- Home

- »

- Homecare & Decor

- »

-

Wallpaper Market Size And Share, Industry Report, 2030GVR Report cover

![Wallpaper Market Size, Share & Trends Report]()

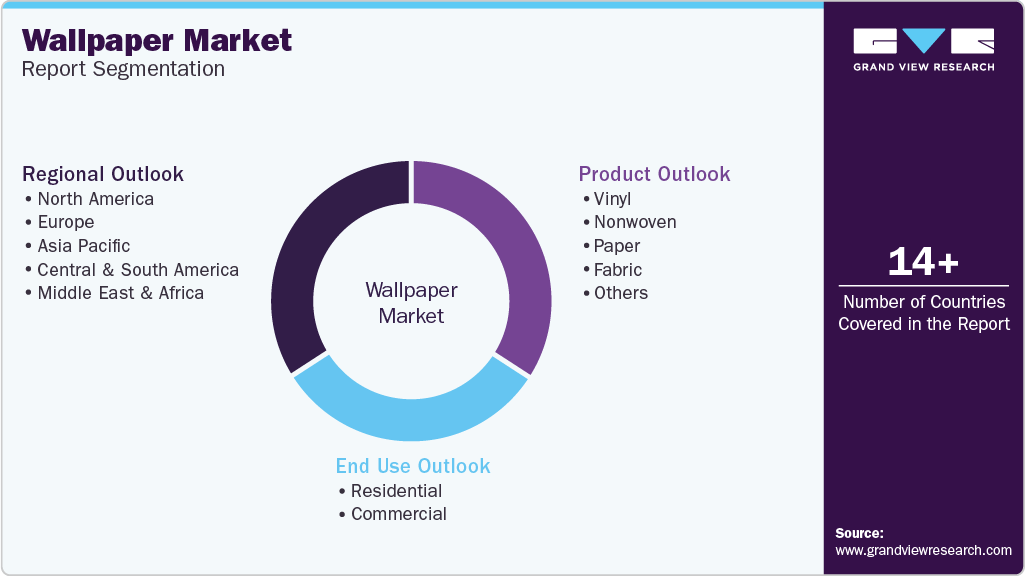

Wallpaper Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Vinyl, Nonwoven, Paper, Fabric), By End Use (Residential, Commercial), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-471-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wallpaper Market Summary

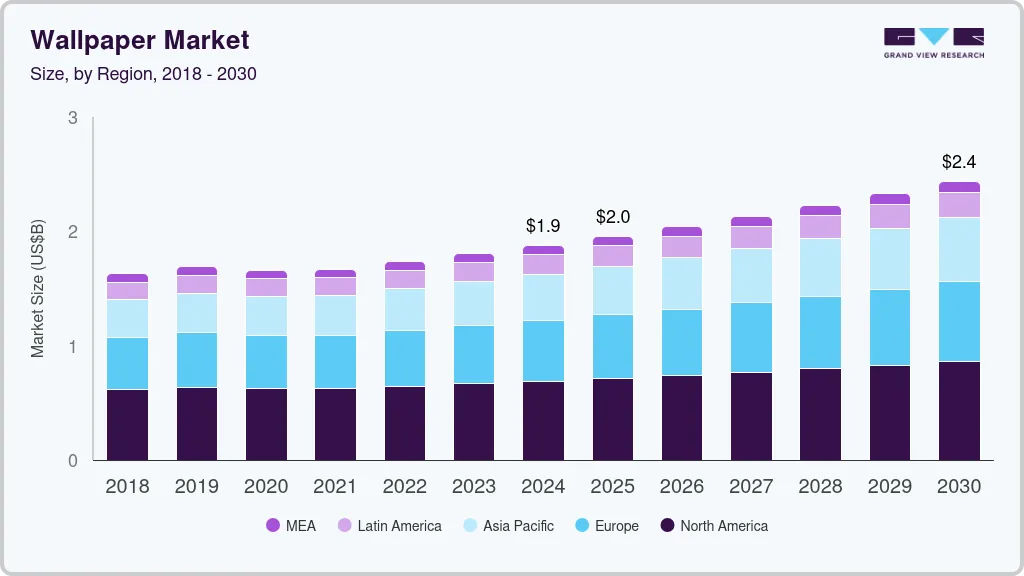

The global wallpaper market size was estimated at USD 1.9 billion in 2024 and is projected to reach USD 2.44 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. The rising adoption of home renovation activities, coupled with advancements in printing techniques, has been significantly driving the demand for wallpapers.

