- Home

- »

- Automotive & Transportation

- »

-

Inbound Logistics Market Size, Share, Industry Report, 2030GVR Report cover

![Inbound Logistics Market Size, Share & Trends Report]()

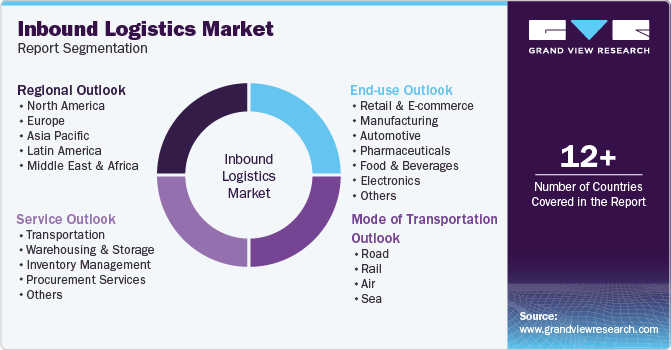

Inbound Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Service, By Mode of Transportation (Road, Rail, Air, Sea), By End Use (Retail & e-commerce, Manufacturing, Automotive, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-510-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inbound Logistics Market Summary

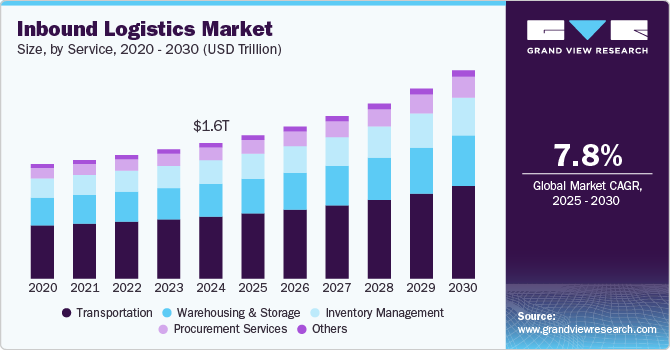

The global inbound logistics market size was estimated at USD 1,569.27 billion in 2024 and is projected to reach USD 2,410.55 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. The globalization of supply chains drives growth of the inbound logistics market. As businesses expand their operations across borders, the complexity of managing inbound logistics has increased.

Key Market Trends & Insights

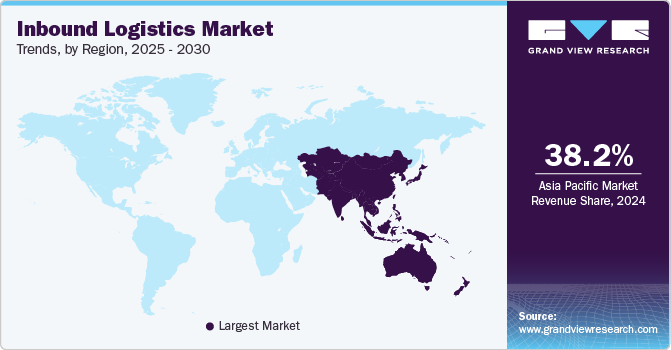

- The Asia Pacific inbound logistics market is anticipated to grow at a CAGR of 8.9% during the forecast period.

- The U.S. inbound logistics market held a dominant position in 2024.

- By service, the transportation segment accounted for the largest share of 45.7% in 2024.

- By mode of transportation, the road segment held the largest market share in 2024.

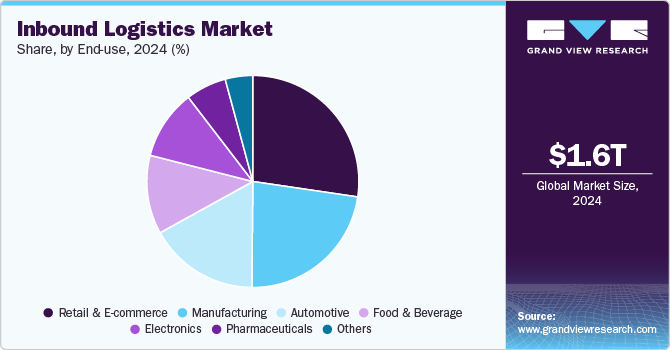

- By end use, the retail & e-commerce segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,569.27 Billion

