- Home

- »

- Next Generation Technologies

- »

-

Industrial Robotics Market Size, Share, Industry Report, 2030GVR Report cover

![Industrial Robotics Market Size, Share & Trends Report]()

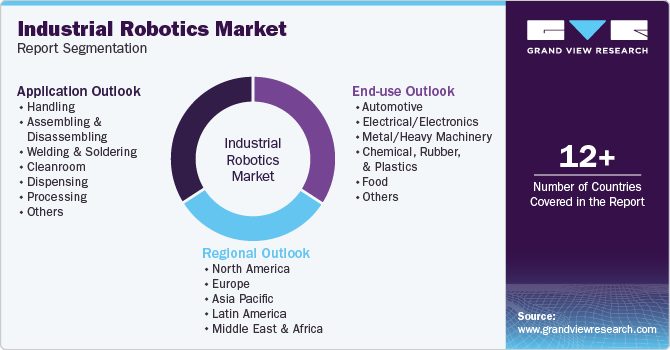

Industrial Robotics Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Handling, Welding & Soldering, Assembling & Disassembling, Processing), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-160-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Robotics Market Summary

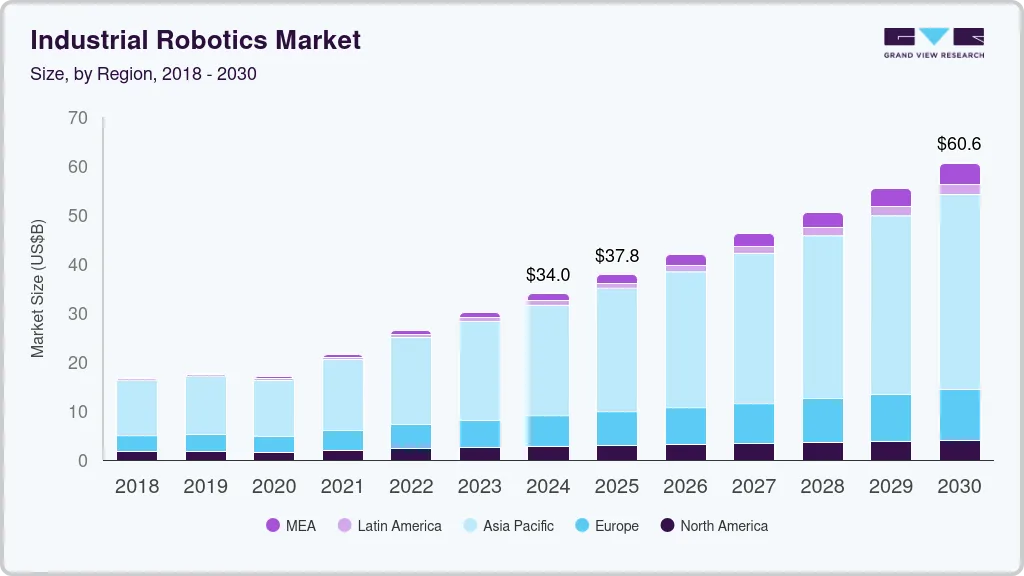

The global industrial robotics market size was estimated at USD 33,956.1 million in 2024 and is projected to reach USD 60,562.0 million by 2030, growing at a CAGR of 9.9% from 2025 to 2030. The surge in e-commerce has accelerated the demand for industrial robotics, warehousing, and logistics. Robots are streamlining operations by automating processes such as sorting, picking, packing, and delivery.

Key Market Trends & Insights

- North America industrial robotics market has a significant revenue share of over 8% in 2024.

- The U.S. Industrial Robotics market is expected to grow at a CAGR from 2025 to 2030.

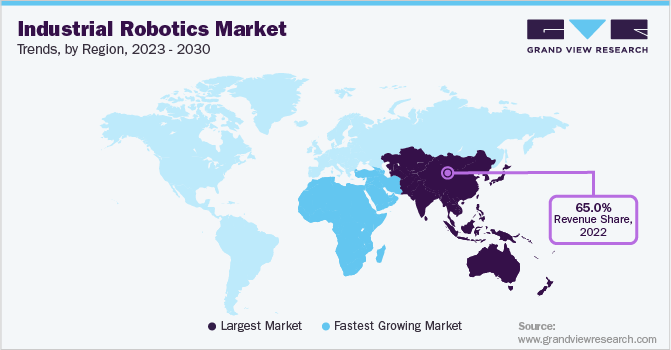

- The industrial robotics market in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period.

