- Home

- »

- Advanced Interior Materials

- »

-

Industrial Valves Market Size, Share & Growth Report, 2030GVR Report cover

![Industrial Valves Market Size, Share & Trends Report]()

Industrial Valves Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Gate Valve, Ball Valve), By Application (Automotive, Oil & Gas), By Region, And Segment Forecasts

- Report ID: 978-1-68038-797-1

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Valves Market Summary

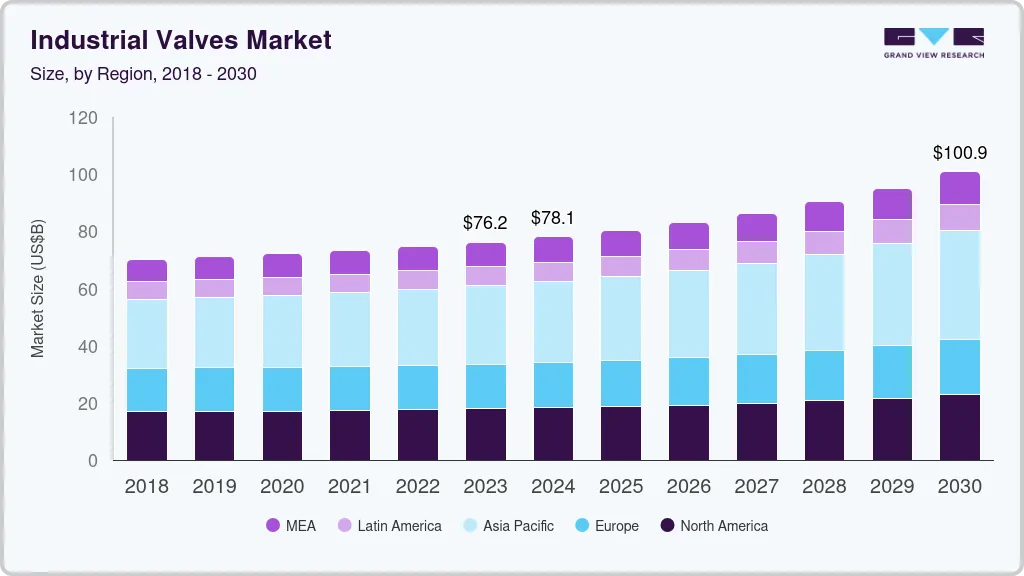

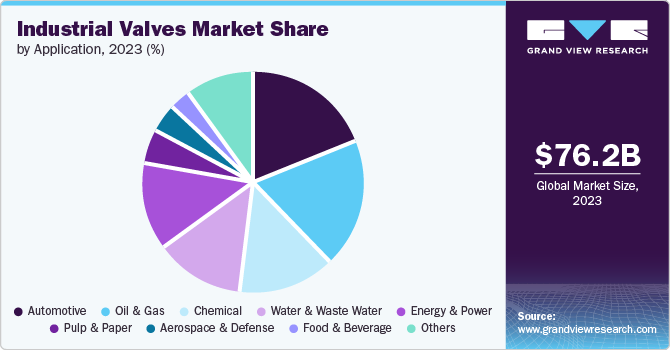

The global industrial valves market size was valued at USD 76.2 billion in 2023 and is projected to reach USD 100.9 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. Market growth is being driven by various factors, such as the construction of new power plants, the increasing use of industrial equipment, and the growing adoption of high-quality industrial valves.

Key Market Trends & Insights

- The North America industrial valves market is expected to grow significantly over the forecast period.

- The U.S. industrial valves market accounted for a 15.6% share of the global market in 2023.

- Based on product, the ball valves segment dominated the market with a revenue share of over 17.3% in 2023.

- Based on application, the automotive segment dominated the market with a revenue share of over 19.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 76.2 Billion

- 2030 Projected Market Size: USD 100.9 Billion

- CAGR (2024-2030): 4.1%

- Asia Pacific: Largest market in 2023

These factors play a crucial role in improving output and reducing losses. Advancements in manufacturing techniques and material technology have facilitated the creation of valves that deliver efficient performance even in demanding pressure and temperature conditions. For instance, in December 2022, Emerson announced the introduction of new & advanced technologies for its Crosby J-Series pressure relief valves, the Bellows Leak Detection and Balanced Diaphragm. These technologies are likely to help reduce ownership costs and improve performance, further driving market growth.

