- Home

- »

- Homecare & Decor

- »

-

India Wallpaper Market Size & Share, Industry Report, 2030GVR Report cover

![India Wallpaper Market Size, Share & Trends Report]()

India Wallpaper Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Product (Vinyl, Nonwoven, Paper, Fabric), By End-use (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-207-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Wallpaper Market Size & Trends

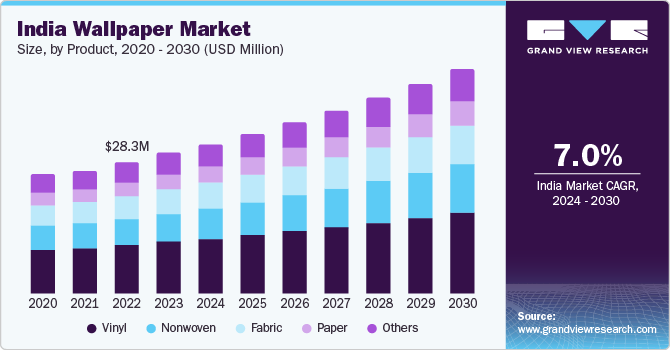

The India wallpaper market size was estimated at USD 30.3 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030. The surging popularity of home remodeling projects and technological advancements in wallpaper printing methods has dynamically boosted the need for wallpaper. The requirement will increase in the forthcoming years owing to a surge in disposable income, a shift in consumer inclinations, and a rise in DIY projects, comprising the usage of wallpaper.

India wallpaper market accounted for the share of 1.67% of the global wallpaper market in 2023. India is among the substantial nations in the Asia Pacific region (with Thailand and Malaysia) that are turning out to be a significant market for nonwoven wallpapers. Furthermore, majority of the Indian wallpaper companies primarily import goods and follow the outsourcing business model or the franchise. Moreover, enterprises from related industries, such those that make furniture and building supplies (such as paint or plywood) have entered the Indian wallpaper market. For instance, using the outsourcing approach, Greenply Industries Limited, a well-known brand in plywood and laminates, entered the wallpaper market. Under the brand name "Greenteriors," the company trades wallpaper assortments from multiple foreign manufacturers to Indian marketplaces. Asian Paints recently entered the wallpaper industry by partnering with designers and Good Earth.

A number of profitable opportunities have led to the growth of companies in the interior design sector, including Livspace, Pepperfry, Homify, and others. These businesses offer a variety of interior choices, including wallpaper, in addition to an immersive experience for home décor. For instance, Marshall's Wallpapers and 3M work together with Livespace to sell wallpaper. These kinds of business concepts have been common in India's luxury wallpaper sector.

Also, e-commerce has turned out to be a favored distribution channel for all the India-based wallpaper companies. The developing startups and the extensive efforts by brick-and-mortar businesses to shift to the e-commerce medium authenticate the online shopping trend in the wallpapers market. Nevertheless, this distribution channel may not outgrow the incomes of retail stores, but may work as a collection for the customers and become a help for selecting the vendor. It is owing to the fact that buyers always choose to inspect the kind of wallpaper, as diverse styles are obtainable presently in the market, involving 3D, embossed, non-woven, and so on.

The two main factors driving the wallpaper market are the growth of Indian suburbs and the increase in disposable income. As a result, rather than painting, clients of days prefer decorative wallpaper. In addition, the fast growth of India's real estate industry has increased demand for wallpaper for both home and commercial use. Nevertheless, prolonged exposure to sunlight increases the risk of damage, burning, or color fading to the wallpaper. Wallpaper cannot withstand for an extended period in locations that are frequently exposed to heat, humidity, or sunlight since these elements cause the wallpaper to peel off. These factors would impede the growth of the Indian wallpaper industry in the years to come.

