- Home

- »

- Consumer F&B

- »

-

India Flavors Market Size And Share, Industry Report, 2033GVR Report cover

![India Flavors Market Size, Share & Trends Report]()

India Flavors Market (2025 - 2033) Size, Share & Trends Analysis Report By Nature (Natural, Synthetic), By Form (Powder, Liquid/Gel), By Application (Food, Beverages, Others), And Segment Forecasts

- Report ID: GVR-4-68040-206-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Flavors Market Summary

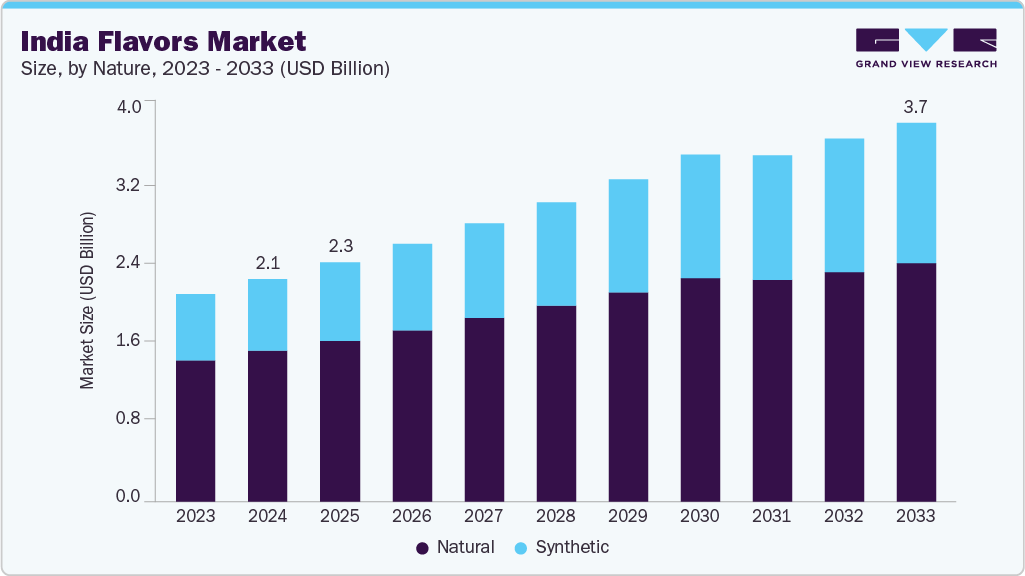

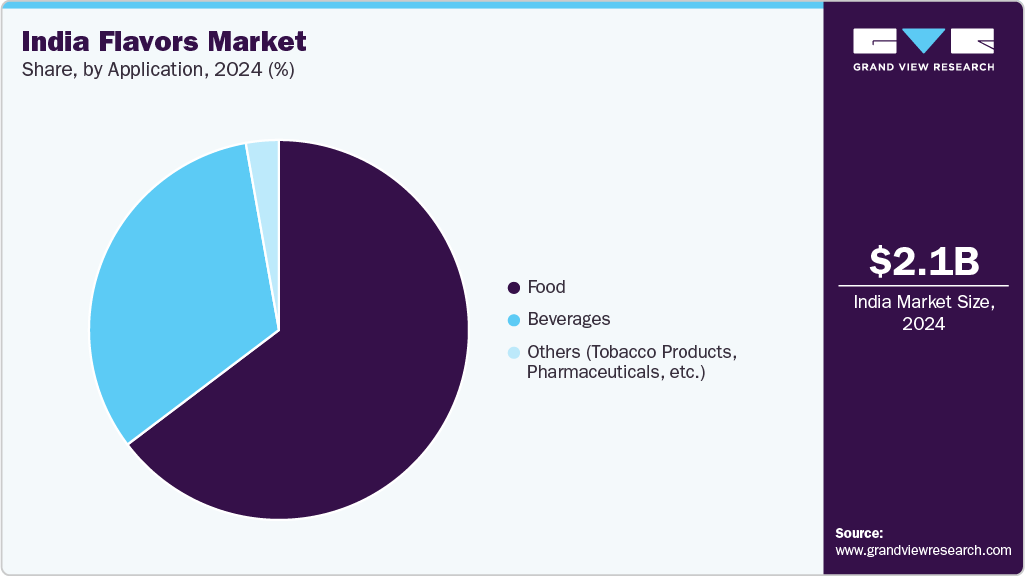

The India flavors market size was estimated at USD 2,168 million in 2024 and is projected to reach USD 3,684.6 million by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The growth can be attributed to factors such as a growing consumer base for processed food & beverages, an increasing number of people relocating to urban areas, and the growth of organised retail in the country.