- Based on application, the handling segment accounted for the largest market revenue share of over 42% in 2024.

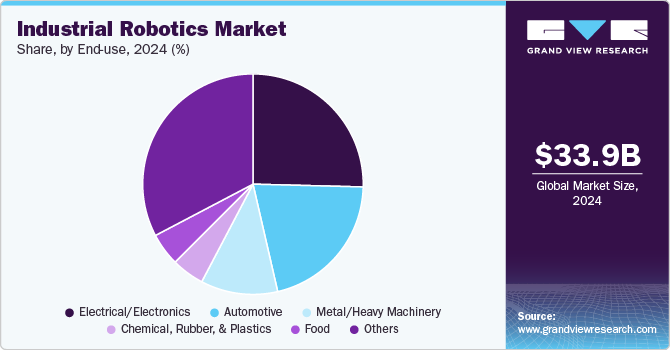

- In terms of end-use, the electrical/electronics segment held a significant share of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33,956.1 million

- 2030 Projected Market Size: USD 60,562.0 million

- CAGR (2025-2030): 9.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This trend is fueled by the need for efficiency and reduced lead times to meet consumer expectations for faster deliveries. Companies are also leveraging robotics to manage seasonal spikes in demand, particularly during holidays. The integration of artificial intelligence (AI) further enhances robotic systems, optimizing supply chain operations through predictive analytics. The RaaS model is gaining traction as businesses seek cost-effective automation solutions. This subscription-based approach allows companies to deploy robots without high upfront investments, making robotics accessible to a broader market.

RaaS providers offer services such as installation, maintenance, and upgrades, ensuring operational efficiency. This model is particularly beneficial for industries with fluctuating demands, enabling scalability and flexibility. As more businesses embrace RaaS, the market is witnessing a shift towards operational expenditure (OPEX)-focused solutions.

The industrial robotics industry is playing a critical role in advancing sustainability objectives. Modern robotic systems are engineered for energy efficiency, significantly reducing the carbon footprint of manufacturing processes. By enabling precision-driven production, robotics minimize material waste and optimize resource usage. Furthermore, industries are increasingly integrating renewable energy solutions into power robotic systems, reinforcing their commitment to eco-friendly operations. Government policies and global regulatory frameworks are actively promoting sustainable automation practices, accelerating this shift. These efforts not only align with sustainability goals but also enhance brand image and address the evolving expectations of environmentally conscious consumers.

The industrial robotics industry is also undergoing a transformation through the integration of AI and machine learning. These technologies empower robots to execute complex functions such as visual inspections, predictive maintenance, and dynamic decision-making. AI-powered systems can process vast datasets in real-time, ensuring optimal functionality and reducing operational downtime. Machine learning further enhances the performance of industrial robots by enabling continuous improvement through experience, driving efficiency and effectiveness over time. This technological evolution is paving the way for tailored robotic solutions across sectors such as manufacturing, healthcare, and pharmaceuticals.

Collaborative robots (cobots) are reshaping the landscape of the industrial robotics industry. Designed to operate alongside human workers, cobots enhance productivity while prioritizing workplace safety. Their affordability and adaptability make them particularly appealing to small and medium-sized enterprises (SMEs), fostering wider adoption across diverse applications. Key industries such as automotive, electronics, and healthcare are leveraging cobots for high-precision tasks. Moreover, advancements in sensors and machine learning are enabling cobots to navigate complex environments and manage intricate workflows, further driving their integration within the industrial robotics industry.

Application Insights

The handling segment accounted for the largest market revenue share of over 42% in 2024. The demand for high-payload robots is rising as industries require automation for handling heavy materials and goods. These robots are particularly useful in sectors such as automotive, aerospace, and construction, where precision and safety are critical for heavy-duty tasks. High-payload robots improve efficiency by reducing the time and labor required to handle large or bulky items. They also enhance workplace safety by minimizing human involvement in potentially hazardous lifting and transportation operations. With advancements in robotics, these machines are becoming more versatile and capable of handling delicate tasks alongside heavy lifting.

