- Home

- »

- Homecare & Decor

- »

-

India Educational Toys Market Size, Industry Report, 2030GVR Report cover

![India Educational Toys Market Size, Share & Trends Report]()

India Educational Toys Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Building & Construction Sets, Role Play Toys), By Age (Toddlers, Pre-schoolers), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-243-4

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Educational Toys Market Size & Trends

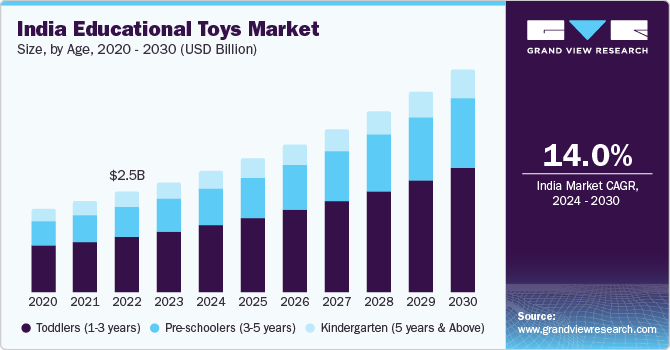

The India educational toys market size was estimated at USD 2.83 billion in 2023 and it is projected to grow at a CAGR of 14.0% from 2024 to 2030. The projected growth can be attributed to aspects such increasing awareness regarding role of early childhood education in overall growth of children, significance of early age learning in cognitive development, availability of numerous alternatives that offer extremely helpful educational toys and acknowledgement by parents and educators. In addition, constant encouragement by government bodies related to education and welfare of children to innovate and launch such products has been assisting the market to grow at rapid pace.

The India market accounted for a share of 5.3% of the global educational toys market in 2023. The educational toys market in India has been growing at rapid pace. The toys industry in country has cultural significance as well as deep-rooted presence across its history. Making of toys can dated back to ancient civilisation times in India. However, with overall economic growth of the region, retain industry started exploring this market. The industry has evolved through lot of phases in terms of technology of making, designs, textures, materials used in making and more. In recent past, educational toys have been generating greater demand in the country. Emergence of science kits, coding game apps and other such combinations of fun and learning have been fuelling this industry like never before.

After technology took over the world, toys such as remote controlled cars, robotic games, and interactive toys gained huge attention from customers. International businesses, domestic companies operating on large scale and brands marketed by big retails stores collected unprecedented revenues from toys industry in India. Mass-manufactured toys dumped in market by technologically advanced nations also occupied a large market share in India. Global companies such as Mattel, Hasbro, Lego have also entered the Indian toys market.

In terms of educational toys, the demand is growing every year. Mainly, increased awareness in educators has led to this scenario. Schools and other learning environment are now fully equipped with such toys as they provide stimulation for cognitive development, psychological growth and help in understanding concepts such as gravity, volume, depth, length, basic math, logic and more.

Market Concentration & Characterization

The India educational toys industry is growing at accelerating pace and growth stage is identified as high. This industry is characterized by the presence of global companies as well as domestic brands. In additions, local vendors and artisans also hold significant share of the market. The industry is poised to grow at rapid pace mainly owing to constant growth in population of the country. The educational toys market in India is fragmented in nature.

Degree of innovation is moderate in the industry. International companies have been adopting innovation as their key strategy to expand their market share. The key technologies involved in this are robotics, 3D printing, artificial intelligence, and virtual reality as well. This industry has always been providing overwhelming response to innovative products launched by makers while adopting cutting-edge technologies.

The level of M&A (mergers & acquisitions) is moderate in the industry. Instead of complete merger or acquisition, companies prefer partnerships or collaborations where they enter in long term contracts for particular function of the business. In addition, key market participants tend to establish tie-ups with online and offline retail stores to support their distribution.

Age Insights

Educational toys for toddlers accounted for a share of 54.0% in 2023. Toys designed for this age group (1-3 years) primarily drive the industry. As per the United Nations, India has more than 300 million children aged 0 to 14, the highest number globally. It is projected that by 2036, India will account for approximately 17% of the world's child population. Parents and caregivers of toddlers increasingly prefer use of educational toys instead of conventional games or toys, as they keep them busy with activities at hand. In addition, the completely immersive experience takes them on learning journey where they explore and discover unknown facts.

The demand for educational toys developed for pre-schoolers (3 - 5 years) is expected to grow at a CAGR of 15.7% from 2024 to 2030. A slight intricate than the toys for toddlers, these products comprise of memory and alphabet games, floor puzzles, building blocks, counting and math games, and art related games as well. After development of basic motor skills and knowledge about fundamental things such as spatial awareness, parents tend to prefer giving these sorts of toys to their children.