Key Market Trends & Insights

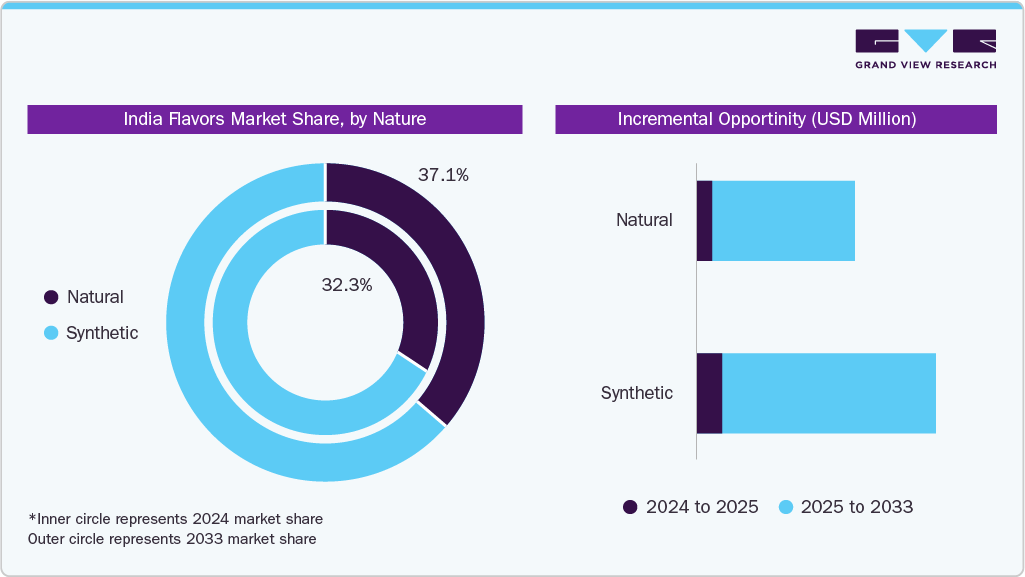

- By nature, the synthetic segment held the highest market share of 67.7% in 2024.

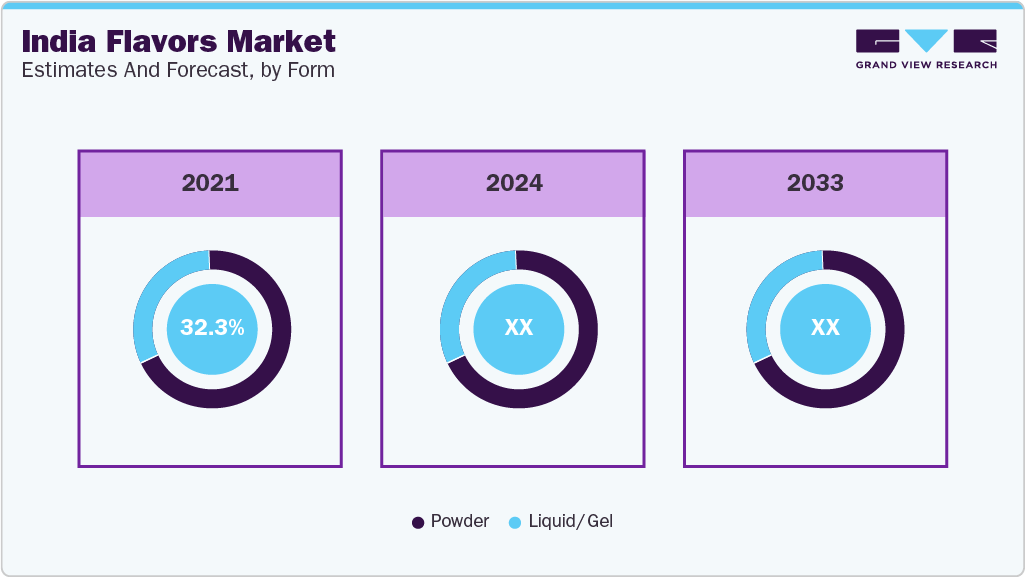

- Based on form, the powder segment held the highest market share of 68.4% in 2024.