The processing segment is predicted to foresee significant growth in the coming years. Industrial robots are increasingly adopted in the food and beverage sector to enhance processing efficiency and meet hygiene standards. Robots perform tasks such as slicing, mixing, and decorating with precision, ensuring consistency and quality. Automation reduces contamination risks by minimizing human contact and addressing stringent regulatory requirements. In addition, robots enable high-speed production lines, meeting the growing demand for ready-to-eat and packaged foods. This trend is driven by the need for agility and innovation in response to changing consumer preferences and global market expansion.

End-use Insights

The electrical/electronics segment held a significant share of the market in 2024. The electrical/electronics industry increasingly relies on industrial robots for precision-driven tasks such as soldering, assembly, and component handling. Robots are essential in manufacturing micro-sized components, where human intervention may lead to errors or inefficiencies. With the miniaturization of devices like smartphones, wearables, and IoT gadgets, the need for precise and consistent robotic assembly is paramount. Advanced robotics solutions equipped with vision systems ensure high-quality outcomes, reducing defects and rework. This trend is driven by manufacturers’ need to meet stringent quality standards while accelerating production timelines.

The headsets segment is predicted to foresee the highest growth in the coming years. The chemical, rubber, and plastics industries are leveraging industrial robots to handle hazardous materials and operate in high-risk environments. Robots are deployed for tasks such as mixing chemicals, handling toxic substances, and operating in extreme temperatures. This trend minimizes human exposure to dangerous conditions, improving workplace safety and compliance with stringent health regulations. Robotic systems ensure precision and consistency in processes, reducing the risk of accidents and product defects. By automating hazardous operations, companies are optimizing efficiency while prioritizing employee well-being.

Regional Insights

North America industrial robotics market has a significant revenue share of over 8% in 2024. North America is witnessing robust adoption of industrial robots, driven by the demand for advanced manufacturing solutions across industries such as automotive, aerospace, and logistics. Companies are leveraging robotics to enhance productivity, ensure precision, and address labor shortages in high-skill roles. Government initiatives supporting automation and Industry 4.0 technologies are further accelerating the deployment of robots in this region.

U.S. Industrial Robotics Market Trends

The U.S. Industrial Robotics market is expected to grow at a CAGR from 2025 to 2030. The U.S. is leading in the adoption of customizable robotics solutions integrated with artificial intelligence (AI) to meet diverse industry requirements. The growing demand for automation in logistics, healthcare, and e-commerce sectors is a key driver of this trend. In addition, the focus on reshoring manufacturing operations has amplified investments in robotics to enhance domestic production capabilities.

Europe Industrial Robotics Market Trends

The industrial robotics market in Europe is expected to witness significant growth over the forecast period. In Europe, the industrial robotics industry is witnessing significant growth due to the region’s emphasis on sustainability and green manufacturing. Collaborative robots (cobots) are widely adopted to improve efficiency while maintaining safety and flexibility in operations. In addition, stringent environmental regulations are pushing industries to utilize robotics for energy-efficient production and waste reduction.

Asia Pacific Industrial Robotics Market Trends

The industrial robotics market in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. Asia Pacific dominates the industrial robotics industry due to rapid industrialization and significant investments in automation technologies, particularly in countries such as China, Japan, and South Korea. The region's strong manufacturing base, coupled with government programs promoting robotics, is fueling the market’s growth. Increasing demand for consumer electronics and automotive products is further driving the adoption of robotics in assembly and material handling.

Key Industrial Robotics Company Insights

Several leading companies in the market for industrial robotics, including ABB Ltd., Fanuc Corporation, Yaskawa Electric Corporation, KUKA AG, Mitsubishi Electric Corporation, and Denso Corporation, are actively pursuing strategies to expand their customer base and strengthen their competitive positioning. These strategies encompass partnerships, mergers and acquisitions, collaborations, and the development of innovative products and technologies. By adopting these initiatives, these companies aim to bolster their market presence and stay attuned to shifting consumer demands. These efforts emphasize fostering innovation and catering to the dynamic requirements of industries reliant on industrial robotics.

