- Home

- »

- Electronic & Electrical

- »

-

India Household Kitchen Appliances Market Size Report, 2033GVR Report cover

![India Household Kitchen Appliances Market Size, Share & Trends Report]()

India Household Kitchen Appliances Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Refrigerator, Cooking Appliances, Others), By Technology (Conventional, Smart Appliances), And Segment Forecasts

- Report ID: GVR-4-68040-682-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Household Kitchen Appliances Market Summary

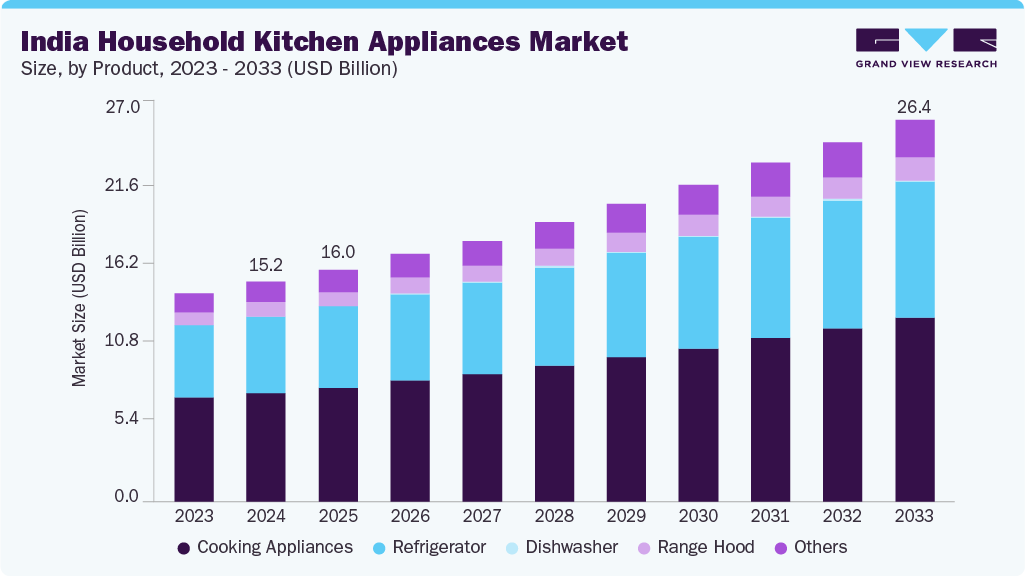

The India household kitchen appliances market size was estimated at USD 15.16 billion in 2024 and is projected to reach USD 26.37 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033. Rising disposable incomes, rapid urbanization, and evolving consumer lifestyles are accelerating the demand for smart and multifunctional kitchen appliances.

Key Market Trends & Insights

- The refrigerator segment held the largest share in the India household kitchen appliances market, accounting for 49.6% in 2024.

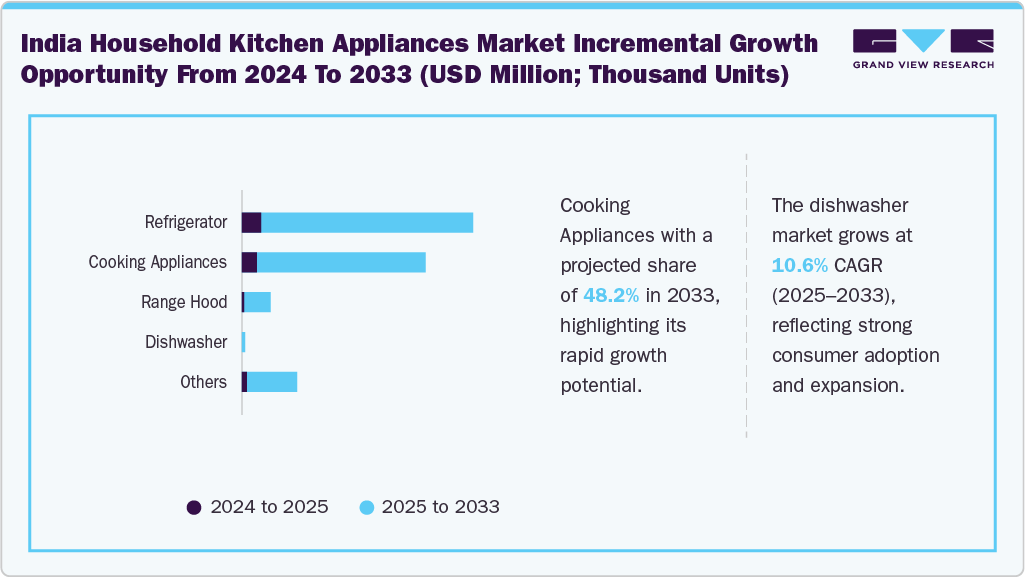

- By product, the dishwasher in the India household kitchen appliances market is experiencing significant growth, projecting a CAGR of 10.6% from 2025 to 2033.