- By application, the beverages segment is expected to grow at the fastest CAGR of 6.2% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,168.0 Million

- 2033 Projected Market Size: USD 3,684.6 Million

- CAGR (2025-2033): 5.9%e

Growing market penetration of ready-to-make, ready-to-eat foods, shifting nutritive preferences, and growth in consumption of gluten-free, sugar-free, alcohol-free products are other key factors fuelling growth for the flavors market in India.

With increased information accessibility, booming use of internet, influence of social media campaigns and rising research revelations about different food ingredients are some of the factors, which influence choice of food in India now. In addition, traditions, occasions, cuisines, conventional ways of food consumption and development have huge impact on food & beverages consumers across the country. International brands and domestic brands both have been paying attention to this feature of the market to present a product portfolio that can cater to a few of changing trends as well as some of the unyielding patterns of consumer behavior. This has been encouraging the key market participants from food & beverage industry to innovate constantly on every front including procurement, production and processes. For instance, in March 2023, PepsiCo India launched the Crop Intelligence Model in Collaboration with Cropin. The new initiative under PepsiCo’s popular brand in the country, Lay’s, is aimed at helping potato farmers maximize yields coupled with quality through handy dashboards on user-friendly mobile apps.

Use of natural flavors in product development has been part of India’s food industry since centuries. However, the increasing cost associated with using natural flavors poses a challenge to many businesses. This has led to unceasing use of synthetic flavors, which can be developed or procured at a lower cost than natural flavors. Synthetic flavors are widely used by beverage companies in the country to attain a hint of desired flavor without the addition of real fruit, which might reduce the shelf life of beverages and significantly increase the cost of making.

Growing health awareness has also influenced the market, prompting a shift toward natural, organic, and clean-label flavor solutions. This trend is particularly prominent among urban, health-conscious consumers who prefer products free from artificial additives and aligned with Ayurvedic or functional health principles. As a result, companies are increasingly investing in plant-based extracts, herbal infusions, and spice-based formulations to meet domestic demand and serve India's growing role as an export hub for natural ingredients.