- 2030 Projected Market Size: USD 2,410.55 Billion

- CAGR (2025-2030): 7.8%

- Asia Pacific: Largest market in 2024

Globalization has led to a surge in cross-border trade and sourcing, requiring sophisticated logistics solutions to manage international suppliers and ensure timely delivery of raw materials. The need to navigate diverse regulatory requirements, customs clearance, and international shipping schedules has spurred the demand for specialized inbound logistics services, contributing to market growth.Moreover, organizations are under constant pressure to optimize costs while maintaining high service levels. Inbound logistics plays a critical role in achieving cost efficiency by minimizing transportation and storage costs. Strategies such as consolidating shipments, improving supplier collaboration, and adopting just-in-time (JIT) inventory practices help businesses reduce waste and overheads. The rising emphasis on cost-saving measures has driven companies to invest in robust inbound logistics systems, boosting market growth.

The rapid expansion of e-commerce and omnichannel retail has amplified the importance of efficient inbound logistics. Retailers and manufacturers must ensure that raw materials and inventory are consistently available to meet fluctuating customer demands. The need for faster replenishment cycles and seamless supplier integration has driven investment in advanced inbound logistics solutions, enabling businesses to keep pace with consumer expectations.

The growing awareness of environmental issues has led companies to prioritize sustainable logistics practices. Inbound logistics is increasingly focusing on reducing carbon footprints by adopting eco-friendly transportation modes, optimizing delivery routes, and utilizing energy-efficient warehouses. Governments and regulatory bodies worldwide are also promoting green logistics through incentives and stricter environmental regulations. This trend is encouraging businesses to adopt sustainable inbound logistics practices, which further propelling the inbound logistics industry.

In addition, the integration of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and big data analytics has transformed inbound logistics. These technologies enable real-time tracking, predictive analytics, and optimized route planning, which improve operational efficiency and reduce lead times. Companies are increasingly leveraging digital platforms to automate processes such as inventory management, order tracking, and supplier coordination, enhancing transparency and reducing errors.

Service Insights

The transportation service segment accounted for the largest share of 45.7% in 2024. The increasing trend of global sourcing and the complexity of international supply chains have placed greater emphasis on transportation services in inbound logistics. As companies source raw materials and products from different parts of the world, they need reliable and efficient transportation services to manage long-distance shipments, customs clearance, and multiple delivery points. This growth in global trade and cross-border logistics has amplified the need for specialized transportation services that can navigate international regulations, optimize shipping schedules, and manage various modes of transport, such as ocean freight, air cargo, and land transportation.

The procurement services segment is expected to grow at a significant CAGR during the forecast period. The growing demand among companies to reduce costs while ensuring quality and operational efficiency is driving the expansion of procurement services. Organizations are constantly seeking ways to reduce procurement costs, negotiate better contracts, and streamline supplier networks. Procurement services provide businesses with expertise in supplier selection, negotiation, and contract management, which helps them achieve significant cost savings.

Mode of Transportation Insights

The road segment held the largest market share in 2024. The flexibility offered by road transportation drives growth of the segment. Flexibility is particularly valuable in localized supply chains, where goods need to be transported quickly across short distances to meet the dynamic demands of manufacturing and retail operations. The ability to adjust routes and schedules quickly in response to changing needs or unexpected disruptions gives road transport a competitive edge.

The air segment is expected to register the fastest CAGR during the forecast period. The increasing demand for time sensitive deliveries fuels growth of the segment. As businesses strive to minimize inventory holding costs and operate with just-in-time (JIT) inventory systems, the need for fast, reliable transportation options has become more critical. Air transport offers the fastest mode of shipping, enabling businesses to receive critical raw materials, components, or products within a short time frame.

