- Home

- »

- Advanced Interior Materials

- »

-

Industrial Boiler Market Size, Share & Growth Report, 2030GVR Report cover

![Industrial Boiler Market Size, Share & Trends Report]()

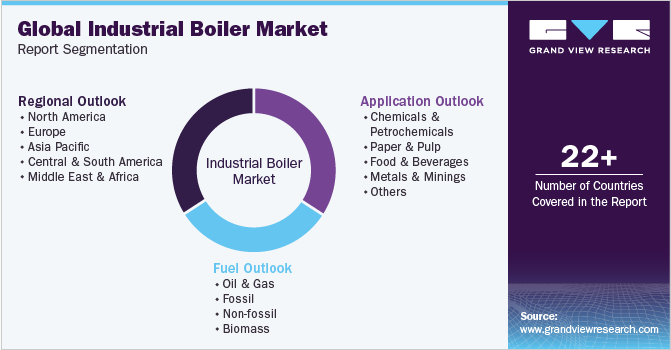

Industrial Boiler Market Size, Share & Trends Analysis Report By Application (Chemicals & Petrochemicals, Paper & Pulp, Food & Beverage, Metals & Minings), By Fuel (Oil & Gas, Fossil, Biomass), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-819-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Industrial Boiler Market Size & Trends

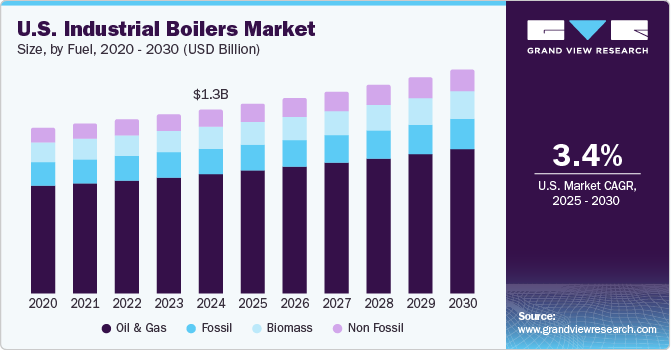

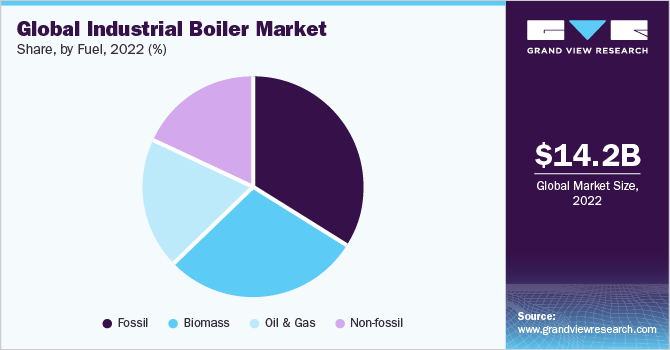

The global industrial boiler market size was valued at USD 14.2 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Rapid industrialization and the growing food and beverage industry are expected to drive the global market over the forecast period. Moreover, stringent laws to regulate harmful emissions in the environment will boost the adoption of these systems boosting the demand for industrial boilers over the coming years. Industrial boilers are used by multiple industries including food and beverage, petrochemical, power, and chemical. Boilers produce steam which is then used to carry out heating processes. The steam produced is transferred to the area of operation through pipes. In order to produce steam, boilers use different types of fuels including oil and gas, fossil, non-fossil, and biomass.

The U.S. accounted for a considerable market share in 2022. High disposable income coupled with increasing population has boosted the growth of numerous industries including food and beverages, textile, and FMCG. In order to fulfill the increased demand, companies are not only expanding their existing manufacturing units but also setting up new industrial plants thereby boosting the demand for industrial boilers over the coming years.

Rapidly growing petrochemical and chemical industries in developing economies including India and China are anticipated to boost demand for industrial boilers. The demand is expected to rise further owing to growing investment to develop mega power projects across the globe. These vessels are widely used in chemical and petrochemical industries which account for the highest market share of industrial boilers in the application segment.

The U.S. Environmental Protection Agency has estimated that new boiler rules are expected to prevent environmental emissions at a large scale. More than 88.0% of the major source boilers can meet emission standards via annual tune-ups, however, the remaining 12.0% would need refurbishing or replacement to minimize toxic emissions, which are anticipated to create opportunities for manufacturers over the forecast period.

