- Home

- »

- Clinical Diagnostics

- »

-

In Vitro Diagnostics Quality Control Market Size Report, 2030GVR Report cover

![In Vitro Diagnostics Quality Control Market Size, Share & Trends Report]()

In Vitro Diagnostics Quality Control Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Controls, Calibrators), By Type (Quality Control, Quality Assurance Services), By Application, By Manufacturer Type, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-925-8

- Number of Report Pages: 185

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In Vitro Diagnostics Quality Control Market Summary

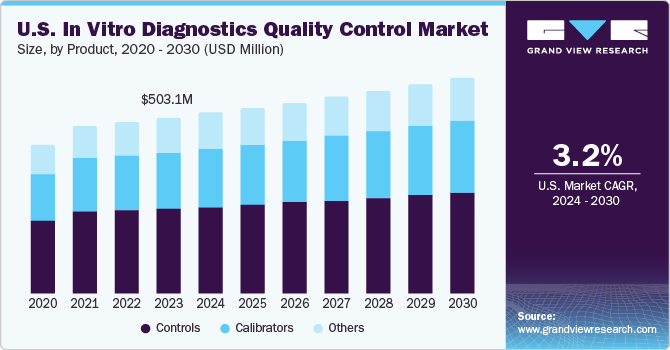

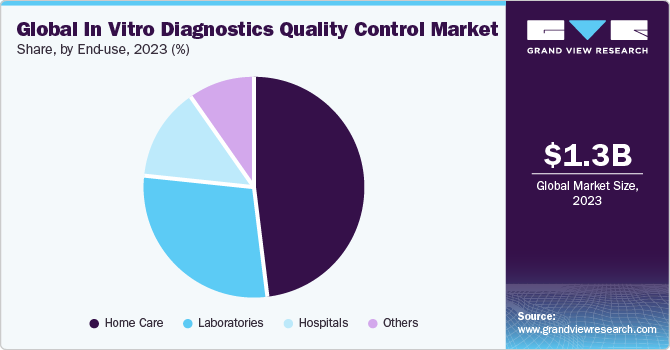

The global in vitro diagnostics quality control market size was estimated at USD 1.28 billion in 2023 and is projected to reach USD 1.59 billion by 2030, growing at a CAGR of 3.2% from 2024 to 2030. The increase in the number of certified clinical laboratories that offer dependable IVD-based diagnostic services lead to the increase in patient confidence, which is driving demand in the market.

Key Market Trends & Insights

- North America in vitro diagnostics quality control market dominated and accounted for a 47.1% share in 2023.

- The U.S. in vitro diagnostics quality control market accounted for a significant share of the global market in 2023.

- By product, the controls segment dominated the market, accounting for a 48.3% share in 2023.

- By type, the quality controls segment held the largest market revenue share in 2023.

- By application, the immunochemistry segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.28 Billion

- 2030 Projected Market Size: USD 1.59 Billion

- CAGR (2024-2030): 3.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Some of the key pathogens routinely diagnosed using multiplex PCR are HIV, HSV (meningitis & encephalitis), H. influenza, S. pneumonia (respiratory tract infections), N. gonorrhea, C. trachoma (genital infections), G. lambardia, C. parvum (diarrheal diseases), and Leishmania spp. (Leishmaniasis).

In addition to assessments, amendments to the regulatory framework are made intermittently to enhance the present standards with the primary objective of safeguarding the qualitative superiority of the diagnostic services rendered to patients. Due to the high prevalence of diseases such as diabetes, cardiovascular diseases, and infectious diseases, the demand for diagnostic laboratories has increased. Many private and public laboratories undergo laboratory accreditation procedures to meet industry standards, increase their procedure volume, and attract more patients. The increasing number of laboratories is anticipated to increase the demand for IVD Quality Control (QC) products across the globe. Laboratories accredited by CLIA are eligible for reimbursement through Medicare and Medicaid services.

The American Clinical Laboratory Association stated that more than 7 billion lab tests are performed in the U.S. annually, and 80% of clinical decisions are taken after laboratory testing. As per the information published by the International Diabetes Federation (IDF), in 2021, approximately 537 million people worldwide had diabetes, and this number is expected to reach around 643 million by 2030 and 783 million by 2045. The increasing number of service providers and rising demand for clinical diagnostic tests are leading to an increase in the usage of IVD QC products.

