- Home

- »

- Advanced Interior Materials

- »

-

Industrial Fasteners Market Size, Share, Growth Report 2030GVR Report cover

![Industrial Fasteners Market Size, Share & Trend Report]()

Industrial Fasteners Market Size, Share & Trend Analysis Report By Raw Material (Metal, Plastic), By Product (Externally Threaded, Internally Threaded, Non-threaded), By Application (Aerospace), By Distribution Channel (Direct, Indirect), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-351-5

- Number of Report Pages: 213

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Industrial Fasteners Market Size & Trends

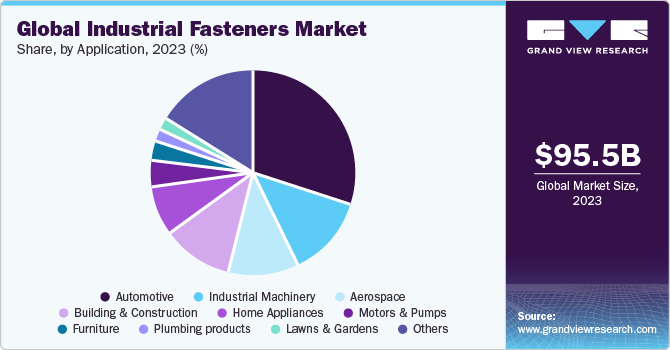

The global industrial fasteners market size was estimated at USD 95.46 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. The market is expected to be driven by the growing population, high investments in the construction sector, and rising demand for industrial fasteners in the automotive and aerospace sectors. Infrastructure development is one of the key parameters to be considered while tracking the regional development of the market. The construction industry notably impacts the demand for industrial fasteners as they are extensively used in buildings, bridges, walls, and roofs. Unlike other industries, fasteners used in construction are standardized and subject to stringent quality checks. Government intervention through a regulatory framework pressurizes manufacturers to offer standardized products with superior performance characteristics.

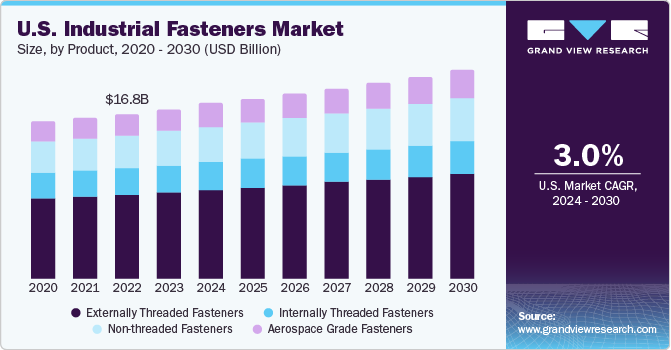

The U.S. is one of the largest fasteners importing countries in the world and is likely to witness a similar trend over the forecast period on account of high product demand in automation, aerospace, and other industrial applications. Moreover, owing to the growing demand for lightweight vehicles and aircraft, companies are shifting from standard to customized products, which in turn is positively increasing the U.S. fastener market size across these industries.

The market for industrial fasteners is characterized by intensive technological developments to produce advanced, lightweight products that find usage in automotive and other industrial applications. With the enhancement in technology, the rising demand for hybrid fasteners, which incorporate a combination of injection-molded plastic components with metal elements, is expected to drive the demand.

Increasing metal prices and the decelerating growth of these fasteners owing to their replacement by plastic fasteners, automotive tapes, and adhesives are expected to be key barriers for metal fastener manufacturers over the forecast period. Plastic fastener manufacturers are expected to gain an advantage owing to the rising demand for lightweight components from automotive manufacturers.

Companies engaged in the manufacturing of fasteners require significant capital investment owing to the high production volumes and stringent specifications concerning testing and labeling. Industrial fasteners such as bolts, screws, nuts, studs, and rivets are manufactured and distributed by different participants. Companies invest significantly in R&D activities, thus resulting in dynamic market conditions.

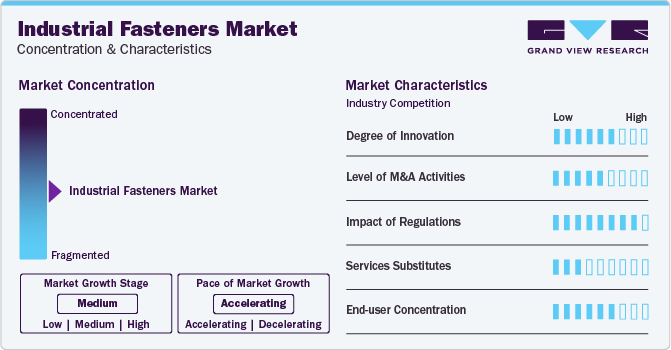

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The industrial fasteners market is fragmented and highly competitive in nature with various large and small-scale manufacturers in China, Taiwan, Thailand, and Japan. Significant development of commercial construction, coupled with the rising demand for green building materials in the region, has triggered market growth, improving the competition in the market. A major challenge faced by the competitors is the fluctuation of raw material prices; hence, a high degree of backward and forward integration is likely to be observed among the major players in the market. This will further intensify the market rivalry and competition, making it difficult for emerging players to sustain in the market.

The fasteners market is characterized by intensive technological developments to produce advanced lightweight products that find use in automotive and other industrial applications. Key fastener companies in the market are majorly focusing on sourcing high-quality raw materials and simpler designs & structures that are easier to assemble.

