- Home

- »

- Pharmaceuticals

- »

-

India In Vitro Diagnostics (IVD) Market Size, Report, 2030GVR Report cover

![India In Vitro Diagnostics (IVD) Market Size, Share & Trends Report]()

India In Vitro Diagnostics (IVD) Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Reagents, Software), By Technology, By Application, By End-use, By Test Location, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-203-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India IVD Market Size & Trends

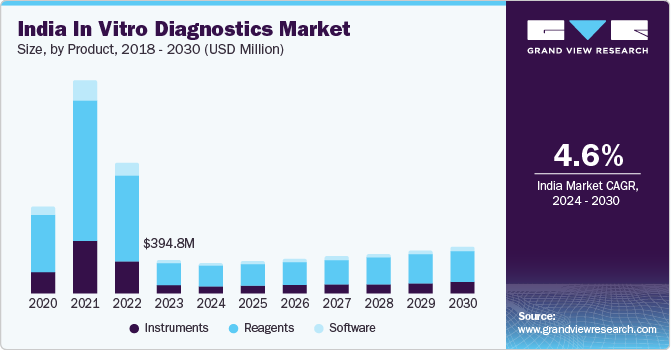

The India in vitro diagnostics market size was valued at USD 394.76 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030. Rising infectious disease testing, chronic disease burden, and a robust lab network drive India's booming in vitro diagnostics (IVD) market. In addition, the presence of a robust network of laboratories and accelerating economic development is further leading to the rapid adoption of IVDs in India. Moreover, Indian government initiatives such as “Make in India” help manufacturers to meet the demand for necessary medical equipment, thereby further increasing the manufacturing capabilities of the nation.

COVID-19 pandemic affected the market and led to a significant growth. Along with that, infectious diseases such as sexually transmitted diseases, Human-immunodeficiency virus infection and acquired immune deficiency syndrome (HIV/AIDS), ventilator-acquired pneumonia, tuberculosis, and hospital-acquired infections are the potential drivers of the market.

Additionally, rising geriatric population in India and the penetration of chronic disease in the population requires effective and reliable diagnostic tests. This is expected to further increase the demand for IVD over the forecast period in the Indian market.

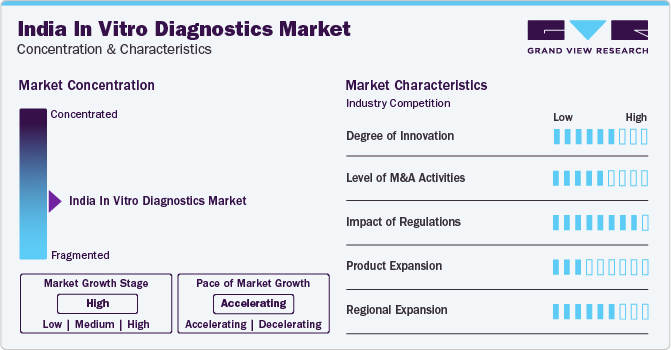

Market Concentration & Characteristics

The market growth is high, and the pace of the market is accelerating. The Indian IVD market is experiencing lucrative growth and rapid innovation, fueled by advancements in molecular diagnostics market and new product launches. For instance, in September 2022, BD Diagnostics, India, launched the BD MAX molecular diagnostic system and BD MAX MDR-TB panel in India launched a system that detects tuberculosis and tests for drug resistance to two important first-line drugs such as isoniazid (INH) and rifampicin (RIF) simultaneously.

Moreover, some of the key players are focusing on product expansion using government initiatives. In May 2022, Cipla Limited started commercialization of the 'RT-Direct' multiplex COVID-19 RT-PCR Test kit in India, in partnership with Genes2Me Pvt. Ltd. This kit is validated at the Indian Council of Medical Research (ICMR) approved Centre.

Companies are actively engaging in mergers and acquisitions (M&A) to boost their market positions, expand capabilities, diversify product portfolios, and enhance overall competitiveness. For instance, in January 2024, Fujirebio collaborates with Agappe to manufacture CLIA reagents for their Mispa analyzers in India. This deal makes Agappe the first Indian company to offer a complete chemiluminescence solution with locally produced reagents.Moreover, stringent regulatory approvals are supporting the market growth. India's fast-track Drugs Controller General of India DCGI approval process attracts global players, boosting market growth.