Key Market Trends & Insights

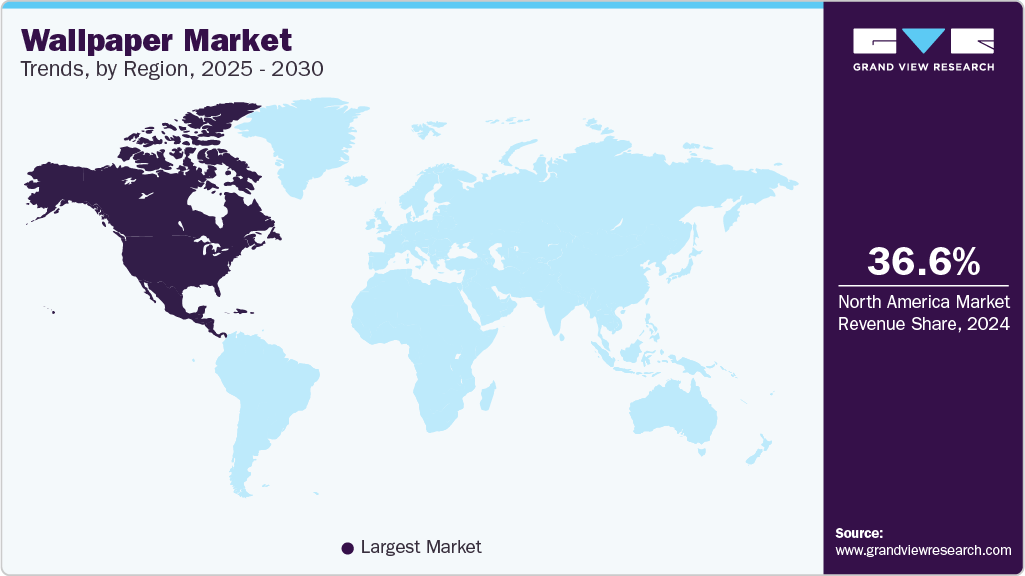

- North America wallpaper market dominated the global industry in 2024 with a revenue share of over 36.65%.

- The wallpaper market in the U.S. is projected to grow at a compound annual growth rate of 3.7% from 2025 to 2030.

- Based on product, the vinyl-based wallpaper dominated the global market with the largest revenue share of around 36.2% in 2024.

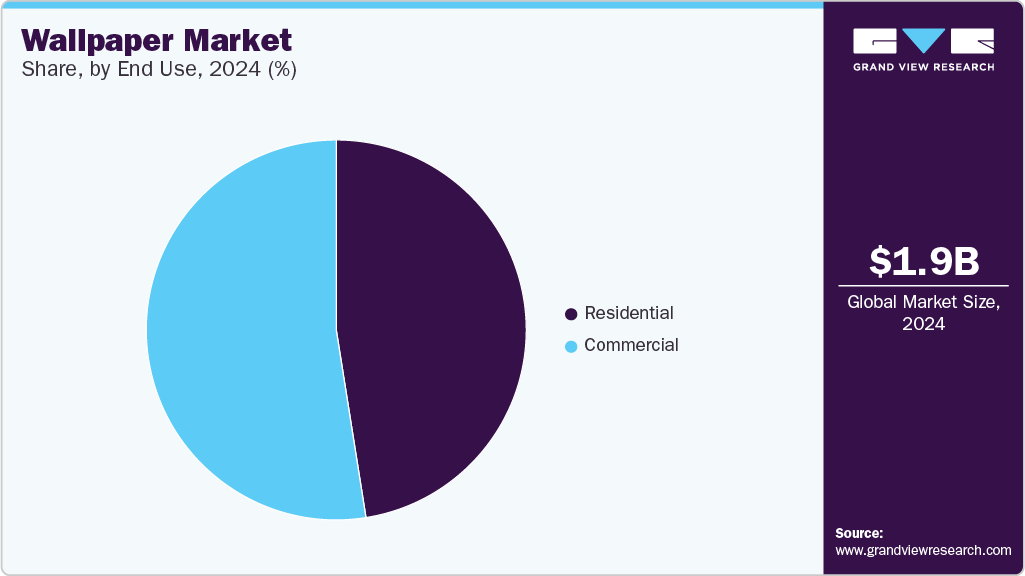

- Based on end use, the wallpaper sales for commercial applications led the global market with a share of around 52.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.9 Billion

- 2030 Projected Market Size: USD 2.44 Billion

- CAGR (2025-2030): 4.5%

- North America: Largest market in 2024

Furthermore, rising disposable income, a shift in consumer preferences, and increasing DIY projects involving the usage of wallpapers are expected to drive their demand in the coming years. Manufacturers in the wallpaper industry segregate the products based on residential and commercial usage, as both types require different types of paper, varying in thickness and weight. Wallpapers used for residential purposes are usually available in pre-pasted or unpasted styles. On the other hand, commercial wallpapers have several types based on thickness and usage. These wallpapers have been passed several tests and measures, as they are used in high-traffic areas.

