- Home

- »

- Next Generation Technologies

- »

-

Industrial Electric Vehicles Market Size, Share Report, 2030GVR Report cover

![Industrial Electric Vehicles Market Size, Share & Trends Report]()

Industrial Electric Vehicles Market Size, Share & Trends Analysis Report By Product Type (Automated Guided Carts, Automated Tow Tractor, Autonomous Mobile Robots, Automated Guided Forklift), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-150-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Industrial Electric Vehicles Market Trends

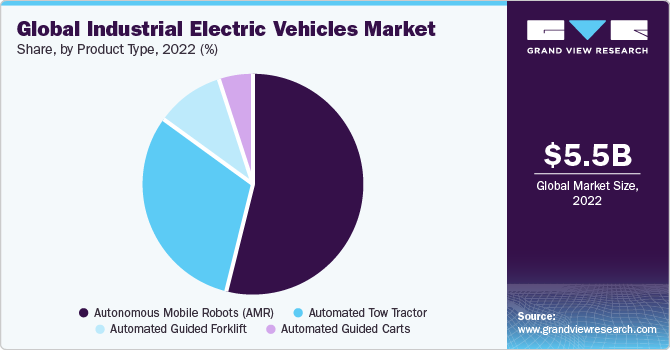

The global industrial electric vehicles market size was estimated at USD 5.47 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.0% from 2023 to 2030. With the growing competition, businesses are seeking ways to optimize their operations and reduce costs. Industrial electric vehicle equipment provides a way to automate material handling and storage processes, increasing efficiency and productivity. Advancements in technology are also contributing to the growth of the market. The development of new technologies such as robotics, AI, and ML has created more sophisticated and versatile industrial electric vehicles to handle a broader range of materials and products.

In September 2021, Locus Robotics, a robotic process automation firm, announced the acquisition of Waypoint Robotics, Inc., a manufacturer of automation machinery, to expand Locus' product portfolio of tried-and-true AMR solutions, which handle use cases ranging from case-picking, e-commerce, and pallet-picking to scenarios needing heavier, larger payloads and fulfillment modalities.

Material handling equipment is required in a warehouse or manufacturing plant for efficient product movement, stock location, order preparation, and localization. Industrial companies worldwide invest in new automated storage, retrieval systems, and other material handling equipment as they improve their facilities, adopt advanced manufacturing techniques, and create new factories and warehouses to increase productivity and lower labor costs. Additionally, the development of AI and automation has led to the emergence of brand-new market sub-segments for industrial electric vehicles, which are expanding more quickly than the conventional sub-segments, and posing severe difficulties for OEMs.

Industrial electric vehicles are increasingly switching from lead acid to lithium-ion batteries, driven by faster charging rates, better round-trip efficiencies, longer life- cycles, and high energy density (about triple the lead-acid battery capacity). As these batteries do not require any watering and give off no gases, they are a perfect fit for industrial electric vehicles that operate around the clock. Lithium-ion batteries are much smaller and lighter than their lead-acid counterparts.

Any warehouse or conveyor operation can be significantly improved by combining industrial vehicles and lithium-ion batteries, and the efficiencies and savings grow as the process evolves. In March 2022, Electrovaya, a manufacturer of lithium-ion batteries, showcased its batteries which have a long-running cycle with UL-certified safety standards and their advantages. EV14S1P is a lithium battery with EV-44 lithium-ion ceramic cells, which powers more than 1000 AGVs. Its UL certification makes its lithium battery safer and offers users longevity.

Industrial EVs such as AGV and AMR can be customized to meet the specific needs of a business, which contributes to the growth of the market. Businesses can work with AGV and AMR providers to design and implement a system tailored to their requirements, allowing for better integration with existing processes and systems. Another essential benefit of these industrial EVs is their potential contribution to environmental sustainability.

By automating material handling and storage processes, these systems can reduce energy consumption and waste, leading to a more sustainable operation. AMR can be designed to optimize the use of space and energy, resulting in reduced energy consumption compared to manual or traditional material handling methods. They can also be programmed to conserve energy by operating only when necessary, such as during peak periods, and shutting down during low-demand periods.

Product Type Insights

The autonomous mobile robots (AMR) segment led the market in 2022, accounting for over 53% share of the global revenue. AMRs, equipped with sensors and advanced software for autonomous navigation, are gaining popularity due to their distinct advantages over conventional material handling methods such as forklifts and conveyor belts. They offer increased flexibility and scalability, leading to improved efficiency and productivity. AMRs can operate 24/7, moving materials swiftly and significantly enhancing operational efficiency. Additionally, they reduce labor costs by automating tasks performed by humans, enhance safety by avoiding obstacles, and provide flexibility and scalability to adapt to changing business needs.

The automated guided forklift segment is predicted to show significant growth during the forecast period. Automated guided forklifts continue to advance in capabilities and find increasing applications across various industries. The ongoing developments in robotics, AI, and connectivity technologies are expected to drive further innovations, resulting in more efficient, safe, and flexible material-handling operations. In September 2022, Jungheinrich AG announced the launch of two new series of full-electric forklift trucks, namely EFG BB and BC series forklifts. These forklift trucks are used in various sectors such as warehouses, manufacturing, production, agriculture, and trade. These forklift trucks offer fast delivery times, low acquisition costs, and reliable essential equipment suitable for outdoor applications.