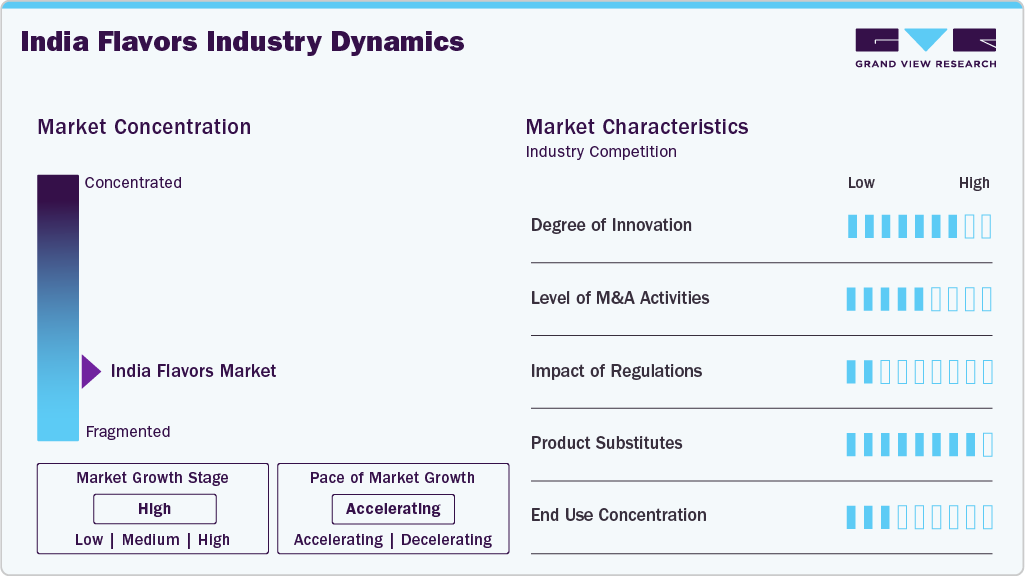

Market Concentration & Characteristics

The Indian flavors market is accelerating, and the growth stage is identified as high. It is predominantly characterized by the extremely competitive market with many established market participants and many small and medium-sized makers and developers across different states within. Numerous branded companies manufacturing food & beverages, dairy products, meat & seafood products, sauces, condiments, snacks, and pet foods procure their ingredients for the production and formulas of popular products from local vendors. Innovation and flexible packaging strategies are two key strategies adopted by these application industries.

Mergers and acquisitions in the Indian flavors market are at a medium level. These partnerships, collaborations, mergers, or acquisitions are primarily strategic moves by key companies to expand their portfolio and, in turn, market share.

Threat of substitutes is rather at low level, as flavors have expanded their role significantly in industrial processes of several products and service delivery businesses. This includes restaurants, processed food manufacturers from the country, food & beverages companies from across the globe, and pharmaceuticals leaders, among others.

This market is highly impacted by regulations in the country, The clear labelling and food safety regulations in India have regulated the market to ensure consumer’s health and safety. The processes to get necessary licenses, permissions and to adhere with compliance practices are set in such manner in the region.

Nature Insights

The synthetic segment held the largest revenue share of 67.7% in 2024 due to its cost-efficiency, long shelf life, and consistent performance across large-scale food and beverage production. Indian manufacturers, especially in confectionery, soft drinks, and snacks, rely heavily on synthetic flavors to meet the mass consumption demand while maintaining flavor uniformity and regulatory compliance. Despite growing consumer awareness around clean-label products, synthetic flavors are widely used due to their affordability and availability in a broad range of profiles suited to Indian taste preferences.

The natural segment is expected to grow at the fastest CAGR of 7.5% during the forecast period, driven by increasing health consciousness, rising demand for organic products, and government initiatives promoting clean-label ingredients. Indian consumers are becoming more selective, seeking natural and Ayurvedic alternatives in their diets, driving the demand for flavors derived from herbs, spices, fruits, and plant extracts. Brands respond by launching products with transparent sources, minimal processes, and functional benefits, contributing to the rapid shift toward natural flavor adoption across food, beverage, and nutraceutical applications.

Form Insights

The powder segment held the largest revenue share of the Indian flavors market in 2024 and is projected to grow at the fastest CAGR during the forecast period. This dominance can be attributed to its longer shelf life, cost-effectiveness, and ease of transportation, which is significant for India's climate and diverse regional distribution networks. Powdered flavors are widely used in instant foods, snacks, dairy mixes, and nutraceuticals, where dry blending and high-heat processing are typical. The rise in demand for convenience and ready-to-cook meals among urban consumers further accelerates innovation in spray-dried and encapsulated flavor formats.

The liquid/gel segment is expected to grow at a significant CAGR over the forecast period, which can be attributed to its vital role in the beverage, bakery, and confectionery industries due to strong solubility and intense flavor delivery. This form is increasingly preferred in India for syrups, health drinks, desserts, and artisanal food applications. Liquid and gel flavors also benefit from the growth of café culture, mixology, and premium home cooking trends, particularly in urban markets. As consumer interest in clean-label and natural extracts grows, manufacturers are developing liquid-based formulations with reduced preservatives and enhanced transparency in ingredient sourcing.

Application Insights

The food segment held the largest revenue share in 2024, driven by high consumption of processed snacks, dairy products, bakery goods, and ready-to-eat meals. Indian consumers' strong preference for diverse and bold taste profiles, often influenced by regional spices and traditional cuisine, has fueled demand for tailored flavor solutions. With increasing urbanization and changing lifestyles, there is a surge in demand for packaged and convenience foods, prompting manufacturers to invest in flavor systems that ensure consistency, shelf stability, and local authenticity.