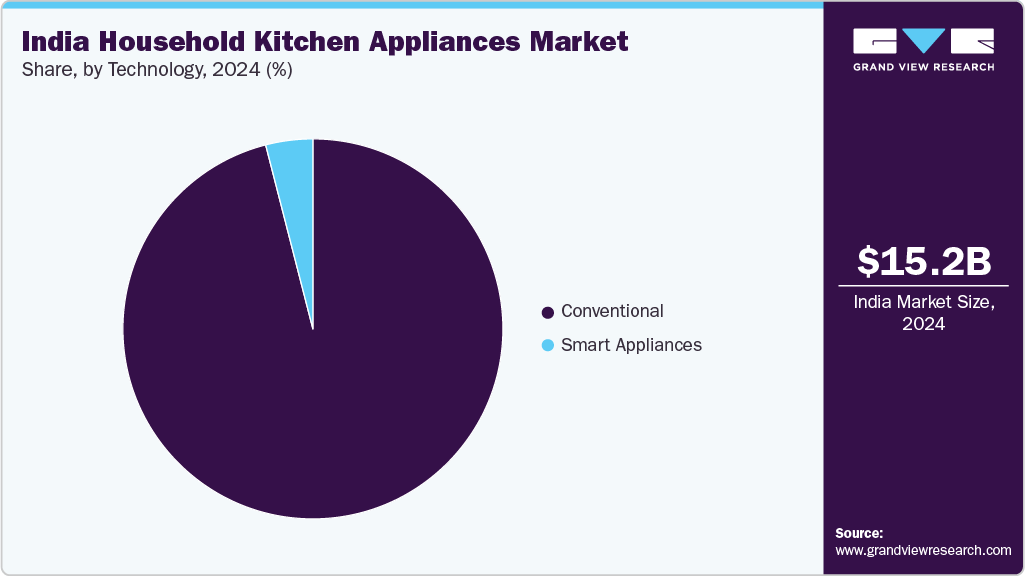

- The conventional technology market in the India household kitchen appliances market held the largest share of 96.0% in 2024.

- The smart appliances market is experiencing significant growth, projecting a CAGR of 8.1% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 15.16 Billion

- 2033 Projected Market Size: USD 26.37 Billion

- CAGR (2025-2033): 6.4%

In addition, increasing awareness around health, convenience, and time-saving technologies is pushing consumers toward advanced and energy-efficient solutions. The India household kitchen appliances market is also being propelled by rising nuclear families and the increasing participation of women in the workforce, which is boosting demand for time-saving and easy-to-use appliances. Technological advancements such as IoT integration and voice-enabled controls are enhancing user experience, while competitive pricing and frequent product innovations by domestic and international players are expanding consumer reach across both urban and rural areas. In addition, government incentives and regulatory measures promoting energy efficiency and environmental sustainability are supporting the adoption of eco-friendly and compliant appliances across the country.

For instance, in November 2023, the National Efficient Cooking Programme (NECP), launched by Energy Efficiency Services Limited (EESL), aims to promote affordable and energy-efficient cooking solutions in India. The initiative focuses on distributing 20 lakh induction cookstoves nationwide, offering a 25% to 30% cost advantage over traditional cooking methods, thereby reducing energy consumption and improving indoor air quality.

In addition, growing health consciousness among Indian consumers is fueling demand for appliances such as air fryers, cold press juicers, and steam ovens that support healthier cooking methods. The influence of global culinary trends through digital media is encouraging experimentation, driving the need for specialized kitchen gadgets. Increased electrification in semi-urban and rural areas is expanding market accessibility. Furthermore, rising interest in modular kitchens is boosting the demand for built-in and space-efficient appliances. For instance, according to the Regalo Kitchens data published in May 2024, the modular kitchen trend is rising in India due to urbanization, technological advancements, and evolving consumer preferences. The company offers modular kitchens in customizable designs, aesthetic appeal with easy installations to help the rising demand.

