- Home

- »

- Petrochemicals

- »

-

Industrial Lubricants Market Size, Industry Report, 2033GVR Report cover

![Industrial Lubricants Market Size, Share & Trends Report]()

Industrial Lubricants Market (2026 - 2033) Size, Share & Trends Analysis Report Product (Process Oils, General Industrial Oils), By Application (Mining, Power Generation) By Region (North America, Europe, Asia Pacific, Middle East & Africa, Latin America), And Segment Forecasts

- Report ID: GVR-1-68038-180-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Lubricants Market Summary

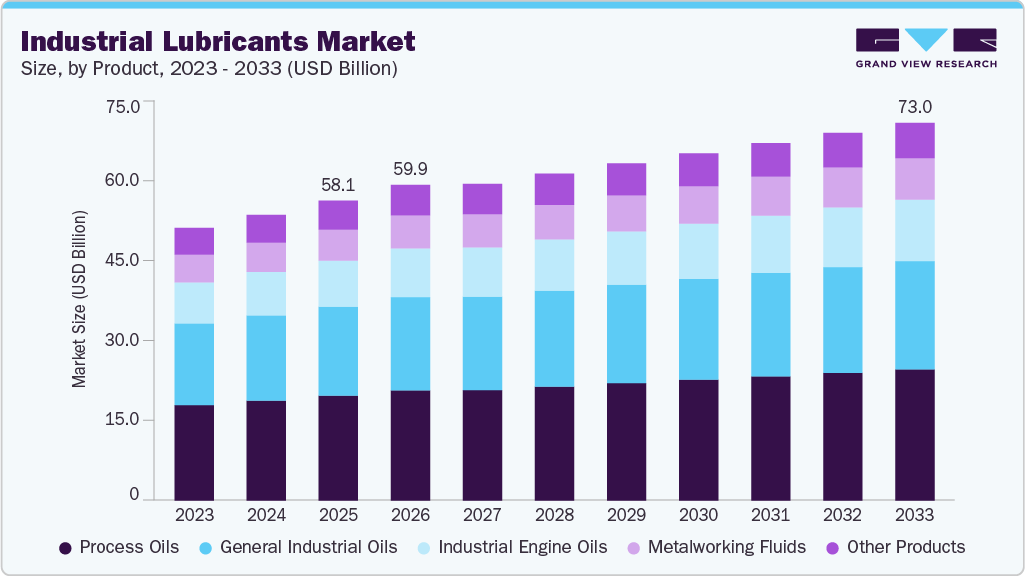

The global industrial lubricants market size was estimated at USD 58.12 billion in 2025 and is projected to reach USD 73.01 billion by 2033, growing at a CAGR of 2.8% from 2026 to 2033. The market is primarily driven by sustained industrialization across mining, power generation, steel & metals, and chemical manufacturing, coupled with rising demand for equipment reliability, higher uptime, and extended maintenance intervals.