The increasing demand for stain-resistant and eco-friendly wallpapers is creating a huge demand among consumers. Several manufacturers are testing the humidity levels to provide products and solutions to combat issues regarding bacterial growth. Additionally, in recent years, companies like Sangetsu Corporation and York Wallcoverings have launched several products that are stain-and damage-resistant. For instance, in June 2022, Asian Paints expanded its home décor portfolio by introducing an extensive collection across various categories, including fabrics, wallpapers, rugs, furniture, lighting, and a new bedding line under its Royale umbrella.

Manufacturers in the industry are increasingly spending on marketing, sponsorships, and partnerships to widen their customer base. The direct-to-customer channel is highly profitable for brands that have consumer loyalty and have already invested in promotional activities to build a strong brand image and a loyal consumer base. Companies are also actively focusing on this sales strategy to increase brand loyalty among consumers. For instance, in May 2022, Sanderson Design Group PLC announced a sponsorship deal with the Emery Walker Trust. This partnership led to the curation of a collection of fabrics, wallpapers, bedding, and homewares inspired by artifacts at Emery Walker's House, reflecting the company's dedication to heritage and design.

The industry is highly competitive due to the presence of a high number of companies with a strong brand image, geographic presence, and wide distribution networks. As key players across the globe focus on expanding their geographical presence, mergers & acquisitions are expected to rise in the near future and contribute to the industry’s growth. For instance, in May 2022, the largest and oldest wallcoverings producer in North America, York Wallcoverings, was acquired by Industrial Opportunities Partners (IOP) and will join Brewster Home Fashions LLC and Fine Decor LTD under the umbrella of a new entity, The Bersham Group. Such initiatives are expected to enable companies to enter the untapped market and widen their consumer outreach while contributing to growth.

Consumer Surveys & Insights

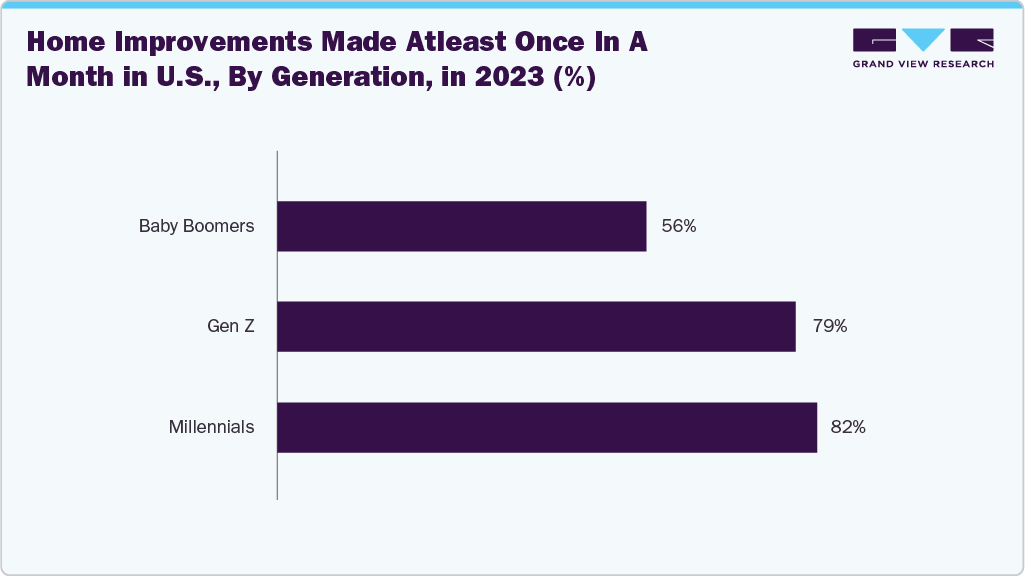

With extended periods spent at home due to work-from-home options, individuals sought to enhance their living environments, resulting in increased interest in home decor and renovations. This trend was particularly evident among millennials, many of whom identified as DIY enthusiasts. The desire for personalized and comfortable spaces drove consumers to undertake various projects, including the application of wallpapers, to transform their interiors.Over half (56%) of Baby Boomers renovated their homes in 2023, comprising the largest percentage of all generational groups who undertook renovations, according to the Houzz study.