-

ABB Ltd. specializes in providing advanced automation and robotic solutions tailored to diverse industries such as automotive, electronics, and logistics. The company is recognized for its innovations in manufacturing robotics, including systems for assembly, welding, and material handling. ABB’s robots are integrated with cutting-edge AI and IoT technologies, enabling smarter, interconnected factory environments. Their focus on energy-efficient and sustainable robotics aligns with global manufacturing trends toward eco-friendly operations. ABB’s broad product portfolio and focus on digital solutions position it as a leader in industrial automation.

-

Logitech Fanuc Corporation is renowned for its expertise in CNC control systems and robotic automation, catering primarily to industries requiring precision. Its robotic solutions are widely used in machining, assembly, and high-speed pick-and-place operations. The company’s emphasis on reliability and long-lasting performance has made its robots a trusted choice in industrial settings. Fanuc also invests heavily in developing systems that combine robotics with AI for enhanced productivity. Its global presence and customer-focused approach ensure that it remains a preferred partner in industrial robotics.

Key Industrial Robotics Companies:

The following are the leading companies in the industrial robotics market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Comau SpA

- KUKA AG

- Fanuc Corporation

- Denso Corporation

- Kawasaki Heavy Industries, Ltd.

- Omron Corporation

Recent Developments

-

In May 2024, Neura Robotics announced a strategic partnership with OMRON aimed at integrating AI-enhanced cognitive robots into manufacturing processes. This collaboration seeks to leverage advanced artificial intelligence to boost operational efficiency and enhance safety measures within factory environments. By combining their respective technologies, both companies aim to create smarter, more responsive robotic systems that can adapt to various production challenges. This initiative represents a significant step forward in the evolution of industrial automation.

-

In February 2024, Olis Robotics formed a partnership with Kawasaki Robotics to deliver integrated solutions that enhance production speed and minimize downtime costs for customers. This collaboration enables the deployment of Olis' remote error recovery technology on Kawasaki's robotic systems, allowing for faster troubleshooting and recovery from operational disruptions. The partnership is designed to significantly reduce downtime costs by up to 90%, providing users with rapid access to expert support. Together, they aim to streamline operations and improve overall productivity in industrial settings.

-

In June 2024, RoboDK entered into a partnership with KEBA Industrial Automation to merge the capabilities of their respective platforms, Kemro X and RoboDK. This collaboration is focused on providing users with the ability to test various real-world configurations of industrial robots, facilitating informed decision-making in automation processes. By integrating these platforms, customers will benefit from enhanced simulation and testing capabilities, ultimately leading to improved efficiency in robot deployment. This partnership underscores a commitment to advancing industrial automation through innovative technological solutions.

Industrial Robotics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37,821.3 million

Revenue forecast in 2030

USD 60,562.0 million

Growth rate

CAGR of 9.9% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ABB Ltd., Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., Comau SpA, KUKA AG, Fanuc Corporation, Denso Corporation, Kawasaki Heavy Industries, Ltd., and Omron Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Robotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial robotics market report based on application, end use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Handling

-

Assembling & Disassembling

-

Welding & Soldering

-

Cleanroom

-

Dispensing

-

Processing

-

Others

-

-

End Use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical/Electronics

-

Metal/Heavy Machinery

-

Chemical, Rubber, & Plastics

-

Food

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global industrial robotics market size was estimated at USD 33,956.1 million in 2024 and is expected to reach USD 37,821.3 million in 2025.

b. The global industrial robotics market is expected to grow at a compound annual growth rate of 9.9% from 2025 to 2030 to reach USD 60,562.0 million by 2030.

b. The electrical application segment dominated the global industrial robotics market with a share of over 25% in 2024. This is attributed to the growing need to integrate advanced electronics in new cars.

b. Some of the key players in the global industrial robotics market include Adept Technology Inc.; Fanuc Robotics Company; Kuka AG; Mitsubishi Electric Corporation; Yamaha Motor Company; and Yaskawa Electric Corporation.

b. Key factors that are driving the market growth include increasing use for non-automotive applications, demand from emerging countries, and improved productivity and cost reduction benefits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.