- Home

- »

- Advanced Interior Materials

- »

-

India Reflective Tapes Market Size & Share Report, 2030GVR Report cover

![India Reflective Tapes Market Size, Share & Trends Report]()

India Reflective Tapes Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Automobile, Building & Construction, Clothing, Others), By Product (Engineer Grade Glass Bead Reflective Tape, High Intensity Glass Bead Reflective Tape), And Segment Forecasts

- Report ID: GVR-2-68038-797-1

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

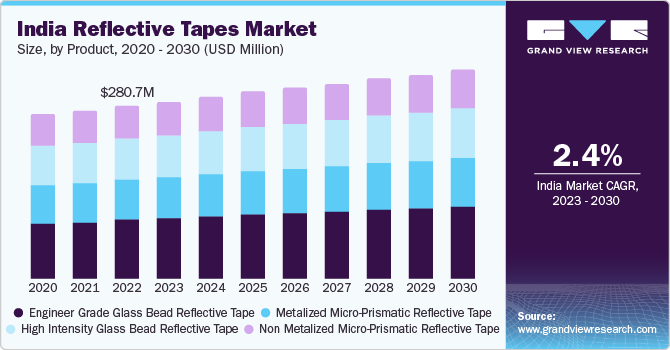

The India reflective tape market size was valued at USD 280.7 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 2.4% from 2023 to 2030.The rise in demand for high-visibility tapes for enhancing safety at the workplace and roadways has stirred up the demand for the product in the country. An increasing number of road accidents is accentuating the need for high-visibility signal tapes as a part of accident avoiding and road safety products. As per a report published by the Ministry of Road Transport and Highways, 4,12,432 instances of road accidents occurred in 2021, resulting in 1,53,972 fatalities and 3,84,448 injuries. Furthermore, the burgeoning importance of employee safety at the workplace is poised to stoke market growth during the forecast period.

The government of India has passed specific regulatory frameworks for the use of reflective materials, including tapes, in automobile exterior body parts. For instance, in April 2023, the Regional Transport Offices (RTOs) of Mumbai took action against more than 100 buses operated by the Mumbai Electric Supply and Transport Undertaking (BEST) for violating laws governing reflective tapes. A campaign was started against BEST buses because they were hiding reflective tapes beneath wraparound ads.

Regulatory frameworks have been undertaken as an initiative to enhance visibility during night and adverse weather conditions, thereby reducing the chances of road accidents. For instance, in January 2022, in Noida’s Gautam Buddha Nagar, traffic cops launched a campaign to apply reflective tape to cars, barricades, and pillars to reduce accidents during bad weather. The tapes are intended to improve visibility at night and in low light conditions. The reflectors on cars play a crucial role in warning commuters travelling in the same direction whenever the back lights of automobiles are not operating properly.

Glass beads and micro-prisms present in reflective tapes are tightly packed and glazed with a thin film of aluminum from behind, thereby illuminating objects in the darkness. This illuminating property aids in the application of the product in apparels such as safety clothing, life jackets, gloves, and helmets, thereby driving its market demand. Rising concerns about employee safety at workplaces, including police officers directing road traffic during rains and construction workers on footpath and roadsides, are likely to boost the demand for high-visibility clothing.

Furthermore, the growing demand for high-visibility fabrics and apparel is expected to augment market expansion in the coming years. However, the number of suppliers in the Indian market is substantially moderate. Manufacturing of these products is associated with several constraints such as volatile prices of raw materials, regulations concerning product manufacturing, and high research & development costs, thus restraining market growth.

Product Insights

The engineer grade glass bead reflective tape segment accounted for the largest revenue share of 33.3% in 2022 and is further expected to expand at the fastest CAGR of 2.8% during the forecast period. This product consists of a metalized film on top, below which several glass beads are applied such that over fifty percent of the bead is embedded in the metalized layer, providing dots with reflective properties.

The demand for non-metalized micro-prismatic reflective tapes is estimated to witness a CAGR of 2.3% during the forecast period. Application of the product in barricades, construction work zones, traffic signs, and drums & channelizer cones, coupled with its long durability, is anticipated to contribute to the growth of the segment. The SWICOFIL Company has industrialized a retroreflective form of technology from raw materials, including micro prisms and glass beads. This technology is established by the utilization of glass beads and micro prisms, which reflect the light falling on them back to its source.

Manufacturing costs associated with metalized micro-prismatic films is the highest. In addition, techniques used for the production of these films are more stringent as compared to other types of tapes. However, as these tapes are metalized, they offer enhanced reflectivity and have applications in vehicle graphics, which drives their demand.