In the case of large-scale power plants, the management of steam and water flow requires the deployment of numerous valves. As the construction of new nuclear plants and the modernization of existing ones is in progress, the demand for valves is steadily increasing. In December 2023, China's state council announced the approval of four new nuclear reactors in the country. The role of industrial valves in regulating the temperature and preventing the fuel from overheating is likely to help drive their demand and foster growth in the market.

Furthermore, the integrating of IoT sensors in industrial valves has facilitated real-time performance and operating conditions monitoring. As a result, predictive maintenance has become possible, leading to reduced downtime and enhanced operational efficiency. Utilizing IoT-enabled valves also contributed to improved safety and responsiveness through remote monitoring. This advancement enables proactive decision-making and efficient resource allocation, thereby driving demand across multiple sectors.

Product Insights

Ball valves segment dominated the market with a revenue share of over 17.3% in 2023. Ball valves, such as trunnion, floating, and threaded series ball valves, are highly sought after in the global market. These valves provide accurate flow control, making them perfect for applications that need precise shut-off and controlling capabilities. The increasing demand for ball valves can be attributed to their availability in different sizes and increasing innovations and product launches. For instance, in November 2023, Flowserve Corporation introduced the Worcester Cryogenic series with a quarter-turn floating ball valve.

The safety valves segment is expected to grow at the fastest CAGR over the forecast period. The expansion of safety valves usage is being fueled by the rapid industrialization occurring on a global scale. For instance, in April 2024, Xylem introduced a single-use pump with an adjustable and integrated pressure relief valves. It is expected to help minimize the risk of fluid contamination and maximize the safety of operators. These valves help in accident prevention, which is likely to help in driving their market demand.

Application Insights

The automotive segment dominated the market with a revenue share of over 19.1% in 2023. The increasing emphasis on urbanization and rising disposable income are driving the growth of the automotive industry. The information published by the European Automobile Manufacturers’ Association in May 2023 reported the production of about 85.4 million motor vehicles in 2022 worldwide, which shows an increase of approximately 5.7% compared to 2021. This rising production of vehicles across the globe is expected to drive demand for industrial valves in the automotive industry.

The water & wastewater segment is projected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the extensive implementation of products across water and wastewater treatment facilities. These products are instrumental in regulating liquid flow, optimizing treatment processes, and ensuring the dependable operation of water distribution systems.

Regional Insights

The North America industrial valves market is expected to grow significantly over the forecast period. The region’s industrialization and increasing population drive the demand for efficient energy generation and delivery. The growth in oil & gas production, exploration, and renewable energy sources fuel the need for high-performance industrial valves. For instance, according to the information published by the U.S. Energy Information Administration in March 2024, crude oil production in the U.S. in 2023 averaged 12.9 million barrels per day (b/d), surpassing the previous global record of 12.3 million b/d, set in 2019. This increasing production and industrial development in the region are expected to drive further growth regional market.

U.S. Industrial Valves Market Trends

The U.S. industrial valves market accounted for a 15.6% share of the global market in 2023. The increasing adoption of technologically advanced valves in various industries to achieve interconnected and intelligent manufacturing systems is contributing to the market growth in the country. In addition, the increasing initiatives taken by the government, such as the Bipartisan Innovation Act (BIA) and the Make More In America initiative by the Export-Import Bank of the U.S. (EXIM), are further expected to help boost the manufacturing industry in the country and drive market growth.

Europe Industrial Valves Market Trends

Europe's industrial valves market is expected to grow significantly over the forecast period. Europe's strict environmental regulations, prioritizing energy efficiency and sustainable practices, are compelling industries to embrace advanced valves technologies to improve control and efficiency. In addition, the increasing number of industrial projects in the region is further expected to drive market growth. For instance, in April 2024, Bechtel, a construction and project management company in Europe, started fieldwork on the site of the first nuclear power plant in Poland.

The UK industrial valves market is expected to grow over the forecast period due to the growing population, intensified exploration of oil and gas reserves, and the expansion of oil refineries. For instance, Exxon Mobil Corporation XOM commenced a USD 1 billion expansion project for diesel production at its oil refinery in Fawley, UK, which is expected to be completed in 2024. In addition, advancements in technology and the development of innovative solutions are further expected to add to the market growth over the forecast period.