End Use Insights

The retail & e-commerce segment dominated the market in 2024. The rapid rise of e-commerce is fueling growth of the growth of inbound logistics in the retail industry. The increasing preference for online shopping, fueled by factors such as convenience, availability of a wide range of products, and price comparison, has led to a surge in demand for logistics services. As more businesses transition to e-commerce or expand their online presence, there is a greater need to optimize inbound logistics processes to handle increased order volumes, manage inventory efficiently, and ensure timely replenishment of stock.

The pharmaceuticals segment is projected to grow at a significant CAGR over the forecast period. The pharmaceutical industry has witnessed a significant shift towards biopharmaceuticals, including biologics, gene therapies, and personalized medicines. These products often require highly specialized raw materials and advanced manufacturing processes that are distinct from traditional pharmaceutical production. The logistics of these biopharmaceuticals are more complex due to the unique requirements of ingredients and the production process. As the demand for biopharmaceuticals rises, so does the need for specialized inbound logistics services that can handle these unique materials, including the management of time-sensitive deliveries, temperature control, and regulatory compliance.

Regional Insights

The North America inbound logistics market held a significant share in 2024. It has invested heavily in transportation infrastructure, including roads, railways, ports, and airports. These improvements have facilitated smoother and faster transportation of goods, reducing lead times and costs. The strategic location of logistics hubs and distribution centers near major transportation corridors has also contributed to the growth of inbound logistics by optimizing supply chain networks.

U.S. Inbound Logistics Market Trends

The U.S. inbound logistics market held a dominant position in 2024 due to the technological advancement in supply chain management. The adoption of advanced technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), has enhanced the efficiency of inbound logistics operations. IoT-enabled sensors provide real-time tracking of shipments, while AI-powered systems optimize routing and scheduling for deliveries.

Europe Inbound Logistics Industry Trends

The Europe inbound logistics market was identified as a lucrative region in 2024. Companies in the region are increasingly adopting sustainable inbound logistics strategies, such as utilizing electric and hybrid vehicles, optimizing delivery routes to minimize fuel consumption, and consolidating shipments to reduce carbon footprints. This shift towards sustainability and green logistics favors growth of the inbound logistics market.

The UK inbound logistics industry is expected to grow rapidly in the coming years due to the adoption of circular economy practices. Organizations are increasingly focusing on reverse logistics to manage the flow of returned or recycled materials back into the supply chain. This shift not only supports sustainability goals but also requires more sophisticated inbound logistics networks to handle the complexity of managing returns.

The Germany inbound logistics market held a substantial market share in 2024 owing to the presence of a robust automotive industry in Germany is a significant driver for the growth of the inbound logistics market. As home to globally renowned automotive manufacturers such as Volkswagen, BMW, Mercedes-Benz, and Audi, Germany is a key player in the global automotive supply chain. These companies rely heavily on efficient inbound logistics to ensure the timely delivery of raw materials, components, and subassemblies needed for vehicle production.

Asia Pacific Inbound Logistics Industry Trends

The Asia Pacific inbound logistics market is anticipated to grow at a CAGR of 8.9% during the forecast period. The rapid growth of e-commerce in the region has heightened the need for efficient inbound logistics to support inventory replenishment and faster delivery times. Retailers and distribution centers are prioritizing just-in-time (JIT) inventory systems and same-day delivery services, which require reliable and well-coordinated inbound logistics operations.

The Japan inbound logistics industry is expected to grow rapidly in the coming years due to its geographic location and status as a key player in the international trade enhance its inbound logistics market. The country’s well-developed port infrastructure, including major ports such as Yokohama, Kobe, and Tokyo, facilitates the efficient import of raw materials and goods.

The China inbound logistics market held a substantial market share in 2024 owing to its position as the world’s manufacturing hub. It produces a significant share of global goods across industries like electronics, textiles, automotive, and machinery. These industries rely heavily on inbound logistics to source raw materials, components, and semi-finished goods from domestic and international suppliers.