Market Concentration & Characteristics

The India wallpaper market is highly fragmented and holds players with niche geographical coverage as well as a restricted product portfolio. Domestic production is inadequate in India, and numerous wallpapers are imported from key international brands, comprising Roberto Cavalli, Versace Home, Blumarine, and Porche Design, among others.

The India wallpaper market is also subjected to extensive governing scrutiny owing to the huge demand and use of the product. Guidelines for wallpaper usually indicated about safety criteria, restricts volatile organic compound (VOC) emission from wallpaper. In addition, compliance with standards regarding ecological sourcing of raw materials are to be involved on the labeling needs.

There are reasonable number of direct product alternatives for wallpaper. Usage of paint over the walls needs less tiresome procedure thus spawning competition from the paint industry. Nevertheless, wallpapers provide numerous benefits to homeowners who desire inexpensive and aesthetically appealing wall decor.

The rising trend of home remodeling among the users is boosting the product demand among users. Huge adoption rate of new products has been noted to be favored among millennials, which is predicted to help product consumption gain advantage in the forthcoming years.

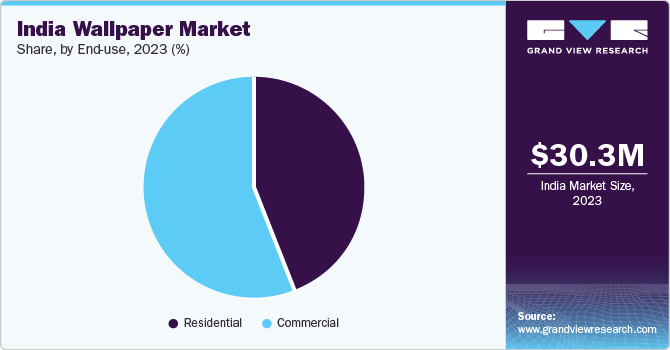

End-use Insights

Commercial wallpaper accounted for the market share of 56% in 2023. Growing urbanization, coupled with the expansion of supermarkets and hypermarkets to further extend their reach to maximum consumers, is anticipated to drive product sales through offline end-user channels across the globe over the forecast period. Also, a rise in the number of high-traffic spaces such as clubs, bars, and restaurants in India is the key factor boosting the demand in the commercial segment.

Residential wallpaper segment is expected to expand at the fastest CAGR during the forecast period. An upsurge in internet penetration among the middle-class population, paired with the increasing usage of smartphones and same devices, is the prime aspect driving the popularity of online channels in the industry. Moreover, the growing trend of offering trendy and aesthetic appeal to the walls is projected to offer prominent players the opportunity to widen their product portfolio.

Product Insights

Vinyl wallpaper market held a revenue share of 36.7% in 2023. It is gaining immense popularity, due to the advantages achieved by the product over the traditional paper wallpapers. These most long-lasting and expansively used wallpapers are totally colorfast, washable, and non-flammable.

The segment's largest share is primarily attributable to its affordability. These washable wallpapers are resistant to water and can be used to repel liquids, including water vapor. These advantages increase home customers' preference for flexibility and durability. The residential market experienced a significant increase in demand due to the solution's cost-effectiveness and rising customer awareness. Owing to the product's ease of cleaning and suitability for congested, high-traffic areas, its growth is also increasing. Furthermore, the damaged vinyl wallpaper is easily repairable. Vinyl-based products are expected to see an increase in demand in the upcoming years due to their capacity to repair damage and their appropriateness for use. Because of its fire resistance, it is a good option for high-traffic areas like schools and medical facilities.

Non-woven wallpaper market is expected to grow at a CAGR of 8.1% from 2024 to 2030. The increasing trend for DIYs is one of the prime reasons that are augmenting the demand for nonwoven wallpaper. This wallpaper can be directly pasted to the wall and can seamlessly hide cracks in the wall. These wallpapers can be removed easily and therefore do not cause any harm to the original wall. Customers in the market favor nonwoven wallpapers as they support digital printing and efficiently evade the problem of molding.

