- Home

- »

- Next Generation Technologies

- »

-

IoT Integration Market Size, Share And Growth Report, 2030GVR Report cover

![IoT Integration Market Size, Share & Trends Report]()

IoT Integration Market (2024 - 2030) Size, Share & Trends Analysis Report By Services, By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-438-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IoT Integration Market Summary

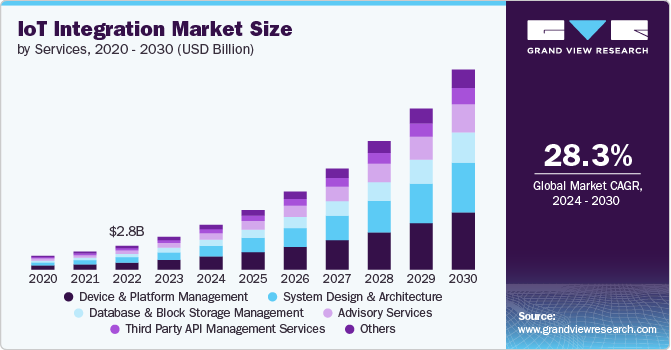

The global IoT integration market size was estimated at USD 3.83 billion in 2023 and is projected to reach USD 23.33 billion by 2030, growing at a CAGR of 28.3% from 2024 to 2030. The proliferation of connected devices, the rise of smart cities, advancements in AI and machine learning, increased focus on cybersecurity, and the emergence of edge computing are driving the market growth.

Key Market Trends & Insights

- The North America region accounted for the largest revenue share of over 36% in 2023.

- The IoT integration market in U.S. is projected to grow at a highest CAGR of over 24% from 2024 to 2030.

- By services, the device and platform segment accounted for the largest market share of over 29% in 2023.

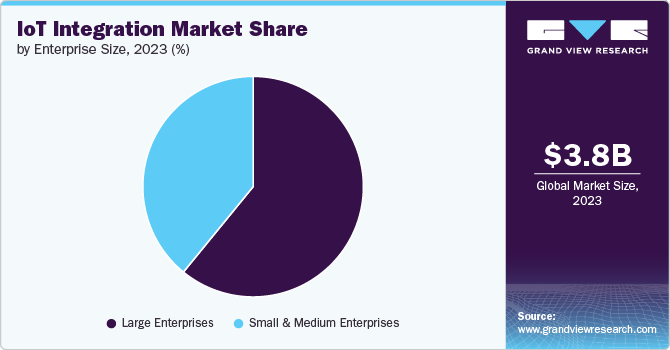

- By enterprise size, the large enterprises segment registered the largest revenue share in 2023.

- By industry vertical, the consumer electronics segment in the market registered the largest share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.83 Billion

- 2030 Projected Market Size: USD 23.33 Billion

- CAGR (2024-2030): 28.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Additionally, the growing emphasis on data-driven decision-making is driving market expansion, leading to increased investments in IoT platforms. These platforms collect data and offer tools for analysis and visualization, empowering businesses to make informed decisions based on real-time information. This trend is expected to fuel market growth in the coming years.

Furthermore, businesses and consumers are adopting a wide range of IoT devices, from smart home gadgets to industrial sensors, thereby enhancing the need for seamless integration between these devices. This proliferation demands robust integration solutions that can ensure interoperability, streamline data flow, and enable comprehensive device management. The surge in connected devices is expected to continue, driven by advancements in technology and the increasing adoption of IoT across sectors such as healthcare, manufacturing, and smart cities, which is expected to further fuel the market growth.

In addition, the growing demand for automation across industries such as manufacturing, logistics, and healthcare is boosting the market demand. The increasing focus of companies to enhance operational efficiency, reduce costs, and improve productivity, is accelerating the adoption of IoT technologies. Automation through IoT allows for real-time monitoring and control of processes, enabling organizations to respond swiftly to changes in their environment. This trend is expected to further fuel the market growth in coming years.

The integration of IoT devices in smart cities is revolutionizing urban environments by creating interconnected systems that boost efficiency and sustainability. IoT-enabled infrastructures gather real-time data from various sources, such as traffic sensors, environmental monitors, and public service systems, enabling city planners to make informed decisions based on analytics. This data-driven approach enhances urban planning by optimizing traffic management with adaptive signal control systems, reducing congestion and emissions. This trend is expected to expand further, driven by the growing demand for smarter solutions that enhance quality of life and operational efficiency.

Moreover, the increasing complexity of IoT ecosystems is driving the need for advanced IoT integration solutions that can handle the complexities of connecting different technologies. This is particularly distinct in large-scale deployments where seamless integration is critical to maintaining system reliability and performance, which is expected to fuel the market expansion in coming years. In addition, organizations are prioritizing IoT integration solutions that include robust security measures to protect their networks and ensure compliance with data protection regulations. This emphasis on security is expected to contribute to significant adoption of comprehensive IoT integration services.