Various problems related to manufacturing are exposed gradually as the development of the product takes place. Major issues witnessed during the manufacturing of these systems include the problems associated with materials, deformation, stress corrosion, welding issues, and hydrogen embrittlement. If the product design fails to cater to the basic functioning, then the whole manufacturing process fails to meet the company’s requirements and goals.

Application Insights

In 2022, the chemicals and petrochemicals application segment dominated the market for industrial boilers and accounted for the largest revenue share of 33.4%. The segment is expected to continue its dominance over the forecast period. These vessels are widely used by numerous industries for heating processes. The technology used has been constantly evolving according to the requirements. These boilers are designed to comply with the emission standards set by EPA.

The steam supplied by industrial boilers in distilleries provides a consistent, mild temperature conducive to successful fermentation, maintenance, and vessel heating. Low-pressure boilers are used for craft distilling due to their ability to provide sufficient energy for the process; however, high-pressure aids in reducing heat loss caused due to the long distances between the boiler and distillery equipment.

Custom boilers with unfired and fired vessels are used in petrochemical plants and petroleum refineries. Large boilers are used in the chemical industry to ensure adequate electricity and heat supply during chemical processing. Chemical manufacturers usually prefer natural gas to fire the boilers, along with the use of other chemical byproducts as fuel such as vent gases and hydrogen.

Co-firing of biomass and coal boilers is frequently used in chemical plants. Furthermore, boilers in the petroleum refining industry are fired with the help of byproduct fuel, including coke and refinery gas. The demand for large boilers in the metals industry is more focused on steel mills, where these boilers are used to produce steam for blast furnace fans, machine drives, and turbine-driven equipment.

The paper and pulp application segment is expected to grow at the fastest CAGR of 6.2% over the forecast period. The paper and pulp industry requires high-pressure steam for various processes such as cooking, bleaching, and drying. Industrial boilers are used to generate this high-pressure steam. Governments around the world are imposing strict regulations on emissions from industrial boilers. This is driving the demand for efficient and environmentally friendly boilers, which are typically water-tube boilers. In addition, there have been significant technological advancements in the design and manufacturing of industrial boilers in recent years. These advancements have led to the development of more efficient and reliable boilers, which are driving the demand for industrial boilers in the paper and pulp industry.

Fuel Insights

The fossil fuel segment accounted for the largest market share of around 34.0% in terms of revenue in 2022. Fossil fuels are widely used in these systems. These fuels produce a high amount of harmful gases including carbon monoxide. Industrial boiler manufacturers are constantly modifying their products to meet national emission standards, thereby driving the market.

Based on fuel, the market for industrial boilers has been segmented into oil and gas, fossil, non-fossil, and biomass. Different types of fuels are used by these vessels in order to produce steam to carry out industrial processes. Fossil fuel includes natural fuels including coal, bitumen, and tar sands among others whereas non-fossil fuels include fuels that are not naturally available including solar and wind.

Bagasse is also used as boiler fuel, which is a byproduct of processing sugarcane or sorghum stalks. It has a high heating value ranging from 8,000 to 9,000 Btu/lb. The biomass fuel segment is expected to witness the fastest CAGR of 6.2% during the forecast period owing to strict regulations regarding harmful emissions in the atmosphere. The biomass fuel releases low harmful gases into the environment, which is expected to boost its demand as fuel for these systems.

Increasing demand for biodegradable and environmentally friendly packaging products, higher demand for packaging, and the expanding e-commerce sector are expected to impact the growth of the pulp and paper industry positively. Thus, the growth in the industries mentioned above is likely to drive the demand for medium-capacity industrial boilers.

Regional Insights

Asia Pacific dominated the market for industrial boilers and accounted for the largest revenue share of 41.8% in 2022 and is also anticipated to witness the fastest CAGR of 5.6% over the forecast period. The region is home to the world’s largest population, which is expected to continue to grow in the coming years. This growing population is putting a strain on energy resources, and industrial boilers are seen as a more efficient and environmentally friendly way to generate steam and heat than traditional methods. Governments of countries in the Asia Pacific are also providing support for the development of industrial boilers. In China, for instance, the government has set targets for increasing the use of renewable energy, and industrial boilers are seen as a key part of this effort. In addition, the region is also enriched with a number of key raw materials used in the production of industrial boilers, such as steel and coal. This makes it a cost-effective region for manufacturing these products.