Third-party QC services in in vitro diagnostics are gaining popularity across the globe. Third-party QC service providers offer a superior solution to test IVD procedures accurately. QC material closely mirrors the performance of IVD tests and provides an unbiased assessment of analytical performance across multiple test systems that helps clinical laboratories maintain the safety and accuracy of their IVD tests. Moreover, many laboratories are opting for third-party QC services such as the International Organization for Standardization recognizes such controls.

The regulatory bodies monitoring QC and regular quality checks of IVD devices & service providers include the FDA for the U.S.; the Medicines and Healthcare Products Regulatory Agency (MHRA) for the UK; the Therapeutic Goods Administration (TGA) for Australia; Central Drug Standard Control Organization (CDSCO) for India; Health Canada for Canada; European Medicines Agency (EMEA) for Europe; Ministry of Health, Labour & Welfare(MHLW) for Japan; Brazilian Health Regulatory Agency (ANVISA) for Brazil; and Ministry of Health for South Africa. Moreover, according to the International Laboratory Accreditation Cooperation (ILAC) report, in 2022, the ILAC MRA Signatories accredited more than 88,000 laboratories, 650 proficiency testing providers, and over 260 reference material producers across the globe.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. Industry players are involved in the development of novel products to increase their market share across the globe. For instance, in January 2024, Fortress Diagnostics introduced Serum Indices to aid in monitoring the detection of lipemia, icterus, and hemolysis in specimens.

The in vitro diagnostics quality control industry is characterized by the leading player's high merger and acquisition (M&A) activity.This is due to several factors, such as strategic expansion initiatives and the pursuit of partnerships to enhance market competitiveness. For instance, in August 2023, Danaher announced the acquisition of Abcam Limited to strengthen its portfolio of biomarkers, antibodies, reagents, and assays for life science applications. The company would pay around USD 5.7 billion to buy Abcam Limited.

The in vitro diagnostics quality control industry is subject to increasing regulatory scrutiny. Moreover, Global Harmonization Task Force (GHTF) regulatory authorities, such as the U.S. FDA, are encouraging the convergence of regulatory systems for medical devices, which is anticipated to promote trade while protecting public health through regulatory means.

Moreover, AABB, American Association for Laboratory Accreditation; Accreditation Commission for Health Care, Inc. (ACHC); American Society for Histocompatibility and Immunogenetics; COLA; College of American Pathologists; and Joint Commission are key organizations under CLIA providing accreditation to clinical laboratories in the U.S. Similarly, in India, NABL accreditation offers rights to a laboratory to perform diagnostic tests and get international recognition & acceptance. Currently, there are more than 2,500 NABL-accredited testing laboratories in India.

Key industry players are adopting regional expansion of IVD quality control market strategies to increase their geographic presence in different parts of the world. For instance, in January 2024, QIAGEN announced the opening of its regional headquarters in Saudi Arabia and signed an MoU with the Saudi Arabian government to support public health initiatives.

Product Insights

The controlssegment dominated the market, accounting for a 48.3% share in 2023. Controls are essential components within the in vitro diagnostics quality control industry that ensure the accuracy, reliability, and consistency of diagnostic tests conducted in clinical laboratories & healthcare settings. The rising occurrence of chronic illnesses and the heightened need for precise diagnostic examinations contribute to the expanding market for controls. The United Health Foundation’s 2023 report on America’s Health Rankings stated that diabetes affects approximately 11.5% of U.S. adults, impacting almost 31.9 million individuals.

The calibrators segment is anticipated to register the fastest CAGR during the forecast period. Calibrators are reference materials with known concentrations of analytes used to standardize and calibrate diagnostic assays. They serve as reference points for establishing the relationship between the signal produced by the assay and the analyte concentration in patient samples. Laboratories calibrate their diagnostic instruments and assays using calibrators to ensure accurate and reproducible measurements of analytes.

In addition, calibration involves comparing the instrument's response to known concentrations of the analyte provided by the calibrator, enabling the conversion of raw instrument signals into quantitative results. For instance, Calibration Verification and Linearity (CVL) programs are conducted by the College of American Pathologists (CAP), which assist laboratories in fulfilling different requirements given for verification of the Analytical Measurement Range (AMR) and scheduled calibration verification as defined in the CAP Laboratory Accreditation Program and the Current Clinical Laboratory Improvement Amendments (CLIA) Regulations Section 493.1255 for most analytes. The CAP's CVL Program delivers laboratories with high-quality surveys to ensure test results' accuracy.

