- Home

- »

- Next Generation Technologies

- »

-

In-vehicle Payment Services Market Size, Share Report 2030GVR Report cover

![In-vehicle Payment Services Market Size, Share & Trends Report]()

In-vehicle Payment Services Market Size, Share & Trends Analysis Report By Mode Of Payment (NFC, QR Code/RFID, App/E-wallet, Credit/Debit Card), By Application (Parking, Shopping, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-072-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

In-vehicle Payment Services Market Trends

The global in-vehicle payment services market size was valued at USD 5.36 billion in 2022 and is expected to grow at a CAGR of 12.1% from 2023 to 2030. In-vehicle payment services allow drivers to order and pay for food, coffee, gasoline, groceries, parking slots, and tolls without having to step out of the vehicle. Advancements in the Internet of Things (IoT) technology and the efforts being pursued aggressively by various automakers to integrate new, advanced infotainment solutions in their vehicle models are expected to drive the growth of the market over the forecast period. The growing preference for contactless payment methods in the wake of the outbreak of the COVID-19 pandemic and continued innovations in smart vehicles also bode well for the growth of the market.

Various payment solution providers, including MasterCard, Visa, and PayPal, are partnering with automakers around the world to develop and integrate new payment processes and methods in vehicles. Several automobile manufacturers such as Volkswagen AG, Honda Motor Co. Ltd., and Ford Motor Co. have also developed in-vehicle payment solutions and platforms. The outbreak of the COVID-19 pandemic has taken a severe toll on the global economy. Supply chains were disrupted and manufacturing activities at several production facilities were suspended temporarily owing to the lockdowns and other restrictions imposed by various governments in different parts of the world as part of the efforts to contain the spread of coronavirus. Nevertheless, the social distancing norms being advocated by various governments and the growing preference among individuals for contactless payments to avoid any potential coronavirus exposure are expected to contribute to the growth of the market over the forecast period.

Automobile manufacturers are focusing on developing built-in systems, including voice-based controls, which can potentially allow drivers to shop while driving without compromising road safety norms. Given that a voice-activated dashboard can divert the driver’s attention, drivers have to always prioritize road safety if they are catering to their shopping needs while driving. A study conducted at the University of Utah has already revealed that speech-to-text technology can cause a high level of cognitive disruption since extra effort is required to chat with a dashboard rather than speaking to an individual. At this juncture, advances in self-driven and connected car technologies would play a vital role in driving the growth of the market over the forecast period.

The growing adoption of driver support systems is also projected to drive the growth of the in-vehicle payment services market over the forecast period. Driver support systems help drivers in various ways, including hassle-free parking and making purchases from the control panel without having to use any other devices or cards to complete the purchase.

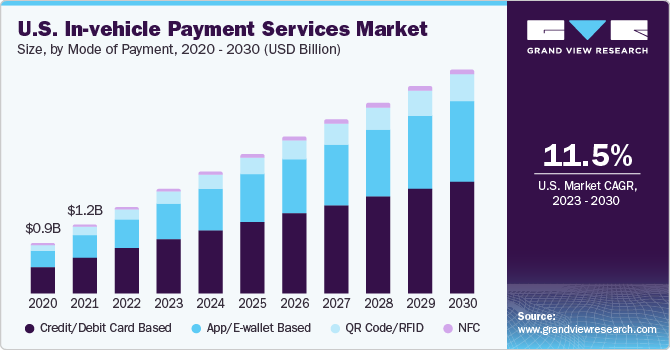

Mode of Payment Insights

The credit/debit card segment accounted for the largest market share of 53.2% in 2022. Debit cards and credit cards remain the most popular payment modes and are used extensively to make contact and contactless payments. The growing preference for card and cardless transactions and post cash transactions among individuals belonging to various age groups is expected to contribute to the growth of the market over the forecast period.

The app/e-wallet segment is estimated to register the fastest CAGR of 13.1% from 2023 to 2030. The rising popularity of digital payment methods and the convenience and ease associated with wallet payments are particularly encouraging individuals to adopt in-vehicle payment services, thereby contributing to the growth of the market. As such, several apps or wallets, including Amazon Pay, Google Pay, AliPay, Apple Pay, Venmo, and Samsung Pay, among others, are being widely used for making payments. Meanwhile, Amazon and Google have linked their intelligent virtual assistants to their respective payment portals and e-wallets as part of the efforts to help consumers in shopping and making payments interactively.

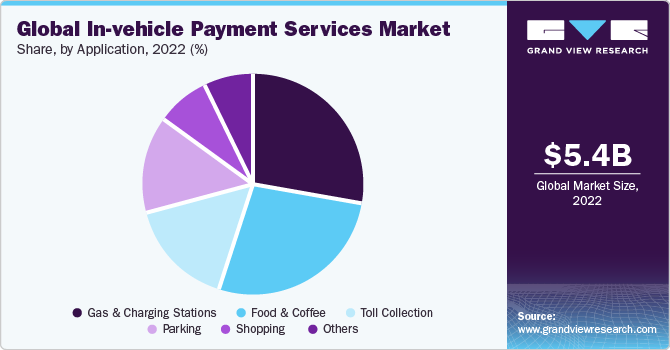

Application Insights

The gas & charging station segment accounted for a significant revenue share of around 27.5% in 2022. This is attributed to the increasing adoption of electric vehicles (EVs), the growing popularity of contactless payments, and the increasing availability of in-vehicle payment technology. Connected cars, new payment technologies, and increasing competition among payment providers are also driving the growth of this market.