Key Inbound Logistics Company Insights

Some of the key companies in the inbound logistics market include CEVA Logistics, Kuehne+Nagel, Ryder System, Inc., Nippon Express, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

CEVA Logistics is a logistics and supply chain management company specializing in freight management and contract logistics. It has operations in over 160 countries with a workforce of more than 110,000 employees. CEVA Logistics focuses on optimizing supply chain processes by providing tailored solutions that enhance efficiency and reduce costs for its clients. The company leverages its extensive global network and advanced technology to manage the flow of goods from suppliers to manufacturers, ensuring timely delivery and inventory management.

-

Kuehne+Nagel is a logistics provider and specializes in a comprehensive range of services, including sea logistics, air logistics, road logistics, and contract logistics. It focuses on optimizing supply chain processes for its clients by offering tailored solutions that enhance efficiency and reduce costs. With nearly 1,300 offices across over 100 countries and a workforce of approximately 79,000 employees, the company leverages its extensive network and advanced technology to manage the flow of goods from suppliers to manufacturers.

Key Inbound Logistics Companies:

The following are the leading companies in the inbound logistics market. These companies collectively hold the largest market share and dictate industry trends.

- CEVA Logistics

- Kuehne+Nagel

- XPO, Inc.

- DB SCHENKER

- United Parcel Service of America, Inc.

- FedEx

- Ryder System, Inc.

- Expeditors International of Washington, Inc.

- Nippon Express

- GEODIS

Recent Developments

-

In September 2024, Delhivery announced a strategic collaboration with Teamglobal Logistics aimed at enhancing ocean freight services, with a strong focus on both inbound and outbound logistics. This collaboration will expand Delhivery's Less than Container Load (LCL) service to over 120 countries. At the same time, Teamglobal will benefit from Delhivery's extensive inland logistics network, which covers more than 18,700 pin codes across India.

-

In May 2024, Allcargo Logistics' subsidiary, ECU Worldwide, partnered with ShipBob to enhance global freight services, particularly focusing on ocean and air freight. This collaboration will integrate ECU Worldwide's extensive logistics capabilities into ShipBob's FreightBob program, which is designed for end-to-end managed freight and inventory distribution. Through this partnership, ECU Worldwide will provide its services to ShipBob's receiving hubs and fulfillment centers across key markets, including the U.S., Europe, Canada, and Australia. The alliance aims to streamline the inbound flow of inventory from suppliers, allowing ShipBob's clients to benefit from comprehensive distribution solutions that improve efficiency in managing e-commerce inventory.

Inbound Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,656.84 billion

Revenue forecast in 2030

USD 2,410.55 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, mode of transportation, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

CEVA Logistics; Kuehne+Nagel; XPO, Inc.; DB SCHENKER; United Parcel Service of America, Inc.; FedEx; Ryder System, Inc.; Expeditors International of Washington, Inc.; Nippon Express; GEODIS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inbound Logistics Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inbound logistics market report based on service, mode of transportation, end use, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Warehousing and Storage

-

Inventory Management

-

Procurement Services

-

Others

-

-

Mode of Transportation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Road

-

Rail

-

Air

-

Sea

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail & e-commerce

-

Manufacturing

-

Automotive

-

Pharmaceuticals

-

Food and beverages

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inbound logistics market size was estimated at USD 1,569.27 billion in 2024 and is expected to reach USD 1,656.84 billion in 2025.

b. The global inbound logistics market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 2,410.55 billion by 2030.

b. Asia Pacific dominated the inbound logistics market with a share of 38.16% in 2024. The rapid growth of e-commerce in the region has heightened the need for efficient inbound logistics to support inventory replenishment and faster delivery times.

b. Some key players operating in the inbound logistics market include CEVA Logistics; Kuehne+Nagel; XPO, Inc.; DB SCHENKER; United Parcel Service of America, Inc.; FedEx; Ryder System, Inc.; Expeditors International of Washington, Inc.; Nippon Express; GEODIS.

b. Key factors that are driving the market growth include the growth of global supply chains and manufacturing activities and advancements in logistics technology and automation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.