- Home

- »

- Next Generation Technologies

- »

-

Industrial Connectivity Market Size, Industry Report, 2033GVR Report cover

![Industrial Connectivity Market Size, Share & Trends Report]()

Industrial Connectivity Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Deployment (On-premise, Cloud-based), By Connectivity (Wired, Wireless), By End Use (Aerospace & Defense, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-744-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Connectivity Market Summary

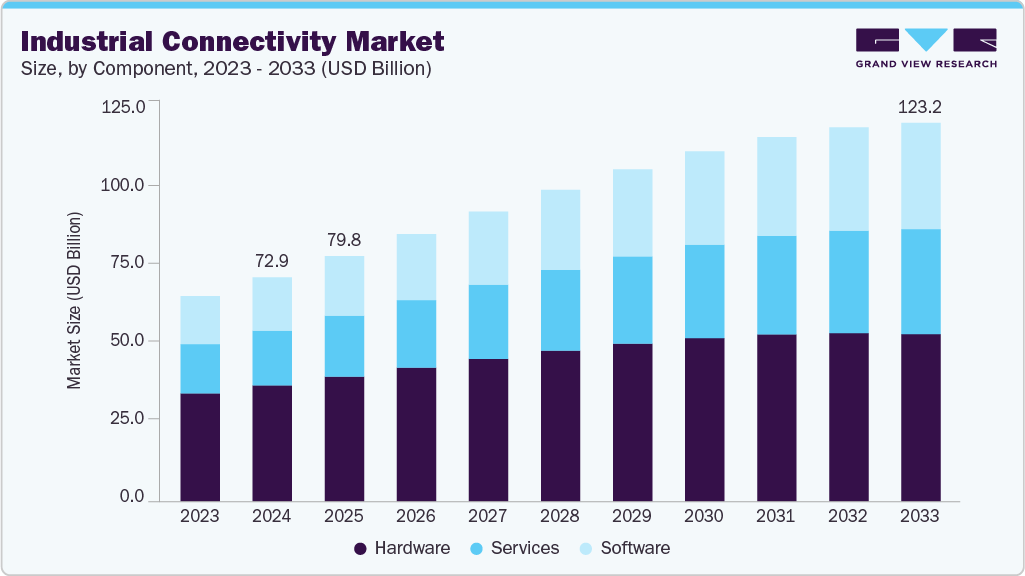

The global industrial connectivity market size was estimated at USD 72.93 billion in 2024 and is projected to reach USD 123.19 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The market growth is primarily driven by the increasing demand for seamless and reliable communication networks.

Key Market Trends & Insights

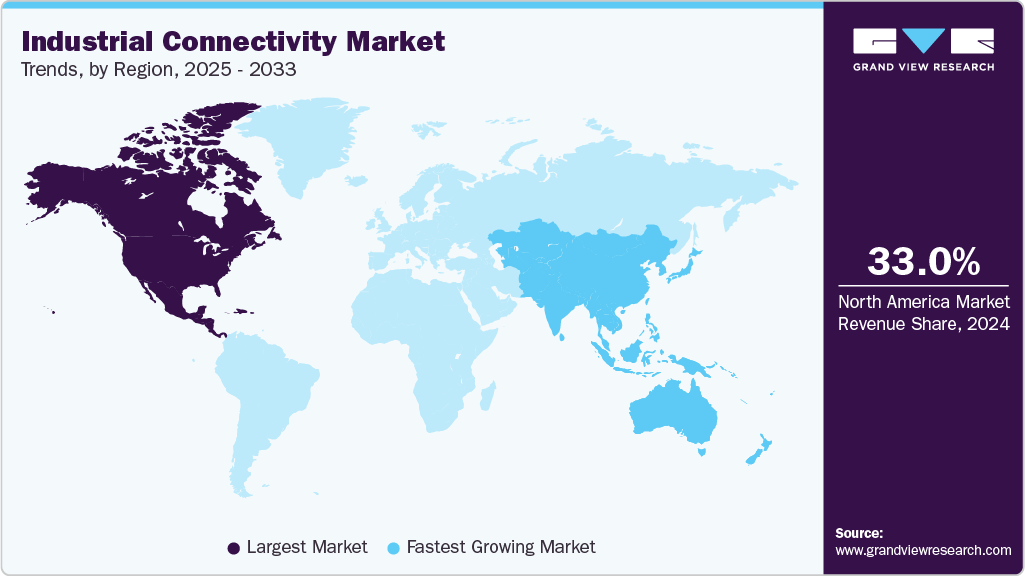

- North America dominated the global industrial connectivity market with the largest revenue share of over 33% in 2024.