Key Market Trends & Insights

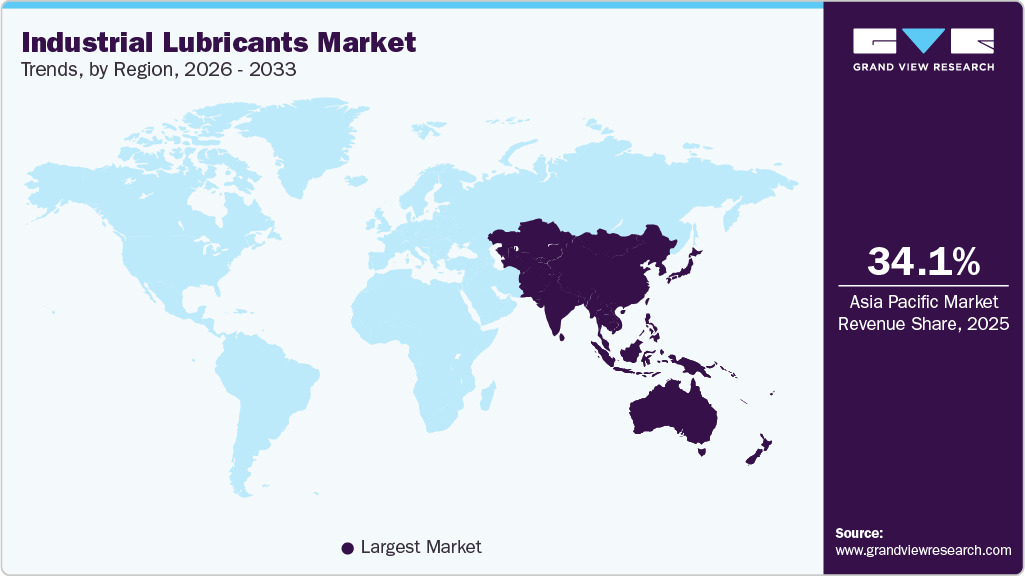

- Asia Pacific dominated the industrial lubricants market with the largest revenue share of 34.1% in 2025.

- The market in China is expected to grow at a significant CAGR of 2.2% from 2026 to 2033 in terms of revenue.

- By product, the metalworking fluids segment is expected to grow at the fastest CAGR of 3.7% from 2026 to 2033 in terms of revenue.

- By product, the process oils segment held the largest revenue share of 34.9% in 2025 in terms of value.

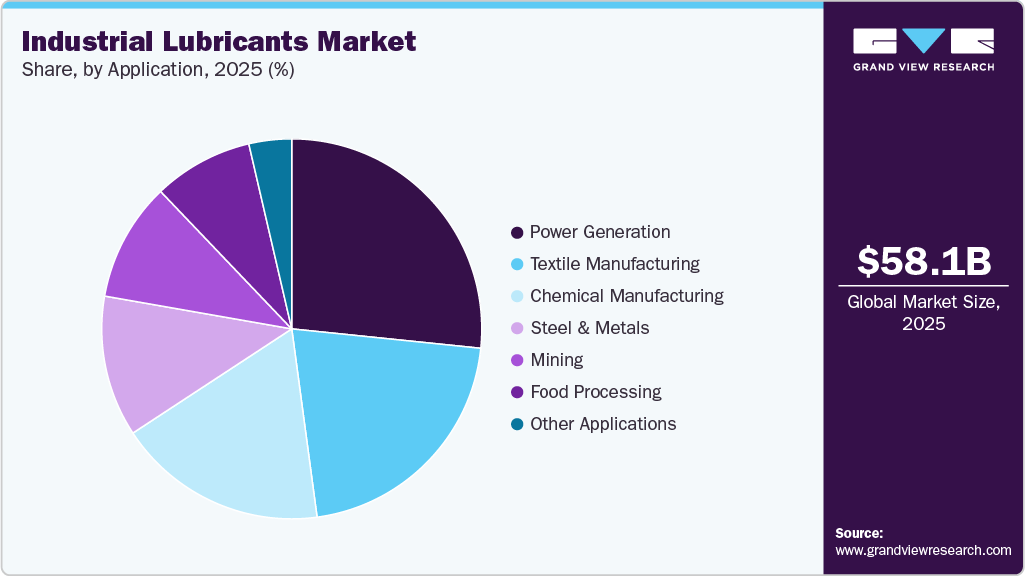

- By application, the power generation segment held the largest revenue share of 26.6% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 58.12 Billion

- 2033 Projected Market Size: USD 73.01 Billion

- CAGR (2026-2033): 2.8%

- Asia Pacific: Largest market in 2025

Increasing adoption of advanced machinery and automated production lines has accelerated the need for high-performance lubricants that can operate under extreme pressure, temperature, and load conditions. The OEM recommendations, growing focus on asset lifecycle optimization, and expanding industrial output in emerging economies continue to underpin consistent lubricant consumption across end-use industries.Significant opportunities are emerging from the growing adoption of synthetic, bio-based, and environmentally acceptable lubricants, driven by sustainability mandates and corporate ESG commitments. Rising demand for food-grade lubricants in food processing and specialty lubricants in chemicals, mining, and metalworking presents strong value-added growth avenues. Moreover, the integration of digital monitoring, predictive maintenance, and lubrication-as-a-service models is enabling suppliers to move beyond product sales toward solution-oriented offerings, strengthening customer retention and long-term revenue streams.