Regional Insights

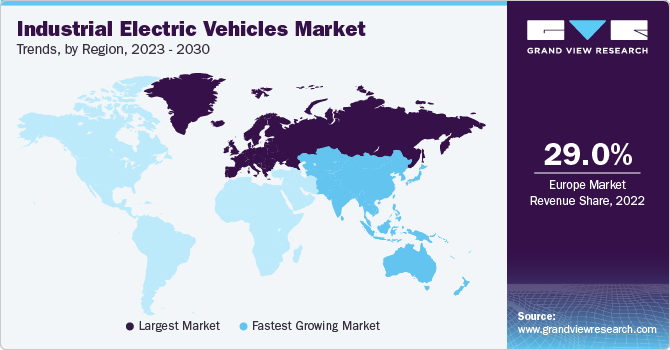

Europe dominated the market in 2022, accounting for over 29% share of the global revenue. Industrial electric vehicles are gaining momentum in Europe due to the increasing demand in the manufacturing industry. The need for efficient and automated manufacturing, warehousing, and logistics processes has led to a growing demand for industrial electric vehicles such as AGV and AMR that streamline operations, increase productivity, and reduce costs. Sustainability also drives the adoption of AGV and AMR in Europe. By reducing waste, energy consumption, and carbon emissions, automated systems can help companies meet their sustainability goals, leading to more sustainable and eco-friendly operations.

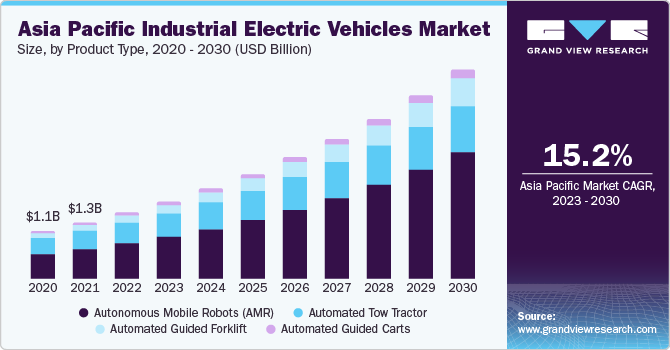

Asia Pacific is anticipated to register the fastest CAGR over the forecast period attributed to several factors, including the increasing demand for industrial electric vehicles across various industries such as e-commerce, automotive, and food & beverage. The market is projected to grow in emerging countries such as India, Indonesia, Malaysia, and Vietnam. The region's flourishing manufacturing and automobile sectors are expected to spur the demand for industrial electric vehicles. In September 2022, Mitsubishi Logisnext Asia Pacific Pte. Ltd. partnered with XSQUARE Technologies Pte. Ltd., an intelligent warehouse automation solutions pioneer. The partnership intends to make (AGVs) automated guided vehicles and expand its presence in the region.

Key Companies & Market Share Insights

Established companies and startups seize opportunities in the rapidly growing and evolving industrial electric vehicles industry. Organic strategies encompass expanding product lines, investing in technology innovation, and exploring new geographical markets. Inorganic tactics involve mergers, acquisitions, and strategic partnerships to access innovation and enter new market segments swiftly, reflecting the dynamic nature of this evolving market.

In June 2023, Dematic, a company that designs and manufactures industrial vehicles and material handling equipment, introduced its third-generation freezer-rated automated guided vehicles (AGVs) with improved navigation and sensor technology that surpasses the latest global safety standards. These advancements demonstrate Dematic's commitment to enhancing the efficiency and safety of automated warehouse operations, particularly in the freezer environments.

Key Industrial Electric Vehicles Market Companies:

- Swisslog Holding AG

- Dematic

- Daifuku Co., Ltd.

- Bastian Solutions, Inc.

- Toyota Industries Corporation

- Hyster-Yale Materials Handling, Inc.

- Balyo

- John Bean Technologies Corporation (JBT)

- Seegrid Corporation

- Kuka AG

- Jungheinrich AG

- Schaefer Holding International GmbH

Industrial Electric Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.32 billion

Revenue forecast in 2030

USD 15.80 billion

Growth rate

CAGR of 14.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Swisslog Holding AG; Dematic; Daifuku Co., Ltd.; Bastian Solutions, Inc.; Toyota Industries Corporation; Hyster-Yale Materials Handling, Inc.; Balyo; John Bean Technologies Corporation (JBT); Seegrid Corporation; Kuka AG; Jungheinrich AG; Schaefer Holding International GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Electric Vehicles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global industrial electric vehicles market report based on product type and region.

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Automated Guided Carts

-

Automated Tow Tractor

-

Autonomous Mobile Robots (AMR)

-

Automated Guided Forklift

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial electric vehicles market size was estimated at USD 5.47 billion in 2022 and is expected to reach USD 6.32 billion in 2023.

b. The global industrial electric vehicles market is expected to grow at a compound annual growth rate of 14.0% from 2023 to 2030 to reach USD 15.80 billion by 2030.

b. Europe dominated the market in 2022, accounting for over 29% share of the global revenue. Industrial electric vehicles are gaining momentum in Europe due to the increasing demand in the manufacturing industry.

b. Some key players operating in the industrial electric vehicles market include Swisslog Holding AG; Dematic; Daifuku Co., Ltd.; Bastian Solutions, Inc.; Toyota Industries Corporation; Hyster-Yale Materials Handling, Inc.; Balyo; John Bean Technologies Corporation (JBT); Seegrid Corporation; Kuka AG; Jungheinrich AG; Schaefer Holding International GmbH.

b. Key factors driving the industrial electric vehicles market growth include increasing demand for automation and material handling equipment in various process industries, replacement of conventional batteries with lithium-ion batteries, and the rapidly growing e-commerce industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."