Product Insights

Based on the product, reagent held the largest share of 66.0% in 2023. The segment is expected to witness growth at a faster rate over the forecast period owing to the wide utility of IVD testing, escalating demand for self-testing & and point-of-care products, and increasing R&D activities. Furthermore, the introduction and commercialization of new reagents are expected to drive market growth. Increasing test frequency during COVID-19 pandemic has led to increasing production of testing kits which in turn boosts the demand for IVD in the market. For instance, in May 2022, Cipla Limited started the commercialization of the 'RT-Direct' multiplex COVID-19 RT-PCR Test kit in India, in partnership with Genes2Me Pvt. Ltd. This kit is validated at the Indian Council of Medical Research (ICMR) approved Centre.

The instrument segment is expected to grow at the fastest rate from 2024 to 2030. This is due to the prevalence of chronic diseases, which need early diagnostic setup and preventive treatment. This in turn boosts the demand in the market. For instance, in October 2022, Thermo Fisher Scientific launched the TaqPath enteric bacterial select panel test to detect gastrointestinal bacterial infections within 2 hours.

Technology Insights

Based on the technology, immunoassay dominated the market with a share of about 33.6% in 2023. The increasing incidence of chronic & communicable diseases and rising need for early diagnosis are the key factors leading to an increase in demand for immunological methods. These include different types of Enzyme-Linked Immunosorbent Assays (ELISAs). Moreover, key players shifting their focus on R&D for the development of new immunological diagnostic instruments and tests for IVD applications.

The coagulation segment is expected to grow at the fastest CAGR from 2024 to 2030. This is owing to the increasing prevalence of cardiovascular diseases, blood-related disorders, and autoimmune diseases. For instance, in January 2023, a new laboratory setting for coagulation opened at King George’s Medical University (KGMU) in Lucknow, to help hemophilia patients.

Application Insights

The infectious diseases segment dominated the market with a share of 52.4% in 2023. This is majorly due to the huge influence of COVID-19. Moreover, key players are introducing novel testing products to improve access to high-quality, innovative laboratory services for patients & healthcare providers. For instance, in February 2023, Thermofisher collaborated with Mylab and announced the launch of RT-PCR kits for infectious diseases, such as multi-drug resistant tuberculosis (MTB MDR), Hepatitis B virus (HBV), Hepatitis C virus (HCV), Human Immunodeficiency Virus (HIV), genetic analysis (HLA B27) with approval of Central Drugs Standard Control Organisation

Oncology is the second largest segment growing with a CAGR rate of 10.8% from 2024 to 2030. As per the National Institute of Health, in 2022, India reported around 14,61,427 cases, driving the demand for biomarker testing at an early stage and, in turn, expected to witness market growth over the forecast period. Moreover, increasing approval of novel tests, R&D activities, and favorable initiatives undertaken by regulatory bodies are expected to drive industry growth. For instance, in October 2023, the Central Drugs Standard Control Organization approved NexCAR19 India’s first CAR-T cell therapy for cancer patients.

End-use Insights

The hospitals segment dominated the revenue share with 39.56% in 2023 owing to a rise in the rate of hospitalizations that require support from early diagnostics. Moreover, emerging economic development and favorable government initiatives are anticipated to enhance the existing hospital facilities. Thus, the demand for hospital-based IVD tests is anticipated to further increase.

The home-care segment is growing at a faster rate of CAGR from 2024 to 2030 due to the rising geriatric population and increasing demand for home-care IVD devices. There is a growing need for novel molecular diagnostic and immunoassay platforms that can assist patients in conducting self-tests. For instance, in July 2021, Abbott introduced the COVID-19 Antigen Self-Test for the detection of the SARS-CoV-2 virus in adults and children with or without symptoms for efficient and effective testing.