The parking segment is projected to register the fastest CAGR of 14.3% from 2023 to 2030. The growing number of passenger and commercial vehicles is particularly expected to contribute to the growth of the parking segment over the forecast period. The data published by OICA revealed that the sales of commercial vehicles in China increased 18.7% over the year in 2020. The increasing number of passenger and commercial vehicles drives the demand for parking spaces. Adapting in-vehicle payment services in the parking spaces will assist in reducing long queues at these spaces.

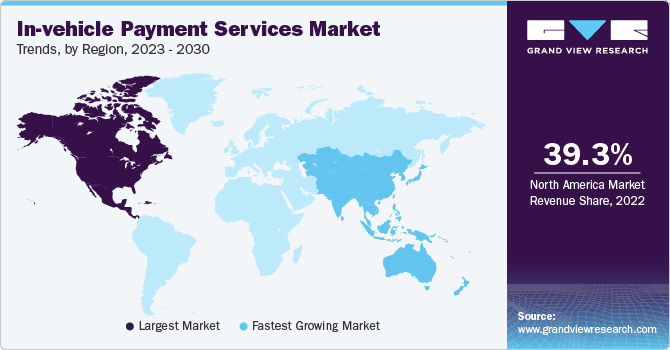

Regional Insights

North America accounted for a market share of around 39.3% in 2022. The region has the maximum penetration of connected cars. Moreover, technology companies, including Apple Inc. and Google Inc., which are based in North America, have also entered the automotive market with their capabilities to innovate and compete with the automotive companies.

The Asia Pacific regional market is projected to register the highest CAGR of 13.4% from 2022 to 2030. The growing population and the rising levels of disposable income are expected to contribute to the growth. Adoption of the latest, advanced technologies and continued innovations in the way payments are made and processed would also play a vital role in driving growth over the forecast period.

Key Companies & Market Share Insights

The leading players in the market are undertaking strategies such as product developments, mergers and acquisitions, strategic partnerships, and business expansions to maintain their stronghold on the market. For instance, in June 2023, Mercedes-Benz launched Mercedes Pay, a new service that allows customers in the U.S. to use their vehicles as a device for booking and paying for off-street parking. Mercedes Pay is integrated with the Mercedes-Benz User Experience (MBUX) infotainment system, which allows drivers to find and book parking spaces, and then automatically pay for them when they arrive.

Key In-vehicle Payment Services Companies:

- BMW AG

- Daimler AG

- Ford Motor Co.

- General Motors Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Jaguar Land Rover Automotive PLC

- Volkswagen AG

- ZF Friedrichshafen AG

- Amazon

- Visa

- MasterCard

- PayPal

Recent Developments

-

In July 2023,Car IQ, a provider of vehicle management systems, collaborated with Visa to introduce a vehicle wallet that allows drivers to make payments directly to Visa network shops and banks. Car IQ pay vehicle wallet can be used to make payments for fuel, tolls, parking, insurance, service, and repairs.

-

In January 2020, Amazon stated that customers can now use Amazon Alexa for fuel payment at all 11,500 Exxon and Mobil stations in the U.S. The transaction is to be conducted by Amazon Pay and powered by Fiserv, a financial services technology provider.

In-vehicle Payment Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.50 billion

Revenue forecast in 2030

USD 14.43 billion

Growth Rate

CAGR of 12.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of payment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

BMW AG; Daimler AG; Ford Motor Co.; General Motors Co.; Honda Motor Co. Ltd.; Hyundai Motor Co.; Jaguar Land Rover Automotive PLC; Volkswagen AG; ZF Friedrichshafen AG; Google; Amazon; Visa; MasterCard: PayPal

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

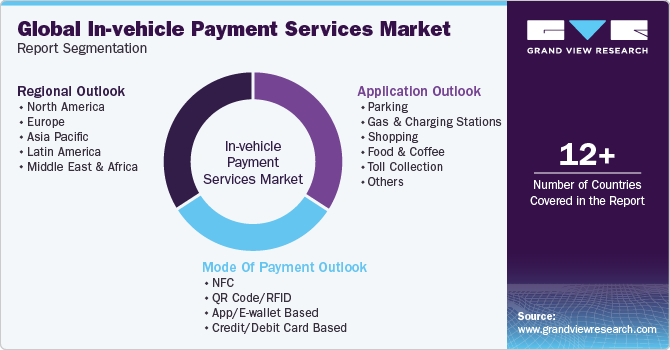

Global In-vehicle Payment Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-vehicle payment services market based on mode of payment, application, and region:

-

Mode Of Payment Outlook (Revenue, USD Million, 2018 - 2030)

-

NFC

-

QR Code/RFID

-

App/E-wallet Based

-

Credit/Debit Card Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Parking

-

Gas & Charging Stations

-

Shopping

-

Food & Coffee

-

Toll Collection

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global in-vehicle payment services market is expected to grow at a compound annual growth rate of 12.1% from 2023 to 2030 to reach USD 14.43 billion by 2030.

b. Some key players operating in the in-vehicle payment services market include Honda Motor Co. Ltd., Ford Motor Co., Volkswagen AG, General Motors Co., among others.

b. Key factors that are driving the in-vehicle payment services market growth include increasing trends of contactless payment post-COVID outbreak, growing customer base to achieve convenience in vehicles, and growing technology innovation.

b. The global in-vehicle payment services market size was estimated at USD 5.36 billion in 2022 and is expected to reach USD 6.49 billion in 2023.

b. North America dominated the in-vehicle payment services market with a share of 39.3% in 2022. This is attributable to the highest penetration of connected cars.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."