Services Insights

The device and platform segment accounted for the largest market share of over 29% in 2023. This growth can be attributed tothe rapid proliferation of connected devices across various sectors such as healthcare, manufacturing, and smart homes, which has further increased the demand for robust IoT platforms that facilitate seamless connectivity and data management. Additionally, advancements in sensor technology and wireless communication protocols have made it easier to integrate devices into existing systems, further fueling segmental growth.

The database and block storage management segment is expected to witness a highest CAGR of over 30% from 2024 to 2030, driven by the surge in data generated by IoT devices. Organizations are increasingly prioritizing effective data management to extract actionable insights, fueling market growth. Advances in cloud computing have also enabled scalable storage solutions that adapt to varying data demands while maintaining performance and security. Additionally, the need for real-time processing is driving investments in advanced database systems, positioning this segment as a key area of innovation within the IoT integration landscape

Enterprise Size Insights

The large enterprises segment registered the largest revenue share in 2023. This growth can be attributed to their substantial financial resources, which enable them to invest heavily in advanced IoT technologies. These organizations often have complex operational needs and a greater demand for efficiency, scalability, and data analytics capabilities that IoT solutions can provide. Additionally, large enterprises are more likely to adopt comprehensive IoT strategies that integrate various systems and processes across their operations, leading to improved decision-making and enhanced productivity.

The small and medium enterprises segment is expected to grow at a significant CAGR from 2024 to 2030. SMEs are increasingly recognize the value of IoT technologies in enhancing operational efficiency and reducing costs. As these businesses become more aware of the benefits of connectivity and automation, they are more inclined to adopt IoT solutions tailored to their specific needs. Furthermore, advancements in technology have led to more affordable IoT devices and platforms, making it easier for SMEs to implement these solutions without significant upfront investment. These trends collectively are expected to drive the segment growth.

Industry Vertical Insights

The consumer electronics segment in the market registered the largest share in 2023, driven by the rising demand for smart devices and technological advancements. The widespread adoption of Internet of Things (IoT) devices, including smart home appliances, wearables, and personal electronics, has been a key contributor to this growth. Consumers are increasingly favoring products that offer greater connectivity, convenience, and functionality. Additionally, higher disposable incomes and evolving lifestyles have spurred increased spending on consumer electronics, further propelling the segment's expansion.

The aerospace & defense segment is anticipated to record the fastest growth from 2024 to 2030, owing to the increased government spending on defense and security measures globally. Heightened geopolitical tensions and the need for advanced military capabilities are prompting nations to invest heavily in aerospace technologies. Furthermore, there is a growing emphasis on modernization programs aimed at upgrading existing defense systems with cutting-edge technologies such as unmanned aerial vehicles (UAVs), satellite systems, and advanced avionics, thereby driving the market growth.

Regional Insights

The North America region accounted for the largest revenue share of over 36% in 2023. North America leads in the adoption of advanced IoT technologies such as edge computing, AI, and 5G. These technologies are being integrated into IoT ecosystems to enhance processing capabilities and reduce latency. This trend is driving the demand for sophisticated IoT integration services that can handle complex deployments across various industries, including healthcare, manufacturing, and smart cities.

U.S. IoT Integration Market Trends

The IoT integration market in U.S. is projected to grow at a highest CAGR of over 24% from 2024 to 2030. The U.S. IoT integration market is driven by the growing concerns over cybersecurity, coupled with stringent regulations, are encouraging organizations to invest in secure and compliant IoT integration solutions.

Europe IoT Integration Market Trends

The IoT integration market in Europe is anticipated to grow at a CAGR of over 26% from 2024 to 2030. This growth is largely driven by regulatory frameworks like the General Data Protection Regulation (GDPR), which significantly impacts the market. The necessity to adhere to strict data protection regulations increases the demand for IoT integration services that guarantee secure and compliant data management within IoT networks. Moreover, Europe’s push for standardization in IoT technologies is also propelling the integration efforts.

Asia Pacific IoT Integration Market Trends

The IoT integration market in the Asia Pacific region is expected to grow at the fastest CAGR of over 31% from 2024 to 2030. Rapid urbanization in Asia Pacific is fueling significant investments in smart city projects. Countries in the region are heavily investing in IoT-enabled infrastructure to tackle urban challenges such as traffic management, energy efficiency, and public safety. The surge in smart city initiatives is driving the demand for IoT integration services that combine various urban systems into a cohesive, AI in network.

Key IoT Integration Company Insights

Some of the key players operating in the IoT integration market include Microsoft Corporation, Amazon Web Services, Inc., and Cisco Systems, Inc. among others.

-

Microsoft Corporation is a multinational technology company actively engaging in the IoT integration market through its comprehensive Azure IoT suite of servicesAzure cloud platform, which provides comprehensive IoT services and solutions. Azure IoT enables businesses to connect, monitor, and manage IoT devices at scale while leveraging advanced analytics and AI capabilities.

-

Amazon Web Services, Inc., a subsidiary of Amazon.com Inc., offers a wide range of infrastructure services that empower businesses to build sophisticated enterprise sizes with increased flexibility, scalability, and reliability. The company has expanded its offerings to include robust IoT solutions such as AWS IoT Core. This service allows users to connect devices securely to the cloud and enables them to efficiently process data generated by those devices.