The manufacturing of fasteners primarily includes casting, forming machining, and thread production processes. The fasteners offered by the major manufacturers comply with the global standards including the American Society for Testing and Materials (ASTM), American Society of Mechanical Engineers (ASME), British Standards (BS), Deutsches Institut für Normung (DIN), and Japanese Industrial Standards (JIS).

The major manufacturers in the market are observed to have long-term contracts with players from automotive, aerospace, and electronics industries. The major fastener manufacturers offer specialty fasteners, which are custom manufactured based on the specifications given by the end users to cater to their specific requirements. As a result, the product pricing and profit margins of these industry players is found to be varied across the industry players.

Raw Material Insights

Metal fasteners account for the largest market share of over 90% in 2023. It includes various materials such as stainless steel, bronze, cast iron, superalloys, and titanium. The high mechanical strength is expected to be an important factor triggering their growth over the forecast period.

Plastic fasteners market is growing at the fastest CAGR over the coming years. The product is gaining importance in the automotive industry owing to its low-cost, lightweight, and superior chemical & corrosion resistance properties. These are manufactured using various raw materials, including polycarbonate, polyurethane (PUR), polyvinylchloride (PVC), polyacrylamide (PA), polystyrene (PS), polyethylene (PE), and nylon.

Product Insights

Externally threaded fasteners accounted for the highest revenue share in 2023. Bolts and screws are the most widely utilized type of externally threaded fasteners. Bolts hold a dominant share in the market owing to their availability in a wide variety and broad application scope.

Non-threaded fasteners accounted for the second largest revenue share in 2023 and are expected to drive at a significant rate over the forecast period. Rising demand for non-threaded fasteners in the construction industry for various applications such as subflooring, decking, and roofing is expected to have a positive impact on growth over the projected period.

Aerospace grade fasteners are expected to expand at the fastest CAGR from 2023 to 2030. This fastener varies significantly as compared to ordinary commercial-grade fasteners in terms of quality, performance, raw material, price, and other technical specifications. The most commonly used aerospace nuts include fiber inserts and castle nuts.

Internally threaded fasteners accounted for a significant share of the market. Stainless steel is the most common material used for manufacturing internally threaded industrial fasteners. Brass, alloy steel, and aluminum are the other materials used to manufacture these industrial fasteners. Innovations in the designs of internally threaded fasteners to provide better performance and high impact and vibration resistance are projected to have a positive impact on growth.

Distribution Insights

Direct distribution channel dominated the industrial fasteners market in 2023. Manufacturers operating in the market have direct-tie ups with companies from the construction, automotive, aerospace, and electronics industries to procure fasteners in bulk quantities. This also eliminates the requirement for middlemen in the market, resulting in higher profit margins for the manufacturers.

Indirect distribution channel is anticipated to grow at a significant rate over the forecast period owing to rising do-it-yourself (DIY) activities in developed economies such as the U.S., Canada, and Germany. In addition, growing home renovation activities as a result of rising consumer income have further increased the purchase of industrial fasteners in smaller quantities for small-scale projects such as furniture building, flooring installation/replacement, and roofing construction.

Application Insights

The automotive segment accounted for the largest revenue share in 2023. High production volumes of automotive vehicles across Asia Pacific have been a key factor driving industry growth over the past few years.

Fasteners are an essential component of the automotive industry and are available in numerous varieties, sizes, and shapes. The common fasteners used in the automotive industry include nuts, bolts, screws, rivets, studs, bits, anchors, and panel fasteners. Metal fasteners have been dominating the fastener industry traditionally, and this trend is likely to continue over the projected period.

Increasing investments in commercial constructions such as hotels, hospitals, and educational institutes in the regions are projected to have a positive impact on the building & construction industry growth projected period. In addition, the rapid growth of heavy machine-driven industries, including textiles, food & beverage, and chemicals, is expected to propel the demand for industrial machinery, thus driving the demand for industrial fasteners over the coming years.

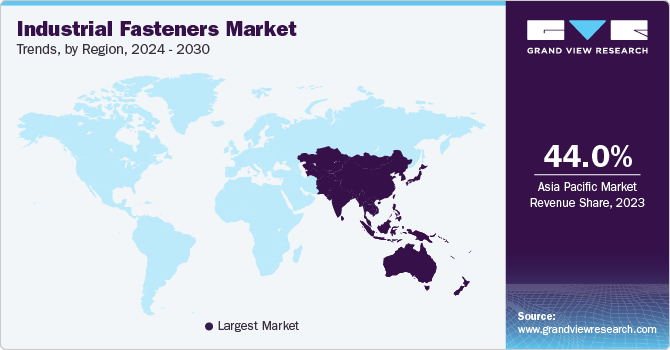

Regional Insights

In North America, the U.S. has been dominating the industrial fasteners industry in terms of consumption owing to the presence of a wide manufacturing base of automotive, electronics, and aerospace companies which makes it a key consumer of automotive fastener. The region is expected to have a positive impact on industry growth over the forecast period.

Asia Pacific is the fastest-growing region in the world, accounting for more than 44% of the market share in 2023. The industrial fasteners industry in the region is primarily driven by automotive, industrial machinery, electronics, and construction applications. Economic growth in Asia Pacific has increased the need for improved public infrastructures such as roads, harbors, airports, and rail transportation networks which is likely to drive the market in the Asia Pacific.

The growing geriatric population in the economies such as China is expected to drive the need for expansion of transportation infrastructure. Moreover, the ongoing construction of railway infrastructure in developing economies such as India including bullet trains and metro rails is expected to drive the demand for construction material. These trends are projected to drive the demand for Bolts as they are widely used in the construction of rail and roadways infrastructure.