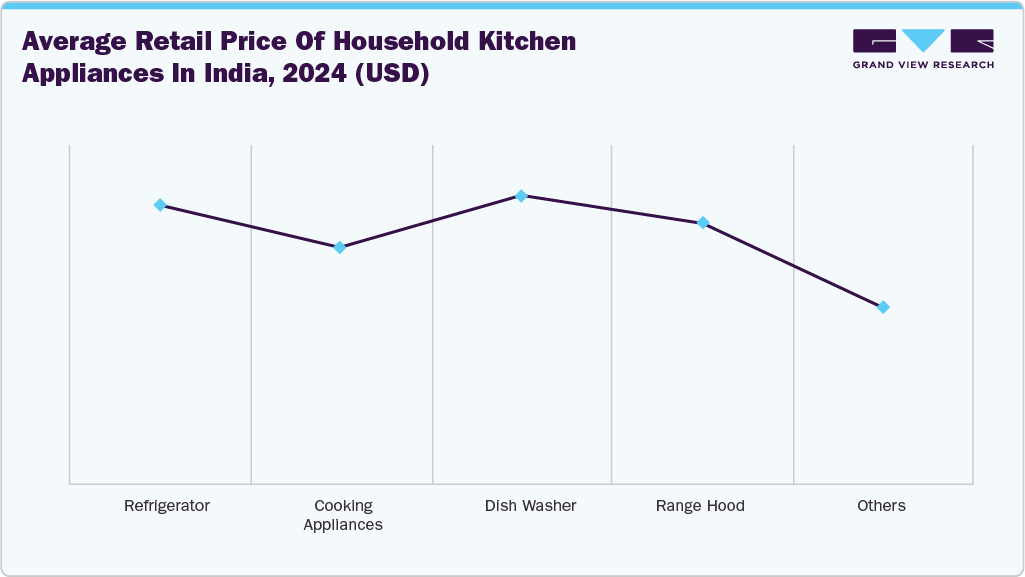

Pricing Analysis

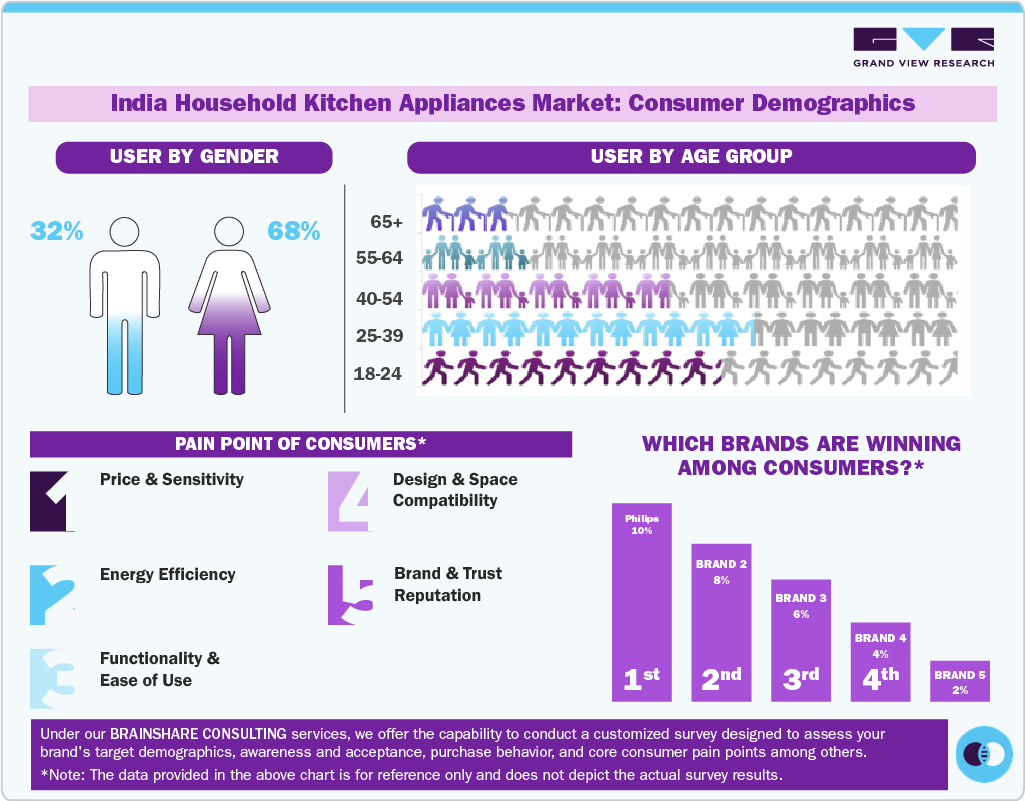

Pricing analysis of the India household kitchen appliances market reveals a dynamic and price-sensitive landscape, with strong competition among domestic and international brands. While premium products are gaining traction among urban consumers seeking smart features and sleek aesthetics, the mid-range segment remains dominant, driven by affordability and perceived value.