In a study, among individuals, changes to the house exterior were most common, with 61% of homeowners doing some work on their garden, patio, or renovating the structure of the house. 58% of respondents also made improvements indoors, such as repainting walls, adding new flooring, or renovating their bathrooms. 44% of homeowners looked towards the future by introducing a tech improvement to their home. 34% made their home more environmentally friendly. This eco-conscious push was stronger among younger people, with 50% of Millennial and Gen Z respondents making steps towards making their homes better for the environment. That sentiment was echoed by only 36% of Gen X and 6% of Baby Boomer households.

Looking ahead, the industry is poised for continued growth, driven by evolving consumer preferences and technological advancements. The increasing demand for eco-friendly and sustainable products is influencing manufacturers to develop wallpapers made from recycled materials and non-toxic inks. As the emphasis on personalized and sustainable living spaces intensifies, the wallpaper industry is expected to adapt and innovate to meet these emerging consumer needs.

Trump’s Tariff Impact Analysis

The wallpaper industry is among the many industries that will be significantly impacted by U.S. President Trump's recent imposition of tariffs on Chinese imports, which can reach up to 145%. These tariffs affect a wide range of materials and products, leading to increased costs, supply chain disruptions, and strategic shifts in sourcing and project planning.

One of the most immediate and direct effects of tariffs is the increase in costs for raw materials and finished goods. Many designs, especially digitally printed and textile-based varieties, rely on Chinese manufacturing due to cost efficiency and scale. In 2023, the leading exporters of wallpaper were China, Germany, and Belgium. The top importers were the United States, France, and Uzbekistan.

Moreover, tariffs on these imports increase wholesale and retail prices, making premium designs less accessible to average consumers. Chinese factories have traditionally been major suppliers for not only raw materials but also finished home décor products like wallpaper, wall panels, and vinyl coatings. Alternative suppliers in Vietnam, India, and parts of Eastern Europe are being considered, but they may not yet match China's capacity or pricing, causing further disruption.

For the wallpaper industry, which has relied heavily on the scale and technology of Chinese printers and fabricators, rebuilding local infrastructure is costly and may result in higher long-term prices. This could potentially reshape the market's structure toward fewer, larger players with greater control over pricing and distribution.

Product Insights

Vinyl-based wallpaper dominated the global market with the largest revenue share of around 36.2% in 2024. The growth of the product is increasing due to its hassle-free cleaning nature and high-traffic spaces. Furthermore, damaged vinyl-based wallpaper can be repaired easily. The demand for vinyl-based products is anticipated to rise in the coming years on account of their damage repair characteristics and ease of use. Its fire-resistant properties make it a desirable choice for high-traffic areas like schools and medical centers.

The non-woven wallpaper sales is expected to witness a CAGR of 5.5% over the forecast period. The growing trend for DIYs is one of the major factors boosting the demand for nonwoven wallpaper. These wallpapers can be directly pasted to the wall and can perfectly hide cracks in the wall. They are easy to remove subsequently offering smoothness and an aesthetic look to the wall. Consumers in the market prefer nonwoven wallpapers as they support digital printing and effectively avoid the problem of molding.

End Use Insights

Wallpaper sales for commercial applications led the global market with a share of around 52.5% in 2024. Growing urbanization, coupled with the expansion of supermarkets and hypermarkets to further extend their reach to maximum consumers, is anticipated to drive product sales through offline end-user channels across the globe over the forecast period. Moreover, a rise in the number of high-traffic spaces like bars, clubs, and restaurants worldwide is the key factor driving the demand in the commercial segment.

Wallpaper sales for residential applications are expected to grow at a CAGR of 4.7% from 2025 to 2030. An increase in internet penetration among the middle-class population, coupled with the rising use of smartphones and similar devices, is the key factor driving the popularity of online channels in the global industry. Additionally, the rising trend of offering trendy and aesthetic appeal to the walls is expected to offer key players the opportunity to broaden their product portfolio.

Regional Insights

North America wallpaper market dominated the global industry in 2024 with a revenue share of over 36.65%. Several home renovation projects undertaken by homeowners in the region are boosting the regional product demand. Also, according to Porch.com, more than 75% of homeowners in the U.S. have carried out at least one home improvement project since the start of the pandemic. Several consumers in the region are opting for wallpapers with bold prints and textures, thereby driving the demand. The growing trend of home remodeling and home renovation is expected to contribute to the growth of the industry.