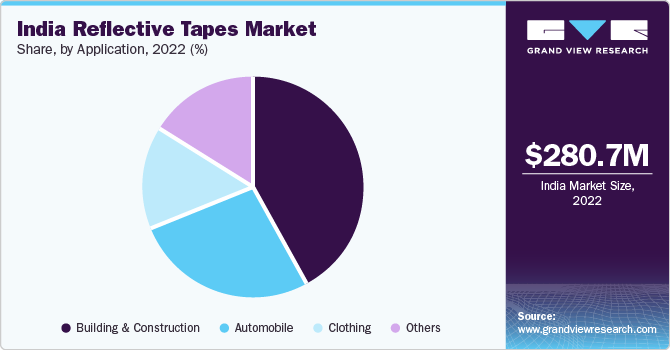

Application Insights

The building & construction segment accounted for the largest revenue share of 41.5% in 2022 and is further expected to expand at the fastest CAGR of 3.0% during the forecast period. Increasing application of reflective tapes at construction sites and industrial facilities, owing to stringent government regulations for the safety of pedestrians and workers, is projected to fuel product demand.

For instance, in October 2021, the Gati Shakti National Master Plan was launched by the Indian government, and it will direct the development of the nation's infrastructure in a comprehensive and integrated manner while creating massive employment possibilities.A total of 81 high impact projects have been compiled by India's Gati Shakti plan, with road infrastructure projects receiving top priority. This plan is anticipated to increase the demand for reflective tapes also in the coming years.

The growth of the India reflective tape market can also be attributed to the increased use of these products for the safety of construction workers. In addition, these products are fabricated for applications that require supreme visual impact in construction zones, especially in potentially hazardous areas. Furthermore, they have significant applications in areas such as automotive, road safety, traffic management, and personal protective equipment & clothing.

The rapidly growing traffic problems and the rising number of road accidents in the country are escalating the demand for these products in automobiles, such as body trim attachments, paint jobs, and bumper repairs. Regional Transport Office (RTO) authorities have issued guidelines to attach reflective tapes, which glow at night, to avoid accidents during foggy and hazy weather. These tapes are stuck on the front and back of vehicles.

The clothing segment is expected to advance at a CAGR of 1.6% during the forecast period. Some of the major applications constitute the production of silver, stretch, and flame-retardant apparel possessing light reflective material on them. These garments are manufactured from basic cloth, micro glass beads, and adhesives, along with several processing technologies including composites, coatings, and hot pressing. These types of accessories assist in the management and control of emergencies, incidents, and evacuations.

Key Companies & Market Share Insights

The industry is moderately competitive on account of the presence of few leading players in India. These players compete in terms of advanced technological innovations and product development. Reflective tapes are distributed through multiple channels in the country. Manufacturing companies market their product directly, as well as through local distributors. A few of the distributors involved in the value chain are individual sellers of products that are acquired from the manufacturing companies.

Key India Reflective Tapes Companies:

- Sha Kundanmal Misrimal

- AVANTIKA ELCON PVT. LTD.

- 3M

- Shiva Industries

- Kohinoor Enterprises

- HS Tapes

India Reflective Tapes Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 340.5 million

Growth Rate

CAGR of 2.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in million square meters, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product

Country scope

India

Key companies profiled

Sha Kundanmal Misrimal; AVANTIKA ELCON PVT. LTD.; 3M; Shiva Industries; Kohinoor Enterprises; HS Tapes

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Reflective Tapes Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the India reflective tapes market report on the basis of application and product:

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Automobile

-

Building & Construction

-

Clothing

-

Others

-

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Engineer Grade Glass Bead Reflective Tape

-

High Intensity Glass Bead Reflective Tape

-

Metalized Micro-Prismatic Reflective Tape

-

Non Metalized Micro-Prismatic Reflective Tape

-

Frequently Asked Questions About This Report

b. The India reflective tape market size was estimated at USD 280.7 million in 2022 and is expected to reach USD 288.4 million in 2023.

b. The India reflective tape market is expected to grow at a compound annual growth rate of 2.4% from 2023 to 2030 to reach USD 340.5 million by 2030.

b. Building & construction industry dominated the India reflective tape market with a share of 41.6% in 2022 owing to the stringent laws for worker safety and pedestrian are expected to drive product demand.

b. Some of the key players operating in the India reflective tape market include Sha Kundanmal Misrimal, Avantika Elcon Private Limited, 3M India, Shiva Industries, Kohinoor Enterprises, and HS Tapes.

b. Key factors that are driving the India reflective tape market include surge in demand for high-visibility tapes for improving workplace and roadway safety has fueled demand in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.