Type Insights

The quality controls segment held the largest market revenue share in 2023 & is anticipated to register the fastest CAGR over the forecast period. Quality control ensures that diagnostic tests are validated, and the results are reliable, enabling healthcare providers to make informed decisions about patient care. This is particularly important for older people, who often face multiple chronic conditions and require precise diagnostic information to manage their health effectively. The aging population worldwide is prone to age-related chronic conditions and diseases, leading to a higher demand for diagnostic testing services. Quality control measures ensure the accuracy and reliability of diagnostic tests, particularly in the elderly population, where timely and accurate diagnosis is crucial for effective disease management and improved patient outcomes.

The data management solutions segment is expected to grow significantly over the forecast period. Data management solutions facilitate seamless integration and connectivity between various diagnostic instruments, Laboratory Information Systems (LIS), and data management platforms. These solutions enable the interoperability of disparate systems, allowing for the automated transfer of data between instruments and software applications. This integration and connectivity streamline workflow processes, reduce manual data entry errors, and improve operational efficiency in diagnostic laboratories. For instance, the medical diagnostic data management system revolves around a centralized database called a Single Source of Truth, housing all pertinent information on the laboratory's available analyses.

Application Insights

The immunochemistry segment held the largest market revenue share in 2023. Immunochemistry assays offer high sensitivity and specificity, making them suitable for the precise measurement of analytes present in low concentrations. This accuracy is crucial for diagnostic decision-making and patient management. Ongoing advancements in immunochemistry technologies have led to the development of automated and high-throughput immunoassay platforms. These platforms offer improved workflow efficiency, reduced turnaround times, and enhanced analytical performance. For instance, the popularity of Lateral Flow Immunoassay (LFIA) platforms is increasing, especially in healthcare facilities with limited budgets and time constraints and in household settings for individual health monitoring.

The clinical chemistry segment is anticipated to register the fastest CAGR during the forecast period. Clinical chemistry involves the analysis of biochemical components present in bodily fluids such as blood, serum, plasma, and urine. It encompasses the measurement of various analytes, including glucose, electrolytes, enzymes, proteins, lipids, hormones, and drugs. In February 2024, Beckman Coulter introduced its new DxC 500 AU chemistry analyzer at the Medlab Middle East event in Dubai. This analyzer is designed to cater to the needs of healthcare systems by offering comprehensive clinical chemistry testing capabilities, particularly for satellite and independent hospital laboratories. The launch of such products is expected to add to the segmental growth over the forecast period.

Manufacturer Type Insights

The third-party controls segment held the largest market revenue share in 2023. Third-party controls help standardize diagnostic testing procedures across different laboratories and testing platforms. Since these controls are manufactured independently of specific diagnostic systems, they can be used as universal references for ensuring consistent performance across different testing environments. Third-party controls are vital in standardizing diagnostic testing procedures across laboratories and testing platforms by providing universal references for consistent performance.

The OEM controls segment is anticipated to register the fastest CAGR during the forecast period. OEM controls are modified to the specifications and performance characteristics of specific diagnostic instruments or testing systems. A focus on customization, flexibility, and the integration of high-volume solutions characterizes the latest advancements in OEM control automation. These advancements enhance efficiency, flexibility, and integration in laboratory and diagnostic systems. For instance, an article from Control Design in April 2023 emphasized the importance of OEMs being in sync with factories' control architectures. This synchronization is crucial for ensuring that the automation and control systems designed and built by OEMs are compatible with the existing infrastructure and requirements of the factories. The choice of platform, from PLCs and PACs to PC-based control and CNC, is typically dictated by the technical expertise and experience of the control engineers. This highlights the role of OEM controls in facilitating the integration of automation and control solutions into existing production lines.

End-use Insights

The home care segment held the largest market revenue share in 2023. Home care involves point-of-care testing (POCT), where diagnostic tests are conducted outside traditional laboratory settings, often in patients’ homes or community settings. POCT devices enable individuals to perform tests themselves or with minimal assistance, providing rapid results for immediate decision-making. According to an Oxford University Press article published in April 2021, their study exploring the use of POCT in managing CKD at home emphasized the importance of POCT in non-dialysis-dependent CKD patients who are at risk of or may already be suffering from various complications associated with CKD.