The market faces challenges stemming from volatility in base oil and additive prices, which directly impacts production costs and margin stability for lubricant manufacturers. Increasing regulatory scrutiny related to environmental toxicity, disposal norms, and workplace safety has heightened compliance costs and limited the use of certain conventional formulations. Furthermore, improvements in equipment efficiency and the shift toward longer oil drain intervals are gradually reducing the intensity of lubricant consumption, creating volume pressure, particularly in mature industrial markets.

Market Concentration & Characteristics

The global industrial lubricants market is moderately consolidated, with competition dominated by large integrated oil & gas companies and established specialty lubricant manufacturers. Players such as Exxon Mobil, Shell, TotalEnergies, Chevron, Valvoline, and Castrol leverage global production capabilities, broad product portfolios, and strong distribution networks, while specialty players, including FUCHS, Lubrizol, Quaker Chemical, and Klüber Lubrication, differentiate through application-specific formulations, OEM approvals, and technical expertise across high-performance industrial segments.

Competitive differentiation is increasingly driven by innovation, sustainability, and service-led offerings rather than price alone. Market participants are investing in synthetic and bio-based lubricants, digital lubrication management solutions, and long-term customer partnerships to enhance equipment efficiency and reduce total cost of ownership. Strategic expansions, acquisitions, and collaborations in high-growth industrial regions further intensify competition, favoring suppliers with strong R&D capabilities and solution-oriented business models.

Product Insights

The process oils segment dominated the global industrial lubricants market, accounting for the largest revenue share of 34.9% in 2025. This dominance is primarily attributed to their extensive use as processing aids and performance enhancers across the rubber, polymer, chemical, and textile manufacturing industries. High consumption volumes, continuous usage cycles, and strong linkage with large-scale industrial output significantly support revenue generation from this segment. In addition, growing demand from tire manufacturing, elastomers, and plastics processing, coupled with the availability of both naphthenic and paraffinic grades, has reinforced the widespread adoption of process oils across emerging and developed industrial economies.

General industrial oils and metalworking fluids represent the next major contributors, driven by their critical role in hydraulic systems, gearboxes, compressors, and metal cutting, forming, and cooling operations across steel & metals, automotive, and heavy machinery manufacturing. Industrial engine oils continue to witness steady demand from stationary engines, generators, and mining equipment, particularly in power generation and resource extraction applications. Meanwhile, other products, including greases, specialty lubricants, and environmentally acceptable formulations, are gaining traction due to increasing focus on equipment protection, regulatory compliance, and sustainability, collectively enhancing the market’s shift toward higher-value and performance-driven lubricant solutions.

Application Insights

The power generation segment dominated the global industrial lubricants market, accounting for the largest revenue share of 26.6% in 2025. This dominance was driven by the extensive use of lubricants in turbines, generators, transformers, compressors, and auxiliary equipment across thermal, hydro, nuclear, and renewable power plants. Continuous, high-load operations and the critical need for reliability, thermal stability, and extended drain intervals have led to strong demand for high-performance industrial oils, including turbine, hydraulic, and gear oils. In addition, ongoing investments in grid expansion, power capacity additions, and the refurbishment of aging infrastructure, particularly in emerging economies, have further reinforced lubricant consumption in this segment.