Europe accounted for a significant revenue share of the global market for industrial fasteners in 2023. The rising product demand to manufacture residential and commercial furniture, ready-to-assemble (RTA) products, and small accent items is expected to have a positive impact on the industry growth over the projected period.

Central & South America market is expected to witness growth on account of rising demand for industrial fasteners in agricultural, commercial, and residential projects and industrial practices. Furthermore, the aerospace sector is expected to witness high growth owing to improvements in defense practices of Argentina and Brazil, thus influencing the demand for aerospace-grade fasteners in the region.

Key Companies & Market Share Insights

The increasing demand for innovative and application-specific industrial fastener designs is expected to present opportunities for new players. Increasing raw material prices and high-volume production by the existing players are expected to be key barriers to new entrants over the forecast period. Moreover, Technological know-how and an established buyer base are likely to offer major fastener manufacturers a competitive advantage over the small-scale players. In addition, companies are opting for various strategies including product portfolio expansion, merger & acquisition, and new product development to increase their market shares. For instance,

-

In February2022, Namakor Holdings acquired Duchesne Ltd. to accelerate the growth of Duchesne. Furthermore, Namakor Holdings will also provide financial and human resources to the company.

-

In February2022, BECK Fastener Group launched its new product, LIGNOLOC wooden nail, after the success of collated wooden nails. LIGNOLOC wooden nails come with a head, specifically designed for façade application.

Key Industrial Fasteners Companies:

- Arconic Fastening Systems and Rings

- Acument Global Technologies, In

- ATF, Inc.

- Dokka Fasteners A S

- LISI Group - Link Solutions for Industry

- Nippon Industrial Fasteners Company (Nifco)

- Hilti Corporation

- MW Industries, Inc.

- Birmingham Fasteners and Supply, Inc.

- SESCO Industries, Inc.

- Elgin Fasteners Group LLC

- Rockford Fasteners, Inc.

- Slidematic

- Manufacturing Associates, Inc.

- Eastwood Manufacturing

- Brunner Manufacturing CO., Inc.

- Decker Industries Corporation

- Penn Engineering & Manufacturing Corporation

- EJOT

- Illinois Tool Works, Inc.

- Stanley Black & Decker, Inc.

- KOVA Fasteners Pvt. Ltd.

- Standard Fasteners Ltd.

- Precision Castparts Corp.

Industrial Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 99.51 billion

Revenue forecast in 2030

USD 131.28 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw Material, product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Malaysia, Indonesia, South Korea, Thailand, Brazil, UAE, Argentina, Saudi Arabia, South Africa

Key companies profiled

Arconic Fastening Systems and Rings, Acument Global Technologies, Inc, ATF, Inc., Dokka Fasteners A S, LISI Group - Link Solutions for Industry, Nippon Industrial Fasteners Company (Nifco), Hilti Corporation, MW Industries, Inc., Birmingham Fasteners and Supply, Inc., SESCO Industries, Inc., Elgin Fastener Group LLC, Rockford Fasteners, Inc., Slidematic, Manufacturing Associates, Inc., Eastwood Manufacturing, Brunner Manufacturing Co., Inc., Decker Industries Corporation, Penn Engineering &Manufacturing Corporation, EJOT, Illinois Tool Works, Inc., Stanley Black & Decker, Inc., KOVA Fasteners Pvt. Ltd., Standard Fasteners Ltd., Precision Castparts Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Fasteners Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the industrial fasteners market on the basis of raw material, product, application, distribution channel, and region:

-

Raw Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Metal Fasteners

-

Plastic Fasteners

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Externally Threaded Fasteners

-

Internally Threaded Fasteners

-

Non-threaded Fasteners

-

Aerospace Grade Fasteners

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Automotive

-

Aerospace

-

Building & Construction

-

Industrial Machinery

-

Home Appliances

-

Lawns And Gardens

-

Motors And Pumps

-

Furniture

-

Plumbing products

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Direct

-

Indirect

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial fasteners market size was estimated at USD 91.73 billion in 2022 and is expected to reach USD 95.46 billion in 2023.

b. The industrial fasteners market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 131.28 billion by 2030.

b. Asia Pacific dominated the industrial fasteners market with a share of 43.6% in 2022 owing high production volumes of automotive vehicles across key economies in the region.

b. Some of the key players operating in the industrial fasteners market include Arconic Fastening Systems and Rings, Acument Global Technologies, Inc, ATF, Inc., Dokka Fasteners A S, LISI Group – Link Solutions for Industry, Nippon Industrial Fasteners Company (Nifco), Hilti Corporation, MW Industries, Inc., Birmingham Fasteners and Supply, Inc., SESCO Industries, Inc.

b. The key factor that are driving the industrial fasteners include the rapidly developing automotive and aerospace defense sector in the developing countries

Table of Contents

Chapter 1. Industrial Fasteners Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Industrial Fasteners Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Industrial Fasteners Market: Variables, Trends & Scope

3.1. Market Lineage/Ancillary Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.1.1. Metal Fasteners

3.2.1.1.1. Stainless Steel

3.2.1.1.2. Bronze

3.2.1.1.3. Cast Iron

3.2.1.1.4. SuperAlloys

3.2.1.1.5. Titanium

3.2.1.2. Plastic Fasteners

3.2.1.2.1. Polycarbonate

3.2.1.2.2. Nylon

3.2.1.2.3. Polyvinyl Chloride (PVC)

3.2.1.2.4. Polyethylene

3.2.1.2.5. Acrylamide

3.3. Technology Overview

3.3.1. Fasteners Production Technologies

3.3.1.1. Casting

3.3.1.2. Forming

3.3.1.2.1. Cold Forming

3.3.1.2.2. Hot Forming

3.3.2. Machining

3.3.3. Thread Production

3.3.4. Injection Molding Technology

3.3.4.1. Heat treatments used in the fasteners manufacturing process

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Macroeconomic Factors in the key Industrial Fasteners Market