The hospital segment is anticipated to register the fastest CAGR during the forecast period. Hospitals implement rigorous quality assurance measures to ensure the accuracy and reliability of diagnostic test results. This includes adherence to standardized protocols, regular proficiency testing, and continuous monitoring of equipment and procedures. Hospitals are making significant advancements in diagnostics to improve patient care. According to a study published in NCBI in October 2022, integrating sensors in hospital-based care transformed diagnostic medicine significantly. Digital image sensor technologies are widely embraced to give medical professionals comprehensive insights into each patient’s health status. These sensors empower doctors to identify areas of damage or abnormalities, execute microsurgical procedures with precision, and evaluate the outcomes of interventions.

Regional Insights

North America's in vitro diagnostics quality control market dominated and accounted for a 47.1% share in 2023. This large share can be attributed to the increasing healthcare expenditure, a well-established healthcare system, and the clinical diagnostics industry in the U.S., which has created a significant demand for internal & external quality control solutions for clinical and research purposes. In addition, continuous advancements in the field of IVD and high affordability & adoption of innovative and advanced diagnostic systems & solutions in the region make it an attractive market globally.

U.S. In Vitro Diagnostics Quality Control Market Trends

The U.S. in vitro diagnostics quality control market accounted for a significant share of the global market in 2023. The high prevalence of targeted diseases such as cancer, infectious diseases, and cardiovascular diseases is increasing the demand for testing solutions, further driving the IVD quality control market. According to the American Cancer Society’s estimates, in 2022, around 1.9 million new cases of cancer are estimated to be diagnosed in the U.S., which is expected to lead to around 609,360 deaths. In addition, during the COVID‐19 outbreak, several U.S.-based companies were involved in extensive R&D of novel diagnostic tests. Thus, there is a high demand for quality control in diagnostics.

Europe In Vitro Diagnostics Quality Control Market Trends

The Europe in vitro diagnostics quality control market is expected to grow significantly over the forecast period. The growth of the European IVD quality control market can primarily be attributed to the increasing demand for quality control products in European countries with flourishing clinical diagnostic industries, such as Germany, the UK, and Italy. Moreover, continuous research initiatives being undertaken by European manufacturers for the development of new and innovative diagnostic solutions are anticipated to create lucrative opportunities for players offering IVD quality control products.

In vitro diagnostics quality control market in UK is expected to show lucrative growth in the coming years. The presence of sophisticated healthcare infrastructure, collaborations between key market players, and the launch of novel products are anticipated to contribute to market growth in the UK. For instance, in January 2024, a UK-based company, Fortress Diagnostics, introduced serum indices to aid in monitoring instruments detecting lipemia, icterus, and hemolysis in samples. Moreover, government support & initiatives are expected to further propel the country’s market growth in the coming years. Increasing commercial partnerships between the government and key players to improve diagnostic services in the country are propelling market growth.

France in vitro diagnostics quality control market is expected to grow over the forecast period. The market is driven by the increasing prevalence of targeted diseases, technological advancements, and the growing adoption of quality control to monitor the accuracy of marketed tests in the country. Growing cases of cancer, infectious diseases, & other medical conditions and increasing initiatives undertaken by market players & government bodies are expected to boost the IVD quality control market growth. In France, there are around 100 companies involved in manufacturing IVD products. These companies include several major global manufacturers and many SMEs, producing 7,000 out of 40,000 in vitro devices in Europe.

In vitro diagnostics quality control market in Germany held a substantial market share in 2023. Germany is one of the major markets in Europe, owing to its established clinical diagnostics industry, increasing R&D activities to develop novel testing methods, and high prevalence of chronic diseases, such as cancer & diabetes. According to GLOBOCAN, in 2022, the prevalence of cancer was 1.88 million, and around 605,805 new cases of cancer were diagnosed in Germany. Increasing awareness among people about early diagnosis and stringent regulations related to the safety and accuracy of diagnostic tests are anticipated to drive the demand for IVD quality control in the country.

Asia Pacific In Vitro Diagnostics Quality Control Market Trends

The Asia Pacific market is expected to grow fastest during the forecast period. Asia Pacific portrays a high potential for this market due to the increasing number of companies involved in manufacturing IVDs and IVD quality control products. Moreover, a rise in awareness for early and precise diagnosis fosters the demand for IVDs. For instance, the Asia Pacific Federation of Clinical Biochemistry and Laboratory Medicine (APFCB) promotes awareness about the use of IVDs through several committees. Moreover, regulatory authorities at a country level, such as the Ministry of Health, Labor and Welfare (MHLW), the Pharmaceuticals and Medical Devices Evaluation Agency (PMDA), the National Medical Products Administration (NMPA), the Central Drugs Standard Control Organization (CDSCO), and others, are undertaking favorable initiatives to increase the market penetration of IVD and IVD quality control products.