U.S. Wallpaper Market Trends

The wallpaper market in the U.S. is projected to grow at a compound annual growth rate (CAGR) of 3.7% from 2025 to 2030. This growth is driven by increasing consumer interest in home renovation and personalized interior design. Vinyl wallpapers currently dominate the market, while nonwoven wallpapers are experiencing the fastest growth due to their durability and ease of installation. The rise of eco-friendly materials and digital printing technologies is also contributing to market expansion.

Europe Wallpaper Market Trends

The wallpaper market in Europe accounted for over 28% revenue share in 2024, owing to strong demand for premium interior decor, growing renovation activities, and widespread adoption of modern aesthetics across residential and commercial spaces. The region's mature real estate market, combined with a cultural preference for stylish and customizable interiors, has driven consistent investment in wallcovering solutions.

Asia Pacific Wallpaper Market Trends

The wallpaper market in Asia Pacific is anticipated to witness the fastest CAGR of around 5.6% from 2025 to 2030. Asia Pacific is witnessing considerable growth in the construction sector owing to the rising population and urbanization. The region has competing brands that are adopting different strategies to increase their presence in the country. For instance, in May 2021, Sangetsu announced an agreement with Sanderson Design Group Plc to become the exclusive licensee of Morris & Co. wallpapers in Taiwan, Singapore, Korea, and Japan.

India wallpaper market is expected to grow at a CAGR of 7.1% during the forecast period. Driven by a significant consumer shift towards sustainable products, a large number of wallpaper manufacturers in the country are adopting specialized eco-friendly materials. For instance, UDC Homes, a major player in India, offers a range of plant-based wallpapers under the Nuance Collection.

Key Wallpaper Companies Insights

Key players operating in the wallpaper market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Wallpaper Companies:

The following are the leading companies in the wallpaper market. These companies collectively hold the largest market share and dictate industry trends.

- Sangetsu Corporation

- York Wall Coverings Inc.

- Brewster Wallpaper Corporation

- F. Schumacher & Co.

- AS Creation Tapeten AG

- Osborne & Little

- The Romo Group

- Grandeco

- 4walls

- Asian Paints

Recent Developments

-

In July 2023, F. Schumacher & Co. established its new office in the historic Devlin building, situated at the heart of Manhattan's vibrant Soho neighborhood. This relocation mirrors the company's identity as a forward-thinking design hub fueled by innovation, housing renowned brands like Schumacher, Patterson Flynn, Backdrop, and Frederic magazine.

-

In April 2023, the Romo Group collaborated with Alice Temperley, founder and creative director of Temperley London, to release a collection of wallpapers, pillows, fabric, and trimmings. Wallpapers were launched in 12 different patterns, ranging from animal prints to exotic chinoiserie to botanicals.

-

In January 2023, Grandeco Wallfashion Group Belgium NV launched a digitally printed wallpaper collection for its Mural Young Edition. The murals are digitally printed in a printing press custom-made for the company.

Wallpaper Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.95 billion

Revenue forecast in 2030

USD 2.44 billion

Growth rate (revenue)

CAGR of 4.5% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Australia & New Zealand; Brazil; Saudi Arabia; South Africa

Key companies profiled

Sangetsu Corporation; York Wall Coverings Inc.; Brewster Wallpaper Corporation; F. Schumacher & Co.; AS Creation Tapeten AG; Osborne & Little; The Romo Group; Grandeco; 4walls; Asian Paints

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wallpaper Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wallpaper market report on the basis of product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vinyl

-

Nonwoven

-

Paper

-

Fabric

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global wallpaper market was estimated at USD 1.87 billion in 2024 and is expected to reach USD 1.95 billion in 2025.

b. The global wallpaper market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 2.44 billion by 2030.

b. Vinyl-based wallpaper dominated the wallpaper market in 2024 with a share of about 36.2%. The growth of the product is increasing due to its hassle-free cleaning nature and high-traffic spaces.

b. Key players in the wallpaper market are Sangetsu Corporation; York Wall Coverings Inc.; Brewster Wallpaper Corporation; F. Schumacher & Co.; AS Creation Tapeten AG; Osborne & Little; The Romo Group; Grandeco; 4walls; Asian Paints, among others.

b. Key factors that are driving the wallpaper market growth include rising adoption of home renovation activities coupled with technological advancements in printing techniques.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.