Mining and steel & metals remain key application areas due to harsh operating conditions that require heavy-duty lubricants capable of withstanding extreme pressure, dust, and temperature variations. Food processing is witnessing increasing adoption of food-grade and specialty lubricants to comply with stringent safety and hygiene regulations, while chemical manufacturing demands lubricants with high chemical resistance and thermal stability. Textile manufacturing continues to generate steady demand for spindle and knitting oils, whereas other applications, including cement, pulp & paper, construction, and marine industries, collectively contribute to stable market growth by supporting diverse, equipment-intensive industrial operations.

Regional Insights

Asia Pacific led the global industrial lubricants market in 2025, accounting for 34.1% of total revenue, driven by rapid industrialization, expanding manufacturing capacity, and strong growth in mining, power generation, and steel & metals across China, India, and Southeast Asia. High-volume consumption of process oils, general industrial oils, and metalworking fluids, supported by cost-competitive production and rising infrastructure investments, continues to position the region as the primary demand hub for industrial lubricants.

China Industrial Lubricants Market Trends

China dominated the Asia Pacific market with a 44.1% share in 2025, underpinned by its large-scale chemical manufacturing, steel production, power generation, and heavy industrial base. Sustained investments in industrial automation, renewable and thermal power capacity, and domestic manufacturing expansion have driven consistent lubricant demand, particularly for process oils and metalworking fluids. Additionally, the presence of extensive local production facilities and growing adoption of higher-performance lubricants support long-term market stability.

Europe Industrial Lubricants Market Trends

Europe accounted for 30.7% of the global industrial lubricants market in 2025, supported by a strong focus on high-value manufacturing, energy efficiency, and sustainability-driven lubricant adoption. The region exhibits higher penetration of synthetic, specialty, and environmentally acceptable lubricants, particularly across power generation, chemicals, and food processing industries. Stringent regulatory frameworks and advanced OEM standards further reinforce demand for premium and application-specific lubricant formulations.

The Germany industrial lubricants market remains a key contributor to the European industrial lubricants market, driven by its leadership in automotive manufacturing, machinery, chemicals, and industrial engineering. High demand for precision lubrication, metalworking fluids, and specialty oils, combined with strong emphasis on equipment reliability and process optimization, supports steady lubricant consumption. The country’s advanced industrial infrastructure and strong OEM ecosystem continue to favor premium and high-performance lubricant solutions.

North America Industrial Lubricants Market Trends

North America held a 22.9% share of the global market in 2025, characterized by mature industrial operations and strong adoption of synthetic and performance-enhancing lubricants. Demand is primarily driven by power generation, mining, chemicals, and food processing, with end users increasingly prioritizing extended drain intervals, predictive maintenance, and total cost of ownership reduction. The region’s focus on operational efficiency and regulatory compliance supports steady replacement and upgrade-driven demand.

The U.S. industrial lubricants market dominated the North American market with a 66.9% share in 2025, supported by its large installed base of power generation assets, advanced manufacturing facilities, and diversified industrial end-use sectors. Strong demand for industrial engine oils, turbine oils, and metalworking fluids, coupled with early adoption of digital lubrication management and service-based models, continues to strengthen the country’s position as a high-value industrial lubricants market.

Middle East & Africa Industrial Lubricants Market Trends

The Middle East & Africa market is driven by demand from power generation, mining, cement, and heavy industrial operations, particularly in GCC countries and South Africa. High operating temperatures and harsh environmental conditions create sustained demand for high-performance and heavy-duty lubricants. Ongoing investments in energy infrastructure, industrial diversification initiatives, and resource extraction projects continue to support moderate but stable market growth across the region.

Latin America Industrial Lubricants Market Trends

Latin America represents a developing yet opportunity-rich industrial lubricants market, driven by mining, metals, power generation, and food processing industries across countries such as Brazil, Mexico, and Chile. Market growth is supported by infrastructure development, rising industrial output, and gradual modernization of equipment, although demand remains relatively price sensitive. Increasing investments in mining and energy projects are expected to drive steady lubricant consumption over the forecast period.