China In Vitro Diagnostics Quality Control Market held a substantial market share in 2023. China's IVD quality control market is expected to grow at a lucrative rate during the forecast period. This fast growth can be attributed to the high market potential, advancements in healthcare services, and increasing healthcare expenditure. According to a study published by the UK’s NHS, healthcare expenditure in China is projected to reach USD 25.2 billion by 2027, as the country has one of the largest populations in the world. In addition, the prevalence of chronic conditions, such as cancer, cardiovascular diseases, and infectious diseases, is increasing in China. These diseases are propelling the demand for improved, technologically advanced, accurate diagnostic tests that can help manage these conditions, increasing the need for reliable & precise laboratory tests.

In vitro diagnostics quality control market in Japan is expected to grow substantially over the forecast period. Japan is anticipated to account for a significant share of the Asia Pacific IVD quality control market, as it has one of the most developed healthcare markets in the region. Moreover, Japan is a rapidly aging Asian country. According to the World Economic Forum, around 25% of the country’s population is aged 65 years & above, and this is expected to increase to 40% by 2060. The growing geriatric population is anticipated to boost the demand for IVD and associated products for early-stage disease diagnosis with high accuracy.

Middle East & Africa In Vitro Diagnostics Quality Control Market Trends

The Middle East & Africa in vitro diagnostics quality control market is anticipated to grow over the forecast period, owing to the growing economic development, coupled with high unmet healthcare needs. The rate of diagnosis of diseases is low in the region. This has created major unmet needs for low-cost and efficient diagnostic tests and laboratories, which is expected to fuel the market over the coming years.

Saudi Arabia In Vitro Diagnostics Quality Control Market is expected to grow over the forecast period. Saudi Arabia’s IVD quality control market is expected to show poised growth over the forecast period. The increasing adoption rate of technologically advanced diagnostic devices is anticipated to drive the calibration and internal & external quality assurance needs for laboratories to maintain the safety and accuracy of IVD tests. Moreover, increased consumer demand due to the growing prevalence of chronic illnesses, a higher need for localized testing, a growing geriatric population, and technological advancements are expected to aid market growth over the forecast period. According to GLOBOCAN, 27,885 new cancer cases with 13,069 deaths were reported in Saudi Arabia. Among new cancer patients, 14,253 cases were reported in males, while 13,632 cases were in females.

Key In Vitro Diagnostics Quality Control Company Insights

Some of the key players operating in the market were Siemens Healthineers AG, Abbott, Bio-Rad Laboratories, and Danaher.

-

Siemens Healthineers AG provides healthcare solutions, such as diagnostics (in vitro and in vivo), imaging & therapy systems, clinical products, audiology solutions, and healthcare IT solutions. The company offers medical accessories, OEM component & medical electronics solutions, refurbished systems for medical imaging & therapy, and technical, maintenance, & professional & consulting services. Its products & solutions are used in various areas, including therapeutic drug monitoring cardiology, organ transplant, urology, infectious diseases, diabetes, women’s health, surgery, oncology, neurology, and growth disorders.

-

Abbott is a healthcare and pharmaceutical company that operates in four core business segments: pharmaceuticals, medical devices, nutritional products, and diagnostics. The company has a presence in more than 160 countries through research, manufacturing, sales, and distribution facilities. Abbott is one of the global leaders in clinical diagnostics, consisting of clinical chemistry, molecular diagnostics, and hematology, among others.

Key In Vitro Diagnostics Quality Control Companies:

The following are the leading companies in the in vitro diagnostics quality control market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers AG

- Abbott

- Bio-Rad Laboratories

- Danaher

- F. Hoffmann-La Roche Ltd

- Sysmex Corporation

- QuidelOrtho Corporation

- Randox Laboratories Ltd

- Helena Laboratories Corporation

- Thermo Fisher Scientific Inc

- SeraCare Life Sciences Inc

- BD

- Merck KGaA

- QIAGEN

- Hologic, Inc.

- Bio-Techne

- Fortress Diagnostics

- Microbiologics

- Trina Bio Reactive AG

- ConeBioproducts

- Biorex Diagnostics

Recent Developments

-

In November 2023, Merck KGaA launched ChemisTwin to analyze the sample’s purity, identification, and degradation of compounds through calibrated algorithm-based digital references.