3.5.1.1. U.S.

3.5.1.2. Europe

3.5.1.3. China

3.5.1.4. India

3.5.1.5. Japan

3.5.2. Market Driver Analysis

3.5.3. Market Restraint Analysis

3.6. Fasteners Industry Trends and Dynamics

3.6.1. Internal Substitution of metal fasteners by plastic fasteners in automotive applications

3.6.2. High investment risk for manufacturers

3.6.3. Non - reusability of fasteners

3.6.4. Hybrid fasteners in demand

3.6.5. Automation in the process

3.6.6. Miniature fasteners

3.7. Global industrial fasteners market: Imports & exports trade analysis

3.8. Industry Analysis Tools

3.8.1. Porter’s Five Forces Analysis

3.8.2. PESTEL by SWOT

Chapter 4. Industrial Fasteners Market: Raw Material Estimates & Trend Analysis

4.1. Raw Material Movement Analysis & Market Share, 2023 & 2030

4.2. Industrial Fasteners Market Estimates & Forecast, By Raw Material, 2018 to 2030 (USD Billion)

4.3. Metal Fasteners

4.3.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Metal Fasteners, 2018 - 2030 (USD Billion)

4.4. Plastic Fasteners

4.4.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Plastic Fasteners, 2018 - 2030 (USD Billion)

Chapter 5. Industrial Fasteners Market: Product Estimates & Trend Analysis

5.1. Product Movement Analysis & Market Share, 2023 & 2030

5.2. Industrial Fasteners Market Estimates & Forecast, By Product, 2018 to 2030 (USD Billion)

5.3. Externally Threaded

5.3.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Externally Threaded, 2018 - 2030 (USD Billion)

5.4. Internally Threaded Fasteners

5.4.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Internally Threaded Fasteners, 2018 - 2030 (USD Billion)

5.5. Non - Threaded Fasteners

5.5.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Non - Threaded Fasteners, 2018 - 2030 (USD Billion)

5.6. Aerospace Grade Fasteners

5.6.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Aerospace Grade Fasteners, 2018 - 2030 (USD Billion)

Chapter 6. Industrial Fasteners Market: Application Estimates & Trend Analysis

6.1. Application Movement Analysis & Market Share, 2023 & 2030

6.2. Industrial Fasteners Market Estimates & Forecast, By Application, 2018 to 2030 (USD Billion)

6.3. Automotive

6.3.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Automotive, 2018 - 2030 (USD Billion)

6.4. Aerospace

6.4.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Aerospace, 2018 - 2030 (USD Billion)

6.5. Building & Construction

6.5.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Building & Construction, 2018 - 2030 (USD Billion)

6.6. Industrial Machinery

6.6.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Industrial Machinery, 2018 - 2030 (USD Billion)

6.7. Home appliances

6.7.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Home appliances, 2018 - 2030 (USD Billion)

6.8. Lawns and gardens

6.8.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Lawns and gardens, 2018 - 2030 (USD Billion)

6.9. Motors and pumps

6.9.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Motors and pumps, 2018 - 2030 (USD Billion)

6.10. Furniture

6.10.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Furniture, 2018 - 2030 (USD Billion)

6.11. Plumbing products

6.11.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Plumbing products, 2018 - 2030 (USD Billion)

6.12. Others

6.12.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Others, 2018 - 2030 (USD Billion)

Chapter 7. Industrial Fasteners Market: Distribution Channel Estimates & Trend Analysis

7.1. Distribution Channel Movement Analysis & Market Share, 2023 & 2030

7.2. Industrial Fasteners Market Estimates & Forecast, By Distribution Channel, 2018 to 2030 (USD Billion)

7.3. Direct

7.3.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Automotive, 2018 - 2030 (USD Billion)