Key Industrial Lubricants Company Insights

Key players, such as Exxon Mobil Corporation, FUCHS , Lubrizol, Shell Global , TotalEnergies , and Klüber Lubrication are dominating the market.

Exxon Mobil Corporation

-

Exxon Mobil Corporation is a leading global player in the industrial lubricants market, leveraging its integrated upstream-to-downstream operations, strong base oil production capabilities, and well-established Mobil industrial lubricants portfolio. The company offers a comprehensive range of high-performance industrial oils, greases, and specialty lubricants serving power generation, mining, chemicals, steel & metals, and manufacturing applications. ExxonMobil’s competitive strength lies in its advanced R&D capabilities, strong OEM approvals, and focus on synthetic and premium lubricant formulations that enhance equipment reliability, extend drain intervals, and reduce total cost of ownership, positioning the company as a preferred supplier for large-scale and mission-critical industrial operations worldwide.

Key Industrial Lubricants Companies:

The following are the leading companies in the industrial lubricants market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- FUCHS

- Lubrizol

- Shell Global

- TotalEnergies

- Klüber Lubrication

- Valvoline Global Operations

- Chevron Corporation

- Quaker Chemical Corporation

- Castrol Limited

Recent Developments

-

In April 2025, FUCHS' acquisition of IRMCO, a U.S.-based manufacturer of metal-forming lubricants, strengthens its position in the industrial lubricants market by expanding its product portfolio and global reach. The deal enhances FUCHS’ capabilities in providing sustainable and high-performance lubrication solutions for demanding manufacturing processes such as metal forming, assembly, and finishing. This strategic move supports the company’s growth in the industrial segment and aligns with rising demand for process-optimized and environmentally friendly lubricants.

-

In May 2024, ExxonMobil’s acquisition of Pioneer Natural Resources significantly enhances its Permian Basin footprint, doubling production capacity and securing long-term feedstock for petroleum-based products, including industrial lubricants. This strengthens ExxonMobil’s position in the lubricants market by improving supply chain integration, cost efficiency, and base oil availability. The deal also supports sustainability goals, with net-zero targets and advanced emission reduction technologies, aligning with rising demand for environmentally responsible lubricants.

Industrial Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 59.98 billion

Revenue forecast in 2033

USD 73.01 billion

Growth rate

CAGR of 2.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Spain; China; India; Indonesia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Exxon Mobil Corporation; FUCHS; Lubrizol; Shell Global; TotalEnergies; Klüber Lubrication; Valvoline Global Operations; Chevron Corporation; Quaker Chemical Corporation; Castrol Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global industrial lubricants market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Process Oils

-

General Industrial Oils

-

Metalworking Fluids

-

Industrial Engine Oils

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Mining

-

Power Generation

-

Food Processing

-

Chemical Manufacturing

-

Textile Manufacturing

-

Steel & Metals

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Indonesia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the industrial lubricants market include Exxon Mobil Corporation, FUCHS, Lubrizol, Shell Global, TotalEnergies, Klüber Lubrication, Valvoline Global Operations, Chevron Corporation, Quaker Chemical Corporation, and Castrol Limited

b. The industrial lubricants market is driven by expanding industrial activity across mining, power generation, steel & metals, and chemical manufacturing, alongside rising emphasis on equipment reliability, uptime, and lifecycle cost optimization. Increasing adoption of high-performance machinery and OEM-recommended lubrication practices further supports steady demand for advanced industrial lubricant solutions.

b. The global industrial lubricants market size was estimated at USD 58.12 billion in 2025 and is expected to reach USD 59.98 million in 2026.

b. The global industrial lubricants market is expected to grow at a compound annual growth rate of 2.8% from 2026 to 2033 to reach USD 73.01 billion by 2033.

b. The process oils segment dominated the market with a 34.9% revenue share in 2025 due to its high volume, continuous consumption across rubber, polymer, chemical, and textile manufacturing industries. Strong linkage with large-scale industrial output and widespread use as processing aids and performance enhancers significantly supported sustained revenue generation from this segment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.