-

In June 2023, Randox Laboratories Ltd acquired Cellix Limited to expand its market footprint in personalized medicine and improve preventative healthcare.

-

In May 2023, ZeptoMetrix launched PROtrol, a new line of quality control products for antigen-based diagnostics methods, such as the lateral flow immunoassay for infectious diseases.

-

In March 2023, SeraCare Life Sciences Inc. released Seraseq BRCA1/2 large genomic rearrangements reference materials to meet clinical laboratory testing needs for somatic and germline levels.

-

In January 2023, QIAGEN launched the EZ2 Connect MDx IVD platform for automated sampling in diagnostic laboratories.

In Vitro Diagnostics Quality Control Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 1.32 billion

Revenue forecast in 2030

USD 1.59 billion

Growth rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, manufacturer type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Siemens Healthineers AG; Abbott; Bio-Rad Laboratories; Danaher; F. Hoffmann-La Roche Ltd; Sysmex Corporation; QuidelOrtho Corporation; Randox Laboratories Ltd; Helena Laboratories Corporation; Thermo Fisher Scientific Inc; SeraCare Life Sciences Inc; BD; Merck KGaA; QIAGEN; Hologic; Inc.; Bio-Techne; Fortress Diagnostics; Microbiologics; Trina Bioreactives AG; ConeBioproducts; Biorex Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Customized purchase options are available to meet your exact research needs. Explore purchase options

Global In Vitro Diagnostics Quality Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. Grand View Research has segmented the global in vitro diagnostics quality control market report based on product, type, application, manufacturer type, end-use, & region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Controls

-

Total Protein

-

Albumin

-

Blood Urea Nitrogen

-

Uric Acid

-

Creatinine

-

Sodium

-

Potassium

-

Chloride

-

Calcium

-

Magnesium

-

Inorganic Phosphorus

-

Aspartate Transaminase

-

Creatine Kinase

-

Gamma Glutamyl transferase

-

Total Bilirubin

-

Glucose

-

Iron

-

Alanine Transaminase

-

Alkaline Phosphatase

-

Alpha-Amylase

-

Total Cholesterol

-

Triglyceride

-

Lactate Dehydrogenase

-

Immunoglobulin G

-

Immunoglobulin A

-

Immunoglobulin M

-

Complement 3

-

Complement 4

-

C-Reactive Protein

-

Rheumatoid Factor

-

Anti-Streptolysin -O

-

Beta 2 Mi

-

Cystatin-C

-

Myoglobin

-

Troponin T and I

-

Others

-

Calibrators

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Quality Controls

-

Plasma-based Control

-

Serum-based Control

-

Whole blood-based Control

-

Others

-

Quality Assurance Services

-

Data Management Solutions

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunochemistry

-

Hematology

-

Clinical Chemistry

-

Alkaline Phosphatase (ALP)

-

Alanine Transaminase (ALT)

-

Aspartate Transaminase (AST)

-

Creatine Kinase MB (CK-MB)

-

Albumin

-

Creatinine

-

Glucose

-

Triglycerides

-

Amylase

-

Others

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

-

Manufacturer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Third-Party Controls

-

Independent Controls

-

Instrument Specific Controls

-

OEM Controls

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Home Care

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global in vitro diagnostics quality control market size was estimated at USD 1.28 billion in 2023 and is expected to reach USD 1.32 billion in 2024.

b. The global in vitro diagnostics quality control market is expected to grow at a compound annual growth rate of 3.17% from 2024 to 2030 to reach USD 1.59 billion by 2030.

b. Quality Control dominated the IVD quality control market with a share of 45.07% in 2023. This is attributable to the high usage of QC in monitoring work processes, detecting problems, and making corrections prior to delivery of products or services. Statistical QC is a major procedure for monitoring the analytical performance of clinical laboratory testing processes.

b. Some key players operating in the IVD quality control market include Siemens Healthineers AG, Abbott, Bio-Rad Laboratories, Inc., Danaher, F. Hoffmann-La Roche Ltd, Sysmex Corporation, QuidelOrtho Corporation, Randox Laboratories Ltd, Thermo Fisher Scientific Inc, Merck KGaA, QIAGEN, and Hologic, Inc.

b. Key factors that are driving the market growth include the increasing number of accredited clinical laboratories worldwide, aided with the increasing third party quality control services, and the presence of favorable regulatory bodies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.