Asia Pacific Industrial Valves Market Trends

The Asia Pacific region accounted for the largest revenue share of 35.8% in 2023 and is expected to witness the fastest growth over the forecast period. The Asia Pacific region is experiencing rapid industrialization, infrastructural development, and a growing emphasis on energy efficiency. The presence of developing countries such as China, India, and Japan and their development activities in industries such as manufacturing, automotive, and power generation are driving significant demand for advanced valves. For instance, in February 2024, Japan extended approximately USD 1,532.8 million in loans for nine infrastructural projects in India. In addition, in December 2022, Toshiba announced its plans to expand its power semiconductor production capacity with a new production facility in Hyogo Prefecture, Japan. The initiation of such large projects in the region is likely to help drive demand in the country and foster market growth.

India industrial valves market is expected to grow during the forecast period due to the rise in urbanization and the development of various industries in the country. According to the information published by the India Brand Equity Foundation (IBEF), India’s annual production of automobiles in 2023 was 25.9 million vehicles, and the share of the automobile industry in the country’s GDP stood at 7.1%. The increasing production of automobiles and the development of various industries in the country are expected to foster growth in the market.

Latin America Industrial Valves Market Trends

Latin America is to witness significant market growth in the industrial valves market over the forecast period. The growth of industrial sectors, such as mining, oil and gas, energy, and water management, is being supported using valves to optimize processes and utilize resources effectively, leading to market expansion. In May 2024, Aura Minerals Inc. acquired exploration rights for two gold projects in Brazil. The development is expected to help boost mining activities in the country and drive market growth.

Key Industrial Valves Company Insights

Some of the key companies in the industrial valves market include, Emerson Electric Co.; Velan Inc.; AVK Water; BEL Valves; Cameron Schlumberger; Fisher Valves & Instruments Emerson, and others. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Emerson stands as a global player in the technology, software, and engineering industries, catering to customers in industrial and commercial sectors. The company offers industrial products such as industrial valves, process control software and systems, fluid control, pneumatic mechanisms, and services, including modernization and migration services, process automation services, and others.

-

Velan is a global manufacturer in the industrial valves sector. The company operates in multiple industries, including nuclear power, power, chemicals, oil and gas, mining, pulp and paper, and marine. Their extensive range of products includes gate, globe, and check valves, quarter-turn valves, specialty valves, and steam traps.

Key Industrial Valves Companies:

The following are the leading companies in the industrial valves market. These companies collectively hold the largest market share and dictate industry trends.

- Emerson Electric Co.

- Velan Inc.

- AVK Water

- BEL Valves Limited.

- SLB.

- Flowserve Corporation.

- KLINGER

- GG Valves Private Limited(www.ggvalves.com.)

- LESER GmbH & Co. KG

Recent Developments

-

In October 2023, AVK Group acquired Bayard S.A.S, Talis Flow Control (Shanghai) Co. Ltd., Belgicast International S.L., and sales companies in Italy and Portugal. The acquisition is expected to help the company expand further.

-

In October 2023, Burhani Engineers Ltd. introduced a valves testing and rehabilitation hub in Nairobi, Kenya. This hub is expected to help lower the repair and maintenance costs for existing valves in oil and gas, power, mining, and other industries.

-

In June 2023, Flowserve Corporation introduced its Valtek Valdisk high-performance butterfly valve. This valves can be used for chemical plants, oil refineries, and other facilities that require control valves.

Industrial Valves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 78.1 billion

Revenue forecast in 2030

USD 100.9 billion

Growth Rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Emerson Electric Co.; Velan Inc.; AVK Water; BEL Valves Limited.; SLB.; Flowserve Corporation.; KLINGER; GG Valves Private Limited.; LESER GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Valves Market Report Segmentation

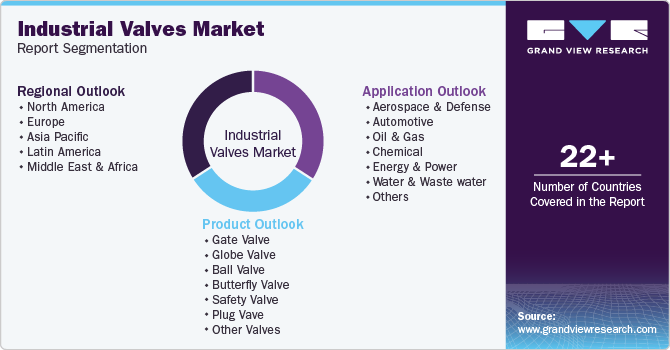

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial valves market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gate Valve

-

Globe Valve

-

Ball Valve

-

Butterfly Valve

-

Safety Valve

-

Plug Vave

-

Other Valves

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace and Defense

-

Automotive

-

Oil & Gas

-

Chemical

-

Energy & Power

-

Water & Waste water

-

Pulp & Paper

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.