Key India Wallpaper Company Insights

The following are the leading companies in the India wallpaper market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy mappings, & products of these companies are analyzed to map the supply network. Such strategic expansions enable companies to position themselves in key locations, aligning with evolving customer preferences and design trends. These initiatives enhance accessibility to target markets and foster brand recognition, driving growth and competitiveness in the industry.

Some key players functioning in the market include:

-

Nilaya by Asian Paints: Nilaya is a brand that sells luxury wallcoverings from Asian Paints with an Indian touch to its product. It was established in 2014, and has managed to achieve a noteworthy presence across the globe, but especially in India. It presents the finest surfaces via its curations from globally-acclaimed designers, partnerships with creative Indian artists, and in-house designs by Nilaya.

-

D’Decor: D’Decor Home Fabrics is a worldwide-famous producer of soft furnishing solutions. They provide an extensive series of premium-quality fabrics that are suitable for numerous applications, drapery, comprising furniture, and more.

Some emerging players in the market include:

- Jaypore: Jaypore is involved in the business of selling varied products through online channel. The company provides accessories, home decoration, apparels, gifts, jewelry, vintage items, books, stationery, kitchen, furniture, tables, dining, bags, and travel kits. Jaypore majorly caters to its audiences that are based in India.

Key India Wallpaper Companies:

- Marshalls

- D'Decor

- Jaypore

- Nilaya by Asian Paints

- Excel Wallpapers

- Elementto

- Wallskin

- Nicobar

- The House Of Things

- Kalakaari Haath

Recent Developments

-

In April 2022, Noor, a collection of wallpapers possessed by UDC Homes, held high regard for India's renowned architectural history and the trained craft of India’s artisans. The colorful new, wallpaper patterns, whose name derives from Arabic word for light, which is "Nur," represent the numerous facets of nature and beauty, similar to a hint of vegetation, the flutter of a bird, and the calm just before dusk.

-

In January 2022, One of the well-known home furnishings companies in India, Nirmals Furnishings, is well-known for its custom-made textiles. The company displayed wall coverings from Coordonne - Wander, a Spanish company, in India. The Barcelona-based company Coordonne is well-known worldwide for its opulent wall covering and fabric selections. Nirmals Furnishings' most recent wallpaper collection, Wander, which they introduced to the Indian market for the first time, showcases the fascinating visuals that inspire daydreams in the minds of creative people.

India Wallpaper Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.3 million

Revenue forecast in 2030

USD 48.6 million

Growth rate

CAGR of 7.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

India

Key companies profiled

Marshalls; D’Decor; Jaypore; Nilaya by Asian Paints; Excel Wallpapers; Elementto; Wallskin; Nicobar; The House Of Things; Kalakaari Haath

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Wallpaper Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the India wallpaper market report based on product and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vinyl

-

Nonwoven

-

Paper

-

Fabric

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. Vinyl-based wallpaper dominated the India wallpaper market with a share of 36.7% in 2023. Vinyl-based wallpaper is becoming more and more popular because of the benefits it provides over traditional paper wallpaper. These most popular and long-lasting wallpapers are fire-retardant, colorfast, and fully washable

b. Some key players operating in the India wallpaper market include Marshalls; D’Decor; Jaypore; Nilaya by Asian Paints; Excel Wallpapers; Elementto; Wallskin; Nicobar; The House Of Things; Kalakaari Haath

b. The growing popularity of home remodeling projects along with technical developments in wallpaper printing methods have been driving up wallpaper demand. In addition, growing disposable income, changing customer tastes, and an increase in do-it-yourself wallpaper projects are anticipated to fuel demand in the upcoming years.

b. The India wallpaper market size was estimated at USD 30.3 million in 2023 and is expected to reach USD 32.3 million in 2024.

b. The India wallpaper market is expected to grow at a compound annual growth rate of 7% from 2024 to 2030 to reach USD 48.6 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.