7.4. Indirect

7.4.1. Industrial Fasteners Market Revenue Estimates and Forecasts, by Aerospace, 2018 - 2030 (USD Billion)

Chapter 8. Industrial Fasteners Market: Regional Estimates & Trend Analysis

8.1. Regional Movement Analysis & Market Share, 2023 & 2030

8.2. North America

8.2.1. North America Industrial Fasteners Market Estimates & Forecast, 2018 - 2030 (USD Billion)

8.2.2. U.S.

8.2.2.1. U.S. industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.2.3. Canada

8.2.3.1. Canada industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.2.4. Mexico

8.2.4.1. Mexico industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.3. Europe

8.3.1. Europe industrial fasteners Market Estimates & Forecast, 2018 - 2030 (USD Billion)

8.3.2. Germany

8.3.2.1. Germany industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.3.3. UK

8.3.3.1. UK industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.3.4. France

8.3.4.1. France industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.3.5. Italy

8.3.5.1. Italy industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.3.6. Spain

8.3.6.1. Spain industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.4. Asia Pacific

8.4.1. Asia Pacific industrial fasteners Market Estimates & Forecast, 2018 - 2030 (USD Billion)

8.4.2. China

8.4.2.1. China industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.4.3. Japan

8.4.3.1. Japan industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.4.4. India

8.4.4.1. India industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.4.5. Malaysia

8.4.5.1. Malaysia industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.4.6. South Korea

8.4.6.1. South Korea industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.4.7. Indonesia

8.4.7.1. Indonesia industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.4.8. Thailand

8.4.8.1. Thailand industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.5. Central & South America

8.5.1. Central & South America industrial fasteners Market Estimates & Forecast, 2018 - 2030 (USD Billion)

8.5.2. Brazil

8.5.2.1. Brazil industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.5.3. Argentina

8.5.3.1. Argentina industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.6. Middle East & Africa

8.6.1. Middles East & Africa industrial fasteners Market Estimates & Forecast, 2018 - 2030 (USD Billion)

8.6.2. UAE

8.6.2.1. UAE industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.6.3. Saudi Arabia

8.6.3.1. Saudi Arabia industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

8.6.4. South Africa

8.6.4.1. South Africa industrial fasteners market estimates & forecast, 2018 - 2030 (USD Billion)

Chapter 9. Supplier Intelligence

9.1. Kraljic Matrix

9.2. Engagement Model

9.3. Negotiation Strategies

9.4. Sourcing Best Practices

9.5. Vendor Selection Criteria

9.6. List of Raw Material Suppliers

9.7. List of Distributors/Suppliers

Chapter 10. Industrial Fasteners Market - Competitive Landscape

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company Categorization

10.3. Company Market Position Analysis

10.4. Company Heat Map Analysis

10.5. Strategy Mapping

10.6. Company Profiles

10.6.1. Arconic Fastening Systems and Rings

10.6.1.1. Participant’s overview

10.6.1.2. Financial performance

10.6.1.3. Product benchmarking

10.6.1.4. Recent developments

10.6.2. Acument Global Technologies, Inc.

10.6.2.1. Participant’s overview

10.6.2.2. Financial performance

10.6.2.3. Product benchmarking

10.6.2.4. Recent developments

10.6.3. ATF, Inc.

10.6.3.1. Participant’s overview

10.6.3.2. Financial performance

10.6.3.3. Product benchmarking

10.6.3.4. Recent developments

10.6.4. Dokka Fasteners A S

10.6.4.1. Participant’s overview

10.6.4.2. Financial performance

10.6.4.3. Product benchmarking

10.6.4.4. Recent developments

10.6.5. LISI Group - Link Solutions for Industry

10.6.5.1. Participant’s overview

10.6.5.2. Financial performance

10.6.5.3. Product benchmarking

10.6.5.4. Recent developments

10.6.6. Nippon Industrial Fasteners Company (Nifco)

10.6.6.1. Participant’s overview

10.6.6.2. Financial performance

10.6.6.3. Product benchmarking

10.6.6.4. Recent developments

10.6.7. Hilti Corporation

10.6.7.1. Participant’s overview

10.6.7.2. Financial performance

10.6.7.3. Product benchmarking

10.6.7.4. Recent developments

10.6.8. MW Industries, Inc.

10.6.8.1. Participant’s overview

10.6.8.2. Financial performance

10.6.8.3. Product benchmarking

10.6.8.4. Recent developments

10.6.9. Birmingham Fasteners and Supply, Inc.

10.6.9.1. Participant’s overview

10.6.9.2. Financial performance

10.6.9.3. Product benchmarking

10.6.9.4. Recent developments

10.6.10. SESCO Industries, Inc.

10.6.10.1. Participant’s overview

10.6.10.2. Financial performance

10.6.10.3. Product benchmarking

10.6.10.4. Recent developments

10.6.11. Elgin Fasteners Group LLC

10.6.11.1. Participant’s overview

10.6.11.2. Financial performance

10.6.11.3. Product benchmarking

10.6.11.4. Recent developments

10.6.12. Rockford Fasteners, Inc.

10.6.12.1. Participant’s overview

10.6.12.2. Financial performance

10.6.12.3. Product benchmarking

10.6.12.4. Recent developments

10.6.13. Slidematic

10.6.13.1. Participant’s overview

10.6.13.2. Financial performance

10.6.13.3. Product benchmarking

10.6.13.4. Recent developments

10.6.14. Manufacturing Associates, Inc.

10.6.14.1. Participant’s overview

10.6.14.2. Financial performance

10.6.14.3. Product benchmarking

10.6.14.4. Recent developments

10.6.15. Eastwood Manufacturing

10.6.15.1. Participant’s overview

10.6.15.2. Financial performance

10.6.15.3. Product benchmarking

10.6.15.4. Recent developments

10.6.16. Brunner Manufacturing CO., Inc.

10.6.16.1. Participant’s overview

10.6.16.2. Financial performance

10.6.16.3. Product benchmarking

10.6.16.4. Recent developments

10.6.17. Decker Industries Corporation

10.6.17.1. Participant’s overview

10.6.17.2. Financial performance

10.6.17.3. Product benchmarking

10.6.17.4. Recent developments

10.6.18. Penn Engineering & Manufacturing Corporation

10.6.18.1. Participant’s overview

10.6.18.2. Financial performance

10.6.18.3. Product benchmarking

10.6.18.4. Recent developments

10.6.19. EJOT

10.6.19.1. Participant’s overview

10.6.19.2. Financial performance

10.6.19.3. Product benchmarking

10.6.19.4. Recent developments

10.6.20. Illinois Tool Works, Inc.

10.6.20.1. Participant’s overview

10.6.20.2. Financial performance

10.6.20.3. Product benchmarking

10.6.20.4. Recent developments

10.6.21. Stanley Black & Decker, Inc.

10.6.21.1. Participant’s overview

10.6.21.2. Financial performance

10.6.21.3. Product benchmarking

10.6.21.4. Recent developments

10.6.22. KOVA Fasteners Pvt. Ltd.

10.6.22.1. Participant’s overview

10.6.22.2. Financial performance

10.6.22.3. Product benchmarking

10.6.22.4. Recent developments

10.6.23. Standard Fasteners Ltd.

10.6.23.1. Participant’s overview

10.6.23.2. Financial performance

10.6.23.3. Product benchmarking

10.6.23.4. Recent developments

10.6.24. Precision Castparts Corp.

10.6.24.1. Participant’s overview

10.6.24.2. Financial performance

10.6.24.3. Product benchmarking

List of Tables

Table 1 List of abbreviation

Table 2 Global industrial fasteners market estimates and forecasts by raw material, 2018 - 2030 (USD Billion)