The beverages segment is projected to grow at the fastest CAGR during the forecast period. It is witnessing rapid innovation due to the rising interest in functional, plant-based, and low-sugar drinks, including flavored water, energy beverages, herbal infusions, and fruit-based juices, driven by health-conscious millennials and Gen Z consumers.

Key India Flavors Company Insights

The India flavors market is identified as a fragmented market. Numerous companies operate on a huge scale; however, the market is also occupied by small and mid-size producers who operate on a smaller scale and yet hold a certain share of the local or state-sized markets.

-

Keva Flavours Pvt. Ltd. is known for its deep understanding of local taste preferences and strong presence across the food, beverage, and personal care sectors. With state-of-the-art manufacturing and R&D facilities, the company combines Indigenous insights with global standards, exporting to over 50 countries while expanding its domestic reach.

Key India Flavors Companies:

- Keva Flavors Pvt. Ltd.

- International Flavors & Fragrances, Inc.

- Fab Flavour

- Oriental Aromatics Limited

- MANE

- Symrise

- Matrix Flavours and Fragrances

Recent Developments

-

In January 2025, Reliance Consumer Products Limited (RCPL) expanded its beverage portfolio by launching RasKik Gluco Energy, a rehydration drink formulated with glucose, electrolytes, and real lemon juice, priced affordably at INR 10 (USD .12). This move reflects RCPL’s broader strategy to penetrate India’s functional drinks segment and position itself as a full-spectrum beverage and FMCG player catering to everyday hydration and energy needs.

-

In May 2022, Symega, one of the key players in the Indian flavors market, entered the plant-based protein space and launched a newly built manufacturing unit in Kochi, India. In addition, it announced its strategy to develop a greenfield facility to make extruded proteins and increase existing capacity to twice as much.

-

In November of 2022, MANE opened a flavor innovation centre in India. This newly opened arm of the French company is located at Hyderabad in 13,900 square feet area, HITEC City, a tech industry hub of the region.

India Flavors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,329.5 million

Revenue forecast in 2033

USD 3,684.6 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Actual data

2024

Historical Period

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, form, application

Key companies profiled

Keva Flavors Pvt. Ltd., International Flavors & Fragrances, Inc., Fab Flavour, Oriental Aromatics Limited, MANE, Symrise, Symega, Matrix Flavours and Fragrances

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Flavors Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the India flavors market report based on nature, form, and application.

-

Nature Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Powder

-

Liquid/Gel

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food

-

Dairy Products

-

Bakery & Confectionery

-

Supplements & Nutrition Products

-

Meat & Seafood Products

-

Snacks

-

Pet Foods

-

Sauces, Dressings & Condiments

-

Others (plant-based food, baby food, etc.)

-

-

Beverages

-

Juices & Juice Natural

-

Functional Beverages

-

Alcoholic Beverages

-

Carbonated Soft Drinks

-

Others (Smoothies, Coffee, etc.)

-

-

Others (Tobacco products, pharmaceuticals, etc.)

-

Frequently Asked Questions About This Report

b. The India flavors market size was estimated at USD 2,168 million in 2024 and is expected to reach USD 2,329.5 million in 2024.

b. The India flavors market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 3,684.6 million by 2033.

b. Food applications dominated the India flavors market with a share of 65% in 2024. This is attributable to the growing demand from key segments, such as supplements & nutritional products, snacks, dairy products, etc.

b. Some key players operating in the India flavors market include Keva Flavors, International Flavors & Fragrances, Inc., FAB FLAVOURS & FRAGRANCES PVT. LTD., Oriental Aromatics, Mane SA, Kalpsutra Chemicals Pvt. Ltd., Symrise Pvt. Ltd., Flavorade India., Symega Ingredients, and Matrix Flavours & Fragrances.

b. Key factors that are driving the market growth include the growing consumer base for processed food & beverages, growth of organized retail in the country, and increasing manufacturing of products with natural and synthetic flavors within the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.