In India, the market is expected to grow fast during the forecast period. Rapid industrialization in the country has resulted in growing investments in numerous sectors including automotive, agribusiness, oil and gas, and renewable energy. Increasing demand for environmentally friendly and biodegradable packaging products and the expanding e-commerce sector is expected to boost market growth in the country over the coming years.

Europe held a considerable revenue share in the market in 2022 on account of several factors including rapid industrialization coupled with growing industries including FMCG, food and beverage, and power industry. Moreover, strict regulations by the European government about harmful emissions in the environment are expected to boost the demand for industrial boilers.

The Central and South America market is anticipated to witness a CAGR of 4.8% over the forecast period owing to increasing industrialization. In addition, the growing food and beverage industry is likely to boost the demand for industrial boilers in developing economies, especially Brazil. In Central and South America, the industrial boilers market is expected to account for a revenue share of around 10.0% by 2030.

Key Companies & Market Share Insights

The market is mature and governed by a large number of regional and global players. Companies such as Babcock and Wilcox, Parker Boiler, and Hurst Boiler have a strong regional presence and usually sell their products directly to the end-users. However, a significant number of companies rely on equipment dealers and brokers as they understand the industry and know what’s in demand and where. Some of the prominent players in the global industrial boiler market include:

-

Thermax Ltd.

-

Siemens AG

-

Bharat Heavy Electricals Ltd.

-

Forbes Marshall

-

Mitsubishi Heavy Industries, Ltd.

-

Harbin Electric Corporation

-

Cheema Boilers Limited

-

IHI Corporation

-

AC Boilers

-

Dongfang Electric Corporation Ltd.

Recent Developments

-

In December 2022, Bharat Heavy Electricals (BHEL) signed a Technology Licence Agreement with Sumitomo SHI FW of Finland to engineer, design, manufacture, erect, commission and sell supercritical & subcritical Circulating Fluidized Bed Combustion (CFBC) boilers inside India & overseas territories. CFBC technology provides fuel flexibility, improved operating flexibility, decreased Sox & Nox emissions, and the capability of providing bio-mass co-fired CFBC boilers.

-

In November 2022, Babcock & Wilcox made an announcement that it received a contract of over USD 24 million for supplying advanced control technologies, 2 industrial package boilers & auxiliary equipment for a petrol processing plant in North America.

-

In August 2022, Thermax, a provider of energy and environmental solutions, developed a unique multi-fuel boiler solution for industrial users wishing to transition from a traditional portfolio to a green one with the flexibility of switching inputs.

-

In August 2022, FlexiSource, a multi-waste solution from Thermax Babcock & Wilcox Energy Solutions, was created to enable energy input flexibility. It solves the problem of fuel availability caused by geopolitical changes, other prices & environmental considerations.

Industrial Boiler Market Report Scope

Report Attributes

Details

Market size value in 2023

USD 14.9 billion

Revenue forecast in 2030

USD 20.7 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, fuel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America (CSA); MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; Spain; China; India; Japan; South Korea; Australia; Thailand; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Thermax Ltd.; Siemens AG; Bharat Heavy Electricals Ltd.; Forbes Marshall; Mitsubishi Heavy Industries, Ltd.; Harbin Electric Corporation; Cheema Boilers Limited; IHI Corporation; AC Boilers; Dongfang Electric Corporation Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Boiler Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial boiler market report based on application, fuel, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chemicals & Petrochemicals

-

Paper & Pulp

-

Food & Beverages

-

Metals & Minings

-

Others

-

-

Fuel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oil & Gas

-

Fossil

-

Non-fossil

-

Biomass

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial boiler market size was estimated at USD 14.2 billion in 2022 and is expected to be USD 14.9 billion in 2023.

b. The global industrial boilers market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 20.7 billion by 2030.

b. Rapid industrialization and the growing food & beverage industry are expected to drive the global market over the forecast period. Moreover, stringent laws to regulate harmful emissions in the environment will boost the adoption of these systems boosting the demand for industrial boilers over the coming years.

b. Asia Pacific dominated the market in 2022 by accounting for a share of 41.8% of the market. Rapid industrialization in the region has resulted in growing investments in numerous sectors, including automotive, agribusiness, oil and gas, and renewable energy.

b. Some of the key players operating in the industrial boiler market include Thermax Ltd, Siemens AG, Bharat Heavy Electricals Ltd., Forbes Marshall, Mitsubishi Heavy Industries, Ltd., Harbin Electric Corporation, Cheema Boilers Limited, IHI Corporation, AC Boilers, Dongfang Electric Corporation Ltd.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."