Table 3 Global industrial fasteners market estimates and forecasts by product, 2018 - 2030 (USD Billion)

Table 4 Global industrial fasteners market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 5 Global industrial fasteners market estimates and forecasts by distribution channel, 2018 - 2030 (USD Billion)

Table 6 Global industrial fasteners market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 7 North America industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 8 North America industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 9 North America industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 10 North America industrial fasteners market by distribution channel, 2018 - 2030 (USD Million)

Table 11 U.S. industrial fasteners market by raw material, 2018 - 2030 (USD Million)

Table 12 U.S. industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 13 U.S. industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 14 U.S industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 15 Canada industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 16 Canada industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 17 Canada industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 18 Canada industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 19 Mexico industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 20 Mexico industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 21 Mexico industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 22 Mexico industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 23 Europe industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 24 Europe industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 25 Europe industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 26 Europe industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 27 Germany industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 28 Germany industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 29 Germany industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 30 Germany industrial fasteners market by distribution channel, 2018 - 2030 (USD Million)

Table 31 France industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 32 France industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 33 France industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 34 France industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 35 UK industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 36 UK industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 37 UK industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 38 UK industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 39 Italy industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 40 Italy industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 41 Italy industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 42 Italy industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 43 Spain industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 44 Spain industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 45 Spain industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 46 Spain industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 47 Asia Pacific industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 48 Asia Pacific industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 49 Asia Pacific industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 50 Asia Pacific industrial fasteners market by distribution channel, 2018 - 2030 (USD Million)

Table 51 China industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 52 China industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 53 China industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 54 China industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 55 India industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 56 India industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 57 India industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 58 India industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 59 Japan industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 60 Japan industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 61 Japan industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 62 Japan industrial fasteners market by distribution channel, 2018 - 2030 (USD Million)

Table 63 South Korea industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 64 South Korea industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 65 South Korea industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 66 South Korea industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 67 Malaysia industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 68 Malaysia industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 69 Malaysia industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 70 Malaysia industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 71 Indonesia industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 72 Indonesia industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 73 Indonesia industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 74 Indonesia industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 75 Thailand industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 76 Thailand industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 77 Thailand industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 78 Thailand industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 79 Central & South America industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 80 Central & South America industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 81 Central & South America industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 82 Central & South America industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 83 Brazil industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 84 Brazil industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 85 Brazil industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 86 Brazil industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 87 Argentina industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 88 Argentina industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 89 Argentina industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 90 Argentina industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 91 Middle East & Africa industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 92 Middle East & Africa industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 93 Middle East & Africa industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 94 Middle East & Africa industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 95 UAE industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 96 UAE industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 97 UAE industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 98 UAE industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 99 Saudi Arabia industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 100 Saudi Arabia industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 101 Saudi Arabia industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 102 Saudi Arabia industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

Table 103 South Africa industrial fasteners market by raw material, 2018 - 2030 (USD Billion)

Table 104 South Africa industrial fasteners market by product, 2018 - 2030 (USD Billion)

Table 105 South Africa industrial fasteners market by application, 2018 - 2030 (USD Billion)

Table 106 South Africa industrial fasteners market by distribution channel, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Information Procurement

Fig. 6 Market Formulation and Validation

Fig. 7 Data Validating & Publishing

Fig. 8 Market Segmentation & Scope

Fig. 9 Industrial Fasteners Market Snapshot

Fig. 10 Segment Snapshot

Fig. 11 Competitive Landscape Snapshot

Fig. 12 Parent market outlook

Fig. 13 Industrial Fasteners Market - Value Chain Analysis

Fig. 14 Industrial Fasteners Market - Market Dynamics

Fig. 15 Industrial Fasteners Market - PORTER’s Analysis

Fig. 16 Industrial Fasteners Market - PESTEL Analysis

Fig. 17 Industrial Fasteners Market Estimates & Forecasts, By Raw Material: Key Takeaways

Fig. 18 Industrial Fasteners Market Share, By Raw Material, 2023 & 2030

Fig. 19 Industrial Fasteners Market Estimates & Forecasts, by Metal, 2018 - 2030 (USD Billion)

Fig. 20 Industrial Fasteners Market Estimates & Forecasts, by Plastic, 2018 - 2030 (USD Billion)

Fig. 21 Industrial Fasteners Market Estimates & Forecasts, By Product: Key Takeaways

Fig. 22 Industrial Fasteners Market Share, By Product, 2023 & 2030

Fig. 23 Industrial Fasteners Market Estimates & Forecasts, by Externally Threaded, 2018 - 2030 (USD Billion)

Fig. 24 Industrial Fasteners Market Estimates & Forecasts, by Internally Threaded, 2018 - 2030 (USD Billion)

Fig. 25 Industrial Fasteners Market Estimates & Forecasts, by Non - Threaded, 2018 - 2030 (USD Billion)