Intel Corporation and Software AG are some of the emerging market participants in the IoT Integration market.

-

Intel Corporation is a semiconductor manufacturer and technology company recognized for its innovative products and solutions. The company offers a comprehensive portfolio of IoT solutions that encompass hardware, software, and services designed to facilitate the integration and management of connected devices. The company’s IoT products leverage advanced processing capabilities, edge computing technologies, and robust security features to enable businesses across industries such as manufacturing, healthcare, and smart cities to harness data-driven insights for improved operational efficiency and enhanced customer experiences.

-

Software AG is a German multinational software corporation offers an array of integration platforms that facilitate connectivity between devices, enterprise sizes, and data sources. The company’s focus on digital transformation through IoT integration helps organizations optimize operations, enhance customer engagement, and drive innovation across various sectors such as manufacturing, logistics, and energy.

Key IoT Integration Companies:

The following are the leading companies in the IoT integration market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Siemens

- Cisco Systems, Inc.

- Intel Corporation

- GE Vernova

- SAP SE

- PTC Inc.

- Bosch Global Software Technologies Pvt Ltd.

- Software AG

Recent Developments

-

In April 2024, Microsoft Corporation announced a partnership with leading industrial companies to enhance the integration of AI with industrial data. This collaboration aims to unlock valuable insights from industrial data, enabling organizations to improve operational efficiency and decision-making processes. The initiative focuses on developing solutions that leverage AI to analyze data from various industrial sources, facilitating predictive maintenance and optimizing production workflows.

-

In October 2023, Amazon Web Services, Inc. announced the general availability of its new Software Package Catalog feature. This fully managed cloud service allows users to register, organize, monitor, and manage IoT devices at scale. The Software Package Catalog enables tracking and monitoring of software package versions across device fleets, providing insights through a centralized dashboard.

-

In October 2023, Amazon Web Services, Inc. announced new features for AWS IoT Twin Maker that enhance the digital twin entity modeling experience. These improvements include support for multiple data sources, simplified data mapping, and the ability to create and manage entities more efficiently. By streamlining the process of creating and managing digital twins, these updates make it easier for construction companies to leverage IoT data to optimize building operations, reduce costs, and improve occupant experiences.

IoT Integration Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.23 billion

Revenue forecast in 2030

USD 23.33 billion

Growth rate

CAGR of 28.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Component

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, enterprise size, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE.

Key companies profiled

Microsoft Corporation; Amazon Web Services Inc.; Siemens; Cisco Systems, Inc.; Intel Corporation; GE Vernova; SAP SE; PTC Inc.; Bosch Global Software Technologies Private Limited; Software AG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IoT Integration Market Report Segmentation

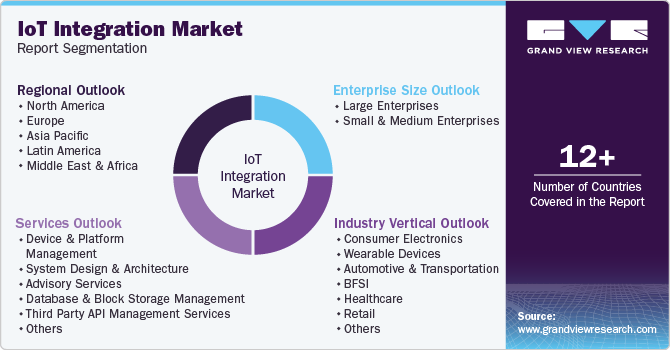

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT Integration market report based on services, enterprise size, industry vertical, and region:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Device And Platform Management

-

System Design And Architecture

-

Advisory Services

-

Database & Block Storage Management

-

Third Party API Management Services

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small And Medium Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Wearable Devices

-

Automotive & Transportation

-

BFSI

-

Healthcare

-

Retail

-

Building Automation

-

Oil & Gas

-

Agriculture

-

Aerospace & Defense

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IoT integration market size was estimated at USD 3.83 billion in 2023 and is expected to reach USD 5.23 billion in 2024.

b. The global IoT integration market is expected to grow at a compound annual growth rate of 28.3% from 2024 to 2030 to reach USD 23.33 billion by 2030.

b. North America accounted for a market revenue share of 36% in 2023. North America leads in the adoption of advanced IoT technologies such as edge computing, AI, and 5G. These technologies are being integrated into IoT ecosystems to enhance processing capabilities and reduce latency.

b. Some key players operating in the IoT integration market include Microsoft Corporation, Amazon Web Services, Inc., Siemens, Cisco Systems, Inc., Intel Corporation, GE Vernova, SAP SE, PTC Inc., Bosch Global Software Technologies Pvt Ltd., Software AG

b. The key factors driving the IoT integration market include the proliferation of connected devices, rise of smart cities, advancements in AI and machine learning, increased focus on cybersecurity, and the emergence of edge computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.