- The industrial connectivity market in the U.S led the North America market and held the largest revenue share in 2024.

- By component, the hardware segment led the market and held the largest revenue share of over 51% in 2024.

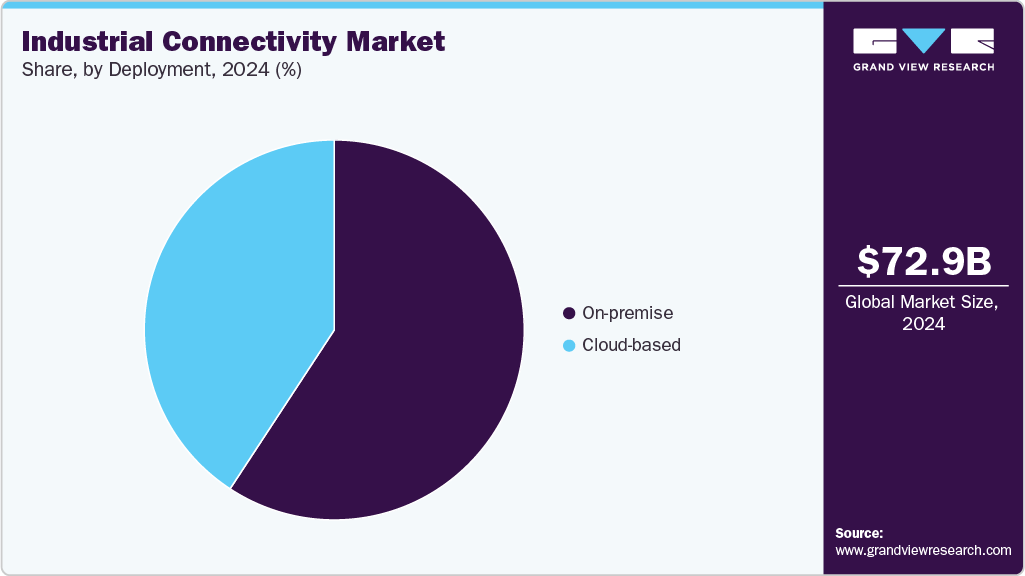

- By deployment, the on-premise segment led the market and held the largest revenue share of over 59% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 72.93 billion

- 2033 Projected Market Size: USD 123.19 billion

- CAGR (2025-2033): 5.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising adoption of IoT-enabled devices for real-time monitoring, data collection, and predictive maintenance is expected to boost the growth of the market. The market growth is primarily driven by the increasing demand for seamless and reliable communication networks. The rising adoption of Industry 4.0 technologies, automation, and IoT-enabled devices is prompting manufacturers and enterprises to invest in advanced connectivity solutions. The emphasis on improving operational efficiency, reducing downtime, and enhancing real-time data exchange is encouraging the deployment of high-speed, low-latency networks. Ongoing advancements in edge computing, network security, and artificial intelligence are enhancing data processing capabilities and enabling smarter decision-making, which is expected to drive the market expansion.

The growing demand for real-time data exchange and seamless communication between devices is significantly fueling the growth of the market. Industrial connectivity solutions provide reliable, high-speed networks that enable machine-to-machine communication, remote monitoring, and predictive maintenance across manufacturing plants and supply chains. These capabilities help companies reduce downtime, optimize asset utilization, and enhance operational efficiency, thereby accelerating the adoption of the market.

In addition, the increasing automation of industrial processes is becoming a major growth driver for the market. Industries such as manufacturing, energy, and logistics are integrating sensors, IoT devices, and robotics that rely on robust connectivity solutions to function effectively. The need for synchronized operations, fault detection, and performance analytics across multiple facilities pushes enterprises to invest in advanced connectivity infrastructure that ensures uninterrupted data flow and process optimization.

Furthermore, stringent government regulations and safety standards are driving the adoption of industrial connectivity systems. Industries are required to implement real-time monitoring and reporting mechanisms to ensure workplace safety, environmental compliance, and disaster prevention. Connectivity platforms that support automated alerts, hazard detection, and remote diagnostics help organizations meet regulatory requirements while minimizing operational risks, particularly in sectors handling hazardous materials and complex machinery.