Fig. 26 Industrial Fasteners Market Estimates & Forecasts, by Aerospace Grade, 2018 - 2030 (USD Billion)

Fig. 27 Industrial Fasteners Market Estimates & Forecasts, By Application: Key Takeaways

Fig. 28 Industrial Fasteners Market Share, By Application, 2023 & 2030

Fig. 29 Industrial Fasteners Market Estimates & Forecasts, by Automotive, 2018 - 2030 (USD Billion)

Fig. 30 Industrial Fasteners Market Estimates & Forecasts, by Aerospace, 2018 - 2030 (USD Billion)

Fig. 31 Industrial Fasteners Market Estimates & Forecasts, by Building & Construction, 2018 - 2030 (USD Billion)

Fig. 32 Industrial Fasteners Market Estimates & Forecasts, by Industrial Machinery, 2018 - 2030 (USD Billion)

Fig. 33 Industrial Fasteners Market Estimates & Forecasts, by Home appliances, 2018 - 2030 (USD Billion)

Fig. 34 Industrial Fasteners Market Estimates & Forecasts, by Lawns and gardens, 2018 - 2030 (USD Billion)

Fig. 35 Industrial Fasteners Market Estimates & Forecasts, by Motors and pumps, 2018 - 2030 (USD Billion)

Fig. 36 Industrial Fasteners Market Estimates & Forecasts, by Furniture, 2018 - 2030 (USD Billion)

Fig. 37 Industrial Fasteners Market Estimates & Forecasts, by Plumbing products, 2018 - 2030 (USD Billion)

Fig. 38 Industrial Fasteners Market Estimates & Forecasts, by Others, 2018 - 2030 (USD Billion)

Fig. 39 Industrial Fasteners Market Estimates & Forecasts, By Distribution Channel: Key Takeaways

Fig. 40 Industrial Fasteners Market Share, By Distribution Channel, 2023 & 2030

Fig. 41 Industrial Fasteners Market Estimates & Forecasts, by Direct, 2018 - 2030 (USD Billion)

Fig. 42 Industrial Fasteners Market Estimates & Forecasts, by Indirect, 2018 - 2030 (USD Billion)

Fig. 43 Industrial Fasteners Market Revenue, By Region, 2023 & 2030 (USD Billion)

Fig. 44 North America Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 U.S. Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 46 Canada Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 Mexico Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Europe Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 49 Germany Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 50 UK Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 51 France Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 52 Italy Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 53 Spain Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Asia Pacific Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 China Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 India Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 Japan Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 58 South Korea Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 Malaysia Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 Indonesia Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 61 Thailand Industrial Fasteners Market Estimates & Forecasts, 2018 (USD Billion)

Fig. 62 Central & South America Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 Brazil Industrial Fasteners Market Estimates & Forecasts, 2018 (USD Billion)

Fig. 64 Argentina Industrial Fasteners Market Estimates & Forecasts, 2018 (USD Billion)

Fig. 65 Middle East & Africa Industrial Fasteners Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 UAE Industrial Fasteners Market Estimates & Forecasts, 2018 (USD Billion)

Fig. 67 Saudi Arabia Industrial Fasteners Market Estimates & Forecasts, 2018 (USD Billion)

Fig. 68 South Africa Industrial Fasteners Market Estimates & Forecasts, 2018 (USD Billion)

Fig. 69 Key Company Categorization

Fig. 70 Company Market Positioning

Fig. 71 Company Market Position Analysis

Fig. 72 Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Industrial Fasteners Market Raw Material Outlook (Revenue, USD Million; 2018 - 2030)

- Metal fasteners

- Plastic Fasteners

- Industrial Fasteners Market Product Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Industrial Fasteners Market Application Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Industrial Fasteners Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

- Direct

- Indirect

- Industrial Fasteners Market Regional Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

- North America

- North America Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- North America Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- North America Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- U.S.

- U.S. Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- U.S. Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- U.S. Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- U.S. Industrial Fasteners Market, By Raw Material

- Canada

- Canada Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Canada Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Canada Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Canada Industrial Fasteners Market, By Raw Material

- Mexico

- Mexico Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Mexico Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Mexico Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Mexico Industrial Fasteners Market, By Raw Material

- North America Industrial Fasteners Market, By Raw Material

- Europe

- Europe Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Europe Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Europe Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Germany

- Germany Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Germany Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Germany Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Germany Industrial Fasteners Market, By Raw Material

- Spain

- Spain Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Spain Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Spain Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Spain Industrial Fasteners Market, By Raw Material

- France

- France Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- France Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- France Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- France Industrial Fasteners Market, By Raw Material

- Europe Industrial Fasteners Market, By Raw Material

- Asia Pacific

- Asia Pacific Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Asia Pacific Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Asia Pacific Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- China

- China Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- China Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- China Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- China Industrial Fasteners Market, By Raw Material

- India

- India Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- India Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- India Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- India Industrial Fasteners Market, By Raw Material

- Japan

- Japan Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Japan Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Japan Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Japan Industrial Fasteners Market, By Raw Material

- South Korea

- South Korea Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- South Korea Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- South Korea Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- South Korea Industrial Fasteners Market, By Raw Material

- Malaysia

- Malaysia Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Malaysia Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Malaysia Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Malaysia Industrial Fasteners Market, By Raw Material

- Indonesia

- Indonesia Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Indonesia Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Indonesia Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Indonesia Industrial Fasteners Market, By Raw Material

- Thailand

- Thailand Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Thailand Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Thailand Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Thailand Industrial Fasteners Market, By Raw Material

- Asia Pacific Industrial Fasteners Market, By Raw Material

- Central & South America

- Central & South America Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Central & South America Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Central & South America Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Brazil