Entry-level appliances cater to cost-conscious buyers, especially in rural and semi-urban regions, where price remains a key deciding factor. Frequent discounts, seasonal promotions, and EMI options are widely used to attract and retain consumers in this rapidly evolving market.

Product Insights

The cooking appliances segment held the largest share of 49.6% of the revenue in 2024. Cooking appliances in the India household kitchen appliances market are gaining momentum due to shifting consumer preferences toward healthier eating and the resurgence of home cooking post-pandemic. The adoption of appliances such as ovens, air fryers, and induction cooktops is rising, driven by the need for convenience, speed, and versatility. Manufacturers are increasingly incorporating smart features, localized presets, and compact designs suited to Indian kitchens. For instance, in November 2024, Häfele India launched a range of household kitchen appliances including Midora Full Steam Oven, Renata Cookerhoods, featuring a filter-free design, and Altius Plus Hobs featuring in a TruMatt finish and sleek alloy knobs.

The dishwashers market in India's household kitchen appliances market is projected to grow at the fastest CAGR of 10.6% from 2025 to 2033. Dishwashers in the India household kitchen appliances market are witnessing growing adoption, driven by changing lifestyles, smaller family units, and increased time constraints among working professionals. Rising awareness about hygiene and the benefits of water-efficient dishwashing is contributing to the shift from manual cleaning to automated solutions. Leading brands are introducing compact, energy-efficient models with features tailored to Indian cooking habits, such as intensive wash for oily utensils and pressure wash cycles. For instance, in July 2024, Elista, a brand under TeknoDome India Pvt. Ltd., introduced a range of dishwashers in India. The new range of dishwashers includes three models, Elista EDC12P, EDC12SS, and EDC12SP, designed specifically to remove 99.9% germs from sticky, ghee-laden utensils. These dishwashers are also A++ rated for energy efficiency and designed for energy conservation while delivering performance.

Technology Insights

The conventional household kitchen appliances market accounted for the largest market share of 96.0% in 2024. The market sees strong demand for traditional technology due to its affordability, simplicity, and familiarity among a broad consumer base. These appliances are especially favored in rural areas and budget-sensitive households, where ease of use and low maintenance are key priorities. Consistent replacement cycles for aging products help sustain steady sales. Furthermore, well-established local brands and widespread retail penetration continue to support the popularity of traditional kitchen appliances across the country.

The smart appliances market in the India household kitchen appliances market is projected to grow at the fastest CAGR of 8.1% from 2025 to 2033. The market is increasingly influenced by rising demand for smart technology that offers convenience, control, and energy efficiency. Consumers, especially in urban areas, are embracing appliances with app connectivity, voice assistant integration, and remote monitoring for a more seamless cooking experience. Features such as personalized cooking presets and compatibility with smart home ecosystems are gaining traction among tech-aware and time-constrained users. For instance, in March 2024, Haier Inc. launched smart kitchen appliances such as refrigerators, microwaves, and more, with an aim to expand its operations in the nation. Growing smartphone penetration, improved internet access, and competitive pricing are further driving the adoption of smart kitchen appliances across the country.