Moreover, the rise of smart factories and Industry 4.0 initiatives creates robust demand for interconnected systems. Industrial connectivity enables predictive maintenance, energy management, and supply chain optimization by leveraging cloud computing, edge analytics, and AI-driven insights. These solutions improve productivity, support scalable operations and data-driven decision-making, offering companies a competitive edge in the market.

Component Insights

The hardware segment dominated the market with a revenue share of over 51% in 2024, driven by the increasing demand for robust and reliable devices that support real-time data acquisition and seamless communication. Their rugged designs and high interoperability with various industrial protocols allow deployment in harsh environments. The growing adoption of industrial sensors, gateways, edge computing devices, process automation, and energy management continues to expand their application scope and reinforces the segment’s momentum in the market.

The software segment is expected to witness the fastest CAGR of over 7% from 2025 to 2033. This growth is attributed to the rising adoption of advanced analytics platforms, cloud-based monitoring solutions, and AI-powered predictive maintenance tools that enhance operational efficiency and reduce downtime. Innovations such as digital twins for process simulation and secure communication protocols for industrial networks improve system reliability and data-driven decision-making, thereby contributing to the software segment’s rapid adoption in the market.

Connectivity Insights

The wired segment accounted for the largest market share in 2024, owing to the rising demand for high-reliability industrial connectivity solutions that offer stable data transmission and minimal latency in critical operations. The segment’s growth is further supported by advancements in ruggedized connectors, enhanced shielding techniques, and high-bandwidth cabling systems that ensure uninterrupted communication in harsh industrial environments. This combination of reliability, performance, and cost-effectiveness continues to drive this segment's dominance in the market.

The wireless segment is expected to witness the fastest CAGR from 2025 to 2033. This growth is driven by the rising demand for scalable and flexible industrial communication networks capable of supporting diverse automation processes. The ability of wireless solutions such as 5G, Wi-Fi 6, and private LTE to deliver ultra-reliable, low-latency communication enhances real-time monitoring. These high-capacity networks are gaining traction in manufacturing and energy sectors, where robust connectivity supports predictive maintenance and digital twin technologies, further propelling the segment’s expansion in the market.

End Use Insights

The manufacturing segment held the largest market share in 2024, fueled by increasing emphasis on smart factory initiatives and predictive maintenance strategies. This growth is driven by the rising adoption of connected sensors, industrial IoT gateways, and real-time data analytics platforms. The growing demand for automated processes, energy optimization, and remote monitoring solutions, along with the need to enhance worker safety and ensure compliance with regulatory standards, reinforces the dominance of the manufacturing segment in the market.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2033. The increasing demand for real-time patient monitoring and remote diagnostics in hospitals and healthcare facilities drives the growth. The industrial connectivity industry enables seamless data exchange between medical devices, wearables, and cloud platforms, ensuring continuous monitoring of patient health metrics. Advancements in edge computing and 5G-enabled low-latency communication enhance connected healthcare systems' speed, reliability, and scalability, reinforcing the segment’s leadership in the market.

Deployment Insights

The on-premises segment accounted for the largest market share in 2024, owing to the rising preference for secure, high-performance industrial networks that require low latency, enhanced control, and compliance. On-premise solutions offer improved reliability, faster data processing, and uninterrupted connectivity in critical industrial environments such as manufacturing plants, energy facilities, and transportation hubs. The segment’s ability to support edge computing, AI-driven analytics, and predictive maintenance is reinforcing its position and continues to drive the segment’s movement in the market.

The cloud-based segment is expected to witness the fastest CAGR from 2025 to 2033. This growth is driven by the increasing need for seamless data integration, real-time monitoring, and predictive maintenance. Equipped with advanced cloud computing infrastructure and scalable storage solutions, cloud-based systems enable remote access to operational data. Cloud platforms support the integration of IoT devices and digital twins, thereby improving system interoperability. These factors collectively drive the adoption of cloud-based solutions in the industrial connectivity industry.