- Brazil Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Brazil Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Brazil Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Brazil Industrial Fasteners Market, By Raw Material

- Argentina

- Argentina Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Argentina Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Argentina Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Argentina Industrial Fasteners Market, By Raw Material

- Central & South America Industrial Fasteners Market, By Raw Material

- Middle East & Africa

- Middle East & Africa Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Middle East & Africa Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Middle East & Africa Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- UAE

- UAE Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- UAE Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- UAE Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- UAE Industrial Fasteners Market, By Raw Material

- Saudi Arabia

- Saudi Arabia Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- Saudi Arabia Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- Saudi Arabia Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- Saudi Arabia Industrial Fasteners Market, By Raw Material

- South Africa

- South Africa Industrial Fasteners Market, By Raw Material

- Metal fasteners

- Plastic Fasteners

- South Africa Industrial Fasteners Market, By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

- South Africa Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Lawns and gardens

- Motors and pumps

- Furniture

- Plumbing products

- Others

- South Africa Industrial Fasteners Market, By Raw Material

- Middle East & Africa Industrial Fasteners Market, By Raw Material

- North America

Industrial Fasteners Market Dynamics

Driver: Increasing Automotive Production In Asia Pacific

Fasteners are an essential component of the automotive industry and available in numerous shapes and sizes. The common fasteners used in this industry include nuts, bolts, screws, rivets, studs, bits, anchors, and panel fasteners. Automotive is the largest market for industrial fasteners. Asia Pacific has emerged as the largest automotive producing region in the world followed by Europe. Major economies in Asia Pacific, including India, Japan, and China, witnessed high levels of car production from 2017 to 2019 owing to the growing population and the rising incomes. China is one of the largest automotive manufacturers in the world. India is witnessing significant growth in terms of automotive production and sales. High investments in the country’s manufacturing sector and favorable government policies for industrial sector are likely to have a positive impact on the automotive production in the country, which is further likely to propel the demand for industrial fasteners over the projected period. The production trends in the automotive industry directly impact the industrial fasteners market growth.

Driver: Rapid Developments In Building & Construction Sector

Construction industry notably impacts the demand for industrial fasteners as they are extensively used in buildings, bridges, walls, and roofs. fasteners used in construction are standardized and subject to stringent quality checks. Government intervention through regulatory framework pressurizes the manufacturers to offer standardized products. The growth of construction industry in Asia, strong economic development, and population expansion favor the growth of industrial fastener market by contributing to the product demand for residential and infrastructural construction. The Construction 2020 Action Plan is established to stabilize construction industry growth and is expected to have a positive impact over the forecast period. The overall construction industry in North American countries including the U.S. and Canada is likely to witness growth over the forecast period. The rising demand for high-tech office buildings and sophisticated housing systems is likely to drive renovation activities in Canda, thus impacting the fasteners industry growth on a positive note.

Restraint: Rising Market Share Of Substitutes

The replacement by plastic fasteners, automotive tapes, and adhesives are expected to be key barriers for metal fastener manufacturers over the forecast period. The laser welding technique introduction in automobiles has fueled the welding market share. Rising consumption of welds and rivets in various types of aircraft is anticipated to drive welding market in aerospace and defense industries, thereby posing a threat to fasteners market share. The rising demand for adhesives in automotive, construction, and packaging applications for binding various materials together is likely to hamper the demand for fasteners over the forecast period. The loosening of fasteners is one of the reasons contributing to equipment failure. The application of adhesives tapes in place of fasteners helps in securing the equipment from corrosion, rust, metallurgical fatigue, and damage. These aforementioned factors, which favor the application of adhesives and tapes in various end-use applications, are likely to impact fasteners market growth.

What Does This Report Include?

This section will provide insights into the contents included in this industrial fasteners market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Industrial fasteners market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Industrial fasteners market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the industrial fasteners market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for industrial fasteners market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of industrial fasteners market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Industrial Fasteners Market Categorization:

The industrial fasteners market was categorized into three segments, namely product (Seeds, Fiber, Shivs), application (Animal Care, Textiles, Automotive, Furniture, Food & Beverages, Paper, Construction Materials, Personal Care), and region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa).

Segment Market Methodology:

The industrial fasteners market was segmented into product, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The industrial fasteners market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into nine countries, namely, the U.S.; Canada; Germany; the UK.; France; China; India; Japan; Brazil.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Industrial fasteners market companies & financials:

The industrial fasteners market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Arconic Fastening Systems and Rings - Arconic Fastening Systems and Rings is a fastener manufacturing company. The company’s product portfolio includes engineered products & solutions, global rolled products, and transportation & construction solutions. It manufactures fasteners through its engineered products & solutions segment and primarily caters to industrial and aerospace sectors.

-

Acument Global Technologies, Inc. - In June 2014, the company was acquired by Italybased Fontana Gruppo. Acument Global Technologies offers fastening and assembly solutions. Its product portfolio is inclusive of three segments including engineered fastening systems, externally threaded fastening systems, and internally threaded fastening systems. It manufactures critical fasteners, machine screws, screw and washer assemblies, and thread forming/thread rolling products under its externally threaded fastening system.

-

ATF, Inc - ATF, Inc. was established in 1946 and is headquartered in Illinois, U.S. The company’s subsidiaries include Asyst Technologies founded in 1996, Rifast Systems, LLC founded in 2000, and EJOT ATF Fasteners de Mexico founded in 2007. The company’s product portfolio includes cold formed specials, anchors, formed & rolled parts, thread-forming fasteners for metals, thread-forming fasteners for plastics, engineered fasteners for light weighting applications, and mechanism & assemblies’ fasteners.

-