Distribution Channel Insights

The offline sales of educational toys in India accounted for a share of 65.3% in 2023. Places such as supermarkets & hypermarkets, specialty stores, shopping malls, local toy stores in towns are part of offline distribution channels. These places are closer to residential areas and workspaces as well, where parents of young children spend most of their day. The distribution is effective through this channel as it provides added features to experience such as immediate possessions and opportunity to examine aspects such as quality, materials used and the overall durability.

The online sales of educational toys are expected to grow at a CAGR of 15.8% from 2024 to 2030. The privacy factor offered by online shopping experience is accompanied by several other added factors such as doorstep delivery, reviews by previous customers, product descriptions, return & refund policy, customer support services and more. These aspects are encouraging great number of customers to opt for online shopping to educational toys. In addition, increased availability of internet, growing information accessibility, and unceasing growth in smart phone technology penetration has resulted in upsurge in use of online retailing websites. Furthermore, lucrative discounts offered by global and domestic e-retailers are luring more number of buyers towards them.

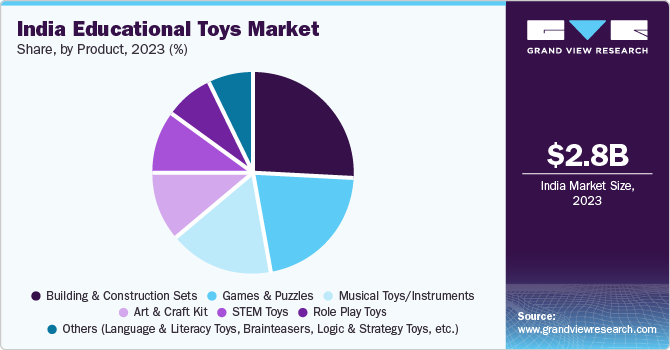

Product Insights

Building & construction sets accounted for share of 25.6% in 2023. Role-play toys, STEM toys, art & craft kits, music toys, interactive toys, games & puzzles, instruments, language and literacy toys, brainteasers, etc. are some other types of the educational toys available in the industry. Distinguish characteristics of constructions sets attract more consumers. Such sets toys fascinate children and generate more responsiveness from them. Unknowingly, children are engaged in activities such as experiment, discovery, effort, and more. These sets encourage them to use their imaginations to optimum level while keeping them abide to a particular form in order to let them explore different possibilities to complete the task at hand.

The demand for STEM toys is expected to grow at a CAGR of 17.8% from 2024 to 2030. Children who belong to the age group of 5 years and above often tend to like these toys as they involve comparatively complex instruments and methods in it. These toys help them learn more than basic skills and assist them in enhancing their cognitive comprehension.

Key India Educational Toys Company Insights

The India educational toys market is characterized by local vendors, brands, artisans and other market participants contributing to the competitive landscape, which already has the presence of global and well-established brands.

Key India Educational Toys Companies:

- Smartivity

- Mattel, Inc.

- Hasbro

- Lego

- Bandai Namco

- Funskool

- Hamleys

- Playgro

- Intelliskills

- Shumee

Recent Developments

- In May 2023, well-known brand is Indian toys industry, Funskool India Ltd. launched range of educational toys which are designed to enhance physical abilities, coordination, motor skills, creativity among children.

India Educational Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.22 billion

Revenue Forecast in 2030

USD 7.06 billion

Growth rate

CAGR of 14.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, distribution channel, age

Key companies profiled

Smartivity; Mattel, Inc.; Hasbro; Lego; Bandai Namco; Funskool; Hamleys; Playgro; Intelliskills; Shumee

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Educational Toys Market Report Segmentation

This report forecasts growth at country level and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the India educational toys market report based on product, distribution channel, and age:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Building & Construction Sets

-

Role Play Toys

-

Art & Craft Kit

-

STEM Toys

-

Games & Puzzles

-

Musical Toys/Instruments

-

Others (language & literacy toys, brainteasers, logic & strategy toys, etc.)

-

-

Age Outlook (Revenue, USD Billion, 2018 - 2030)

-

Toddlers (1-3 years)

-

Pre-schoolers (3-5 years)

-

Kindergarten (5 years & Above)

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Others (Departmental stores, specialty stores)

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the India educational toys market include Smartivity; Mattel, Inc.; Hasbro; Lego; Bandai Namco; Funskool; Hamleys; Playgro; Intelliskills; and Shumee.

b. Key factors that are driving the market growth include constant encouragement by government bodies, related to the education and welfare of children, to innovate and launch advanced educational toys, coupled with the increasing awareness among parents regarding the benefits provided by such products in cognitive development.

b. The India educational toys market size was estimated at USD 2.83 billion in 2023 and is expected to reach USD 3.22 billion in 2024.

b. The India educational toys market is expected to grow at a compound annual growth rate of 14.0% from 2024 to 2030 to reach USD 7.06 billion by 2030.

b. Building & construction sets dominated the India educational toys market with a share of 25.6% in 2023. This is attributable to the increasing awareness regarding the significance of such products in the cognitive as well as overall development of children.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.