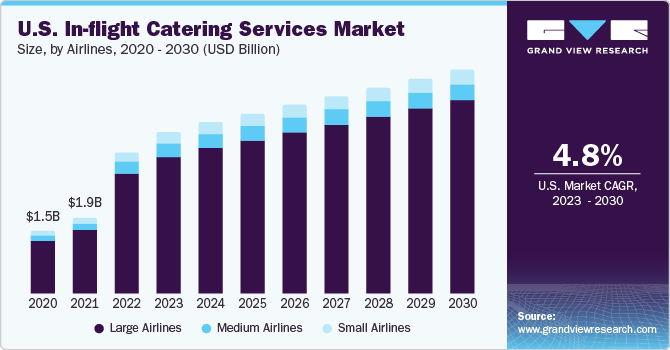

Airlines Insights

The large airline segment accounted for the largest revenue share of 64.5% in 2022 and is expected to grow at the fastest CAGR of 6.2% during the forecast period. The large airline segment is witnessing rapid growth worldwide due to lower airfares, booming tourism, and the stimulus for exceptional connectivity in a rapidly increasing globalized economic system. Airlines are trying to aid more travelers by updating their fleets and investing in new-generation aircraft that are becoming more sophisticated retailers to compete with low-cost rivals, maintaining healthy profitability and being more fuel-efficient. Therefore, this positive change in the airline industry is expected to increase the number of air passengers and lead to the growth of in-flight catering services in large airlines in the forecast period.

The medium airlines are expected to grow at a significant CAGR of 6.1% during the forecast period. This growth can be attributed to the increased adoption of analytical tools, automation in in-flight catering to reduce cost and time for food delivery, and an increased number of travelers from all over the world resuming travel after the COVID-19 pandemic. Medium-sized airlines mainly operate within a nation or selected international locations and have a comparatively lower area of operation than large airlines; hence, it is easier to curate a specific cuisine for medium airlines.

Airline Class Insights

The economy segment accounted for the largest revenue share of 59.2% in 2022. The segment growth is attributed to consumers' growing preference for traveling in economy class for short- to medium-distance vacations. Over the past few years, APAC has seen an increase in disposable income and the middle class, which has fuelled the demand for economy-class aircraft seating in the market. Additionally, the accessibility of inexpensive meal options is anticipated to spur segment growth.

The premium economy segment is expected to grow at the fastest CAGR of 9.2% during the forecast period. Due to the significant GDP growth in emerging economies worldwide, leisure travelers prefer to fly in a premium economy. The excellent economy is anticipated to witness tremendous growth in the market for in-flight catering services during the forecast period due to longer hauls and travel times.

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations to augment their market share. For instance, in March 2022, DNATA partnered with EasyJet to manage its in-flight catering services. The partnership benefits the company as DNATA will manage catering for airlines across the airline’s global network.

Key In-flight Catering Services Companies:

- ANA HOLDINGS INC.

- dnata

- DO & CO Aktiengesellschaft

- Emirates Flight Catering

- Flying Food Group, LLC

- Gate Group (Gate gourmet)

- LSG Lufthansa Service Holdings AG

- Newrest International Group

- SATS Ltd.

- Servair SA

Recent Development

-

In June 2023,Dnata, a flight and travel services provider, introduced a culinary robot at the World Travel Catering & Onboard Services Expo (WTCE). The robot is the world's first AI-powered cooking robot, capable of performing cooking tasks in commercial and domestic kitchens.

-

In June 2023,Gulf Marketing Group, a health and wellness organization, collaborated with Emirates Flight Catering to offer a unique line of on-the-go meals. Fresh, high-quality ingredients are used to produce the meals, packaged in recyclable materials. The menu contains foods to meet various dietary preferences, including vegetarian, vegan, and gluten-free options. The meals are available at GMG's retail locations around the UAE.

-

In June 2023, Dnata, a flight and travel services provider, renewed its long-term partnership with Lufthansa and SWISS in Singapore. The new contract sets Dnata to continue to provide high-quality inflight catering services to the two airlines from its state-of-the-art facility at Changi Airport.

-

In April 2023, German airline Lufthansa agreed to sell its entire catering business, LSG Group, to private equity firm Aurelius. The sale of LSG Group is part of Lufthansa's strategy to focus on its core airline business.

-

In January 2023, Newrest, a flight catering services provider, announced the acquisition of EIH Flight Services Ltd. in Mauritius. The acquisition allows Newrest to expand its presence in Africa and the Indian Ocean region and to better serve its customers in the growing tourism market in Mauritius.

-

In October 2022,ANA (All Nippon Airways) announced a step towards promoting the "universalization of food" as part of its ANA Future Promiseblank initiative by introducing new vegan, vegetarian, and gluten-free meal options on international flights. Collaborating with THE CONNOISSEURS member Chef Hideki Takayama and ANA Chefs, these special menus will be accessible to all passengers.

In-flight Catering Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.47 billion

Revenue forecast in 2030

USD 27.62 billion

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flight type, airlines, airline class, F&B type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, South Africa, UAE

Key companies profiled

ANA Catering Services Co. Ltd.; DNATA; DO & CO.; Emirates Flight Catering; Flying Food Group, LLC; Gate Group (Gate gourmet); LSG Lufthansa Service Holdings AG; Newrest International Group; SATS Ltd.; Servair SA

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-flight Catering Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-flight catering services market report based on flight type, airlines, airline class, F&B type, and region:

-

Flight Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Full-Service Carrier

-

Low-Cost Carrier

-

Other

-

-

Airlines Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Airlines

-

Medium Airlines

-

Small Airlines

-

-

Airline Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Economy

-

Premium Economy

-

Business

-

First Class

-

-

F&B Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Meal

-

Bakery & Confectionery

-

Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global in-flight catering services market size was estimated at USD 16.01 billion in 2022 and is expected to reach USD 18.47 billion in 2023.

b. The global in-flight catering services market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 27.62 billion by 2030

b. Based on Airlines segment, the market is segmented into Large airlines, medium airlines and small airlines. The large airlines segment dominated the in-flight catering services market in 2022 and accounted for a revenue share of over 64.5%.

b. Some key players operating in the in-flight catering services market includes ANA Catering Services Co. Ltd, DNATA, DO & CO., Emirates Flight Catering, Flying Food Group, LLC, Newrest International Group, SATS Ltd and Gate Group (Gate gourmet)

b. Key factors that are driving the in-flight catering services market growth include rise in long-haul and non-stop flights, rise in long-haul and non-stop flights and rise in passenger willingness to pay a premium price for high-quality and healthy food.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.