Regional Insights

The North America industrial connectivity industry accounted for the largest market share of over 33% in 2024, primarily driven by the region’s rapid adoption of Industry 4.0 technologies and the expansion of smart manufacturing facilities. Stringent government regulations on workplace safety and environmental monitoring are prompting industries to implement advanced connectivity solutions for predictive maintenance and compliance reporting. The growing focus on energy efficiency and sustainable operations is accelerating the deployment of the industrial connectivity industry in North America.

U.S. Industrial Connectivity Market Trends

The U.S. industrial connectivity industry accounted for the largest market share of over 82% in 2024. Rising investments in smart manufacturing and automation, automotive, and energy significantly drive the demand for reliable connectivity solutions. Expanding 5G infrastructure and edge computing capabilities in metropolitan hubs like Silicon Valley further enhances data-driven decision-making and enables seamless integration of IoT-enabled equipment. The growing need for energy optimization is prompting U.S.-based industries to adopt secure connectivity platforms, thereby strengthening the overall growth of the country's market.

Europe Industrial Connectivity Market Trends

The Europe industrial connectivity industry is expected to grow at a CAGR of over 5% from 2025 to 2033. In Europe, the market is driven by increasing investments in smart manufacturing and Industry 4.0 initiatives supported by EU policies promoting digital transformation. The region’s focus on energy efficiency and sustainability encourages industries to adopt connected solutions for predictive maintenance, real-time monitoring, and optimized resource management. Significant growth opportunities are emerging in the industrial connectivity industry in Europe. The expanding collaboration between technology providers and industrial sectors, along with strong regulatory support for innovation and automation, is creating significant growth opportunities in the industrial connectivity industry in Europe.

The UK industrial connectivity industry is expected to grow at a significant rate in the coming years. The country’s focus on renewable energy and smart grid development drives the need for reliable, high-speed networks. Its advanced aerospace and automotive sectors require seamless data exchange for automation and efficiency. Investments in smart city projects and intelligent transportation systems are further boosting demand. Strict safety and environmental regulations are encouraging the adoption of connected solutions for monitoring and compliance.

The Germany industrial connectivity industry is driven by the country’s strong focus on Industry 4.0 and its advanced manufacturing ecosystem. Government initiatives promoting smart factories, energy efficiency, and automation are encouraging industries to adopt seamless communication networks and IoT-based solutions. Germany’s robust automotive, aerospace, and chemical sectors are investing in real-time monitoring and predictive maintenance systems to enhance productivity and safety. The increasing use of 5G networks and edge computing for data-driven operations is further propelling the growth of the industrial connectivity industry across the country.

Asia Pacific Industrial Connectivity Market Trends

The Asia Pacific industrial connectivity industry is expected to grow at the fastest CAGR of over 8% from 2025 to 2033, fueled by rapid industrialization, expansion of smart factories, and increasing adoption of automation technologies. Rising investments in manufacturing, energy, and logistics sectors and government initiatives promoting Industry 4.0 fuel demand for reliable connectivity solutions. Supportive regulatory frameworks and increasing focus on operational efficiency and real-time data analytics further position the Asia Pacific as a key hub for the market.

The Japan industrial connectivity industry is gaining momentum, driven by the country’s rapid adoption of Industry 4.0 technologies and its focus on smart manufacturing. Japan’s advanced manufacturing sector, high automation levels, and widespread use of robotics create strong demand for reliable industrial connectivity solutions. The need for real-time monitoring, predictive maintenance, and seamless data exchange across supply chains is strengthening the market’s growth trajectory across the country.

The China industrial connectivity industry is rapidly expanding.Increasing industrial automation and the country’s push toward smart manufacturing drive demand for advanced connectivity solutions. Rising adoption of IoT, AI, and cloud-based platforms in factories and logistics hubs is enhancing operational efficiency and real-time monitoring. China’s large-scale manufacturing base and growing need for safety compliance and predictive maintenance are boosting the deployment of industrial connectivity systems.

Key Industrial Connectivity Company Insights

Some of the key players operating in the market include Cisco Systems, Inc. and Siemens among others.

-

Cisco Systems, Inc. is a global player in the market for industrial connectivity, leveraging its expertise in networking, IoT platforms, and secure industrial communications. Cisco’s solutions enable real-time data exchange, predictive maintenance, and seamless machine-to-machine connectivity across manufacturing and logistics sectors. Through continuous R&D, strategic acquisitions, and integration of cloud-based analytics and cybersecurity features, Cisco has strengthened its leadership position in the market.