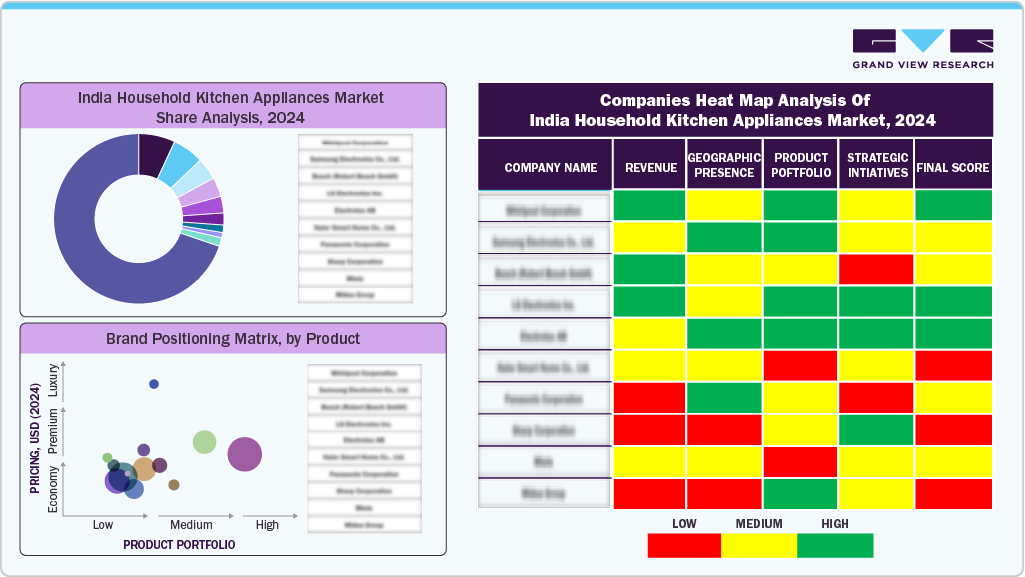

Key India Household Kitchen Appliances Company Insights

Many brands in the India household kitchen appliances market are actively pursuing untapped growth opportunities by catering to evolving consumer preferences and regional demands. Companies are expanding their product lines with multifunctional, compact, and cost-effective solutions tailored to Indian cooking styles. There's a growing emphasis on integrating smart features even in mid-range segments to appeal to tech-savvy consumers. Brands are also focusing on local manufacturing and energy-efficient designs to align with government initiatives and sustainability goals. These strategies aim to strengthen brand presence and capture greater market share in a highly competitive and diverse market.

Key India Household Kitchen Appliances Companies:

- TTK Prestige Ltd.

- Bajaj Electricals Ltd

- Philips India Ltd

- LG Electronics India Limited

- Samsung

- Bosch Home Appliances

- Havells India Ltd.

- Stovekraft Ltd.

- Whirlpool Corporation

- Electrolux

Recent Developments

-

In February 2024, Electrolux expanded its Indian portfolio by introducing a premium built‑in range featuring microwaves, ovens, including models with warming drawers, hobs, cooker hoods, dishwashers, and built‑in coffee machines, delivering a sleek design tailored to modern modular kitchens.

-

In October 2021, Samsung launched its IntensiveWash Dishwasher range in India, designed specifically for Indian cooking, featuring a Triple Rinse function that effectively removes grease, oil, and masala stains. The dishwashers eliminate up to 99.99% of food bacteria, ensuring hygienic cleaning for Indian cookware such as cookers and kadhai.

India Household Kitchen Appliances Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 16.04 billion

Revenue Forecast in 2033

USD 26.37 billion

Growth rate (Revenue)

CAGR of 6.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD million/billion; Thousand Units, Volume in Thousand Units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology

Country scope

India

Key companies profiled

TTK Prestige Ltd.; Bajaj Electricals Ltd; Philips India Ltd.; LG Electronics India Limited; Samsung; Bosch Home Appliances; Havells India Ltd.; Stovekraft Ltd.; Whirlpool Corporation; Electrolux

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options India Household Kitchen Appliances Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the India household kitchen appliances market report based on product, and technology:

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

Refrigerator

-

Cooking Appliances

-

Cooktops & cooking range

-

Ovens

-

Others

-

-

Dishwasher

-

Range Hood

-

Others

-

-

Technology Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

Conventional

-

Smart Appliances

-

Frequently Asked Questions About This Report

b. The India household kitchen appliances market size was estimated at USD 15.16 billion in 2024 and is expected to reach USD 16.04 billion in 2025.

b. The India household kitchen appliances market is expected to grow at a compound annual growth rate (CAGR) of 6.4 % from 2025 to 2033 to reach USD 26.43 billion by 2033.

b. Refrigerators accounted for a revenue share of 49.6% in 2024, driven by rising health consciousness and demand for fresh, probiotic-rich food storage.

b. Some key players operating in the India household kitchen appliances market include TTK Prestige Ltd., Bajaj Electricals Ltd, Philips India Ltd, LG Electronics India Limited, Samsung, Bosch Home Appliances and Havells India Ltd.

b. Key factors driving growth in the India household kitchen appliances market include rising health awareness, increasing urbanization, and a growing preference for smart, energy-efficient appliances. Expanding middle-class income, rapid technological advancements, and greater availability through organized retail and e-commerce platforms further contribute to market expansion across the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.