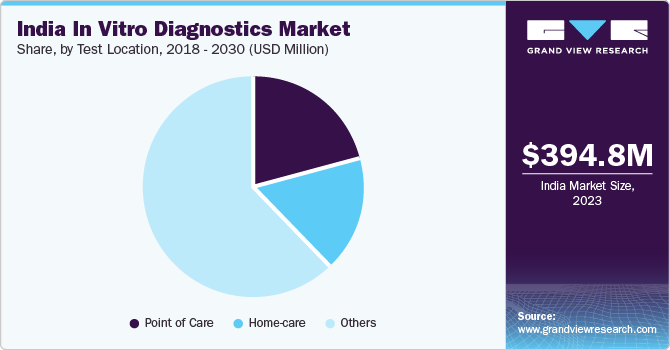

Test Location Insights

The others (lab-based tests) was identified as the largest revenue contributor in 2023. A large number of tests can be analyzed at one time and the higher accuracy of laboratory-based tests make them more reliable compared to PoC and home tests, giving the segment a competitive edge. Moreover, the availability of tests that allow for sample collection at home and sending it to the laboratories for testing makes testing highly convenient for patients.

The home-care segment is expected to grow at the highest CAGR from 2024 to 2030 due to the increasing reliability of these tests and the patient-centric approaches of manufacturers. Moreover, the prevalence of geriatric population results in a surge of home care diagnostics. For instance, in Jun 2021, an Indian healthcare start-up Healthians started the initiative of at-home diagnostic services in more than 100 cities of India.

Key India In Vitro Diagnostics Company Insights

Some of the prominent key players operating in the India in vitro diagnostics market include F. Hoffmann-La Roche Ltd.; Abbott; BD, Transasia Bio-Medicals Ltd, and Thermo Fisher Scientific Inc,.

Market players are adopting various strategies, such as new product launches through Make in India, mergers & acquisitions, and partnerships, to enhance their product portfolios and provide diverse technologically advanced & innovative products.

Key India IVD Companies:

The following are the leading companies in the India in vitro diagnostics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these India in vitro diagnostics companies are analyzed to map the supply network.

- Abbott

- BD

- F. Hoffmann-La Roche Ltd

- Transasia Bio-Medicals Ltd

- Thermo Fisher Scientific Inc,

- J Mitra & Co Pvt Ltd.

- Advatech Healthcare Pvt Ltd.

- Tulip Diagnostics PVT. Ltd.

- Transasia Bio-Medicals Ltd.

- Siemens Healthcare Pvt. Ltd.,

- Bio-Rad Laboratories India Pvt. Ltd

Recent Developments

-

In June 2022, Genes2Me Pvt. Ltd introduced the CoviEasy Self-test Rapid Antigen kit for COVID-19, which is an AI-driven mobile app.In February 2022, Mylab Discovery Solutions came up with CoviSwift, a point-of-care (POC) testing solution that consists of the CoviSwift assay and Compact-Q machines. It performs a cycle of 16 samples within 40 minutes, four times faster than the typical RT-PCR testing procedure.

India In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 358.07 million

Revenue Forecast in 2030

USD 523.04 million

Growth rate

CAGR of 4.6% from 2024 to 2030

The base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Product, technology, application, end-user, test location

Regional scope

India

Country scope

India

Key companies profiled

Abbott; BD; F. Hoffmann-La Roche Ltd; Transasia Bio-Medicals Ltd; Thermo Fisher Scientific Inc,; J Mitra & Co Pvt Ltd.;Advantech Healthcare Pvt Ltd.; Tulip Diagnostics Pvt. Ltd.;Transasia Bio-Medicals Ltd.; Siemens Healthcare Pvt. Ltd.,Bio-Rad Laboratories India Pvt. Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India In Vitro Diagnosticsmarket report based on product, technology, application, end-use, test location, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Hematology

-

Clinical Chemistry

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Diabetes

-

Oncology

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Other applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Home-care

-

Others

-

-

Test Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Point of Care

-

Home-care

-

Others

-

Frequently Asked Questions About This Report

b. The India in vitro diagnostics market is estimated at USD 394.76 million in 2023 and is expected to reach USD 358.07 million in 2024.

b. The India in vitro diagnostics market is expected to grow at a CAGR of 4.6% from 2024 to 2030 to reach USD 523.04 million 2030.

b. Reagent held the largest share of 66.0% in 2023. The segment is expected to grow faster over the forecast period owing to the wide utility of IVD testing, escalating demand for self-testing & and point-of-care products, and increasing R&D activities.

b. Some of the prominent key players operating in the India in vitro diagnostics market include F. Hoffmann-La Roche Ltd.; Abbott; BD, Transasia Bio-Medicals Ltd, and Thermo Fisher Scientific Inc,

b. The presence of a robust network of laboratories and accelerating economic development is further leading to the rapid adoption of IVDs in India.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.