-

Siemens is capitalizing on its extensive portfolio of automation, IoT, and smart factory solutions. Siemens’ connectivity systems support real-time monitoring, energy management, and predictive analytics across diverse industrial sectors. Through innovations in AI-driven process optimization, strategic collaborations, and Industry 4.0 initiatives, Siemens has reinforced its prominence and influence in the industrial connectivity industry.

Advantech Co., Ltd. and Huawei Technologies Co., Ltd. are some of the emerging market participants in the market.

-

Advantech Co., Ltd. is an emerging player gaining recognition for its industrial IoT and edge computing connectivity solutions. Products like the Advantech ECU series are specifically designed for real-time monitoring, data aggregation, and predictive maintenance. Advantech is rapidly expanding its presence through strategic partnerships and customized industrial connectivity deployments, positioning itself as a growing force in the market.

-

Huawei Technologies Co., Ltd. is an emerging player gaining traction with its 5G-enabled industrial connectivity platforms. Huawei’s OceanConnect IoT suite supports seamless machine-to-machine communication, cloud integration, and low-latency data transmission for smart manufacturing. Huawei is actively implementing these solutions across industrial facilities in China and globally, establishing itself as a key emerging player in the market.

Key Industrial Connectivity Companies:

The following are the leading companies in the industrial connectivity market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Siemens

- ABB

- Schneider Electric

- Honeywell International Inc.

- General Electric Company

- Rockwell Automation

- Advantech Co., Ltd.

- Emerson Electric Co.

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Nokia

Recent Developments

-

In July 2025, ABB launched the ACS380-E machinery drive, engineered for industrial connectivity. This product offers high performance, seamless connectivity through built-in Ethernet ports supporting major industrial protocols, and robust cybersecurity features. Enhanced by ABB’s Drive Composer software, it simplifies equipment monitoring, adaptive programming, and rapid offline configuration, marking a significant advancement in industrial network integration.

-

In June 2025, Cisco Systems, Inc. introduced a new network architecture specifically designed to advance the market. This architecture enhances industrial networks by providing unmatched operational simplicity through unified management, next-generation networking devices optimized for AI workloads in industrial environments, and advanced security features embedded directly into the network.

-

In June 2025, Honeywell International Inc. introduced new digital technologies leveraging artificial intelligence. These AI-driven solutions are designed to accelerate the shift from automation to autonomy in industrial environments, improving operational efficiency, safety, and cybersecurity. Honeywell's innovations include AI-enabled cybersecurity defenses and an expanded Digital Prime platform that enhances connectivity and protects operational technology (OT) systems, marking a significant advancement in the market.

Industrial Connectivity Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 79.79 billion

Revenue forecast in 2033

USD 123.19 billion

Growth Rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, connectivity, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Cisco Systems, Inc.; Siemens; ABB; Schneider Electric; Honeywell International Inc.; General Electric Company; Rockwell Automation; Advantech Co., Ltd.; Emerson Electric Co.; Huawei Technologies Co., Ltd.; Mitsubishi Electric Corporation; Nokia

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Industrial Connectivity Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the industrial connectivitymarket report based on component, deployment, connectivity, application, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Cloud-based

-

-

Connectivity Outlook (Revenue, USD Billion, 2021 - 2033)

-

Wired

-

Wireless

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Aerospace & Defense

-

Automotive

-

Chemical

-

Energy & Utilities

-

Food & Beverage

-

Healthcare

-

Manufacturing

-

Mining & Metal

-

Oil & Gas

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial connectivity market size was estimated at USD 72.93 billion in 2024 and is expected to reach USD 79.79 billion in 2025.

b. The global industrial connectivity market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 123.19 billion by 2033.

b. The hardware segment dominated the market with a share of over 51% in 2024, driven by the increasing demand for robust and reliable devices that support real-time data acquisition and seamless communication.

b. Key players operating in the industrial connectivity market include Cisco Systems, Inc., Siemens, ABB, Schneider Electric, Honeywell International Inc., General Electric Company, Rockwell Automation, Advantech Co., Ltd., Emerson Electric Co., Huawei Technologies Co., Ltd., Mitsubishi Electric Corporation, and Nokia.

b. The increasing demand for seamless and reliable communication networks, the rising adoption of IoT-enabled devices for real-time monitoring, data collection, and predictive maintenance, and the increasing automation of industrial processes are key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.